Home Improvement Loan: 7 Strategies That Maximize Your Property’s Value

Transform Your Home While Building Equity Through Strategic Home Improvement Loan Financing

Renovating your home shouldn’t mean depleting your savings or settling for high-interest credit cards. Home improvement loans offer a strategic path to fund upgrades that enhance your living space while potentially increasing your property’s market value. Whether you’re updating a kitchen, adding square footage, or making essential repairs, understanding your financing options helps you make informed decisions that align with your financial goals and renovation timeline.

Key Details You’ll Learn:

- How home improvement loans differ from traditional mortgages and when each option makes sense for your project scope

- The various loan structures available, from secured options using your home’s equity to unsecured personal loan alternatives

- Documentation requirements and qualification factors that lenders evaluate when reviewing your renovation financing application (Consumer Financial Protection Bureau mortgage resources)

- Tax implications and potential deductions associated with different types of home improvement financing (IRS Publication 523 on home sale exclusions)

- How renovation loans can increase your borrowing capacity by using your home’s after-repair value instead of current market value

- Strategic timing considerations for refinancing existing debt while simultaneously funding renovation projects

- The role of contractor relationships and project documentation in securing competitive financing terms (HUD home improvement loan programs)

- Alternative financing structures for investors, self-employed borrowers, and non-traditional income situations

- How to compare total project costs across different financing options, including long-term interest implications

Ready to explore your options? Schedule a call with a loan advisor.

What Is a Home Improvement Loan and How Does It Work?

A home improvement loan is financing specifically designed to fund renovations, repairs, or upgrades to your residential property. Unlike personal loans used for any purpose, these loans are structured around your renovation project’s scope, with lenders often requiring project documentation, contractor estimates, and in some cases, inspection milestones before releasing funds.

How does a home improvement loan differ from a home equity loan? While both can fund renovations, home improvement loans represent a broader category that includes multiple financing structures, from unsecured personal loans to government-backed programs like FHA 203(k) loans that combine purchase or refinance with renovation costs in a single mortgage.

The fundamental advantage lies in accessing capital without liquidating investments or disrupting your emergency fund. You maintain liquidity while spreading renovation costs over time, potentially benefiting from tax deductions if the improvements qualify under IRS guidelines for capital improvements versus repairs.

Types of Home Improvement Financing Structures

Different renovation scenarios call for different financing approaches:

- Cash-out refinance options – Replace your existing mortgage with a larger one, extracting equity to fund renovations while potentially securing better interest terms on your overall debt

- Home equity line of credit (HELOC) – Revolving credit line secured by your home, ideal for projects with uncertain timelines or phased renovations where you draw funds as needed

- Home equity loans – Fixed lump sum borrowed against your equity, providing predictable payment structures for projects with defined budgets

- Personal loan structures – Unsecured financing based on creditworthiness, useful for smaller projects or when you lack sufficient equity in your property

- Government-backed renovation programs – FHA 203(k) and VA renovation loans that combine purchase or refinance with improvement costs in a single mortgage transaction

- Construction-to-permanent loans – For major renovations or additions, these convert from construction financing to permanent mortgage after project completion

Each structure carries distinct advantages depending on your equity position, credit profile, project timeline, and whether you’re simultaneously purchasing or refinancing.

Home Improvement Loan Strategy #1: Leverage After-Repair Value for Maximum Borrowing Power

Can you borrow more than your current home value for renovations? Yes, with certain renovation loan programs that evaluate your property’s after-repair value (ARV) rather than current market value, significantly expanding your borrowing capacity for transformative projects.

Traditional lending focuses on current value as collateral. If your home is worth $400,000 and you owe $300,000, conventional approaches limit borrowing to the $100,000 equity difference minus any equity requirements. This constraint prevents many homeowners from funding substantial improvements that would dramatically increase property value.

ARV-based lending changes this dynamic. If your $400,000 home will appraise at $550,000 after renovations, lenders may structure financing around the higher future value. This approach particularly benefits:

- Homeowners purchasing fixer-uppers who need renovation funds at closing

- Properties in appreciating markets where strategic improvements capture market momentum

- Homes requiring essential repairs that currently limit marketability or refinance options

- Investors planning value-add renovations on primary residences before converting to rentals

The lender typically orders two appraisals: current “as-is” value and projected “as-completed” value based on your renovation plans and contractor estimates. Your borrowing capacity derives from the higher projected value, though lenders maintain risk management through renovation escrow accounts that release funds at completion milestones.

Documentation Requirements for ARV Lending

Securing ARV-based financing requires thorough project documentation:

- Licensed contractor estimates with detailed scope of work

- Architectural plans for structural changes or additions

- Permit applications showing municipal approval for proposed work

- Material specifications demonstrating quality standards

- Timeline projections with milestone schedules

- Comparable sales supporting projected after-repair value

Lenders review this documentation to validate the projected value increase is realistic and achievable within the proposed timeline and budget.

Strategy #2: Time Your Home Improvement Loan With Refinance Opportunities

Should you refinance and take cash out for renovations simultaneously? When market conditions favor refinancing your existing mortgage, combining this with cash-out for renovations can optimize your overall debt structure while funding improvements in a single transaction.

Consider a scenario where you currently maintain a mortgage from several years ago. If prevailing market conditions offer refinancing opportunities, extracting equity simultaneously for renovations avoids the complexity and expense of two separate transactions. You close once, pay one set of closing costs, and streamline the entire process.

This strategy delivers multiple benefits:

- Single closing process reduces total transaction costs compared to separate refinance and home equity loan

- Consolidated debt at potentially competitive terms simplifies monthly payments

- One loan servicing relationship instead of managing multiple lenders

- Tax documentation simplified with single mortgage interest statement

- Potential to restructure overall debt while accessing renovation capital

The refinance-plus-improvement approach works particularly well when you’re already considering refinancing for other reasons—perhaps to eliminate mortgage insurance, shift from an adjustable rate to fixed terms, or modify your repayment timeline.

When to Consider Separate Financing

Separate home improvement financing sometimes makes more strategic sense:

- Your current mortgage already carries very competitive terms you don’t want to refinance away

- Closing costs on a full refinance outweigh the benefits of debt consolidation

- You need renovation funds quickly and can’t wait through a refinance timeline

- Your current mortgage has significant prepayment penalties

- You plan to relocate within a few years and want flexibility

Evaluate the total cost analysis including current mortgage terms, refinancing expenses, and your expected occupancy timeline.

Considering a refinance? Submit a refinance inquiry to see if this makes sense for you.

What Are the Documentation Requirements for Home Improvement Loan Approval?

What documents do lenders require for home improvement loan approval? Documentation requirements vary by loan structure, but most lenders evaluate your income stability, creditworthiness, existing debt obligations, property value, and renovation project specifics before approving financing.

Understanding these requirements before applying helps streamline the process and avoid delays. Lenders need to verify both your ability to repay and the reasonableness of your renovation plans.

Standard Financial Documentation

All home improvement loan applications require baseline financial verification:

- Income documentation showing stable earnings capacity (forms vary by loan type and employment situation)

- Credit report authorization for lender to evaluate payment history

- Asset statements demonstrating reserves for project contingencies

- Existing debt obligations to calculate overall debt-to-income ratios

- Property insurance declarations showing adequate coverage

- Property tax records confirming current payment status

How does employment type affect home improvement loan documentation? Self-employed borrowers, business owners, 1099 contractors, and those with non-traditional income often face additional documentation requirements compared to W-2 employees, though specialized loan programs accommodate these situations.

Project-Specific Documentation

Renovation financing requires additional documentation beyond standard loan applications:

- Contractor estimates – Detailed bids from licensed contractors including labor, materials, and timeline projections

- Scope of work – Written descriptions of all planned improvements with specifications

- Permit documentation – Building permits for structural work, additions, or major system replacements

- Architectural plans – Professional drawings for additions, structural changes, or significant modifications

- Product specifications – Documentation of materials and fixtures meeting quality standards

- Project timeline – Completion schedule with milestone markers for fund disbursement

- After-repair valuation – Appraiser’s opinion of projected value upon completion

Lenders use this documentation to verify your renovation plans are realistic, properly scoped, and likely to deliver the projected value increase that justifies the loan amount.

Alternative Documentation for Non-Traditional Borrowers

Can you get a home improvement loan with 1099 income or bank statement documentation? Yes, specialized loan programs accommodate self-employed borrowers, business owners, and those with non-traditional income through alternative documentation methods that verify income differently than standard W-2 employee processes.

These programs may evaluate:

- Bank statement deposits over recent months showing consistent cash flow

- 1099 income documentation without requiring full tax returns

- Asset-based qualification using liquid reserves rather than income

- Debt service coverage for investment property improvements

- Business revenue and profit/loss statements

Explore all loan programs to find documentation approaches that match your income situation.

Strategy #3: Use Home Improvement Loans to Increase Property Value Before Selling

Should you finance improvements before listing your home for sale? Strategic renovations funded through short-term financing can significantly increase sale price and marketability, often delivering returns that exceed financing costs when projects target high-impact improvements.

Sellers frequently face a dilemma: their property needs updates to command premium pricing, but they lack liquid capital to fund improvements before listing. Home improvement loans solve this timing problem by providing upfront capital repaid at closing from sale proceeds.

This approach particularly benefits:

- Homes requiring essential repairs that otherwise limit buyer interest or financing options

- Properties in competitive markets where updated homes command substantial premiums

- Sellers who lack liquid savings but have significant equity positions

- Situations where projected sale price increase exceeds total financing costs

- Estates or inherited properties requiring updates before listing

What renovations deliver the highest return on investment? Kitchen updates, bathroom renovations, flooring replacement, fresh paint, and curb appeal improvements typically generate strong returns relative to cost, while highly personalized or over-improved features may not recoup investment in every market.

Calculating Your Break-Even Point

Before financing pre-sale improvements, analyze whether projected returns justify the costs:

- Research comparable sales to estimate current “as-is” value and potential “updated” value

- Obtain contractor estimates for proposed improvements

- Calculate total financing costs including interest for your expected sale timeline

- Factor in additional holding costs if renovations delay your listing

- Compare net proceeds under both scenarios (sell as-is versus renovate first)

If updated homes in your market command significantly higher prices and your property requires only moderate investment, financing improvements often proves financially advantageous.

Timing and Project Selection

Focus on improvements that maximize marketability relative to investment:

- Essential repairs that affect home inspections or buyer financing

- Cosmetic updates that help buyers envision the property as move-in ready

- Kitchen and bathroom modernization that appeals to broad buyer demographics

- Flooring, paint, and lighting creating fresh, updated aesthetics

- Curb appeal improvements that influence first impressions

Avoid over-personalized renovations, luxury upgrades that exceed neighborhood norms, or extensive projects that significantly delay your listing timeline.

How Do Home Improvement Loan Interest Rates and Terms Work?

How do home improvement loan rates compare to other financing options? Interest structures and repayment terms vary significantly based on whether you choose secured financing backed by your home equity versus unsecured personal loan approaches, with secured options typically offering more competitive pricing due to collateral protection.

Understanding rate structures helps you evaluate true borrowing costs across different loan types. The lowest advertised pricing may not represent your actual cost once you factor in your specific credit profile, loan structure, and total repayment timeline.

Factors Influencing Your Pricing

Multiple variables affect the terms you’ll receive:

- Credit profile – Payment history and credit scores influence risk-based pricing tiers

- Loan-to-value ratio – Amount borrowed relative to property value affects lender risk

- Debt-to-income ratio – Your total monthly obligations relative to income impact qualification

- Loan structure – Secured versus unsecured, fixed versus variable, revolving versus installment

- Project scope – Renovation type and complexity may influence underwriting

- Property type – Primary residence, second home, or investment property designation

- Occupancy status – Owner-occupied properties typically receive better pricing than rentals

Are home improvement loan interest rates fixed or variable? Both options exist depending on loan structure, with fixed-rate installment loans providing payment predictability while variable-rate lines of credit may offer initial flexibility with exposure to market rate fluctuations.

Comparing Total Cost Across Loan Types

When evaluating different home improvement loan options, analyze total project cost rather than focusing solely on nominal pricing:

- Calculate total interest paid over your expected repayment timeline

- Factor in all fees including origination, appraisal, and closing costs

- Consider tax deductions if applicable (consult tax professionals for guidance)

- Evaluate prepayment flexibility if you might pay off early

- Account for rate adjustment potential with variable-rate options

A slightly higher rate on a flexible credit line might cost less total if you repay quickly, while a fixed-rate installment loan provides certainty for longer repayment periods.

Calculate your home improvement loan scenario:

Strategy #4: Structure Your Home Improvement Loan Around Project Timeline

Should you use a lump sum loan or a line of credit for home improvements? Your project timeline and scope determine the optimal financing structure—one-time installment loans work well for defined projects with fixed budgets, while revolving credit lines offer flexibility for phased renovations or uncertain timelines.

Matching your loan structure to renovation plans prevents paying interest on unused funds while ensuring capital availability when contractors need payment.

Lump Sum Installment Loans

These provide all funds at closing in a single disbursement:

- Best for projects with defined budgets and clear timelines

- Fixed repayment schedules with predictable monthly obligations

- No temptation to borrow more than planned project scope

- Potential for competitive fixed-rate structures

- Simplified budgeting with set payment amounts

This structure works well when you have detailed contractor bids, a licensed contractor ready to begin work, necessary permits approved, and a clear project timeline from start to completion.

Revolving Credit Line Structures

These provide access to funds you draw as needed:

- Flexibility to draw funds when expenses actually occur

- Pay interest only on outstanding balance, not full credit limit

- Useful for phased projects or uncertain timelines

- Option to reborrow as you repay during draw period

- Adapts to project changes or unexpected expenses

How do renovation escrow accounts work with home improvement loans? Some lenders hold renovation funds in escrow accounts, releasing portions as contractors complete specific project milestones verified through inspections, protecting both borrower and lender from contractor performance issues.

Matching Structure to Project Type

Different renovation approaches favor different financing structures:

Project Type | Recommended Structure | Reasoning |

Kitchen remodel with fixed contractor bid | Lump sum installment | Defined scope, clear budget, set timeline |

Series of smaller improvements over time | Revolving credit line | Phased approach, uncertain total scope |

Major addition with architect and permits | Escrow-based renovation loan | Milestone-based progress, inspection requirements |

Emergency repairs plus future upgrades | Revolving credit line | Immediate needs plus flexibility for future projects |

Pre-sale improvements | Short-term bridge financing | Quick access, repayment from sale proceeds |

Consider how your project will actually unfold—if you’re managing multiple contractors, dealing with permit delays, or making decisions as work progresses, flexible credit lines may better serve your needs despite potentially different rate structures.

What Home Improvement Loan Options Exist for Self-Employed and Non-Traditional Borrowers?

Can self-employed borrowers qualify for home improvement loans? Yes, multiple loan programs specifically accommodate business owners, 1099 contractors, freelancers, and others with non-traditional income through alternative documentation methods that verify income and repayment capacity without requiring standard W-2 employee documentation.

Traditional lending heavily relies on W-2 income documentation and tax returns showing stable employment. This approach creates challenges for self-employed borrowers whose business structures, deductions, and income reporting don’t fit conventional underwriting models.

Alternative Documentation Programs

Specialized loan structures accommodate various non-traditional situations:

- Bank statement programs – Verify income through consistent deposit patterns over recent months rather than tax returns

- 1099 income loans – Qualify using 1099 contractor income without requiring full business tax returns

- Asset-based qualification – Leverage substantial liquid assets rather than income documentation

- DSCR programs for investment properties – Qualify based on rental property cash flow rather than personal income

- Stated income options – Limited availability programs for specific borrower profiles with strong equity positions

How do bank statement home improvement loans work? Lenders analyze personal or business bank account deposits over a specific timeframe (typically 12-24 months), calculating average monthly income from deposit patterns and applying this to debt-to-income ratio analysis without requiring tax returns.

This approach particularly benefits business owners who maximize business deductions that reduce reported taxable income but maintain strong cash flow that demonstrates repayment capacity.

Documentation Requirements for Non-Traditional Borrowers

While alternative programs reduce traditional documentation, they require other verification:

- Multiple months of bank statements – Personal and/or business accounts showing consistent deposits

- Business license or registration – Documentation proving legitimate business operation

- CPA letter – Professional statement regarding business income and stability

- Profit and loss statements – Current financial statements showing business performance

- Explanation of income variations – Context for seasonal or irregular deposit patterns

- Strong credit profile – Payment history demonstrating financial responsibility

- Adequate reserves – Liquid assets covering several months of payments

These programs typically require stronger credit profiles and larger reserve requirements compared to standard documentation loans, offsetting the reduced income verification through other risk factors.

Investment Property Considerations

Can you use home improvement loans for rental property renovations? Yes, though qualification and structure differ from primary residence financing, with programs evaluating rental income potential or property cash flow rather than solely focusing on personal income documentation.

DSCR (Debt Service Coverage Ratio) loans for investment properties calculate whether the property’s rental income covers the mortgage payment plus renovation loan obligations, making your personal income less relevant to qualification.

Explore specialized programs:

- Bank Statement Loan – For self-employed borrowers with strong bank deposit history

- 1099 Loan – For contractors and freelancers with 1099 income

- DSCR Loan – For investment property cash flow qualification

- Asset-Based Loan – For borrowers with substantial liquid assets

View all loan programs to find options matching your income documentation situation.

Strategy #5: Coordinate Your Home Improvement Loan With Tax Planning

Are home improvement loan interest payments tax deductible? Interest may be deductible if the loan is secured by your home and funds are used for substantial improvements that add value, prolong useful life, or adapt the property to new uses, though tax laws have specific limitations and requirements that warrant consultation with tax professionals.

Understanding tax implications helps you structure financing to maximize potential benefits while remaining compliant with IRS guidelines that distinguish between repairs, improvements, and capital projects.

IRS Classification of Home Projects

The IRS draws important distinctions:

- Repairs – Maintain property in ordinary, efficient operating condition (fixing broken window, patching roof leak, painting)

- Improvements – Add value, prolong useful life, or adapt property to new uses (room addition, new roof, central air installation)

- Restorations – Return property to previous condition after casualty or event (repairing damage from flooding, fire, or casualty)

Why does the distinction between repairs and improvements matter for taxes? Improvements and restorations may be added to your home’s cost basis, potentially reducing capital gains when you eventually sell, while routine repairs generally cannot be added to basis or deducted unless the property is a rental.

Interest Deduction Considerations

For personal residence improvements, several factors affect deductibility:

- Secured debt requirement – Loan must be secured by your primary or secondary home

- Aggregate loan limit – Total mortgage debt (including home improvement borrowing) subject to deduction limits

- Use of proceeds – Funds must be used to buy, build, or substantially improve the qualified home securing the loan

- Itemization requirement – You must itemize deductions rather than taking standard deduction

- Documentation – Maintain records proving fund usage for qualifying improvements

Consult tax professionals for guidance specific to your situation, as tax laws change and individual circumstances vary significantly.

Rental Property Considerations

How do tax rules differ for investment property improvements? Rental property improvements follow different tax treatment, with costs potentially depreciable over time and interest generally deductible as rental property business expense, subject to passive activity loss limitations and other factors.

Investment property owners should work with tax professionals to optimize depreciation strategies, understand material participation rules, and coordinate improvement timing with overall tax planning.

The IRS provides detailed guidance on home improvement tax treatment in Publication 523 for primary residences and Publication 527 for rental property.

How Do Government-Backed Home Improvement Loan Programs Work?

What government home improvement loan programs are available? Several federal programs facilitate renovation financing through FHA 203(k) loans, VA renovation loans, and USDA repair programs, each designed for specific borrower types and property situations with competitive terms backed by government guarantee.

These programs often provide advantages over conventional financing for borrowers who qualify, including potentially flexible credit requirements, competitive pricing, and the ability to finance both purchase and improvements in a single transaction.

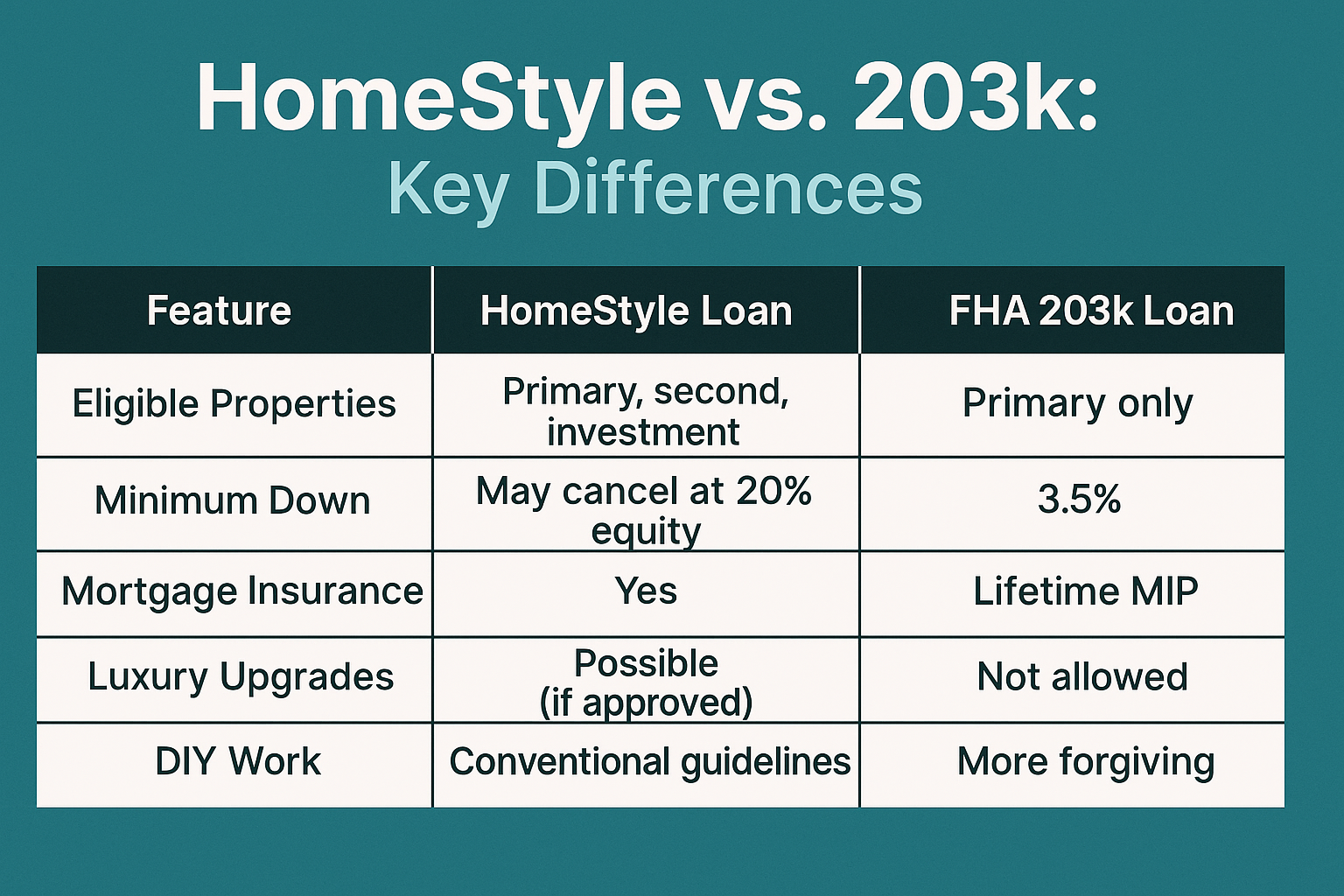

FHA 203(k) Renovation Loans

The FHA 203(k) program allows borrowers to finance both home purchase (or refinance) and renovation costs through a single mortgage:

- Combines acquisition and improvement costs in one loan

- Available in Standard and Limited versions based on renovation scope

- Requires FHA-approved lenders and contractors for Standard version

- Allows borrowers to qualify based on after-repair value

- Includes repair escrow with funds released as work completes

- Requires property to become borrower’s primary residence

What types of improvements qualify for FHA 203(k) financing? Eligible projects range from minor repairs to major renovations including structural alterations, room additions, kitchen and bathroom remodels, energy efficiency upgrades, accessibility modifications, and remediation of health and safety issues.

The program particularly benefits:

- First-time buyers purchasing fixer-uppers who lack separate renovation funds

- Homeowners needing to refinance and make substantial repairs simultaneously

- Properties requiring updates to meet FHA minimum property standards

- Borrowers with modest initial equity who need after-repair value lending

- Buyers in markets where updated homes exceed their purchase budget

VA Renovation Loans

Veterans and eligible service members can access renovation financing through VA-backed programs:

- Available for purchase or refinance with renovation component

- No initial equity contribution requirements (subject to funding fee)

- Competitive terms backed by VA guarantee

- Property must become borrower’s primary residence

- Requires VA-approved appraisers to determine after-repair value

USDA Repair Programs

The USDA offers renovation assistance for rural properties:

- Section 504 loans for low-income homeowners needing repairs

- Grants available for elderly very-low-income borrowers

- Focus on health and safety improvements in eligible rural areas

- Income limits and property location restrictions apply

Where can you find details on government home improvement loan programs? The Department of Housing and Urban Development provides comprehensive program information at HUD.gov, including eligibility requirements, approved lender lists, and application processes.

Strategy #6: Leverage Home Improvement Loans for Energy Efficiency and Long-Term Savings

Can home improvement loans finance energy efficiency upgrades that reduce monthly costs? Yes, many borrowers use renovation financing to fund energy efficiency improvements that generate ongoing utility savings, potentially offsetting financing costs while improving comfort and increasing property value through reduced operating expenses.

Strategic energy investments often deliver compounding benefits: immediate comfort improvements, reduced monthly utility bills, increased property marketability, and potential tax credits or utility rebates that offset installation costs.

High-Impact Energy Efficiency Projects

These improvements typically deliver strong returns relative to investment:

- HVAC system replacement – Modern high-efficiency heating and cooling reduces energy consumption substantially

- Window and door upgrades – Eliminates drafts and improves insulation for year-round efficiency

- Insulation improvements – Attic, wall, and basement insulation dramatically affects heating and cooling costs

- Solar panel installation – Generates electricity offsetting utility costs with long-term savings potential

- Water heater upgrades – Tankless or high-efficiency models reduce energy and water consumption

- LED lighting conversion – Minimal cost with immediate reduction in lighting expenses

- Smart thermostat systems – Optimize heating and cooling patterns based on occupancy and preferences

How do you calculate whether energy improvements justify financing costs? Compare projected monthly savings from reduced utility bills against monthly financing costs, calculating your break-even timeline and total savings over your expected occupancy period.

Combining Rebates and Incentives

Many energy improvements qualify for financial incentives that reduce net cost:

- Federal tax credits – The IRS offers credits for qualifying energy efficiency improvements including solar, windows, insulation, and HVAC systems

- State and local rebates – Many states provide additional incentives for energy upgrades

- Utility company programs – Power and gas utilities often rebate energy efficiency improvements

- Manufacturer rebates – Equipment manufacturers may offer promotions on high-efficiency products

- Property tax exemptions – Some localities exempt energy improvement value from reassessment

Research available incentives before finalizing project scope, as some programs require pre-approval or have application deadlines.

Energy-Specific Loan Programs

Specialized financing programs target energy improvements:

- C-PACE programs – Commercial Property Assessed Clean Energy financing for commercial properties

- R-PACE programs – Residential PACE financing in participating states

- FHA Energy Efficient Mortgage – Additional borrowing capacity for energy improvements

- Energy-focused credit lines – Some lenders offer specialized products for efficiency upgrades

The Database of State Incentives for Renewables & Efficiency provides comprehensive information on available programs by location.

What Are Common Home Improvement Loan Mistakes to Avoid?

What mistakes do borrowers make when choosing home improvement loans? Common errors include borrowing more than necessary, choosing inappropriate loan structures for their project timeline, failing to budget for contingencies, selecting contractors based solely on price, and not comparing total borrowing costs across different financing options.

Avoiding these pitfalls helps ensure your renovation financing supports your goals without creating unnecessary financial stress or limiting future flexibility.

Mistake #1: Insufficient Project Budget Planning

How much should you borrow above contractor estimates for contingencies? Experienced renovators typically add buffer for unexpected issues, change orders, and cost overruns that frequently emerge during construction, particularly in older homes where hidden problems surface once work begins.

Underfunding your project creates stress when unexpected issues arise:

- Structural problems discovered during demolition

- Electrical or plumbing issues requiring code updates

- Material price increases during construction

- Change orders for improvements you decide to add

- Timeline delays that extend contractor costs

Budget realistic contingencies based on project scope:

- Minor cosmetic updates: 10-15% buffer

- Kitchen or bathroom remodels: 15-20% buffer

- Major renovations or additions: 20-30% buffer

- Older homes or gut renovations: 25-35% buffer

Mistake #2: Poor Contractor Selection and Documentation

Choosing contractors based solely on lowest bid often backfures:

- Unlicensed contractors may produce work that fails inspections

- Inadequately insured contractors expose you to liability

- Inexperienced contractors extend timelines or deliver poor quality

- Contractors without proper estimates create funding release issues

- Disappearing contractors leave projects incomplete

Protect yourself through thorough contractor vetting:

- Verify active licenses and insurance coverage

- Check references from recent similar projects

- Obtain detailed written estimates with specifications

- Review contracts carefully before signing

- Understand payment schedules and lien waivers

- Document all changes and approvals in writing

Many lenders require licensed, insured contractors for renovation loan approval, so establish these relationships early in your planning process.

Mistake #3: Choosing the Wrong Loan Structure

Should you use a HELOC or cash-out refinance for home improvements? The optimal choice depends on your current mortgage terms, total borrowing needs, project timeline, and whether you’re already considering refinancing for other reasons—each structure offers distinct advantages in different scenarios.

Common structure mismatches:

- Using high-interest credit cards for major renovations (expensive short-term solution)

- Taking lump sum when phased credit line would save interest

- Refinancing away excellent current rate just to access equity

- Choosing unsecured personal loan when equity-based options would cost less

- Selecting variable-rate credit line for large borrowing you’ll carry long-term

Analyze total costs across different structures using calculators before committing to one approach.

Mistake #4: Ignoring Total Cost Analysis

What costs beyond interest rates affect home improvement loan expenses? Origination fees, appraisal charges, title insurance, recording fees, and other closing costs can total several thousand dollars, making a slightly lower nominal rate more expensive overall if it comes with higher fees.

Calculate total borrowing cost:

- All upfront fees and closing costs

- Total interest paid over expected repayment timeline

- Prepayment penalties if you might pay off early

- Annual fees on revolving credit products

- Tax benefits if applicable (consult tax professional)

A loan advertising competitive pricing may prove more expensive than alternatives when you factor in all costs, particularly if you plan to repay quickly.

Mistake #5: Over-Improving for the Neighborhood

Can you borrow too much for home improvements relative to neighborhood values? Yes, excessive improvements that push your property value far above comparable homes in your area often fail to recoup investment if you sell, as buyers typically won’t pay premium prices that exceed neighborhood norms regardless of your investment.

Research comparable sales before financing luxury upgrades:

- What is the highest recent sale price in your immediate area?

- How does your proposed post-renovation value compare?

- Are you creating the neighborhood’s most expensive property?

- Do improvements match buyer expectations in your market?

Match improvement quality and scope to your neighborhood’s character unless you plan very long-term ownership where personal enjoyment justifies the investment.

Home Improvement Loan Requirements: What Lenders Evaluate

What credit score do you need for home improvement loan approval? Requirements vary significantly by loan program and structure, with conventional equity-based financing typically requiring stronger credit profiles while alternative programs may accommodate lower scores with compensating factors like substantial equity, strong income, or significant reserves.

Understanding what lenders evaluate helps you prepare applications and address potential concerns before they delay approval.

Credit Profile Assessment

Lenders analyze several credit factors:

- Payment history – Track record of on-time payments for mortgages, installment loans, and revolving credit

- Credit utilization – Outstanding balances relative to available credit limits

- Credit history length – Average age of accounts and oldest account

- Recent credit inquiries – Number of applications in recent months

- Public records – Bankruptcies, foreclosures, judgments, tax liens

- Account mix – Diversity of credit types (mortgages, auto loans, cards)

How do recent late payments affect home improvement loan approval? While a single late payment may not disqualify you, patterns of late payments, recent 30-day late marks on mortgages, or multiple recent late payments across accounts signal higher risk and may require explanation letters or compensating factors.

Income and Employment Verification

Lenders need confidence in your repayment capacity:

- Income stability – Consistent earnings over time in same field or industry

- Income documentation – Pay stubs, tax returns, bank statements, or alternative verification

- Employment verification – Direct employer contact or recent pay stubs confirming current employment

- Future income reliability – Likelihood your income will continue throughout repayment

- Income types – Base salary, bonuses, commissions, rental income, retirement benefits

Self-employed borrowers, business owners, and those with non-traditional income should explore specialized programs that accommodate alternative documentation:

Debt-to-Income Ratio Calculations

What debt-to-income ratio do you need for home improvement loans? Most programs prefer total monthly debt obligations (including the new loan payment) to remain below specific thresholds relative to gross monthly income, though acceptable ratios vary by loan program, credit strength, and compensating factors.

Lenders calculate two ratios:

- Front-end ratio – Housing expenses divided by gross monthly income

- Back-end ratio – Total monthly debts divided by gross monthly income

Improve your ratios by:

- Paying down existing credit card balances

- Paying off small installment loans completely

- Adding co-borrower income if available

- Documenting additional income sources

- Addressing errors on credit report

Equity and Loan-to-Value Requirements

How much equity do you need for home improvement loans? Secured financing using your home as collateral requires sufficient equity to protect lender interests, with specific requirements varying by program—some conventional programs require substantial equity while government-backed options may work with minimal equity positions.

Equity calculations compare:

- Current property value (via appraisal)

- Total existing mortgage debt

- Proposed new borrowing for improvements

- Required equity cushion for lender protection

Borrowers with limited equity should explore:

- Government-backed renovation programs with flexible equity requirements

- After-repair value lending that uses post-renovation value

- Unsecured personal loan structures not tied to equity

- Family financing or partnerships

Frequently Asked Questions About Home Improvement Loans

How Long Does Home Improvement Loan Approval Take?

The approval timeline depends on loan structure complexity, documentation completeness, and whether property appraisal is required. Simple unsecured personal loans may approve within days, while secured financing involving appraisals, title work, and renovation plan review typically requires several weeks from application to fund disbursement.

Factors affecting timeline:

- Documentation completeness at application

- Appraisal scheduling and completion

- Title search and insurance requirements

- Renovation plan review and contractor verification

- Underwriter workload and complexity

- Closing coordination with all parties

Expedite the process by:

- Gathering all documentation before applying

- Responding quickly to lender requests

- Having renovation plans and contractor bids ready

- Maintaining communication with your loan officer

- Being flexible with appraisal and closing scheduling

Can You Get a Home Improvement Loan With Bad Credit?

Borrowers with challenged credit can access renovation financing, though options narrow and pricing typically reflects higher risk. Strategies include secured financing leveraging substantial equity, adding co-borrowers with stronger credit, alternative documentation programs, working with specialized lenders, or taking time to improve credit before applying.

What can you do to improve home improvement loan approval chances with challenged credit? Provide detailed explanation letters for negative items, demonstrate recent positive payment history, show strong income and employment stability, offer larger reserves, increase your equity contribution, or address incorrect information on your credit report.

Alternative paths for challenged credit:

- Family loans or partnerships

- Delayed financing (save and pay cash, then refinance)

- Government programs with flexible credit requirements

- Contractor financing programs

- Phased improvements matching available cash flow

Should You Use Credit Cards for Home Improvements?

Credit cards rarely represent optimal renovation financing due to pricing structures, but may serve specific limited purposes. Small projects you can repay within promotional periods might work, while major renovations requiring extended repayment warrant structured loan products with competitive terms.

When credit cards might make sense:

- Very small projects under a few thousand dollars

- Promotional 0% APR offers you’ll repay before rate increases

- Capturing rewards or cash back on purchases

- Temporary bridge financing before other funding arrives

- Emergency repairs requiring immediate payment

When to avoid credit cards:

- Large projects requiring extended repayment

- Situations where you’ll carry balances at high rates

- When structured loans offer substantially better terms

- Projects needing contractor payments over time

- Renovations where you lack clear repayment plan

How Do You Compare Different Home Improvement Loan Offers?

What factors should you evaluate when comparing home improvement loan options? Beyond interest rates, analyze total borrowing costs including all fees, repayment term flexibility, prepayment options, fund disbursement structure, lender reputation and service quality, and alignment between loan structure and your project timeline.

Create a comparison framework:

Factor | Offer A | Offer B | Offer C |

Loan structure | Lump sum | Credit line | Cash-out refi |

Total borrowing cost | All-in calculation | All-in calculation | All-in calculation |

Upfront fees | Itemized list | Itemized list | Itemized list |

Prepayment penalties | Terms | Terms | Terms |

Fund disbursement | Method and timeline | Method and timeline | Method and timeline |

Repayment flexibility | Options | Options | Options |

Request good faith estimates from multiple lenders showing all costs, then use calculators to compare total repayment costs under different scenarios.

Strategy #7: Create a Home Improvement Loan Repayment Strategy Before Borrowing

How can you minimize total interest costs on home improvement loans? Develop a repayment strategy before borrowing that includes realistic monthly payment budgets, prepayment plans when cash flow allows, and potential refinancing opportunities if market conditions shift significantly during your repayment period.

Borrowing without a clear repayment plan often leads to extended debt duration and higher total costs than necessary.

Prepayment Strategies

Even modest additional payments dramatically reduce total interest and repayment timeline:

- Biweekly payment schedules – Making half-payments every two weeks results in one extra monthly payment annually

- Round-up payments – Rounding monthly payments to next hundred or adding fixed amount monthly

- Windfall application – Directing bonuses, tax refunds, or unexpected income to principal

- Equity acceleration – Making large lump payments when opportunities arise

Do home improvement loans have prepayment penalties? Some loan structures include prepayment penalties that charge fees if you repay early, particularly on larger loans where lenders expect to earn interest over longer terms—always review prepayment terms before selecting a loan.

Coordination With Other Financial Goals

Integrate home improvement loan repayment with broader financial planning:

- Emergency fund priority – Maintain liquid reserves before aggressively prepaying

- Retirement contribution balance – Don’t sacrifice retirement savings for accelerated debt repayment

- Other debt considerations – Address higher-rate debt before prepaying secured home improvement loans

- Future borrowing plans – Consider how improved credit and equity will serve future needs

- Tax optimization – Work with tax professionals on timing and deductibility

Refinancing Opportunities

Market conditions may create refinancing opportunities during your repayment period:

- Significantly improved pricing environment

- Credit score increases that qualify you for better terms

- Consolidation opportunities with multiple debts

- Shift from variable to fixed rates for certainty

- Cash-out to fund additional improvements

Monitor market conditions and your financial profile for potential refinancing windows that could reduce total costs or improve your financial flexibility.

Calculate your home improvement loan scenario:

Ready to discuss your purchase scenario? Submit a purchase inquiry to explore your options.

Advanced Home Improvement Loan Questions

Can You Deduct Home Improvement Loan Interest on Rental Properties?

How does rental property home improvement loan interest deductibility work? Interest on loans used to improve rental properties generally qualifies as deductible business expense on Schedule E of your tax return, subject to passive activity loss limitations and proper documentation proving fund usage for qualifying improvements rather than personal use.

Rental property owners should:

- Maintain detailed records linking loan proceeds to specific improvements

- Distinguish between repairs (immediately deductible) and improvements (depreciable)

- Understand material participation rules affecting loss deductibility

- Track improvement costs for depreciation schedules

- Consult tax professionals for guidance on their specific situation

The IRS provides comprehensive guidance in Publication 527 covering rental income and expenses.

What Happens If You Sell Your Home Before Repaying the Home Improvement Loan?

Do you have to pay off home improvement loans when you sell your property? Yes, all loans secured by the property must be paid at closing from sale proceeds, while unsecured personal loans remain your obligation regardless of property sale—this distinction affects how much net proceeds you’ll receive.

Secured home improvement debt:

- Automatically paid from sale proceeds at closing

- Reduces your net proceeds dollar-for-dollar

- Includes mortgages, home equity loans, and HELOCs

- May include liens if contractors weren’t paid

Unsecured debt:

- Remains your personal obligation after sale

- Does not reduce sale proceeds directly

- You’ll need separate repayment plan from other funds

Can You Get a Home Improvement Loan for a Second Home or Investment Property?

Yes, renovation financing exists for second homes and investment properties, though terms, qualification requirements, and structures differ from primary residence financing. Investment property programs often focus on rental income or debt service coverage rather than solely personal income, while second home programs may require larger reserves and equity positions.

How do DSCR loans work for investment property improvements? Debt Service Coverage Ratio loans evaluate whether the property’s rental income will cover all debt obligations including the improvement loan, making your personal income less relevant to qualification—particularly useful for investors with multiple properties or complex personal income situations.

Explore investment property options:

- View DSCR loan case studies

- View DSCR refinance case studies

- View DSCR cash-out refinance case studies

How Do Home Improvement Loans Work During Divorce?

Property division during divorce creates unique challenges with home improvement loans. If one spouse retains the property, they typically must refinance to remove the other spouse from loan obligations or assume the loan with lender approval. If selling, improvement loan balances are paid from proceeds before equity division.

Can one spouse be removed from a home improvement loan without refinancing? Most lenders won’t release a co-borrower from loan obligations without full loan payoff or refinancing, as the original underwriting included both borrowers’ income and credit—removal changes the risk profile substantially.

Divorcing couples should:

- Obtain payoff quotes for all property-secured debt

- Understand equity calculations including recent improvements

- Consider timing of improvements relative to separation

- Consult divorce attorneys about equitable distribution

- Plan refinancing strategy if one party retains property

What Are Home Improvement Loan Options for Seniors and Retirees?

Can retirees on fixed income qualify for home improvement loans? Yes, multiple programs accommodate retirees through alternative qualification methods including asset-based lending that evaluates liquid reserves rather than income, reverse mortgage programs that don’t require monthly payments, and conventional programs that recognize retirement income from pensions, Social Security, and investment distributions.

Options for senior borrowers:

- Asset depletion loans – Qualify based on retirement account balances rather than monthly income

- Reverse mortgage renovations – HECM for Purchase or refinance includes improvement costs without monthly payments

- Conventional equity loans – Standard programs recognizing retirement income

- FHA 203(k) for seniors – Combines competitive terms with renovation financing

Seniors should consider:

- Whether monthly payments fit fixed income budgets

- Asset preservation for healthcare and emergencies

- Estate planning implications of different structures

- Timeline for occupancy and potential care transitions

- Family consultation on major financial decisions

Explore senior-focused options:

Want to explore if a reverse mortgage fits your situation? Submit a reverse mortgage inquiry to learn more.

How Do Construction Loans Differ From Home Improvement Loans?

Should you use a construction loan or home improvement loan for major renovations? Construction loans apply to ground-up building or extremely substantial renovations essentially creating a new structure, while home improvement loans fund renovations to existing livable properties—the distinction affects loan structure, draw schedules, and qualification requirements.

Construction loans typically:

- Require detailed architectural plans and engineering

- Involve staged fund releases tied to completion milestones

- Convert to permanent mortgage after construction completes

- Need qualified general contractor or owner-builder approval

- Carry different pricing during construction versus permanent phase

Home improvement loans:

- Fund renovations to existing habitable structures

- May release funds in lump sum or via revolving credit

- Apply to projects maintaining home’s livability during work

- Work with various contractor relationships

- Maintain consistent terms throughout repayment

Can You Use Home Improvement Loans for Accessory Dwelling Units (ADUs)?

Are ADU construction costs eligible for home improvement loan financing? Yes, adding accessory dwelling units, in-law suites, or rental units qualifies as home improvement and can be financed through renovation loan programs, though lenders will evaluate the project’s impact on property value and may have specific requirements for permitted legal secondary units.

ADU financing considerations:

- Local zoning and permit requirements for legal ADU status

- Appraisal treatment of ADU value contribution

- Rental income potential from ADU if seeking income qualification

- Construction complexity and timeline

- Utility infrastructure and separate systems needs

Lenders evaluate whether the ADU will be:

- Owner-occupied with family member in ADU

- Rented for investment income

- Used for short-term rental purposes

- Legally permitted and code-compliant

ADU projects often benefit from after-repair value lending since the improvement substantially increases property worth.

What Are Bridge Loans for Home Improvement?

How do bridge loans work for renovation timing? Bridge loans provide short-term financing when you need immediate renovation funds before receiving expected capital from property sale, business proceeds, or other sources—particularly useful for pre-sale improvements or projects with imminent payoff sources.

Bridge loan characteristics:

- Short repayment terms (typically 6-24 months)

- Expectation of defined payoff event

- Generally higher pricing due to short duration and risk

- May be interest-only during bridge period

- Quick closing processes

Common bridge scenarios:

- Funding pre-sale improvements repaid from sale proceeds

- Renovating inherited property before sale or refinance

- Business owners awaiting large payment or transaction

- Timing gap between property sale and new purchase

- Lawsuit settlement or insurance proceeds expected

Alternative Loan Programs for Property Owners

If a home improvement loan isn’t the right fit, consider these alternatives:

- FHA 203k Loan – Purchase property and finance renovations in a single government-backed loan

- HomeStyle Renovation Loan – Conventional purchase-plus-renovation financing with flexible terms

- HELOC – Flexible line of credit against home equity with draw-as-needed access for renovations

- Home Equity Loan – Fixed-rate lump sum borrowing against your home equity for renovation projects

- Cash-Out Refinance – Refinance your existing mortgage and access equity for improvements

Explore all 30+ loan programs to find your best option.

Not sure which program is right for you? Take our discovery quiz to find your path.

Helpful Home Improvement Loan Resources

Official Government Guidance

FHA 203(k) Rehabilitation Loan Program – Official HUD resource detailing standard and limited 203(k) programs, eligible improvements, contractor requirements, and application processes for combining purchase or refinance with renovation financing.

IRS Publication 523: Selling Your Home – Comprehensive IRS guidance on home sale exclusions, capital improvements that increase cost basis, and tax treatment of various home-related expenses for primary residences.

IRS Publication 527: Residential Rental Property – Official IRS resource explaining tax treatment of rental property expenses, depreciation rules for improvements, and deductibility guidelines for investment property financing.

Consumer Financial Protection Bureau Home Loan Resources – Federal consumer protection agency providing educational resources on mortgages, refinancing, home equity loans, and borrower rights throughout the lending process.

Industry Organizations

National Association of Home Builders Remodeling – Industry trade association offering market research, contractor resources, and consumer guidance on renovation planning, contractor selection, and project management.

Database of State Incentives for Renewables & Efficiency (DSIRE) – Comprehensive database of federal, state, and local incentives for energy efficiency and renewable energy improvements, including tax credits, rebates, and financing programs.

Educational Resources

Energy Star Home Improvement Guide – EPA resource providing guidance on energy-efficient home improvements, qualified products, potential savings estimates, and available tax credits for energy upgrades.

Appraisal Institute Home Valuation Resources – Professional appraisal organization offering consumer resources on property valuation, understanding appraisals, and how improvements affect home value.

Need local expertise? Get introduced to trusted partners including loan officers, realtors, and contractors in your area.

Ready to get started? Apply now or schedule a call to discuss your situation.

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Not Sure About Your Next Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Related Posts

Subscribe to our newsletter

Get program updates and rate insights in your inbox.