Jumbo Loan: 7 Strategies for Financing Luxury Properties Above Conforming Limits

Access High-Balance Financing for Premium Real Estate Through Strategic Jumbo Loan Solutions

Purchasing luxury real estate or refinancing high-value properties requires specialized financing that exceeds standard conforming loan limits. Jumbo loans provide the purchasing power needed for premium properties, exclusive neighborhoods, and high-cost markets where property values surpass conventional lending thresholds. Understanding how jumbo financing works, what lenders evaluate, and how to position yourself for competitive terms helps you navigate the luxury real estate market with confidence and secure the capital needed for significant property investments.

Key Details You’ll Learn About Jumbo Loans:

- How jumbo loans differ from conforming mortgages and why loan limits create the need for specialized high-balance financing structures

- Current conforming loan limits by county and how these thresholds determine whether your financing needs require jumbo loan products (Federal Housing Finance Agency conforming loan limits)

- Documentation requirements and underwriting standards that jumbo lenders apply when evaluating high-balance loan applications

- Credit score, reserve, and equity requirements that typically exceed conforming loan standards for jumbo financing approval

- How debt-to-income calculations work differently for jumbo loans, with many lenders applying stricter ratio thresholds

- Strategic approaches to qualifying for jumbo financing with non-traditional income including business ownership, investment income, and asset-based qualification

- Portfolio lending versus securitization and how lender structure affects jumbo loan availability and pricing (Consumer Financial Protection Bureau jumbo mortgage resources)

- Second home and investment property considerations for jumbo financing with different qualification standards

- How to position your financial profile to secure competitive jumbo loan terms in luxury real estate markets

Ready to explore your options? Schedule a call with a loan advisor.

What Is a Jumbo Loan and How Does It Differ From Conforming Mortgages?

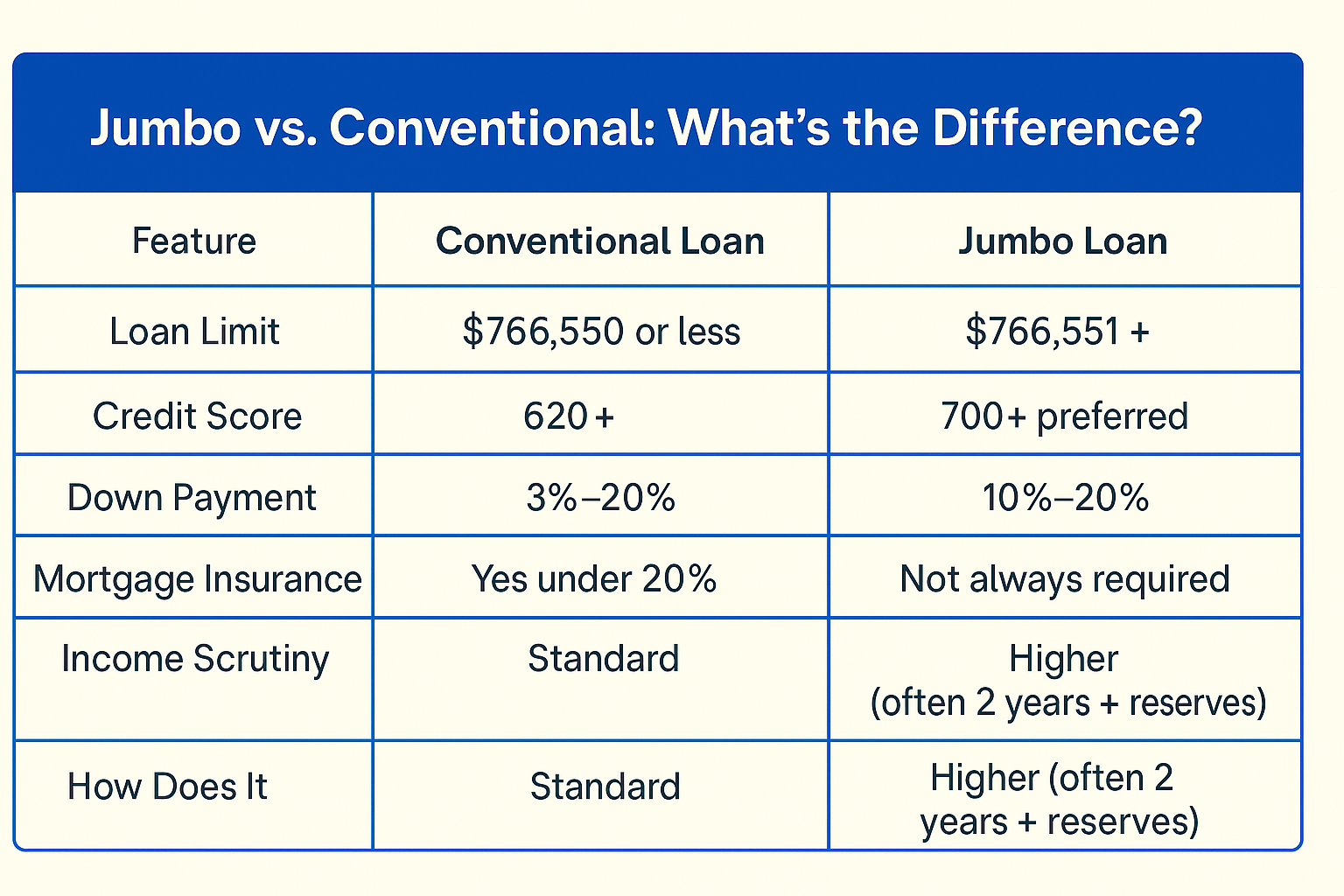

A jumbo loan is a mortgage that exceeds the conforming loan limits established annually by the Federal Housing Finance Agency (FHFA). These limits vary by county based on local housing costs, with most counties following the baseline conforming limit while high-cost areas receive higher thresholds. Any loan amount above these limits requires jumbo financing, which operates outside the government-sponsored enterprise (GSE) system of Fannie Mae and Freddie Mac.

Why do jumbo loans have stricter requirements than conforming mortgages? Because jumbo loans cannot be purchased by Fannie Mae or Freddie Mac, lenders either hold these loans in portfolio or sell them to private investors, assuming greater risk without the GSE guarantee—this increased exposure typically translates to more stringent underwriting standards and documentation requirements.

The fundamental distinction lies in risk distribution. Conforming loans benefit from standardized underwriting guidelines and GSE backing, creating liquidity and consistency across lenders. Jumbo loans lack this standardized support system, requiring lenders to independently evaluate risk and maintain higher quality standards since they can’t easily transfer risk to government-sponsored entities.

Current Conforming Loan Limits and Jumbo Thresholds

Conforming limits adjust annually based on housing market data:

- Baseline conforming limit – Applies to most counties with moderate housing costs (single-family properties)

- High-cost area limits – Elevated thresholds for counties where housing costs exceed national averages

- Multi-unit property limits – Higher limits for 2-4 unit properties regardless of location

- Alaska, Hawaii, Guam, Virgin Islands – Special higher limits recognizing exceptional housing costs

Where can you find current conforming loan limits for your county? The FHFA publishes an interactive map and searchable database at their website, allowing you to enter your property location and determine whether your loan amount requires jumbo financing based on current year limits.

For example, if the baseline conforming limit is $766,550 and you’re purchasing a property for $850,000 in a standard-cost county, you need jumbo financing. However, that same loan amount might fall within conforming limits in a designated high-cost area with limits exceeding $1 million.

Portfolio Lending Versus Securitization

Jumbo loans follow two primary paths after origination:

- Portfolio lending – Banks and credit unions retain jumbo loans on their balance sheets, maintaining the servicing relationship and assuming long-term performance risk

- Private securitization – Lenders package jumbo loans into private-label securities sold to institutional investors seeking mortgage-backed investment opportunities

How does the lender’s business model affect jumbo loan availability? Portfolio lenders may offer more flexible underwriting since they’re making their own lending decisions rather than conforming to investor guidelines, while lenders focused on securitization must meet investor standards that often mirror but sometimes deviate from GSE guidelines.

Understanding your lender’s approach helps explain why terms and flexibility vary significantly across jumbo loan providers.

Jumbo Loan Strategy #1: Build Your Financial Profile Before Applying

What credit score do you need for jumbo loan approval? Most jumbo lenders establish minimum credit score thresholds significantly higher than conforming loan minimums, typically requiring scores in the excellent range to qualify for competitive terms, though specific requirements vary by lender, loan amount, and compensating factors.

Jumbo underwriting scrutinizes your entire financial picture with greater intensity than conforming loans. Lenders want certainty that borrowers with high-balance loans possess the financial sophistication, stability, and resources to manage substantial debt obligations through various economic conditions.

Credit Profile Optimization

Strong credit positioning dramatically improves jumbo loan approval odds and pricing:

- Payment history perfection – Even single late payments within recent years may affect approval or pricing, particularly on mortgage or installment debt

- Credit utilization management – Keeping revolving credit balances well below limits demonstrates financial discipline and available capacity

- Credit inquiries – Minimize new credit applications in months preceding jumbo loan application to avoid inquiry concerns

- Account seasoning – Established credit history with accounts open for years shows long-term financial management

- Diverse credit mix – Successful management of different credit types (mortgage, auto, credit cards) demonstrates versatility

- Credit report accuracy – Review reports from all three bureaus and dispute errors well before applying

How do recent credit inquiries affect jumbo loan approval? While rate shopping for mortgages within a focused timeframe typically counts as single inquiry, numerous non-mortgage credit applications shortly before your jumbo loan application may signal financial stress or major purchases that increase your debt obligations.

Reserve Requirements

Jumbo lenders typically require substantial liquid reserves beyond your initial equity contribution and closing costs:

- Minimum reserve months – Many jumbo programs require 6-12+ months of total housing payments in liquid reserves after closing

- Reserve calculation – Based on your total principal, interest, taxes, insurance, and HOA fees for all financed properties

- Acceptable reserve assets – Cash, checking, savings, money market accounts, stocks, bonds, mutual funds, retirement accounts (sometimes discounted)

- Restricted assets – Illiquid investments, retirement accounts with withdrawal restrictions, or assets requiring liquidation over time may receive limited credit

Can you use retirement accounts for jumbo loan reserves? Many lenders accept retirement account balances toward reserve requirements, though they may apply discount factors (commonly 60-70% of value) to account for potential taxes and penalties on early withdrawal, or may require the accounts be accessible without penalty.

Income Stability and Documentation

Jumbo lenders evaluate income with heightened scrutiny:

- Income consistency – Stable earnings over multiple years in the same field or profession

- Income trajectory – Preference for stable or increasing income rather than declining trends

- Income sources – Clear documentation of all income types used for qualification

- Future income reliability – Assessment of whether income will continue throughout loan term

- Industry stability – Consideration of your profession’s recession resistance and stability

See how other borrowers have successfully used jumbo financing:

- View jumbo loan purchase case studies

- View jumbo loan refinance case studies

- View jumbo loan cash-out refinance case studies

- View jumbo construction loan case studies

What Are Jumbo Loan Documentation Requirements?

What documents do jumbo lenders require beyond standard mortgage applications? Jumbo underwriting typically demands more extensive documentation than conforming loans, including additional asset verification, detailed income documentation covering longer timeframes, letters explaining any unusual financial patterns, and comprehensive analysis of all debt obligations and payment histories.

The elevated documentation burden reflects lenders’ need for complete financial clarity when approving high-balance loans that carry greater absolute risk exposure despite potentially strong borrower profiles.

Standard Employment and Income Documentation

Employed borrowers typically provide:

- Recent pay stubs covering at least 30 days of earnings

- W-2 forms for the most recent two years

- Federal tax returns (sometimes required even for W-2 employees on jumbo loans)

- Verification of employment directly from employer

- Documentation of bonus, commission, or overtime income over two-year period

- Social Security benefit letters for retirement income

- Pension or annuity statements with payment details

- Investment account statements showing dividend or interest income

Why do jumbo lenders sometimes require tax returns even for W-2 employees? Tax returns provide comprehensive income verification including side income, investment earnings, rental property cash flow, and business interests that might not appear on pay stubs but affect your overall financial picture and ability to manage jumbo loan obligations.

Self-Employed and Business Owner Documentation

Business owners and self-employed borrowers face more extensive requirements:

- Personal tax returns – Complete returns with all schedules for two years

- Business tax returns – Corporate, partnership, or Schedule C returns for two years showing business income

- Year-to-date profit and loss – Current financial statements if applying outside tax filing season

- Business balance sheet – Showing business assets, liabilities, and equity

- CPA letters – Professional accountant statements regarding business health and income

- Business license – Documentation proving legitimate business operation

- Explanation letters – Context for income variations, business changes, or unusual patterns

Jumbo lenders analyze self-employment income to ensure stability and sustainability rather than one-time events or declining business performance.

Asset Documentation and Verification

Comprehensive asset documentation verifies reserves, initial equity, and overall financial strength:

- Complete bank statements for all accounts (typically 2-3 months)

- Investment account statements showing current holdings and values

- Retirement account statements (401k, IRA, etc.)

- Documentation of any gifted funds including gift letters from donors

- Paper trail for large deposits explaining source of funds

- Documentation of asset sales if liquidating investments for purchase

- Trust documents if assets held in trust structures

- Business valuations for closely-held business interests used as reserves

How do jumbo lenders verify large deposits in bank accounts? Any significant deposits that don’t clearly correlate to documented income sources require explanation and documentation—lenders want to verify funds come from acceptable sources rather than undisclosed debt, borrowed funds, or other sources that might affect your true financial position.

Property Documentation

Jumbo loans require thorough property documentation:

- Full appraisal by licensed appraiser familiar with luxury market

- Property insurance quote meeting lender requirements

- HOA documents if applicable, including budgets and reserve studies

- Property tax records and payment history

- Title report showing clear ownership and no unexpected liens

- Property survey for some property types

- Environmental assessments for large parcels or specific property types

Luxury properties, unique homes, and properties with extensive land may require specialized appraisers with experience valuing high-end real estate.

Jumbo Loan Strategy #2: Understand Debt-to-Income Ratio Requirements

What debt-to-income ratio do you need for jumbo loan approval? While conforming loans often allow debt-to-income ratios approaching 50% with strong compensating factors, jumbo lenders typically prefer more conservative ratios, though exact thresholds vary by lender, loan amount, credit profile, and reserves.

Debt-to-income (DTI) calculations measure your monthly debt obligations against gross monthly income, providing lenders insight into how comfortably you can manage additional housing debt while maintaining existing obligations.

Front-End and Back-End Ratios

Jumbo lenders evaluate two distinct ratio calculations:

- Front-end ratio (housing ratio) – Your proposed housing payment (principal, interest, taxes, insurance, HOA) divided by gross monthly income

- Back-end ratio (total debt ratio) – All monthly debt obligations including housing payment, credit cards, auto loans, student loans, and other installment debt divided by gross monthly income

Why do jumbo lenders care about both ratios separately? The front-end ratio isolates housing affordability regardless of other debt, while back-end ratio shows total financial obligations—borrowers might qualify on back-end ratio while exceeding front-end thresholds, signaling housing costs are disproportionate to income even if total debt remains manageable.

Strategies for Improving Debt-to-Income Ratios

If your ratios exceed lender preferences, several strategies can improve your profile:

- Pay down revolving debt – Eliminating credit card balances reduces monthly obligations and improves ratios significantly

- Pay off installment loans – Consider paying off auto loans, student loans, or personal loans with remaining balances

- Remove co-signed obligations – Document that co-signed debts are paid by other party if possible

- Defer student loans – Some lenders calculate student loan payments differently based on deferment status

- Increase documented income – Add co-borrower income or document additional income sources

- Make larger initial equity contribution – Reducing loan amount directly lowers your proposed housing payment

- Choose lower property tax area – If flexible on location, lower tax jurisdictions reduce housing payment

Can you exclude certain debts from jumbo loan DTI calculations? Debts being paid by others with documented payment history, loans with fewer than 10 months remaining, or obligations clearly paid from business accounts rather than personal income may receive special consideration, though policies vary by lender.

Alternative Qualification Approaches

Some jumbo programs offer qualification flexibility through alternative structures:

- Asset-based qualification – Qualify based on liquid assets rather than traditional income verification, particularly useful for retirees or high-net-worth individuals with substantial portfolios

- Global cash flow analysis – Evaluate total income and expenses across all personal and business finances rather than traditional DTI calculations

- Debt service coverage for investors – Qualify investment properties based on rental income rather than personal income

Explore alternative qualification:

- Asset-Based Loan – Qualify using liquid assets instead of traditional income

- DSCR Loan – Investment property qualification by rental income

Strategy #3: Navigate Jumbo Loan Requirements for Self-Employed Borrowers

Can self-employed borrowers get jumbo loans? Yes, self-employed individuals, business owners, and entrepreneurs regularly secure jumbo financing, though they face additional documentation requirements and potential scrutiny of business stability, income consistency, and future earnings reliability that employed borrowers don’t encounter.

Traditional jumbo underwriting analyzes tax returns to determine qualifying income, which creates challenges for business owners who maximize deductions to minimize taxable income—this strategy reduces reported income that lenders use for qualification even though actual cash flow may be substantially higher.

Tax Return Analysis Challenges

Standard jumbo underwriting calculates self-employment income by:

- Starting with net profit or loss from tax returns

- Adding back non-cash deductions like depreciation

- Subtracting one-time income that won’t continue

- Averaging income over two years to smooth variations

- Applying this calculated income to debt-to-income ratios

Why does depreciation get added back for self-employed jumbo loan qualification? Depreciation is a non-cash deduction that reduces taxable income without affecting actual cash flow—lenders add it back because you didn’t actually spend this money, making it available for debt obligations.

This methodology works well for businesses with stable income and minimal deductions but creates qualification barriers for:

- Business owners with substantial depreciation from equipment or vehicles

- Companies investing heavily in growth, reducing current taxable income

- Businesses with legitimate deductions that significantly lower reported income

- Income structures involving S-corp distributions beyond salary

- Multiple business entities with complex tax structures

Alternative Documentation for Self-Employed Jumbo Borrowers

Several specialized programs accommodate self-employed jumbo borrowers:

Bank Statement Jumbo Loans – Analyze business or personal bank deposits over 12-24 months to calculate income rather than using tax returns, bypassing the deduction challenge entirely while focusing on actual cash flow.

1099 Income Loans – Verify contractor income using 1099 forms without requiring complete business tax returns, useful for independent contractors without complex business structures.

CPA Letter Programs – Some portfolio lenders accept certified accountant letters explaining income, business health, and sustainability to supplement or replace traditional tax return analysis.

Asset-Based Jumbo Loans – Eliminate income documentation entirely, instead qualifying based on substantial liquid asset holdings that demonstrate ability to manage debt obligations regardless of reported income.

How do bank statement jumbo loans calculate qualifying income? Lenders review deposit patterns in business or personal accounts, calculate average monthly deposits, and apply an expense factor (typically 25-50%) to account for business costs, resulting in qualifying income that often exceeds tax return calculations.

Real examples of self-employed jumbo loan success:

Business Ownership Structure Considerations

Your business structure affects jumbo loan documentation:

- Sole proprietors (Schedule C) – Simplest documentation with business income reported directly on personal returns

- S-Corporation owners – Must document both W-2 salary and K-1 distributions, with complex allocation rules

- Partnership interests – K-1 income analysis with partnership return review to understand sustainability

- LLC members – Documentation depends on tax treatment (disregarded entity, partnership, or corporation)

- C-Corporation shareholders – Salary plus dividend analysis if significant ownership stake

Can you use business income if you own less than 25% of a company? Most lenders require at least 25% ownership to use business income for qualification, as minority stakeholders lack control over distributions and business decisions affecting income continuity.

What Credit Score Do You Need for a Jumbo Loan?

Are jumbo loan credit requirements higher than conforming mortgage standards? Yes, most jumbo lenders establish minimum credit score thresholds significantly above conforming loan minimums, reflecting the larger absolute risk exposure on high-balance loans and the lack of GSE backing that reduces lender flexibility on credit exceptions.

While conforming loans might accept credit scores in certain ranges with compensating factors, jumbo programs typically require excellent credit profiles to access competitive terms and sometimes to qualify at all.

Typical Jumbo Credit Score Thresholds

Credit requirements vary by lender and loan structure:

- Minimum scores – Many jumbo programs establish floors below which they won’t lend regardless of compensating factors

- Pricing tiers – Credit score ranges that determine pricing structures, with better scores receiving better terms

- High-balance considerations – Some lenders increase minimum score requirements as loan amounts increase

- Property type – Second homes and investment properties may require higher credit scores than primary residences

- Occupancy impact – Primary residence jumbo loans typically have more lenient credit requirements than non-owner occupied

How do jumbo lenders evaluate borrowers with limited credit history? Thin credit files with few accounts or short history create challenges even with perfect payment records—jumbo lenders prefer demonstrated ability to manage multiple credit types over time, making alternative credit documentation sometimes necessary.

Recent Credit Events and Jumbo Qualification

Past credit challenges create different waiting periods depending on severity:

- Late payments – Recent 30-day late marks may affect approval or pricing depending on frequency and recency

- Bankruptcies – Chapter 7 or 13 filings typically require substantial waiting periods (4-7+ years) before jumbo qualification

- Foreclosures – Property loss through foreclosure creates extended waiting periods similar to bankruptcy

- Short sales or deeds-in-lieu – Alternative property disposition methods carry waiting periods though sometimes shorter than foreclosure

- Collections or charge-offs – Unpaid collections, especially in certain categories, may require resolution before approval

- Judgments or liens – Must typically be resolved before closing

Can you get a jumbo loan after bankruptcy? While possible after appropriate waiting periods and credit rebuilding, post-bankruptcy jumbo qualification requires exceptional credit management following discharge, substantial reserves, strong income stability, and typically larger equity contributions than borrowers without previous credit events.

Credit Improvement Strategies

Optimize your credit profile before jumbo loan application:

- Time your application strategically – Allow several months after resolving any credit issues before applying

- Maintain low credit utilization – Keep revolving balances well below limits, ideally under 30% total and per card

- Avoid new credit – Don’t open new accounts or make major purchases on credit before or during your application

- Dispute errors – Review reports from all three bureaus and dispute inaccuracies well in advance

- Pay down collections strategically – Consult with credit professionals about whether paying old collections might temporarily lower scores

- Build payment history – If you lack sufficient credit history, become authorized user on established accounts

- Document explanations – Prepare letters explaining any credit issues with supporting documentation

Jumbo Loan Strategy #4: Maximize Your Initial Equity Contribution

What down payment do you need for jumbo loans? While specific requirements vary by lender and program, jumbo loans typically require more substantial initial equity contributions than conforming loans, with many programs establishing minimum thresholds and offering better terms with larger contributions.

Your initial equity position affects multiple underwriting factors simultaneously—the amount you invest reduces lender risk, demonstrates financial commitment, influences pricing tiers, impacts reserve requirements, and may affect whether you need mortgage insurance or face coverage limitations.

Equity Requirements by Property Type

Different property uses carry distinct equity expectations:

- Primary residence purchases – Generally offer the most flexible equity requirements within jumbo lending

- Second home purchases – Typically require larger equity contributions than primary residences

- Investment properties – Usually require the most substantial equity positions due to higher perceived risk

- Cash-out refinances – May limit the amount you can extract, requiring you to maintain substantial equity

- Rate-and-term refinances – Often more flexible than cash-out structures if you’re not extracting equity

Why do second homes and investment properties require more equity for jumbo loans? Lenders view non-primary residences as higher risk because borrowers facing financial stress will prioritize their primary residence payments over secondary properties, increasing default risk on vacation homes and rental properties.

Benefits of Larger Equity Contributions

Increasing your initial investment beyond minimums delivers multiple advantages:

- Better pricing tiers – Higher equity often qualifies you for improved pricing structures

- Reduced reserve requirements – Some lenders decrease reserve expectations with larger equity contributions

- Avoiding mortgage insurance – Sufficient equity eliminates mortgage insurance requirements that might otherwise apply

- Easier qualification – Lower loan amounts relative to income make debt-to-income ratios more favorable

- Greater lender flexibility – Substantial equity gives underwriters comfort approving compensating factors

- Protection against market fluctuations – Larger equity cushions protect against short-term value declines

Can you avoid mortgage insurance on jumbo loans? Many jumbo programs don’t require mortgage insurance at all regardless of equity contribution, though some programs do implement coverage requirements—when required, sufficient equity contributions eliminate this additional cost.

Creative Equity Strategies

If you lack sufficient liquid savings for desired equity contribution, consider alternatives:

- Asset liquidation – Sell investments, though consider tax implications and market timing

- Retirement account withdrawals – Possible though subject to taxes and penalties depending on age and account type

- Gift funds from family – Many jumbo lenders accept gift funds from relatives with proper documentation

- Bridge loans – Short-term financing against existing property equity to fund purchase before sale closes

- Pledged asset loans – Use investment portfolio as collateral instead of liquidating

- Seller concessions – Negotiate seller contributions toward closing costs to preserve cash for equity

Are gift funds acceptable for jumbo loan down payments? Yes, most jumbo lenders accept gift funds from family members for all or part of your equity contribution, though they require gift letters stating the funds don’t need to be repaid, documentation of the donor’s ability to provide funds, and sometimes paper trail showing fund transfer.

Calculate your jumbo loan scenarios:

How Do Jumbo Loan Interest Rates Compare to Conforming Mortgages?

Are jumbo loan rates higher than conforming mortgage rates? Rate relationships between jumbo and conforming loans fluctuate based on market conditions, investor demand, portfolio lender appetite, and economic factors—sometimes jumbo rates exceed conforming rates while other periods see competitive or even lower jumbo pricing.

Understanding what drives jumbo loan pricing helps you time your borrowing and understand whether quoted terms represent competitive offers or opportunities to shop more aggressively.

Factors Influencing Jumbo Loan Pricing

Multiple variables affect the terms you’ll receive:

- Overall rate environment – General mortgage market conditions driven by Federal Reserve policy and bond markets

- Jumbo market liquidity – Investor demand for private-label mortgage securities affects pricing

- Lender portfolio capacity – Banks’ appetite for holding jumbo loans on balance sheets influences availability and terms

- Your credit profile – Score, payment history, and overall credit management significantly impact pricing tiers

- Loan-to-value ratio – Amount borrowed relative to property value affects risk and pricing

- Debt-to-income ratio – Your total obligations relative to income influence risk assessment

- Reserve levels – Substantial liquid reserves beyond requirements may improve pricing

- Property type and location – Primary residence, second home, investment property designation affects terms

- Loan size – Some lenders price differently for larger jumbo amounts

- Rate lock period – Longer locks typically cost more than shorter commitments

Why do jumbo rates sometimes beat conforming mortgage rates? When portfolio lenders have balance sheet capacity and seek quality loan assets, or when private-label securities market demand is strong, competition for jumbo borrowers with excellent profiles can drive pricing below conforming rates that carry GSE fees and standardized pricing.

Fixed Versus Adjustable Rate Jumbo Loans

Jumbo borrowers can choose between rate structures:

Fixed-rate jumbo mortgages provide payment certainty:

- Predictable payments throughout life of loan

- Protection against rate increases

- Simplified budgeting for long-term planning

- Typically available in various terms

Adjustable-rate jumbo mortgages offer initial lower pricing:

- Lower initial pricing compared to fixed-rate options

- Fixed period (commonly 5, 7, or 10 years) before adjustments begin

- Periodic rate adjustments tied to index plus margin

- Payment caps limiting how much payments can increase

- Useful for borrowers planning to sell or refinance before adjustment period

When should you consider adjustable-rate jumbo loans? If you plan to relocate, refinance, or pay off the loan within the initial fixed period, the lower initial pricing can reduce costs compared to fixed-rate alternatives—however, you assume rate increase risk if circumstances change and you hold the loan through adjustment periods.

Jumbo Loan Pricing Optimization

Strategies to secure competitive jumbo terms:

- Shop multiple lenders – Jumbo pricing varies significantly across lenders based on their business models

- Compare portfolio lenders and securitizers – Different business models sometimes produce very different pricing

- Consider credit unions – Member-owned institutions sometimes offer competitive jumbo portfolio lending

- Improve your risk profile – Better credit, lower DTI, more reserves, and larger equity all affect pricing

- Time your application strategically – Monitor market conditions and apply when jumbo markets are competitive

- Negotiate fees – While rates are rate-driven, some fees may be negotiable

- Bundle banking relationships – Some lenders offer pricing advantages for deposit relationships or multiple accounts

Jumbo Loan Requirements for Second Homes and Investment Properties

How do jumbo loan requirements differ for second homes and investment properties? Non-primary residence jumbo financing typically requires larger equity contributions, higher credit scores, lower maximum debt-to-income ratios, increased reserve requirements, and may receive different pricing compared to primary residence loans.

Lenders apply stricter standards recognizing that borrowers facing financial pressure prioritize primary residence payments, making vacation homes and rental properties more likely to default during economic stress.

Second Home Jumbo Loan Considerations

Vacation properties and second homes intended for personal use face unique requirements:

- Occupancy declaration – Must establish the property is for personal enjoyment, not rental income

- Distance requirements – Many lenders require second homes be sufficient distance from primary residence

- Equity contributions – Typically higher minimums than primary residence jumbo loans

- Reserve requirements – Must demonstrate reserves covering both properties’ housing payments

- Existing mortgage impact – Primary residence mortgage payment included in debt-to-income calculations

- Property use restrictions – Rental activity may reclassify the loan as investment property with different terms

Can you use rental income from your second home for jumbo loan qualification? If you plan to rent the property, it should be treated as investment property rather than second home—lenders may discover rental intent through tax returns, rental history, or property management arrangements, potentially violating occupancy certifications.

Investment Property Jumbo Loans

Rental properties and investment real estate require specialized consideration:

- Higher equity requirements – Investment properties typically require the largest equity contributions

- Rental income analysis – If using rental income for qualification, lenders require lease agreements and may discount income

- Property management – Some lenders prefer or require professional property management for certain properties

- Experience considerations – First-time investors may face additional scrutiny or requirements

- Multiple property portfolios – Borrowers with numerous properties may need specialized portfolio analysis

- Property condition and marketability – Investment properties must meet lender habitability and marketability standards

How do jumbo lenders calculate rental income for qualification? Most lenders require executed lease agreements, may discount rental income by a percentage (commonly 25%) to account for vacancies and expenses, and will verify rental income on tax returns if you’ve owned the property previously.

DSCR Jumbo Loans for Investors

Debt Service Coverage Ratio loans offer alternative qualification for investment property jumbo financing:

- Qualify based on property’s rental income rather than personal income

- Particularly useful for investors with multiple properties or complex personal income

- No personal income documentation required

- Focus on whether rental income covers property debt obligations

- Available for various property types in diverse markets

Explore investment property options:

- View DSCR loan case studies

- View DSCR refinance case studies

- View DSCR cash-out refinance case studies

Ready to discuss your purchase scenario? Submit a purchase inquiry to explore your options.

Frequently Asked Questions About Jumbo Loans

How Long Does Jumbo Loan Approval Take?

Jumbo loan timelines generally align with conforming mortgages for straightforward applications, typically requiring 30-45 days from application to closing. However, complex financial situations, self-employment documentation, multiple properties, unique assets, or unusual property types may extend timelines due to additional underwriting analysis and documentation requirements.

Factors affecting jumbo loan timelines:

- Documentation completeness – Having all financial records ready at application accelerates processing

- Income complexity – Self-employment or multiple income sources require more extensive review

- Asset verification – Complex investment portfolios or business holdings need detailed analysis

- Property appraisal – Luxury properties may require specialized appraisers with longer scheduling windows

- Title issues – Clearing title exceptions on high-value properties sometimes presents challenges

- Underwriter workload – Lender capacity and jumbo loan volume affects processing speed

Expedite your jumbo loan approval by gathering documentation proactively, responding quickly to requests, selecting experienced jumbo lenders, maintaining clear communication throughout the process, and allowing realistic timelines rather than creating unnecessary pressure.

Can You Get a Jumbo Loan With Less Than Perfect Credit?

While jumbo loans typically require excellent credit profiles, borrowers with credit challenges can potentially secure financing through portfolio lenders with flexible underwriting, by providing substantial compensating factors like large equity contributions and extensive reserves, or by improving credit profiles before applying to meet traditional jumbo standards.

What compensating factors help jumbo loan approval with lower credit scores? Substantial liquid reserves far exceeding requirements, very low debt-to-income ratios, large equity contributions well beyond minimums, stable long-term employment in recession-resistant fields, strong relationship with portfolio lender, or significant assets with the institution all provide compensating strengths.

Alternative approaches for challenged credit:

- Work with portfolio lenders who make individual credit decisions

- Improve credit score before applying through strategic credit management

- Add co-borrower with stronger credit profile

- Provide detailed explanation letters with supporting documentation

- Increase equity contribution to reduce lender risk

- Build banking relationship with portfolio jumbo lender

Should You Make a 20% Down Payment on a Jumbo Loan?

While specific equity requirements vary by lender and program, many jumbo borrowers benefit from equity contributions beyond minimum thresholds to access better pricing tiers, reduce total interest costs, avoid potential mortgage insurance, strengthen their qualification profile, and provide larger equity cushions protecting against market fluctuations.

What is the optimal down payment strategy for jumbo loans? The answer depends on your alternative uses for capital—if you have high-yield investment opportunities, strong risk tolerance, or prefer maintaining liquidity for business opportunities, minimum equity contributions might make sense, while risk-averse borrowers or those without compelling alternative investments often benefit from larger equity positions.

Consider these factors when determining your equity contribution:

- Pricing tiers and how much better terms you’ll receive with additional equity

- Alternative investment returns you’re confident achieving with preserved capital

- Your personal risk tolerance and comfort with leverage

- Liquidity needs for emergencies or business opportunities

- Tax implications of liquidating investments for larger equity contribution

- Long-term occupancy plans and likelihood of needing flexibility

How Do Jumbo Loans Work for Condo Purchases?

Jumbo condo financing faces additional scrutiny beyond single-family properties, with lenders evaluating both individual unit suitability and overall project health including financial reserves, litigation status, owner-occupancy ratios, commercial space percentages, and whether the condo association maintains adequate insurance and follows sound financial management practices.

What makes a condo project ineligible for jumbo financing? Common disqualifiers include pending or active litigation involving the homeowners association, insufficient reserve funds for common area maintenance, high percentages of investor-owned units, significant commercial space, incomplete construction or unsold developer units, unusual rental restrictions, or deferred maintenance creating potential future assessment risks.

Jumbo condo considerations:

- Project review requirements – Lenders review condo association finances, insurance, legal status

- Owner-occupancy ratios – Too many rental units may create financing challenges

- Association reserves – Adequate funds for maintenance and unexpected repairs

- Special assessments – Pending or recent large assessments may affect approval

- Insurance coverage – Proper liability and hazard insurance required

- Litigation status – Active lawsuits against association create concerns

Before making offers on luxury condos, verify the project meets jumbo lending requirements to avoid surprises during underwriting.

Strategy #5: Leverage Portfolio Lenders for Jumbo Loan Flexibility

What advantages do portfolio lenders offer for jumbo financing? Banks and credit unions that hold jumbo loans on their balance sheets rather than selling them can offer more flexible underwriting, customized terms, relationship-based pricing, streamlined documentation for existing customers, and creative solutions for complex financial situations that don’t fit standardized investor guidelines.

Portfolio jumbo lending represents a relationship-driven approach where the lender evaluates your complete financial picture and makes individualized credit decisions rather than applying rigid investor guidelines designed for loan purchases.

Portfolio Lender Benefits

These institutions can provide unique advantages:

- Underwriting flexibility – Individual credit decisions rather than strict investor rules

- Complex income accommodation – Better equipped to evaluate non-traditional or complex income structures

- Unique property types – May finance properties other lenders won’t touch

- Relationship pricing – Deposit accounts, investment relationships may improve terms

- Faster decisions – No investor approval process for non-standard situations

- Long-term servicing – You’ll work with the same lender throughout the loan life

- Portfolio diversity – May seek specific loan types or borrower profiles to balance their portfolio

How do you find portfolio jumbo lenders? Local and regional banks, credit unions with membership requirements, private banks serving high-net-worth individuals, and community banks focused on relationship banking most commonly hold jumbo loans in portfolio rather than selling them.

Building Lender Relationships

Maximize portfolio lender benefits through strategic relationship development:

- Establish banking relationship before needing financing – Build history with deposits, investments, or other services

- Consolidate accounts – Bringing substantial assets to the institution increases your importance as customer

- Use multiple services – Business banking, personal banking, wealth management, and lending create deeper relationships

- Demonstrate financial sophistication – Professional interaction and clear documentation show you’re a quality borrower

- Maintain open communication – Discuss your financial goals and needs so lenders can proactively offer solutions

Can relationship banking really affect jumbo loan terms? Yes, portfolio lenders often provide preferential pricing, reduced fees, or increased flexibility to valuable customers with substantial deposits or investment relationships, as they view you holistically rather than just as a loan applicant.

When Portfolio Lending Makes Most Sense

Certain scenarios particularly benefit from portfolio jumbo lending:

- Self-employment with complex income structures

- Multiple income sources difficult to document traditionally

- Unique or luxury properties that don’t fit typical guidelines

- Recent credit events with strong compensating factors

- Complex asset holdings for reserves or qualification

- Multiple properties or sophisticated real estate portfolios

- Foreign national status or non-permanent resident

- Situations requiring customized loan structures

Jumbo Loan Strategy #6: Understand Jumbo Refinance Opportunities

When should you refinance your jumbo loan? Consider refinancing when market conditions offer substantially better terms, when your credit profile has improved significantly since originating your current loan, when you need to extract equity for other purposes, or when you want to restructure debt by consolidating other obligations.

Jumbo refinancing follows similar principles to initial jumbo purchases but with additional considerations around break-even analysis, existing loan terms you’re refinancing away, and whether you’re simply improving terms or also extracting equity.

Rate-and-Term Jumbo Refinancing

This structure simply replaces your existing mortgage with improved terms without extracting equity:

When rate-and-term refinancing makes sense:

- Market pricing has improved substantially since your origination

- Your credit score has increased significantly

- You’re eliminating mortgage insurance from your original loan

- You want to switch from adjustable to fixed rate (or vice versa)

- You’re modifying your repayment timeline

- You’re consolidating a first and second lien into one loan

How much must rates improve to justify jumbo refinancing? Break-even analysis compares your closing costs against monthly savings—if you’ll recoup costs within your expected occupancy period and total interest savings exceed all transaction costs, refinancing typically makes financial sense.

Calculate your refinance scenario:

Cash-Out Jumbo Refinancing

Extract equity while potentially restructuring your mortgage:

Common reasons for jumbo cash-out refinancing:

- Property improvements – Fund renovations that increase property value

- Investment opportunities – Deploy home equity in business ventures or investments

- Debt consolidation – Pay off higher-interest debt with mortgage financing

- Tax planning – Strategically deploy equity for tax-advantaged purposes

- Tuition or education – Fund significant educational expenses

- Emergency reserves – Build substantial liquidity cushions

How much equity can you extract through jumbo cash-out refinancing? Lenders typically limit cash-out refinancing to specific maximum loan-to-value ratios that vary by property type, with primary residences generally allowing higher ratios than second homes or investment properties, and each lender maintaining their own guidelines.

Compare scenarios:

Jumbo Refinance Documentation

Expect similar documentation to your original jumbo loan:

- Current income verification

- Updated asset statements

- Current credit report and score review

- Updated property appraisal reflecting current value

- Existing mortgage payment history

- Property insurance declarations

- Updated debt obligations

Is jumbo refinance documentation easier since you already have the loan? Sometimes, particularly with your existing lender who already knows your file, but market conditions and your financial situation may have changed significantly requiring full underwriting analysis—don’t assume documentation will be dramatically simplified.

Considering a refinance? Submit a refinance inquiry to see if this makes sense for you.

What Are Common Jumbo Loan Mistakes to Avoid?

What mistakes do borrowers make when applying for jumbo loans? Common errors include making major financial changes during the application process, failing to compare multiple lenders, neglecting to optimize their credit profile before applying, choosing inappropriate loan structures for their situation, underestimating reserve requirements, and not thoroughly documenting complex income sources.

Avoiding these pitfalls helps ensure smooth jumbo loan approval and positions you for the most competitive terms available given your financial profile.

Mistake #1: Major Financial Changes During Application

Lenders verify your financial situation immediately before closing, and significant changes can derail approved loans:

Actions that jeopardize jumbo loan approval:

- Opening new credit accounts or making major credit purchases

- Changing jobs or employment status

- Large unexplained deposits appearing in accounts

- Closing credit accounts, especially revolving credit

- Co-signing loans for others

- Making large transfers between accounts without documentation

- Taking on new debt obligations

- Making large cash withdrawals

Why do lenders re-verify everything before closing jumbo loans? The increased absolute risk on high-balance loans makes lenders particularly sensitive to last-minute changes that might affect your ability to manage the substantial debt obligation—what might be minor on conforming loans becomes significant on jumbo mortgages.

Mistake #2: Inadequate Lender Comparison

Jumbo loan markets are less standardized than conforming mortgages, creating significant pricing variations:

Compare at minimum:

- Multiple portfolio lenders in your area

- National jumbo lenders with active presence in your market

- Credit unions where you qualify for membership

- Private banks serving high-net-worth individuals

- Your existing banking relationships

How much can jumbo loan pricing vary between lenders? Differences of significant percentages in pricing or thousands of dollars in fees occur regularly in jumbo markets due to varying business models, portfolio appetite, and underwriting flexibility—comprehensive shopping often identifies materially better opportunities.

Mistake #3: Neglecting Credit Optimization

Minor credit management improvements can shift you into better pricing tiers or strengthen borderline applications:

Strategic credit optimization for jumbo loans:

- Pay down credit card balances to very low utilization well before applying

- Dispute any errors on credit reports from all three bureaus

- Time your application to allow late payments to age off consideration

- Avoid new credit applications for several months before jumbo application

- Maintain consistent payment patterns showing financial discipline

- Don’t close old accounts which might shorten credit history average

Plan credit optimization at least 3-6 months before your anticipated jumbo loan application for maximum impact.

Mistake #4: Misunderstanding Reserve Requirements

Many borrowers underestimate liquid assets needed after closing:

Reserve calculation mistakes:

- Not accounting for all financed properties in reserve calculation

- Miscounting which assets qualify as acceptable reserves

- Forgetting some asset types receive discounted valuation

- Not planning for reserves needed at closing plus future months required

- Liquidating retirement accounts creating tax obligations

- Not documenting asset seasoning when required

Before applying, verify you’ll meet reserve requirements comfortable margin after your initial equity contribution and closing costs.

Mistake #5: Poor Documentation of Complex Income

Self-employed borrowers and those with diverse income often sabotage their applications through inadequate documentation:

Self-employment documentation errors:

- Incomplete tax returns missing schedules or supporting forms

- Unexplained discrepancies between personal and business returns

- Declining income trends without clear explanation

- Inadequate year-to-date financial statements if applying mid-year

- Mixing business and personal expenses in unclear ways

- Failing to provide context for unusual items

- Not organizing documentation logically for underwriter review

Work with experienced jumbo loan officers who can guide self-employed borrowers through documentation requirements before submission.

Jumbo Loan Options for High-Net-Worth Borrowers

What specialized jumbo loan programs exist for wealthy individuals? Private banks, wealth management divisions, and specialized lenders offer ultra-high-net-worth jumbo programs featuring very high loan limits, asset-based qualification without income documentation, relationship pricing based on total assets, and concierge service including dedicated lending teams.

These programs cater to borrowers with substantial wealth who may have complex income structures, desire privacy, value relationship banking, or don’t fit traditional underwriting despite obvious financial capacity.

Asset-Based Jumbo Loans

Qualify based on liquid asset holdings rather than income:

How asset-based jumbo qualification works:

- Lender evaluates your total liquid assets (cash, investments, etc.)

- Calculates whether assets could theoretically cover the loan obligation

- May use formulas considering asset amount, loan size, and terms

- Eliminates need for tax returns, pay stubs, or employment verification

- Particularly valuable for retirees, trust beneficiaries, or ultra-wealthy

What assets count toward asset-based jumbo loan qualification? Most programs accept checking, savings, money market accounts, stocks, bonds, mutual funds, and sometimes retirement accounts (possibly with discounts), while excluding illiquid assets like real estate, business interests, collectibles, or assets with restricted access.

Real examples:

Private Banking Jumbo Solutions

High-net-worth individuals with substantial banking relationships access premium jumbo services:

Private banking jumbo advantages:

- Relationship pricing based on total assets with institution

- Portfolio managers coordinating with mortgage specialists

- Flexible underwriting considering your complete financial picture

- Ability to pledge securities instead of liquidating positions

- Streamlined documentation for established clients

- Very high loan limits for substantial properties

- Privacy and discretion in handling sensitive information

How do pledged asset lines work for jumbo properties? Rather than selling investments for your equity contribution or taking traditional loans, you pledge investment portfolio as collateral, maintaining investment upside potential while accessing liquidity for real estate purchases.

Foreign National Jumbo Loans

Non-U.S. citizens purchasing U.S. real estate access specialized programs:

Foreign national considerations:

- Typically larger equity requirements than U.S. citizen loans

- May accept foreign income and asset documentation

- Often don’t require U.S. credit history

- Focus on property as primary collateral

- May have different rate structures

- Require specific documentation for wire transfers

- Navigate tax withholding and reporting requirements

Can foreign nationals get jumbo loans without U.S. credit history? Yes, specialized programs evaluate foreign credit reports, bank statements, asset documentation, and income verification from home countries, using property equity position as primary underwriting focus rather than U.S. credit systems.

Advanced Jumbo Loan Questions

Can You Get a Jumbo Loan for New Construction?

Yes, jumbo construction-to-permanent loans finance building custom homes by providing construction financing that converts to permanent mortgage upon completion, though these programs require detailed architectural plans, licensed builder contracts, property appraisals based on completed plans, and typically larger equity contributions due to construction risk.

How do jumbo construction loans disburse funds? Rather than lump sum distribution, construction loans release funds in draws as building milestones complete and pass inspection—this protects both borrower and lender from contractor performance issues while ensuring quality construction matching approved plans.

Construction loan considerations:

- Detailed architectural plans and specifications required

- Licensed builder with strong credentials and insurance

- Construction budget with line-item breakdown

- Timeline with milestone schedule

- Appraisal based on completed plans (“as-completed” value)

- Potentially interest-only payments during construction

- Single closing combining construction and permanent financing

What Happens to Your Jumbo Loan in Divorce?

Property division during divorce affects jumbo loans significantly—one spouse retaining the property must typically refinance to remove the other from loan obligations, or if selling, jumbo loan payoff comes from proceeds before equity division, with timing considerations around market conditions and refinancing qualification.

Can you remove a spouse from a jumbo loan without refinancing? Most lenders won’t release co-borrowers from loan obligations without full payoff or refinancing since original underwriting included both borrowers’ income and credit—removal changes the risk profile substantially and violates the original lending agreement.

Divorce strategies for jumbo properties:

- Spouse keeping property refinances into their name alone

- Both parties sell property and split proceeds after loan payoff

- Short-term arrangements where both remain on loan temporarily with clear exit strategy

- One spouse buys out the other’s equity interest

- Property remains jointly owned with clear agreements (risky)

Divorcing parties should work with attorneys understanding real estate implications, engage mortgage professionals early about refinancing feasibility, obtain property valuations and loan payoff quotes, and understand tax implications of various division scenarios.

How Do Jumbo Loan Limits Vary by Location?

Conforming loan limits determining jumbo thresholds vary significantly by county based on local median home values, with high-cost areas including much of California, metro New York, Washington D.C., Hawaii, and other expensive markets receiving substantially higher conforming limits than baseline levels.

Where can you find conforming loan limits for your specific county? The Federal Housing Finance Agency maintains an interactive map and searchable database at FHFA.gov allowing you to enter your property address or county and determine current year conforming loan limits, which change annually based on housing market data.

Location considerations:

- Baseline conforming limit applies to most counties

- High-cost area designation provides higher conforming limits

- Alaska, Hawaii, Guam, Virgin Islands receive special higher limits

- Limits affect single-family homes differently than 2-4 unit properties

- Limits adjust annually, sometimes significantly in volatile markets

Understanding your local limit determines whether you need jumbo financing or can potentially use conforming loan programs.

Can You Have Multiple Jumbo Loans Simultaneously?

Yes, borrowers can carry multiple jumbo mortgages on different properties simultaneously, though qualification becomes progressively complex as lenders must evaluate combined debt obligations, reserves covering all properties, management of multiple high-balance loans, income supporting total debt, and overall financial capacity to handle substantial aggregate leverage.

How do multiple jumbo loans affect qualification for additional financing? Each existing jumbo loan’s payment appears in debt-to-income calculations, reserve requirements multiply to cover all properties, lenders scrutinize income stability more closely, credit profile must demonstrate consistent payment management, and equity in multiple properties affects overall risk assessment.

Multiple jumbo loan strategies:

- Build strong relationship with portfolio lender who knows your finances

- Maintain substantial reserves far exceeding minimum requirements

- Keep debt-to-income ratios conservative across all properties

- Document strong income growth trajectory

- Consider DSCR loans for investment properties to exclude from personal debt ratios

- Maintain excellent credit with perfect payment history

- Organize financial documentation professionally

How Do Interest-Only Jumbo Loans Work?

Interest-only jumbo structures allow you to pay only interest during an initial period (commonly 5-10 years) before beginning principal amortization, reducing initial payment obligations while maintaining ultimate repayment, though you don’t build equity during interest-only period and face payment increases when amortization begins.

When do interest-only jumbo loans make sense? Borrowers expecting significant future income increases, those planning to sell before amortization begins, investors focusing cash flow on other opportunities, ultra-wealthy individuals who prefer liquidity over equity building, or those with irregular income patterns matching interest-only flexibility.

Interest-only considerations:

- Lower initial payments compared to fully amortizing loans

- No equity build-up during interest-only period

- Payment shock when principal amortization begins

- Potentially higher rates than fully amortizing loans

- Flexibility for sophisticated borrowers

- Risk if property values decline and you haven’t built equity

- Refinancing challenges if financial situation weakens

What happens when the interest-only period ends? Payments increase significantly as principal amortization begins, calculated to fully repay the loan over remaining term—borrowers must plan for this payment adjustment through income growth, refinancing, property sale, or asset liquidation.

Are Jumbo Loan Interest Rates Fixed or Variable?

Both fixed and adjustable-rate structures exist for jumbo loans, with fixed-rate mortgages providing payment certainty throughout the loan term while adjustable-rate mortgages offer lower initial pricing during fixed periods before periodic adjustments begin, and the optimal choice depends on your occupancy plans, risk tolerance, and rate outlook.

How do jumbo ARM adjustment periods work? After an initial fixed period (typically 5, 7, or 10 years), rates adjust periodically (commonly annually) based on an index plus margin, with adjustment caps limiting how much rates can change per adjustment and over the loan life, providing some protection against dramatic payment increases.

ARM considerations:

- Lower initial rates than fixed-rate equivalents

- Rate adjustment risk after initial fixed period

- Useful if selling or refinancing before adjustments begin

- Periodic and lifetime rate caps limit potential increases

- Index selection affects future rate behavior

- Margin added to index determines actual rate

Fixed-rate advantages:

- Payment certainty throughout loan term

- Protection against rate increases

- Simplified long-term budgeting

- Stability for conservative borrowers

Alternative Loan Programs for High-Value Properties

If a jumbo loan isn’t the right fit, consider these alternatives:

- Conventional Loan – Traditional financing for properties within conforming loan limits

- Asset-Based Loan – Leverage investment portfolios for qualification on high-value properties

- Bank Statement Loan – For self-employed high-net-worth borrowers using bank deposits for income qualification

- No-Doc Loan – Minimal income verification for borrowers with strong credit and substantial assets

- Foreign National Loan – For non-U.S. citizens purchasing high-value properties in the United States

Explore all 30+ loan programs to find your best option.

Not sure which program is right for you? Take our discovery quiz to find your path.

Helpful Jumbo Loan Resources

Official Government Guidance

Federal Housing Finance Agency Conforming Loan Limits – Official FHFA interactive map and searchable database showing current year conforming loan limits by county, helping determine whether your financing needs require jumbo loan products.

Consumer Financial Protection Bureau Jumbo Mortgage Information – Federal consumer protection agency resource explaining jumbo loan basics, differences from conforming mortgages, and consumer rights throughout the lending process.

IRS Publication 936: Home Mortgage Interest Deduction – Official IRS guidance on mortgage interest deductibility including limitations on deduction amounts, qualified residence rules, and reporting requirements for itemized deductions.

Industry Organizations

Mortgage Bankers Association Research on Jumbo Lending – National trade association providing market research, industry trends, and analysis of jumbo mortgage markets including origination volumes, pricing trends, and market conditions.

Urban Institute Housing Finance Policy Center – Research organization analyzing housing finance markets including jumbo lending trends, policy implications, and market dynamics affecting high-balance mortgage availability.

Educational Resources

Freddie Mac Understanding Mortgage Rates and Limits – Weekly mortgage market survey tracking rate trends including jumbo versus conforming rate relationships and historical data for market analysis.

Federal Reserve Consumer Resources on Mortgages – Central bank educational resources explaining how monetary policy affects mortgage markets, interest rate factors, and economic conditions influencing lending.

Need local expertise? Get introduced to trusted partners including loan officers, realtors, and contractors in your area.

Ready to get started? Apply now or schedule a call to discuss your situation.

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Not Sure About Your Next Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Related Posts

Subscribe to our newsletter

Get program updates and rate insights in your inbox.