USDA Construction Loan: General Contractor Builds Dream Home in Rural Florida with Zero Down Payment

Educational Case Study Disclosure

This case study is hypothetical and for educational purposes only. Scenarios, borrower profiles, loan terms, interest rates, and outcomes are illustrative examples and do not represent current offers or guaranteed terms.

For specific details including down payment requirements, closing cost estimates, interest rate details, closing cost breakdowns, payment calculations, cash-to-close estimates, or an official Loan Estimate, it is highly recommended you schedule a meeting with one of our licensed mortgage advisors.

Learn more:

- USDA construction loan Reg Z advertising requirements (§1026.24) – CFPB official regulation

- USDA construction loan Reg Z full text and compliance – Electronic Code of Federal Regulations

- Official USDA construction loan advertising interpretations (§1026.24) – CFPB interpretations

- USDA construction loan MAP Rule (Reg N) mortgage advertising – Mortgage advertising rules

- NMLS Consumer Access – Verify USDA construction loan lender licensure

Actual loan terms vary by credit profile, property, occupancy, location, market conditions, and lender guidelines. For current options tailored to you, schedule a consultation or apply online.

Ready to explore your options? Schedule a call with a loan advisor.

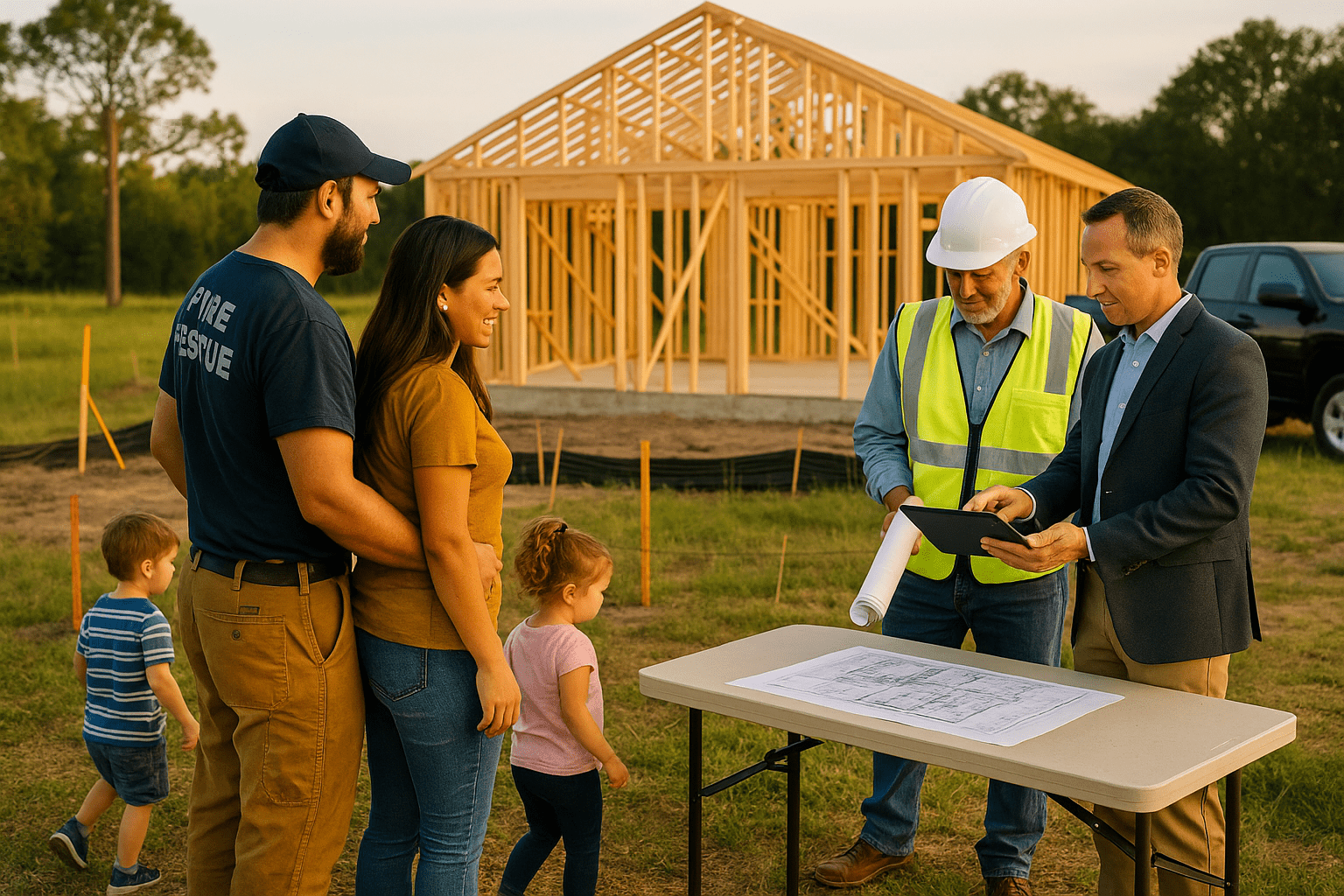

Discover How a USDA Construction Loan Made Custom Home Building Affordable Without a Down Payment

James R., a 34-year-old general contractor from Brooksville, Florida, had spent his entire career building custom homes for other people. After years of renting and moving from job site to job site, he was ready to build his own dream home on a beautiful piece of rural land he’d found in Hernando County. With his construction expertise, James knew he could build exactly what his growing family needed while staying within budget. His long-term vision included not just this home, but eventually building investment properties on adjacent lots to create generational wealth for his children.

Despite having excellent credit and stable income from his contracting business, James faced an unexpected obstacle: he had modest savings after supporting his family and running his business, and traditional construction loans required substantial down payments—often significantly more than standard purchase loans. The lot was perfect, the plans were ready, but the financing seemed out of reach.

Facing similar challenges? Schedule a call to explore your options.

The Challenge: Why Traditional Construction Lenders Required Too Much Cash

James first approached his local bank where he’d maintained accounts for years. The loan officer was enthusiastic about his construction plans and praised his detailed blueprints, but the conversation quickly turned discouraging when they discussed down payment requirements.

How Much Do Traditional Construction Loans Require Down?

Traditional construction-to-permanent loans typically require substantial down payments—often significantly more than conventional purchase loans. The bank told James he’d need to bring considerable cash to closing, funds he simply didn’t have after purchasing the land and preparing the site.

Why Do USDA Construction Loan Lenders Require Higher Down Payments?

“The loan officer explained that construction loans are considered higher risk because there’s no existing collateral until the home is built,” James recalled. “They wanted me to have significant skin in the game before they’d finance the construction. But I’d already invested everything into buying the land and getting permits.”

James contacted two more construction lenders. Both offered similar terms with substantial down payment requirements. One suggested he wait another few years to save more money. Another recommended he scale back his plans significantly to reduce the construction budget—but that would mean sacrificing the square footage his growing family needed.

What Gap Did James Face Between Savings and Requirements?

The gap between what James had saved and what lenders required was substantial. He’d been meticulous about planning every aspect of construction, from foundation to finishes, but traditional lenders focused only on his liquid reserves rather than his construction expertise or the home’s future value.

“I felt defeated,” James explained. “Here I was, a licensed contractor who’d built dozens of homes successfully, and I couldn’t get financing to build my own. The irony wasn’t lost on me.”

Time was also a factor. James had already secured building permits with expiration dates, and construction material prices were fluctuating. Every month of delay meant potentially higher costs or starting the permit process over again.

Experiencing similar rejection? Schedule a call to discuss alternative qualification methods.

The Discovery: How James Found Zero-Down Construction Financing

Frustrated but not defeated, James mentioned his financing struggle to another contractor he’d worked with on several projects. His colleague had recently built his own home using a USDA construction loan and encouraged James to explore the program.

“I’d heard of USDA loans for home purchases, but I had no idea they offered construction financing,” James admitted. “My friend explained that USDA construction loans work just like USDA purchase loans—including the zero down payment benefit.”

What Makes USDA Construction Loans Different from Traditional Construction Financing?

James scheduled a consultation with a USDA construction loan specialist to understand how the program worked. During that call, everything changed. The loan advisor explained that USDA construction loans are available in eligible rural areas and offer the same zero down payment benefit as standard USDA purchase loans—but for building a new home instead of buying an existing one.

The property James had already purchased was in a USDA-eligible rural area of Hernando County. His income qualified within USDA limits. His credit score met program requirements. And most importantly, he wouldn’t need to bring a substantial down payment to closing.

“That conversation was a game-changer,” James said. “For the first time, someone understood that my construction expertise was an asset, not a risk. And the zero down payment meant I could allocate my savings to upgrades and finishes that would increase the home’s value rather than tying it all up in a down payment.”

The Solution: USDA Construction Loan Approval Process

How Does a USDA Construction Loan Work?

James worked with his USDA construction loan advisor to assemble the required documentation. Unlike traditional construction loans that required significant cash reserves, the USDA construction loan focused on his income qualification, creditworthiness, detailed construction plans, and the property’s location in an eligible rural area.

Documentation provided:

- Complete construction plans and specifications prepared by a licensed architect

- Detailed cost breakdown for all construction phases from foundation to finishes

- Building permits already secured from Hernando County

- Licensed contractor credentials and proof of insurance (James would serve as his own general contractor)

- Recent pay stubs and tax returns showing stable income

- Excellent credit score demonstrating responsible financial management

- Property appraisal showing future value after construction completion

- Verification that property was located in USDA-eligible rural area

- Zero down payment required—all construction costs financed

The USDA construction loan approval process:

- Initial consultation – Discussed construction plans, timeline, and USDA eligibility

- Property verification – Confirmed lot location in USDA-eligible area

- Plan review – USDA construction loan underwriter reviewed architectural plans and cost estimates

- Income verification – Confirmed James’s income met USDA qualification limits

- Credit approval – Excellent credit score qualified for favorable program terms

- Appraisal ordered – Property appraised based on completed value using plans and specifications

- Construction draw schedule established – Created milestone-based funding schedule

- Final approval – Cleared to close with zero down payment requirement

- Closing – Funded construction loan, project ready to begin

How Long Does USDA Construction Loan Approval Take?

The entire process from application to closing took approximately six weeks—faster than James expected given the complexity of construction lending. The USDA construction loan lender worked closely with him to ensure all documentation met program guidelines.

“The draw schedule was particularly well-structured,” James explained. “Funds were released at specific construction milestones—foundation, framing, rough-in, drywall, and final completion. This protected both me and the lender while ensuring I had the capital needed at each phase.”

Ready to build? Submit a purchase inquiry to discuss your construction scenario.

The Results: James Builds Custom Home with Zero Down Payment

What Results Did James Achieve with USDA Construction Loan?

James broke ground on his custom home just two weeks after closing. The construction process took approximately seven months from foundation to final inspection, and he moved his family in right before the holidays. The four-bedroom, three-bathroom home included every feature his family needed, from an open-concept kitchen to a dedicated home office for managing his contracting business.

Final USDA construction loan outcome:

- Zero down payment required for construction financing

- Competitive interest rate for USDA construction loan program

- Long-term fixed-rate mortgage structure

- Single closing process—no need to refinance after construction completed

- Construction timeline: Seven months from groundbreaking to certificate of occupancy

- Property: 4BR/3BA custom-built home, Brooksville, FL (Hernando County)

- Home features: Open-concept design, energy-efficient construction, premium finishes throughout

- Located in peaceful rural setting with room for future expansion

Traditional construction loan vs. USDA construction loan comparison:

- Traditional lender requirement: Substantial down payment (significantly more than standard purchase loans)

- USDA construction loan requirement: Zero down payment

- James’s available capital: Could invest in premium finishes and energy-efficient upgrades instead of down payment

- Construction timeline: Met all milestones on schedule

- Homeownership goal: ACHIEVED ✓

How Did USDA Construction Loan Compare to Traditional Financing?

“Without the USDA construction loan program, I would have delayed building by several years while saving for a down payment,” James reflected. “Instead, I’m living in the custom home I built for my family, with every dollar of my savings invested into making it exactly what we wanted rather than satisfying a down payment requirement.”

The home’s energy-efficient construction means manageable monthly utility costs. The rural location provides privacy and space for his children to play safely. And the dedicated workshop on the property allows James to store equipment and materials for his contracting business.

What’s Next for James After USDA Construction Loan Success?

James views this home as more than just a place to live—it’s the foundation for his family’s long-term wealth-building strategy. He purchased additional land adjacent to his property and plans to build investment homes on those lots in the coming years, creating rental income streams that will fund his children’s education and his eventual retirement.

“This is house #1 in my plan,” James said. “I’m already working on designs for the first rental property I’ll build on the adjacent lot. The USDA construction loan program proved I can build quality homes without tying up massive amounts of capital, and I plan to use that strategy to build generational wealth for my family.”

Ready to get started? Get approved or schedule a call to discuss your construction plans.

Exploring Other USDA Construction Loan Options?

While James used a USDA construction loan to build his custom home, USDA financing works for multiple scenarios:

- Already own a USDA-financed home? See how a homeowner achieved significant savings with USDA loan refinance

- Want to purchase existing rural property? See how a medical technician bought their first home with USDA loan purchase

- View all case studies to find success stories matching your situation

Key Takeaways for Rural Home Builders

- USDA construction loans offer zero down payment financing for building new homes in eligible rural areas—the same benefit as USDA purchase loans, but for new construction instead of existing homes (USDA Rural Development eligible areas)

- Single-close construction loans convert automatically to permanent financing—no need for a second closing or refinance after construction completes, saving time and closing costs

- Detailed construction plans and cost estimates strengthen applications—USDA construction loan lenders need comprehensive documentation showing the project is well-planned and properly budgeted

- Licensed contractor credentials can improve approval odds—whether you’re serving as your own general contractor or hiring one, demonstrating construction expertise reduces perceived risk (Licensed contractor requirements by state)

- Think beyond the single home—successful builders view each project as one step in a larger wealth-building strategy, using the equity and experience from home #1 to build investment properties that create passive income and generational wealth for their families

Have questions about USDA construction loan qualification? Schedule a call with a loan advisor today.

Alternative Loan Programs for Home Builders

If a USDA construction loan isn’t the perfect fit, consider these alternatives:

- FHA Construction Loan – Build with lower down payment requirements in non-rural areas

- Conventional Construction Loan – Flexible construction financing for various property types

- VA Construction Loan – Zero down construction financing for eligible veterans

- One-Time Close Construction Loan – Single closing simplifies the construction-to-permanent process

Explore all loan programs to find your best option.

Helpful USDA Construction Loan Resources

Learn more about this loan program:

- Complete USDA Construction Loan Guide – Detailed requirements, rates, and qualification guidelines

- USDA Construction Loan Calculator – Estimate your construction budget and payments

Similar success stories:

- How a physical therapist achieved significant savings with USDA loan refinance – Rate reduction success story

- Medical technician purchases first home with USDA loan – Zero down payment purchase

- View all case studies – Browse by your journey stage

External authoritative resources:

- USDA Rural Development eligible areas map – Check property eligibility

- USDA guaranteed housing loan program overview – Official program details

- Licensed contractor requirements by state – Contractor licensing information

Ready to get started?

- Apply online – Start your application today

- Schedule a consultation – Discuss your construction plans

- Take the discovery quiz – Clarify your homebuilding goals

Need local expertise? Get introduced to trusted partners including loan officers, realtors, and contractors in your area.

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Not Sure About Your Next Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Related Posts

Subscribe to our newsletter

Get the latest insights and mortgage case studies in your inbox.