Conventional Loan: 7 Essential Requirements Every Home Buyer Should Know

How a Conventional Loan Offers Competitive Financing for Qualified Borrowers

Conventional mortgages remain the most widely used home financing option, offering competitive terms for borrowers with established credit and stable income. These loans follow guidelines set by Fannie Mae and Freddie Mac, providing standardized qualification criteria and flexible down payment options. Whether you’re a first-time buyer or experienced homeowner, understanding conventional loan parameters helps you determine if this mainstream financing path aligns with your purchase or refinance goals.

Key Details: What You’ll Learn About Conventional Loans

- A conventional loan is not government-backed and follows guidelines established by Fannie Mae and Freddie Mac for standardized qualification criteria (Fannie Mae conventional loan guidelines)

- Borrowers with stable employment, documented income, and solid credit profiles access competitive market rates through conventional loan programs (CFPB conventional mortgage information)

- Property types including primary residences, second homes, and investment properties qualify under a conventional loan structure

- Credit score thresholds and equity contribution requirements vary based on property type and borrower qualifications (Federal Housing Finance Agency conventional loan standards)

- A conventional loan accommodates first-time buyers, repeat purchasers, and experienced investors with documented qualifying capacity

- Private mortgage insurance requirements apply when equity contributions fall below specific thresholds, but can be removed once equity positions improve

- Conforming loan limits adjust annually based on housing market trends, with higher limits available in designated high-cost areas (FHFA conforming loan limits)

Ready to explore your options? Schedule a call with a loan advisor.

What Is a Conventional Loan?

A conventional loan represents the most common mortgage type in the United States, accounting for the majority of home purchase financing. Unlike government-backed programs such as FHA, VA, or USDA loans, a conventional loan operates without federal insurance or guarantees.

Fannie Mae and Freddie Mac—government-sponsored enterprises established to provide liquidity in the mortgage market—purchase conventional loans from lenders and establish the underwriting guidelines that define qualification standards. These standardized guidelines create consistency across the lending industry, enabling competitive pricing and broad availability.

How does a conventional loan differ from government programs? The fundamental distinction lies in the risk assumption and insurance structure. Government-backed loans include federal insurance protecting lenders against borrower default, enabling more flexible qualification standards. A conventional loan requires lenders to assess risk independently (or through private mortgage insurance), resulting in stricter qualification criteria but often more competitive costs for well-qualified borrowers.

The conventional loan market offers flexibility across property types, loan amounts, and borrower situations while maintaining consistent underwriting standards that protect both lenders and borrowers through sustainable lending practices.

Who Benefits Most from a Conventional Loan?

Several borrower profiles find exceptional value in conventional loan structures. These programs serve individuals with established credit, stable income, and sufficient resources for competitive homeownership.

First-time home buyers with solid financial profiles represent a significant portion of conventional loan borrowers. If you’ve built good credit, maintained stable employment, and saved for a meaningful equity contribution, a conventional loan often provides the most competitive financing available for your first home purchase.

Repeat buyers and move-up purchasers frequently prefer conventional loan financing when transitioning between properties. Established homeowners typically have equity from previous properties, strong credit histories from mortgage payment experience, and stable income documentation—all factors that optimize conventional loan qualification and pricing.

Investment property buyers building rental portfolios find conventional loan programs accommodate investment properties with competitive structures. While government programs restrict usage to primary residences, a conventional loan extends to investment properties with appropriate qualification adjustments.

High-income borrowers purchasing above conforming loan limits in expensive markets access jumbo conventional loan programs offering competitive rates without government program restrictions. These programs serve luxury home buyers and high-cost area purchasers needing larger loan amounts.

Borrowers seeking PMI removal flexibility appreciate conventional loan structures allowing private mortgage insurance cancellation once equity reaches specific thresholds. Unlike government programs with mortgage insurance for the loan’s life, a conventional loan provides paths to eliminate insurance costs as equity builds.

Explore all loan programs to understand your full range of options.

What Are the Requirements for a Conventional Loan?

Understanding the specific qualification criteria helps you assess whether a conventional loan fits your financial profile. While requirements vary slightly between lenders, Fannie Mae and Freddie Mac guidelines establish baseline standards across the industry.

Credit score minimums – Most conventional loan programs require credit scores of at least 620 for approval, though stronger scores (700+) provide access to optimal pricing and program flexibility. Your credit history demonstrates financial responsibility and payment reliability to lenders.

Income documentation standards – A conventional loan requires verifiable income through W-2 forms, tax returns, pay stubs, or alternative documentation for self-employed borrowers. Lenders evaluate income stability, continuity likelihood, and qualifying capacity using standardized debt-to-income ratio calculations.

Equity contribution expectations – Minimum required contributions vary based on property type and borrower qualifications. Primary residences may require as little as 3% for qualified first-time buyers or 5% for repeat purchasers. Investment properties typically require 15-25% depending on the specific property and borrower profile.

Employment history verification – Most programs require demonstrating two years of employment history, preferably within the same field or industry. Recent job changes within your profession typically don’t disqualify you, but career field transitions may require additional explanation or documentation.

Debt-to-income ratio limits – Conventional loan guidelines establish maximum debt-to-income ratios—typically 43-50%—though specific limits vary based on compensating factors including credit scores, reserves, and equity contributions. Your total monthly debt obligations divided by gross monthly income must fall within acceptable parameters.

Reserve requirements – Depending on your equity contribution, credit profile, and property type, lenders may require demonstrating liquid reserves covering several months of housing expenses after closing. Investment properties typically carry higher reserve requirements than primary residences.

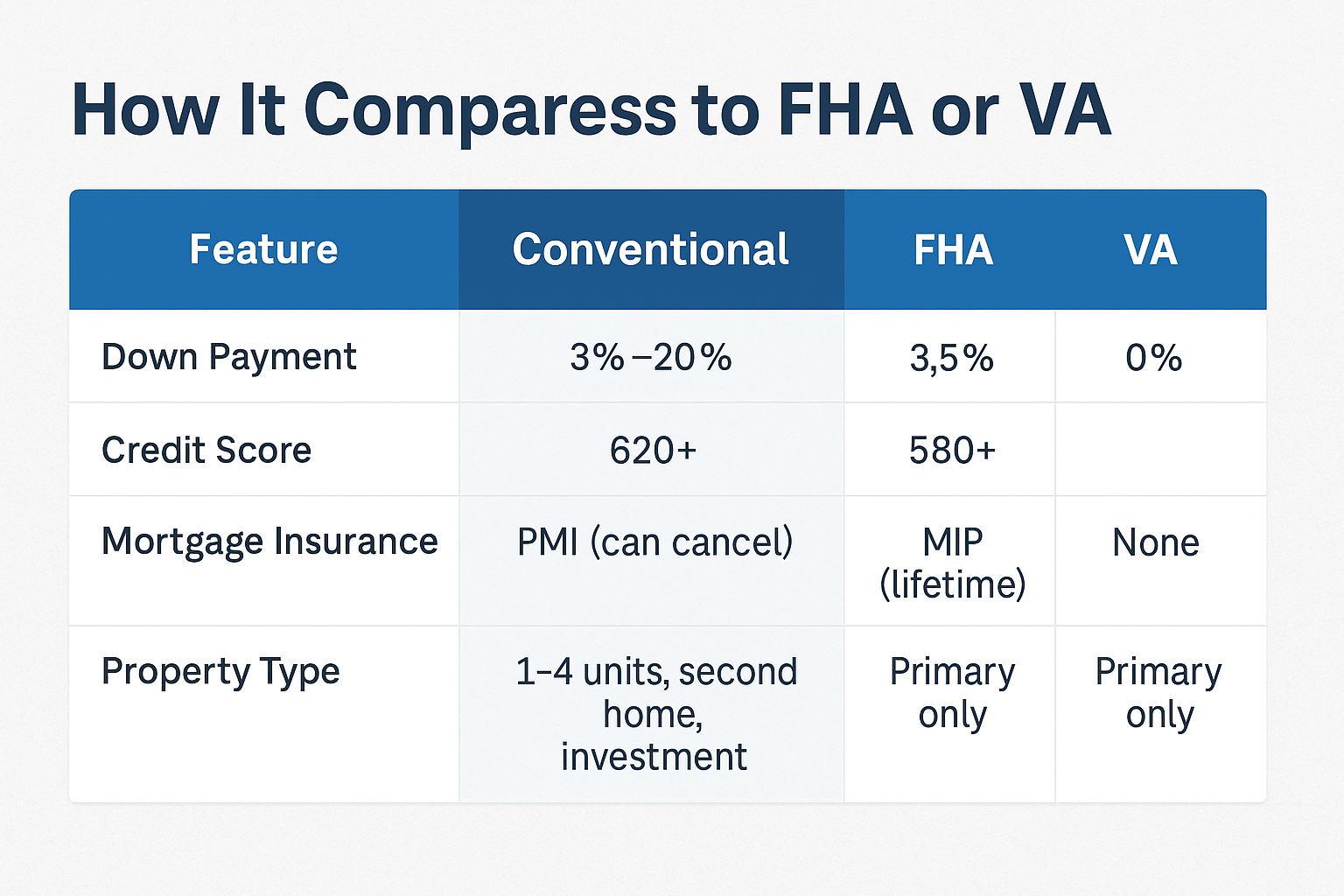

How Does a Conventional Loan Differ from Government-Backed Programs?

The fundamental distinction lies in the insurance structure, qualification flexibility, and program restrictions. Understanding these differences helps you select the optimal financing approach for your situation.

FHA loans vs conventional loan:

- FHA requires lower credit scores (often 580 minimum)

- FHA accepts smaller equity contributions (as low as 3.5%)

- FHA includes mandatory mortgage insurance for the loan’s life

- FHA limits to primary residences only

- FHA requires property meeting specific condition standards

- A conventional loan often provides lower overall costs for well-qualified borrowers

VA loans vs conventional loan:

- VA serves eligible military veterans and service members only

- VA offers zero-equity-contribution options for qualified veterans

- VA includes funding fees but no monthly mortgage insurance

- VA limits to primary residences with occupancy requirements

- A conventional loan accommodates non-military borrowers and investment properties

USDA loans vs conventional loan:

- USDA serves rural property purchases only with income limits

- USDA offers zero-equity-contribution rural homeownership programs

- USDA includes upfront and annual guarantee fees

- USDA requires property in eligible rural designations

- A conventional loan works anywhere without rural location restrictions

Why choose a conventional loan over government programs? Well-qualified borrowers often find conventional loan financing provides superior overall value through competitive rates, lower mortgage insurance costs, flexible property eligibility, and paths to eliminate insurance once equity builds. Government programs serve specific purposes but may not optimize costs for borrowers meeting conventional loan standards.

Ready to discuss your purchase scenario? Submit a purchase inquiry to explore your options.

What Property Types Qualify for a Conventional Loan?

A conventional loan program accommodates diverse property categories and ownership purposes. Understanding eligibility across different property types helps you plan your real estate strategy.

Primary residences:

- Single-family detached homes

- Townhomes and row houses

- Condominiums in approved developments

- Planned unit developments (PUDs)

- Manufactured homes meeting specific criteria

- Co-operative apartments in some markets

Second homes and vacation properties:

- Properties in resort or recreational areas

- Seasonal residences for periodic use

- Homes in different climates for seasonal living

- Properties meeting occupancy and distance requirements

- Vacation condos in approved developments

Investment properties:

- Single-family rental homes

- Multi-unit properties (2-4 units)

- Condominiums purchased for rental income

- Properties in diverse geographic locations

- Vacation rentals in approved areas

What about property condition requirements? A conventional loan requires properties meeting basic safety, soundness, and livability standards. Homes must have functioning systems including heating, plumbing, electrical, and roofing without immediate safety hazards. Properties requiring significant repairs may need renovation financing or alternative programs.

Are there location restrictions? A conventional loan works in all 50 states including urban centers, suburban communities, small towns, and many rural areas. Unlike USDA loans with rural requirements or VA loans with certificate of reasonable value processes, conventional loan programs impose minimal location-based restrictions.

See how other borrowers have successfully used conventional financing:

What Is Private Mortgage Insurance and How Does It Work?

Private mortgage insurance (PMI) represents a critical component of conventional loan structures when equity contributions fall below specific thresholds. Understanding PMI costs, requirements, and removal options helps you evaluate total financing costs.

When does PMI apply to a conventional loan? Lenders require private mortgage insurance when your equity contribution is less than 20% of the property value. This insurance protects lenders against potential losses if you default on the loan, enabling them to offer competitive financing despite lower initial equity positions.

How much does PMI cost? Private mortgage insurance typically ranges from 0.3% to 1.5% of your loan amount annually, depending on your credit score, equity contribution, and loan characteristics. This cost translates to monthly additions to your mortgage payment. A loan amount with modest PMI rates might add moderate monthly costs to your housing expenses.

Can you remove PMI from a conventional loan? Yes—this represents a significant advantage over government loan programs. Once your loan balance decreases to 80% of the original property value through scheduled payments or value appreciation, you can request PMI cancellation. At 78% loan-to-value, automatic termination requirements typically apply.

Are there alternatives to monthly PMI? Some conventional loan programs offer lender-paid mortgage insurance (LPMI) where the lender covers insurance costs in exchange for a slightly higher interest rate. This approach eliminates monthly PMI payments but embeds insurance costs in your permanent rate. Other borrowers make larger initial equity contributions specifically to avoid PMI entirely.

Does PMI apply to all conventional loan scenarios? Investment property financing often uses different insurance structures or pricing adjustments rather than traditional PMI. Second home purchases may have different PMI rates than primary residences. High-balance conventional loans sometimes incorporate alternative insurance or pricing approaches.

Calculate your conventional loan scenarios:

What Documentation Does a Conventional Loan Require?

Understanding the specific documentation requirements helps you prepare for a smooth application process. A conventional loan follows standardized verification procedures ensuring consistent qualification across the lending industry.

Required documentation typically includes:

- W-2 forms from the most recent two years

- Pay stubs covering the most recent 30-60 days

- Personal tax returns for the past two years

- Bank statements covering the most recent 2-3 months

- Identification documents including driver’s license or passport

- Credit report authorization

- Property appraisal documentation

- Homeowner’s insurance information

- Purchase contract for the subject property

- Gift letters if using gift funds for equity contribution

How do self-employed borrowers document income? Self-employment income requires business tax returns (typically two years), profit and loss statements, and verification of business continuity. The complexity increases compared to W-2 income verification, but a conventional loan accommodates self-employed borrowers meeting documentation standards.

What about down payment source verification? Lenders verify that equity contribution funds come from acceptable sources including savings, investment accounts, gift funds from family members, or proceeds from property sales. Large deposits in your accounts within recent months require explanation and documentation to ensure funds don’t represent undisclosed loans.

Do you need to explain credit inquiries or recent financial changes? Any significant financial events including job changes, large purchases, new credit accounts, or unusual deposits may require written explanations. Lenders want to understand your complete financial picture to assess stability and commitment to the mortgage obligation.

Common Conventional Loan Questions

Can you buy investment properties with a conventional loan?

Yes, a conventional loan accommodates investment property purchases with appropriate qualification adjustments. Lenders typically require larger equity contributions (often 15-25%), higher credit scores, and additional reserves compared to primary residence financing. The rental income potential may factor into qualification when you can document rental history or provide lease agreements.

Investment property conventional loan programs enable portfolio building for real estate investors without the primary residence restrictions that limit government programs. Whether purchasing single-family rentals, multi-unit properties, or vacation rentals, conventional loan financing provides accessible investment property funding.

How do debt-to-income ratios affect qualification?

Your debt-to-income ratio represents your total monthly debt obligations divided by gross monthly income. A conventional loan typically requires ratios below 43-50%, though specific limits vary based on compensating factors. Stronger credit scores, larger equity contributions, and substantial reserves may enable qualification with higher debt ratios.

Debts included in ratio calculations:

- Proposed mortgage principal, interest, taxes, and insurance

- Existing mortgage obligations on other properties

- Auto loans and personal loans

- Credit card minimum payments

- Student loan obligations

- Alimony or child support payments

What if you have gaps in employment history?

Employment gaps require explanation but don’t automatically disqualify you from a conventional loan. Acceptable gaps include education, medical leave, maternity or paternity leave, or temporary layoffs with subsequent re-employment. The key is demonstrating current stable employment and explaining that gaps don’t indicate ongoing employment instability.

Recent graduates entering the workforce with limited employment history can qualify through a conventional loan when they’ve secured positions in their field of study. The education period explains the employment gap, and your new position provides qualifying income.

Can you qualify immediately after bankruptcy or foreclosure?

A conventional loan requires specific waiting periods after major credit events. Chapter 7 bankruptcy typically requires a four-year waiting period from discharge date, while Chapter 13 bankruptcy may permit qualification two years after discharge with demonstrated credit recovery. Foreclosures generally require seven-year waiting periods, though extenuating circumstances may reduce these timeframes.

How Do Conventional Loan Rates Compare to Other Programs?

Understanding the pricing framework helps you evaluate whether a conventional loan provides competitive overall costs for your situation. Interest rates represent only one component of the total financing expense.

What factors influence conventional loan pricing? Several elements affect your specific rate:

- Credit score and credit history

- Equity contribution percentage

- Property type (primary residence, second home, or investment)

- Loan amount relative to conforming limits

- Occupancy intentions and timeline

- Overall financial profile including reserves and stability

Are conventional loan rates lower than government programs? Well-qualified borrowers often secure more competitive pricing through conventional loan programs compared to FHA, VA, or USDA alternatives. The combination of competitive interest rates and lower mortgage insurance costs (or no insurance with sufficient equity) frequently results in lower total costs.

What about adjustable-rate vs fixed-rate options? A conventional loan offers both fixed-rate mortgages providing payment stability throughout the loan term and adjustable-rate mortgages (ARMs) offering initial rate advantages with periodic adjustments. Your specific situation, risk tolerance, and ownership timeline influence which structure optimizes your financing.

Can you lock rates during the application process? Most conventional loan programs offer rate lock options protecting you from rate increases during the application and closing period. Lock periods typically range from 30-60 days, with extensions available for longer closing timelines. The rate lock decision involves evaluating current market conditions and your closing timeline.

Considering a refinance? Submit a refinance inquiry to see if this makes sense for you.

What Are the Advantages of a Conventional Loan?

Understanding the specific benefits helps you evaluate whether this financing approach aligns with your homeownership goals and financial profile. A conventional loan offers distinct advantages for qualified borrowers.

Key advantages include:

Competitive overall costs for qualified borrowers – Well-qualified applicants with strong credit, stable income, and adequate equity contributions often find conventional loan financing provides the lowest total costs through competitive rates and minimal insurance requirements.

PMI removal flexibility – Unlike government programs requiring mortgage insurance for the loan’s life, a conventional loan allows removing private mortgage insurance once equity reaches appropriate levels. This flexibility provides long-term cost savings as your equity position improves through value appreciation or principal reduction.

Property flexibility – A conventional loan accommodates primary residences, second homes, and investment properties without the occupancy restrictions that limit government programs. Whether building a rental portfolio or purchasing a vacation home, conventional loan financing provides necessary flexibility.

Streamlined processing for standard scenarios – Conventional loan programs benefit from standardized underwriting guidelines creating efficient processing for straightforward applications. Automated underwriting systems provide rapid initial decisions for many borrowers.

Higher loan limits – Conforming conventional loan limits exceed government program limits in most markets, accommodating higher-value home purchases. Jumbo conventional loan programs extend even further for luxury properties or high-cost markets.

Minimal property condition restrictions – While basic safety and soundness standards apply, a conventional loan typically imposes fewer property condition requirements than FHA or VA programs that mandate specific repairs before closing.

Alternative Loan Programs for Home Purchase Scenarios

If a conventional loan isn’t the right fit, consider these alternatives:

- FHA Loan – Government-backed financing with flexible qualification standards and various initial investment options

- VA Loan – Competitive financing for eligible military families with flexible initial investment structures

- USDA Loan – Rural property financing with competitive terms for eligible areas

- Jumbo Loan – For properties exceeding conforming loan limits in high-cost markets

- Bank Statement Loan – Alternative documentation for self-employed borrowers when tax returns don’t reflect true income

Explore all 30+ loan programs to find your best option.

Not sure which program is right for you? Take our discovery quiz to find your path.

Advanced Conventional Loan Questions

Can you finance multiple properties simultaneously with conventional loans?

Yes, conventional loan programs accommodate borrowers financing multiple properties with appropriate qualification. Fannie Mae and Freddie Mac guidelines allow up to 10 financed properties under specific circumstances, making conventional loan financing valuable for real estate investors building substantial portfolios.

Multiple property qualification requirements:

- Strong credit profiles with demonstrated payment history

- Substantial reserves covering all property obligations

- Documentation of rental income for existing properties

- Appropriate equity contributions for each acquisition

- Clear rationale for portfolio growth strategy

How do conventional loans handle non-occupant co-borrowers?

Non-occupant co-borrowers—family members who contribute to qualification without living in the property—can strengthen applications for borrowers needing additional income or credit support. The co-borrower’s income, assets, and credit profile enhance qualification while the primary borrower occupies the home.

Non-occupant co-borrower considerations:

- Co-borrower assumes equal liability for mortgage obligations

- Co-borrower’s debts and income both factor into qualification

- Larger equity contributions may be required with non-occupant co-borrowers

- Clear documentation of relationship and co-borrowing purpose

What if you’re purchasing a condo—are there special requirements?

Condominium purchases through conventional loan financing require the condo development meeting Fannie Mae or Freddie Mac approval standards. These standards address financial health of the homeowners association, owner-occupancy ratios, commercial space limitations, and legal documentation.

Condo-specific conventional loan requirements:

- Development must appear on approved condo list or qualify through project review

- Homeowners association must maintain adequate reserves and insurance

- Owner-occupancy rates must meet minimum thresholds

- Litigation affecting the development may impact approval

- Warrantable vs non-warrantable condo status affects program availability

Can you use gift funds for your entire equity contribution?

Yes, conventional loan programs permit using gift funds from family members for all or part of your equity contribution, though specific rules vary based on the contribution percentage. Larger equity contributions (20%+ typically) can come entirely from gifts, while smaller contributions may require you to contribute some personal funds.

Gift fund documentation requirements:

- Gift letters signed by donors stating no repayment expectation

- Documentation showing fund transfer from donor to you

- Verification of donor’s capacity to provide gifts

- Relationship documentation for non-family member gifts

How do conventional loans handle rental income from multi-unit properties?

When purchasing multi-unit properties (2-4 units) as your primary residence, conventional loan programs allow using projected rental income from non-occupied units toward qualification. This rental income can offset a portion of the mortgage obligation, improving your debt-to-income ratios.

Multi-unit rental income qualification:

- You must occupy one unit as your primary residence

- Lenders apply percentage reductions (typically 75%) to projected rents

- Lease agreements for existing tenants strengthen income documentation

- Appraiser provides fair market rent estimates for units

- Investment property experience may influence rental income treatment

What if you’re self-employed with declining income trends?

Self-employed borrowers showing declining income over the documentation period face additional scrutiny under conventional loan underwriting. Lenders evaluate whether income trends indicate business challenges or represent temporary fluctuations with reasonable explanations.

Addressing declining income patterns:

- Provide detailed explanations for income changes

- Demonstrate business stability through other metrics

- Show recovery trends in recent months if applicable

- Maintain strong credit and substantial reserves as compensating factors

- Consider waiting for additional positive income documentation

Can foreign nationals qualify for conventional loans?

Foreign national borrowers without U.S. citizenship or permanent residency face challenges with standard conventional loan programs. However, specialized conventional loan variations accommodate foreign nationals with U.S. income, substantial assets, and valid visa documentation.

Foreign national conventional loan requirements:

- Valid visa authorizing extended U.S. presence

- U.S. credit history or alternative credit documentation

- Larger equity contributions (typically 30%+ minimum)

- U.S. income sources or substantial documented income

- Increased documentation regarding identity and financial capacity

How do conventional loans handle recent large deposits?

Large deposits in your bank accounts during the months before application require documentation explaining the source. Lenders want to ensure deposit sources represent acceptable funds rather than undisclosed loans that would affect your qualification.

Acceptable large deposit explanations:

- Proceeds from asset sales with documentation

- Gift funds with appropriate gift letters

- Tax refunds with copies of returns

- Bonuses verified through employer

- Transfers from other accounts you own

Unexplained large deposits may require additional documentation or exclude from available funds for closing costs or reserves.

Can you lock in a conventional loan rate before finding a property?

Some lenders offer pre-approval rate locks allowing you to secure current market rates while house hunting. These programs typically require application submission, preliminary approval, and limit lock periods to 30-90 days depending on the lender’s specific program.

Pre-approval rate lock considerations:

- Fees may apply for extended lock periods

- Lock expires if you don’t find property within timeframe

- Rate locks protect against increases but prevent benefiting from decreases

- Not all lenders offer this option for conventional loan programs

What happens if the appraisal comes in lower than the purchase price?

When the property appraises below your contracted purchase price, you face several options. The appraised value becomes the maximum value for loan calculation purposes, affecting your financing structure.

Low appraisal resolution strategies:

- Negotiate purchase price reduction with seller

- Increase your equity contribution to maintain planned financing

- Challenge the appraisal with supporting comparable sales

- Request second appraisal if lender permits

- Restructure transaction terms or seek alternative properties

Ready to get started? Apply now or schedule a call to discuss your situation.

Helpful Conventional Loan Resources

Official Government Guidance:

Fannie Mae Conventional Loan Guidelines – Official Fannie Mae underwriting standards for conventional mortgages explaining qualification requirements, property eligibility, documentation standards, and program variations for diverse borrower scenarios.

CFPB Conventional Mortgage Information – Consumer Financial Protection Bureau resource explaining conventional loan structures, comparison to government programs, qualification basics, and borrower protections under federal lending regulations.

Federal Housing Finance Agency Conventional Loan Standards – FHFA guidance on conventional mortgage programs, conforming loan limits, qualification guidelines, and oversight of Fannie Mae and Freddie Mac conventional lending operations.

Industry Organizations:

FHFA Conforming Loan Limits – Federal Housing Finance Agency annual conforming loan limit announcements showing maximum conventional loan amounts for standard and high-cost areas across the United States.

Freddie Mac Conventional Mortgage Standards – Official Freddie Mac underwriting guidelines for conventional mortgages covering qualification methods, property requirements, and program features paralleling Fannie Mae standards.

Educational Resources:

HUD Home Buying Resources – Department of Housing and Urban Development comprehensive home buying education covering mortgage types including conventional loans, qualification preparation, and comparison to government-backed programs.

Federal Reserve Mortgage Shopping Information – Federal Reserve consumer guidance on mortgage shopping, comparing loan types including conventional financing, understanding costs, and evaluating lender offers.

Need local expertise? Get introduced to trusted partners including loan officers, realtors, and financial advisors in your area.

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Not Sure About Your Next Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Related Posts

Subscribe to our newsletter

Get program updates and rate insights in your inbox.