Construction Loan: 7 Essential Steps to Finance Your Dream Home Build

How a Construction Loan Provides Funding from Ground Breaking to Move-In

Building a custom home or undertaking major renovations requires specialized financing that releases funds progressively as work completes. Construction loans provide the capital structure and draw schedule that aligns with your building timeline, converting to permanent financing once construction finishes. Whether you’re building from the ground up or transforming an existing property, this financing approach manages risk while funding your vision from blueprint to certificate of occupancy.

Key Details: What You’ll Learn About Construction Loans

- A construction loan provides short-term financing to build a new home from the ground up, with funds disbursed in stages as construction progresses (HUD construction loan guidance)

- Borrowers can build custom homes on purchased land or existing lots using specialized construction-to-permanent financing that converts to a traditional mortgage after completion (CFPB construction loan information)

- A construction loan accommodates owner-builders, general contractor builds, and spec home construction depending on program structure and borrower qualifications

- Draw schedules release funds at predetermined construction milestones such as foundation completion, framing, roofing, and final inspection rather than providing full loan amount upfront

- Interest-only payments during construction keep obligations manageable before the home generates value or rental income (Fannie Mae construction loan guidelines)

- A construction loan typically requires detailed project plans, builder contracts, cost estimates, and construction timelines for lender approval

- Construction-to-permanent programs eliminate the need for two separate loans and two closings, streamlining the building process from start to finish

Ready to explore your options? Schedule a call with a loan advisor.

What Is a Construction Loan?

A construction loan represents specialized financing designed to fund the building of a new residential property from the ground up. Unlike traditional mortgages that provide a lump sum to purchase an existing home, a construction loan disburses funds incrementally as your home progresses through various construction stages.

How does a construction loan work? The lender establishes a total loan amount based on your plans, cost estimates, and the anticipated completed value of your home. Rather than receiving all funds at closing, you draw money as needed throughout construction—typically at key milestones like foundation completion, framing, mechanical rough-in, drywall, and final completion.

This draw-based approach protects both you and the lender by ensuring funds release only as work completes and value creates. The lender typically inspects the property at each draw stage to verify completion before releasing the next installment. During the construction period, you typically make interest-only payments on the funds actually disbursed rather than the full loan amount.

Who Benefits Most from a Construction Loan?

Several borrower profiles find exceptional value in a construction loan structure. These programs serve individuals ready to build custom homes tailored to their specific needs and preferences.

Custom home builders seeking exactly the home design they want represent ideal candidates for a construction loan. When existing home inventory doesn’t match your vision—whether due to layout preferences, specific features, lot characteristics, or architectural style—building custom with construction financing creates your perfect living space.

Buyers with land already owned can leverage a construction loan to finally build on property they’ve held for years. Whether you purchased a lot previously, inherited family land, or acquired acreage for future development, construction financing converts raw land into your dream home.

Families with unique needs requiring specific accessibility features, multi-generational layouts, home office spaces, or specialized rooms benefit from custom construction. A construction loan funds building precisely what your family needs rather than renovating existing homes to approximate your requirements.

Investment property developers building spec homes or rental properties use construction loan financing to create inventory or portfolio additions. Real estate investors can build properties tailored to target rental markets or buyer demographics.

Relocating professionals moving to areas with limited desirable existing inventory may find building new provides better value and satisfaction than purchasing older homes requiring updates. A construction loan enables creating modern, efficient homes in developing communities.

Explore all loan programs to understand your full range of options.

What Are the Requirements for a Construction Loan?

Understanding the specific qualification criteria helps you assess whether a construction loan fits your project. Construction financing involves more complexity than traditional mortgages due to the building process variables and timeline uncertainties.

Credit profile expectations – Most construction loan programs require solid credit scores, typically 620-680 minimum for basic programs, with higher thresholds (700+) for optimal terms. Your credit history demonstrates financial responsibility during the construction period when you’ll manage contractor payments and construction obligations.

Equity contribution requirements – Construction loans typically require larger upfront contributions than traditional mortgages, often 20-25% of the total project cost. This equity investment demonstrates your commitment to project completion and provides lender security against construction delays or cost overruns.

Detailed construction plans – Lenders require comprehensive architectural plans, specifications, and blueprints before approval. These documents must detail every aspect of construction enabling accurate cost estimation and project timeline development. Working with licensed architects or designers to produce professional construction documents is typically necessary.

Builder qualifications – Most programs require using licensed, insured general contractors with demonstrated construction experience. Lenders verify builder credentials, review previous project portfolios, and confirm appropriate licensing for your location. Owner-builder programs exist but carry stricter requirements and higher costs.

Comprehensive budget and timeline – You’ll need detailed cost estimates covering all construction phases from site preparation through final finishes. Realistic timelines showing construction milestones help lenders structure appropriate draw schedules. Experienced builders provide these estimates based on current material costs and labor availability.

Appraisal requirements – Construction loans require “subject-to” appraisals estimating your home’s value upon completion rather than current value. These appraisals consider your plans, location, and comparable sales to project finished home value supporting your loan request.

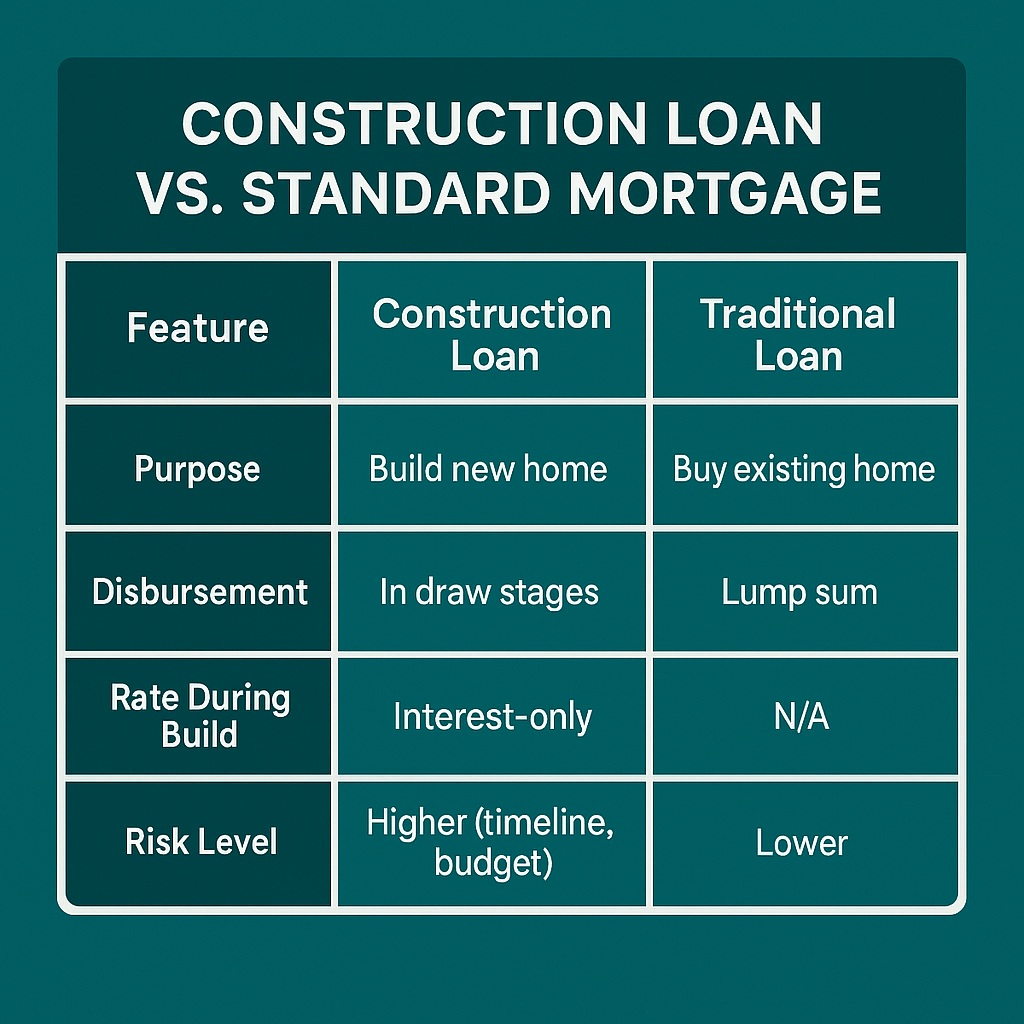

How Does a Construction Loan Differ from a Traditional Mortgage?

The fundamental distinction lies in the disbursement timing, payment structure, and conversion process. Traditional mortgages provide funds immediately for existing properties while construction loans release money incrementally as building progresses.

Traditional mortgage characteristics:

- Funds complete existing home purchase at closing

- Repayment begins immediately with principal and interest

- Property provides immediate collateral securing the loan

- Single closing process with standard documentation

- Predictable payment obligations throughout term

Construction loan characteristics:

- Funds disburse in stages throughout construction period

- Interest-only payments during building phase

- Collateral value increases as construction progresses

- May involve multiple closings or single construction-to-permanent closing

- Variable payment obligations during construction

What happens after construction completes? This depends on your loan structure. Construction-only loans require refinancing into permanent mortgages after building finishes—involving a second closing, additional costs, and requalification. Construction-to-permanent loans automatically convert to traditional mortgages upon completion, eliminating the need for refinancing and reducing total transaction costs.

How do payments work during construction? Most construction loan structures require only interest payments on funds actually disbursed during the building period. As your project draws $100,000, you pay interest on $100,000. After drawing another $50,000, you pay interest on $150,000. This approach keeps payment obligations manageable while your home builds and before you can occupy or rent the property.

Ready to discuss your purchase scenario? Submit a purchase inquiry to explore your options.

What Are the Different Types of Construction Loan Structures?

Understanding the various construction loan formats helps you select the approach that best fits your building timeline and financial goals. Lenders offer several structural variations to accommodate different construction scenarios.

Construction-to-permanent loan – This single-close structure provides construction financing that automatically converts to a permanent mortgage upon project completion. You close once, lock in your final interest rate during construction, and transition seamlessly from building to long-term financing. This approach minimizes closing costs, simplifies the process, and eliminates requalification after construction.

Construction-only loan – This separate short-term loan funds only the construction period, typically 12-18 months. After your home completes, you must refinance into a permanent mortgage—requiring a second closing, additional fees, and requalification based on current circumstances. This structure provides flexibility if you expect financial changes enabling better refinancing terms after construction.

Renovation construction loan – These specialized programs fund major renovations, additions, or rebuilds of existing properties rather than ground-up construction. The structure resembles traditional construction financing but accommodates properties with existing structures requiring significant improvements.

Owner-builder construction loan – Some programs accommodate borrowers who want to act as their own general contractor during construction. These loans carry stricter requirements, higher costs, and require demonstrating construction experience or expertise. Most borrowers work with licensed general contractors rather than pursuing owner-builder arrangements.

Spec construction loan – Real estate investors building homes for sale rather than personal occupancy use spec construction financing. These programs require different qualification approaches focusing on construction experience, market demand, and exit strategies rather than personal income for occupancy.

What Property Types and Situations Qualify for a Construction Loan?

A construction loan program accommodates various building scenarios and property types. Understanding eligibility helps you determine whether construction financing fits your specific project.

Eligible construction projects:

- Single-family primary residences on purchased or owned lots

- Second homes and vacation properties in desirable locations

- Investment properties including single-family rentals

- Multi-unit properties including duplexes, triplexes, and fourplexes

- Custom home builds with architectural plans

- Model homes or spec properties for sale

Land ownership scenarios:

- Building on lots you already own with clear title

- Purchasing land and building simultaneously with combined financing

- Building on family land with proper ownership documentation

- Construction on lots with existing utilities and infrastructure

- Building in established neighborhoods or developing communities

Can you include land purchase in construction loan financing? Yes, many construction loan programs combine land acquisition and building costs into single financing packages. This approach particularly benefits buyers who’ve found ideal lots but haven’t purchased yet. The combined loan covers land purchase, closing costs, and all construction expenses through project completion.

What about utilities and site preparation? Construction loans typically include funds for site preparation, utility connections, driveway installation, landscaping, and other lot development costs. Comprehensive budgets should account for all expenses from raw land to move-in ready condition.

See how other borrowers have successfully used construction financing:

How Does the Construction Loan Draw Process Work?

Understanding the draw schedule and inspection process helps you manage cash flow and construction progress effectively. The systematic release of funds at completion milestones protects all parties involved in the transaction.

What are typical draw stages? Most construction loans establish 4-6 draw periods aligned with major construction milestones:

- Foundation and slab completion

- Framing and roof completion

- Mechanical rough-in (plumbing, electrical, HVAC)

- Drywall and interior finishes

- Final completion and certificate of occupancy

How do you request draws? When your contractor completes a milestone stage, you submit a draw request to your lender. The request typically includes contractor invoices, lien waivers from subcontractors, and documentation of work completed. The lender schedules an inspection to verify the work matches the draw request.

What happens during inspections? Lenders hire third-party inspectors or use staff inspectors to verify construction progress matches draw requests. Inspectors ensure work quality meets building codes and plans, materials match specifications, and completed work justifies the requested draw amount. After satisfactory inspection, the lender releases funds—either directly to your builder or to you for contractor payment.

How long does draw approval take? Draw processing typically requires 5-10 business days from request submission through inspection completion and fund disbursement. Planning ahead and submitting draw requests promptly when milestones complete helps maintain construction momentum and contractor payment schedules.

What if the project runs over budget? Most construction loans include contingency reserves (typically 5-10% of the budget) for unexpected costs, change orders, or material price increases. If expenses exceed your total loan amount plus reserves, you’ll need to provide additional funds from personal resources to complete construction.

Calculate your construction loan scenario:

What Documentation Does a Construction Loan Require?

Understanding the specific documentation requirements helps you prepare for a smooth application process. Construction loan approval involves more extensive documentation than traditional mortgages due to the complexity of building projects.

Required documentation typically includes:

- Complete architectural plans and specifications

- Detailed construction budget with line-item costs

- Construction timeline with milestone dates

- Builder contract and licensing information

- Builder insurance certificates and liability coverage

- Land purchase contract or proof of ownership

- Subject-to appraisal based on completed value

- Personal income and asset documentation

- Credit report authorization

- Homeowner’s insurance binder (construction and final)

- Survey and title work for the property

How detailed must construction plans be? Lenders require complete construction documents sufficient for permitting and accurate cost estimation. Basic sketches or conceptual drawings are insufficient—you need professional architectural plans showing floor layouts, elevations, roof design, structural details, electrical plans, plumbing layouts, and material specifications.

What builder information do lenders need? Expect to provide your contractor’s business license, insurance certificates, references from previous projects, financial statements demonstrating business stability, and detailed contractor agreement outlining scope of work, payment schedules, warranty provisions, and completion timelines.

Do you need permits before loan approval? While most lenders don’t require permits in hand at application, they need confirmation your plans meet local building codes and permit approval is probable. Some programs require permits before closing, while others allow closing with permit applications pending.

Common Construction Loan Questions

Can you make changes to plans during construction?

Yes, but change orders require careful management and lender approval. When you want to modify plans after construction begins—whether upgrading finishes, adjusting layouts, or adding features—you must document the changes, obtain revised cost estimates, and submit requests to your lender.

Change order considerations:

- Additional costs may require increasing your loan amount

- Significant changes might require updated appraisals

- Timeline adjustments may extend your construction loan term

- Lenders evaluate whether changes affect projected home value

- Excessive changes may trigger additional scrutiny or requirements

What if construction takes longer than expected?

Construction delays happen frequently due to weather, material availability, subcontractor scheduling, or permitting issues. Most construction loans include extension options when projects exceed initial timelines.

Managing construction delays:

- Communicate proactively with your lender about timeline changes

- Request term extensions before your construction loan expires

- Understand extension fees and requirements

- Continue making interest payments during extended periods

- Document reasons for delays and revised completion estimates

Can you act as your own general contractor?

Some construction loan programs accommodate owner-builders who want to manage their own projects. However, owner-builder programs carry stricter requirements and typically cost more than traditional construction loans.

Owner-builder requirements often include:

- Demonstrated construction experience or relevant expertise

- Higher equity contributions (often 25-30%)

- More frequent inspections and draws

- Comprehensive project management documentation

- Builder’s risk insurance with appropriate coverage

- Higher interest rates reflecting additional risk

Most borrowers find that working with experienced licensed contractors—despite the markup—provides better value through professional expertise, contractor warranties, and streamlined lender approval.

How do you handle cost overruns?

Construction projects frequently encounter unexpected costs for site conditions, material price increases, code compliance requirements, or desired upgrades. Planning strategies help manage cost overrun risks.

Cost overrun management approaches:

- Include adequate contingency reserves (10-15% of budget)

- Obtain multiple bids from contractors for competitive pricing

- Lock material prices for major components when possible

- Prioritize must-have features over nice-to-have upgrades

- Maintain personal reserves for unexpected expenses

- Consider value engineering to reduce costs without sacrificing quality

How Do Construction Loan Costs Compare to Traditional Financing?

Understanding the financial implications helps you budget appropriately for your building project. Construction loan structures involve unique costs beyond traditional mortgage expenses.

What are typical construction loan costs? Construction financing generally includes:

- Origination fees or points on the loan amount

- Appraisal fees for subject-to completed value assessment

- Construction inspection fees for each draw stage

- Title insurance and escrow fees

- Interest charges during construction (typically interest-only)

- Permit and plan review fees

- Builder’s risk insurance during construction

- Conversion fees if using construction-only structure

Are construction loan interest rates higher than conventional mortgages? Construction loan rates during the building phase typically reflect a premium compared to traditional mortgages due to the short-term nature and construction risks. However, construction-to-permanent loans lock your final rate early, protecting against rate increases during your building timeline.

How do you calculate total construction financing costs? Consider both the direct loan costs and the carrying costs during construction. If your project takes 12 months with an average $250,000 outstanding balance, interest-only payments at a representative rate create significant costs before conversion to permanent financing.

Can construction loan costs be financed? Many programs allow financing closing costs and construction period expenses within your loan amount rather than requiring cash payment. This approach preserves liquidity during construction when you may face various project-related expenses.

What Are the Advantages of a Construction Loan?

Understanding the specific benefits helps you evaluate whether building custom makes sense versus purchasing existing homes. A construction loan offers distinct advantages for borrowers ready to create precisely the home they want.

Key advantages include:

Complete customization – Design every aspect of your home from floor plan layouts to cabinet finishes, appliance selections, flooring materials, and architectural details. A construction loan funds building exactly what you want rather than compromising with existing home features.

Modern systems and efficiency – New construction includes current building codes, energy-efficient systems, modern electrical and plumbing infrastructure, and contemporary insulation standards. These features provide lower utility costs and reduced maintenance compared to older homes.

Warranty protection – New home construction typically includes builder warranties covering workmanship and materials, plus manufacturer warranties on appliances, HVAC systems, roofing, and other components. This protection provides peace of mind unavailable with existing home purchases.

Location flexibility – Build in developing areas, on land you already own, in established neighborhoods with available lots, or rural locations where existing inventory is limited. A construction loan enables homeownership in your preferred location regardless of existing home availability.

No renovation surprises – Avoid the hidden problems common in existing homes including outdated wiring, plumbing issues, structural concerns, or deferred maintenance. Starting from scratch eliminates surprise repairs and renovation costs.

Current design trends – New construction incorporates contemporary layouts including open floor plans, primary suite configurations, home office spaces, and modern storage solutions rather than dated designs requiring expensive remodeling.

Alternative Loan Programs for Building and Renovation Projects

If a construction loan isn’t the right fit, consider these alternatives:

- VA Construction Loan – Construction-to-permanent financing for eligible military families with competitive VA benefits

- USDA Construction Loan – Build in eligible rural areas with flexible initial investment options

- FHA Construction Loan – Government-backed construction financing with accessible qualification standards

- Jumbo Construction Loan – For high-value custom home construction exceeding conforming loan limits

- Renovation Loan – Finance purchase plus improvements when buying existing homes needing updates

Explore all 30+ loan programs to find your best option.

Not sure which program is right for you? Take our discovery quiz to find your path.

Advanced Construction Loan Questions

Can you finance modular or manufactured home construction?

Many construction loan programs accommodate modular or manufactured homes when they meet specific criteria. The home must be permanently affixed to owned land with appropriate foundation systems, classified as real property rather than personal property, and meet local building codes and zoning requirements.

Modular and manufactured home considerations:

- Factory-built home must be delivered and installed on permanent foundation

- Land must be owned or financed simultaneously with home

- Home must meet HUD standards or local building codes

- Setup and site preparation costs include in construction budget

- Some lenders specialize in manufactured home financing

How do construction loans work for teardown rebuilds?

Purchasing existing properties for demolition and rebuilding requires specialized construction financing that accounts for both acquisition and new construction costs. These programs combine purchase financing with construction loan features.

Teardown rebuild requirements:

- Purchase existing property with structures

- Obtain demolition permits and budget for removal costs

- Secure building permits for new construction

- Finance both acquisition costs and construction expenses

- Manage timeline for demolition and construction phases

Can investment property construction loans use rental income for qualification?

Construction loans for rental properties typically require qualification based on personal income during the building phase since the property doesn’t generate rental income until completion. However, lenders consider projected rental income when evaluating the subject-to appraisal and overall investment viability.

Rental construction considerations:

- Qualify based on personal income during construction

- Projected rents support completed value appraisal

- Consider refinancing after stabilization to optimize financing

- DSCR loans may provide better long-term financing after construction

- Maintain reserves for rental property startup costs

What if you want to do some work yourself to save money?

Some construction loans accommodate “sweat equity” arrangements where you perform portions of work yourself to reduce construction costs. However, lenders typically restrict this to non-structural, non-mechanical work and require professional completion of critical building components.

Sweat equity considerations:

- Lenders usually require licensed contractors for structural, electrical, plumbing, and HVAC work

- You might handle painting, landscaping, flooring installation, or finish carpentry

- Document your construction experience and capabilities

- Budget conservatively for sweat equity timelines

- Maintain appropriate insurance during work you perform

How do construction loans handle energy-efficient or green building features?

Many construction loans support energy-efficient construction including solar panels, geothermal systems, high-efficiency HVAC, superior insulation, or green building certifications. Some programs offer incentives or improved terms for energy-efficient construction.

Green building financing approaches:

- Include energy-efficient systems in construction budget

- Higher home values may support additional financing for green features

- Energy-efficient mortgages provide enhanced borrowing for efficiency upgrades

- Long-term utility savings improve affordability despite higher upfront costs

- Some lenders specialize in green construction financing

Can you build in phases or stages over time?

Traditional construction loans require continuous construction from start to completion within the loan term. Building in phases over extended periods typically requires alternative financing strategies.

Phased construction alternatives:

- Complete initial livable phase with construction loan, then expand later using home equity

- Use personal funds for initial construction, then construction-to-permanent loan for additions

- HELOC financing for staged improvements over time

- Consider whether phased building truly provides cost benefits given financing complexity

What happens if you want to change builders during construction?

Changing general contractors mid-project creates significant complications but occasionally becomes necessary due to contractor performance, bankruptcy, or disputes. This situation requires careful coordination with your lender.

Mid-project builder change considerations:

- Lender must approve new builder before work continues

- New builder requires proper licensing, insurance, and qualifications

- Legal implications regarding original contract termination

- Potential cost increases if new builder doesn’t honor original pricing

- Timeline delays during transition period

- Lien resolution from original builder and subcontractors

Can foreign nationals qualify for construction loans?

Foreign national borrowers with U.S. land ownership and substantial financial resources may qualify for specialized construction loan programs. Requirements typically exceed those for U.S. citizens due to the complexity of construction lending combined with non-citizen status.

Foreign national construction requirements:

- Valid passport and visa documentation

- Owned U.S. land with clear title

- Larger equity contributions (often 30-40%)

- Substantial reserves in U.S. accounts

- Credit profile through alternative verification

- Detailed construction plans with experienced U.S. builders

How do construction loans work for unique or unconventional designs?

Highly unique architectural designs, unconventional materials, or experimental construction methods may face additional lender scrutiny. Appraisers struggle to value unique properties lacking comparable sales, creating approval challenges.

Unique design considerations:

- Work with experienced architects providing professional credibility

- Research comparable sales for unusual designs in your market

- Be prepared for conservative appraisals on unique properties

- Consider whether unique features truly add value or create resale challenges

- Some lenders specialize in custom or unique construction projects

What if you’re building in a remote or rural location?

Construction in rural areas, on large acreage, or in remote locations may involve additional considerations including utility access, road maintenance, well and septic systems, and contractor availability.

Rural construction financing factors:

- Budget for well drilling, septic installation, electrical service extension

- Account for longer construction timelines due to contractor travel

- Consider whether remote location affects appraisal and resale value

- Verify contractor availability and willingness to work in location

- Some lenders specialize in rural construction financing

Ready to get started? Apply now or schedule a call to discuss your situation.

Helpful Construction Loan Resources

Official Government Guidance:

HUD Construction Loan Guidance – Department of Housing and Urban Development official resource on construction-to-permanent financing, FHA construction loan programs, and requirements for building new homes with government-backed mortgage insurance.

CFPB Construction Loan Information – Consumer Financial Protection Bureau resource explaining construction loan structures, draw processes, qualification requirements, and costs for borrowers planning to build new homes.

IRS Construction Period Interest Deduction Rules – Internal Revenue Service guidance on mortgage interest deductions during construction periods, including rules for interest-only payments and conversion to permanent financing affecting tax treatment.

Industry Organizations:

Fannie Mae Construction-Permanent Financing Guidelines – Official Fannie Mae underwriting standards for construction-to-permanent loans explaining qualification methods, draw procedures, and documentation requirements for residential construction projects.

National Association of Home Builders Resources – Industry organization providing education for home builders, construction standards, building codes information, and resources for consumers planning custom home construction projects.

Educational Resources:

EPA Energy Efficient Home Construction Information – Environmental Protection Agency resource on energy-efficient construction practices, building standards, and green building certifications for new home construction projects.

FEMA Building Code Resources – Federal Emergency Management Agency guidance on building codes, construction standards, and best practices for residential construction in various climates and hazard zones.

Need local expertise? Get introduced to trusted partners including loan officers, builders, and contractors in your area.

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Not Sure About Your Next Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Related Posts

Subscribe to our newsletter

Get program updates and rate insights in your inbox.