USDA Loan: 7 Strategies for Rural and Suburban Homeownership With Flexible Financing

Access Homeownership in Eligible Areas Through USDA-Guaranteed Programs

Saving for initial equity contributions creates barriers to homeownership for many qualified buyers—USDA loans provide flexible financing solutions. This federally-guaranteed program through the U.S. Department of Agriculture enables eligible buyers to purchase homes in qualifying rural and suburban areas with minimal initial investment requirements, competitive interest rates, and favorable terms. Understanding USDA loan eligibility requirements, income limits, property location rules, and strategic approaches to maximizing program benefits helps you achieve homeownership while building equity in communities across America where many don’t realize this financing option exists.

Key Details You’ll Learn About USDA Loans:

- How USDA loans differ from conventional mortgages and FHA loans in terms of eligibility, location requirements, and program structure

- Property location eligibility and how USDA defines “rural” areas including many suburban communities near major metropolitan areas (USDA eligibility map and property lookup)

- Income limits based on household size and county median income that determine who qualifies for USDA financing in specific areas

- The loan guarantee structure and how federal backing enables flexible financing while protecting lenders against default risk

- Credit score and financial requirements that emphasize stable payment history rather than requiring perfect credit profiles

- Guarantee fee structure including upfront and annual fees that replace traditional mortgage insurance requirements (USDA Rural Development housing programs)

- Property condition standards and how homes must meet USDA’s safety, soundness, and functionality requirements

- Refinancing options through USDA Streamline programs and conventional refinancing for existing USDA borrowers

- Strategic approaches to maximizing USDA loan benefits including timing purchases and coordinating with seller concessions

Ready to explore your options? Schedule a call with a loan advisor.

What Is a USDA Loan and How Does It Work?

A USDA loan is a mortgage program guaranteed by the United States Department of Agriculture designed to promote homeownership in eligible rural and suburban areas—the program enables qualified buyers to purchase homes with minimal initial investment while offering competitive terms, making homeownership accessible to moderate-income families in communities the USDA seeks to strengthen through increased residential development and economic stability.

Why does the USDA guarantee home loans? The program supports the agency’s mission of strengthening rural America by encouraging homeownership in less densely populated areas—increased homeownership promotes community stability, economic development, and population retention in rural and suburban communities that might otherwise struggle to attract and retain residents without accessible financing options.

The guarantee structure enables private lenders to offer favorable terms by transferring default risk to the federal government. Lenders originate USDA loans through their normal operations, but if borrowers default, the USDA guarantee covers lender losses up to the guaranteed amount, allowing lenders to extend financing they might otherwise consider too risky given the minimal borrower equity investment.

Two USDA Loan Program Types

The USDA offers distinct programs serving different purposes:

USDA Guaranteed Loan Program (Section 502 Guaranteed):

- Most common USDA loan type for homebuyers

- Originated by approved private lenders (banks, credit unions, mortgage companies)

- USDA provides guarantee to lender reducing their risk

- Borrowers work with participating lenders for application and closing

- Competitive market rates determined by lenders

- Minimal initial investment requirements

- Available to moderate-income households meeting eligibility

USDA Direct Loan Program (Section 502 Direct):

- Loans funded directly by USDA, not private lenders

- Serves very low and low-income applicants

- Subsidized interest rates as low as 1% for qualifying borrowers

- Payment assistance available reducing monthly obligations

- Limited funding and longer processing times

- Typically requires working directly with USDA Rural Development offices

- More restrictive income limits than guaranteed program

Which USDA program should you pursue? Most homebuyers use the Guaranteed Loan Program working with approved lenders for faster processing, competitive market rates, and broader availability—Direct Loans serve very low-income applicants who may benefit from subsidized rates and payment assistance, though limited funding and longer timelines make this option less accessible for most buyers.

USDA Loan Advantages

Several features make USDA loans attractive:

- Minimal initial investment requirements enabling homeownership without substantial savings

- Competitive interest rates often comparable to conventional financing

- Flexible credit requirements emphasizing payment history over credit scores

- No maximum purchase price (though income limits restrict borrowing capacity)

- Ability to finance closing costs into loan amount in some situations

- Seller concessions allowed up to 6% helping cover buyer costs

- Available for primary residences promoting stable homeownership

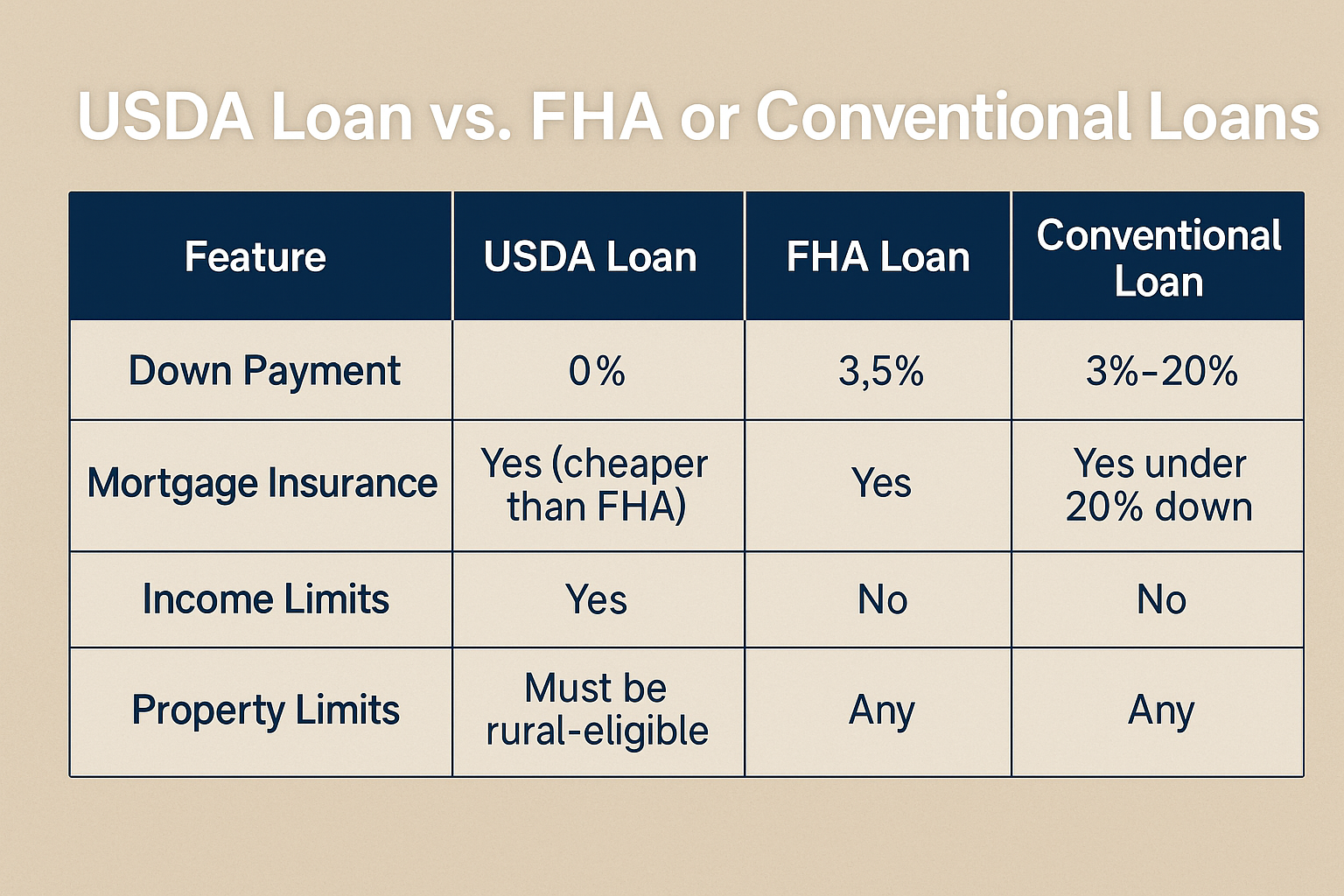

How do USDA loans compare to FHA financing? Both programs offer flexible qualification standards and serve moderate-income buyers, but USDA requires no initial equity contribution while FHA requires contributions, USDA has geographic restrictions while FHA works anywhere, USDA has income limits while FHA doesn’t, and USDA annual fees are lower than FHA mortgage insurance—choice depends on property location eligibility and income qualification.

USDA Loan Strategy #1: Verify Property Location Eligibility Before House Hunting

How do you determine if a property qualifies for USDA financing? Use the USDA’s online eligibility map at eligibility.sc.egov.usda.gov where you can enter specific addresses to check property location qualification instantly—this verification should happen before making offers or even viewing homes to avoid disappointment from finding perfect properties in ineligible areas.

Understanding USDA’s definition of “rural” prevents common misconceptions about where the program works and helps you focus home searches on qualifying areas.

USDA’s Definition of “Rural” Areas

The term “rural” encompasses more than remote farmland:

Eligible areas include:

- Small towns and communities outside metropolitan areas

- Suburban areas on the edges of cities and metro regions

- Many communities within 50 miles or less of major cities

- Areas with populations under specific thresholds

- Open country and agricultural regions

- Some areas within city limits if population density meets requirements

Ineligible areas:

- Dense urban cores and city centers

- Most areas within major metropolitan statistical areas

- Communities exceeding population density thresholds

- Certain suburbs too close to urban centers

- Areas USDA determines don’t meet rural character requirements

What determines if an area is USDA-eligible? Population size, density, character, and proximity to urban areas all factor into designations—USDA updates eligible areas periodically based on census data, development patterns, and policy objectives, with some areas gaining or losing eligibility as communities grow or regulations change.

Using the USDA Eligibility Map

The online tool provides instant verification:

- Visit the eligibility website – Navigate to eligibility.sc.egov.usda.gov

- Enter property address – Input complete street address for specific property

- Review results – System displays whether address qualifies as eligible or ineligible

- Check surrounding areas – Test nearby streets if primary location doesn’t qualify

- Verify current status – Confirm information is current as designations can change

- Save documentation – Screenshot or print results for reference

How accurate is the online eligibility map? The system reflects current USDA designations and updates regularly, providing reliable guidance—however, borderline properties or recent designation changes may warrant confirmation with USDA Rural Development offices or experienced USDA lenders familiar with local eligibility nuances.

Surprising Areas That Qualify

Many buyers don’t realize USDA eligibility extends to suburban communities:

Examples of qualifying areas:

- Suburbs 30-50 miles from major cities

- Bedroom communities serving metropolitan workforces

- Growing towns on metro area fringes

- Exurban developments with good highway access

- Communities with 20,000-35,000 population

- Some areas with city services and amenities

Why do suburban areas qualify? USDA eligibility focuses on population density and metro area boundaries rather than just distance from cities—many thriving suburban communities fall outside metropolitan statistical area boundaries or maintain population densities below USDA thresholds despite proximity to urban employment centers.

Geographic Strategies

Maximize home search effectiveness:

Smart search approaches:

- Check eligibility before viewing properties or making offers

- Focus searches on areas you’ve confirmed qualify

- Explore multiple communities within your target region

- Consider slightly longer commutes to access eligible areas

- Research communities on metropolitan area edges

- Work with real estate agents familiar with USDA boundaries

Areas to investigate:

- Towns just outside major metro area boundaries

- Communities along highways connecting cities

- Suburban areas in adjacent counties from urban cores

- Growing regions balancing rural character with modern amenities

- Areas with good schools and services that still qualify

Can USDA eligibility change for an area? Yes, designations update periodically based on census data and population growth—rapidly developing areas may lose eligibility as they become denser and more urban, while other areas may gain eligibility, making verification at the time of purchase critical rather than assuming past eligibility continues.

What Are USDA Loan Income Limits and Requirements?

Do USDA loans have income restrictions? Yes, household income cannot exceed specific limits based on county median income and household size—limits vary by location with higher allowances in expensive areas and lower thresholds in affordable regions, designed to serve low and moderate-income households rather than high earners who can access conventional financing.

Understanding income calculation methods and limits helps you determine qualification and plan strategically if you’re near threshold boundaries.

How USDA Calculates Household Income

Income assessment includes all household members:

Included income sources:

- W-2 employment wages and salaries

- Self-employment income from businesses

- Social Security and retirement benefits

- Disability income and government assistance

- Investment income from dividends and interest

- Rental income from investment properties

- Alimony and child support received

- Any other regular recurring income

Household member inclusion:

- All adults living in the home regardless of relation

- Income from adults who won’t be on the mortgage

- Children’s income typically excluded unless substantial

- Non-purchasing household members’ income counts

- Even non-related roommates if they’ll live in the home

Why does non-borrower household income matter? USDA limits address total household resources available for housing costs—including all adult household members’ income ensures the program serves truly moderate-income families rather than situations where high-earning household members could provide financial support but aren’t on the mortgage.

Income Limit Structure

Limits adjust for household size and location:

Household size categories:

- 1-4 members: Standard limit

- 5-8 members: Adjusted higher limit (typically 115% of standard)

- 9+ members: Contact USDA for applicable limits

Geographic variations:

- Limits vary by county based on area median income

- Expensive markets like California have higher thresholds

- Affordable rural areas have lower limits

- Same household size can have different limits in different counties

- Annual adjustments reflect changing economic conditions

Example income limits (vary by location):

- Low-cost area, 4-person household: May have limits around $80,000-$90,000

- Moderate-cost area, 4-person household: Limits around $90,000-$100,000

- High-cost area, 4-person household: Limits may exceed $110,000-$125,000

- Check USDA website for specific county limits

Where do you find your area’s income limits? Visit the USDA Rural Development website at rd.usda.gov, search for income eligibility, select your state, and find your county to see current limits—lenders can also provide county-specific limits during pre-qualification conversations.

Income Documentation Requirements

USDA requires thorough income verification:

Standard employment documentation:

- Recent pay stubs covering 30 days

- W-2 forms from previous two years

- Employer verification of current employment

- Tax returns if income includes bonuses or commissions

- Year-to-date earnings verification

Self-employment documentation:

- Personal and business tax returns (typically two years)

- Current profit and loss statement

- Business bank statements

- CPA letters if applicable

- Documentation of business ownership and operations

Other income documentation:

- Social Security benefit letters

- Pension or retirement account statements

- Disability income verification letters

- Investment account statements for dividend/interest income

- Rental property leases and tax return Schedule E

- Court documents for alimony or child support

How does self-employment affect USDA qualification? Self-employed applicants must provide more extensive documentation with two years of tax returns showing business income—USDA calculates qualifying income similar to conventional lending, analyzing tax returns after business deductions, requiring stable income history and adequate earnings after expenses.

Strategies for Borderline Income Situations

If you’re near income limits, consider these approaches:

- Timing of application – Apply before anticipated raises or bonuses increase income

- Household composition planning – Consider whether non-purchasing adults could maintain separate residences

- Income averaging – Declining income trends might average below limits

- Geographic alternatives – Explore counties with higher income limits

- Wait for limit increases – Annual adjustments might raise thresholds

- Evaluate FHA or conventional – If over income limits, explore alternative programs

Can you exclude any household member income? Only if they genuinely won’t live in the home—you cannot manipulate household composition just to qualify, as USDA requires honest reporting of all adults who will occupy the property, with fraud consequences for misrepresenting household circumstances.

USDA Loan Strategy #2: Understand Credit and Financial Requirements

What credit score do you need for USDA loans? While USDA doesn’t establish absolute minimum credit scores, most lenders require scores in the mid-600s for standard automated underwriting approval—borrowers with lower scores may still qualify through manual underwriting emphasizing payment history, though this process involves more scrutiny and documentation beyond automated approval systems.

Understanding complete financial requirements helps you prepare applications and identify areas needing attention before applying.

Credit Score and History Standards

USDA emphasizes payment patterns over scores:

Credit score considerations:

- Automated underwriting typically requires 640+ scores

- Manual underwriting considers scores below 640

- Payment history weighs heavily in all decisions

- Credit depth matters—limited history can work with compensating factors

- Recent payment performance more important than old issues

Payment history focus:

- Recent 12 months of housing payments (rent or mortgage) critical

- Installment loan payment patterns reviewed carefully

- Revolving credit management demonstrates financial discipline

- Utility and recurring bill payment history if using alternative credit

- Explanation letters can address past payment issues

What’s manual underwriting and when does it apply? Human underwriters review applications that don’t meet automated approval thresholds—this process examines complete financial pictures including payment histories, extenuating circumstances, compensating factors, and overall creditworthiness beyond algorithmic scoring, taking longer but enabling approvals that automated systems might decline.

Recent Credit Events

Past financial difficulties require disclosure:

Bankruptcy:

- Chapter 7: Typically 3 years from discharge date

- Chapter 13: May qualify after 12 months of on-time plan payments with court permission

- Must demonstrate credit reestablishment after bankruptcy

- Explanation letters describing circumstances required

Foreclosure:

- Typically 3 years from completion date

- Extenuating circumstances may reduce waiting periods

- Must demonstrate financial recovery and stability

- Re-established housing payment history helps

Short sales or deeds-in-lieu:

- Similar waiting periods to foreclosure apply

- May be viewed somewhat less severely than foreclosure

- Documentation of circumstances and recovery necessary

Collections and judgments:

- Open collections may need resolution or payment plans

- Judgments typically must be satisfied or explained

- Medical collections often treated more leniently

- Non-medical collections may require resolution depending on amount

Can you qualify for USDA loans with recent credit problems? Possibly, especially with manual underwriting, if you demonstrate financial recovery, provide documentation of extenuating circumstances beyond your control, show reestablished positive credit patterns, and have strong compensating factors like stable income and employment.

Debt-to-Income Ratio Requirements

USDA allows reasonable debt levels:

Standard DTI guidelines:

- Housing expense ratio: typically 29% of gross income (flexible with automated approval)

- Total debt ratio: typically 41% of gross income (flexible with automated approval)

- Manual underwriting may exceed these with strong compensating factors

- Ratios include all debt obligations and housing costs

Debt-to-income calculations include:

- Principal and interest on proposed USDA loan

- Property taxes and homeowner’s insurance

- USDA annual guarantee fee

- HOA or condo fees if applicable

- All installment loans with 10+ months remaining

- Revolving credit minimum payments

- Child support and alimony obligations

- Student loan payments

Compensating factors allowing higher DTI:

- Excellent credit history with no late payments

- Substantial cash reserves beyond closing requirements

- Minimal increase from current housing payment

- Long-term employment stability

- Additional income not fully counted in qualification

- Strong payment history on comparable housing costs

What if your debt-to-income ratio is too high? Pay down revolving credit balances, pay off installment loans with low remaining balances, increase income through raises or additional employment, reduce purchase price to lower housing payment, or wait to improve financial position before applying.

Reserve Requirements

Cash reserves demonstrate financial stability:

USDA reserve expectations:

- Minimal reserves typically required for standard transactions

- Some reserves beneficial for stronger applications

- Investment properties or special situations may require more

- Reserves calculated as months of principal, interest, taxes, insurance (PITI)

Acceptable reserve assets:

- Checking and savings accounts

- Money market accounts

- Certificate of deposit accounts

- Stocks, bonds, and mutual funds

- Retirement accounts (sometimes with discounts)

How much cash should you have beyond closing? While USDA doesn’t mandate substantial reserves for most transactions, maintaining some liquid assets after closing provides cushion for unexpected expenses, demonstrates financial prudence to underwriters, and protects you from stress if emergencies arise shortly after purchase.

Ready to discuss your purchase scenario? Submit a purchase inquiry to explore your options.

What Are USDA Loan Costs and Fees?

Are USDA loan costs higher than conventional mortgages? USDA loans involve guarantee fees similar to FHA mortgage insurance but generally lower—upfront guarantee fee of 1% of loan amount plus annual fee of 0.35% of outstanding balance make USDA one of the most affordable government-backed programs, particularly compared to FHA’s higher mortgage insurance costs and conventional PMI for minimal equity contribution scenarios.

Understanding complete cost structure helps you budget accurately and compare USDA to alternative financing options.

Guarantee Fee Structure

USDA charges fees supporting the guarantee fund:

Upfront guarantee fee:

- 1% of loan amount charged at closing

- Can be financed into loan balance

- Lower than FHA’s 1.75% upfront mortgage insurance premium

- Supports USDA guarantee fund protecting lenders

- Example: $200,000 loan = $2,000 upfront fee

Annual guarantee fee:

- 0.35% of outstanding loan balance annually

- Divided into monthly installments added to payment

- Significantly lower than FHA annual MIP (0.55-0.80%)

- Continues for life of USDA loan

- Reduces over time as principal balance decreases

Example total guarantee fee cost:

- $200,000 loan amount

- Upfront: $2,000 (1%)

- Annual: $700 first year ($200,000 × 0.35% = $700 ÷ 12 = $58.33/month)

- Annual fee decreases as principal balance reduces through payments

Can guarantee fees be avoided or eliminated? No, guarantee fees are mandatory program components enabling the federal backing that allows minimal initial investment—these fees fund the guarantee program making USDA lending viable and sustainable for taxpayers and participants.

Interest Rates

USDA rates compete favorably with other programs:

Rate positioning:

- Generally similar to FHA interest rates

- Competitive with conventional financing

- Market-driven rates varying by lender and borrower profile

- Fixed-rate mortgages standard for USDA loans

Factors affecting your rate:

- Credit score and payment history

- Debt-to-income ratios

- Lender-specific pricing

- Market conditions at time of lock

- Loan amount and property location

- Overall financial profile strength

Why do USDA rates vary between lenders? Each approved lender establishes pricing within program parameters based on business model, desired profit margins, volume expectations, and risk assessments—shopping multiple USDA lenders helps identify optimal pricing rather than assuming uniform rates across all lenders.

Other Closing Costs

Standard mortgage costs apply to USDA loans:

Typical closing costs:

- Appraisal fee for professional property valuation

- Credit report charges

- Title search and title insurance

- Recording fees and documentary stamps

- Lender processing and underwriting fees

- Survey if required by lender

- Home inspection (recommended but not required)

- Pest inspection in certain areas

- Attorney fees if required in your state

How much should you budget for closing costs? Generally 2-5% of purchase price for total closing costs including the upfront guarantee fee—actual costs vary by property location, loan amount, title insurance rates, and lender-specific charges.

Seller Concessions and Closing Cost Assistance

USDA allows flexibility funding closing costs:

Seller concession limits:

- Up to 6% of property sales price

- Can cover buyer’s closing costs and prepaids

- Cannot be applied toward initial investment if required

- Reduces buyer’s out-of-pocket cash needs significantly

Closing cost financing:

- May finance closing costs into loan amount in certain situations

- Depends on property appraised value and loan-to-value limits

- Lender overlays may restrict this option

- Not available if it causes total loan to exceed property value

Gift funds:

- Acceptable for closing costs and required contributions

- Must come from family members or approved sources

- Gift letters required stating funds don’t need repayment

- Paper trail documenting transfer necessary

How can you minimize cash needed at closing? Negotiate strong seller concessions toward closing costs, ask seller to pay some prepa

id items, shop lenders for competitive fees, consider timing closing date to reduce prepaid interest, and use gift funds from family if available.

Calculate your USDA loan scenarios:

USDA Loan Strategy #3: Ensure Property Meets Condition Standards

What property requirements must homes meet for USDA financing? Properties must be safe, sanitary, and structurally sound meeting HUD minimum property standards—homes need adequate heating, plumbing, and electrical systems, sound roofing and foundation, functional utilities, and safe access, ensuring borrowers purchase homes in acceptable condition rather than requiring extensive repairs immediately after purchase.

Understanding property standards prevents pursuing homes that won’t qualify and helps you evaluate whether properties need repairs before closing.

Minimum Property Standards

USDA adopts HUD property requirements:

Structural requirements:

- Sound foundation without major settlement or damage

- Roof in good condition with remaining useful life

- Adequate structural support throughout home

- No significant damage to walls, floors, or ceilings

- Windows and doors functioning properly and secure

Mechanical systems:

- Adequate heating system for climate

- Functional plumbing with hot and cold running water

- Electrical service meeting local codes

- Proper ventilation throughout home

- Kitchen appliances if permanent fixtures

Safety and health concerns:

- No lead-based paint hazards in homes built before 1978

- Adequate egress from bedrooms

- Working smoke detectors and carbon monoxide alarms

- No evidence of pest infestation requiring treatment

- No mold or water damage creating health hazards

- Septic systems functioning properly if not on municipal sewer

Property size and utilities:

- Adequate square footage for residential use

- Access to public or private water supply

- Septic or sewer service

- Legal access to property via roads or easements

- Adequate parking areas

What happens if a property doesn’t meet USDA standards? The appraiser identifies deficiencies in their report—sellers must address required repairs before closing, you can negotiate repair costs, or you may walk away if repairs are extensive and sellers won’t cooperate, protecting you from purchasing homes with significant issues.

Common Property Issues

Certain problems frequently arise during USDA inspections:

Issues requiring resolution:

- Peeling or chipped paint on pre-1978 homes (lead hazard)

- Roof damage or remaining useful life under 3 years

- Non-functioning mechanical systems

- Water damage or active leaks

- Broken windows or damaged doors

- Electrical hazards or outdated wiring

- Plumbing leaks or inadequate pressure

- Foundation cracks or settlement

- Pest infestation or damage

Property types requiring extra scrutiny:

- Older homes with dated systems

- Rural properties on well and septic

- Homes with additions or modifications

- Properties with outbuildings or structures

- Homes on larger acreage parcels

Can you purchase a fixer-upper with USDA financing? Not for homes needing extensive work—properties must be move-in ready and habitable, though minor cosmetic issues are acceptable if they don’t affect safety, sanitation, or structural integrity, distinguishing between homes needing updates versus those requiring major repairs.

Well and Septic Requirements

Rural properties often have private systems:

Well water requirements:

- Must provide adequate supply for household needs

- Water quality testing required showing potable water

- Testing for bacteria and other contaminants

- Well must meet local health department standards

- Mechanical components functioning properly

Septic system requirements:

- System adequate for home size and occupancy

- Functioning properly with no signs of failure

- Inspection by qualified professional typically required

- Compliance with local health department regulations

- Adequate drain field without saturation or failure

What if well or septic systems fail inspection? Sellers typically must repair or replace failed systems before closing—costs can be substantial (septic replacement often $10,000-$30,000), making pre-inspection due diligence important before making offers on properties with private systems.

Acreage and Property Size

USDA finances residential sites with limitations:

Acreage restrictions:

- Primarily residential sites typically under 10 acres

- Larger parcels must not derive significant income from agricultural production

- Property value should come primarily from residence, not land

- Working farms don’t qualify as residential properties

Income-producing property:

- Small hobby farms acceptable if no significant income

- Cannot have substantial agricultural revenue

- Outbuildings for personal use acceptable

- Commercial operations disqualify properties

Why does USDA restrict acreage and income? The program supports residential homeownership, not agricultural operations or commercial ventures—large parcels generating farming income should use USDA Farm Service Agency programs designed for agricultural lending rather than residential housing programs.

What Are USDA Loan Refinancing Options?

Can you refinance a USDA loan? Yes, USDA offers streamline refinancing for existing USDA borrowers and standard refinancing when switching from other loan types to USDA—streamline refinancing provides simplified processing with reduced documentation, while regular USDA refinancing requires full underwriting but enables homeowners in eligible areas to access USDA benefits.

Understanding refinancing options helps you optimize your financing as circumstances change or rates improve.

USDA Streamline Refinancing

Simplified refinancing for existing USDA borrowers:

Streamline eligibility requirements:

- Current USDA loan in good standing

- At least 12 months of payments completed

- No late payments in previous 12 months

- Property still eligible under USDA location rules

- Must result in net tangible benefit to borrower

- Cannot add non-borrowing spouse or co-borrower

Streamline process simplifications:

- No income documentation or verification required

- No credit report required (though many lenders still obtain)

- No appraisal required in most cases

- No employment verification needed

- Simplified application process

- Faster processing timelines

Net tangible benefit requirement:

- Interest rate must reduce by minimum amount (varies by loan age)

- Or convert ARM to fixed-rate for stability

- Must improve borrower’s financial situation

- Cannot just generate fees without borrower advantage

What are typical USDA streamline requirements? Rate reduction of at least 0.5% for loans under 24 months old, no minimum reduction for loans over 24 months as long as monthly savings occur, or ARM to fixed conversion—specific requirements vary by lender overlays beyond basic USDA rules.

Standard USDA Refinancing

Full underwriting for non-streamline situations:

Standard refinance purposes:

- Refinancing conventional or FHA loans to USDA in eligible areas

- Adding or removing borrowers from existing USDA loans

- Cash-out refinancing on USDA properties

- When streamline doesn’t provide optimal terms

Standard refinance requirements:

- Property must be in USDA-eligible location

- Meet current income limits for area

- Full credit and income documentation

- Property appraisal required

- Home equity position adequate for program

- Meet all standard USDA qualification requirements

Can you do cash-out refinancing with USDA? Limited cash-out is possible though uncommon—USDA generally discourages cash-out refinancing with restrictions on the amount you can extract, and most borrowers needing significant cash-out explore conventional or FHA options providing more flexibility for equity extraction.

Refinancing to Other Programs

USDA borrowers can refinance to different loan types:

When to consider leaving USDA:

- Income now exceeds USDA limits preventing streamline refinance

- Property no longer in eligible area due to designation changes

- Conventional financing offers better terms with adequate equity

- You need substantial cash-out exceeding USDA limitations

- Moving to different property requiring portable financing

Programs to consider:

- Conventional refinancing if you have adequate equity

- FHA refinancing if USDA no longer available

- VA refinancing if you’re eligible veteran

- Cash-out refinancing through conventional or FHA for equity access

How much equity do you need to refinance out of USDA? Conventional refinancing typically requires maintaining meaningful equity after refinancing, while FHA allows refinancing with minimal equity—evaluate whether leaving USDA’s low annual fees for conventional or FHA mortgage insurance makes financial sense based on your equity position and rates available.

Considering a refinance? Submit a refinance inquiry to see if this makes sense for you.

Frequently Asked Questions About USDA Loans

Can You Buy a Fixer-Upper With a USDA Loan?

USDA loans require properties to be move-in ready meeting minimum property standards—extensive renovations, major repairs, or homes in poor condition don’t qualify for standard USDA financing, though the USDA does offer a Section 504 loan and grant program for repairs and improvements to existing USDA-financed homes in specific situations for very low-income borrowers.

What if you want to buy a home needing repairs? Consider FHA 203(k) renovation loans allowing you to finance both purchase and repairs in one loan, conventional renovation financing if you have adequate resources, or purchasing with cash or hard money then refinancing to USDA after completing improvements if the property’s in an eligible area.

Property condition considerations:

- USDA works best for homes in good condition needing minimal work

- Minor cosmetic updates acceptable after closing

- Major system failures must be addressed before closing

- Look for well-maintained properties meeting standards

- Budget for future improvements after building equity

Are Manufactured Homes Eligible for USDA Loans?

Yes, USDA finances manufactured homes meeting specific requirements—the home must be built after June 15, 1976 to HUD manufactured home standards, permanently affixed to a foundation, titled as real property rather than personal property, and meet all standard USDA property requirements for safety and condition.

Manufactured home requirements:

- HUD Code manufactured home (not pre-1976 mobile home)

- Permanently attached to land-owned foundation

- Wheels, axles, and towing hitch removed

- Titled as real estate, not personal property

- Meets local zoning and building codes

- Adequate land ownership or lease

- Standard utilities connected permanently

What’s the difference between manufactured and mobile homes? Manufactured homes built after June 15, 1976 meet HUD Code federal construction standards and can qualify for mortgage financing including USDA, while mobile homes built before that date to lesser standards typically cannot qualify for standard mortgage programs.

Manufactured home considerations:

- Financing available but fewer lenders offer manufactured home programs

- Property must meet all standard USDA requirements

- Land ownership or adequate lease term required

- Appraisal must support manufactured home value

- Some lenders have overlays restricting manufactured homes

Can You Have Another Property and Get a USDA Loan?

Yes, you can own other properties and still qualify for USDA loans—the USDA loan must be for your primary residence, but owning additional homes, investment properties, or vacation properties doesn’t automatically disqualify you, though underwriters will scrutinize whether you genuinely intend to occupy the USDA-financed home as your main residence.

Situations involving multiple properties:

- Relocating for employment and keeping previous home

- Owning investment properties while buying primary residence

- Vacation homes in different areas than USDA purchase

- Inheriting properties while seeking primary residence

What documentation proves primary residence intent? Employment location near new property, school enrollment for children, driver’s license and voter registration changes, utility transfers, and explanation letters describing relocation reasons all support genuine intent to occupy the USDA-financed home as your primary residence.

Multiple property considerations:

- All property payments count in debt-to-income calculations

- May need to document existing properties as rentals with leases

- Underwriters review overall financial capacity with multiple obligations

- Strong reserves help if carrying multiple properties

- Clear occupancy intent for USDA property is essential

How Long Does USDA Loan Approval Take?

USDA loan timelines generally align with conventional financing for straightforward applications—most USDA loans close within standard 30-45 day periods once applications are complete, though the USDA-required appraisal and rural property characteristics may extend timelines, and lender experience with USDA processing significantly affects speed and efficiency.

Factors affecting USDA closing timeline:

- Lender’s USDA processing experience and volume

- Rural property appraisal scheduling

- Automated versus manual underwriting

- Documentation completeness at application

- Property condition and repair requirements

- Title work complexity in rural areas

- Well and septic inspections if applicable

How can you expedite USDA closing? Submit complete applications with all documentation upfront, respond immediately to lender requests, schedule appraisals and inspections promptly, maintain clear communication with all parties, work with experienced USDA lenders, and set realistic timeline expectations in purchase contracts.

Timeline strategies:

- Get pre-approved before house hunting

- Gather all financial documents in advance

- Research property eligibility before making offers

- Allow adequate time in purchase agreements (45-60 days recommended)

- Work with USDA-experienced real estate agents

- Stay in close contact with lender throughout process

Can Self-Employed Borrowers Get USDA Loans?

Yes, self-employed applicants qualify for USDA loans with appropriate documentation showing stable business income—requirements include two years of self-employment history, personal and business tax returns, year-to-date profit and loss statements, and income analysis following standard mortgage underwriting practices that calculate earnings after business expenses and deductions.

Self-employed documentation requirements:

- Personal tax returns for previous two years

- Business tax returns (Schedule C, corporate, or partnership)

- Current profit and loss statement

- Business bank statements

- CPA letter supporting business and income (helpful but not always required)

- Business license or registration

How do lenders calculate self-employed income for USDA? Similar to conventional lending—analyzing tax returns after adding back non-cash deductions like depreciation, subtracting one-time income, averaging over two years, and ensuring stable or increasing income trends demonstrate reliable earnings supporting mortgage obligations.

Self-employment considerations:

- Two-year history strongly preferred

- Declining income creates challenges

- Significant tax deductions reduce qualifying income

- Business cash flow versus reported income disconnect common

- May need larger compensating factors

- Alternative documentation programs exist if USDA doesn’t work

For self-employed borrowers with complex income:

- Bank Statement Loan – Alternative income documentation

- 1099 Loan – For contractors and freelancers

Do You Need Perfect Credit for USDA Loans?

No, USDA loans don’t require perfect credit—the program emphasizes payment history over credit scores with automated underwriting typically requiring mid-600s scores while manual underwriting considers lower scores with compensating factors, recognizing that rural and moderate-income borrowers may have limited credit access or past financial challenges.

Credit considerations for USDA:

- Payment history weighs more than credit scores

- Recent 12 months of payments most important

- Explanation letters can address past issues

- Limited credit history acceptable with alternative credit

- Credit rebuilding after past problems demonstrates responsibility

What compensating factors help with challenged credit? Strong recent payment history, stable employment over several years, low debt-to-income ratios, cash reserves beyond closing requirements, minimal housing payment increase from current costs, and overall financial responsibility demonstrated through explanations and documentation.

Credit improvement strategies:

- Pay all bills on time for 12+ months before applying

- Address collections and judgments proactively

- Keep credit card balances low relative to limits

- Don’t open new credit accounts before applying

- Build payment history through utility and rent payments

- Consider credit counseling if needed to rebuild

USDA Loan Strategy #4: Coordinate With Experienced USDA Lenders

Why does lender experience matter for USDA loans? USDA lending involves program-specific requirements, income calculations, property eligibility nuances, and appraisal standards that inexperienced lenders may handle inefficiently—working with USDA-knowledgeable lenders prevents delays, ensures accurate guidance, facilitates smoother processing, and increases approval odds through proper application structuring.

Finding and working with qualified USDA lenders helps ensure successful transactions.

Identifying USDA-Approved Lenders

Not all mortgage lenders offer USDA financing:

USDA-approved lender types:

- National mortgage lenders with government lending divisions

- Regional banks serving rural markets

- Community banks in USDA-eligible areas

- Credit unions with USDA program approval

- Mortgage brokers with USDA lender relationships

How to find USDA lenders:

- USDA Rural Development website has lender lists by state

- Local USDA Rural Development offices provide referrals

- Real estate agents in rural markets know active lenders

- Online search for “USDA lenders” plus your state

- Mortgage brokers can access multiple USDA lenders

Verifying USDA lending experience:

- Ask about monthly USDA loan volume

- Request references from recent USDA borrowers

- Inquire about processing timelines for typical transactions

- Confirm direct USDA underwriting versus third-party processing

- Evaluate knowledge when asking program-specific questions

Why avoid inexperienced USDA lenders? Learning on your transaction causes delays from misunderstanding requirements, incorrect income calculations, property eligibility mistakes, processing inefficiencies, and potential denials from improper structuring—experienced lenders navigate complexities smoothly producing better outcomes.

Lender Selection Criteria

Evaluate lenders beyond interest rates:

Important factors:

- USDA lending volume and experience

- Understanding of income limit calculations

- Knowledge of property eligibility nuances

- Processing efficiency and timeline capabilities

- Communication quality and responsiveness

- Rates, fees, and overall costs

- References from recent borrowers

- Technology and online application tools

Questions for potential USDA lenders:

- How many USDA loans do you close monthly?

- What percentage of your volume is USDA?

- What’s your typical USDA closing timeline?

- How do you handle income calculations for [your situation]?

- Can you provide recent USDA borrower references?

- What are your complete costs including all fees?

- Do you process and underwrite in-house or use third parties?

Should you work with local or national lenders? Both can work well—local lenders may understand regional property markets and local USDA office nuances, while national lenders often have higher volume creating processing efficiency and competitive pricing through scale, making experience and service more important than geographic scope.

Working With Mortgage Brokers

Brokers provide access to multiple USDA lenders:

Broker advantages:

- Relationships with multiple USDA-approved lenders

- Can shop rates and programs across lenders

- Experience placing USDA loans with various institutions

- May find approval where one lender declined

- Potentially more competitive pricing through wholesale access

Broker considerations:

- Verify the broker works with reputable USDA lenders

- Understand fee structure and broker compensation

- Ensure broker has USDA experience specifically

- Ask about lender options available for your situation

When do brokers provide most value? Complex situations benefiting from multiple lender options, borderline qualifications needing lender with flexible overlays, or situations where shopping rates across institutions helps secure optimal pricing.

USDA Loan Strategy #5: Understand Seller Concessions and Negotiations

How can seller concessions reduce your cash needed for USDA purchases? Sellers can contribute up to 6% of the home’s purchase price toward buyer’s closing costs, significantly reducing out-of-pocket requirements—negotiating strong concessions in purchase agreements enables USDA homeownership with minimal cash investment, particularly valuable given USDA’s already flexible initial investment requirements.

Strategic negotiation maximizes USDA program benefits.

Maximum Seller Concession Allowances

USDA permits generous seller assistance:

Concession limits:

- Up to 6% of property sales price

- Higher than conventional (3% owner-occupant) and FHA (6% matching) limits

- Can cover closing costs, prepaids, and discount points

- Cannot be applied toward required initial investment

- Reduces buyer’s cash requirement significantly

Eligible uses for seller concessions:

- Lender fees and origination charges

- Appraisal and credit report fees

- Title insurance and escrow charges

- Recording fees and transfer taxes

- Homeowner’s insurance prepayment

- Property tax reserves and insurance escrows

- Pest inspections and other required tests

- Discount points buying down interest rate

What cannot be covered by seller concessions? Any required initial investment must come from buyer’s funds, gifts, or approved down payment assistance—seller concessions cannot satisfy equity contribution requirements if program requires contributions beyond financed amounts.

Negotiating Seller Concessions

Strategic approaches maximize seller assistance:

Effective negotiation strategies:

- Request concessions in initial offer rather than adding later

- Justify requests by explaining USDA program parameters

- Offer full price or close to asking in exchange for concessions

- Emphasize that concessions enable transaction to close

- Structure as win-win—seller gets sale, you get needed assistance

- Work with agents who understand USDA and rural markets

Market conditions affecting negotiations:

- Buyer’s markets favor concession requests

- Seller’s markets make concessions harder to obtain

- Properties with extended market time more receptive

- Motivated sellers more likely to accommodate

- Multiple offer situations reduce concession likelihood

How do you present concession requests? Include in initial purchase offer as integral part of the transaction—”Purchase price $200,000 with seller contributing $8,000 (4%) toward buyer’s closing costs”—presenting as package deal rather than separate requests increases acceptance rates.

Combining Assistance Sources

Multiple funding sources can work together:

Possible combinations:

- Seller concessions plus gift funds from family

- Seller concessions plus down payment assistance programs

- Seller concessions plus employer relocation benefits

- Seller concessions plus other approved sources

Down payment assistance programs:

- State housing finance agency programs

- County or city first-time buyer assistance

- Nonprofit organization grants

- Employer homeownership programs

- Native American housing programs if applicable

- Rural development grants in some areas

Can you use multiple assistance sources together? Yes, as long as each source individually meets program requirements and combined assistance doesn’t exceed property value or create other issues—coordinating multiple sources requires careful documentation and lender coordination to ensure compliance.

USDA Loan Success Stories

See how other borrowers have successfully used USDA financing:

Alternative Loan Programs for Rural and Suburban Buyers

If USDA loans aren’t the right fit, consider these related options:

- FHA Loan – Flexible qualification with modest initial investment requirements anywhere

- VA Loan – For eligible veterans and service members with minimal investment requirements

- Conventional Loan – Standard financing with various initial investment options

- First-Time Homebuyer Loan – Programs designed for buyers purchasing their first homes

- Bank Statement Loan – For self-employed buyers with alternative income documentation

- HomeReady Loan – Fannie Mae program for low-to-moderate income buyers

Explore all 30+ loan programs to find your best option.

Not sure which program is right for you? Take our discovery quiz to find your path.

Helpful USDA Loan Resources

Official Government Guidance

USDA Rural Development Single Family Housing Programs – Official USDA resource covering guaranteed and direct loan programs, eligibility requirements, income limits, property standards, and application processes for rural homeownership.

USDA Property Eligibility Map and Address Lookup – Interactive tool allowing you to enter specific addresses to verify USDA location eligibility, search by map, and understand property qualification in real-time.

Consumer Financial Protection Bureau Mortgage Resources – Federal consumer protection agency providing educational materials on mortgages, borrower rights, shopping for loans, and understanding loan programs including government-backed options.

Industry Organizations

National Association of Realtors Rural and Resort Property Resources – Real estate professional organization offering market data, property search tools, and resources for buyers and sellers in rural markets where USDA financing is commonly used.

Mortgage Bankers Association Government Lending Resources – Trade association providing industry research, market trends, and educational materials on government-backed mortgage programs including USDA guaranteed loans.

Educational Resources

HUD Housing Counseling Agencies – HUD-approved housing counseling agencies offering free or low-cost homebuyer education, budget counseling, and guidance on government loan programs including USDA financing options.

Federal Reserve Consumer Credit Resources – Central bank educational materials explaining mortgage markets, interest rates, loan programs, and economic factors affecting housing finance and homeownership accessibility.

USDA State Rural Development Offices – State-specific USDA Rural Development offices providing local guidance, eligible area information, approved lender lists, and direct assistance with program questions.

Need local expertise? Get introduced to trusted partners including loan officers, realtors, and contractors in your area.

Ready to get started? Apply now or schedule a call to discuss your situation.

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Not Sure About Your Next Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Related Posts

Subscribe to our newsletter

Get program updates and rate insights in your inbox.