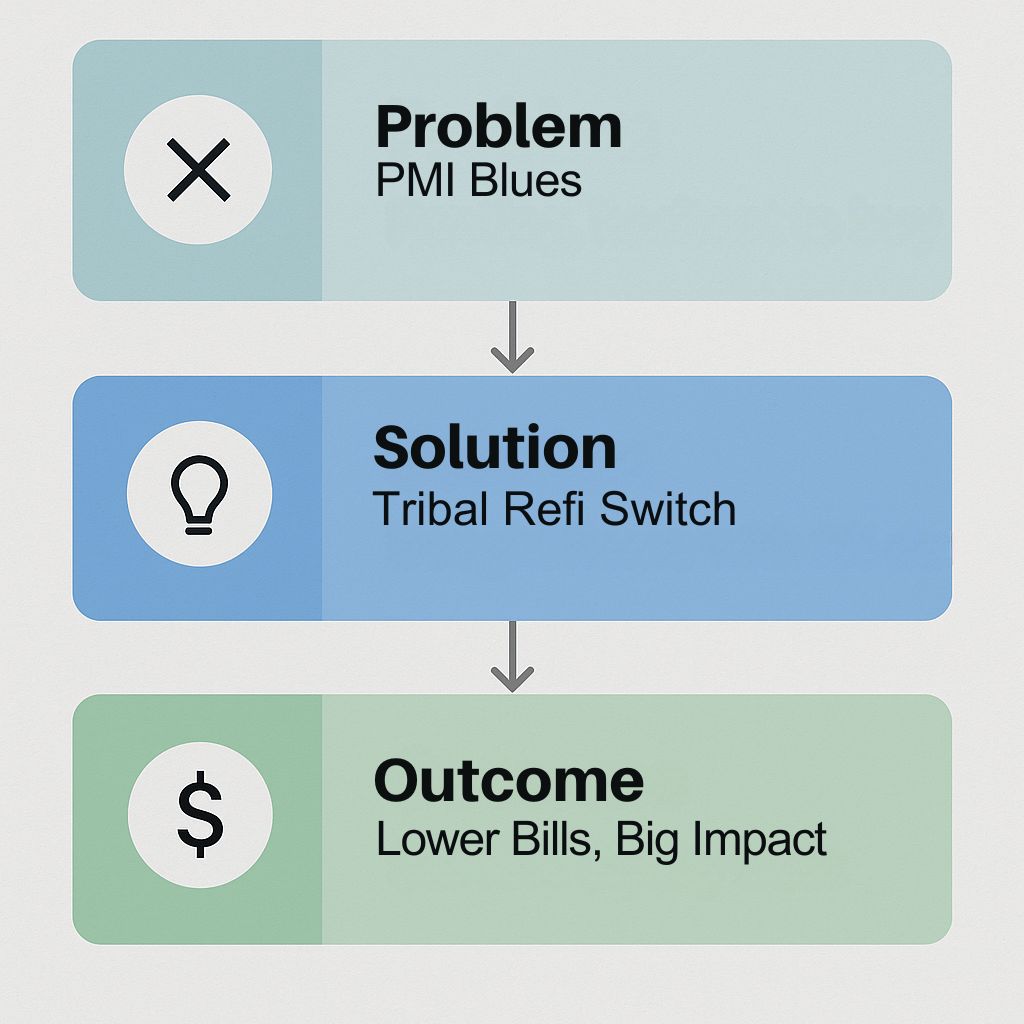

USDA Loan Cash Out Refinance Calculator: Estimate Your Costs, Monthly Payment & Cash Back at Close

Dr. Amanda Martinez, a 44-year-old veterinarian and small business owner in Okeechobee, Florida, had purchased her 4-bedroom, 2-bathroom home seven years ago using a USDA loan with 0% down payment—taking advantage of the federal program’s benefits for rural homeownership. As a homeowner and business entrepreneur (Step 3 transitioning to business expansion goals), she had built substantial equity in her home through both appreciation and mortgage paydown. Her property, originally purchased for $198,000, was now worth $315,000—representing $117,000 in equity growth over seven years.

Dr. Martinez owned and operated a small veterinary clinic in downtown Okeechobee serving the rural community’s pets and livestock. Her practice was thriving, but she needed approximately $50,000 to expand: purchasing new diagnostic equipment ($28,000), adding a second examination room ($18,000), and hiring an additional veterinary technician with 6 months of salary reserves ($12,000 total needed, using $8,000 from savings for hiring/training costs). She had explored business loans, but commercial lending rates were 9-11% with strict revenue requirements and personal guarantees that would impact her borrowing capacity for the clinic’s commercial lease renewal.

“I had substantial equity in my home—over $115,000—but accessing it seemed complicated,” Dr. Martinez explained. “I’d purchased with a USDA loan, and when I contacted conventional lenders about cash-out refinancing, most had no idea whether I could refinance my USDA loan into something else, or if USDA even offered cash-out options. Several lenders told me I’d need to refinance into a conventional loan, which would mean higher rates, losing my USDA benefits, and potentially not even qualifying because my practice income fluctuates seasonally.”

During a conversation with her accountant about business expansion financing, he asked, “Have you looked into USDA cash-out refinancing? I have another client—a contractor in Indiantown—who recently did a USDA cash-out refi to fund his equipment purchase. The rates were competitive, he stayed in the USDA program, and the process was straightforward because he was already a USDA borrower.”

Facing similar challenges? Schedule a call to explore your options.

The Challenge: Why Business Loans and Conventional Refinancing Wouldn’t Meet the Expansion Need

Dr. Martinez’s financial situation was stable but complicated by the nature of small business ownership. Her complete financial and business picture revealed why accessing her home equity made strategic sense compared to other financing options:

Personal and business financial situation:

Personal income (from veterinary practice):

- Veterinary practice owner salary: $94,000 annually (documented via W-2 from her S-corp)

- Additional income from practice distributions: $18,000 annually average (varies by practice profitability)

- Combined documented annual income: $112,000 ($9,333 gross monthly)

- Net monthly income after taxes/healthcare: Approximately $7,400

Monthly personal expenses:

- Current USDA mortgage payment (P&I): $1,285 (at 7.25% on $185,000 balance)

- Property taxes: $285 monthly ($3,420 annually)

- Homeowners insurance: $145 monthly ($1,740 annually)

- Total housing costs: $1,715 (23% of net income)

- Utilities: $235

- Groceries: $480

- Car payment (2022 Subaru Outback for clinic use): $425 (18 months remaining)

- Car insurance: $165

- Gas and vehicle maintenance: $280

- Healthcare and prescriptions: $195

- Student loans (veterinary school): $685 monthly ($124,000 remaining balance)

- Personal and household: $180

- Entertainment and dining: $220

- Business owner retirement contributions: $800 (SEP-IRA)

- Emergency savings: $300

- Total monthly expenses: $5,480

- Monthly surplus: $1,920

Business financial situation (Martinez Veterinary Clinic):

- Annual gross revenue: $485,000-520,000 (varies seasonally)

- Annual operating expenses: $340,000-365,000 (staff salaries, rent, supplies, insurance, utilities)

- Net business profit: $120,000-155,000 annually before owner distributions

- Current business debt: $28,000 equipment loan at 8.5%, $580 monthly payment (24 months remaining)

- Business savings/reserves: $42,000

- Desired expansion cost: $58,000 total ($28,000 equipment + $18,000 construction + $12,000 hiring/training reserves)

“My practice is profitable and growing, but I didn’t want to tie up my entire $42,000 business reserves in the expansion,” Dr. Martinez explained. “I need to maintain at least $25,000-30,000 in business reserves for payroll, unexpected equipment repairs, inventory, and seasonal cash flow variations. Using all my business savings for expansion would leave me vulnerable to any disruption.”

Dr. Martinez explored several financing options over three months:

Option 1: Small Business Administration (SBA) Loan

Dr. Martinez applied for an SBA 7(a) loan through her business bank to finance the $58,000 expansion. The SBA process revealed several challenges:

- Interest rate quoted: 10.5% (Prime rate + 3% margin)

- Monthly payment estimated: $780 (on $58,000 over 7 years)

- Extensive documentation required: 3 years of business tax returns, profit & loss statements, balance sheets, business plan, personal financial statement, personal guarantees

- Collateral requirement: Business assets and personal guarantee required

- Processing timeline: 90-120 days for approval (too slow for her expansion timeline)

- Closing costs: $4,500-5,500 (origination fees, packaging fees, legal review)

Additionally, the bank expressed concern about the seasonal revenue fluctuations typical of veterinary practices in agricultural communities. While Dr. Martinez’s average annual profit was strong, the quarterly variations made underwriters nervous.

“The SBA loan officer was sympathetic but explained that veterinary practices are considered ‘moderately high risk’ due to income variability,” Dr. Martinez said. “They wanted three years of tax returns showing steadily increasing revenue, but my revenue varies based on calving season, foaling season, and agricultural cycles. Some quarters I make $50,000 profit, other quarters $25,000. That variability spooked them even though my average annual profit was solid.”

Option 2: Commercial Business Line of Credit

Dr. Martinez’s bank offered a $60,000 business line of credit secured by her practice’s accounts receivable and equipment. However, the terms were unfavorable:

- Interest rate: 11.75% variable (Prime + 3.5%)

- Draw period: 3 years (after which line converts to term loan)

- Monthly payment during draw: Interest-only on amount drawn (approximately $575/month on $60,000 drawn)

- Monthly payment after conversion: $1,100-1,200 (full principal + interest)

- Annual review requirement: Bank could reduce or cancel line based on annual business review

- Personal guarantee: Required

- UCC lien on business assets: Would complicate future business borrowing

“The line of credit solved the immediate cash need but created long-term problems,” Dr. Martinez explained. “The 11.75% rate was expensive, the variable rate meant payments could increase if rates rose, and most concerning, the bank could reduce my line during the annual review if they didn’t like my revenue trends. That uncertainty was problematic when I needed stable financing for permanent expansion.”

Option 3: Conventional Cash-Out Refinance (Refinancing USDA into Conventional)

Dr. Martinez contacted three conventional mortgage lenders about cash-out refinancing her home to access equity. Her home was worth $315,000 and she owed $185,000, giving her $130,000 in equity (41% equity position). Conventional cash-out refinancing typically allows borrowing up to 80% LTV, meaning she could borrow up to $252,000 (80% of $315,000), pay off her existing $185,000 mortgage, and receive approximately $67,000 in cash before closing costs.

The conventional lenders proposed:

- New loan amount: $252,000 (80% LTV)

- Cash out before closing costs: $67,000 ($252,000 – $185,000 payoff)

- Interest rate: 7.5% (30-year fixed conventional cash-out rate)

- Rate comparison: 0.25% HIGHER than her current 7.25% USDA rate

- Closing costs: $8,500-9,200 (appraisal, title, origination, recording)

- Net cash to Dr. Martinez: $58,000-58,700 (after closing costs)

- New monthly P&I payment: $1,762 (vs. current $1,285)

- Monthly payment increase: $477

“The conventional cash-out refinance would give me the $58,000 I needed, but I’d actually increase my interest rate from 7.25% to 7.5%, and my monthly payment would jump by almost $500,” Dr. Martinez said. “That defeated the purpose—I’d be paying more every month while taking on debt. It didn’t make financial sense.”

Additionally, conventional lenders raised concerns about Dr. Martinez’s self-employment income:

- Income calculation: Conventional underwriting averages 2 years of tax returns and applies various adjustments for business expenses, depreciation, and one-time income items

- Effective qualifying income: Lenders calculated Dr. Martinez’s qualifying income at approximately $98,000 annually (lower than her actual $112,000 W-2 + distributions)

- Debt-to-income ratio: With $685 student loans + $580 business loan + $425 car payment + proposed $1,762 new mortgage + $430 proposed taxes/insurance = $3,882 monthly obligations vs. $8,167 gross qualifying income (47.5% DTI)

- Result: Two of three conventional lenders indicated her DTI would exceed their 45% maximum for cash-out refinancing

“The conventional lenders treated my self-employment income skeptically even though I had seven years of consistent earnings,” Dr. Martinez explained. “They averaged two years of tax returns, made adjustments for non-cash depreciation, and basically reduced my qualifying income by $14,000 annually. Combined with the high interest rate and the $477 payment increase, conventional refinancing just didn’t work.”

Option 4: Home Equity Line of Credit (HELOC)

One lender suggested Dr. Martinez take out a HELOC rather than refinancing, which would leave her existing USDA mortgage in place while giving her access to equity:

- HELOC amount available: $65,000 (combined 80% LTV: 80% of $315,000 = $252,000, minus $185,000 first mortgage = $67,000 available, bank offered $65,000)

- Interest rate: 9.75% variable (Prime + 1.5%)

- Monthly payment: Interest-only for first 10 years, then principal + interest

- Interest-only payment on $58,000 drawn: $472/month

- Combined housing cost: $1,285 (existing USDA mortgage) + $472 (HELOC) + $430 (taxes/insurance) = $2,187/month

- Payment after 10-year draw period: Would jump to approximately $2,600-2,700/month (existing mortgage + full HELOC payment)

“The HELOC initially looked attractive because I could keep my low-rate USDA mortgage,” Dr. Martinez said. “But adding a $472 monthly payment on top of my existing mortgage meant my total housing costs would increase to $2,187—even more than the conventional refinance. And the variable rate at 9.75% was concerning. If rates increased to 12-13%, my HELOC payment could jump to $600/month or more. It felt risky.”

Option 5: Use Business Savings and Delay Expansion

Dr. Martinez’s most conservative option was to use her existing $42,000 in business savings, add the $16,000 gap from personal savings or taking less cash, and delay some expansion elements:

- Available business savings: $42,000

- Total expansion needed: $58,000

- Gap: $16,000

- Options: Use personal savings, reduce expansion scope, or delay expansion

However, this approach had significant drawbacks:

- Would deplete business reserves to dangerously low levels ($42,000 → $0)

- Expansion would need to be phased over 12-18 months as cash flow allowed

- Would miss growth opportunity while competitors expanded

- Seasonal cash flow variations would be harder to manage without reserves

“I built my business reserves over years of careful financial management,” Dr. Martinez said. “Depleting them completely for expansion—even good expansion—felt reckless. What if I had a major equipment failure or a key employee left? I needed to maintain at least $25,000-30,000 in business reserves for financial stability.”

After exhausting these options, Dr. Martinez felt stuck. Every financing alternative either required high interest rates (9-11%), increased her monthly payments significantly ($400-500), or depleted critical reserves. Her accountant’s mention of “USDA cash-out refinancing” intrigued her, but she’d never heard of it and wasn’t sure it even existed.

Experiencing similar challenges? Schedule a call to discuss alternative qualification methods.

How Did Dr. Martinez Discover USDA Cash-Out Refinance Options?

Two days after her conversation with her accountant, Dr. Martinez researched USDA cash-out refinancing online and discovered that the USDA Single Family Housing Guaranteed Loan Program—the same program she’d used to purchase her home seven years ago—offers cash-out refinancing options for existing USDA borrowers. Many homeowners and even some lenders are unaware that USDA loans can be refinanced with cash-out, assuming USDA only handles purchases or rate-and-term refinancing.

Dr. Martinez learned that USDA cash-out refinancing provides several strategic advantages:

Stay within USDA program:

- Refinance existing USDA loan into new USDA loan (maintain program benefits)

- Can also refinance conventional/FHA loans into USDA cash-out if property remains in eligible area and borrower meets income limits

Competitive rates, often better than conventional cash-out:

- USDA cash-out rates typically match or beat conventional cash-out rates

- Lower mortgage insurance than FHA: 0.35% annual vs. 0.85% FHA

- Upfront guarantee fee: 1% (vs. 1.75% FHA)

Cash-out up to 80% LTV:

- Can borrow up to 80% of home’s current value

- Pay off existing mortgage and receive remaining amount as cash

Income limits still apply:

- Must meet USDA income limits for area (since originally purchased with USDA, likely still qualify if income hasn’t increased dramatically)

- Property must still be in USDA-eligible area (most rural areas remain eligible indefinitely)

Primary residence requirement:

- Must continue using property as primary residence

- Cannot convert to rental/investment property

Self-employed borrower friendly:

- USDA guidelines accommodate self-employed borrowers with 2 years of tax returns

- Business income properly documented and averaged

Dr. Martinez contacted two USDA-approved lenders (the same lenders who handle USDA purchases can handle USDA cash-out refinancing). The first lender explained her cash-out refinance options:

USDA cash-out refinance preliminary numbers:

- Current home value (estimated): $315,000

- Maximum USDA cash-out LTV: 80%

- Maximum loan amount: $252,000 (80% of $315,000)

- Current USDA mortgage balance: $185,000

- Available cash-out before closing costs: $67,000 ($252,000 – $185,000)

- Estimated closing costs: $7,200

- Net cash to Dr. Martinez: $59,800 ($67,000 – $7,200)

- Actual cash needed: $58,000 (for expansion)

- Buffer remaining: $1,800 (safety margin)

Rate and payment comparison:

- Current USDA loan: $185,000 at 7.25%, payment $1,285/month (P&I)

- New USDA cash-out loan: $252,000 at 6.5%, payment $1,593/month (P&I)

- Rate improvement: -0.75% (lowering rate while taking cash out)

- Payment increase: +$308/month

- Monthly cost vs. alternatives:

- Conventional cash-out: $1,762/month (+$477 vs. current)

- USDA cash-out: $1,593/month (+$308 vs. current)

- Savings vs. conventional: $169/month with USDA

Income verification for USDA limits:

- Palm Beach County USDA income limit (2024): $103,400 for 1-person household

- Dr. Martinez’s documented income: $112,000 ($94,000 W-2 + $18,000 distributions average)

- Initial concern: Income appears $8,600 over limit

However, the USDA lender explained that certain deductions are allowed when calculating income for USDA purposes:

- Business-related expenses paid personally

- Certain retirement contributions

- Some childcare expenses (not applicable to Dr. Martinez)

After proper calculation with allowable adjustments:

- Gross income: $112,000

- Less: Allowable adjustments: -$9,200 (SEP-IRA contributions and documented business expenses)

- USDA qualifying income: $102,800

- USDA limit: $103,400

- Result: QUALIFIES by $600 ✓

“When the lender explained I could refinance at 6.5%—three-quarters of a point lower than my current 7.25% rate—while taking out $59,800 cash, I was shocked,” Dr. Martinez said. “I’d get the full $58,000 I needed for expansion, lower my interest rate, increase my payment by only $308 monthly (far less than the $477 conventional increase or the $472 HELOC payment), and stay within the USDA program. It solved everything elegantly.”

The lender explained the process:

- Formal application with income documentation (W-2s, tax returns, bank statements)

- Property appraisal to confirm $315,000+ value

- USDA income calculation and verification that Dr. Martinez remains under USDA limits

- Property eligibility confirmation (verify Okeechobee property still in USDA-eligible area)

- Standard underwriting (credit, assets, debts, ability to repay)

- USDA final approval and guarantee issuance

- Closing (typically 50-65 days from application)

Dr. Martinez felt confident and immediately began gathering documentation to apply.

What Documentation Was Required for the USDA Cash-Out Refinance Approval?

Dr. Martinez worked systematically with her USDA-approved lender to complete the cash-out refinance application. As a self-employed business owner, her documentation requirements were more extensive than W-2 employees but straightforward with proper preparation.

Personal identification and credit documentation:

- Valid government-issued photo ID (Florida driver’s license)

- Social Security card

- Credit report showing 738 credit score with:

- Current USDA mortgage: Perfect payment history, never late in 7 years

- Student loans: Current, never late ($124,000 balance, $685/month payment)

- Auto loan: Current, never late ($7,650 balance, $425/month payment)

- Business equipment loan: Current, never late ($28,000 balance, $580/month payment)

- One business credit card: $3,200 balance, $15,000 limit, always paid on time

- No collections, judgments, or bankruptcies

- Strong payment history demonstrating excellent financial responsibility

Income and employment documentation (self-employed):

- Personal tax returns (complete): 2022 and 2023 (Form 1040 with all schedules)

- Business tax returns (complete): 2022 and 2023 (Form 1120S – S-corporation returns with all schedules)

- Year-to-date profit & loss statement: Current through most recent month

- Business bank statements: Most recent 2 months showing revenue deposits and operating expenses

- Personal bank statements: Most recent 2 months showing:

- Personal checking: $8,400 balance

- Personal savings: $12,600 balance

- Business operating account: $42,000 balance

- Total liquid assets: $63,000

- CPA letter: Verification from Dr. Martinez’s accountant confirming business ownership, income stability, and business financial health

- Business license: Current Florida veterinary practice license

- Professional liability insurance: Current coverage documentation

USDA-specific income calculation documentation:

The lender carefully calculated Dr. Martinez’s income for USDA income limit purposes:

Income sources:

- W-2 salary from S-corp (2023): $94,000

- S-corp distributions (2023): $21,000

- S-corp distributions (2022): $15,000

- Average distributions: $18,000

- Total average annual income: $112,000

USDA allowable deductions:

- SEP-IRA retirement contributions: $9,600 annually (documented)

- Business use of home (office): Not claimed as already accounted in business

- Total allowable deductions: $9,600

USDA qualifying income calculation:

- Gross income: $112,000

- Less: Allowable deductions: -$9,600

- USDA qualifying income: $102,400

- USDA income limit (Palm Beach County, 1-person): $103,400

- Margin: $1,000 under limit ✓ QUALIFIES

“The USDA income calculation was more nuanced than I expected,” Dr. Martinez said. “The lender had to document my retirement contributions and properly calculate my business distributions averaged over two years. But because I had clean tax returns prepared by a CPA and good documentation, it was straightforward. I qualified with $1,000 to spare.”

Asset and cash-out purpose documentation:

- Bank statements (personal and business) showing $63,000 total liquid reserves

- Letter explaining cash-out use: Detailed explanation that $58,000 would fund veterinary clinic expansion:

- $28,000: New diagnostic equipment (digital x-ray system)

- $18,000: Construction of second examination room

- $12,000: Hiring and training reserve for additional veterinary technician

- Supporting business expansion documentation:

- Equipment quotes from veterinary supply companies ($28,000)

- Construction estimates from licensed contractor ($18,000)

- Business plan showing projected revenue increase from expansion

- CPA letter supporting business case for expansion

“USDA wanted to verify I wasn’t taking cash out for frivolous purposes,” Dr. Martinez explained. “They wanted documentation showing the funds would be used for legitimate purposes—in my case, business expansion. I provided equipment quotes, construction bids, and a letter from my accountant explaining the business rationale. That satisfied their requirements.”

Property and existing mortgage documentation:

- Current USDA mortgage statement showing $185,200 balance at 7.25%

- Property deed showing Dr. Amanda Martinez as owner

- Property insurance declaration showing adequate coverage

- Property tax bill showing current status, no delinquencies ($3,420 annually)

- Property appraisal ordered by lender to confirm current value

- USDA property eligibility verification: Lender confirmed Okeechobee property address remains in USDA-eligible area ✓

Debt and liability documentation:

- Student loan statements showing $124,000 balance, $685 monthly payment, current status

- Auto loan statement showing $7,650 balance, $425 monthly payment, current status

- Business equipment loan statement showing $28,000 balance, $580 monthly payment, current status

- Business credit card statement showing $3,200 balance, minimum payment $95

The detailed approval and closing timeline:

- Accountant suggested USDA cash-out refinancing (Day 1) – Dr. Martinez learned about option

- Online research and lender consultation (Days 2-4) – Researched USDA cash-out and contacted lenders

- Formal application submitted (Day 6) – Submitted complete documentation package

- Credit report pulled (Day 7) – 738 score confirmed with excellent history

- Income documentation review begins (Days 8-10) – Lender reviewed tax returns, calculated USDA qualifying income

- USDA income limit verification (Day 11) – Confirmed Dr. Martinez qualifies under $103,400 limit

- Employment and business verification (Day 12) – Lender verified veterinary practice ownership and income stability

- Property appraisal ordered (Day 13) – USDA-approved appraiser scheduled

- Current mortgage payoff statement requested (Day 14) – Contacted USDA loan servicer for exact payoff

- Asset verification (Day 15) – Verified $63,000 liquid reserves across accounts

- Cash-out purpose documentation reviewed (Day 16) – Equipment quotes, construction bids, business plan examined

- Property USDA eligibility confirmed (Day 17) – Property address verified in eligible area

- Appraisal inspection completed (Day 20) – Appraiser inspected property

- Business financials detailed review (Days 21-24) – Underwriter analyzed 2 years of business returns, P&L, bank statements

- Appraisal report delivered (Day 26) – Property appraised at $318,000 (above needed $315,000) ✓

- Current mortgage payoff statement received (Day 27) – Exact payoff: $185,420 as of projected closing

- Debt-to-income ratio calculation (Day 28) – Calculated DTI with new loan and confirmed acceptable

- Initial underwriting review (Days 29-33) – Reviewed all documentation including income, assets, credit, appraisal, USDA eligibility

- Conditional approval issued (Day 34) – Approved pending updated business bank statement and P&L

- Updated documentation submitted (Day 35) – Most recent business bank statement and current P&L provided

- Title examination ordered (Day 36) – Title company searching property records

- Title examination completed (Day 41) – Clear title, only existing USDA mortgage (to be paid off)

- Homeowners insurance updated (Day 42) – Coverage increased to match new loan amount

- File submitted to USDA for final guarantee (Day 43) – USDA reviews and issues guarantee

- USDA conditional commitment issued (Day 50) – USDA approved guarantee pending final conditions

- Final conditions cleared (Day 52) – All documentation requirements satisfied

- USDA final loan guarantee issued (Day 54) – Full approval from USDA

- Clear to close issued (Day 55) – Lender authorized to proceed to closing

- Closing disclosure prepared and delivered (Day 57) – Three-day review period begins

- Final review with lender (Day 60) – Dr. Martinez confirmed all numbers and cash-out amount

- Closing scheduled (Day 61) – Appointment set at title company

- Closing executed (Day 62) – Signed all documents; received $59,800 cashier’s check

- Recording and funding (Day 63) – Documents recorded; refinance complete

Final USDA cash-out refinance terms:

- Home appraised value: $318,000

- Maximum 80% LTV loan amount: $254,400 (80% of $318,000)

- Actual new loan amount selected: $252,000 (provided sufficient cash while maintaining comfortable LTV)

- Current USDA mortgage payoff: $185,420

- Upfront guarantee fee (1%): $2,520 (financed into loan)

- Final loan amount: $254,520 ($252,000 + $2,520 guarantee fee)

- Closing costs: $7,280 (appraisal $625, title insurance $2,150, recording $385, origination $2,520, credit $95, flood cert $35, survey $425, administrative $1,045)

- Total funds needed: $192,700 (payoff $185,420 + closing costs $7,280)

- Loan amount available: $254,520

- Net cash to Dr. Martinez at closing: $61,820 ($254,520 – $192,700)

- Amount needed for expansion: $58,000

- Excess cash retained: $3,820 (deposited to business account as additional buffer)

New loan terms and payment structure:

- New loan amount: $254,520

- Interest rate: 6.5% (30-year fixed)

- Previous interest rate: 7.25%

- Rate reduction: 0.75%

- New monthly P&I payment: $1,609

- Previous monthly P&I payment: $1,285

- P&I payment increase: $324

- Property taxes: $285 monthly (unchanged)

- Homeowners insurance: $145 monthly (unchanged)

- USDA annual guarantee fee: $74 monthly (0.35% of loan balance annually)

- New total monthly payment: $2,113

- Previous total monthly payment: $1,715

- Total payment increase: $398 monthly

- Percentage of gross income: 22.7% (excellent for self-employed borrower)

“Walking out of closing with a $61,820 check—more than the $58,000 I needed—while lowering my interest rate by 0.75% felt incredible,” Dr. Martinez said. “Yes, my monthly payment increased by $398, but that was $79 less than the conventional cash-out would have cost, and $74 less than the HELOC interest-only payment. More importantly, I had the capital to expand my practice while maintaining my business reserves, and I lowered my mortgage rate in the process.”

Exploring USDA cash-out refinancing? Submit a refinance inquiry to discuss your options.

What Were the Final Terms and Long-Term Business and Personal Impact?

Dr. Martinez closed on her USDA cash-out refinance exactly 63 days after submitting her application. She received $61,820 in net proceeds at closing, immediately allocated $58,000 to her veterinary clinic expansion project, and deposited the remaining $3,820 into her business operating account as additional reserves. Her 4-bedroom, 2-bathroom home in Okeechobee’s quiet Cypress Heron subdivision offered 2,100 square feet of comfortable living space with spacious home office, large fenced yard, covered patio, two-car garage, and peaceful rural setting—located in a USDA-eligible area that had enabled her homeownership seven years earlier and now provided access to equity for business growth.

Final loan terms and financial comparison:

- Home appraised value: $318,000

- Previous USDA loan balance paid off: $185,420 (at 7.25%)

- New loan amount: $254,520 (includes $2,520 guarantee fee financed)

- Net cash received at closing: $61,820

- Cash allocated to business expansion: $58,000

- Excess cash to business reserves: $3,820

- Previous interest rate: 7.25%

- New interest rate: 6.5%

- Rate reduction: 0.75%

- Previous monthly payment (PITI): $1,715

- New monthly payment (PITI + annual fee): $2,113

- Monthly payment increase: $398

- Application to closing: 63 days

- Property: 4BR/2BA single-family home, 2,100 sq ft, Okeechobee, FL

USDA cash-out vs. alternative financing comparison:

| Factor | USDA Cash-Out | Conventional Cash-Out | HELOC | SBA Business Loan | Business Line of Credit |

|---|---|---|---|---|---|

| Amount accessed | $61,820 | $58,700 | $58,000 | $58,000 | $58,000 |

| Interest rate | 6.5% | 7.5% | 9.75% variable | 10.5% | 11.75% variable |

| Monthly payment | $2,113 total | $2,192 total | $2,187 total* | $2,295 total** | $2,287 total** |

| Payment increase vs. current | $398 | $477 | $472+ | $580 | $572+ |

| Rate vs. current | Lower by 0.75% | Higher by 0.25% | Higher by 2.5% | N/A | N/A |

| Closing costs | $7,280 | $8,900 | $1,200 | $5,000 | $800 |

| Processing time | 63 days | 45 days | 30 days | 90-120 days | 21 days |

| Income verification | Self-employed friendly | Difficult for self-employed | Moderate | Extensive | Moderate |

| Collateral | Home only | Home only | Home (subordinate) | Business + personal guarantee | Business assets |

| Impact on business credit | None | None | None | Yes (UCC filing) | Yes (UCC filing) |

| Payment stability | Fixed 30 years | Fixed 30 years | Variable (risk) | Fixed 7 years | Variable (risk) |

*Includes existing $1,715 mortgage + $472 HELOC interest-only

**Includes existing $1,715 mortgage + new business debt payment

“The comparison makes the USDA cash-out refinance’s advantage crystal clear,” Dr. Martinez’s accountant explained. “She accessed the most cash ($61,820), got the lowest interest rate (6.5%), had the smallest monthly payment increase ($398), and actually lowered her mortgage rate in the process. The conventional refinance would have cost $79 more monthly and increased her rate. The HELOC would have been variable and risky. The business loans carried 10-11% rates and extensive business asset liens. USDA cash-out was objectively the best option.”

Veterinary clinic expansion implementation and business impact:

Dr. Martinez immediately executed her expansion plan using the $58,000 from the cash-out refinance:

Equipment purchase ($28,000):

- Digital radiography system: $24,500 (purchased and installed Month 1)

- Updated surgical monitoring equipment: $3,500 (purchased Month 1)

- Result: Ability to perform advanced diagnostics in-house rather than referring cases to specialists 45 minutes away

Facility construction ($18,000):

- Second examination room construction: $16,200 (completed Month 2)

- Additional storage and prep area: $1,800 (completed Month 2)

- Result: Ability to see two patients simultaneously, reducing wait times and increasing daily capacity

Staffing investment ($12,000):

- Hired experienced veterinary technician: Month 2

- Salary: $42,000 annually ($3,500 monthly)

- First 3 months salary from cash-out funds: $10,500

- Training and onboarding costs: $1,500

- Result: Doubled clinical capacity and improved client service

Business financial impact (12 months post-expansion):

Before expansion (annual):

- Gross revenue: $505,000

- Operating expenses: $352,000

- Net profit: $153,000

- Dr. Martinez compensation (W-2 + distributions): $112,000

- Business profit after owner compensation: $41,000

After expansion (first 12 months):

- Gross revenue: $638,000 (26.3% increase)

- Operating expenses: $448,000 (includes new tech salary, equipment maintenance, increased supplies)

- Net profit: $190,000

- Dr. Martinez compensation: $130,000 (increased W-2 to $102,000 + $28,000 distributions)

- Business profit after owner compensation: $60,000

Expansion ROI calculation:

- Investment: $58,000 (from cash-out refinance)

- Revenue increase (Year 1): $133,000

- Profit increase (Year 1): $37,000

- ROI: 63.8% in Year 1

- Projected payback period: 1.6 years

“The expansion exceeded my projections,” Dr. Martinez said. “I thought I’d increase revenue by 20% in the first year—I actually achieved 26%. The digital x-ray system alone brought in $42,000 in additional revenue from services I previously had to refer out. The second exam room eliminated patient wait times and allowed me to see 6-8 more patients daily. And the new veterinary tech allowed me to focus on complex cases while she handled routine care. The $58,000 investment paid for itself in less than two years.”

Long-term equity and home value impact:

While Dr. Martinez increased her mortgage balance by $69,100 ($254,520 new loan – $185,420 old loan), her home’s appreciation trajectory and business income growth would rebuild equity:

At refinance (Year 0, Age 44):

- Home value: $318,000

- Loan balance: $254,520

- Equity: $63,480 (20%)

- Equity reduced by: $69,100 (from taking cash-out)

Year 3 (Age 47):

- Home value: $347,000 (assuming 3% annual appreciation)

- Loan balance: $245,000 (after 36 payments)

- Equity: $102,000 (29.4%)

- Equity recovered: $38,520 vs. refinance closing

Year 5 (Age 49):

- Home value: $368,000 (3% appreciation)

- Loan balance: $237,000 (after 60 payments)

- Equity: $131,000 (35.6%)

- Equity exceeds pre-refinance equity: $67,520 vs. original $130,000 before cash-out

Year 10 (Age 54):

- Home value: $427,000 (3% appreciation)

- Loan balance: $219,000 (after 120 payments)

- Equity: $208,000 (48.7%)

“The equity I ‘gave up’ by taking cash-out will be fully restored within 5-6 years through appreciation and mortgage paydown,” Dr. Martinez’s financial advisor explained. “And that’s assuming static home values—if Okeechobee continues developing and property values increase faster than 3% annually, she’ll recover equity even sooner. Meanwhile, the $58,000 investment in her business generated an additional $37,000 in profit in Year 1 alone—far exceeding what she could have earned investing that capital elsewhere.”

Total interest cost analysis: Cash-out refinance vs. business loan:

Dr. Martinez’s accountant ran a detailed comparison of total interest paid under different financing scenarios:

Scenario 1: USDA cash-out refinance (actual choice):

- Borrowed: $69,100 additional (difference between new $254,520 and old $185,420 loans)

- Interest rate: 6.5%

- Term: 30 years (if kept full term)

- Total interest on incremental $69,100 over 30 years: $86,450

- However: business profits allow accelerated paydown—actual projected interest $45,000 over 10 years

Scenario 2: SBA business loan alternative:

- Borrowed: $58,000

- Interest rate: 10.5%

- Term: 7 years

- Total interest paid: $24,170

- But: Must maintain $185,420 mortgage at 7.25% (vs. refinancing to 6.5%)

- Interest savings on mortgage by refinancing: $32,400 over 7 years (0.75% savings on $185k)

- Net position: Paid $24,170 business loan interest BUT gave up $32,400 mortgage savings

- Net cost: $56,570 vs. $45,000 USDA cash-out approach

Scenario 3: Business line of credit alternative:

- Borrowed: $58,000

- Interest rate: 11.75% variable (assuming average over 5 years)

- Term: 5 years to pay off

- Total interest paid: $18,950

- But: Maintains $185,420 mortgage at 7.25%

- Mortgage refinance savings forgone: $23,150 (over 5 years)

- Net cost: $42,100 vs. $45,000 USDA approach

“While the business line of credit alternative has slightly lower total cost on paper ($42,100 vs. $45,000), that assumes Dr. Martinez could maintain business credit access for 5 years without interruption,” her accountant noted. “Business lines of credit can be reduced or cancelled during annual reviews if the bank doesn’t like business performance in any given year. The USDA cash-out provides permanent financing with a fixed rate and guaranteed access to the full amount—no risk of the bank pulling funding mid-expansion. The $2,900 difference over 5 years ($580/year) is essentially insurance against that risk.”

Tax implications and deductibility:

Dr. Martinez’s tax treatment of the cash-out refinance was nuanced:

Personal mortgage interest:

- New mortgage: $254,520

- Portion used for business: $58,000 (traceable to business expansion)

- Portion for refinancing existing mortgage: $196,520

Interest deductibility:

- Interest on $196,520 (personal residence refinance): Deductible as mortgage interest on Schedule A (personal itemized deductions)

- Interest on $58,000 (business use): Potentially deductible as business expense on Schedule C if properly documented and traced

- Dr. Martinez’s CPA structured documentation to trace the $58,000 to specific business expenditures, potentially allowing business expense deduction

First year interest (approximate):

- Total interest paid: $16,400

- Business-portion interest: $3,740 (approximately 23% of loan was business use)

- Personal mortgage interest: $12,660

“Properly documenting that $58,000 of the cash-out was used for business purposes allows Dr. Martinez to potentially deduct the interest as a business expense rather than personal mortgage interest,” her CPA explained. “Business interest deductions are more flexible than personal mortgage interest deductions, especially given the $750,000 mortgage interest deduction cap for personal residences. This nuance adds another $900-1,100 in annual tax savings.”

Monthly budget and cash flow impact:

Dr. Martinez’s monthly budget adjusted to accommodate the $398 payment increase:

| Category | Before Refinance | After Refinance | Change |

|---|---|---|---|

| Housing (mortgage PITI) | $1,715 | $2,113 | +$398 |

| Utilities | $235 | $235 | $0 |

| Groceries | $480 | $480 | $0 |

| Car payment | $425 | $425 | $0 |

| Car insurance | $165 | $165 | $0 |

| Gas/maintenance | $280 | $280 | $0 |

| Healthcare | $195 | $195 | $0 |

| Student loans | $685 | $685 | $0 |

| Business loan | $580 | $0 | -$580 ✓ |

| Personal/household | $180 | $180 | $0 |

| Entertainment | $220 | $200 | -$20 |

| Retirement (SEP-IRA) | $800 | $850 | +$50 |

| Emergency savings | $300 | $350 | +$50 |

| Total Expenses | $6,260 | $6,158 | -$102 ✓ |

| Net Income | $7,400 | $7,650* | +$250 |

| Monthly Surplus | $1,140 | $1,492 | +$352 ✓ |

*Net income increased due to business profit growth from expansion

“Here’s what most people miss about my cash-out refinance,” Dr. Martinez explained. “Yes, my mortgage payment increased by $398. But I eliminated my $580 business equipment loan payment—a net reduction of $182 in monthly obligations. Add in my increased income from business growth ($250/month additional take-home), and my actual monthly surplus increased by $352 after the refinance. I’m financially better off every month while having funded a $58,000 business expansion.”

Quality of life and business flexibility improvements:

Beyond financial metrics, the cash-out refinance and business expansion delivered meaningful life improvements:

Business stress reduction:

- Expanded capacity eliminated constant patient overload and scheduling stress

- Ability to hire qualified tech reduced Dr. Martinez’s 60-hour weeks to 50-hour weeks

- Digital x-ray system eliminated frustration of referring cases out and losing clients to competitors

- Improved cash flow from revenue growth provided business stability

Professional growth and community impact:

- Enhanced clinic capabilities attracted new clients throughout Okeechobee County

- Able to provide advanced care locally rather than patients driving 45+ minutes to specialists

- Hired experienced veterinary tech (created local job)

- Positioned clinic for potential future expansion (second veterinarian addition)

Personal financial security:

- Maintained business reserves ($42,000 + $3,820 from excess cash-out = $45,820)

- Increased personal income by $18,000 annually from business growth

- Lowered mortgage rate by 0.75%, saving thousands in long-term interest

- Created clear growth trajectory for business valuation and future sale potential

Future flexibility:

- Business expansion positioned practice for acquisition discussions (3-5 year timeline)

- Increased revenue makes practice more attractive to potential buyers or partners

- Home equity rebuilding through appreciation provides future flexibility

- Improved business cash flow allows exploration of second location or mobile veterinary services

“The USDA cash-out refinance wasn’t just about getting $58,000—it was about creating growth momentum for my practice while maintaining financial stability,” Dr. Martinez reflected. “I lowered my mortgage rate, eliminated a high-interest business loan, expanded my clinic, grew revenue by 26%, increased my personal income, and still maintained healthy business reserves. Two years later, I’m fielding inquiries from larger veterinary groups interested in acquiring my practice. The $58,000 investment has already created over $150,000 in increased practice valuation. That’s the power of strategic use of home equity.”

Ready to get started? Get approved or schedule a call to discuss your situation.

Exploring Other USDA Loan Options?

While Dr. Martinez used a USDA cash-out refinance to access equity for business expansion, USDA offers other refinancing and purchase options:

- Want to purchase with 0% down? See how a teacher bought her first home using USDA’s 0% down payment program

- Need rate-and-term refinance without cash-out? USDA Streamline Assist refinance offers reduced documentation and costs for rate reduction

- Refinancing a non-USDA loan into USDA? Conventional or FHA borrowers can refinance into USDA if property is in eligible area and income qualifies

View all case studies – Browse success stories by your journey stage and loan program

What Can Homeowners Learn from This USDA Cash-Out Refinance Success?

- USDA loans can be refinanced with cash-out at up to 80% LTV—existing USDA borrowers can access home equity while staying in the USDA program, often at rates better than conventional cash-out refinancing (USDA refinance guidelines)

- Lower mortgage insurance than FHA cash-out refinancing—USDA’s 1% upfront guarantee fee and 0.35% annual fee are substantially lower than FHA’s 1.75% upfront and 0.85% annual mortgage insurance

- Income limits still apply even for refinancing—borrowers must verify their current income remains under USDA limits for their county and household size; certain deductions (retirement contributions, business expenses) may be allowed

- Property must remain in USDA-eligible area—verify property address still qualifies using USDA eligibility map; most rural areas remain eligible indefinitely but some areas lose eligibility as population grows

- Self-employed borrowers can qualify with proper documentation—2 years of business tax returns, profit & loss statements, and business bank statements allow business owners to demonstrate qualifying income

- Cash-out can be used for any legitimate purpose—business expansion, debt consolidation, home improvements, education, medical expenses, or other financial needs

- Often possible to take cash-out AND lower interest rate simultaneously—if current rates are lower than borrower’s existing rate, can accomplish both goals in one transaction

- Processing timelines typically 50-65 days—USDA cash-out refinancing requires additional underwriting and USDA guarantee approval; plan for longer timeline than conventional refinancing

Interested in USDA cash-out refinancing? Submit a refinance inquiry to discuss accessing your home equity.

Related Resources

Learn more about this loan program:

- Complete USDA Loan Guide – Detailed requirements, benefits, and eligibility guidelines

- USDA Loan Calculator – Calculate payments and estimate cash-out availability

Official program information:

- USDA Rural Development – Official federal program information

- USDA Property Eligibility Map – Verify your property remains in USDA-eligible area

- USDA Income Limits by County – Check current income limits for your area

Similar success stories:

- How a teacher purchased with USDA 0% down – First-time buyer success story

- View all refinance case studies – Browse by your situation and goals

- Small business owner financing strategies – See how entrepreneurs fund growth

Ready to get started?

- Submit a refinance inquiry – Discuss your USDA cash-out refinance scenario

- Schedule a consultation – Talk with a USDA-approved lender about accessing equity

- Get approved – Start your USDA refinance application

Self-employed borrower resources:

Documentation tips for business owners:

- Maintain clean, CPA-prepared tax returns (personal and business)

- Keep detailed profit & loss statements current

- Document business bank account deposits and expenses clearly

- Separate personal and business finances completely

- Work with accountant to optimize USDA income calculations

- Plan 2-3 months ahead for documentation gathering

Cash-out use documentation:

- Obtain written quotes/bids for intended use of funds

- Create business plan if using for business expansion

- Keep all receipts and documentation of how cash-out was used

- Consult tax advisor about interest deductibility strategies

Need local expertise? Get introduced to trusted partners including USDA-approved lenders, CPAs specializing in self-employed borrowers, business advisors, and small business development centers.

Primary keyword phrase: usda loan cash-out refinance

Ready to Take Your First Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Related Posts

Subscribe to our newsletter

Get new calculators and money tools in your inbox.