HELOC: 7 Smart Ways to Unlock Your Home Equity for Financial Flexibility

Access Your Home's Value Without Selling or Refinancing Your First Mortgage

Your home equity represents potentially hundreds of thousands of dollars in untapped financial power. A Home Equity Line of Credit (HELOC) gives you flexible access to this wealth without disrupting your existing mortgage, providing a financial safety net and opportunity fund that adapts to your changing needs over time.

Key Details: What You’ll Learn About Home Equity Lines of Credit

- How HELOCs function as revolving credit lines secured by your home equity, including draw periods and repayment structures (Consumer Financial Protection Bureau HELOC guide)

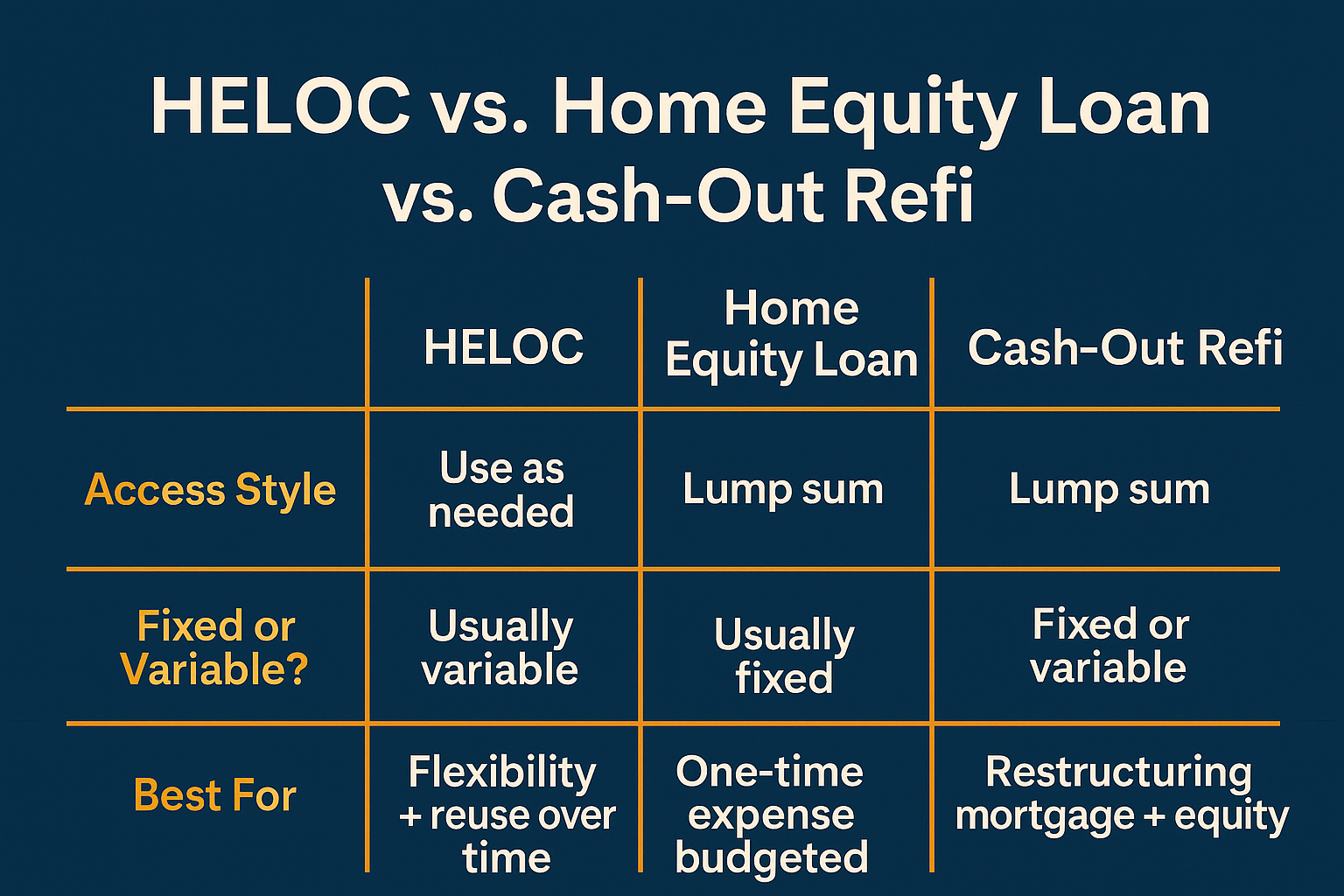

- The differences between HELOCs, home equity loans, and cash-out refinancing for accessing equity (Federal Reserve consumer credit information)

- Qualification requirements including equity positions, credit profiles, and income verification standards

- Strategic uses for HELOC funds from home improvements to emergency reserves and investment opportunities

- Variable rate structures and how payment obligations change throughout the loan lifecycle (Federal Trade Commission home equity borrowing guidance)

- Tax implications and potential deductibility of HELOC interest for qualified purposes (IRS home mortgage interest deduction rules)

- State-specific regulations and how HELOC availability varies by location and property type

Ready to explore your options? Schedule a call with a loan advisor.

What Is a HELOC?

A Home Equity Line of Credit (HELOC) is a revolving credit line secured by your home’s equity—the difference between your property’s current value and what you owe on your mortgage. Unlike traditional loans that provide a lump sum, a HELOC works like a credit card: you can borrow, repay, and borrow again up to your credit limit during the draw period.

How does a HELOC give you financial flexibility that other loan types can’t match? The revolving nature means you only pay interest on what you actually use, not the entire credit limit. You can access funds whenever needed without reapplying, making it ideal for ongoing projects, unpredictable expenses, or multiple financial goals over time.

Most HELOCs operate in two distinct phases:

Draw period (typically 5-10 years): You can access funds up to your credit limit and make interest-only payments or pay down principal voluntarily. Many HELOCs provide checks, debit cards, or online transfer capabilities for easy access.

Repayment period (typically 10-20 years): The line closes to new borrowing and converts to a standard amortizing loan where you repay both principal and interest until the balance is eliminated.

How Does a HELOC Differ from Other Home Equity Products?

Understanding your equity access options helps you choose the right tool:

HELOC advantages:

- Borrow only what you need when you need it

- Pay interest only on outstanding balance

- Revolving access during draw period

- Flexible payment options during draw phase

- Keeps your first mortgage untouched

- Quick access to additional funds without reapplying

Home equity loan characteristics:

- Lump sum disbursed at closing

- Fixed interest rate and payment

- Predictable repayment schedule

- Best when you know exact amount needed upfront

- No revolving access to funds

Cash-out refinance considerations:

- Replaces your existing first mortgage

- May make sense when refinancing to better rate

- Single payment on one loan

- Closing costs typically higher than HELOC

- Extends new mortgage term

For borrowers with excellent first mortgage terms who want flexible access to equity, HELOCs typically offer the most efficient solution.

7 Smart Ways to Use a HELOC

1. Fund Major Home Improvements That Increase Property Value

What’s the smartest way to finance renovations that boost your home’s worth? HELOCs offer several advantages for home improvement projects:

Strategic renovation financing benefits:

- Access funds as projects progress rather than borrowing entire amount upfront

- Pay interest only on funds actually drawn for completed work

- Potential tax deductibility when funds improve your home (consult tax advisor)

- Build equity through improvements while leveraging existing equity

- Flexibility to adjust project scope based on available funds

High-return improvement projects particularly suited for HELOC financing:

- Kitchen remodels that modernize layouts and appliances

- Bathroom additions or upgrades enhancing functionality

- Finished basements creating additional living space

- Energy-efficient upgrades reducing long-term utility costs

- Outdoor living spaces like decks, patios, and landscaping

- Roof replacements and major system upgrades

- Accessibility modifications for aging in place

The revolving nature perfectly matches renovation timelines—draw funds for materials as contractors need them, repay during pauses between phases, and access additional funds for subsequent projects.

2. Create an Emergency Financial Reserve for Peace of Mind

Why keep tens of thousands in a low-interest savings account when you can access equity instantly? A HELOC serves as an emergency fund that doesn’t sacrifice investment returns:

Emergency HELOC strategy advantages:

- Maintain higher-yielding investments instead of holding excessive cash

- Access funds within hours when unexpected needs arise

- Pay no interest until you actually use the line

- Typically lower interest costs than credit cards or personal loans

- Preserve cash flow during income disruptions

- Create breathing room for major unexpected expenses

Common emergency scenarios where HELOCs provide valuable backup:

- Job loss or income reduction periods

- Major medical expenses not covered by insurance

- Essential vehicle replacement

- Critical home repairs like HVAC failure or roof damage

- Family emergencies requiring immediate funds

- Natural disaster recovery costs

- Unexpected tax obligations

Having available credit prevents desperate financial decisions during crises. You’ll maintain better sleep knowing you have substantial backup funds accessible without selling investments at inopportune times or disrupting long-term financial plans.

3. Consolidate High-Interest Debt into Lower-Cost Financing

Consolidating expensive credit card balances, personal loans, or other high-interest debt into a HELOC can dramatically reduce interest costs:

Debt consolidation benefits:

- Interest rates typically substantially lower than credit cards

- Potential tax deductibility depending on fund usage (consult tax professional)

- Single payment simplifying financial management

- Improved cash flow from reduced monthly obligations

- Accelerated debt payoff by directing savings toward principal

Critical considerations for debt consolidation:

- Requires discipline to avoid running up new credit card balances

- Converts unsecured debt into secured debt against your home

- Default consequences become more severe with home as collateral

- Only makes financial sense if you address spending patterns causing debt

Debt consolidation through HELOCs works brilliantly for financially disciplined borrowers who accumulated debt through specific circumstances (medical bills, business investments, one-time expenses) rather than ongoing overspending patterns.

Calculate potential savings and develop a strategic payoff plan before consolidating to ensure this approach genuinely improves your financial position.

4. Finance Investment Opportunities and Business Ventures

How can real estate investors and entrepreneurs leverage home equity for business growth? HELOCs provide flexible capital for wealth-building opportunities:

Investment and business financing applications:

- Down payments on additional investment properties

- Business startup costs and equipment purchases

- Real estate fix-and-flip project funding

- Stock market or other investment opportunities during market downturns

- Franchise purchases or business acquisitions

- Professional licensing, certifications, or education advancing your career

- Bridge financing while waiting for other capital sources

The revolving structure particularly benefits real estate investors who:

- Need quick access to down payments when opportunities arise

- Can repay the HELOC from refinancing or sale proceeds

- Want to preserve relationship with existing first mortgage lender

- Require flexible capital for multiple deal transactions

Business owners appreciate the ability to access capital without diluting ownership through investors or navigating complex business loan requirements. The speed and flexibility of HELOCs enable seizing time-sensitive opportunities that traditional financing would miss.

Important note: Investment and business uses typically aren’t tax-deductible. Consult tax and financial advisors to understand the full implications of using home equity for these purposes.

Considering using equity for investments? Submit a refinance inquiry to explore if a HELOC makes sense for your goals.

5. Pay for Education Without High-Interest Student Loans

Education financing through HELOCs can offer advantages over traditional student loans:

Education financing considerations:

- Interest rates often more favorable than private student loans

- No loan origination fees typical of student loans

- Flexible repayment during and after education

- Potential tax deductibility for qualified education expenses (consult tax advisor)

- No restrictions on which schools or programs qualify

When HELOC education financing makes sense:

- Parent borrowing for children’s education

- Adult education or career advancement programs

- Graduate school or professional certifications

- Education expenses exceeding federal loan limits

- International education programs not eligible for U.S. student loans

Important considerations:

- Student loan protections (deferment, income-based repayment, forgiveness) don’t apply

- Puts your home at risk if repayment becomes difficult

- May not be dischargeable in bankruptcy like some student loans

- Requires sufficient home equity and qualifying credit

HELOC education financing works best for borrowers with stable income, clear repayment capacity, and education investments with strong return-on-investment potential.

6. Bridge Gaps Between Home Purchases

How can you buy your next home before selling your current one? HELOCs solve timing challenges in competitive real estate markets:

Bridge financing advantages:

- Make non-contingent offers that sellers prefer

- Avoid temporary housing during the transition

- Take time finding the right property without pressure

- Fund down payment on new home before selling current property

- Manage overlap periods between purchase and sale

- Eliminate rushed sale decisions to meet purchase deadlines

This strategy requires:

- Sufficient equity in your current home

- Income qualifying for both mortgages temporarily

- Realistic timeline for selling your current property

- Financial reserves handling both payments if sale delays occur

Many homeowners find this approach less stressful than coordinating simultaneous closing dates or living in temporary housing while searching for their next home.

Once your current home sells, you can repay the HELOC from sale proceeds, eliminate the overlap, and maintain the line for future needs.

7. Supplement Retirement Income Without Selling Investments

Retirees and pre-retirees can use HELOCs strategically to enhance financial flexibility:

Retirement HELOC applications:

- Avoid selling investments during market downturns

- Bridge gaps between asset sales and large expense needs

- Fund major purchases without disrupting portfolio allocation

- Cover unexpected medical or long-term care expenses

- Support adult children without liquidating retirement accounts

- Manage tax implications of retirement account withdrawals

Retirement-specific considerations:

- Qualification may be challenging with limited income

- Requires clear repayment strategy from future income or assets

- Variable rates create payment uncertainty

- Should be part of comprehensive retirement income plan

Retirees with substantial home equity but limited liquid assets often benefit from HELOC access, particularly when coordinated with tax-efficient withdrawal strategies from retirement accounts.

Working with financial advisors who understand both investments and home equity strategies ensures HELOC usage aligns with your overall retirement plan.

Explore all loan programs to compare equity access options.

What Are the HELOC Requirements?

Who qualifies for a Home Equity Line of Credit? Lenders evaluate several key factors when considering HELOC applications.

Equity Position and Combined Loan-to-Value Ratios

Your available equity directly determines your maximum HELOC amount:

Equity calculation basics:

- Current home value (based on appraisal)

- Minus existing mortgage balance(s)

- Equals available equity

Most lenders allow borrowing that keeps your total debt (first mortgage plus HELOC) within certain limits relative to your home’s value. The exact percentage varies by lender, credit profile, and property characteristics.

Factors affecting maximum borrowing capacity:

- Your credit profile and financial strength

- Property type and location

- Documentation type (full documentation versus alternative verification)

- Occupancy status (primary residence, second home, or investment property)

Higher equity positions and stronger financial profiles typically access more favorable terms and higher credit limits.

Credit Profile and Financial Stability

What credit profile do you need for HELOC approval? Requirements vary by lender and program type:

Credit evaluation factors:

- Credit history demonstrating responsible borrowing

- Payment patterns on existing obligations

- Credit utilization on revolving accounts

- Recent credit inquiries and new accounts

- Public records and collections

- Overall financial stability and management

Lenders consider your complete financial picture, not just credit scores. Strong compensating factors like substantial equity, high income, or significant reserves can sometimes offset credit concerns.

Income Documentation and Debt-to-Income Ratios

Lenders verify your ability to handle HELOC payments alongside existing obligations:

Income verification methods:

- W-2 employees: Recent paystubs and tax returns

- Self-employed borrowers: Business and personal tax returns, sometimes bank statements

- Retirees: Social Security statements, pension documentation, investment account statements

- Multiple income sources: Documentation for all income types

Your total monthly debt obligations relative to your gross income influences approval and credit limit decisions. Lower debt ratios demonstrate greater capacity to handle HELOC payments comfortably.

Debt-to-income considerations:

- All monthly housing costs (mortgage, insurance, taxes, HOA)

- Minimum payments on credit cards and installment loans

- Potential HELOC payment (calculated conservatively)

- Other regular obligations like alimony or child support

Stronger income documentation and lower existing debt burdens generally result in larger credit lines and better terms.

Property Requirements and Appraisal

Your property must meet lender standards and be accurately valued:

Property eligibility factors:

- Primary residences typically offer most favorable terms

- Second homes may have slightly tighter requirements

- Investment properties face stricter standards and lower limits

- Property must be in acceptable condition

- Clear title without significant liens or judgments

Professional appraisals determine your property’s current market value, which directly impacts your available credit. Appraisers evaluate:

- Recent comparable property sales in your area

- Your home’s condition, size, and features

- Location factors and market trends

- Property improvements and upgrades

- Overall market conditions

Strong property values in appreciating markets maximize your available equity and borrowing capacity.

How Does the HELOC Process Work?

Application and Documentation Phase

What should you prepare before applying for a HELOC? Gathering documents early streamlines the approval process:

Essential documentation checklist:

Income verification:

- Recent pay stubs covering a month of earnings

- W-2 forms for recent years

- Tax returns for recent years (complete with schedules)

- Business documentation if self-employed

- Retirement income statements

- Investment account statements showing dividends/distributions

Asset verification:

- Bank statements for checking and savings accounts

- Investment and retirement account statements

- Documentation of other significant assets

- Gift funds documentation (if applicable)

Property documentation:

- Current homeowners insurance policy

- Property tax statements

- HOA documentation (if applicable)

- Mortgage statements showing current balance

- Recent property improvements or appraisals

Identity and credit:

- Government-issued photo identification

- Social Security card or verification

- Authorization for credit report pull

- Explanation letters for any credit issues

Organized documentation demonstrates your preparedness and professionalism, often resulting in faster processing and fewer follow-up requests.

Appraisal and Underwriting

After application submission, lenders order property appraisals and begin underwriting:

Appraisal process:

- Licensed appraiser inspects your property

- Comparable sales analysis determines market value

- Condition assessment ensures property meets standards

- Report typically completed within 1-2 weeks

- Value determines maximum available credit line

Underwriting evaluation:

- Income verification and stability assessment

- Credit report analysis and risk evaluation

- Debt-to-income ratio calculations

- Property value and equity verification

- Overall financial profile review

Underwriters may request additional documentation or clarification during their review. Prompt responses keep your application progressing smoothly toward approval.

Most HELOC applications process within 2-4 weeks from complete application to closing, though timelines vary based on appraisal scheduling, documentation complexity, and lender workload.

Closing and Accessing Your Line

Once approved, you’ll attend a closing to sign final documents and establish your credit line:

Closing process:

- Review and sign HELOC agreement and disclosures

- Receive checks, debit card, or online access credentials

- Understand draw period terms and access methods

- Review payment schedules and requirements

- Ask questions about any terms or conditions

Methods for accessing HELOC funds:

- Paper checks written against your line

- Debit card linked to your account

- Online transfers to checking account

- Wire transfers for large transactions

- Some lenders offer mobile apps for management

Most HELOCs activate immediately upon closing, giving you instant access to your approved credit line.

Right of rescission: For HELOCs on primary residences, federal law provides a three-day rescission period after closing during which you can cancel without penalty. The line becomes accessible after this period expires.

Frequently Asked Questions About HELOCs

How do HELOC payments work during the draw period?

What payment obligations do you have while accessing your HELOC? Draw period payment structures vary by lender:

Common draw period payment options:

- Interest-only payments: Pay only accrued interest on outstanding balance monthly

- Interest-plus payments: Pay interest plus optional principal to reduce balance

- Minimum payments: Some lenders require minimum principal payments

- Flexible payments: Some programs allow varying payment amounts above minimums

Interest typically accrues on your outstanding balance and compounds monthly. Your payment amount fluctuates based on your balance and current interest rate (since most HELOCs have variable rates).

Payment example concept: If you’ve drawn funds from your line, you’ll make monthly payments based on that outstanding amount. As you repay principal, your balance and payments decrease. If you draw additional funds, your balance and payments increase.

Many borrowers appreciate interest-only options during draw periods, as they provide maximum flexibility. However, paying down principal during the draw period reduces your balance and creates available credit for future needs.

Calculate your HELOC scenario:

Can HELOC interest be tax-deductible?

Under what circumstances might HELOC interest be deductible? Tax treatment depends on how you use the funds:

Current IRS guidance indicates HELOC interest may be deductible when funds are used to buy, build, or substantially improve your home—the property securing the loan. Interest on funds used for other purposes typically isn’t deductible under current tax law.

Potentially deductible uses:

- Home renovations and improvements

- Home additions or expansions

- Major repairs maintaining property value

Typically non-deductible uses:

- Debt consolidation

- Vehicle purchases

- Education expenses

- Investment purposes

- Business financing

- General living expenses

Tax laws are complex and change periodically. Consult qualified tax professionals who understand your complete financial situation before making decisions based on tax considerations.

Proper documentation tracking how you use HELOC funds supports your tax position if the IRS questions deductibility.

What happens when the draw period ends?

How does your HELOC change when it converts to repayment? Understanding this transition helps you plan effectively:

End of draw period changes:

- No additional borrowing: Your line closes to new draws

- Payment structure changes: Converts to principal-plus-interest payments

- Amortization begins: Balance repaid over remaining term

- Payments typically increase: Adding principal to interest-only payments raises monthly cost

- Predictable payoff: Known repayment schedule eliminates balance by term end

Payment increase example concept: During draw period with interest-only payments, your monthly obligation might be relatively modest. When converting to full amortization, payments often increase substantially as you begin repaying principal over the remaining term.

Some lenders offer options to refinance or modify your HELOC as the draw period ends, potentially extending draw periods or adjusting repayment terms. Discussing options with your lender before transition helps you prepare for payment changes.

Can you pay off a HELOC early without penalties?

Most HELOCs don’t charge prepayment penalties, allowing you to repay your balance anytime without additional fees. However, some important considerations apply:

Early payoff considerations:

- Review your specific HELOC agreement for any early closure fees

- Some lenders charge fees if you close the line within initial years

- Closing the line terminates your ability to access funds again

- Keeping the line open with zero balance maintains access for future needs

When early payoff makes sense:

- You’ve completed the purpose for borrowing and don’t need future access

- You’re selling the property and must satisfy all liens

- Variable rates increased substantially and you prefer elimination of exposure

- You’ve achieved debt-free status as a financial goal

When keeping the line open makes sense:

- Maintaining emergency access even with zero balance

- Anticipating future needs without wanting to reapply

- Annual fees are minimal or non-existent

- Established credit line supports overall financial flexibility

Many borrowers keep HELOCs open indefinitely even after repaying balances, treating them as permanent emergency reserves and opportunity funds.

How do variable rates affect HELOC costs?

What should you understand about HELOC rate structures? Most HELOCs use variable interest rates that adjust based on market indexes:

Variable rate mechanics:

- Index rate: Benchmark rate like Prime Rate or SOFR

- Margin: Lender’s markup added to index (fixed throughout term)

- Combined rate: Index plus margin equals your current rate

- Adjustment frequency: Rate typically adjusts monthly or quarterly

- Rate caps: Most HELOCs have maximum rates limiting upward movement

Your actual interest costs fluctuate as the underlying index changes. When the Federal Reserve raises rates, HELOC rates typically increase. When the Fed lowers rates, HELOC rates typically decrease.

Rate risk management strategies:

- Monitor Federal Reserve policy and economic indicators

- Maintain payment capacity for potential rate increases

- Consider fixed-rate conversion options some lenders offer

- Accelerate paydown during low-rate environments

- Build reserves to handle higher payment periods

Some HELOCs offer options to convert all or part of your balance to fixed rates for specific periods, providing predictability while maintaining line flexibility.

What happens to your HELOC if you sell your home?

Can you transfer a HELOC to your next property? HELOCs are secured by specific properties and typically must be satisfied when selling:

Sale process HELOC considerations:

- Payoff at closing: HELOC balance paid from sale proceeds along with first mortgage

- Title clearance: Lender releases lien once balance is satisfied

- Proceeds calculation: Sale proceeds minus mortgages, HELOC, and closing costs

- No portability: Cannot transfer HELOC to new property

- New application: Must apply for new HELOC on new property

Calculate your net proceeds by subtracting all liens (first mortgage, HELOC, any other liens) plus selling costs from your sale price. Remaining equity becomes your available funds for your next purchase or other purposes.

After closing on your new home, you can apply for a new HELOC if you have sufficient equity and meet qualification requirements.

See how other homeowners have successfully used HELOC financing:

Alternative Loan Programs for Accessing Home Equity

If a HELOC isn’t the right fit, consider these alternatives:

- Home Equity Loan – Fixed-rate lump sum borrowing against your home equity with predictable monthly payments

- Cash-Out Refinance – Refinance your existing mortgage and access equity in a single loan with fixed terms

- Home Improvement Loan – Specialized financing for renovation projects with competitive terms

- Bridge Loan – Short-term financing using current home equity for purchasing a new property

- Reverse Mortgage – For homeowners 62+ to access equity without monthly payments

Explore all 30+ loan programs to find your best option.

Not sure which program is right for you? Take our discovery quiz to find your path.

Advanced HELOC Questions

How do HELOCs work for investment properties?

Can you get a HELOC on rental properties? Yes, though requirements are stricter than primary residence HELOCs:

Investment property HELOC considerations:

- Lower maximum borrowing relative to property value

- Higher interest rates reflecting increased lender risk

- More stringent credit and reserve requirements

- Rental income documentation and verification required

- Property cash flow analysis may influence approval

- Some lenders don’t offer investment property HELOCs

Investment property HELOCs work well for real estate investors who:

- Want flexible capital for additional property acquisitions

- Need funds for improvements across multiple properties

- Manage seasonal cash flow variations from rentals

- Prefer keeping first mortgages undisturbed

- Value flexibility over fixed loan structures

Qualification typically requires demonstrating both personal income stability and rental property profitability, along with substantial reserves and equity positions.

Can you have multiple HELOCs on different properties?

Yes, borrowers with multiple properties can potentially establish HELOCs on each, subject to overall debt capacity and qualification:

Multiple HELOC management:

- Each property evaluated independently for equity and value

- Combined debt obligations factor into qualification for each

- Income must support all mortgage payments and HELOCs

- Substantial reserves typically required for multiple lines

- Lender appetite varies for borrowers with multiple HELOCs

Real estate investors and second home owners often maintain multiple HELOCs, creating flexible capital access across their portfolio. This strategy provides liquidity without selling properties or disrupting existing favorable first mortgages.

Managing multiple HELOCs requires disciplined financial oversight, ensuring you maintain available capacity without overextending your debt obligations.

What happens to your HELOC during bankruptcy?

How does bankruptcy affect HELOC obligations? HELOCs are secured debts treated differently than unsecured obligations:

Bankruptcy and HELOC considerations:

- HELOCs typically cannot be discharged while retaining the property

- Chapter 13 bankruptcy may restructure repayment terms

- Lender maintains lien against property regardless of bankruptcy

- Failure to pay HELOC can result in foreclosure proceedings

- Some bankruptcy strategies involve negotiating HELOC settlements

If facing financial distress, communicating with your HELOC lender early often produces better outcomes than ignoring the situation. Many lenders offer hardship programs, temporary payment modifications, or workout arrangements preventing foreclosure.

Consulting bankruptcy attorneys and financial advisors helps you understand options and consequences before making decisions affecting your home equity and credit.

Can you convert HELOC balances to fixed-rate loans?

Many lenders offer fixed-rate conversion options providing payment predictability:

Fixed-rate conversion features:

- Convert all or portion of balance to fixed rate

- Typical fixed periods range from several years to the full remaining term

- Converted amounts removed from revolving credit availability

- Unconverted balance remains variable with flexible access

- May involve conversion fees or rate adjustments

When fixed-rate conversion makes sense:

- Interest rate environment suggests rates will rise substantially

- You want payment predictability for budgeting

- You’ve completed borrowing and want to lock in repayment terms

- Variable rate volatility creates financial stress

Fixed-rate conversions provide middle ground between full HELOC flexibility and predictable home equity loan structures, allowing you to stabilize payments while maintaining access to remaining available credit.

How do HELOC draws affect your taxes and basis?

Do HELOC draws increase your property’s tax basis? Generally no—borrowing against equity doesn’t change your cost basis:

Tax basis considerations:

- HELOC borrowing itself doesn’t affect property basis

- Using HELOC funds for home improvements may increase basis

- Properly documenting improvement expenses supports basis adjustments

- Increased basis reduces capital gains when selling

- Interest deductibility depends on fund usage

Maintaining detailed records of how you use HELOC funds becomes important for:

- Interest deduction documentation

- Basis adjustment substantiation for improvements

- Investment tracking if funds used for investment purposes

- Business expense documentation if used for business

Working with tax professionals ensures you properly handle HELOC-related tax implications and maximize available benefits under current tax law.

What credit score impact does opening a HELOC create?

How does a HELOC affect your credit profile? Opening and managing a HELOC influences multiple credit factors:

Credit score impacts:

- Initial inquiry: Credit check creates small, temporary score reduction

- New account: New credit line slightly lowers average account age

- Credit utilization: Available credit may improve overall utilization ratios

- Payment history: On-time payments build positive history

- Credit mix: Adding installment credit may benefit score diversity

Ongoing credit management:

- Keeping balances low relative to credit limit helps scores

- On-time payments maintain positive history

- High utilization can reduce scores even with good payment history

- Closing the line reduces available credit impacting utilization

For most borrowers with good credit, opening a HELOC causes only minor, temporary score reductions, followed by score improvements from lower overall credit utilization and positive payment history.

Maintaining low HELOC balances relative to the credit limit optimizes credit score benefits while preserving access to funds.

Can you get a HELOC with a reverse mortgage?

Do reverse mortgages and HELOCs work together? Generally no—combining these products faces significant obstacles:

Reverse mortgage and HELOC conflicts:

- Reverse mortgages typically prohibit subordinate liens

- HELOC would require monthly payments conflicting with reverse mortgage benefits

- Limited remaining equity after reverse mortgage reduces HELOC availability

- Most HELOC lenders won’t lend behind reverse mortgages

- Regulatory restrictions on senior borrowers with both products

Borrowers typically choose one product or the other based on their circumstances:

Choose reverse mortgage when:

- You want to eliminate monthly mortgage payments

- You’re 62+ with substantial home equity

- Income is limited but you want to stay in your home

- You don’t need revolving credit access

Choose HELOC when:

- You want flexible access to funds

- You can handle monthly payments comfortably

- You’re under 62 or don’t qualify for reverse mortgage

- You prefer maintaining traditional mortgage structure

Each product serves different financial goals and life stages, rarely working effectively together.

How do economic downturns affect HELOC availability?

Can lenders freeze or reduce your HELOC during economic stress? Yes—lenders maintain certain rights to protect against declining property values:

Economic crisis HELOC impacts:

- Line freezes: Lenders can freeze additional draws if property values decline significantly

- Balance reductions: Credit limits may be reduced to reflect current property values

- Tighter qualification: New HELOC applications face stricter standards

- Rate increases: Variable rates often rise during financial crises

- Property revaluations: Lenders may order new appraisals triggering limit adjustments

The 2008 financial crisis taught lenders that home values can decline dramatically, leaving them over-secured. Federal regulations allow lenders to freeze or reduce credit lines when property values drop or economic conditions create risk.

Protecting against HELOC disruptions:

- Maintain strong credit and payment history

- Keep debt-to-income ratios conservative

- Build substantial reserves beyond HELOC access

- Draw needed funds before economic deterioration becomes evident

- Don’t rely exclusively on HELOC for emergency reserves

Understanding these risks helps you incorporate HELOCs into financial plans appropriately without over-reliance on credit that could become restricted during the times you need it most.

What happens to HELOC balances when you pass away?

How are HELOC debts handled after the borrower’s death? HELOCs become part of estate settlement:

Estate and HELOC considerations:

- HELOC balance becomes debt against your estate

- Property cannot transfer to heirs until HELOC is satisfied

- Estate executor must address HELOC in settlement process

- Heirs inheriting property typically must pay off or refinance HELOC

- Life insurance can provide liquidity for HELOC payoff

- Lender maintains lien rights until balance is satisfied

Estate planning with HELOCs:

- Consider life insurance covering HELOC balances

- Communicate HELOC existence to estate executors and heirs

- Ensure estate has liquidity to address obligations

- Review whether heirs could qualify to assume or refinance HELOC

- Document HELOC terms and access information for estate administrators

Heirs who want to keep inherited properties must either pay off HELOCs from estate assets, refinance into new loans, or sell properties and satisfy liens from proceeds.

Planning for these scenarios ensures your estate can handle HELOC obligations efficiently without forcing rushed property sales or creating hardship for heirs.

Can you negotiate HELOC terms with lenders?

Are HELOC terms fixed or negotiable? Many aspects of HELOC agreements involve some negotiation potential:

Potentially negotiable HELOC terms:

- Interest rate margin: The markup above the index rate

- Closing costs and fees: Some lenders waive or reduce fees

- Credit limit: Maximum line amount relative to equity

- Draw period length: Duration of flexible access phase

- Appraisal requirements: Sometimes waived for existing customers

- Rate caps: Maximum rates during the term

Strengthening your negotiating position:

- Excellent credit profiles command better terms

- Large credit lines give you more leverage

- Existing banking relationships provide negotiating opportunity

- Competing offers from other lenders create leverage

- Low loan-to-value ratios reduce lender risk

Shopping among multiple lenders remains your most powerful negotiating tool—competitive pressure naturally produces better terms than simply accepting initial offers.

Consider the total cost and structure rather than focusing exclusively on interest rates. Low rates offset by high fees may cost more than slightly higher rates with minimal costs.

Ready to get started? Apply now or schedule a call to discuss your situation.

Helpful HELOC Resources

Official Government Guidance

Consumer Financial Protection Bureau Home Equity Line of Credit Guide – Federal consumer protection agency resource explaining HELOC features, risks, costs, and borrower rights throughout the lending process.

Federal Reserve Consumer Guide to Home Equity Credit Lines – Comprehensive Federal Reserve publication covering HELOC mechanics, cost comparisons with alternatives, and smart borrowing strategies.

Federal Trade Commission Home Equity Lending Information – Federal guidance on shopping for home equity products, understanding terms, and avoiding predatory lending practices.

Tax and Financial Planning Resources

IRS Publication 936 Home Mortgage Interest Deduction – Official IRS guidance on mortgage interest deductibility rules including limitations and qualified residence definitions affecting HELOC interest.

IRS Home Improvement Tax Basis Guidelines – Federal tax information explaining how home improvements affect your property’s cost basis and capital gains calculations.

Consumer Protection and Fair Lending

CFPB Mortgage Assistance Resources – Tools and information for mortgage shopping, understanding loan estimates, and resolving disputes with lenders.

Federal Reserve Truth in Lending Act Disclosures – Information about required HELOC disclosures protecting borrowers through transparent cost and term information.

Educational Resources

Freddie Mac Home Equity Borrowing Guidance – Educational content comparing home equity access methods including HELOCs, home equity loans, and cash-out refinancing.

Need local expertise? Get introduced to trusted partners including loan officers, financial advisors, and real estate professionals experienced in home equity strategies in your area.

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Not Sure About Your Next Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Related Posts

Subscribe to our newsletter

Get program updates and rate insights in your inbox.