Bank Statement Loan: 7 Proven Ways Self-Employed Borrowers Qualify Faster

How a Bank Statement Loan Simplifies Mortgage Approval Without Tax Returns

Self-employed borrowers often find their tax returns don’t reflect their true earning capacity due to legitimate business deductions. Bank statement loans bypass traditional income documentation by analyzing your actual cash flow through business or personal bank deposits. Whether you’re a business owner, freelancer, or independent contractor, this qualification method recognizes the income that flows through your accounts rather than what appears on your tax returns.

Key Details: What You’ll Learn About Bank Statement Loans

- A bank statement loan uses personal or business bank deposits to verify income instead of tax returns or W-2 forms (CFPB alternative income verification mortgage information)

- Self-employed borrowers, business owners, and entrepreneurs qualify using 12-24 months of bank statements showing consistent deposits (Fannie Mae self-employed income documentation guidelines)

- Properties including primary residences, second homes, and investment properties qualify under a bank statement loan structure

- Lenders calculate qualifying income by analyzing average monthly deposits rather than taxable income shown on tax returns

- A bank statement loan accommodates borrowers who write off business expenses that reduce tax liability but not actual cash flow

- Credit profiles with solid payment history strengthen qualification even when tax returns show minimal income (IRS self-employment tax guidelines)

- Personal bank statements, business bank statements, or a combination of both can document qualifying income depending on business structure

Ready to explore your options? Schedule a call with a loan advisor.

What Is a Bank Statement Loan?

A bank statement loan represents a mortgage qualification approach designed specifically for self-employed borrowers whose tax returns don’t reflect their true earning capacity. Instead of analyzing tax returns with complex Schedule C deductions, depreciation, and business expenses, lenders verify your income by reviewing deposits in your personal or business bank accounts.

How does bank statement income verification work? Lenders collect 12-24 months of bank statements and analyze deposits to calculate your average monthly income. Rather than using the net income shown on tax returns—which often appears artificially low due to legitimate business deductions—a bank statement loan recognizes the actual cash flowing through your accounts.

The methodology acknowledges a fundamental truth about self-employment: smart business owners minimize taxable income through strategic deductions including vehicle expenses, home office costs, equipment purchases, meals, travel, and depreciation. While these strategies reduce tax liability, they also reduce the income shown on tax returns that conventional lenders use for qualification. A bank statement loan solves this disconnect.

Who Benefits Most from a Bank Statement Loan?

Several borrower profiles find exceptional value in a bank statement loan structure. These programs serve business owners and self-employed professionals whose financial strategies prioritize tax efficiency over reported income.

Business owners with significant write-offs represent ideal candidates for a bank statement loan. If your accountant helps you legally minimize taxes through aggressive but legitimate business deductions, your tax returns likely show minimal net income despite strong cash flow. A bank statement loan evaluates your actual deposits rather than taxable income.

Independent contractors and freelancers who operate as sole proprietors often write off substantial business expenses. While these deductions save thousands in taxes annually, they devastate mortgage qualification under traditional programs. A bank statement loan recognizes your gross revenue rather than penalizing your tax planning.

Real estate investors and agents frequently show minimal taxable income due to depreciation, vehicle expenses, marketing costs, and other business deductions. A bank statement loan accommodates real estate professionals building their own property portfolios alongside their businesses.

Restaurant owners, contractors, and cash-intensive businesses may have income flowing through accounts that doesn’t perfectly align with complex business tax returns. A bank statement loan focuses on demonstrated deposits rather than intricate tax documentation.

Recently self-employed professionals who transitioned from W-2 employment may lack two years of business tax returns required by conventional programs. Some bank statement loan structures accommodate borrowers with shorter self-employment history when strong bank deposits demonstrate earning capacity.

Explore all loan programs to understand your full range of options.

What Documentation Does a Bank Statement Loan Require?

Understanding the specific documentation requirements helps you prepare for a smooth application process. A bank statement loan simplifies qualification compared to traditional self-employment verification but requires thorough bank account documentation.

Required documentation typically includes:

- Personal or business bank statements for 12-24 months

- Profit and loss statement (year-to-date)

- Business license or documentation proving self-employment

- Credit report authorization

- Property appraisal documentation

- Homeowner’s insurance information

- Standard closing documentation

Do you need personal or business bank statements? The answer depends on your business structure and where your income deposits. Sole proprietors typically use personal bank statements showing all business deposits. LLC owners, S-corporation shareholders, or partnership members might use business bank statements. Some borrowers provide both personal and business statements for comprehensive income documentation.

How many months of bank statements do lenders require? Most bank statement loan programs require 12 or 24 months of consecutive bank statements. The 12-month option typically applies to borrowers with very strong credit, substantial reserves, and stable deposit patterns. The 24-month requirement provides more comprehensive income analysis and accommodates borrowers with seasonal businesses or variable income.

What if you have multiple bank accounts? Many self-employed borrowers maintain separate checking accounts for different business lines, personal expenses, or savings strategies. Lenders can typically aggregate deposits across multiple accounts to calculate your total qualifying income, though you’ll need to provide complete statement sets for each account used in the calculation.

Do you still need tax returns? While the bank statement loan doesn’t use tax returns for income calculation, most lenders still request your most recent year or two of personal tax returns. These documents verify you’re filing taxes, confirm self-employment status, and provide additional financial context—but the actual income shown doesn’t determine your qualification.

How Do Lenders Calculate Income from Bank Statements?

Understanding the income calculation methodology helps you estimate your potential qualification before applying. A bank statement loan uses a more intuitive approach than traditional tax return analysis, but specific formulas vary by lender.

What’s the basic calculation method? Lenders review all deposits in your bank statements and add them up to determine gross monthly income. They then apply an expense factor—typically 25-50%—to account for business costs that don’t appear as separate expenses in your statements. The remaining amount becomes your qualifying income.

Why do lenders deduct an expense percentage? Even though your bank deposits represent actual cash received, lenders recognize you incur business costs. The expense factor accounts for typical business obligations without requiring detailed expense documentation. A 50% expense factor means lenders assume half your deposits represent business costs, leaving the other half as net qualifying income.

Can you get a lower expense factor? Some programs offer expense factors as low as 25% or even 0% for specific industries or borrower profiles. Lower expense factors result in higher qualifying income, enabling larger loan amounts. Factors affecting your expense percentage include:

- Your industry and typical cost structures

- Your credit score and overall financial strength

- Your equity contribution and reserves

- Documentation you provide about business expenses

- The specific lender and program guidelines

How do lenders handle non-income deposits? Bank statements often show deposits beyond business income including transfers between accounts, loan proceeds, reimbursements, or returns. Experienced underwriters distinguish between income-generating deposits and non-income transfers when calculating your qualifying capacity.

What about seasonal businesses? Many self-employed borrowers experience seasonal income fluctuations—landscapers busy in summer, tax preparers swamped in spring, or retailers peaking during holidays. Lenders typically average deposits over the full 12-24 month period to smooth seasonal variations and establish consistent monthly qualifying income.

Calculate your bank statement loan scenarios:

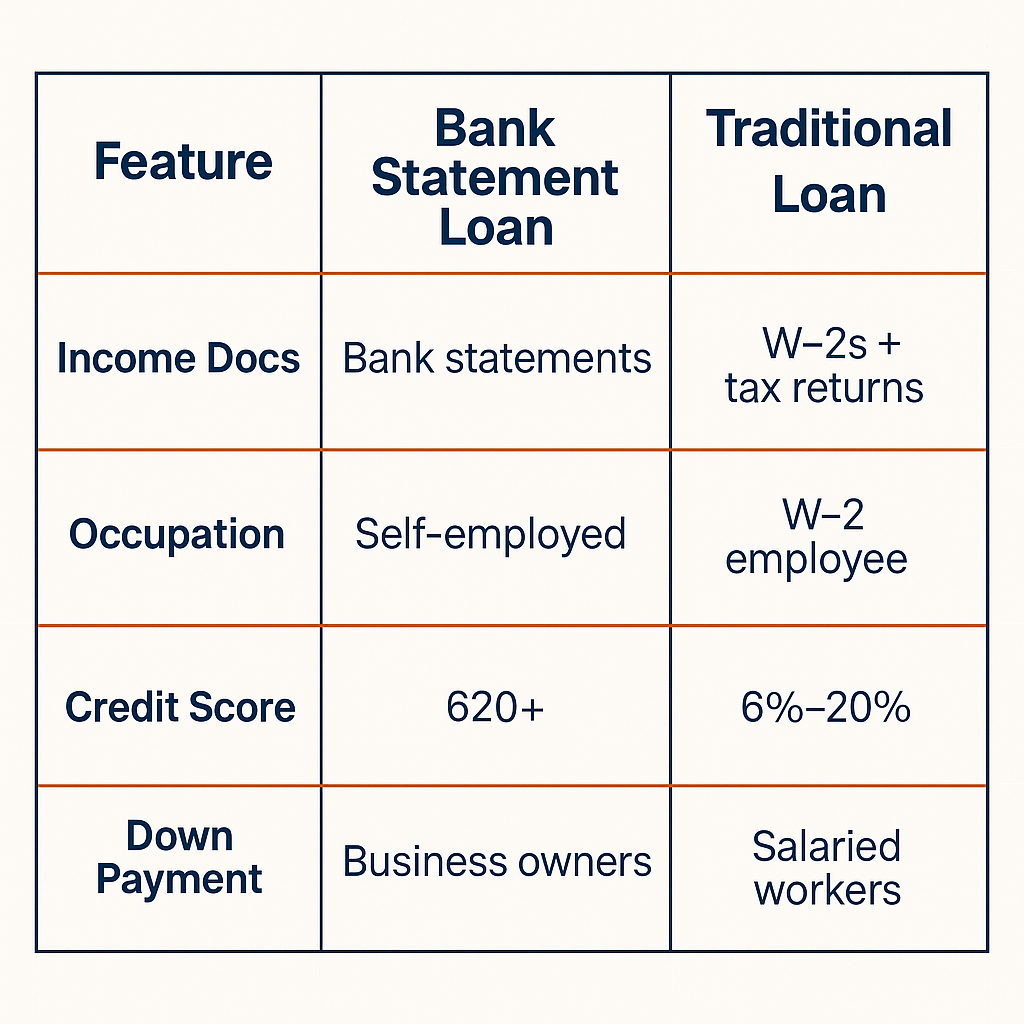

How Does a Bank Statement Loan Differ from Traditional Mortgage Qualification?

The fundamental distinction lies in how lenders evaluate your income and which documentation determines your qualifying capacity. Traditional mortgages require extensive tax return analysis while a bank statement loan focuses on actual deposits.

Traditional mortgage qualification for self-employed borrowers:

- Requires 2 years of complete business and personal tax returns

- Analyzes Schedule C or business returns line by line

- Deducts all business expenses from gross income

- Adds back depreciation and certain one-time expenses

- Requires detailed profit and loss statements

- Results in net income often 40-70% lower than gross revenue

Bank statement loan qualification approach:

- Uses 12-24 months of bank statements as primary documentation

- Calculates income based on actual deposits

- Applies standard expense factor (typically 25-50%)

- Minimizes complex tax return analysis

- Streamlined documentation requirements

- Results in higher qualifying income for most self-employed borrowers

Why do business deductions hurt conventional qualification so much? Every legitimate business expense you claim—vehicle costs, home office deductions, equipment purchases, business meals, professional development, insurance, supplies—reduces your net income on Schedule C. While these deductions save you thousands in taxes, they devastate mortgage qualification by lowering the income number lenders use for approval.

A bank statement loan recognizes this disconnect. Your actual earning capacity appears in your bank deposits, not in your strategically minimized taxable income.

Ready to discuss your purchase scenario? Submit a purchase inquiry to explore your options.

What Property Types Qualify for a Bank Statement Loan?

A bank statement loan program accommodates diverse property categories, providing flexibility for various real estate goals. Understanding which property types qualify helps you plan your home purchase or investment strategy.

Eligible property categories:

- Primary residences in urban, suburban, and rural locations

- Second homes and vacation properties

- Single-family rental properties

- Multi-unit investment properties including duplexes, triplexes, and fourplexes

- Condominiums in approved developments

- Townhomes and single-family attached properties

Can you purchase investment properties with a bank statement loan? Yes, many bank statement loan programs accommodate investment property purchases. Self-employed borrowers building real estate portfolios can leverage their business bank deposits to qualify for rental acquisitions without analyzing rental income projections through traditional underwriting.

Are there property value limits? Bank statement loan programs typically extend beyond conventional conforming limits, accommodating luxury properties and high-value acquisitions. Many programs approve properties well into the multi-million dollar range, making them particularly valuable for successful business owners purchasing upscale homes.

What about property condition requirements? Most bank statement loan programs require properties in good condition suitable for immediate occupancy. Properties needing extensive repairs, significant safety issues, or major system replacements may require renovation financing or alternative program structures.

See how other self-employed borrowers have successfully used bank statement financing:

What Credit Requirements Apply to a Bank Statement Loan?

Credit profile evaluation remains important for a bank statement loan qualification, though specific requirements vary by lender and program. Understanding the credit standards helps you assess your readiness to apply.

Minimum credit score expectations – Most bank statement loan programs establish baseline credit score requirements ranging from 600 to 700 depending on the specific program structure, equity contribution, and compensating factors. Higher credit scores typically provide access to more competitive pricing and lower expense factors in income calculation.

How does credit history impact approval? Lenders evaluate your credit report for payment patterns, credit utilization, derogatory marks, and overall credit management. Consistent on-time payments on credit cards, business debts, auto loans, and previous housing obligations demonstrate financial responsibility even when your tax returns show minimal income.

Can you qualify with past credit challenges? Many bank statement loan programs accommodate borrowers with previous credit issues including collections, charge-offs, late payments, or even past foreclosures when sufficient seasoning has occurred. The focus shifts to demonstrating credit recovery and current responsible financial management alongside your documented bank deposits.

Does bankruptcy disqualify you from a bank statement loan? Previous bankruptcy—whether Chapter 7 or Chapter 13—doesn’t automatically disqualify you. Most programs require waiting periods ranging from 2-4 years after discharge or dismissal, depending on the bankruptcy type and the presence of extenuating circumstances.

Common Bank Statement Loan Questions

Can you use both personal and business bank statements?

Yes, many borrowers benefit from combining personal and business bank statement analysis to maximize qualifying income. If you operate as a sole proprietor with business deposits flowing into personal accounts while also maintaining a business checking account, lenders can typically aggregate deposits across both account types.

This approach requires providing complete statement sets for all accounts used in the income calculation and ensuring no double-counting of transfers between accounts. Experienced underwriters track fund flows to identify true income deposits versus internal transfers.

What if you have large irregular deposits?

Self-employed borrowers often receive large irregular deposits including annual bonuses, project completions, real estate commissions, or seasonal income. Lenders accommodate irregular deposit patterns by averaging income over the full 12-24 month statement period rather than requiring consistent monthly amounts.

How lenders handle irregular deposits:

- Total all qualifying deposits over the analysis period

- Divide by the number of months to establish average monthly income

- Apply the appropriate expense factor

- Result becomes your qualifying monthly income

This averaging approach naturally smooths income fluctuations common in self-employment, making qualification accessible even when month-to-month deposits vary significantly.

Do you need to explain every deposit in your statements?

Unlike the extensive deposit sourcing required for down payment verification in conventional mortgages, bank statement loan income analysis focuses on patterns rather than individual deposit explanations. Lenders understand self-employment income arrives in diverse forms from multiple sources.

However, you may need to explain unusually large deposits, transfers between accounts, loan proceeds, or non-income items that could artificially inflate your deposit totals. Clear business operations with straightforward income patterns require minimal explanation.

Can you qualify with less than 2 years of self-employment?

Most bank statement loan programs require demonstrating 12-24 months of consistent bank deposits, effectively requiring at least one year of self-employment history. However, specific programs accommodate borrowers with shorter self-employment periods when:

- You transitioned to self-employment in the same industry

- You have exceptionally strong credit and reserves

- Your deposits show clear upward trends

- You provide additional income documentation beyond bank statements

The shorter your self-employment history, the more important compensating factors become in securing approval.

How Do Interest Rates Compare on a Bank Statement Loan?

Competitive program structures reflect the specialized underwriting approach for self-employed borrowers. While specific pricing varies based on individual scenarios, understanding the general pricing framework helps you evaluate whether a bank statement loan fits your financial strategy.

What factors influence pricing on a bank statement loan? Several elements affect your specific rate structure:

- Credit score and payment history

- Expense factor applied to your income (25% vs 50%)

- Number of bank statement months provided (12 vs 24)

- Property type and location

- Equity contribution and funding structure

- Overall financial profile including reserves

Are rates higher than conventional mortgages? A bank statement loan typically carries slightly higher pricing compared to traditional W-2 employment mortgages due to the alternative documentation approach. However, the pricing differential often proves minimal compared to the qualification advantages—many self-employed borrowers cannot qualify conventionally at any rate due to tax return income limitations.

Can you improve your rate with stronger qualification factors? Demonstrating multiple years of increasing deposits, maintaining excellent credit, providing 24 months of statements instead of 12, offering larger equity contributions, or showing substantial cash reserves often provides access to more competitive pricing tiers within bank statement loan programs.

The total value evaluation should consider both pricing and qualification accessibility. For self-employed borrowers who would qualify for significantly lower loan amounts using tax returns—or who cannot qualify conventionally at all—a bank statement loan often represents the optimal financing solution despite potentially higher costs.

Considering a refinance? Submit a refinance inquiry to see if this makes sense for you.

What Are the Advantages of a Bank Statement Loan?

Understanding the specific benefits helps you evaluate whether this program aligns with your financial situation as a business owner. A bank statement loan offers distinct advantages for self-employed professionals whose tax strategies create qualification challenges.

Key advantages include:

Significantly higher qualifying income – By focusing on gross deposits rather than net taxable income, most self-employed borrowers qualify for substantially larger loan amounts. Business owners with $200,000 in gross revenue but $50,000 in net income after deductions might qualify based on $150,000+ using bank statement analysis versus $50,000 using tax returns.

Rewards tax-efficient business strategies – Instead of penalizing smart tax planning, a bank statement loan recognizes that business deductions reduce tax liability without proportionally reducing your ability to afford housing obligations. Your accountant’s tax-saving strategies no longer sabotage your mortgage qualification.

Simpler documentation requirements – Skip the complex tax return analysis including Schedule C reconstruction, depreciation add-backs, and intricate business financial statements. Bank statements provide straightforward income verification without extensive supplementary documentation.

Faster approval process – Without extensive business tax return analysis and complicated income calculations, underwriting proceeds more efficiently. Many business owners experience compressed timelines from application to approval compared to traditional self-employment mortgages.

Accommodates various business structures – Whether you operate as a sole proprietor, LLC, S-corporation, or partnership, a bank statement loan can accommodate your structure by analyzing the appropriate bank accounts where your income flows.

Works with shorter self-employment history – Some programs accommodate borrowers with 12 months of consistent deposits rather than requiring 2 years of business tax returns, providing earlier homeownership access for new business owners.

Alternative Loan Programs for Self-Employed Borrowers

If a bank statement loan isn’t the right fit, consider these alternatives for self-employed financing:

- 1099 Loan – For independent contractors using 1099 income documentation without full tax return analysis

- Profit and Loss Loan – Qualifies using CPA-prepared profit and loss statements showing business profitability

- Asset-Based Loan – Leverages investment portfolios and liquid assets for qualification when income documentation is challenging

- No-Doc Loan – Minimal income verification for borrowers with strong credit and substantial assets

- DSCR Loan – For investment properties qualifying based on rental cash flow without personal income documentation

Explore all 30+ loan programs to find your best option.

Not sure which program is right for you? Take our discovery quiz to uncover your goals.

Advanced Bank Statement Loan Questions

How do business bank accounts with employee payroll affect qualification?

Business bank accounts showing payroll expenses, contractor payments, or other business disbursements require careful analysis. Lenders distinguish between gross revenue deposits and operational expenses flowing through the account to isolate your actual qualifying income.

If your business bank statements show $500,000 in annual deposits but $300,000 flows immediately to employee payroll and vendor payments, lenders focus on the net amount available to you. This scenario might benefit from providing both business accounts (showing gross revenue) and personal accounts (showing your actual compensation) for clearer income documentation.

What if you transferred from W-2 employment to self-employment recently?

Transitioning from traditional employment to business ownership creates unique qualification scenarios. If you have extensive W-2 history in the same industry followed by 12 months of strong self-employment bank deposits, some programs accommodate this transition by considering both your employment history and current business income.

Transition qualification strategies:

- Provide final W-2 showing employment end date

- Demonstrate business launch in same industry or profession

- Show 12+ months of consistent business bank deposits

- Explain the transition narrative in borrower letters

- Leverage strong credit and reserves as compensating factors

Can you use bank statements from savings or investment accounts?

Bank statement loan programs focus on checking account deposits representing business revenue or self-employment income. Savings account interest, investment dividends, or capital gains shown in brokerage statements typically don’t qualify as business income for bank statement analysis.

However, some hybrid programs consider various income sources by combining bank statement analysis for business income with traditional documentation for investment income, creating comprehensive qualification for borrowers with diversified income streams.

How do cryptocurrency deposits or digital payment platforms affect qualification?

Modern self-employed professionals often receive income through digital platforms including PayPal, Venmo, Cash App, cryptocurrency exchanges, or payment processors. These deposits appear in bank statements when transferred to traditional accounts, making them accessible for bank statement loan qualification.

Digital income considerations:

- Transfers from payment platforms to bank accounts qualify as deposits

- Consistent patterns demonstrate sustainable income

- Platform statements may supplement bank statements for detailed analysis

- Cryptocurrency conversions to USD qualify once deposited

- Lenders evaluate stability and sustainability of digital income sources

What if your business is registered under a different name?

Many self-employed borrowers operate under DBAs (Doing Business As), trade names, or business entities with names different from their personal names. When deposits show business names or client names that don’t match your personal name, you’ll need documentation connecting you to the business.

Documentation for business name verification:

- Business license or DBA registration

- Articles of incorporation or LLC formation documents

- Business bank account statements showing ownership

- Tax returns showing business income reported

- Letter explaining business structure and ownership

Can you use bank statements showing mixed business and personal expenses?

Sole proprietors frequently commingle business and personal expenses in a single checking account. While not ideal accounting practice, this reality doesn’t disqualify you from a bank statement loan. Lenders analyze total deposits to determine income, and the expense factor applied accounts for both business and personal obligations.

However, cleaner separation between business and personal finances may result in more favorable underwriting review and potentially lower expense factors, leading to higher qualifying income.

How do business losses in previous years affect current bank statement qualification?

Even if your tax returns show business losses for previous years, a bank statement loan focuses on current deposits rather than historical tax return income. If your business experienced difficulties in prior years but recent bank statements demonstrate recovery with strong consistent deposits, you can qualify based on current performance.

This approach particularly benefits business owners who weathered economic challenges, business transitions, or startup losses but now show sustainable revenue in their bank accounts.

What happens if deposit patterns change significantly during underwriting?

Lenders typically verify that income patterns remain consistent from initial application through closing. If your business deposits drop significantly during the approval process—perhaps due to seasonal slowdowns, client losses, or business changes—this may trigger additional review or require updated documentation.

Maintaining qualification consistency:

- Avoid major business structure changes during approval

- Communicate expected seasonal variations upfront

- Provide updated statements if closing delays occur

- Demonstrate reserves compensating for income fluctuations

- Consider timing applications after strong income periods

Can foreign nationals qualify for a bank statement loan?

Foreign national borrowers operating businesses in the United States and maintaining U.S. bank accounts may qualify for specialized bank statement loan programs depending on visa status, business documentation, and lender guidelines. The combination of non-citizen status and self-employment income requires careful program selection.

Foreign national bank statement qualification typically requires:

- Valid visa documentation authorizing U.S. business operations

- U.S. bank accounts with consistent deposit patterns

- Business registration or licensing in the United States

- Larger equity contributions than U.S. citizens

- Credit profile through alternative verification methods

- Proof of U.S. business ties or permanent presence intent

How do multiple business income streams affect qualification?

Many entrepreneurs operate several businesses simultaneously or maintain multiple income streams through various ventures. A bank statement loan can accommodate multiple income sources by analyzing all business bank accounts where these income streams deposit.

Multiple business considerations:

- Provide bank statements for all business accounts

- Aggregate total deposits across all income sources

- Apply appropriate expense factors based on combined businesses

- Document ownership and operation of each venture

- Demonstrate sustainability of diversified income approach

Ready to get started? Apply now or schedule a call to discuss your situation.

Helpful Bank Statement Loan Resources

Official Government Guidance:

CFPB Alternative Income Verification Mortgage Information – Consumer Financial Protection Bureau resource explaining alternative documentation mortgages, qualified mortgage standards, and income verification methods for self-employed borrowers beyond traditional tax return analysis.

IRS Self-Employment Tax Guidelines – Internal Revenue Service comprehensive resource on self-employment tax calculations, quarterly payment requirements, and business income reporting that affects mortgage qualification for business owners.

IRS Schedule C Business Expense Information – Internal Revenue Service official guidance on Schedule C profit or loss from business, explaining business expense deductions that reduce taxable income but may not reflect actual cash flow for mortgage qualification.

Industry Organizations:

Fannie Mae Self-Employed Income Documentation Guidelines – Official Fannie Mae underwriting standards for self-employed borrowers explaining traditional income calculation methods and documentation requirements that bank statement loans provide alternatives to.

National Association of Self-Employed Resources – Industry organization providing education, advocacy, and resources for self-employed professionals including guidance on financial management, business banking, and recordkeeping practices that support mortgage qualification.

Educational Resources:

SBA Small Business Financial Management – Small Business Administration guidance on business financial management, cash flow analysis, and accounting practices that support strong bank statement documentation for mortgage applications.

IRS Business Banking Account Information – Internal Revenue Service resource on business banking accounts, recordkeeping requirements, and financial documentation best practices for self-employed professionals and business owners.

Need local expertise? Get introduced to trusted partners including loan officers, realtors, and financial advisors in your area.

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Not Sure About Your Next Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Related Posts

Subscribe to our newsletter

Get program updates and rate insights in your inbox.