FHA Construction Loan: 7 Key Steps to Build Your Dream Home with Accessible Financing

How an FHA Construction Loan Finances Building from Ground Up with Low Initial Investment

Building a new home with FHA financing combines the accessibility of FHA qualification standards with construction loan functionality. The FHA construction loan provides a single-close solution that finances both the building process and converts to permanent FHA financing upon completion. Whether you’re a first-time builder or experienced homeowner, this approach delivers construction funding with the flexible qualification parameters that make FHA loans accessible to a broader borrower base.

Key Details: What You’ll Learn About FHA Construction Loans

- An FHA construction loan provides government-insured financing to build new homes from the ground up with the same accessible equity contributions as standard FHA purchases (HUD construction loan guidance)

- Borrowers with credit scores as low as 580 can access construction-to-permanent financing that converts automatically to standard FHA mortgages after building completes (FHA construction loan requirements)

- Two program variations exist: construction-to-permanent single-close loans and construction-only loans requiring separate permanent financing after completion

- Properties including single-family homes, multi-unit buildings up to four units, and FHA-approved manufactured homes qualify when construction meets FHA standards

- An FHA construction loan accommodates first-time buyers building custom homes, families in markets with limited existing inventory, and buyers seeking specific accessibility features

- Construction funds disburse through draw schedules as builders complete milestones, with interest-only payments during the building phase before conversion to permanent financing

- Credit requirements mirror standard FHA loans with flexible qualification standards, making new construction financing accessible to borrowers who wouldn’t qualify for conventional construction programs (CFPB construction loan information)

Ready to explore your options? Schedule a call with a loan advisor.

What Is an FHA Construction Loan?

An FHA construction loan represents government-insured financing that enables qualified borrowers to build new homes from the ground up using the same flexible qualification standards and accessible equity contributions that make FHA purchase loans available to many buyers. This program extends FHA’s benefits to new construction scenarios that conventional construction financing often places out of reach for first-time builders.

How does an FHA construction loan work? The lender calculates your loan amount based on the projected completed value of your new home rather than current land value. You finance land acquisition costs (if needed) plus all construction expenses plus applicable fees in one mortgage. During construction, the loan disburses funds in stages as builders complete work, with borrowers making interest-only payments on disbursed amounts before the loan converts to permanent FHA financing.

The program addresses a fundamental challenge for home buyers with limited savings: building custom homes typically requires larger equity contributions and higher credit standards than purchasing existing properties. An FHA construction loan applies FHA’s accessible minimum equity requirement to total construction costs, making custom home building feasible for borrowers who couldn’t meet conventional construction financing thresholds.

This government-backed approach brings FHA’s flexible credit standards, higher debt-to-income tolerance, and seller concession allowances to construction scenarios, creating pathways to custom homeownership that would otherwise require years of additional savings or substantially higher incomes.

Who Benefits Most from an FHA Construction Loan?

Several borrower profiles find exceptional value in an FHA construction loan structure. These programs serve individuals whose homeownership goals align with building custom homes but whose financial profiles don’t meet conventional construction lending standards.

First-time home buyers building custom represent ideal candidates for an FHA construction loan. If you’ve identified the perfect lot but lack the substantial equity contributions conventional construction loans require, FHA’s accessible minimums make custom building feasible without years of additional savings.

Buyers with moderate credit profiles find FHA construction loan flexibility particularly valuable. While conventional construction financing typically requires credit scores of 680-700+, an FHA construction loan accommodates scores as low as 580, enabling borrowers still building credit histories to pursue custom home construction.

Families in markets with limited existing inventory where available homes are scarce, overpriced, or don’t meet needs can build custom homes through FHA construction financing. When existing home competition is fierce but buildable lots are available, construction financing provides an alternative path to homeownership.

Buyers requiring specific accessibility features including wheelchair accessibility, single-floor living, wider doorways, or specialized modifications find building custom more practical than renovating existing homes. An FHA construction loan funds these necessary features from the start rather than requiring expensive post-purchase modifications.

Multi-generational families needing specific layouts, multiple primary suites, or configurations not common in existing homes benefit from custom construction. An FHA construction loan enables building homes tailored to extended family living situations with the same accessible equity as standard purchases.

Explore all loan programs to understand your full range of options.

What Are the Two Types of FHA Construction Loans?

Understanding the distinction between construction-to-permanent and construction-only FHA loans helps you select the appropriate structure for your building timeline and financial strategy.

Construction-to-permanent FHA loan (one-time close) provides the most streamlined approach, combining construction financing that automatically converts to permanent FHA mortgage financing upon completion. You close once, lock your permanent mortgage rate, and transition seamlessly from building to long-term financing.

Construction-to-permanent advantages:

- Single closing reducing total transaction costs

- Lock permanent mortgage rate during construction

- Automatic conversion to FHA mortgage at completion

- Eliminates need for separate permanent financing

- No requalification required after construction

- Streamlined process from start to finish

Construction-to-permanent structure:

- Interest-only payments during construction phase

- Loan converts to standard FHA mortgage upon completion

- All qualification occurs at initial closing

- Rate locks protect against increases during building

Construction-only FHA loan (two-time close) provides separate short-term construction financing requiring refinancing into permanent mortgages after building completes. You close on construction financing, complete building, then close again on permanent FHA financing once the home is finished.

Construction-only characteristics:

- Separate construction loan funding building phase

- Short-term construction financing (typically 12-18 months)

- Requires refinancing into permanent mortgage after completion

- Two closings with separate costs and qualifications

- Flexibility if circumstances change during construction

- May enable better permanent financing terms after completion

Why choose construction-only over construction-to-permanent? Construction-only structures provide flexibility if you expect financial improvements during construction that would enable better permanent financing terms. However, most borrowers prefer the simplicity, cost savings, and rate protection of construction-to-permanent single-close programs.

What Are the Requirements for an FHA Construction Loan?

Understanding the specific qualification criteria helps you assess whether an FHA construction loan fits your building project and financial profile. Requirements combine standard FHA qualification standards with construction-specific stipulations.

Credit score minimums – FHA construction loans accept the same credit scores as standard FHA financing: 580 minimum for modest equity contributions, or 500-579 with larger equity investments. These accessible thresholds extend to construction scenarios that conventional programs would require significantly higher scores.

Initial investment requirements – Minimum contributions follow standard FHA guidelines applied to the total project cost (land plus construction). This calculation applies to the complete cost including land acquisition, construction expenses, and applicable fees—substantially lower than conventional construction requirements.

Builder qualifications – FHA requires licensed, insured general contractors with demonstrated construction experience. Builders must provide credentials, insurance certificates, previous project portfolios, and financial stability documentation. FHA maintains approved builder lists in some markets, though many licensed contractors can meet FHA builder requirements.

Construction plans and specifications – Detailed architectural plans, engineering specifications, and construction documents must meet FHA standards and local building codes. Plans need sufficient detail for accurate cost estimation, FHA appraisal, and construction execution.

Property eligibility standards – Completed properties must meet FHA minimum property standards addressing safety, security, and soundness. Construction must result in properties suitable as FHA-financed primary residences with functioning systems and no safety hazards.

Appraisal requirements – FHA requires “subject-to” appraisals estimating completed home value based on plans, specifications, and comparable sales. The appraised value determines maximum loan amounts and ensures construction investments create appropriate value.

Debt-to-income ratio limits – FHA construction loans accommodate the same flexible debt-to-income ratios as standard FHA mortgages (typically 43-50%). Your total debts including the projected permanent mortgage payment must fall within acceptable parameters.

Reserve requirements – Many FHA construction loan programs require demonstrating liquid reserves covering several months of the projected permanent housing expense after closing. These reserves provide cushion for unexpected construction costs or timeline extensions.

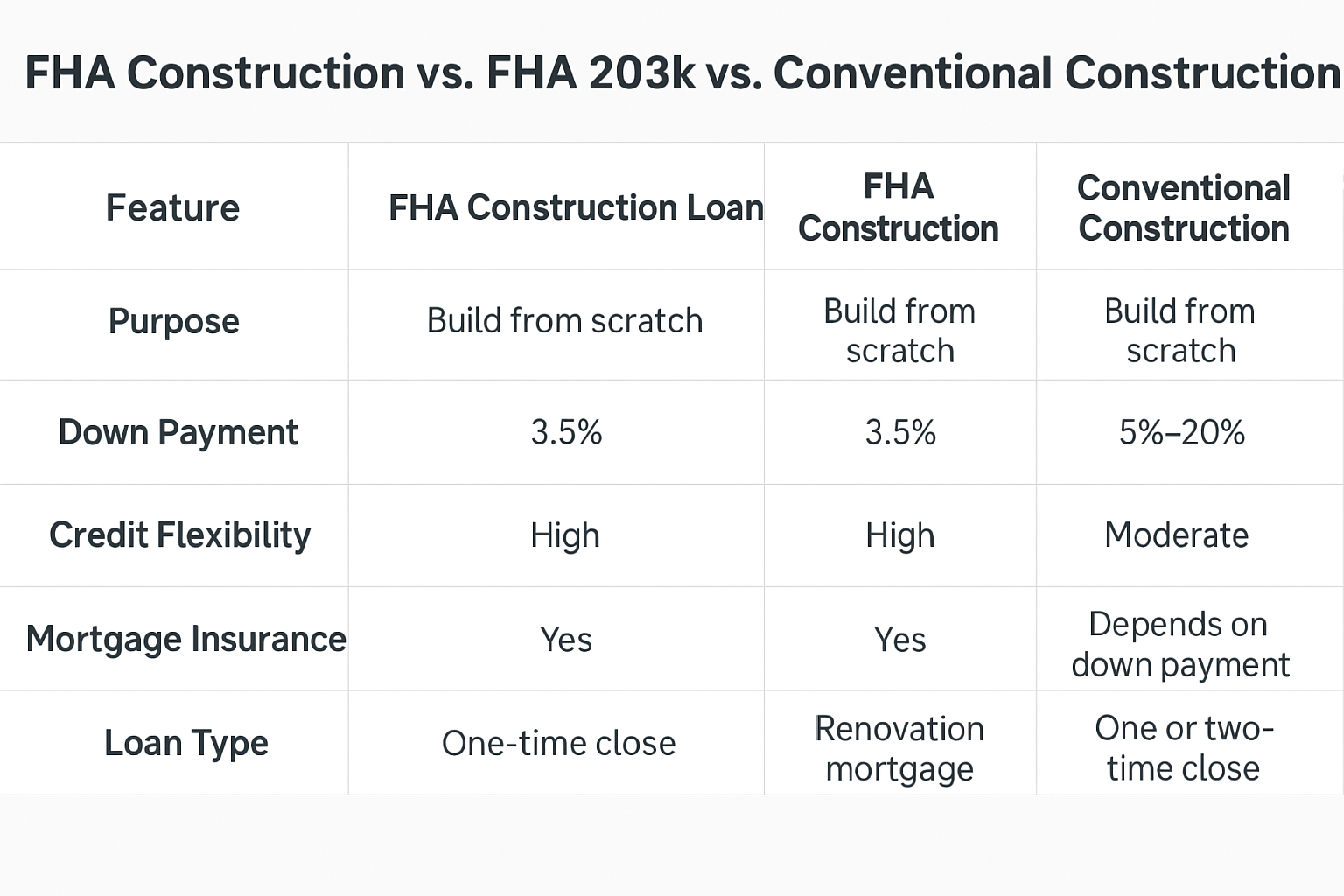

How Does an FHA Construction Loan Differ from Conventional Construction Financing?

The fundamental distinction lies in the equity requirements, credit flexibility, and qualification standards. Understanding these differences helps you evaluate which construction financing approach best serves your situation.

FHA construction loan characteristics:

- Modest minimum equity contribution

- Credit scores as low as 580 accepted

- Debt-to-income ratios up to 43-50%

- Government insurance protects lenders

- Completed property must meet FHA standards

- Primary residence requirement

- Mortgage insurance required throughout loan term

Conventional construction loan characteristics:

- Larger minimum equity typically required

- Credit scores of 680-700+ generally necessary

- Conservative debt-to-income ratio requirements

- No government insurance or guarantees

- Standard property condition requirements

- Can accommodate investment properties

- No mortgage insurance with sufficient equity

Cost comparison considerations:

- FHA charges upfront and annual mortgage insurance premiums

- Conventional avoids mortgage insurance with sufficient equity

- FHA may offer competitive rates for qualified borrowers

- Conventional may provide better long-term costs with strong profiles

- Total project cost evaluation should consider all financing expenses

Why choose FHA construction over conventional? Borrowers with limited savings, moderate credit, or higher debt ratios find FHA construction loans provide accessible paths to custom home building. The lower equity requirement and flexible standards enable construction projects that conventional financing would delay for years of additional savings.

Ready to discuss your purchase scenario? Submit a purchase inquiry to explore your options.

What Property Types Qualify for an FHA Construction Loan?

An FHA construction loan program accommodates various property categories for primary residence construction. Understanding eligibility helps you plan your building project appropriately.

Eligible construction projects:

- Single-family detached homes built from ground up

- Townhomes and row houses in new construction

- Multi-unit properties (2-4 units) with owner occupancy

- Planned unit developments meeting FHA standards

- Manufactured homes built to FHA specifications on permanent foundations

- Properties built on owned or purchased land

Can you build multi-unit properties with FHA construction loans? Yes, FHA construction financing accommodates 2-4 unit buildings when you occupy one unit as your primary residence. This house-hacking strategy enables building rental income directly into your custom construction project with the same accessible FHA equity contributions.

What about land acquisition? Many FHA construction loan programs combine land purchase with construction financing in single transactions. If you’ve identified the perfect lot but haven’t purchased yet, combined financing covers land acquisition and all construction costs. Alternatively, if you already own land with clear title, the construction loan finances only the building costs.

Are there property location restrictions? FHA construction loans work in urban, suburban, and rural markets throughout the United States. Properties must have utility access, comply with local zoning and building codes, and meet FHA site standards. Remote locations or properties without standard utilities may face additional scrutiny or requirements.

Can you relocate existing structures? Some FHA programs accommodate moving existing structures onto new foundations or relocating buildings to different sites when the process complies with local regulations and results in properties meeting FHA minimum property standards.

See how other borrowers have successfully used FHA construction financing:

How Does the FHA Construction Loan Draw Process Work?

Understanding the draw schedule and disbursement process helps you manage construction cash flow and contractor payments effectively. The systematic release of funds protects borrowers and ensures appropriate fund usage.

What are typical construction draw stages? Most FHA construction loans establish 4-6 draw periods aligned with major construction milestones:

- Foundation and slab completion

- Framing and roof completion

- Mechanical rough-in (plumbing, electrical, HVAC)

- Drywall and interior finishes

- Final completion and certificate of occupancy

How do you request construction draws? When contractors complete milestone stages, you or your builder submit draw requests to the lender including contractor invoices, lien waivers from subcontractors, and documentation of work completed. The lender schedules inspections to verify progress.

What happens during inspections? Lenders hire inspectors (often FHA-approved) to verify construction progress matches draw requests. Inspectors confirm work quality meets building codes and FHA standards, materials match specifications, and completed work justifies requested draw amounts. After satisfactory inspection, the lender releases funds.

How are draw funds disbursed? Disbursement methods vary by lender—some pay contractors directly, others provide funds to borrowers who then pay contractors. Direct contractor payment reduces fraud risk and simplifies the process, though borrower-controlled disbursement provides more oversight of contractor payments.

What about interest during construction? Most FHA construction-to-permanent loans require interest-only payments during construction on funds actually disbursed. As your project draws funds, your monthly interest obligation increases proportionally. This structure keeps payment obligations manageable during construction before permanent financing activates.

How long does draw approval take? Draw processing typically requires 5-10 business days from request submission through inspection completion and fund disbursement. Planning ahead and submitting draw requests promptly when milestones complete helps maintain construction momentum.

Calculate your FHA construction loan scenario:

What Documentation Does an FHA Construction Loan Require?

Understanding the specific documentation requirements helps you prepare for a smooth application process. An FHA construction loan combines standard FHA mortgage documentation with construction-specific materials.

Standard FHA documentation:

- W-2 forms and pay stubs for income verification

- Personal tax returns for the past two years

- Bank statements covering recent months

- Credit report authorization

- Government-issued identification

- Employment verification

- Gift letters if using gift funds for equity contribution

Construction-specific documentation:

- Complete architectural plans and specifications

- Detailed construction budget with line-item costs

- Construction timeline showing project phases and durations

- Builder contract with payment schedules and completion terms

- Builder licenses, insurance certificates, and bonding documentation

- Building permits and approvals (or evidence of insurability)

- Land purchase contract or proof of land ownership

- Subject-to appraisal based on completed value

- Construction draw schedule showing payment milestones

How detailed must construction plans be? FHA requires complete construction documents sufficient for permitting, accurate cost estimation, and FHA appraisal. Basic sketches or conceptual drawings are insufficient—you need professional architectural plans showing floor layouts, elevations, structural details, electrical and plumbing plans, and material specifications.

What builder information do lenders need? Expect to provide your contractor’s business license, comprehensive insurance certificates (general liability and workers’ compensation), financial statements demonstrating business stability, references from previous projects, and detailed contractor agreements outlining scope, timelines, payment terms, and warranty provisions.

Do you need permits before loan approval? While most lenders don’t require permits in hand at application, they need confirmation your plans meet local building codes and permit approval is likely. Some programs require permits before closing, while others allow closing with permit applications pending approval.

Common FHA Construction Loan Questions

Can you act as your own general contractor?

FHA construction loan programs generally require licensed general contractors for construction management and oversight. Owner-builder scenarios where borrowers manage construction themselves face significant restrictions, substantially higher equity requirements, and limited lender participation.

The vast majority of FHA construction loan borrowers work with licensed contractors rather than pursuing owner-builder arrangements. Professional contractors provide expertise, coordination, warranties, and lender confidence that owner-builder projects cannot match.

What if construction costs exceed initial estimates?

Construction projects frequently encounter unexpected expenses—site conditions, code requirements, material cost increases, or desired upgrades—causing budgets to exceed original estimates. Contingency reserves (typically 10-15% of construction budget) help manage these overruns.

Cost overrun management strategies:

- Draw from contingency reserves for unexpected expenses

- Request loan modifications if costs substantially exceed reserves

- Contribute personal funds to cover excess costs

- Reduce project scope by eliminating non-essential features

- Work with contractors to value-engineer cost-saving solutions

How long do you have to complete construction?

FHA construction loans establish maximum completion timeframes—typically 12-18 months from closing to final completion. Extensions may be available with lender approval when circumstances justify delays, but the program expects timely construction completion.

Timeline factors affecting completion:

- Weather delays extending construction periods

- Material availability impacting project schedules

- Contractor scheduling and labor availability

- Complexity of home design and construction

- Permit and inspection delays from local authorities

Can you make changes to plans after approval?

Change orders—modifications to approved construction plans—require lender approval, potentially revised appraisals, and updated documentation. Minor changes like material substitutions typically process smoothly. Major scope changes may require substantial re-evaluation.

Change order considerations:

- Written documentation of proposed changes

- Revised cost estimates from contractors

- Lender review and approval processes

- Possible appraisal updates for significant changes

- Timeline implications of plan modifications

How Do FHA Construction Loan Costs Compare to Standard FHA Financing?

Understanding the cost implications helps you budget appropriately for your construction project. FHA construction loans involve standard FHA costs plus construction-specific expenses.

Standard FHA costs:

- Upfront mortgage insurance premium (percentage of loan amount)

- Annual mortgage insurance premium (divided into monthly payments)

- Origination fees and lender charges

- Appraisal fees for subject-to completed value

- Title insurance and closing costs

Additional construction-specific costs:

- Supplemental origination fees (typically higher than standard FHA)

- Multiple inspection fees throughout construction

- Architectural and engineering fees for plans

- Building permits and plan review fees

- Survey and site preparation costs

- Construction contingency reserves

- Interest-only payments during building phase

Are FHA construction loan rates competitive with standard FHA mortgages? Interest rates on FHA construction-to-permanent loans typically match or modestly exceed standard FHA purchase rates. The construction phase may carry slightly higher interest reflecting additional risk and administration, though rates normalize once the loan converts to permanent FHA financing.

Can you finance most costs? FHA construction loans allow financing the vast majority of costs including land acquisition (when applicable), all construction expenses, applicable fees, and upfront mortgage insurance premium into your loan amount. Your equity contribution applies to the complete project cost rather than requiring cash for individual cost components.

What’s the total cost premium versus purchasing existing? Expect FHA construction loan total costs to exceed standard FHA purchases by several thousand dollars due to architectural fees, multiple inspections, and construction administration. However, these costs are typically modest compared to the customization value and potential equity created through strategic design choices.

What Are the Advantages of an FHA Construction Loan?

Understanding the specific benefits helps you evaluate whether building custom with FHA financing aligns with your homeownership goals. An FHA construction loan offers distinct advantages for borrowers pursuing new construction.

Key advantages include:

Accessible equity contribution on total project – The modest FHA minimum applies to your complete construction cost including land and building expenses. This dramatically reduces the cash needed compared to conventional construction financing, making custom building accessible years earlier.

Flexible credit requirements – FHA’s accessible credit score minimums extend to construction scenarios that conventional lenders would require significantly higher scores. Borrowers still building credit or recovering from past challenges can pursue custom home construction.

Single-close convenience – Construction-to-permanent programs complete your construction and permanent financing in one transaction, eliminating the expense, hassle, and requalification requirements of separate construction and permanent loans. This streamlined approach saves money and reduces complexity.

Higher debt-to-income tolerance – FHA’s flexible debt-to-income standards accommodate borrowers with student loans, auto payments, or other obligations that conventional construction lenders would find prohibitive. This flexibility enables custom building for borrowers managing existing debts responsibly.

Build exactly what you need – Rather than purchasing existing homes and living with prior owners’ choices, build homes reflecting your specific needs, preferences, and lifestyle from the foundation up. Customize everything from layouts to finishes, accessibility features to energy efficiency.

Government insurance protection – FHA’s government backing provides lender confidence enabling flexible qualification standards and accessible terms. This insurance structure makes construction financing available to borrowers who couldn’t obtain conventional construction loans.

Alternative Loan Programs for Building New Homes

If an FHA construction loan isn’t the right fit, consider these alternatives:

- VA Construction Loan – Construction-to-permanent financing for eligible military families with competitive VA benefits

- USDA Construction Loan – Build in eligible rural areas with flexible initial investment options

- Construction Loan – Conventional construction financing with flexible terms for qualified borrowers

- Jumbo Construction Loan – For high-value custom home construction exceeding conforming loan limits

- FHA 203k Loan – Purchase existing homes and finance renovations rather than building from scratch

Explore all 30+ loan programs to find your best option.

Not sure which program is right for you? Take our discovery quiz to find your path.

Advanced FHA Construction Loan Questions

Can you purchase land separately before applying for construction financing?

Yes, you can purchase land using cash or separate land financing, then later apply for FHA construction loans to build on owned land. The construction loan finances only building costs since you already own the site. However, combining land purchase with construction financing in single transactions often provides better overall terms and simplifies the process.

If you purchased land with land loan financing, some FHA construction programs can refinance the land loan plus fund construction costs in single construction-to-permanent transactions, consolidating your financing efficiently.

What if you’re self-employed—can you still qualify?

Yes, self-employed borrowers qualify for FHA construction loans using the same documentation standards as regular FHA financing. You’ll provide business tax returns, profit and loss statements, verification of business continuity, and standard self-employment documentation.

The combination of self-employment income verification and construction planning creates extensive paperwork, but the program remains accessible when you meet FHA’s self-employment qualification requirements. Strong recent earnings, growing business trends, and substantial reserves strengthen applications.

How do FHA construction loans handle energy-efficient features?

Energy-efficient construction including superior insulation, high-efficiency HVAC systems, solar panels, or energy-efficient windows qualifies as eligible construction costs under FHA programs. Additionally, FHA Energy Efficient Mortgages (EEM) may increase loan amounts above standard limits when energy features create sufficient utility savings.

Building energy-efficient homes from the start proves more cost-effective than retrofitting existing properties. FHA construction financing accommodates these investments in efficiency, potentially enabling higher loan amounts justified by long-term utility savings.

Can you build spec homes for sale using FHA construction loans?

No, FHA construction loans serve primary residence construction only. You must occupy the completed property as your main home. Builders constructing homes for sale to others cannot use FHA construction financing—they need commercial construction financing or builder-specific programs.

However, multi-unit properties where you occupy one unit while renting others qualify, enabling you to build rental income streams while establishing homeownership through FHA construction financing.

What happens if construction quality issues arise?

Construction defects, workmanship problems, or code violations discovered during inspections must be corrected before draw releases or final completion. FHA inspection processes protect borrowers by ensuring construction quality meets standards before releasing funds to contractors.

If disputes arise between borrowers and contractors regarding quality, completion, or payment, resolution becomes necessary before projects can proceed. FHA construction loans typically include mechanisms for holding funds pending dispute resolution or completion of corrective work.

Can foreign nationals qualify for FHA construction loans?

Foreign nationals face the same FHA restrictions for construction loans as standard FHA purchases—generally requiring U.S. citizenship or lawful permanent resident status. Non-permanent resident aliens may qualify with appropriate work visas and employment authorization, though documentation requirements increase substantially.

The complexity of combining foreign national financing with construction lending makes these transactions uncommon. Alternative construction financing through portfolio lenders or conventional programs may provide more accessible options for non-citizens building custom homes.

How do FHA construction loans handle modular or prefabricated homes?

FHA construction loans can accommodate modular or factory-built homes when they meet FHA manufactured housing standards, are permanently affixed to owned land with appropriate foundations, are classified as real property, and comply with local building codes.

Modular construction considerations:

- Factory-built sections must be delivered and permanently installed

- Foundations must meet FHA and local requirements

- Homes must meet HUD standards or local building codes

- Setup, delivery, and site preparation costs include in construction budget

- Final product must be indistinguishable from site-built homes

What if you want to build in phases over time?

Traditional FHA construction loans require continuous construction from start to completion within the loan term. Building in phases over extended periods typically needs alternative financing strategies rather than single FHA construction loans.

Some borrowers build initial livable phases with FHA construction financing, then later use home equity products to fund additions or expansions. However, the original construction loan must result in a complete, livable home meeting FHA standards.

Can you refinance during construction if rates drop?

Construction-to-permanent FHA loans with locked rates cannot refinance during construction periods. The rate lock protects you from increases but prevents capitalizing on decreases during building. Once construction completes and the loan converts to permanent FHA financing, standard FHA streamline refinancing becomes available after appropriate seasoning.

Construction-only loans with separate permanent financing provide flexibility to capitalize on rate changes between construction and permanent financing, though this requires two-close structures with additional costs and complexity.

How do divorce or inheritance situations affect construction projects?

Construction projects interrupted by divorce, death, or other major life changes create complex scenarios. If borrowers divorce during construction, determining who continues the project, how construction loan obligations divide, and whether remaining borrower(s) can continue requires legal and financial restructuring.

Inheritance of partially completed construction projects involves probate processes, assumption or refinancing of construction loans, and potential completion funding from estate assets or beneficiary resources. These situations benefit from legal counsel and lender communication to develop resolution strategies.

Ready to get started? Apply now or schedule a call to discuss your situation.

Helpful FHA Construction Loan Resources

Official Government Guidance:

HUD Construction Loan Guidance – Department of Housing and Urban Development official resource on FHA construction-to-permanent financing, program requirements, builder qualifications, and construction draw procedures for ground-up residential building.

FHA Construction Loan Requirements Handbook – HUD comprehensive handbook sections on construction loan underwriting standards, builder requirements, draw processes, and completion standards for new residential construction.

CFPB Construction Loan Information – Consumer Financial Protection Bureau guidance explaining construction loan structures, qualification requirements, costs, and borrower protections for financing new home construction projects.

Industry Organizations:

HUD Minimum Property Standards – Department of Housing and Urban Development standards for residential property construction, safety requirements, and building specifications that FHA-financed new construction must meet.

National Association of Home Builders Resources – Industry organization providing education for home builders, construction standards, building codes information, and resources for consumers planning custom home construction projects.

Educational Resources:

HUD Homebuyer Education for New Construction – Department of Housing and Urban Development guidance on purchasing and financing new construction homes including FHA construction loan programs and custom building considerations.

EPA Building Science Resources – Environmental Protection Agency guidance on energy-efficient construction practices, building science fundamentals, and green building strategies for new residential construction projects.

Need local expertise? Get introduced to trusted partners including loan officers, builders, and architects in your area.

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Not Sure About Your Next Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Related Posts

Subscribe to our newsletter

Get program updates and rate insights in your inbox.