Home Equity Loan: 7 Benefits of Fixed-Rate Lump Sum Financing Using Your Property Equity for Major Expenses

Tap Into Your Home's Wealth with Predictable, One-Time Financing

Your home equity represents years of mortgage payments and property appreciation—potentially tens or hundreds of thousands of dollars in Trade Commission home equity lending guidance accessible wealth. A home equity loan transforms this paper value into spendable cash with a fixed lump sum, stable interest rate, and predictable monthly payments that make budgeting simple and financial planning straightforward.

Key Details: What You’ll Learn About Home Equity Loans

- How home equity loans provide lump-sum financing secured by your property equity with fixed repayment terms (Consumer Financial Protection Bureau home equity loan overview)

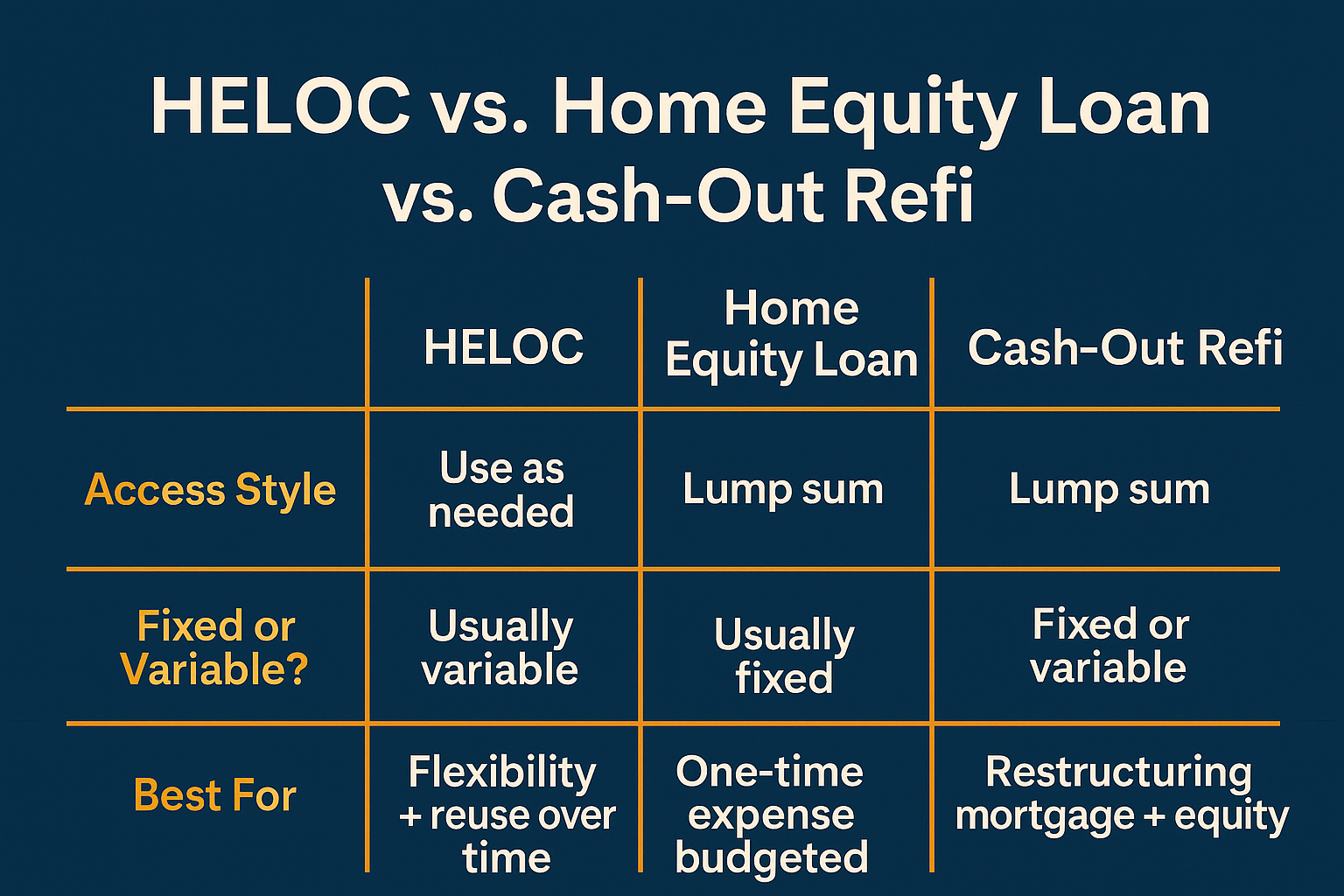

- The differences between home equity loans, HELOCs, and cash-out refinancing for accessing property value (Federal Reserve home equity borrowing guide)

- Qualification criteria including equity requirements, credit profiles, and income verification standards

- Strategic uses for home equity loan funds from consolidation to improvements and major purchases

- Fixed-rate structures providing payment stability throughout the entire loan term (Federal Trade Commission home equity lending guidance)

- Tax implications and potential interest deductibility for qualified expenditures (IRS home mortgage interest deduction rules)

- Closing costs, fees, and total cost considerations when comparing equity access options

Ready to explore your options? Schedule a call with a loan advisor.

What Is a Home Equity Loan?

A home equity loan, sometimes called a second mortgage, is a fixed-amount loan secured by your home’s equity—the difference between your property’s current market value and what you owe on your mortgage. You receive the entire loan amount at closing, then repay it over a set term with fixed monthly payments that never change.

Why choose a home equity loan over other borrowing options? The combination of fixed payments, typically competitive interest rates, and substantial borrowing capacity makes home equity loans ideal when you need a specific amount for a defined purpose and want absolute payment predictability.

Unlike credit cards or personal loans with variable rates and higher costs, home equity loans leverage your property’s value to secure lower interest rates. Unlike HELOCs with variable payments and revolving access, home equity loans provide certainty—you know exactly how much you’ll borrow, what you’ll pay monthly, and when the loan will be completely repaid.

How Does a Home Equity Loan Differ from Other Financing Options?

Understanding your equity access alternatives helps you select the right financing tool:

Home equity loan characteristics:

- Lump sum disbursed at closing

- Fixed interest rate throughout entire term

- Predictable monthly payment that never changes

- Set repayment period with specific payoff date

- Keeps your first mortgage separate and untouched

- Best when you know exact amount needed

HELOC comparison points:

- Revolving credit line like a credit card

- Variable interest rates that fluctuate

- Borrow only what you need when you need it

- Interest-only payment options during draw period

- Flexibility for ongoing or uncertain needs

- Payment amounts vary based on balance and rates

Cash-out refinance differences:

- Replaces your existing first mortgage entirely

- Single loan payment instead of two

- May make sense when refinancing to better rate

- Typically higher closing costs

- Extends new mortgage term

- Changes your existing mortgage terms

For borrowers with favorable first mortgage rates who need a specific lump sum with payment certainty, home equity loans typically offer the most efficient solution.

7 Smart Ways to Use a Home Equity Loan

1. Consolidate High-Interest Debt into One Manageable Payment

How much can you save by consolidating expensive credit card balances? Home equity loans offer dramatic interest savings compared to credit cards and personal loans:

Debt consolidation advantages through home equity loans:

- Interest rates substantially lower than credit cards

- Single fixed payment replacing multiple variable obligations

- Potential tax deductibility depending on fund usage (consult tax professional)

- Improved monthly cash flow from reduced payments

- Simplified financial management with one payment date

- Clear payoff timeline with defined loan term

- Credit score improvements from reduced credit utilization

Common high-interest debts worth consolidating:

- Credit card balances with double-digit interest rates

- Personal loans with elevated interest costs

- Medical bills creating financial stress

- Auto loans with unfavorable terms

- Student loans with private lender rates

- Tax obligations requiring payment plans

- Legal fees or settlement obligations

Critical consideration: Converting unsecured debt into secured debt means your home backs the new loan. This strategy requires financial discipline to avoid accumulating new credit card balances after consolidation, which would leave you worse off with both mortgage debt and new unsecured obligations.

Successful debt consolidation combines lower-cost financing with behavioral changes addressing the root causes of debt accumulation.

2. Fund Major Home Improvements That Increase Property Value

Home equity loans provide ideal financing for renovations and improvements that enhance your property’s functionality, comfort, and market value:

Why finance improvements with home equity loans?

- Fixed payments simplify renovation budgeting

- Lump sum ensures complete project funding upfront

- Potential tax deductibility when improving the secured property

- Improvements often increase home value exceeding borrowing costs

- Payment terms typically longer than contractor financing

- Competitive interest rates compared to alternatives

High-return improvement projects suited for home equity loan financing:

- Kitchen remodels updating layouts, appliances, and finishes

- Bathroom renovations adding functionality or additional bathrooms

- Room additions expanding livable square footage

- Basement finishing creating usable living space

- Roof replacement protecting long-term property integrity

- HVAC system upgrades improving efficiency and comfort

- Energy-efficient windows and insulation reducing utility costs

- Outdoor living spaces including decks, patios, and landscaping

Strategic improvement approach: Focus on renovations that align with your neighborhood’s value range and appeal to broad buyer preferences if resale value matters. Over-improving beyond your area’s standards may not generate proportional value increases.

Even if improvements don’t fully recover costs at resale, the enjoyment and utility you gain during ownership often justify the investment.

3. Finance Education Expenses with Better Terms Than Student Loans

Can home equity loans provide more favorable education financing than traditional student loans? For many families, the answer is yes:

Education financing through home equity loan advantages:

- Interest rates often more competitive than private student loans

- No origination fees typical of many student loan programs

- Fixed payments providing budget certainty throughout school

- Flexible use for any education-related expenses

- No restrictions on schools, programs, or degree types

- Potential tax deductibility for qualified education expenses

- Faster approval process than federal student loan programs

Appropriate education financing scenarios:

- Parent borrowing for children’s college expenses

- Graduate school or professional degree programs

- Continuing education and career advancement certifications

- International study programs not eligible for federal aid

- Education costs exceeding federal student loan limits

- Private K-12 education expenses

Important considerations before using home equity for education:

- Student loan protections (deferment, forbearance, forgiveness) don’t apply to home equity loans

- Your home secures the debt, creating foreclosure risk if repayment becomes difficult

- Home equity loans typically aren’t dischargeable in bankruptcy

- Requires sufficient home equity and qualifying credit

- Education investment should have strong career return potential

Home equity education financing works best for families with stable income, clear repayment capacity, and education investments likely to generate career advancement and earning increases.

4. Purchase or Finance Investment Properties and Business Ventures

How can entrepreneurs and real estate investors leverage home equity for business growth? Home equity loans provide accessible capital for wealth-building opportunities:

Investment and business financing applications:

- Down payments on rental properties and investment real estate

- Business startup costs and initial operating capital

- Equipment purchases for existing businesses

- Franchise acquisitions or business purchases

- Real estate development or fix-and-flip projects

- Professional practice purchases or partnerships

- Inventory financing for retail or wholesale businesses

- Commercial vehicle or equipment acquisitions

Investment financing advantages:

- Faster approval than traditional business loans

- Less documentation than SBA or commercial financing

- Competitive interest rates leveraging home equity

- Fixed payments simplifying business cash flow planning

- No equity dilution unlike bringing in investors

- Flexible use of funds without lender restrictions

Investment financing risks:

- Your personal residence secures business or investment debt

- Business failures or investment losses still require loan repayment

- Mixing personal and business finances creates complexity

- Interest typically not deductible for investment or business purposes

Real estate investors particularly appreciate home equity loans for down payments on additional properties. After purchasing and stabilizing rental properties, many investors refinance those properties to repay home equity loans, then repeat the process—a strategy called the BRRRR method (Buy, Rehab, Rent, Refinance, Repeat).

Considering using equity for investments? Submit a refinance inquiry to explore if a home equity loan makes sense for your goals.

5. Cover Major Life Expenses with Predictable Financing

Life brings significant expenses that strain budgets and savings. Home equity loans provide manageable financing for major one-time costs:

Significant life expenses suited for home equity financing:

- Wedding celebrations and associated costs

- Adoption expenses and family expansion costs

- Medical procedures not covered by insurance

- Elder care expenses for aging parents

- Funeral and estate settlement costs

- Divorce settlements and legal obligations

- Natural disaster recovery and uninsured losses

- Major vehicle purchases for family needs

When home equity loans make sense for life expenses:

- The expense is substantial relative to available savings

- Alternative financing options carry higher interest costs

- You prefer fixed predictable payments over variable options

- The expense provides long-term value or necessity

- Depleting emergency savings would create vulnerability

Exercise caution using home equity for:

- Discretionary luxury purchases with limited lasting value

- Expenses that could reasonably be saved for over time

- Consumption that doesn’t improve your long-term financial position

- Lifestyle inflation beyond your actual income capacity

The key is distinguishing between necessary major expenses and wants that should be financed through savings or forgone entirely. Your home equity represents accumulated wealth that deserves thoughtful deployment toward genuinely important financial needs.

6. Make Large Purchases Without Depleting Emergency Reserves

Should you drain savings for major purchases when home equity provides alternative financing? Strategic use of home equity loans preserves financial flexibility:

Preserving liquidity while making major purchases:

- Maintain emergency funds for unexpected income disruptions

- Keep investment portfolios growing without forced liquidation

- Avoid capital gains taxes from selling appreciated investments

- Preserve retirement account balances and avoid early withdrawal penalties

- Maintain financial flexibility for other opportunities

- Build credit through additional payment history

Purchase scenarios where preserving cash makes strategic sense:

- Vehicle replacements necessary for employment or family needs

- Essential home systems requiring immediate replacement (HVAC, roof, etc.)

- Time-sensitive investment opportunities with high return potential

- Major appliance packages for new or renovated homes

- Furniture and furnishings for significant life changes

This strategy works best when:

- Your income reliably supports the additional payment

- The purchase provides genuine long-term value

- Maintaining liquid reserves offers meaningful security or opportunity

- Alternative financing costs more than home equity loan rates

Treating home equity as a tool for optimizing overall financial position—rather than simply the cheapest available money—leads to smarter borrowing decisions.

7. Bridge Financial Gaps During Career Transitions or Income Changes

Income disruptions from career changes, business transitions, or life circumstances create temporary cash flow challenges. Home equity loans can provide bridge financing during these periods:

Career transition scenarios benefiting from home equity financing:

- Starting new businesses with delayed revenue

- Returning to school for career advancement

- Relocating for better employment opportunities

- Transitioning from employment to self-employment

- Sabbaticals for personal or professional development

- Recovery periods after job loss or health issues

Strategic bridge financing approach:

- Calculate realistic timeline for income restoration or growth

- Ensure conservative estimate of transition duration

- Maintain strict budget during transition period

- Have backup plans if transition takes longer than expected

- Build reserves before initiating voluntary transitions

Home equity loans provide breathing room during transitions without forcing premature decisions or suboptimal compromises. Fixed payments allow precise budgeting during uncertain income periods.

Warning: Using home equity to support lifestyle during indefinite unemployment or failing business ventures can lead to home loss. This strategy works best for well-planned transitions with realistic timelines and high success probability.

Explore all loan programs to compare equity access options.

What Are the Home Equity Loan Requirements?

Who qualifies for home equity loan financing? Lenders evaluate several key factors when considering applications.

Equity Position and Loan-to-Value Requirements

Your available equity directly determines your maximum borrowing capacity:

Equity calculation fundamentals:

- Current property market value (determined by appraisal)

- Minus your existing first mortgage balance

- Minus any other liens or obligations against the property

- Equals your available equity

Most lenders allow total borrowing (first mortgage plus home equity loan) up to certain percentages of your property’s value. The exact ratio varies based on your credit profile, property type, documentation, and lender program.

Factors influencing maximum borrowing capacity:

- Strength of your overall financial profile

- Property type, condition, and location characteristics

- Primary residence versus investment property or second home

- Income documentation type and verification method

- Credit history and payment patterns

Larger equity cushions provide greater borrowing capacity and typically access more favorable interest rates reflecting reduced lender risk.

Credit Profile and Payment History

What credit profile supports home equity loan approval? Requirements vary by lender and program structure:

Credit evaluation considerations:

- Overall credit history demonstrating responsible borrowing patterns

- Payment history on existing mortgage and other obligations

- Credit utilization on revolving accounts

- Recent credit inquiries and new account openings

- Public records including bankruptcies, foreclosures, and judgments

- Collections and charge-offs indicating financial stress

- Overall financial management and stability patterns

Lenders consider your complete financial picture beyond just credit scores. Strong compensating factors including substantial equity, high stable income, or significant reserves can sometimes offset credit concerns.

Borrowers with stronger credit profiles typically access larger loan amounts, better interest rates, and more favorable terms reflecting their lower risk profile.

Income Verification and Debt-to-Income Analysis

Lenders must verify your capacity to handle home equity loan payments alongside existing obligations:

Income documentation requirements:

- W-2 employees: Recent paystubs and tax returns spanning recent years

- Self-employed borrowers: Business and personal tax returns with all schedules

- Retirees: Social Security awards, pension statements, investment distributions

- Rental income: Lease agreements and tax return Schedule E documentation

- Multiple income sources: Verification for each income type

Your monthly debt obligations relative to gross monthly income significantly impacts approval decisions and maximum loan amounts. Lower debt-to-income ratios demonstrate greater financial capacity to comfortably handle additional payments.

Debt-to-income ratio components:

- Current mortgage principal, interest, taxes, insurance, and HOA fees

- Proposed home equity loan payment

- Minimum payments on all credit cards and installment loans

- Auto loans, student loans, and personal loans

- Alimony, child support, and other regular obligations

Stronger income documentation combined with lower existing debt obligations generally produces larger loan approvals and better terms.

Property Eligibility and Condition Standards

Your property must meet lender requirements and be accurately valued:

Property eligibility factors:

- Primary residences typically offer most favorable terms and maximum loan amounts

- Second homes may have slightly reduced loan limits

- Investment properties face stricter requirements and lower maximums

- Property must meet minimum condition and safety standards

- Clear title without problematic liens or encumbrances

- Adequate property insurance coverage

Professional appraisals establish your property’s current market value, directly determining available equity. Appraisers evaluate:

- Recent comparable property sales in your specific market area

- Your property’s condition, size, layout, and feature set

- Location factors including neighborhood quality and market trends

- Improvements and upgrades enhancing value

- Overall market conditions and appreciation patterns

Properties in strong, appreciating markets with good condition maximize available equity and borrowing capacity.

How Does the Home Equity Loan Process Work?

Application and Initial Qualification

What should you prepare before applying for a home equity loan? Organized documentation accelerates the approval process:

Essential documentation preparation:

Income and employment verification:

- Recent pay stubs covering at least one month of earnings

- W-2 forms for the past two years

- Complete tax returns for recent years with all schedules

- Self-employment business documentation (tax returns, P&Ls, bank statements)

- Retirement income award letters and distribution statements

- Investment account statements showing dividends and interest

Asset documentation:

- Bank statements for all checking and savings accounts

- Investment and brokerage account statements

- Retirement account balances (401k, IRA, etc.)

- Other significant assets including vehicles, real estate, business interests

- Gift funds documentation if applicable

Property information:

- Current homeowners insurance declaration page

- Recent mortgage statements showing current balance

- Property tax bills and payment history

- HOA documentation and fee information

- Recent property improvements or appraisals

Credit and identity:

- Government-issued photo identification

- Social Security number verification

- Authorization for credit report access

- Explanation letters for any credit issues or recent inquiries

Thorough documentation preparation demonstrates professionalism and often results in faster processing with fewer follow-up requests interrupting the approval timeline.

Appraisal and Property Valuation

After submitting your application, lenders order professional property appraisals:

Appraisal process overview:

- Licensed appraiser physically inspects your property

- Comparable sales analysis establishes current market value

- Property condition assessment ensures minimum standards

- Appraisal report typically completed within 1-2 weeks

- Final value determines your maximum available borrowing

Appraisal considerations:

- Market conditions significantly impact valuations

- Recent comparable sales drive value conclusions

- Property condition and improvements influence value

- Appraisers use objective standards, not your opinions

- Appeal processes exist if you believe appraisal is inaccurate

Lower-than-expected appraisals sometimes limit borrowing capacity. If this occurs, options include:

- Accepting lower loan amount aligned with actual value

- Providing additional comparable sales supporting higher value

- Challenging appraisal through formal dispute process

- Delaying application until additional market appreciation occurs

- Making improvements that increase property value before reapplying

Underwriting and Final Approval

Underwriters thoroughly review your complete financial profile:

Underwriting evaluation components:

- Income verification and employment stability assessment

- Credit report analysis and risk evaluation

- Debt-to-income ratio calculations

- Asset verification and reserve adequacy

- Property value and equity confirmation

- Overall financial capacity and stability review

Underwriters frequently request additional documentation or clarification during their review. Common requests include:

- Explanation letters for credit inquiries, account changes, or employment gaps

- Additional income documentation for complex situations

- Updated asset statements reflecting recent activity

- Property documentation clarifying condition or ownership

- Verification of funds for closing costs and reserves

Responding promptly to underwriter requests maintains application momentum and prevents unnecessary delays.

Most home equity loan applications process within 2-4 weeks from complete application submission to final approval, though timelines vary based on documentation complexity, appraisal scheduling, and lender processing volume.

Closing and Fund Disbursement

Once approved, you’ll attend closing to sign final documents and receive your funds:

Closing process:

- Review and sign loan agreement and closing disclosures

- Sign promissory note obligating repayment

- Record lien against property securing the loan

- Receive funds via check, wire transfer, or direct deposit

- Obtain all final loan documents for your records

Right of rescission: Federal law provides a three-day rescission period for home equity loans on primary residences, during which you can cancel without penalty. Funds become available after this period expires.

Your first payment typically begins 30-45 days after closing, giving you time to receive and cash your loan proceeds before repayment obligations begin.

Want to discuss your specific refinance scenario? Submit a refinance inquiry to explore your options.

Frequently Asked Questions About Home Equity Loans

How do home equity loan payments work?

What can you expect regarding payment structure and obligations? Home equity loans feature straightforward, predictable payment schedules:

Payment structure characteristics:

- Fixed monthly payment amount throughout entire loan term

- Principal and interest combined in each payment

- Payment amount never changes regardless of market conditions

- Amortization schedule showing principal/interest breakdown

- Clear payoff date when loan will be completely satisfied

- Payments typically begin 30-45 days after closing

Each payment reduces your outstanding principal balance while covering accrued interest. Early in the loan term, higher portions go toward interest with relatively small principal reduction. As the loan ages, principal portions increase while interest portions decrease—standard amortization mathematics.

Payment stability benefits:

- Simplified budgeting with unchanging obligations

- No payment shock from rate adjustments

- Predictable payoff timeline

- Easy comparison shopping based on fixed terms

This predictability contrasts sharply with variable-rate products where payments fluctuate based on market interest rate changes.

Calculate your home equity loan scenario:

Can home equity loan interest be tax-deductible?

Under what circumstances might home equity loan interest qualify for tax deductions? Tax treatment depends entirely on fund usage:

Current IRS guidance indicates home equity loan interest may be deductible when proceeds are used to buy, build, or substantially improve the home securing the loan. Interest on funds used for other purposes typically doesn’t qualify for deductions under current tax law.

Potentially deductible uses:

- Home renovations and improvements

- Room additions or expansions

- Major repairs maintaining or increasing property value

- Home purchase down payment assistance

Typically non-deductible uses:

- Debt consolidation

- Vehicle purchases

- Education expenses

- Investment activities

- Business financing

- General consumption and living expenses

Tax laws are complex, change periodically, and depend on individual circumstances. Always consult qualified tax professionals who understand your complete financial picture before making decisions based on tax considerations.

Proper documentation tracking exactly how you use home equity loan proceeds supports your tax position if questioned by the IRS.

What happens if you sell your home before paying off the equity loan?

How are home equity loans handled during property sales? Equity loans must be satisfied when selling, just like first mortgages:

Sale process with home equity loans:

- Payoff calculation: Lender provides exact payoff amount including accrued interest through closing date

- Lien satisfaction: Home equity loan paid from sale proceeds at closing

- Title clearance: Lender releases lien after receiving payment

- Net proceeds: Remaining funds after paying all mortgages, liens, and closing costs

- No portability: Cannot transfer home equity loan to new property

Your net proceeds equal your sale price minus:

- First mortgage payoff

- Home equity loan payoff

- Any other liens or judgments

- Real estate commissions

- Closing costs and prorations

- Other seller obligations

Calculate net proceeds carefully when considering selling to ensure you’ll have sufficient funds for your next purchase or other goals after satisfying all obligations.

Can you pay off a home equity loan early without penalties?

Most home equity loans allow early payoff without prepayment penalties, though reviewing your specific loan agreement is essential:

Early payoff considerations:

- Verify your loan documents don’t contain prepayment penalty clauses

- Some lenders charge fees if you pay off within initial years

- Interest savings can be substantial when paying off early

- Eliminating debt frees up monthly cash flow

- Reduces risk exposure from secured debt against your home

When early payoff makes financial sense:

- You receive lump sums from bonuses, inheritance, or asset sales

- Interest rates are relatively high compared to investment returns

- You’re achieving debt-free status as financial goal

- Eliminating debt provides peace of mind and reduced stress

- Monthly payment freed up serves other financial priorities

When maintaining the loan might make sense:

- Interest rate is very competitive compared to other debt

- Funds earning higher returns in investments than loan costs

- Tax deductibility makes effective interest rate extremely low

- Maintaining liquidity serves other financial objectives

- Payment is easily manageable and doesn’t constrain your budget

Run the numbers considering your complete financial picture rather than assuming early payoff is always optimal.

How do home equity loans affect your credit score?

What credit impacts should you expect from home equity loans? Opening and managing these loans influences multiple credit factors:

Credit score impact factors:

- Hard inquiry: Credit check creates small, temporary score reduction (typically minor)

- New account: Slightly lowers average account age initially

- Credit mix: Adding installment debt may benefit score diversity

- Payment history: On-time payments build positive history over time

- Debt levels: Increased total debt may initially reduce scores slightly

- Credit utilization: Doesn’t directly affect utilization like revolving credit

Ongoing credit management:

- Consistent on-time payments gradually improve scores

- Lower overall debt-to-income ratio benefits future applications

- Closing paid-off account reduces total available credit slightly

- Missed payments severely damage credit scores and future borrowing

For most borrowers with good credit, opening home equity loans causes only small, temporary score reductions. Over time, perfect payment history typically results in net score improvements compared to pre-loan levels.

What’s the difference between a home equity loan and a second mortgage?

Are these terms interchangeable or different products? They’re essentially the same thing with slightly different usage contexts:

The terms “home equity loan” and “second mortgage” are generally synonymous, both describing loans secured by your property in second lien position behind your primary mortgage. The subtle distinction lies in emphasis:

“Home equity loan” emphasizes:

- Using accumulated equity as borrowing basis

- Consumer-friendly marketing terminology

- Focus on accessing property value you’ve built

“Second mortgage” emphasizes:

- Lien position behind the first mortgage

- Technical/legal terminology

- Priority in foreclosure situations

Functionally, they operate identically—fixed-rate, lump-sum loans secured by your home in subordinate position to your first mortgage. Both terms appear interchangeably in lending documentation and casual conversation.

See how other homeowners have successfully used home equity loan financing:

Alternative Loan Programs for Accessing Home Equity

If a home equity loan isn’t the right fit, consider these alternatives:

- HELOC – Flexible line of credit against home equity with variable rates and draw-as-needed access

- Cash-Out Refinance – Refinance your existing mortgage and access equity in a single loan with one monthly payment

- Home Improvement Loan – Specialized financing for renovation projects with competitive terms

- Bridge Loan – Short-term financing using current home equity for purchasing a new property

- Reverse Mortgage – For homeowners 62+ to access equity without monthly payments

Explore all 30+ loan programs to find your best option.

Not sure which program is right for you? Take our discovery quiz to find your path.

Advanced Home Equity Loan Questions

How do home equity loans work for investment properties?

Can you get home equity loans on rental properties? Yes, though qualification requirements are more stringent:

Investment property home equity loan considerations:

- Lower maximum borrowing relative to property value

- Higher interest rates reflecting increased lender risk

- More substantial down payment and reserve requirements

- Rental income must be documented and verified

- Property cash flow analysis influences approval

- Stronger credit profiles typically required

- Some lenders don’t offer investment property programs

Investment property equity loans work well for real estate investors who:

- Want to access equity for additional property acquisitions

- Need capital for improvements across their portfolio

- Prefer keeping existing first mortgages undisturbed

- Value payment predictability for business planning

- Have specific, defined capital needs rather than ongoing access requirements

Qualification typically requires demonstrating both strong personal income and rental property profitability, combined with substantial reserves covering extended vacancy periods.

Can you have multiple home equity loans on one property?

How many equity loans can you stack on a single property? Technically possible but increasingly difficult:

Multiple home equity loan considerations:

- Each subsequent loan takes a lower lien position (third, fourth, etc.)

- Lower priority liens carry higher risk, resulting in higher interest rates

- Combined loan amounts limited by available equity and qualification

- Income must support all mortgage payments simultaneously

- Most lenders hesitant to take third or lower lien positions

- Finding lenders for multiple equity loans becomes progressively harder

Most borrowers find one properly-sized home equity loan or HELOC more practical than multiple smaller loans. Consolidating needs into single financing usually produces better terms and simplified management.

Real estate investors sometimes use multiple properties’ equity through separate loans on each property rather than stacking multiple loans on one property.

What happens to your home equity loan during divorce?

How are home equity loans handled in divorce proceedings? Treatment varies based on state law and individual circumstances:

Divorce and home equity loan scenarios:

If keeping the property:

- Spouse keeping home typically assumes both first mortgage and equity loan

- Refinancing may be necessary to remove ex-spouse from obligations

- Court may order equity loan payoff from asset division

- Lenders require formal assumption or refinance for liability release

If selling the property:

- Home equity loan paid from sale proceeds like first mortgage

- Remaining equity divided per divorce settlement

- Both parties released from obligations after sale completion

- Negative equity situations require negotiated resolution

If neither can afford payments:

- Short sale may be necessary if equity insufficient to cover loans

- Foreclosure becomes possibility if payments stop

- Both parties’ credit damaged by mortgage defaults

- Negotiated loan modifications sometimes available

Divorce financial settlements should address home equity loan responsibility explicitly. Divorce decrees don’t automatically release either party from lender obligations—formal assumption, refinance, or payoff is required.

Consult family law attorneys and financial advisors to understand implications and options for your specific situation.

Can you convert a home equity loan to a first mortgage?

Is there a way to combine your first mortgage and home equity loan? Yes, through cash-out refinancing:

Loan consolidation through refinancing:

When consolidation makes sense:

- Your first mortgage interest rate is unfavorable compared to current market

- Combined payment would be lower than separate payments

- You want simplified finances with single payment

- You can access better terms through consolidation

- Eliminating second lien provides psychological or financial benefit

Consolidation process:

- Apply for new first mortgage for amount covering both loans

- New mortgage pays off existing first mortgage and home equity loan

- Results in single monthly payment at blended rate

- Extends to new full-term mortgage timeline

- Involves standard closing costs and fees

When keeping loans separate makes more sense:

- Your first mortgage has excellent rate that would worsen through refinancing

- Closing costs exceed the benefit of consolidation

- You’re close to paying off one or both loans

- Maintaining separate payments isn’t burdensome

- You value having different terms and payoff timelines

Calculate total costs and long-term interest comparing separate loans versus consolidated refinancing before making decisions.

How do home equity loans affect property tax assessments?

Will borrowing against equity increase your property taxes? No—taking out home equity loans doesn’t directly affect property tax assessments:

Property tax and home equity loan relationship:

- Borrowing against equity doesn’t change your property’s assessed value

- Property taxes based on assessed value, not loan amounts

- Tax assessments update based on sales, improvements, and periodic revaluations

- Using equity loan funds for improvements may eventually increase assessed value

- Tax increases come from improvements themselves, not the financing method

When improvements financed with equity loans might increase taxes:

- Major additions increasing square footage

- Significant upgrades substantially improving property condition

- New construction on the property

- Finished spaces previously counted differently (basements, attics)

Tax assessors evaluate physical property changes, not how you financed them. Improvements funded through savings would have identical tax implications as those funded through equity loans.

Can self-employed borrowers qualify for home equity loans?

Do home equity loans work for business owners and self-employed individuals? Absolutely, with appropriate documentation:

Self-employed borrower qualification:

Documentation requirements:

- Business and personal tax returns for recent years (typically two years minimum)

- All schedules including Schedule C, depreciation schedules, K-1s, etc.

- Year-to-date profit and loss statements

- Business bank statements showing income deposits

- Business licenses and registration documentation

- CPA-prepared financials for complex businesses

Income calculation methods:

- Average income across recent years

- Adjustments for one-time income or expenses

- Add-backs for depreciation, depletion, and non-cash expenses

- Business expense analysis for personal benefit items

- Trending analysis showing income stability or growth

Self-employment challenges:

- Income volatility creates qualification uncertainty

- Tax strategies minimizing income reduce qualifying income

- Business losses in any year significantly impact calculations

- Newer businesses without history face greater obstacles

- Documentation requirements substantially exceed W-2 employees

Self-employed borrowers with established businesses, consistent profitability, and complete documentation routinely qualify for home equity loans. Working with lenders experienced in self-employed lending improves approval odds and expedites processing.

What closing costs should you expect for home equity loans?

How much do home equity loans cost beyond the borrowed amount? Closing costs vary but typically include several standard components:

Common home equity loan closing costs:

- Appraisal fee: Property valuation (typically several hundred dollars)

- Origination or application fee: Lender processing charges

- Title search and insurance: Ensuring clear title and protecting lender

- Recording fees: Government charges for filing lien documentation

- Credit report fee: Pulling and analyzing credit information

- Attorney or settlement fees: Closing coordination and document preparation

- Tax service fee: Monitoring property tax payment status

- Flood certification: Determining flood insurance requirements

Total closing costs typically range from a few hundred to several thousand dollars depending on loan amount, location, and lender fee structures.

Cost reduction strategies:

- Shop multiple lenders comparing fee structures

- Negotiate origination or processing fees

- Ask about no-closing-cost options (fees added to loan balance or rate)

- Time application to avoid rate lock extension fees

- Provide documentation promptly avoiding rush fees

Some lenders offer no-closing-cost home equity loans where fees are either absorbed into loan balance or compensated through slightly higher interest rates. Calculate total cost over your expected loan duration to determine whether paying upfront or financing fees makes better financial sense.

How do home equity loans work during economic downturns?

What happens to home equity loans when property values decline? Economic downturns create challenges for equity-based lending:

Economic downturn impacts:

For existing loans:

- Your payment obligations continue regardless of property value changes

- Declining values don’t trigger payoff demands if you remain current

- You maintain the loan until maturity or you choose to refinance/payoff

- Being “underwater” (owing more than property value) doesn’t immediately matter

- Selling becomes challenging if proceeds won’t cover all liens

For new applications:

- Lenders tighten qualification standards during recessions

- Lower maximum loan-to-value ratios reduce borrowing capacity

- Stricter income and reserve requirements apply

- Appraisals more conservative during declining markets

- Some lenders temporarily suspend equity loan programs

Protecting yourself during economic uncertainty:

- Maintain substantial equity cushion beyond minimum requirements

- Build emergency reserves exceeding normal recommendations

- Ensure stable income from diverse sources

- Avoid using equity for consumption or depreciating assets

- Consider economic timing when planning large equity borrowing

Home equity loans’ fixed-rate structure provides advantage during downturns—your payment remains stable even if adjustable-rate products see payment increases from monetary policy responses to recession.

Can you refinance a home equity loan to better terms?

What options exist for improving home equity loan terms after origination? Refinancing home equity loans works similarly to refinancing first mortgages:

Home equity loan refinancing scenarios:

When refinancing makes sense:

- Market interest rates dropped substantially since origination

- Your credit improved significantly opening access to better terms

- Property value increased creating better loan-to-value ratio

- You want to extend term reducing monthly payment

- Consolidating with other debt produces net benefit

Refinancing process:

- Apply with same lender or shop competitors

- Property reappraisal establishes current value

- Income and credit reverification required

- New closing costs apply

- Calculate breakeven point comparing costs to savings

Alternatives to full refinancing:

- Some lenders offer loan modifications adjusting existing terms

- Rate renegotiation may be possible without full refinance

- Consolidating into cash-out refinance of first mortgage

- Paying off equity loan and opening new HELOC for different structure

Compare all costs including closing fees, interest rate changes, and term differences to ensure refinancing genuinely improves your financial position rather than just appearing better through lower monthly payments achieved by extending the term.

How do home equity loans work for recently purchased properties?

Can you access equity shortly after buying a home? Yes, though limitations often apply:

Recent purchase home equity loan considerations:

Seasoning requirements:

- Many lenders require 6-12 months ownership before home equity loans

- Seasoning periods ensure stable value and prevent flip schemes

- Some programs allow immediate equity access with restrictions

- Recent major appreciation may not count toward equity

Purchase price versus appraised value:

- Most lenders use lesser of purchase price or current appraised value

- Recent appreciation over purchase price often discounted

- Prevents borrowers immediately extracting equity from favorable purchases

- Significant improvements may support value increases

Strategic timing for equity access:

- Plan major improvements before or immediately after purchase

- Allow appropriate seasoning period for value to establish

- Build additional principal paydown improving equity position

- Consider using HELOC during first year with delayed draws

Borrowers who purchased well below market value may find disappointing equity availability until adequate seasoning period passes, even if current appraisals support higher values.

What recourse do lenders have if you default on home equity loans?

What happens if you stop making home equity loan payments? Secured debt means lenders have specific remedies:

Default and foreclosure process:

Consequences of home equity loan default:

- Late fees and default interest rate charges

- Negative credit reporting severely damaging scores

- Acceleration clause making entire balance immediately due

- Foreclosure proceedings possible after sustained default

- Second lien position means foreclosure less likely than first mortgage default

- Credit damage lasting seven years from default

Foreclosure priority in second lien position:

- First mortgage gets paid first from foreclosure proceeds

- Home equity lender receives proceeds only after first mortgage satisfied

- If proceeds insufficient, second lien holder may receive partial or no payment

- Deficiency judgments possible if state law permits

Options before defaulting:

- Contact lender immediately when trouble begins

- Request hardship forbearance or modification

- Explore refinancing to reduce payments

- Consider selling property before foreclosure

- Seek credit counseling for workout options

First mortgage defaults typically result in faster foreclosure since first lien holders have priority. Second lien holders may be more willing to negotiate since foreclosure provides less certain recovery.

Never ignore payment problems—early communication with lenders produces better outcomes than avoiding contact until foreclosure proceedings begin.

Ready to get started? Apply now or schedule a call to discuss your situation.

Helpful Home Equity Loan Resources

Official Government Guidance

Consumer Financial Protection Bureau Home Equity Loan Information – Federal consumer protection resource explaining home equity loan features, differences from first mortgages, and borrower rights throughout the lending process.

Federal Reserve Consumer Home Equity Borrowing Guide – Comprehensive Federal Reserve publication covering home equity loan mechanics, cost comparisons with alternatives, and strategic borrowing considerations.

Federal Trade Commission Home Equity Lending Guidance – Federal guidance on shopping for home equity products, understanding loan terms, and protecting yourself from predatory lending practices.

Tax and Financial Planning Resources

IRS Publication 936 Home Mortgage Interest Deduction – Official IRS guidance on mortgage interest deductibility rules including home equity loan interest limitations and qualified residence definitions.

IRS Publication 523 Selling Your Home – Federal tax information explaining capital gains treatment, home improvement basis adjustments, and principal residence exclusions.

Consumer Protection and Fair Lending

CFPB Mortgage Shopping Tools – Tools and resources for comparing mortgage products, understanding loan estimates, and resolving disputes with lenders.

Federal Reserve Truth in Lending Act Information – Information about required loan disclosures protecting borrowers through transparent cost and term information.

Educational Resources

Fannie Mae Home Equity Borrowing Education – Educational content on responsible home equity borrowing, managing mortgage debt, and avoiding foreclosure during financial hardship.

Freddie Mac Home Equity Access Comparison Guide – Comparative analysis of different home equity access methods including loans, lines of credit, and cash-out refinancing.

Need local expertise? Get introduced to trusted partners including loan officers, financial advisors, and real estate professionals experienced in home equity strategies in your area.

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Not Sure About Your Next Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Related Posts

Subscribe to our newsletter

Get program updates and rate insights in your inbox.