Reverse Mortgage: 7 Strategies for Accessing Home Equity Without Monthly Payments

Convert Your Home Equity Into Tax-Free Cash Flow While Maintaining Homeownership

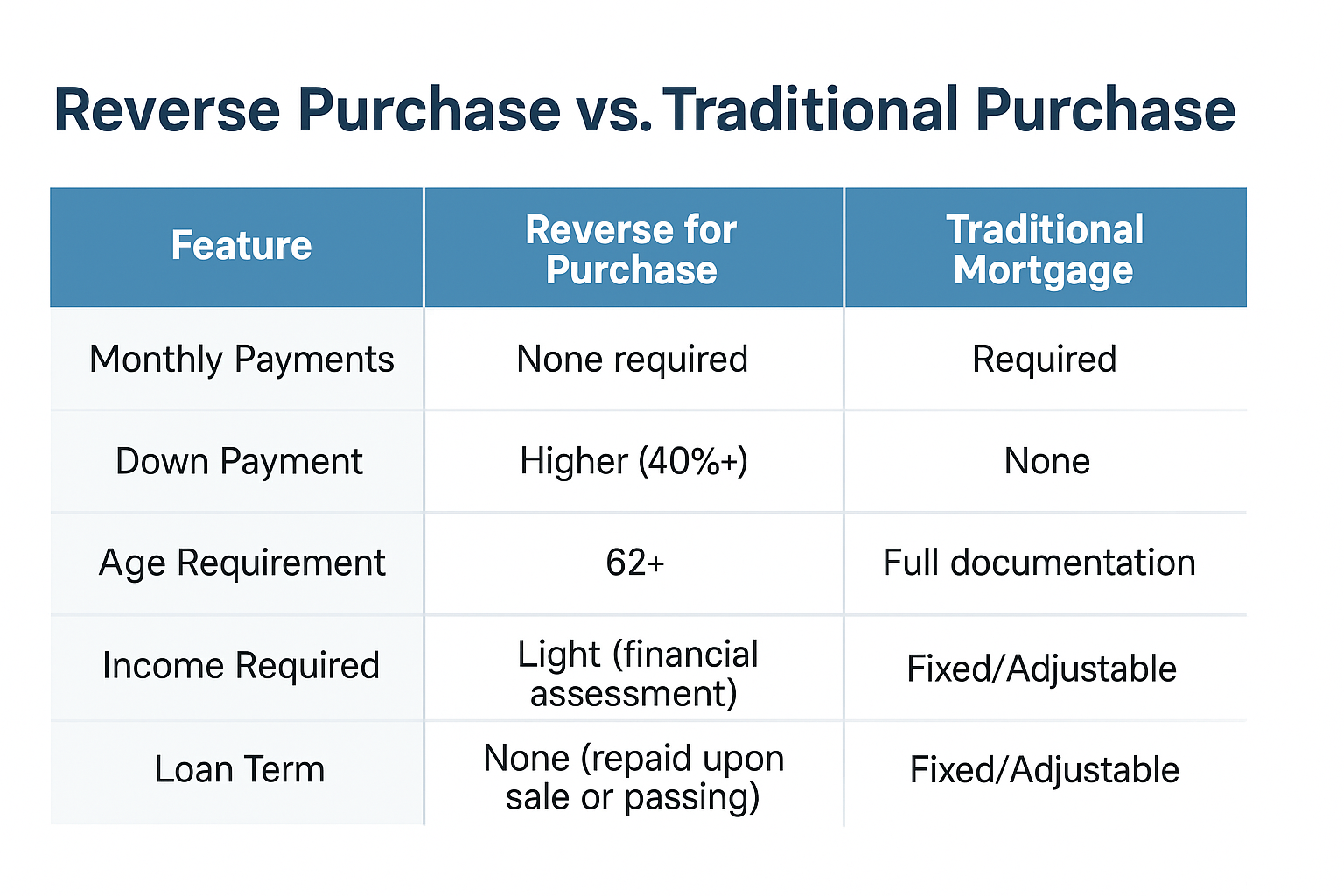

Traditional mortgages require monthly payments that strain budgets, especially for retirees on fixed incomes. Reverse mortgages flip this model, allowing homeowners 62 and older to convert home equity into accessible funds without monthly mortgage payments—the loan balance grows over time and gets repaid when you sell, move, or pass away. Understanding how reverse mortgages work, who benefits most, what protections exist, and how to structure withdrawals helps you make informed decisions about accessing your home’s value while aging in place with greater financial flexibility and security.

Key Details You’ll Learn About Reverse Mortgages:

- How reverse mortgages differ from traditional mortgages and home equity loans in terms of repayment structure and qualification requirements

- The various reverse mortgage types including HECM loans, proprietary jumbo programs, and single-purpose reverse mortgages for specific expenses (HUD HECM program information)

- Age, equity, and property requirements that determine reverse mortgage eligibility and maximum loan amounts available

- Withdrawal options including lump sum, monthly payments, line of credit, or combination structures providing flexibility for different financial needs

- Consumer protections built into federally-insured HECM programs including non-recourse provisions, counseling requirements, and spouse protections

- Tax implications and how reverse mortgage proceeds differ from taxable income while potentially affecting government benefit eligibility (IRS Publication 936 on mortgage interest)

- Costs associated with reverse mortgages including origination fees, mortgage insurance, and ongoing service charges affecting net proceeds

- Estate planning considerations and how reverse mortgages affect inheritance, heirs’ options, and long-term legacy planning

- Strategic approaches to maximizing reverse mortgage benefits while minimizing costs and preserving wealth for future generations

Ready to explore your options? Schedule a call with a loan advisor.

What Is a Reverse Mortgage and How Does It Work?

A reverse mortgage is a loan that allows homeowners age 62 and older to convert home equity into cash without selling their property or making monthly mortgage payments—instead of paying the lender each month like traditional mortgages, the lender pays you while loan balance and interest accumulate over time, becoming due when you permanently leave the home through sale, relocation, or death.

How does a reverse mortgage differ from a home equity loan? Home equity loans require monthly payments from your income and can result in foreclosure if you can’t pay, while reverse mortgages have no monthly payment requirement and can’t force you out as long as you meet basic obligations like paying property taxes, maintaining insurance, and keeping the home in good condition.

The fundamental shift reverses the traditional mortgage model. With conventional mortgages, you make payments reducing loan balance while building equity over time. With reverse mortgages, you receive payments or access funds while loan balance increases, gradually reducing your equity position until repayment occurs.

How Reverse Mortgage Repayment Works

Understanding when and how repayment occurs:

Loan becomes due when:

- You permanently move out of the home for 12+ consecutive months

- You sell the property to another party

- The last borrower or eligible non-borrowing spouse passes away

- You fail to pay property taxes or maintain homeowner’s insurance

- You don’t maintain the property in reasonable condition

- You violate other loan terms in material ways

Repayment options for heirs:

- Sell the home and use proceeds to repay the loan

- Refinance the reverse mortgage with traditional financing to keep the property

- Pay off the reverse mortgage balance with other funds if wanting to retain the home

- Walk away if the loan balance exceeds property value (non-recourse protection)

What happens if the reverse mortgage balance exceeds the home’s value? HECM reverse mortgages include non-recourse provisions meaning you or your heirs never owe more than the home’s value at repayment time—FHA mortgage insurance covers any shortfall, protecting borrowers and heirs from owing more than the property is worth.

Types of Reverse Mortgages

Three main reverse mortgage categories exist:

Home Equity Conversion Mortgage (HECM):

- Federally-insured through FHA with consumer protections

- Most common reverse mortgage type

- Requires HUD-approved counseling before closing

- Non-recourse protection ensures you never owe more than home value

- Eligible non-borrowing spouse protections in many cases

- Loan limits based on FHA maximums

Proprietary (Jumbo) Reverse Mortgages:

- Private loans for high-value homes exceeding HECM limits

- No federal insurance or government backing

- May offer larger loan amounts for expensive properties

- Typically fewer consumer protections than HECM loans

- Requirements and terms vary by lender

Single-Purpose Reverse Mortgages:

- Offered by some state and local government agencies or nonprofits

- Lowest cost option but very limited availability

- Funds restricted to specific purposes (property taxes, home repairs)

- Not available in all areas

Which reverse mortgage type should you choose? Most borrowers use HECM loans due to federal protections, widespread availability, and comprehensive counseling requirements—proprietary reverse mortgages make sense only for high-value homes exceeding HECM limits, while single-purpose options work if available in your area for specific approved expenses.

Reverse Mortgage Strategy #1: Understand Eligibility Requirements

Who qualifies for a reverse mortgage? Homeowners must be at least 62 years old, own the property outright or have substantial equity, live in the home as their primary residence, meet financial assessment standards showing ability to pay ongoing property charges, and complete HUD-approved counseling for HECM loans—property must also meet FHA standards and be an eligible property type.

Understanding complete eligibility criteria helps you assess whether reverse mortgages fit your situation and what preparation might improve your qualification odds.

Age Requirements

Age determines both eligibility and loan amounts:

- Minimum age – You must be at least 62 years old for HECM and most proprietary programs

- Multiple borrowers – With married couples or co-borrowers, calculations based on youngest borrower’s age

- Age affects proceeds – Older borrowers qualify for higher loan amounts due to shorter actuarial life expectancy

- Non-borrowing spouse considerations – Spouses under 62 can receive certain protections even if not on the loan

How much more do older borrowers receive? Payment amounts increase with age—a 62-year-old might access approximately 50-55% of home value, while an 82-year-old might access 65-75% depending on interest rates and property value, though exact percentages vary based on multiple factors and change as program parameters adjust.

Equity and Property Requirements

Your home equity position determines available proceeds:

Minimum equity standards:

- Must own property outright or have very low mortgage balance relative to value

- Any existing mortgage must be paid off with reverse mortgage proceeds at closing

- After paying off existing liens, sufficient equity must remain to provide meaningful proceeds

- Home value relative to HECM limits affects maximum available amounts

Eligible property types:

- Single-family homes (most common)

- FHA-approved condominiums in warrantable projects

- Townhomes and PUDs (Planned Unit Developments)

- 2-4 unit properties where you occupy one unit as primary residence

- Manufactured homes meeting FHA standards

Ineligible property types:

- Co-ops and most non-FHA approved condos

- Investment properties or vacation homes

- Properties not maintained as primary residence

- Homes on leased land in most cases

- Properties with certain structural or safety issues

Can you get a reverse mortgage on a condo? Yes, if the condominium project meets FHA approval standards—the building must be on HUD’s approved condo list or receive spot approval, have adequate insurance and reserves, meet owner-occupancy requirements, and satisfy other FHA condominium project standards similar to forward mortgages.

Financial Assessment Standards

HECM programs include financial qualification requirements:

- Credit history review – Willingness to meet financial obligations based on credit report

- Income and asset verification – Ability to pay property taxes, insurance, and maintenance

- Property charge payment history – Recent track record paying taxes and insurance

- Residual income analysis – Sufficient income after expenses for property charges

- Set-aside requirements – May require withholding funds for taxes and insurance if financial concerns exist

What happens if you don’t meet financial assessment standards? Lenders may require a “Life Expectancy Set Aside” (LESA) where they withhold portion of loan proceeds to pay future property taxes and insurance on your behalf—this reduces your available proceeds but allows approval for borrowers who might otherwise be declined due to income concerns.

Primary Residence Requirement

The home must serve as your main residence:

- Must live in the property as primary residence throughout loan term

- Temporarily leaving (vacations, medical care under 12 months) is acceptable

- Permanently moving to assisted living or leaving for 12+ months triggers loan due

- Cannot maintain reverse mortgage on vacation home or investment property

- Conversion to rental property violates loan terms

What happens if you need to move to assisted living temporarily? Brief stays under 12 consecutive months for medical care typically don’t trigger loan maturity—however, if you’re absent more than 12 months even for legitimate reasons, the loan becomes due and must be repaid.

What Are the Costs Associated With Reverse Mortgages?

Are reverse mortgage costs higher than traditional mortgages? Yes, reverse mortgages typically involve higher upfront costs including origination fees, FHA mortgage insurance premiums, and third-party charges—additionally, ongoing costs include mortgage insurance premiums, service fees, and accumulating interest that compounds over time, though no monthly payments are required.

Understanding complete cost structure helps you evaluate whether reverse mortgage benefits justify expenses and how costs affect your net proceeds and remaining equity over time.

Upfront Costs

Several fees apply at closing:

Origination fee:

- Lender charges for processing and underwriting the loan

- HECM origination fees are capped based on home value

- First $200,000: 2% of home value (minimum $2,500)

- Amount over $200,000: 1% of value

- Maximum origination fee: $6,000

- Can be financed into the loan rather than paid out of pocket

FHA mortgage insurance premium (MIP):

- Upfront premium of 2% of home’s appraised value or HECM limit, whichever is less

- Provides non-recourse protection ensuring you never owe more than home value

- Protects both borrower and lender against value declines

- Can be financed into loan balance

- Example: $400,000 home = $8,000 upfront MIP

Third-party costs:

- Appraisal fees for professional property valuation

- Title search and title insurance

- Recording fees and documentary stamps

- Credit report charges

- Inspection fees if property condition concerns exist

- Attorney fees if required in your state

Counseling fee:

- HUD-approved counseling required before HECM application

- Typically costs between minimal amounts

- Some counseling agencies offer reduced fees based on income

- Can sometimes be financed into loan

- Provides important consumer education and protections

Can reverse mortgage closing costs be financed? Yes, most closing costs can be rolled into the loan balance rather than paid out of pocket—this preserves your cash but increases the loan balance from day one, reducing your available credit line or proceeds and increasing total interest accumulation over time.

Ongoing Costs

Continuing charges throughout the loan term:

Annual mortgage insurance premium:

- 0.5% of outstanding loan balance annually

- Accrues monthly and adds to loan balance

- Continues as long as loan remains outstanding

- Protects the non-recourse guarantee

Servicing fees:

- Some loans include monthly servicing fees

- Typically range from minimal amounts if charged

- Added to loan balance monthly

- Many current HECM loans don’t include servicing fees

Interest accumulation:

- Interest charges on your outstanding loan balance

- Compounds over time, adding to amount owed

- Never paid out of pocket during loan term

- Grows your loan balance until repayment

Property charges you must pay:

- Property taxes (failure to pay can trigger foreclosure)

- Homeowner’s insurance (required to maintain coverage)

- HOA fees if applicable (must remain current)

- Property maintenance and repairs

How quickly does a reverse mortgage balance grow? Growth rate depends on interest rates and ongoing costs—with interest around 6-7% annually plus 0.5% mortgage insurance, loan balance increases roughly 6.5-7.5% per year through compound interest, though actual growth varies based on specific loan terms and market conditions.

Total Cost Comparison

Evaluate costs relative to alternatives:

- Calculate all upfront fees as percentage of loan amount

- Project loan balance growth over expected timeframes (5, 10, 15+ years)

- Compare to home equity loan or HELOC costs with monthly payments required

- Consider opportunity cost of other equity access methods

- Factor in the value of no monthly payment requirement

Are reverse mortgage costs worth it? For seniors with limited income who need home equity access while aging in place, the no-monthly-payment structure often justifies costs despite premiums over traditional loans—however, younger borrowers or those with adequate income for home equity loans might find traditional borrowing more cost-effective.

Want to explore if a reverse mortgage fits your situation? Submit a reverse mortgage inquiry to learn more.

Reverse Mortgage Strategy #2: Choose the Right Payment Structure

What payment options do reverse mortgages offer? HECM reverse mortgages provide flexible withdrawal structures including lump sum at closing, monthly payments for fixed terms or life, line of credit you can draw from as needed, or combination approaches using multiple payment methods—your choice affects available amounts, flexibility, and strategic planning opportunities.

Selecting the optimal payment structure requires understanding your cash flow needs, risk tolerance, long-term plans, and strategic goals for the proceeds.

Payment Structure Options

Five main withdrawal methods exist:

Lump sum:

- Receive all available proceeds at closing in single distribution

- Only option if you choose fixed interest rate

- Provides immediate liquidity for specific large expenses

- No remaining available credit after initial distribution

- Loan balance begins growing immediately on full amount

Tenure payments:

- Receive equal monthly payments for as long as you live in the home

- Payments continue even if loan balance grows beyond home value (FHA insurance covers)

- Provides predictable monthly income supplement

- Cannot access lump sums or additional credit later

- Payments stop if you permanently leave the home

Term payments:

- Receive equal monthly payments for fixed period you choose

- Higher monthly amounts than tenure since concentrated over shorter timeframe

- Useful for covering specific time period before other income starts (delayed Social Security, pension)

- No additional access after term ends

- Payments stop at term end regardless of remaining equity

Line of credit:

- Access funds as needed up to available credit limit

- Credit line grows over time at same rate as interest charges

- Only pay interest on funds actually withdrawn

- Provides maximum flexibility and strategic planning opportunities

- Can leave unused for emergencies while line grows

Modified tenure or modified term:

- Combines line of credit with monthly payments (tenure or term)

- Portion of available proceeds goes to monthly income

- Remaining amount available as credit line

- Provides both ongoing income and emergency access

- Balances multiple financial goals

Which payment structure is most popular? Line of credit has become most common due to flexibility—you can withdraw funds as needed while unused portions grow, providing both current access and increasing emergency reserves, with ability to take monthly draws mimicking payment structures if desired while maintaining control over timing.

Strategic Line of Credit Advantages

The credit line growth feature creates unique benefits:

How does reverse mortgage credit line growth work? Your available credit line increases annually at the same rate as interest and mortgage insurance charges accumulate—if you start with $200,000 available credit and leave it unused with 6.5% growth rate, after 10 years you’d have roughly $370,000 available, regardless of home value changes.

Strategic benefits:

- Increasing emergency reserve – Grows larger each year you don’t use it

- Hedge against home value decline – Line continues growing even if home value drops

- Deferred access – Can establish line at 62 but not use until later, allowing growth

- Flexibility – Take large or small draws as needs arise

- Planning tool – Knowing available credit helps with long-term financial planning

Should you take a reverse mortgage just to establish a growing credit line? Some financial planners advocate taking HECM line of credit even without immediate need, allowing it to grow as standby reserve—this strategy works best if you can afford closing costs and the growing credit line serves specific estate planning or emergency reserve purposes in your comprehensive financial plan.

Combining Payment Methods

Modified structures blend approaches:

Example combination:

- Establish $300,000 total available credit

- Allocate $100,000 to tenure payments providing $500 monthly

- Reserve remaining $200,000 as growing credit line

- Receive monthly income plus emergency access

- Credit line continues growing on unused portion

Combinations work well when you need:

- Some predictable monthly income supplementation

- Plus emergency reserves for unexpected expenses

- Without committing all available credit immediately

How Do Reverse Mortgages Affect Taxes and Government Benefits?

Are reverse mortgage proceeds taxable income? No, reverse mortgage funds are loan proceeds, not income, making them non-taxable—you don’t report reverse mortgage distributions on tax returns as income, though interest accumulating on the loan balance isn’t deductible until actually paid (typically at loan repayment), and proceeds may affect eligibility for certain government benefits based on asset testing.

Understanding tax and benefit implications helps you structure reverse mortgages to minimize negative impacts on your overall financial situation.

Tax Treatment of Reverse Mortgage Proceeds

IRS treatment clarifies taxation questions:

Non-taxable proceeds:

- Lump sum distributions are not taxable income

- Monthly payments from tenure or term structures are not taxable

- Line of credit draws are not taxable

- No 1099 or other tax reporting on distributions received

- Does not affect your tax bracket or marginal rate

Interest deductibility:

- Interest accumulating on loan balance is not deductible as it accrues

- Interest becomes potentially deductible only when actually paid

- Most borrowers (or heirs) pay interest at loan repayment when selling

- Deduction limited by itemization requirements and interest deduction rules

- Heirs who pay off loan to keep property may claim deduction if they itemize

Capital gains considerations:

- Reverse mortgage doesn’t affect your home sale capital gains exclusion

- $250,000 exclusion ($500,000 married) still available if you meet requirements

- Loan payoff from sale proceeds happens before calculating taxable gain

- Must have lived in home 2 of last 5 years for exclusion (with certain exceptions)

Can reverse mortgage interest be deducted if you pay it down voluntarily? Potentially yes if you make voluntary interest payments during the loan term and itemize deductions, though most borrowers don’t voluntarily pay interest since the no-payment feature is the primary reverse mortgage benefit—consult tax professionals for guidance on your specific situation.

Impact on Government Benefits

Different programs treat reverse mortgage proceeds differently:

Programs generally not affected:

- Social Security retirement benefits – Not means-tested, so reverse mortgage doesn’t affect payments

- Medicare – Not means-tested, coverage continues regardless of reverse mortgage

- Programs based solely on income – Since proceeds aren’t income, they don’t affect these programs

Programs potentially affected:

- Supplemental Security Income (SSI) – Asset-tested program where reverse mortgage proceeds held as cash could exceed asset limits

- Medicaid – Asset limits apply, so reverse mortgage proceeds retained as liquid assets may affect eligibility

- Some state or local assistance programs – Varies by program and how they define countable assets

How can you protect government benefit eligibility? Spend down reverse mortgage proceeds in the month received to avoid them counting as assets, use proceeds for exempt expenses like home repairs or medical care that don’t increase countable assets, structure distributions strategically to align with benefit rules, or consult with benefits specialists before proceeding if you receive asset-tested assistance.

Managing Proceeds to Preserve Benefits

Strategic approaches minimize impacts:

- Take only what you need when you need it – Avoid large distributions you’ll hold as cash

- Use line of credit rather than lump sum – Withdraw funds as needed for immediate use

- Spend proceeds quickly on necessities – Housing costs, medical care, living expenses

- Consult benefits specialist – Understand your specific programs’ rules before proceeding

- Document spending – Keep records showing proceeds used for living expenses

For detailed tax guidance:

- IRS Publication 936 covers mortgage interest deduction rules

- Social Security Administration provides benefit program information

Real-World Reverse Mortgage Success Stories

Seeing how other seniors have used reverse mortgages helps you understand practical applications:

Purchase scenarios:

View reverse mortgage purchase case studies – Real examples of seniors using reverse mortgages to purchase new homes without monthly payments

Cash-out refinance scenarios:

View reverse mortgage cash-out refinance case studies – Examples of homeowners accessing equity for various purposes while eliminating mortgage payments

Payment elimination scenarios:

View reverse mortgage refinance case studies – Cases where existing mortgage payments were eliminated through reverse mortgage refinancing

Income supplement scenarios:

View reverse mortgage income case studies – Examples of seniors creating monthly income streams from home equity

These real examples demonstrate how reverse mortgages solve different financial challenges across various situations and property types.

Reverse Mortgage Strategy #3: Protect Non-Borrowing Spouses

What happens to a reverse mortgage if one spouse dies? If both spouses are borrowers, the surviving spouse continues living in the home with no changes—however, if only one spouse is on the reverse mortgage and that spouse dies first, historically the non-borrowing spouse faced potential displacement, though current HECM rules provide protections allowing eligible non-borrowing spouses to remain in the home.

Understanding spouse protections and requirements helps couples structure reverse mortgages to protect both parties regardless of who passes away first.

Eligible Non-Borrowing Spouse Protections

HECM loans originated after August 4, 2014 include non-borrowing spouse protections:

Requirements for protection:

- You must be legally married to the borrower at closing and remain married

- Marriage must be documented and disclosed at loan origination

- Non-borrowing spouse must be named in loan documents as eligible non-borrowing spouse

- Must have occupied and continue occupying the home as principal residence

- Must comply with all loan obligations (taxes, insurance, maintenance)

How protection works:

- When borrowing spouse dies, non-borrowing spouse can remain in home

- Loan does not become immediately due and payable at borrower’s death

- Non-borrowing spouse cannot access additional proceeds or draws

- Must continue meeting property charge and maintenance obligations

- Loan becomes due when non-borrowing spouse dies, sells, or permanently leaves

Why would one spouse not be on the reverse mortgage? If one spouse is under age 62, they cannot be a borrower—couples must decide whether to wait until both reach 62 (potentially reducing proceeds due to younger age calculation) or proceed with one borrower while protecting the younger spouse through eligible non-borrowing spouse provisions.

Comparing Options for Couples

Different timing strategies affect proceeds and protections:

Both spouses as borrowers (both over 62):

- ✅ Both protected regardless of who dies first

- ✅ Either spouse can access credit line or payments

- ❌ Lower proceeds calculated on younger spouse’s age

- ❌ Must wait if one spouse under 62

One spouse as borrower with non-borrowing spouse protection:

- ✅ Higher proceeds calculated on older spouse’s age alone

- ✅ Can proceed before younger spouse reaches 62

- ✅ Non-borrowing spouse can remain in home after borrowing spouse dies

- ❌ Non-borrowing spouse cannot access additional funds after borrower’s death

- ❌ Must meet all eligibility requirements for protection

Should you wait until both spouses are 62? Decision depends on your need timeline, age gap, health situations, and financial circumstances—larger age gaps create more significant proceed differences, while immediate financial needs may outweigh waiting several years, and health concerns might make proceeding with available protections more prudent than delaying.

Important Considerations for Couples

Additional factors affect spouse protection planning:

- Deferral period impact – Non-borrowing spouse typically experiences period after borrowing spouse dies when they can’t access new funds

- Property charge responsibility – Non-borrowing spouse must have income/assets to pay taxes and insurance

- Estate planning coordination – Reverse mortgage should align with overall estate documents and planning

- Health insurance – Consider healthcare access if older spouse carried younger spouse on Medicare supplement or other coverage

- Income sources – Evaluate whether non-borrowing spouse has adequate income after borrowing spouse’s death

What happens if non-borrowing spouse can’t afford property charges? If the non-borrowing spouse cannot pay property taxes, insurance, or maintain the home after the borrowing spouse dies, the loan can become due even with protections in place—ensuring adequate income sources or setting aside funds for these obligations is critical.

What Are Common Reverse Mortgage Misconceptions?

Do you lose ownership of your home with a reverse mortgage? No, you retain title and ownership throughout the loan—the lender has a lien against the property securing the loan, just like with traditional mortgages, but you maintain ownership, can leave the property to heirs, and retain all homeowner responsibilities and benefits including any appreciation in property value beyond the loan balance.

Understanding common myths helps you evaluate reverse mortgages accurately rather than dismissing them based on misconceptions.

Myth #1: The Lender Owns Your Home

The truth: You retain complete ownership and title to your property. The reverse mortgage is simply a loan secured by your home, identical to how traditional mortgages work—the lender has a lien but no ownership interest. You remain on title, can make decisions about the property, receive any appreciation beyond the loan balance, and can sell whenever you choose.

Myth #2: You Can Lose Your Home

The truth: You cannot lose your home as long as you meet basic obligations—living in the home as your primary residence, paying property taxes, maintaining homeowner’s insurance, and keeping the property in reasonable condition. Unlike traditional mortgages, you cannot be foreclosed for failure to make monthly mortgage payments because no monthly payments exist. The only ways to lose your home are violating these basic requirements or voluntarily selling or leaving.

Myth #3: You’ll Leave Debt to Your Heirs

The truth: Reverse mortgages include non-recourse protection meaning neither you nor your heirs will ever owe more than the home’s value—if the loan balance exceeds property value when it becomes due, FHA insurance covers the difference and heirs can walk away without obligation. Your heirs have options to repay the loan and keep the home, sell the property and keep any remaining equity, or let the lender sell the home with no deficiency judgment possible.

Myth #4: Reverse Mortgages Are Scams

The truth: While scams targeting seniors exist, legitimate reverse mortgages are heavily regulated financial products—HECM loans require HUD-approved counseling to educate borrowers, have federal oversight and consumer protections, and are offered by FHA-approved lenders. Scams typically involve third parties trying to sell you unnecessary products or services, not the reverse mortgages themselves. Working with reputable lenders and completing mandatory counseling protects against fraud.

How can you avoid reverse mortgage scams? Work only with HUD-approved lenders, complete mandatory counseling with independent HUD-approved counselors, never pay large upfront fees to third parties promising to “help” with applications, avoid anyone encouraging you to deed your home to them, don’t let contractors or financial advisors pressure you into reverse mortgages to buy their services, and report suspicious activity to authorities.

Myth #5: Reverse Mortgages Are Only for Desperate People

The truth: While reverse mortgages help seniors with limited income access home equity, they’re also used by affluent retirees as strategic financial planning tools—financial planners increasingly recommend reverse mortgage credit lines as emergency reserves, portfolio diversification, or methods to delay Social Security while drawing on home equity, making them potentially valuable tools across various economic circumstances.

Myth #6: You Can’t Have Any Other Mortgages

The truth: You can have existing mortgages or liens when obtaining a reverse mortgage, but they must be paid off at closing using reverse mortgage proceeds—many borrowers use reverse mortgages specifically to eliminate monthly mortgage payments by paying off their existing loans, freeing up monthly income by removing that payment obligation.

What happens to your existing mortgage? The reverse mortgage proceeds first pay off any existing mortgage balance at closing, and you receive access to the remaining equity after satisfying existing liens—this eliminates your previous monthly mortgage payment while giving you access to additional equity beyond what was needed for the payoff.

Reverse Mortgage Strategy #4: Consider Strategic Delay and Line of Credit Growth

Should you take a reverse mortgage at 62 or wait until older? This strategic decision depends on immediate financial needs, the value of credit line growth, expected longevity, home appreciation projections, and alternative income sources—waiting allows larger proceeds from age-based calculations and potentially higher home values, while starting early maximizes credit line growth years and addresses immediate financial needs.

Understanding the tradeoffs helps you time reverse mortgage decisions optimally for your situation.

Benefits of Early Establishment

Taking a reverse mortgage earlier provides advantages:

Credit line growth potential:

- More years for unused credit line to compound and grow

- Establishes growing emergency reserve for future decades

- Example: $200,000 line at 62 growing at 6.5% = $400,000+ by age 75

- Protects against later home value declines since line grows regardless

Eliminate mortgage payments sooner:

- Use reverse mortgage to pay off existing mortgage immediately

- Free up monthly income for other uses

- Remove payment stress for more retirement years

- Improve monthly cash flow earlier in retirement

Lock in current terms:

- Secure today’s program rules rather than risking future changes

- Establish protections under current regulations

- Avoid potential for reduced benefits or eliminated programs

- Current home value determines proceeds rather than future potentially lower value

What’s the risk of waiting too long? Future health issues might prevent qualification, program changes could reduce benefits or availability, home value declines would reduce available proceeds, or life changes might make you ineligible (moving to care facility, extended medical absence)—establishing the loan while healthy and eligible protects against these scenarios.

Benefits of Strategic Delay

Waiting until older can provide advantages:

Higher proceeds from age:

- Proceeds increase significantly with age due to actuarial calculations

- 70-year-old receives substantially more than 62-year-old from same home value

- Can access more equity when you may need it most

- Allows larger lump sum if planning specific use for proceeds

Home appreciation potential:

- Property value increases raise available proceeds

- Appreciation outpaces credit line growth (typically 3-4% annually vs. 6-7%)

- Works well in appreciating markets or desirable locations

- Larger home value means more equity to tap

Lower total interest accumulation:

- Loan balance compounds for fewer years

- Less total interest owed at eventual repayment

- Preserves more equity for heirs or other purposes

- Particularly relevant if you don’t need funds immediately

Alternative income sources:

- Other assets or income may suffice in early retirement

- Savings can cover needs for several years

- Social Security or pensions may start soon

- Investment portfolio drawdown may be preferable initially

Should you establish a line of credit even without immediate need? Some financial planners advocate this strategy—establish a HECM line of credit in your 60s, leave it unused while it grows, and draw from it later if needed—this approach works best if you can afford closing costs, plan to stay in the home long-term, and want the growing reserve as financial planning tool.

Calculating Your Optimal Timing

Factors to evaluate when deciding timing:

- Immediate financial need – Do you need funds now or can you wait?

- Existing mortgage status – Would eliminating payments improve your monthly situation significantly?

- Health outlook – Are you healthy enough to qualify now and likely to remain so?

- Property appreciation projection – Is your home in appreciating or stable market?

- Longevity expectations – Do you expect to live in the home for many years?

- Alternative asset availability – Do you have other resources to use first?

- Program stability concerns – Do you worry about future program changes?

How Do Reverse Mortgages Affect Your Estate and Heirs?

What happens to your home after you die with a reverse mortgage? Your heirs have several options—they can sell the home using proceeds to repay the loan and keep any remaining equity, refinance the reverse mortgage with traditional financing to keep the property, pay off the balance with other funds, or walk away if the loan exceeds the home’s value (non-recourse protection prevents deficiency claims).

Understanding estate implications helps you plan appropriately and communicate with heirs about expectations and options.

Heir Options and Rights

When the reverse mortgage becomes due, your heirs can choose:

Sell the property:

- List and sell the home through normal processes

- Use sale proceeds to repay reverse mortgage balance

- Keep any remaining equity after loan repayment

- Simplest option if heirs don’t want to keep the home

- Must complete sale within specific timeframe (typically 6 months with extensions possible)

Refinance and keep the home:

- Obtain traditional mortgage to pay off the reverse mortgage

- Must qualify for new financing based on their income and credit

- Allows family to retain property and continue building equity

- Requires heirs to make monthly payments going forward

- Works well if heirs want to keep family home

Pay off with other funds:

- Use cash, investments, or life insurance proceeds to pay balance

- No need to qualify for financing if paying with liquid assets

- Immediate ownership transfer without refinancing delays

- Preserves the home outright for heirs without new mortgage

Walk away from the property:

- If loan balance exceeds home value, heirs can deed property to lender

- Non-recourse protection means no deficiency judgment possible

- No impact on heirs’ credit or financial status

- Lender sells property and FHA insurance covers shortfall

- Appropriate when no equity remains or home needs extensive work

How long do heirs have to decide? Initially 30 days to inform lender of intentions, then typically 6 months to complete sale or refinancing with possible extensions to 12 months if actively working toward resolution—timelines vary somewhat by lender and circumstances, but acting promptly protects heirs’ interests and options.

Impact on Inheritance Value

Reverse mortgages affect what you leave behind:

Equity reduction:

- Loan balance grows over time, reducing remaining equity

- Longer you live with reverse mortgage, less equity remains

- Interest compounds, accelerating balance growth

- However, home appreciation can offset some balance growth

Appreciation still benefits estate:

- You retain all appreciation beyond the loan balance

- If home value increases faster than loan balance, equity grows despite the loan

- Strong markets can leave substantial equity even with long-term reverse mortgages

- Non-recourse protection means heirs never owe more than value regardless of balance

Example scenarios:

- Home worth $500,000, reverse mortgage balance $300,000 = $200,000 equity to heirs

- Home worth $400,000, reverse mortgage balance $425,000 = heirs walk away, no deficiency

- Home worth $600,000, reverse mortgage balance $250,000 = $350,000 equity to heirs

Can you protect inheritance while using a reverse mortgage? Life insurance represents one strategy—purchase or maintain life insurance with death benefit covering projected reverse mortgage balance, allowing heirs to pay off loan and keep home, or providing liquidity replacing equity consumed by the reverse mortgage.

Estate Planning Coordination

Integrate reverse mortgages with comprehensive estate planning:

- Communicate with heirs – Discuss your reverse mortgage decision and implications

- Document in estate plan – Ensure will and estate documents address property with reverse mortgage

- Provide information – Give executor or heirs lender contact information and loan details

- Consider life insurance – Evaluate coverage to offset reverse mortgage impact

- Update beneficiaries – Ensure other accounts coordinate with estate distribution goals

- Consult professionals – Work with estate planning attorneys who understand reverse mortgages

Should you avoid reverse mortgages to preserve inheritance? Not necessarily—if the reverse mortgage significantly improves your quality of life, provides needed funds for aging in place, or eliminates financial stress, these benefits may outweigh inheritance preservation, particularly if you discuss the decision with heirs and they understand the tradeoffs.

Frequently Asked Questions About Reverse Mortgages

Can You Refinance a Reverse Mortgage?

Yes, you can refinance an existing reverse mortgage to potentially increase your available credit (if home value increased or you’re now older), obtain better terms if rates have improved, change payment structures, or add a spouse who previously wasn’t eligible—however, refinancing involves new closing costs and fees, so benefits must justify these expenses.

When does reverse mortgage refinancing make sense? If your home has appreciated significantly providing access to substantially more equity, if you’re now considerably older increasing available proceeds meaningfully, if interest rates have dropped significantly, or if you need to add a spouse to the loan who has now reached 62—refinancing for marginal improvements often isn’t worth the costs.

Refinance considerations:

- All standard closing costs and fees apply to the new loan

- Existing loan balance transfers to new reverse mortgage

- New loan must provide at least 5 times the closing costs in additional proceeds (HECM requirement)

- Must qualify under current program rules, which may have changed

- Restart the accumulation clock on interest and insurance

Can You Rent Out Your Home With a Reverse Mortgage?

No, you must occupy the home as your primary residence to maintain reverse mortgage compliance—temporarily renting a room to a tenant might be acceptable depending on circumstances and lender policies, but converting the home to a rental property or moving out while renting to others violates occupancy requirements and triggers loan maturity.

What happens if you need to move to assisted living or with family? Temporary absences under 12 consecutive months for medical reasons are generally acceptable—however, if you’re absent more than 12 consecutive months even with legitimate reasons, the reverse mortgage becomes due and must be repaid regardless of intent to eventually return.

Occupancy considerations:

- You must live in the home as your main residence

- Maintaining another primary residence elsewhere violates terms

- Moving to adult children’s home permanently triggers maturity

- Entering care facility permanently makes loan due

- Temporary medical care under 12 months typically acceptable

- Extended vacations are fine if you return regularly

Are Reverse Mortgages Available for Condos?

Yes, reverse mortgages are available for condominium units if the project meets FHA approval requirements—the condo building must be on HUD’s approved condo list or receive spot approval, maintain adequate insurance and reserves, meet owner-occupancy ratios, and satisfy other FHA condominium standards similar to forward mortgage requirements.

What makes a condo ineligible for reverse mortgages? High investor concentration exceeding limits, pending or active litigation, insufficient reserves, excessive commercial space, inadequate insurance coverage, or structural issues can disqualify projects—additionally, co-ops typically don’t qualify for HECM reverse mortgages though some proprietary products might be available.

Condo-specific considerations:

- Project must meet all FHA condo approval requirements

- HOA fees count in financial assessment calculations

- Special assessments may affect qualification or proceeds

- Must maintain condo insurance and pay HOA fees to avoid default

- Condo approval status can change over time

Can You Get a Reverse Mortgage With Bad Credit?

Credit history is less important for reverse mortgages than traditional mortgages, but financial assessment still reviews your credit to evaluate willingness to meet financial obligations—seriously delinquent taxes or federal debts, recent mortgage foreclosure, or patterns indicating unwillingness to pay obligations can create challenges, though many credit issues that would prevent traditional mortgage approval don’t automatically disqualify reverse mortgage applicants.

What credit issues cause reverse mortgage denial? Recent foreclosure, outstanding federal tax liens, delinquent property taxes on the subject property, or patterns showing unwillingness to meet financial obligations—additionally, if financial assessment determines you lack ability to pay property taxes and insurance going forward, you may be declined or face mandatory set-aside requirements reducing proceeds.

Credit and financial assessment considerations:

- Willingness to meet obligations matters more than scores

- Must demonstrate ability to pay property taxes and insurance

- Recent payment of property charges shows good faith

- Explanation letters can address past credit events

- Life Expectancy Set Asides can accommodate borderline situations

- Residual income analysis evaluates whether income suffices

What Happens to a Reverse Mortgage in Bankruptcy?

Filing bankruptcy doesn’t automatically trigger reverse mortgage maturity, but bankruptcy trustees may require selling the home to satisfy creditors if sufficient equity exists beyond the reverse mortgage balance and bankruptcy exemptions—reverse mortgage borrowers can file bankruptcy and potentially remain in their homes if they have little equity beyond the loan balance and their situation qualifies for bankruptcy protection.

Should you consider reverse mortgages to avoid bankruptcy? Using reverse mortgage proceeds to pay debts and avoid bankruptcy is a significant decision requiring professional legal and financial advice—while reverse mortgages can provide funds to manage debt, the proceeds are limited and the decision should consider all alternatives, long-term implications, and whether bankruptcy might actually serve your interests better.

Bankruptcy considerations:

- Consult bankruptcy attorney before using reverse mortgage to pay debts

- Understand which debts are dischargeable in bankruptcy

- Consider whether postponing bankruptcy makes strategic sense

- Reverse mortgage proceeds become assets in bankruptcy if not spent

- Must continue meeting reverse mortgage obligations even in bankruptcy

- Home may be sold in bankruptcy if equity exists beyond exemptions

Can You Have a Reverse Mortgage and Home Equity Line of Credit?

You can have a HELOC or other lien before getting a reverse mortgage, but all existing liens must be paid off with reverse mortgage proceeds at closing—after obtaining a reverse mortgage, you generally cannot take out additional liens against the property as this would violate reverse mortgage terms requiring the lender to maintain first lien position.

Why can’t you add a HELOC after getting a reverse mortgage? Reverse mortgage lenders require first lien position on the property as primary protection for their loan—allowing additional liens would reduce their security and create complications, so reverse mortgage agreements prohibit additional borrowing against the home without lender permission (rarely granted).

Lien considerations:

- All existing mortgages, HELOCs, and liens must be paid at reverse mortgage closing

- Cannot take out additional secured loans against the property after reverse mortgage

- Second mortgages or HELOCs violate reverse mortgage terms

- Property tax liens or HOA liens can still attach and must be paid

- Judgment liens from lawsuits can attach but must be resolved

Reverse Mortgage Strategy #5: Evaluate Alternatives Before Proceeding

Should you consider alternatives before getting a reverse mortgage? Yes, reverse mortgages serve specific purposes well but aren’t optimal for every situation—evaluating alternatives like home equity loans or HELOCs, downsizing and relocating, spending down other assets first, or seeking family assistance helps you determine whether reverse mortgages genuinely represent your best option or if simpler solutions might work better.

Comprehensive evaluation ensures you’re not choosing reverse mortgages simply because you haven’t fully explored other approaches.

Home Equity Loans and HELOCs

Traditional equity borrowing offers alternatives:

Home equity loan advantages:

- Lower interest rates than reverse mortgages typically

- Fewer upfront costs and fees

- Fixed monthly payments provide structure

- Build credit through payment history

- More straightforward product structure

Home equity loan disadvantages:

- Requires monthly payments from your income

- Must qualify based on income and credit

- Can lead to foreclosure if you can’t make payments

- Depletes monthly cash flow

- May be difficult for retirees with limited income to qualify

When home equity loans work better:

- You have adequate income to afford monthly payments

- You need funds for short-term purposes with plan to repay quickly

- You want to preserve more long-term equity

- You’re younger than 62 and can’t qualify for reverse mortgages

- You prefer simpler product without reverse mortgage complexity

When reverse mortgages work better:

- You cannot afford monthly loan payments

- Income insufficient to qualify for traditional home equity products

- You want to eliminate existing mortgage payment burden

- You plan to age in place long-term

- You value the no-payment structure for peace of mind

Downsizing and Selling

Relocating to smaller or less expensive homes provides equity access:

Downsizing advantages:

- Access equity without ongoing debt

- Reduce property taxes, insurance, and maintenance costs

- Eliminate future home appreciation dependence

- Simplify lifestyle with smaller space

- Relocate closer to family or preferred location

Downsizing disadvantages:

- Must leave your home and community

- Moving costs and stress of relocation

- Smaller homes may not accommodate your needs

- May regret leaving familiar surroundings

- Transaction costs reduce net proceeds

When downsizing makes more sense than reverse mortgages:

- Your home is too large or difficult to maintain

- Property taxes and upkeep costs are burdensome

- You’re open to relocating and embracing change

- Family or preferred location is elsewhere

- You want to eliminate homeownership responsibilities entirely

Spending Other Assets First

Using retirement accounts or investments before tapping home equity:

Asset drawdown advantages:

- Preserves home equity for true emergencies or heirs

- Avoids reverse mortgage costs and complexity

- Maintains flexibility to move if circumstances change

- May provide tax management opportunities

- Simpler from planning and accounting perspective

Asset drawdown disadvantages:

- Depletes retirement savings potentially needed later

- May require selling investments at inopportune times

- Reduces investment portfolio returns

- Creates taxable events unlike reverse mortgage proceeds

- Eliminates liquid emergency reserves

When using other assets first makes sense:

- You have substantial retirement accounts or investments

- Current market conditions favor liquidating investments

- Tax situation makes draws from retirement accounts advantageous

- You want to preserve home equity for heirs or other purposes

- You may need to relocate in near term

Family Assistance

Borrowing from or receiving support from family members:

Family assistance advantages:

- Avoids commercial loan costs and interest

- May be offered on better terms or as gift

- Keeps finances within family

- Provides flexibility not available with formal loans

Family assistance disadvantages:

- Creates emotional and relationship dynamics

- May strain family relationships if misunderstandings occur

- Reduces inheritance to other family members

- May not be sustainable long-term

- Can create fairness issues among siblings

When is family assistance appropriate? Only when family members genuinely have capacity to help without jeopardizing their own financial security, clear written agreements exist documenting terms, all parties understand and accept the arrangement, and relationships can withstand potential complications—family money often creates complex dynamics requiring careful navigation.

Reverse Mortgage Success Stories

See how other seniors have successfully used reverse mortgages:

- View reverse mortgage purchase case studies

- View reverse mortgage refinance case studies

- View reverse mortgage cash-out refinance case studies

- View reverse mortgage income case studies

Calculate your reverse mortgage scenarios:

- Reverse mortgage calculator

- Reverse mortgage refinance calculator

- Reverse mortgage cash-out refinance calculator

- Reverse mortgage income calculator

Alternative Loan Programs for Seniors and Retirees

If a reverse mortgage isn’t the right fit, consider these alternatives:

- HELOC – Flexible line of credit against home equity with monthly payment obligations

- Home Equity Loan – Fixed-rate lump sum borrowing against home equity requiring monthly payments

- Cash-Out Refinance – Refinance existing mortgage and access equity with traditional monthly payments

- Asset-Based Loan – Leverage investment portfolios for home purchases or refinancing

- Bridge Loan – Short-term financing for purchasing a new home before selling current residence

Explore all 30+ loan programs to find your best option.

Not sure which program is right for you? Take our discovery quiz to find your path.

Helpful Reverse Mortgage Resources

Official Government Guidance

HUD HECM Reverse Mortgage Information – Department of Housing and Urban Development’s official resource center for Home Equity Conversion Mortgages providing program details, borrower protections, counseling requirements, and lender approval lists.

Consumer Financial Protection Bureau Reverse Mortgage Guide – Federal consumer protection agency offering educational resources on reverse mortgages, borrower rights, costs, risks, and alternatives to help seniors make informed decisions.

IRS Publication 936: Home Mortgage Interest Deduction – Official IRS guidance on mortgage interest deductibility including treatment of reverse mortgage interest, limitations on deductions, and reporting requirements for itemized returns.

Industry Organizations

National Council on Aging Reverse Mortgage Resources – Nonprofit organization serving older Americans providing objective reverse mortgage education, benefits checkup tools, financial planning resources, and counseling referrals for seniors considering home equity conversion.

AARP Reverse Mortgage Information – Membership organization for Americans 50+ offering comprehensive reverse mortgage guidance, scam warnings, calculator tools, and educational materials helping seniors evaluate whether reverse mortgages fit their situations.

Educational Resources

National Reverse Mortgage Lenders Association – Trade association representing reverse mortgage industry providing consumer education, lender directories, market data, and resources on responsible reverse mortgage origination and servicing.

Financial Industry Regulatory Authority Reverse Mortgage Guide – Financial industry regulatory organization offering investor protection resources including reverse mortgage education, cost comparisons, risk analysis, and guidance on evaluating products.

Social Security Administration Benefit Programs – Official information on Social Security retirement benefits, Medicare, Supplemental Security Income, and other programs that may interact with reverse mortgage proceeds in planning your retirement income strategy.

Need local expertise? Get introduced to trusted partners including loan officers, realtors, and contractors in your area.

Ready to get started? Apply now or schedule a call to discuss your situation.

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Not Sure About Your Next Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Related Posts

Subscribe to our newsletter

Get program updates and rate insights in your inbox.