VA Loan: Marine Veteran Purchases $385K Home with $0 Down Payment Using 100% VA Financing

Educational Case Study Disclosure

This case study is hypothetical and for educational purposes only. Scenarios, borrower profiles, loan terms, interest rates, and APRs are illustrative examples and do not represent current offers or guaranteed terms.

If specific loan terms (e.g., down payment %, payment amount, rate/APR, points, or repayment period) appear in this article, required disclosures will be shown immediately next to those terms per Regulation Z.

For specific details including down payment incentives, closing cost incentives, interest rate details, closing cost breakdowns, payment calculations, cash-to-close estimates, or an official Loan Estimate, it is highly recommended you schedule a meeting with one of our licensed mortgage advisors.

Learn more:

- Reg Z – Advertising (§1026.24) – CFPB official regulation

- Reg Z Full Text – Electronic Code of Federal Regulations

- Official Interpretations to §1026.24 – CFPB interpretations

- MAP Rule (Reg N), 12 CFR Part 1014 – Mortgage advertising rules

- NMLS Consumer Access – Verify licensure

Actual loan terms vary by credit profile, property, occupancy, location, market conditions, and lender guidelines. For current options tailored to you, schedule a consultation or apply online.

Ready to explore your options? Schedule a call with a loan advisor.

How This VA Loan Enabled Zero Down Payment Homeownership for Military Service Member Without Mortgage Insurance

James R., a 29-year-old Marine Corps veteran who served six years including two deployments overseas, had recently transitioned to civilian employment as a logistics coordinator earning $72,000 annually with a defense contractor in Fort Lauderdale. After years of military service and frequent relocations, James was ready to establish permanent roots and achieve homeownership as a first-time buyer (Step 2). Despite stable income and a 695 credit score, James had only managed to save $6,500—insufficient for traditional down payments on homes in his price range. His military service had earned him VA loan eligibility, but he didn’t fully understand the benefits until his real estate agent explained that VA loans offered zero down payment financing specifically designed to reward military service.

James identified a three-bedroom, two-bathroom home in Pembroke Pines listed at $385,000—perfect for his needs with room to start a family, excellent schools, and reasonable commute to his Fort Lauderdale office. When traditional lenders explained he’d need $11,550-$13,475 down payment (3-3.5%) plus closing costs for conventional or FHA financing, totaling $20,000-$23,000, he faced a $14,000-$17,000 shortfall. The $6,500 he’d saved over three years fell far short of requirements.

“I’d saved $6,500 through careful budgeting, but conventional lenders said I needed $20,000-$23,000 total,” James explained. “That $14,000+ gap would take another 2-3 years to close while paying $2,200 monthly rent building zero equity. I felt frustrated that my military service hadn’t translated into homeownership benefits—until I learned about VA loans offering zero down payment financing.”

Facing similar down payment barriers as a veteran? Schedule a call to explore VA loan options.

Why Traditional Mortgages Created Barriers Despite Military Service

James’s situation illustrated how conventional financing overlooks veterans’ service and earned benefits, treating them like any borrower despite their military sacrifice.

Cash requirements comparison:

Conventional loan (3% down):

- Down payment: $11,550 (3% of $385,000)

- Closing costs: $9,000-$11,000

- Total cash needed: $20,550-$22,550

- James’s savings: $6,500

- Shortfall: $14,050-$16,050

FHA loan (3.5% down):

- Down payment: $13,475 (3.5%)

- Closing costs: $8,000-$10,000

- Total cash needed: $21,475-$23,475

- Shortfall: $14,975-$16,975

VA loan (0% down):

- Down payment: $0 (100% financing)

- VA funding fee: 2.15% ($8,278, can be financed)

- Closing costs: $7,000-$9,000

- Total cash needed: ~$7,000-$9,000 (if financing fee)

- James’s savings: $6,500

- Gap: $500-$2,500 (manageable with seller credits)

“The VA loan transformed affordability from impossible to achievable,” James said. “Zero down payment meant I only needed closing costs—$7,000-$9,000—within reach with my $6,500 plus modest seller credits. Conventional required $20,000+, creating a gap I couldn’t bridge without years more saving. The VA loan recognized my military service with tangible financial benefits.”

VA loan advantages beyond zero down:

- No mortgage insurance: Unlike conventional <20% down or FHA requiring ongoing insurance

- Competitive rates: Often lower than conventional/FHA

- Flexible credit: More forgiving underwriting

- No prepayment penalties: Pay off early without penalty

- Assumable: Future buyers can assume favorable rate

- Lifetime benefit: Can use multiple times

Ready to use your earned VA benefits? Schedule a call to discuss eligibility.

How James Discovered His VA Loan Eligibility

After his real estate agent mentioned VA loans, James researched benefits online and obtained his Certificate of Eligibility (COE) through the VA website in 15 minutes—proving his service qualified him for VA loan benefits.

VA eligibility requirements James met:

- Active duty: 90 consecutive days during wartime OR 181 days during peacetime

- James’s service: 6 years active duty Marine Corps (far exceeds minimums)

- Honorable discharge: Required for benefits

- Current service: Not required (benefits continue after separation)

“Getting my COE was surprisingly easy—I logged into the VA website, entered my service information, and received instant approval,” James explained. “The certificate confirmed my six years Marine Corps service qualified me for full VA loan benefits. I’d earned this benefit through military service but hadn’t realized the financial advantage it provided—zero down payment, no mortgage insurance, competitive rates. Understanding these benefits motivated me to pursue VA financing rather than accepting conventional barriers.”

James scheduled consultations with two VA-approved lenders who explained the complete program, requirements, and timeline. Both confirmed his eligibility and estimated 35-40 day closing—comparable to conventional loans.

Documentation Required for James’s VA Loan

James worked with his VA loan specialist to assemble required documentation.

Documentation provided:

VA eligibility proof:

- Certificate of Eligibility (COE) from VA

- DD Form 214 (discharge papers)

- Service verification

Income and employment:

- Two years W-2 forms ($72,000 logistics coordinator salary)

- Recent pay stubs and employment verification

- Defense contractor employment (stable, government-related)

Credit and financial:

- 695 credit score with good payment history

- Bank statements showing $6,500 savings

- No collections or derogatory items

Property documentation:

- Purchase contract at $385,000

- Homeowners insurance quote

- VA appraisal (ordered during process)

The approval process:

- Initial consultation (Day 1) – Discussed VA benefits and requirements

- COE verification (Days 2-3) – Confirmed VA eligibility

- Pre-approval application (Day 5) – Submitted complete documentation

- Income verification (Days 6-10) – Verified employment and salary

- Credit review (Days 11-12) – Confirmed 695 score, payment history

- Asset verification (Days 13-14) – Confirmed savings

- Pre-approval issued (Day 15) – Approved for up to $400,000

- Purchase contract submitted (Day 17) – Contract accepted

- VA appraisal ordered (Day 19) – VA-approved appraiser assigned

- VA appraisal completed (Day 26) – Appraised at purchase price

- Final underwriting (Days 27-35) – Comprehensive analysis

- Clear to close (Day 36) – Final approval

- Closing (Day 40) – Funded VA loan with 0% down

The lender approved James’s VA loan based on his verified military service and COE, stable $72,000 income, good 695 credit score, adequate reserves, and property appraisal confirming value.

“The approval was straightforward—they verified my military service, confirmed my income and credit, and approved quickly,” James said. “The VA appraisal took slightly longer than conventional appraisals because VA inspectors check property condition ensuring homes meet minimum standards—protecting veterans from purchasing defective properties. That thoroughness benefited me. We closed in 40 days total.”

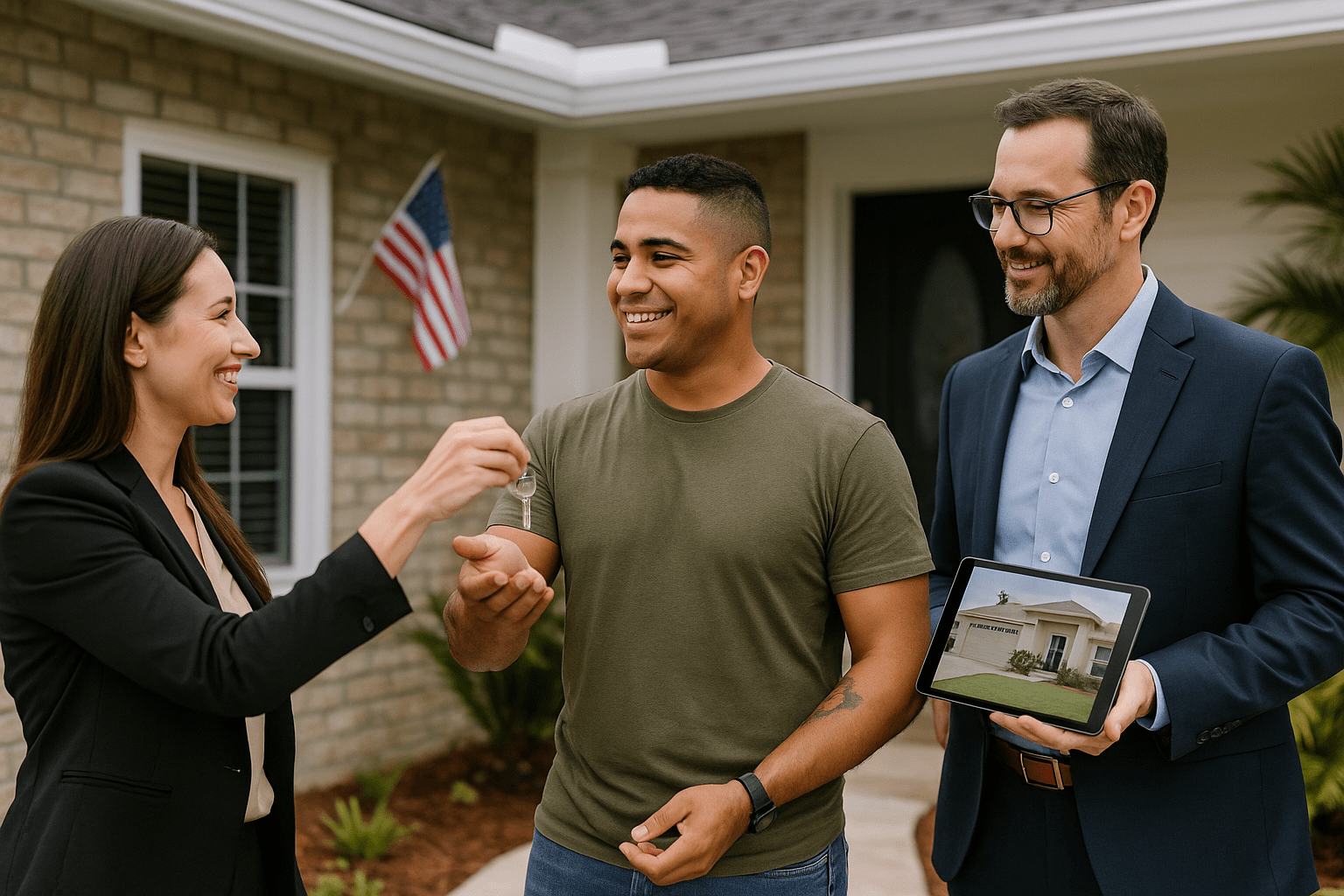

The 2.15% VA funding fee ($8,278) was financed into the loan balance, and James negotiated $3,000 seller credits toward closing costs, reducing his cash needed to only $4,500—well within his $6,500 savings.

Ready to purchase using VA benefits? Submit a purchase inquiry to get started.

Final Results of James’s VA Loan Purchase

James successfully closed on his Pembroke Pines home using 100% VA financing, achieving homeownership approximately 2-3 years earlier than conventional financing would have enabled.

Final VA loan details:

- Purchase price: $385,000

- Down payment: $0 (100% financing)

- VA funding fee: $8,278 (2.15%, financed)

- Final loan amount: $393,278

- Seller credits: $3,000 (toward closing costs)

- Cash at closing: $4,500

- Remaining savings: $2,000

- Competitive VA loan rates – Try this VA Loan Calculator

- Property: 3BR/2BA, Pembroke Pines, FL

- Application to closing: 40 days

Comparison to alternatives:

VA loan (actual):

- Down payment: $0

- Cash at closing: $4,500

- Monthly payment: ~$2,475 (no mortgage insurance)

- Timeline: Immediate

Conventional (3% down):

- Down payment: $11,550

- Cash needed: $20,550-$22,550

- Additional saving required: $14,000-$16,000

- Monthly PMI: $150-175 (until 20% equity)

- Timeline: 2-3 years additional saving

“The VA loan enabled immediate homeownership versus waiting 2-3 years saving another $14,000+,” James explained. “I preserved $2,000 savings for moving and reserves. Conventional would have depleted everything plus required saving another $14,000—another 2+ years paying $2,200 rent ($52,800) building zero equity. The VA loan saved that time and money.”

Monthly housing comparison:

Previous rent: $2,200 VA mortgage: $2,475 (comparable) Difference: Only $275 more But now: Building equity, no landlord, stable housing

James views his home as foundation for long-term wealth building. When ready for his next property, he can use his VA loan eligibility again (it renews after selling) or access equity through a VA cash-out refinance or VA IRRRL for rate improvement.

“The VA loan honored my military service with tangible financial benefits,” James concluded. “Zero down payment, no mortgage insurance, competitive rates—these aren’t marketing gimmicks, they’re earned benefits recognizing military sacrifice. I’m building wealth and security because my country values my service. Every veteran should understand and use these earned benefits.”

Ready to use your VA benefits? Get approved or schedule a call.

Key Takeaways for Military Service Members

- VA loans offer 100% financing (zero down) for eligible veterans and service members—James purchased $385K with $0 down (VA home loan information)

- No monthly mortgage insurance required—saves $150-200+ monthly versus conventional/FHA

- Certificate of Eligibility (COE) required—obtain instantly online through VA website

- Funding fee 2.15% for first-time use, 3.3% for subsequent use—can be financed into loan

- Funding fee reduced or waived for disabled veterans—10%+ disability rating qualifies

- Lifetime benefit reusable—can use multiple times throughout life

- Property must meet VA minimum standards—appraisal ensures quality

Questions about VA eligibility? Schedule a call with a VA loan specialist.

Alternative Loan Programs for Veterans

If a VA loan isn’t perfect:

- Conventional Loan – 3% down for non-VA-eligible co-borrowers

- FHA Loan – 3.5% down alternative

- VA Construction Loan – Build custom with 0% down

- VA IRRRL – Streamline refinance existing VA loan

- USDA Loan – 0% down in rural areas

Explore all loan programs.

Helpful VA Loan Resources

Learn more:

Similar stories:

External resources:

Need local expertise and connections? Get introduced to trusted partners including USDA-approved lenders and rural area mortgage specialists experienced with refinancing optimization.

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Not Sure About Your Next Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required