USDA Loan: Young Couple Purchases $295K Home with $0 Down Payment in Rural Florida Community

- By Jim Blackburn

- on

- Buy A House, First Time Home Buyer, USDA Loan, Zero Down Payment

Educational Case Study Disclosure

This case study is hypothetical and for educational purposes only. Scenarios, borrower profiles, loan terms, interest rates, and APRs are illustrative examples and do not represent current offers or guaranteed terms.

If specific loan terms (e.g., down payment %, payment amount, rate/APR, points, or repayment period) appear in this article, required disclosures will be shown immediately next to those terms per Regulation Z.

For specific details including down payment incentives, closing cost incentives, interest rate details, closing cost breakdowns, payment calculations, cash-to-close estimates, or an official Loan Estimate, it is highly recommended you schedule a meeting with one of our licensed mortgage advisors.

Learn more:

- Reg Z – Advertising (§1026.24) – CFPB official regulation

- Reg Z Full Text – Electronic Code of Federal Regulations

- Official Interpretations to §1026.24 – CFPB interpretations

- MAP Rule (Reg N), 12 CFR Part 1014 – Mortgage advertising rules

- NMLS Consumer Access – Verify licensure

Actual loan terms vary by credit profile, property, occupancy, location, market conditions, and lender guidelines. For current options tailored to you, schedule a consultation or apply online.

Ready to explore your options? Schedule a call with a loan advisor.

How This USDA Loan Enabled 100% Financing for First-Time Home Buyers in Eligible Rural Area Without Down Payment

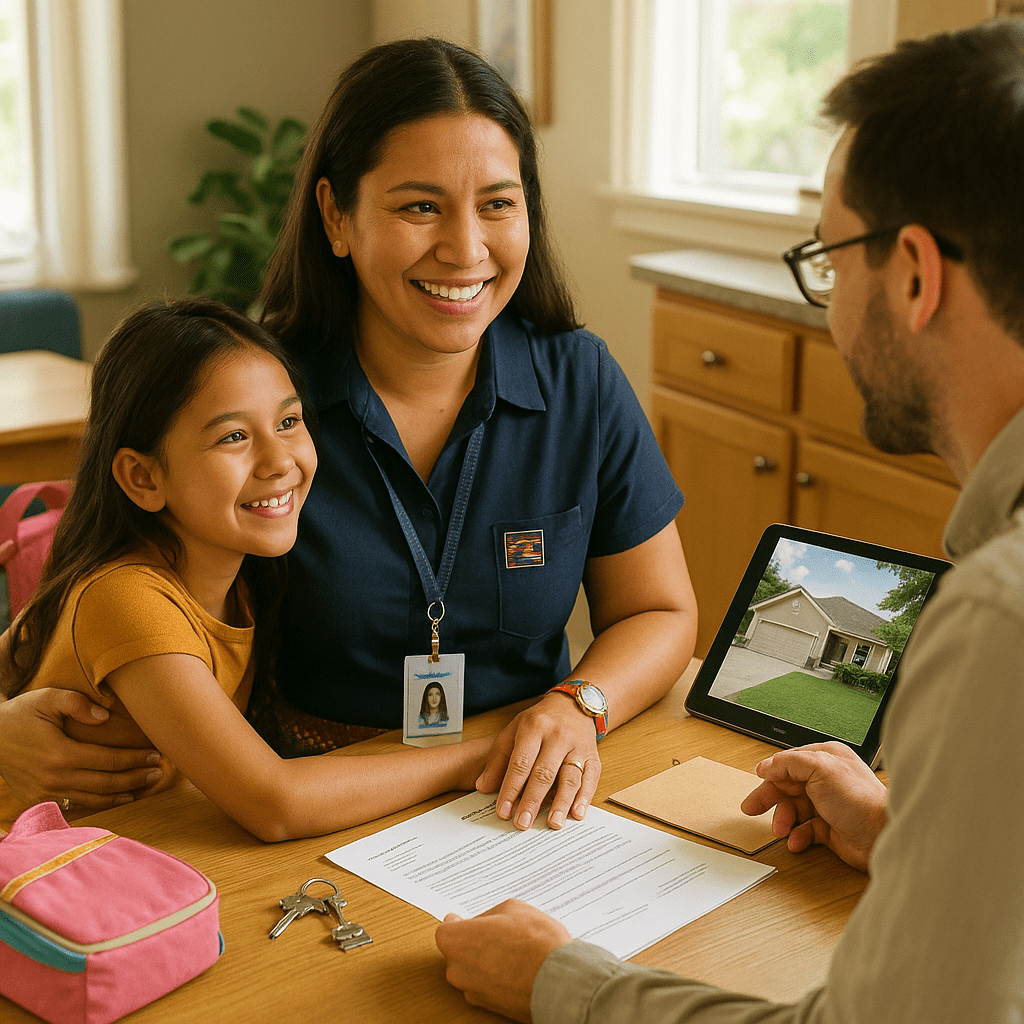

Daniel and Ashley K., a young married couple ages 28 and 27, were ready to transition from renting to homeownership after three years of marriage and careful financial planning. Daniel worked as an electrician earning $54,000 annually through stable employment with a commercial contractor serving clients throughout South Florida, while Ashley earned $42,000 annually as an elementary school administrative assistant with the school district. Combined, their $96,000 household income provided comfortable living but limited capacity for substantial down payment savings given South Florida’s high cost of living. As first-time home buyers (Step 2 in their financial journey), they’d managed to save $8,500 over two years through disciplined budgeting—cutting discretionary spending, eating at home, limiting entertainment expenses, and carefully tracking every dollar—but this amount fell far short of the $15,000-$20,000 needed for conventional or FHA down payments plus closing costs on homes in their price range.

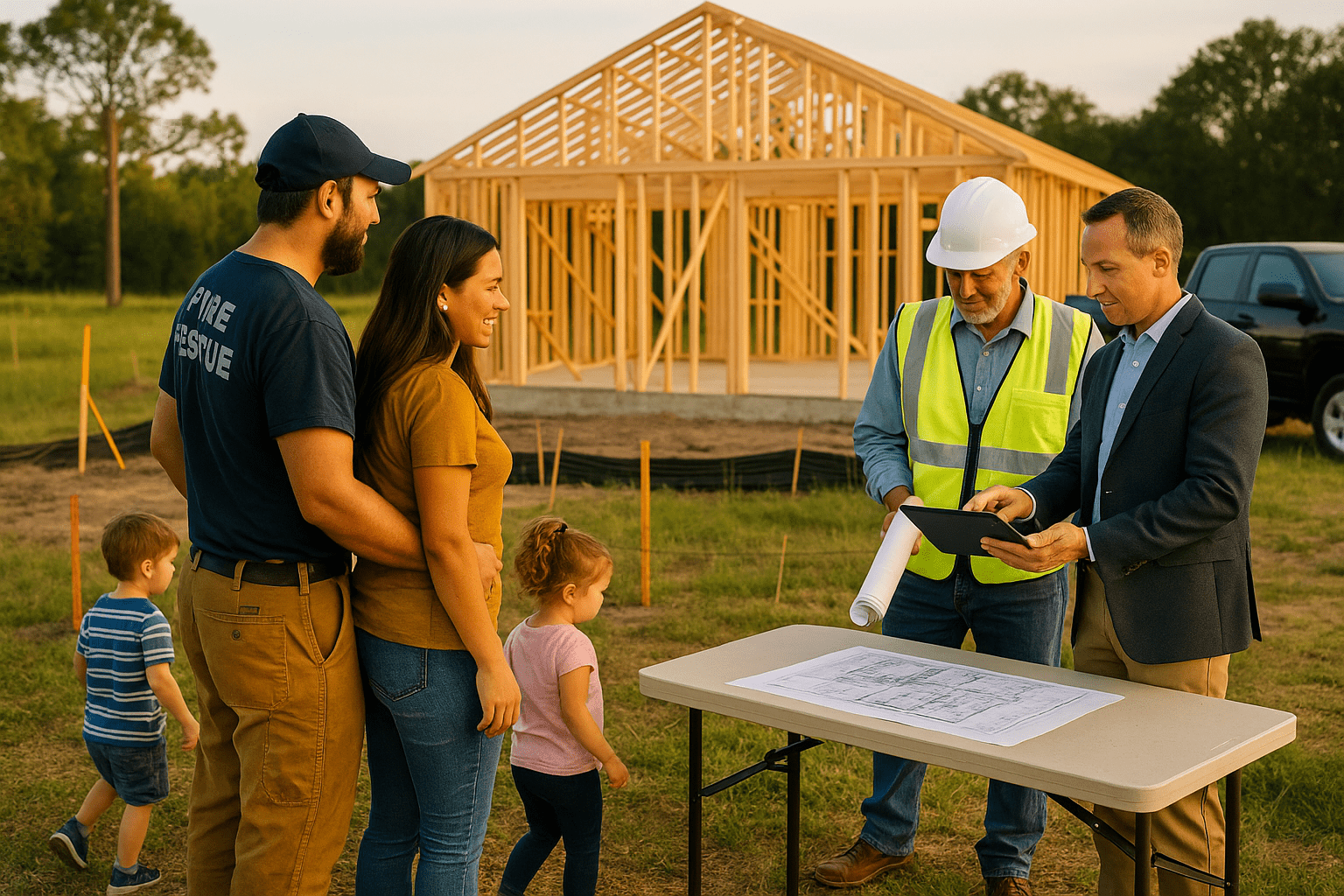

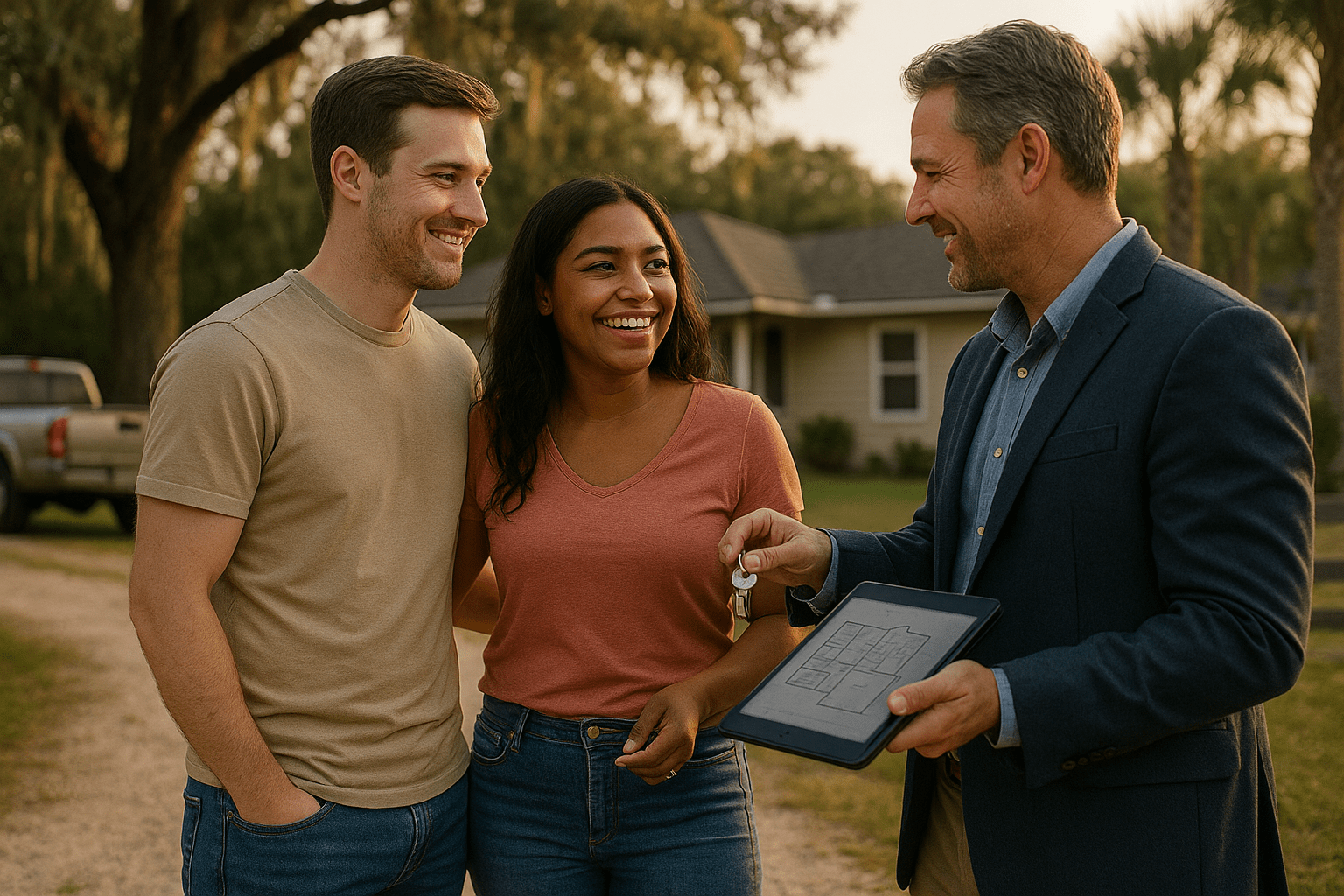

Daniel and Ashley identified a perfect three-bedroom, two-bathroom home in Southwest Ranches listed at $295,000—a property in a quiet residential community approximately 30 minutes west of Fort Lauderdale, offering the space, yard, and family-friendly environment they wanted for starting a family. The home represented their ideal: affordable pricing below Fort Lauderdale’s inflated urban rates, excellent schools, safe neighborhood, room to grow, and a quarter-acre lot providing outdoor space impossible to find in expensive urban areas. Southwest Ranches offered the perfect balance—close enough to Daniel’s Fort Lauderdale work for reasonable commuting (30-35 minutes), yet far enough into western Broward County’s semi-rural areas to provide affordable housing, less congestion, and family-oriented lifestyle.

However, the property’s location raised interesting questions about financing options. Southwest Ranches sits in a semi-rural area that straddles the boundary between suburban sprawl spreading westward from Fort Lauderdale and agricultural communities still actively operating in western Broward County. The area maintains lower population density, agricultural heritage, and community character distinct from dense urban coastal neighborhoods—characteristics that would prove crucial for their financing options.

When Daniel and Ashley approached three traditional lenders, all presented the same barrier: down payment requirements that exceeded their carefully accumulated savings. Conventional loans required 3-5% down ($8,850-$14,750), FHA required 3.5% ($10,325), and both required additional closing costs ($8,000-$12,000). Even with their $8,500 savings—representing two years of sacrifice and disciplined financial management—they faced a $10,000-$18,000 shortfall between saved funds and total cash needed for down payment plus closing costs. The lenders suggested continuing to rent while saving for another 1-2 years—during which time home prices and rents would continue rising throughout South Florida, potentially making homeownership even more challenging to achieve.

“We’d saved $8,500 over two years through careful budgeting and real sacrifice,” Ashley explained with frustration in her voice. “We stopped going out to eat, cut our entertainment budget, postponed vacations, and tracked every expense religiously. But conventional and FHA lenders said we needed $18,000-$26,000 total for down payment and closing costs on a $295,000 home. That $10,000-$18,000 gap felt insurmountable. We were paying $2,100 monthly rent—money disappearing into a landlord’s pocket building zero equity. Waiting another year or two to save meant throwing away another $25,000-$50,000 in rent while home prices kept climbing throughout South Florida. We felt trapped in the rental cycle despite doing everything right—stable jobs, good credit, money saved, responsible finances, careful planning.”

The couple faced a difficult and demoralizing choice: delay homeownership another 1-2 years while continuing to enrich landlords through $2,100 monthly rent payments ($50,400 over two years building zero equity), or find alternative financing solutions that could bridge the gap between their savings and traditional down payment requirements. Traditional lenders treated them as generic borrowers without considering whether specialized programs existed that might recognize their rural property choice, moderate income level, and responsible financial profile.

During a conversation with Ashley’s parents about their frustrating homeownership challenges, her father mentioned hearing about “zero-down government loans for rural areas” through his work with clients in agricultural businesses. The comment sparked Ashley’s curiosity—she spent an evening researching and discovered USDA loans, officially called the USDA Single Family Housing Guaranteed Loan Program, administered by the United States Department of Agriculture’s Rural Development office. These loans were specifically designed by the federal government to promote homeownership in rural and suburban areas by offering 100% financing (zero down payment required) with competitive terms for qualified buyers purchasing homes in designated rural areas.

When Ashley checked the USDA eligibility map online using the property address, she was surprised and thrilled to discover that Southwest Ranches, despite being just 30 minutes from Fort Lauderdale’s urban core, qualified as an eligible rural area under USDA’s definitions. The USDA defines “rural” broadly—including not just remote farmland but many suburban and semi-rural communities within reasonable commuting distance of urban employment centers. Southwest Ranches qualified because it sits outside densely populated urban cores, maintains lower population density despite proximity to Fort Lauderdale, preserves semi-rural character with larger lots and agricultural activities, and meets USDA’s technical population and density thresholds for rural designation.

“Learning that Southwest Ranches qualified for USDA financing changed everything for our homeownership dreams,” Daniel said with relief evident. “We’d assumed USDA loans were only for farms or remote rural areas hours from cities—places we’d never consider living given our work in Fort Lauderdale. But the USDA defines ‘rural’ to include many suburban and semi-rural communities within reasonable commuting distance of urban centers. Southwest Ranches qualified because it’s outside Fort Lauderdale’s densely populated urban core and maintains lower density and semi-rural character despite being only 30 minutes away. That meant we could potentially purchase our dream home with zero down payment required—eliminating the $9,000-$11,000 gap between our savings and traditional financing requirements.”

Daniel and Ashley needed a USDA loan—100% financing backed by the U.S. Department of Agriculture’s Rural Development program, specifically designed to promote homeownership in eligible rural and suburban communities by eliminating down payment barriers for qualified buyers meeting income limits and property location criteria.

Facing similar down payment barriers? Schedule a call to explore USDA loan options.

Why Were Traditional Mortgage Programs Creating Insurmountable Barriers for Daniel and Ashley?

Daniel and Ashley’s situation illustrated common and frustrating challenges young first-time buyers face throughout expensive housing markets—stable employment providing good household income, excellent credit demonstrating financial responsibility, careful savings showing discipline and planning capacity—yet insufficient liquid savings for substantial down payments given high living costs that consume income, creating artificial barriers to homeownership despite clear affordability and responsibility.

Detailed cash requirements comparison revealed the problem:

Conventional loan requiring 3% down payment minimum:

- Down payment required: $8,850 (3% of $295,000 purchase price)

- Typical closing costs: $9,000-$11,000 (3.0-3.7% of purchase price for appraisal, title insurance, recording fees, origination, prepaid taxes/insurance)

- Total cash needed at closing: $17,850-$19,850

- Daniel and Ashley’s carefully accumulated savings: $8,500

- Shortfall requiring additional savings: $9,350-$11,350

- Additional months of aggressive saving required: 12-18 months at $600-800/month savings rate

FHA loan requiring 3.5% down payment:

- Down payment required: $10,325 (3.5% of $295,000)

- Typical closing costs: $8,000-$10,000 (slightly lower than conventional)

- Total cash needed at closing: $18,325-$20,325

- Their savings: $8,500

- Shortfall: $9,825-$11,825

- Additional saving time: 12-18 months

USDA loan with zero down payment (potential solution):

- Down payment required: $0 (100% financing—zero down payment)

- Closing costs: $8,000-$10,000 (similar to other programs)

- USDA guarantee fee: 1% upfront (~$2,950, can be financed into loan balance)

- Total cash needed: ~$8,000-$10,000 (closing costs only, if financing guarantee fee)

- Their savings: $8,500

- Gap: $0-$1,500 (manageable with their savings, potentially with modest seller credits)

- Timeline to homeownership: IMMEDIATE rather than 12-18 months additional waiting

“The USDA loan transformed affordability from impossible to achievable literally overnight,” Ashley explained with visible emotion. “Zero down payment meant we only needed to cover closing costs—approximately $8,000-$10,000—which was within reach of our $8,500 savings, especially if we could negotiate even modest seller credits toward closing costs. Conventional and FHA required $18,000-$20,000 total—creating a $10,000+ gap we couldn’t bridge without another year or more of aggressive saving while paying rent and watching home prices rise. USDA eliminated that barrier completely through 100% financing, making homeownership achievable right now rather than forcing us to wait another year throwing away $25,000+ in rent.”

Beyond the obvious down payment elimination benefit that solved Daniel and Ashley’s immediate barrier, USDA loans offered additional structural advantages that made them attractive even compared to conventional or FHA financing if buyers somehow managed to accumulate required down payment funds:

Comprehensive USDA loan benefits and advantages:

Zero down payment requirement:

- 100% financing up to USDA loan limits

- Enables homeownership without years of down payment savings

- Preserves liquid savings for emergency reserves, moving costs, immediate home needs

- Eliminates largest barrier preventing working families from achieving homeownership

Competitive interest rates:

- Rates often comparable to or even slightly lower than conventional/FHA rates

- Government backing through USDA guarantee reduces lender risk

- Enables attractive rate pricing despite zero down payment structure

Lower mortgage insurance costs than FHA:

- USDA upfront guarantee fee: 1% of loan amount (can be financed)

- USDA annual fee: 0.35% of loan balance (added to monthly payment)

- Compare to FHA: 1.75% upfront + 0.55-0.85% annual (higher ongoing cost)

- Monthly savings: USDA typically $50-$100 lower monthly insurance versus FHA

- Lifetime savings: Thousands over loan term through lower annual fees

Flexible credit score requirements:

- Minimum credit score typically 640 (similar to FHA 580-640 range)

- Daniel’s 698 and Ashley’s 682 scores exceeded minimums comfortably

- Focus on stable income, employment, responsible payment history beyond just scores

Income limits ensure program serves intended moderate-income families:

- Maximum income limits vary by county and household size

- Broward County limit approximately $103,500 for 2-person household

- Daniel and Ashley’s $96,000 combined income qualified comfortably

- Program designed to serve working middle-class families, not high earners who can afford conventional financing

Property eligibility promotes rural community development:

- Property must be located in USDA-designated rural or suburban area

- Promotes homeownership in communities outside dense urban cores

- Supports rural economic development and community sustainability

- Many suburban areas surprisingly qualify despite proximity to cities

“The USDA program wasn’t just about zero down payment—everything about it was designed to help first-time buyers like us succeed,” Daniel said thoughtfully. “Lower mortgage insurance than FHA saved us $50-100 monthly. Competitive rates meant our overall cost was excellent. The income limits meant it truly served middle-class families like ours who earn good incomes but can’t save huge down payments. The property had to be in eligible rural areas, which aligned perfectly with our deliberate choice to live in Southwest Ranches rather than expensive urban Fort Lauderdale. Everything about USDA felt like it was designed for our exact situation—young couple with stable moderate income wanting to own a home in a family-friendly community outside expensive urban areas.”

Property location verification—critical USDA requirement:

One absolutely critical USDA requirement that determines eligibility is property location. Not all properties qualify for USDA financing—only homes located in USDA-designated rural areas are eligible. Daniel and Ashley used the official USDA property eligibility map online (freely available to anyone) to verify whether the Southwest Ranches property qualified before getting too excited about USDA financing possibilities:

USDA eligibility verification process:

- Property address entered: Specific Southwest Ranches listing address

- USDA eligibility result: ELIGIBLE (property qualified as rural area)

- Population density: Below USDA urban density threshold for Broward County

- Distance from urban center: Outside Fort Lauderdale city limits (sufficient distance)

- Community character: Semi-rural residential maintaining lower density and agricultural heritage

- Official designation: Qualified rural area under USDA Rural Development definitions

“Confirming property eligibility was absolutely crucial before pursuing USDA financing seriously,” Ashley emphasized. “We loved the Southwest Ranches home, but it would have been absolutely heartbreaking to learn it didn’t qualify for USDA after getting excited about zero-down financing possibilities. Fortunately, when we entered the address into the USDA eligibility map online, it immediately confirmed ‘ELIGIBLE’—the property qualified as a rural area. That single confirmation gave us confidence to pursue USDA financing seriously and invest time in the application process.”

Income eligibility verification—another critical requirement:

USDA loans include household income limits that ensure the program serves low-to-moderate income families rather than high earners who can afford conventional financing without assistance. Income limits vary by county based on local median incomes and household size. For Broward County with a 2-person household (Daniel and Ashley):

Income eligibility verification:

- Maximum income limit (Broward County, 2-person household): Approximately $103,500 annually (varies by year, confirmed with lender)

- Daniel’s electrician income: $54,000 annually

- Ashley’s school district income: $42,000 annually

- Combined household income: $96,000 annually

- Income eligibility status: QUALIFIED (comfortably below $103,500 maximum threshold)

“The income limit initially worried us slightly—we didn’t want to earn ‘too much’ to qualify, though obviously earning more would be nice for financial security,” Daniel explained. “Our $96,000 combined put us comfortably within the $103,500 limit for Broward County with our 2-person household. The USDA loan officer explained that the program is designed to serve families earning decent middle-class incomes who are financially stable but don’t have capacity to save huge down payments quickly—exactly our situation. We weren’t struggling financially, but we also weren’t high earners who could easily save $20,000 for down payments while paying expensive South Florida rent. We were exactly the target demographic USDA wants to serve: stable moderate income, creditworthy, responsible, but needing zero-down assistance to achieve homeownership in rural communities.”

Experiencing similar down payment barriers despite stable income? Schedule a call to discuss USDA loan qualification and property eligibility.

How Did Daniel and Ashley Discover USDA Loans and Verify Their Eligibility?

After Ashley’s father mentioned “zero-down government loans for rural areas” during their family conversation about homeownership frustrations, Ashley dedicated an evening to thorough online research. She discovered the USDA Single Family Housing Guaranteed Loan Program (commonly called USDA loans or Rural Development loans)—a federal program administered by the U.S. Department of Agriculture specifically designed to promote homeownership in rural and suburban communities by offering 100% financing with competitive terms to qualified buyers.

“I was honestly skeptical initially when researching—zero-down government loans sounded almost too good to be true, like it must have major catches or hidden problems,” Ashley said candidly. “But researching on the official USDA.gov website confirmed it’s a completely legitimate, well-established federal program that’s been successfully helping families achieve rural homeownership for decades. The program made perfect policy sense when I understood the rationale—the federal government wants to promote homeownership in rural communities to support economic development, maintain population sustainability, preserve community character, and ensure rural areas remain vibrant rather than declining as everyone moves to expensive cities. Offering 100% financing removes the primary barrier—down payment savings—preventing moderate-income families from choosing to live in rural communities. It’s smart policy that benefits both borrowers and rural community development.”

Ashley used the USDA property eligibility tool available free online to check whether the Southwest Ranches home they loved would qualify for USDA financing. When the tool immediately returned “ELIGIBLE” confirmation, she felt tremendous excitement and relief—their dream home qualified for zero-down financing. She immediately shared the discovery with Daniel, and together they scheduled consultations with two USDA-approved lenders to explore their qualification likelihood and understand the application process requirements.

“The USDA lenders we consulted were highly experienced with the program and immediately confirmed that Southwest Ranches commonly qualifies for USDA despite being relatively close to Fort Lauderdale,” Daniel explained about their initial consultations. “They explained that ‘rural’ under USDA definitions isn’t just remote farmland hours from anywhere—it includes many suburban and semi-rural communities within reasonable commuting distance of urban centers, as long as those communities maintain lower population density, semi-rural character, and sit outside densely populated urban cores. Southwest Ranches perfectly fit those criteria. The lenders walked us through income limits, property requirements, credit standards, documentation needs, and the application timeline. Everything indicated we’d qualify based on our preliminary information—our $96,000 income was safely within limits, our credit scores of 698 and 682 significantly exceeded the 640 minimum, we had stable multi-year employment histories, and the property clearly qualified as USDA-eligible based on the eligibility map confirmation.”

The lenders explained honestly that USDA loans require slightly more documentation and modestly longer processing timelines than conventional loans because every application must receive USDA review and approval beyond standard lender underwriting—but the zero-down benefit and competitive terms more than justified the modest additional timeline and documentation requirements. They estimated 45-50 days from completed application to closing—slightly longer than conventional loans that might close in 30-40 days, but absolutely acceptable given the substantial financial benefits of zero-down 100% financing.

“We were completely willing to wait an extra 10-15 days for processing if it meant purchasing our home with zero down payment rather than waiting another full year or more to save additional $10,000+ for conventional down payment requirements,” Ashley said emphatically. “The timeline seemed very reasonable given the complexity of government program approval processes, and the lenders explained that most of the additional time came from USDA’s review and conditional commitment process—steps necessary for program integrity to ensure properties truly qualify and borrowers meet income limits. We appreciated that thoroughness because it demonstrated the program’s legitimacy and proper oversight rather than being a questionable scheme.”

What Documentation Was Required for Daniel and Ashley’s USDA Loan Application?

Daniel and Ashley worked closely with their chosen USDA loan specialist to assemble comprehensive documentation demonstrating their income eligibility within USDA limits, creditworthiness, employment stability, capacity to afford mortgage payments, and property qualification under program rules.

Comprehensive documentation provided:

Income verification (absolutely critical for USDA income limit compliance):

- Daniel’s income: Two complete years of W-2 wage statements ($54,000 annual electrician salary)

- Daniel’s income: Two complete years of federal tax returns (Forms 1040)

- Daniel’s income: Most recent 30 days of pay stubs showing year-to-date earnings

- Daniel’s employment: Written verification letter from commercial electrical contractor confirming position, salary, hire date, employment status

- Ashley’s income: Two complete years of W-2 statements ($42,000 annual school district salary)

- Ashley’s income: Two complete years of federal tax returns

- Ashley’s income: Most recent 30 days of pay stubs with year-to-date totals

- Ashley’s employment: Written verification letter from school district HR confirming position, salary, tenure, employment status

- Combined household income calculation: $96,000 annually

- Broward County USDA income limit verification: ~$103,500 maximum for 2-person household

- Income qualification status: VERIFIED AND APPROVED (comfortably below maximum threshold)

Credit reports and financial documentation:

- Daniel’s credit report: 698 credit score with perfect payment history across all accounts

- Ashley’s credit report: 682 credit score with perfect payment history

- Joint bank statements: Last 2 months showing $8,500 in verified savings (down payment not needed but demonstrates financial stability and capacity for closing costs)

- Retirement account statements: Not required but provided showing modest 401(k) balances demonstrating long-term financial planning

- No outstanding collections, judgments, or derogatory credit items

- No late payments on any accounts within past 24 months

- Student loan payments: Both in good standing with on-time payment histories

Employment history and stability documentation:

- Daniel: 5 years continuous employment history as licensed electrician (career progression demonstrating stability)

- Ashley: 6 years continuous employment with same school district (excellent job security and stability)

- Both: Career fields offering strong long-term income potential and stability (electricians and school district employees)

- Both: No recent job changes or employment gaps suggesting instability

Rental payment history (demonstrating housing payment reliability):

- Three full years of rental payment history verified through landlord written statements

- Perfect on-time payment record with zero late or missed payments

- Current rent amount: $2,100 monthly (demonstrating ability to afford similar mortgage payments)

- No evictions, payment disputes, or negative rental history

Property-specific documentation:

- Executed purchase contract: Southwest Ranches home at $295,000 purchase price

- Property address: Verified as USDA-eligible using official USDA eligibility map tool

- Homeowners insurance quote: Coverage meeting USDA and lender requirements

- Property appraisal: Ordered during process, completed by USDA-approved appraiser

- Property inspection: Not required by USDA but recommended and completed (home in excellent condition)

USDA program-specific documentation:

- Income eligibility affidavit: Signed statement confirming household income and composition

- Property eligibility verification: Official USDA map confirmation showing eligible rural area designation

- Primary residence certification: Sworn statement that property will be owner-occupied as primary residence (not investment property)

- U.S. citizenship or legal permanent residency verification: Both provided through documentation

The comprehensive approval timeline and process:

- Initial consultation with USDA lender (Day 1) – Discussed USDA loan benefits, requirements, qualification likelihood

- Property eligibility verification (Days 2-3) – Confirmed Southwest Ranches address qualified on USDA eligibility map

- Pre-approval application submission (Day 5) – Submitted comprehensive income, credit, employment, asset documentation

- Income eligibility detailed review (Days 6-10) – Lender meticulously verified $96,000 combined income qualified within $103,500 Broward County limit (most scrutinized aspect given income limits’ importance)

- Credit report review and analysis (Days 11-12) – Confirmed credit scores 698/682 exceeded 640 minimum, verified perfect payment histories

- Employment stability verification (Days 13-15) – Confirmed 5-6 year stable employment histories through employer verification letters

- Asset and reserves verification (Days 16-17) – Confirmed $8,500 savings adequate for closing costs (down payment not required)

- Rental payment history verification (Days 18-19) – Verified 3 years perfect on-time rent payments through landlord statements

- Lender pre-approval issued (Day 20) – Approved for USDA financing up to $310,000 based on income, credit, assets, employment

- Purchase contract formal submission (Day 22) – Submitted executed Southwest Ranches purchase contract to lender

- Property appraisal ordered (Day 24) – USDA-approved appraiser scheduled to evaluate property

- Property appraisal completed (Day 31) – Home appraised at full $295,000 purchase price (met value requirement)

- USDA conditional commitment request (Day 33) – Lender submitted complete file to USDA for government review and approval

- USDA conditional commitment received (Day 42) – USDA reviewed complete application and issued conditional approval (longest part of process but critical government approval step)

- Final lender underwriting completed (Days 43-48) – Lender completed comprehensive final underwriting analysis

- Clear to close issued (Day 49) – All conditions satisfied, final approval granted

- Closing scheduled and completed (Day 52) – Successfully funded and closed USDA loan with zero down payment

The lender and USDA jointly approved Daniel and Ashley’s USDA loan based on their carefully documented combined $96,000 household income that qualified comfortably within Broward County’s ~$103,500 income limit for 2-person households (most critical qualifying factor), excellent credit scores of 698 and 682 significantly exceeding 640 minimum requirements with perfect payment histories demonstrating financial responsibility, stable 5-6 year employment histories in careers offering strong income security and growth potential, sufficient $8,500 savings demonstrating financial discipline and capacity for closing costs, three years of perfect rental payment history proving reliable housing obligation management, property location definitively verified as USDA-eligible rural area through official designation, property appraisal at purchase price confirming value, and overall low-risk borrower profile as responsible first-time homebuyers with stable moderate income choosing to invest in rural community homeownership.

“The approval process was admittedly thorough and detailed, but everything felt completely reasonable and appropriate for a government-backed zero-down financing program,” Daniel said reflectively. “The most heavily scrutinized aspect was our income qualification—they needed extensive documentation proving our $96,000 combined income qualified within USDA limits since income eligibility is absolutely fundamental to program integrity. They verified our employment histories carefully to ensure income stability. They checked our credit meticulously and confirmed perfect payment histories. They verified the property qualified under USDA geographic eligibility rules. Everything was professional, organized, and moved steadily forward. We closed in 52 days total from initial application—slightly longer than conventional loans but absolutely acceptable given we were getting zero-down 100% financing. The modest extra time was completely worth it.”

The USDA’s 1% upfront guarantee fee (approximately $2,950 calculated on their loan amount) was financed directly into their loan balance rather than required as cash at closing—further reducing their out-of-pocket cash needs and making the transaction achievable with their $8,500 savings. Additionally, Daniel and Ashley successfully negotiated $4,000 in seller credits toward their closing costs during purchase contract negotiations, reducing their net out-of-pocket cash needed to approximately $4,500 at closing—well within their $8,500 savings while leaving $4,000 remaining for moving expenses, immediate home needs, furniture, and maintaining emergency reserves.

“Being able to finance the USDA guarantee fee into our loan balance rather than paying it upfront in cash was absolutely crucial for our transaction’s feasibility,” Ashley emphasized. “Instead of needing to pay the $2,950 guarantee fee upfront plus $8,500 in closing costs (total $11,450 in cash required), we financed the fee and negotiated $4,000 seller credits—reducing our actual closing cash to only about $4,500. That was easily manageable from our $8,500 savings while leaving us $4,000 for moving costs, immediate home purchases like window treatments and lawn equipment, and maintaining reasonable emergency reserves. Without USDA’s zero-down structure and the ability to finance fees while negotiating seller credits, this entire transaction would have been completely impossible on our savings and income level.”

Ready to purchase with USDA zero-down financing? Submit a purchase inquiry to discuss your property eligibility and income qualification.

What Were the Final Results of Daniel and Ashley’s USDA Loan Home Purchase?

Daniel and Ashley successfully closed on their Southwest Ranches home using USDA 100% financing, achieving homeownership approximately 12-18 months earlier than conventional or FHA programs would have enabled given their savings constraints—a timeline acceleration that saved them $25,000-$38,000 in rent payments while locking in purchase price before further appreciation.

Final USDA loan transaction details:

- Purchase price: $295,000

- Down payment required: $0 (100% financing—zero down payment)

- USDA upfront guarantee fee: $2,950 (1% of loan amount, financed into loan balance)

- Final loan amount: $297,950 (includes purchase price plus financed guarantee fee)

- Competitive USDA loan interest rates -Try this USDA Loan Calculator to explore current scenarios

- Seller credits negotiated: $4,000 (applied toward closing costs)

- Actual cash needed at closing: $4,500 (closing costs minus seller credits)

- Funds used from savings: $4,500 from their $8,500 total savings

- Remaining savings after closing: $4,000 (preserved for moving expenses, immediate home needs, emergency reserves)

- Property type: 3-bedroom, 2-bathroom single-family home

- Property features: Quarter-acre lot, Southwest Ranches, FL, excellent schools, quiet family community

- Total application to closing timeline: 52 days

Comprehensive comparison to alternative financing approaches:

USDA loan (actual result achieved):

- Down payment required: $0 (0%)

- Cash needed at closing: $4,500 (after $4,000 seller credits)

- Loan amount: $297,950 (100% financing plus financed guarantee fee)

- Monthly USDA annual fee: 0.35% (approximately $87 monthly, lower than FHA insurance)

- Timeline to homeownership: Immediate (52 days from application to closing)

- Remaining savings after closing: $4,000 (preserved for moving and reserves)

- Rent avoided while saving: $0 (purchased immediately)

Conventional loan alternative (3% down):

- Down payment required: $8,850 (3% of $295,000)

- Total cash needed: $17,850-$19,850 (including closing costs)

- Additional savings required beyond their $8,500: $9,350-$11,350

- PMI requirement: Ongoing monthly private mortgage insurance until 20% equity reached (approximately $150-175/month)

- Timeline to homeownership: Additional 12-18 months saving required at $600-800/month rate

- Remaining savings: $0 (completely depleted by down payment and closing costs)

- Additional rent paid while saving: $25,200-$37,800 (12-18 months at $2,100/month, building zero equity)

FHA loan alternative (3.5% down):

- Down payment required: $10,325 (3.5% of $295,000)

- Total cash needed: $18,325-$20,325 (including closing costs)

- Additional savings required: $9,825-$11,825 beyond their $8,500

- MIP requirement: FHA mortgage insurance 0.55-0.85% annually ($135-210/month, permanent for life of loan if less than 10% down)

- Timeline to homeownership: Additional 12-18 months saving required

- Remaining savings: $0 (completely depleted)

- Additional rent paid while saving: $25,200-$37,800 (zero equity building)

“The USDA loan enabled our immediate homeownership versus facing another 12-18 months of saving additional funds for conventional or FHA down payment requirements,” Daniel explained with deep satisfaction and relief. “With our carefully accumulated $8,500 savings, $4,000 in negotiated seller credits, and USDA’s zero-down 100% financing structure, we had exactly what we needed to close on our dream home. We preserved $4,000 in remaining savings for moving costs, immediate home needs like window treatments and lawn equipment, and maintaining emergency reserves rather than completely depleting every dollar. Conventional or FHA financing would have required saving another $9,000-$11,000 beyond what we had—another full year or more of aggressive saving while throwing away $25,000+ in rent payments and watching home prices continue rising throughout South Florida. That year saved through USDA financing is literally worth tens of thousands of dollars in rent avoided, equity building we started immediately, and purchase price we locked in before further appreciation. USDA made an absolutely transformational difference in our financial trajectory and family’s future.”

Daniel and Ashley moved into their Southwest Ranches home within three weeks of closing, immediately transforming their family’s housing stability, financial trajectory, and quality of life. The three-bedroom, two-bathroom layout provided perfect space for their current needs plus room for starting their family within the next few years as they’d hoped and planned. The quarter-acre lot gave them substantial outdoor space for gardening, a future dog, children’s play equipment, and outdoor entertaining—space that would be impossible to afford in expensive urban Fort Lauderdale areas. The excellent school district positioned them perfectly for their future children’s education. The quiet, family-friendly Southwest Ranches community offered the safety, neighbors, and lifestyle they’d specifically chosen over urban alternatives.

“Homeownership through USDA financing changed absolutely everything for our family’s future trajectory,” Ashley said with visible emotion. “We’re building equity through every monthly mortgage payment and home appreciation rather than enriching landlords through rent payments building zero equity. Our housing cost is essentially fixed through our mortgage while rents continue rising 5-8% annually throughout South Florida. We have permanence, stability, and roots in a community we deliberately chose for starting our family. The excellent schools are perfect for our future children. We have space, privacy, and a yard on our quarter-acre lot—impossible to find or afford in expensive urban areas. We have pride of ownership and investment in our home and community. And we achieved all of this literally years earlier than we’d thought possible—specifically and entirely because the USDA loan program eliminated down payment barriers and made homeownership achievable on our moderate $96,000 income with our $8,500 in carefully accumulated savings.”

Monthly housing cost detailed comparison and wealth-building impact:

Previous rental situation:

- Monthly rent payment: $2,100

- Annual housing cost: $25,200

- Equity building: $0 (rent builds zero ownership or equity)

- Tax benefits: None (renters cannot deduct housing costs)

- Wealth building: Zero (money spent, never recovered)

Current homeownership with USDA loan:

- Monthly mortgage payment (PITI + USDA fee): Approximately $2,150 (very comparable to previous rent)

- Annual housing cost: Approximately $25,800 (similar to renting)

- Equity building: $600-800 monthly through principal paydown PLUS home appreciation

- Tax benefits: Mortgage interest deduction, property tax deduction (thousands in annual tax savings)

- Forced savings: Equity accumulation with every payment building real wealth

- Net wealth-building benefit: $8,000-$10,000 annually in equity versus $0 when renting

“Our monthly housing cost is almost identical to our previous rent—we’re paying about $2,150 monthly for mortgage, taxes, insurance, and USDA annual fee compared to $2,100 in rent,” Daniel explained enthusiastically. “But the economic difference is absolutely transformational. Every mortgage payment builds equity—we’re paying down principal while benefiting from home appreciation. We’re building approximately $8,000-$10,000 in equity this first year alone through our monthly principal payments plus modest appreciation. Over five years, that will be $40,000-$50,000 in wealth we’re building versus throwing away $126,000 in rent payments ($25,200 annually for 5 years) building absolutely zero equity or wealth. We’re saving thousands annually in income taxes through mortgage interest and property tax deductions. That’s the fundamental difference between renting and homeownership—similar monthly costs but completely different wealth-building outcomes. USDA financing made that wealth-building accessible to us years earlier than we could have achieved otherwise.”

Daniel and Ashley view their Southwest Ranches home as the essential foundation for their family’s long-term wealth building, financial security, and generational wealth creation. As their careers progress and incomes grow—Daniel advancing toward master electrician certifications commanding higher rates and Ashley progressing in school district administration—their fixed mortgage payment becomes increasingly affordable as a percentage of rising income while their equity position grows steadily through both appreciation and principal paydown. When they’re ready to upgrade to a larger home as their family grows, purchase investment property to build rental income, or access capital for other purposes, they can leverage their equity through a USDA refinance or use a HELOC or Home Equity Loan to access accumulated equity while potentially maintaining their favorable first mortgage rate.

“The absolutely best part of this entire experience is knowing we made homeownership possible through a federal program specifically designed to help working families like ours succeed,” Ashley concluded with pride. “USDA loans exist because the federal government recognizes that young families in rural and suburban communities face down payment barriers to homeownership despite having stable incomes, good credit, and financial responsibility—exactly our situation. The zero-down 100% financing structure, competitive interest rates, lower mortgage insurance costs compared to FHA, and income-qualified focus made the critical difference between indefinite renting and achieving homeownership. We’re building wealth, providing stability for our growing family, investing in our deliberately chosen community, and living the American Dream of homeownership—all made possible because USDA financing was specifically designed to promote homeownership in rural America for families exactly like ours earning moderate incomes and contributing to rural community vitality.”

Ready to achieve homeownership with USDA zero-down financing? Get approved or schedule a call to discuss USDA loan qualification, property eligibility, and income limits.

What Can First-Time Home Buyers Learn from Daniel and Ashley’s USDA Loan Success?

- USDA loans offer true 100% financing (zero down payment required) for eligible properties located in qualified USDA-designated rural and suburban areas—Daniel and Ashley purchased their $295,000 home with $0 down payment (USDA Rural Development program information)

- Property must be located in USDA-eligible rural area—always verify using free online USDA eligibility map before pursuing USDA financing—Southwest Ranches qualified despite being only 30 minutes from Fort Lauderdale because it maintains lower density and rural character

- Household income limits apply ensuring program serves low-to-moderate income families—their $96,000 combined income qualified comfortably within Broward County’s ~$103,500 limit for 2-person households

- 1% upfront USDA guarantee fee can be financed into loan balance—dramatically reduces cash needed at closing versus paying $2,950 upfront

- USDA annual fee 0.35% is significantly lower than FHA mortgage insurance 0.55-0.85%—saves $50-$150+ monthly compared to FHA financing with similar low-down-payment structure

- Minimum credit score typically 640 required—both Daniel (698) and Ashley (682) exceeded this threshold comfortably, but 640+ is generally sufficient with strong compensating factors

- Processing timeline typically 45-55 days due to required USDA review and conditional commitment—modestly longer than conventional 30-40 days but absolutely worth the wait for zero-down benefit eliminating years of additional down payment savings

Have questions about USDA loan qualification, property eligibility, or income limits? Schedule a call with an experienced USDA loan advisor today.

Alternative Loan Programs for First-Time Home Buyers

If a USDA loan isn’t the perfect fit for your specific situation, consider these alternative first-time buyer financing options:

- FHA Loan – 3.5% down payment for borrowers with 580+ credit scores, works in all geographic areas (not limited to rural locations like USDA)

- Conventional Loan – 3% down payment options available for qualified first-time buyers through HomeReady and Home Possible programs

- VA Loan – 0% down payment for eligible veterans, active-duty military, and qualifying spouses

- Down Payment Assistance – State and local government programs providing grants or forgivable loans for down payment and closing costs

- Section 184 Loan – 2.25% minimum down payment for enrolled Native Americans purchasing on or off tribal lands

- Conventional 97 – 3% down conventional loan option through Fannie Mae/Freddie Mac programs

Explore all available loan programs to find your optimal financing solution.

Want to assess your complete homeownership readiness and explore which programs fit your situation best? Take our discovery quiz to clarify your goals, timeline, and next steps.

Helpful USDA Loan Resources and Tools

Learn more about USDA loan program:

- Complete USDA Loan Guide – Comprehensive requirements, benefits, and qualification guidelines for 100% financing in rural areas

- USDA Loan Calculator – Estimate monthly payments with zero down payment structure

- USDA Property Eligibility Map – Official USDA tool to verify if specific properties qualify as eligible rural areas

Similar USDA loan success stories:

- USDA loan refinance for payment optimization – Converting FHA to USDA for lower costs

- USDA cash-out refinance for home improvements – Accessing equity in rural properties

- USDA construction loan for custom building – Building new homes with zero down

- Browse all case studies organized by journey stage and profession

External authoritative resources:

- USDA Rural Development Single Family Housing Programs – Official government program information and resources

- USDA Property Eligibility Tool – Official map to check if properties qualify for USDA financing

- USDA Income Eligibility Guidelines by County – Verify household income limits for your specific county and household size

- CFPB Complete Homebuying Guide – Consumer Financial Protection Bureau resources and protections

Ready to take action toward USDA-financed homeownership?

- Apply online now – Start your USDA loan application process

- Schedule personal consultation – Discuss your specific property eligibility, income qualification, and timeline

- Take homeownership discovery quiz – Explore your complete homeownership and wealth-building goals and strategy

Need local expertise and connections? Get introduced to trusted partners including USDA-approved lenders, rural area real estate specialists, and mortgage professionals experienced with zero-down rural financing.

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Not Sure About Your Next Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required