VA IRRRL: 7 Ways to Streamline Your VA Loan Refinance

The Fastest Path to Lower Your Existing VA Mortgage Costs

Veterans and service members with existing VA loans often miss opportunities to reduce their mortgage costs through the VA’s streamlined refinance program. The Interest Rate Reduction Refinance Loan (IRRRL)—commonly called the VA Streamline Refinance—provides a simplified path to lower interest expenses without the extensive documentation, appraisal requirements, or rigorous qualification processes typical of standard refinancing. This specialized program exists specifically to help military families reduce their VA loan costs quickly and efficiently. This comprehensive guide reveals how eligible VA borrowers can leverage the IRRRL to reduce monthly obligations, switch from adjustable to fixed structures, and navigate the streamlined process while understanding when standard VA refinancing might serve you better.

Key details you’ll discover:

- How IRRRL streamlined processing eliminates appraisal requirements and minimizes documentation compared to standard refinancing (VA IRRRL Program Overview)

- Net tangible benefit requirements that ensure refinancing actually reduces your costs or improves your loan structure (VA Net Tangible Benefit Standards)

- Seasoning requirements mandating at least six months of payments on your existing VA loan before refinancing eligibility

- Funding fee structures for IRRRLs that differ from purchase loans and standard refinances (VA IRRRL Funding Fees)

- Occupancy certification rules requiring previous occupancy of the property even if you no longer live there

- Cash-out limitations that restrict IRRRLs to minimal cash back at closing compared to standard refinances

- Recoupment period calculations showing how quickly your savings offset refinancing costs

- Critical differences between IRRRLs and standard VA refinances including when each option makes more sense

Ready to explore your options? Schedule a call with a loan advisor.

What Is a VA IRRRL?

The VA Interest Rate Reduction Refinance Loan (IRRRL) is a streamlined refinancing program designed exclusively for veterans and service members with existing VA loans. Unlike standard refinances requiring extensive documentation, appraisals, and full underwriting reviews, the IRRRL simplifies the process to help military families reduce interest costs quickly and efficiently.

The IRRRL serves one primary purpose: lowering your interest expense on an existing VA loan. Whether you want to reduce your monthly obligations, switch from an adjustable structure to a fixed one, or simply take advantage of improved market conditions, the IRRRL provides the fastest path to accomplish these goals.

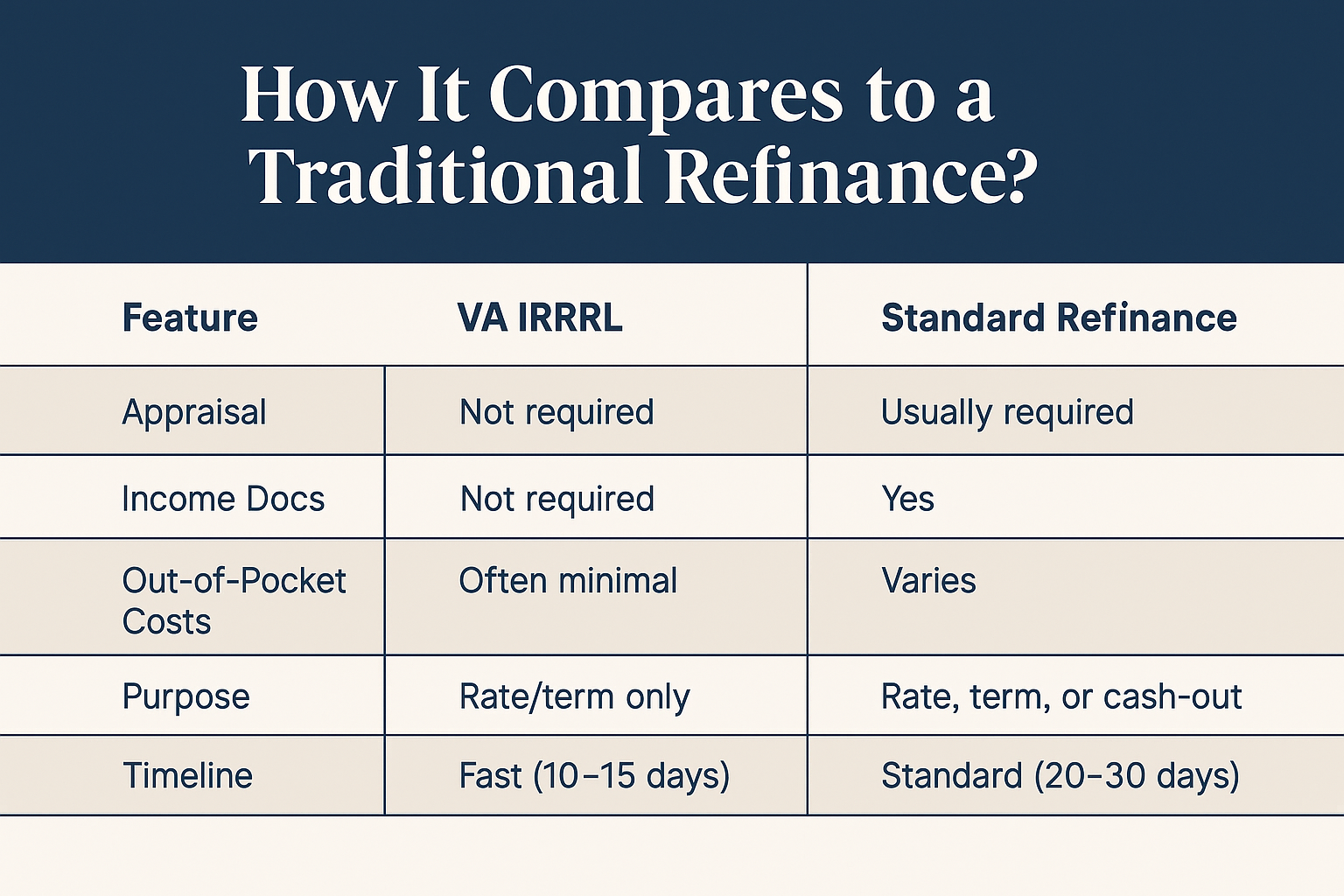

How does the IRRRL differ from standard VA refinancing?

The IRRRL offers distinct processing advantages:

- No appraisal required – Most IRRRLs proceed without new property valuations, eliminating appraisal costs and delays

- Minimal documentation – Limited income and employment verification compared to standard refinances

- No certificate of eligibility needed – Your existing VA loan serves as proof of eligibility

- Streamlined underwriting – Simplified review processes focusing on loan performance rather than comprehensive qualification

- Lower funding fees – Reduced fee structure compared to other VA loan types

- Faster closings – Typical processing in 20-30 days versus 30-45 days for standard refinances

However, the IRRRL comes with specific restrictions:

- Must currently have a VA loan – Cannot refinance FHA, conventional, or other non-VA mortgages

- Limited cash back – Typically capped at minimal amounts compared to standard refinances

- Cannot add or remove borrowers – The same borrowers must remain on the new loan

- Must lower interest costs – Need to demonstrate net tangible benefit through reduced expenses or improved loan structure

- Occupancy certification required – Must certify previous occupancy even if no longer living in the property

These streamlined features make the IRRRL ideal when your sole objective is reducing costs on your existing VA loan without modifying borrowers or accessing equity.

See how other veterans have successfully used IRRRL refinancing:

- View VA IRRRL case studies

- View standard VA refinance case studies (when you need more flexibility)

- View VA cash-out refinance case studies (when you need to access equity)

Who Qualifies for VA IRRRL Refinancing?

IRRRL eligibility centers on having an existing VA loan with satisfactory payment history. The streamlined nature means fewer qualification hurdles than standard refinancing, but specific requirements still apply.

Existing VA Loan Requirement

Must you currently have a VA loan to use an IRRRL?

Yes. The IRRRL exclusively refinances existing VA loans. You cannot use this program to refinance:

- FHA loans into VA financing

- Conventional mortgages into VA loans

- USDA loans into VA financing

- Any other non-VA mortgage products

If you currently have a non-VA loan and want VA financing, you need a standard VA refinance instead. The standard VA refinance offers more flexibility including the ability to:

- Refinance from any loan type into VA financing

- Receive funds back at closing (typically up to a certain amount)

- Add or remove borrowers due to marriage, divorce, or inheritance

- Eliminate private mortgage insurance from conventional loans

View standard VA refinance case studies to understand when this option makes more sense than an IRRRL.

Payment History Requirements

What payment history must you demonstrate for IRRRL approval?

Lenders require satisfactory payment performance on your existing VA loan:

Minimum seasoning – At least six months of payments on your current VA loan before IRRRL eligibility

Recent payment history – No late payments (typically) in the past six months, though some lenders accept one 30-day late payment with explanation

Current status – Cannot be in default or foreclosure proceedings on your existing VA loan

Occupancy certification – Must certify that you previously occupied the property as your primary residence, even if you no longer live there

This payment requirement ensures the IRRRL program serves veterans managing their mortgages responsibly rather than those already struggling with existing obligations.

Credit and Income Verification

Does the IRRRL require full income and credit documentation?

The IRRRL significantly reduces documentation compared to standard refinancing:

Credit verification – Lenders typically pull credit reports but focus primarily on VA loan payment history rather than comprehensive credit analysis

Income documentation – Many IRRRLs process with limited or no income verification, especially when:

- The new payment doesn’t increase significantly

- Your loan payment history demonstrates ability to afford the mortgage

- You’re reducing your monthly obligations

Employment verification – Streamlined or waived in many cases when payment history is strong

However, some circumstances trigger additional documentation:

- Significant payment increases requiring income verification

- Recent late payments needing explanation

- Cash-out portions (within allowed limits) requiring standard documentation

- Lender-specific overlay requirements beyond VA minimums

The streamlined approach makes IRRRLs accessible even for veterans whose income or employment situations have changed since obtaining their original VA loan.

Calculate your IRRRL scenario:

- VA IRRRL calculator

- Standard VA refinance calculator (for comparison)

Net Tangible Benefit Requirement

What is the net tangible benefit requirement for IRRRLs?

The VA mandates that IRRRLs provide clear financial advantage to borrowers. You cannot refinance simply because you want to—you must demonstrate one of these net tangible benefits:

Reducing Your Interest Structure

The most common benefit: lowering your interest percentage to reduce either your monthly payment or your total interest paid over the life of the loan. The new structure must be lower than your current one (with specific exceptions for refinancing adjustable structures).

Converting to a Fixed Structure

If you currently have an adjustable structure, you can refinance to a fixed one even if it doesn’t immediately reduce your payment. This provides:

- Payment predictability over the remaining loan life

- Protection against future increases when adjustable periods reset

- Long-term cost certainty for budgeting and planning

Reducing Your Loan Duration

You can refinance to a shorter period to build equity faster and reduce total interest paid, even if your monthly payment increases. This strategy works when:

- Your income has increased since obtaining your original loan

- You want to pay off your mortgage faster to reduce total interest costs

- You’re approaching retirement and want to eliminate mortgage obligations sooner

The VA recognizes that some veterans prefer accelerated equity building even with higher monthly obligations, accepting this as a valid net tangible benefit.

Recoupment Period Analysis

How quickly must you recoup refinancing costs?

Lenders must demonstrate that you’ll recoup closing costs through reduced monthly payments within a reasonable timeframe:

Standard recoupment calculation – Divide total closing costs by monthly payment reduction to determine months until break-even

Acceptable timeframes – The VA doesn’t mandate specific maximum recoupment periods, but most lenders prefer periods under 36 months

Exclusions from calculation – Certain costs don’t count toward recoupment including:

- Prepaid items like property taxes and insurance

- Amounts financed rather than paid at closing

- Funding fees that can be financed into the loan

Understanding recoupment helps determine whether refinancing makes financial sense based on how long you plan to keep the property and maintain the new loan.

IRRRL Funding Fees Explained

What funding fees apply to IRRRL refinances?

IRRRLs include funding fees that help sustain the VA loan program for future veterans. However, IRRRL funding fees are lower than fees for purchase loans or cash-out refinances:

Standard IRRRL Funding Fee Structure

IRRRL funding fees vary based on:

First-time vs. subsequent use – Lower fees apply for your first IRRRL, while subsequent IRRRLs carry slightly higher fees

Regular military vs. Reserves/Guard – Reserve and National Guard members typically pay modestly higher fees

Financing method – You can either:

- Pay the funding fee at closing with your own funds

- Finance it into the new loan amount, spreading the cost over the loan life

Most veterans choose to finance funding fees into their new loan amounts rather than paying at closing. This approach minimizes upfront cash requirements while marginally increasing the loan balance and monthly payment.

Funding Fee Exemptions

Who qualifies for IRRRL funding fee waivers?

The same exemptions that apply to other VA loans apply to IRRRLs:

- Veterans receiving VA disability compensation for service-connected disabilities

- Veterans eligible to receive disability compensation but receiving retirement pay instead

- Surviving spouses receiving Dependency and Indemnity Compensation

- Service members awarded the Purple Heart

Veterans with funding fee exemptions save substantially on each IRRRL refinance, making it easier to take advantage of improved market conditions multiple times without accumulating fees.

Check the VA IRRRL funding fee chart for current fee amounts based on your specific circumstances.

The IRRRL Process Step-by-Step

How does the IRRRL application and approval process work?

The streamlined IRRRL process typically completes in 20-30 days from application to closing:

Step 1: Initial Application

Contact a VA-approved lender and provide:

- Current VA loan information including lender name and loan number

- Current mortgage statement showing payment amount and balance

- Basic contact and employment information

- Authorization for credit report

Unlike standard refinances, you typically don’t need:

- Tax returns or W-2 forms

- Pay stubs or employment verification letters

- Bank statements or asset documentation

- Certificate of Eligibility (your existing VA loan proves eligibility)

Step 2: Lender Review and Processing

Your lender verifies:

- Your current loan is a VA loan eligible for IRRRL refinancing

- You’ve made at least six months of payments

- Your payment history meets acceptable standards

- The new loan provides net tangible benefit

- Basic credit standing remains acceptable

This review typically completes within 5-10 business days, much faster than standard refinance underwriting.

Step 3: Rate Lock and Loan Structure Selection

Once your IRRRL qualifies, you’ll:

- Lock your interest structure for a specified period

- Choose your new loan duration if different from your current one

- Decide whether to finance closing costs and funding fees

- Review estimated monthly payments and total costs

Market conditions affect available structures, so timing your rate lock strategically can maximize your savings.

Step 4: Closing Preparation

Your lender coordinates:

- Title work verifying property ownership and existing liens

- Payoff statement from your current lender showing exact balance

- Closing disclosure showing all costs, terms, and cash requirements

- Closing appointment scheduling at convenient location

What happens to your current loan during IRRRL processing?

Continue making your regular monthly payments on your existing VA loan until your IRRRL closes. Your current lender receives payoff proceeds at closing, and your new loan replaces the old one. Any payments made after your closing are typically refunded or applied to your new loan depending on timing.

Step 5: Closing and Funding

At closing, you’ll:

- Review and sign final loan documents

- Pay any closing costs not being financed

- Receive copies of all executed documents

- Have the option to ask questions about your new loan terms

The new loan typically funds within 1-2 business days after closing. Your first payment on the new loan usually isn’t due for 30-45 days after closing, giving you a brief payment holiday between your final payment on the old loan and your first payment on the new one.

Ready to discuss your IRRRL scenario? Submit a refinance inquiry to explore whether this makes sense for you.

Common Questions About VA IRRRLs

Can You Do an IRRRL If You No Longer Live in the Property?

Yes. IRRRLs require only that you previously occupied the property as your primary residence when you obtained the original VA loan. You can refinance with an IRRRL even if you:

- Moved and converted the property to a rental

- Relocated due to military orders or employment changes

- Purchased a new primary residence elsewhere

- No longer occupy the property for any other reason

You must certify at closing that you previously occupied the property, but current occupancy isn’t required. This flexibility helps military families who relocate frequently manage mortgages on properties they’ve converted to rentals.

How Many Times Can You Use an IRRRL?

Is there a limit on how many IRRRLs you can complete?

No maximum limit exists on IRRRL usage. You can refinance your VA loan multiple times using the IRRRL program, provided you:

- Wait at least 210 days from the first payment on your current loan

- Make at least six monthly payments on your current loan

- Demonstrate net tangible benefit with each refinance

- Meet the recoupment requirement each time

Veterans commonly use IRRRLs multiple times as market conditions improve or their financial circumstances change. However, consider diminishing returns—each refinance incurs closing costs and funding fees, so ensure the benefits justify these expenses.

Does an IRRRL Require an Appraisal?

No. The IRRRL’s streamlined nature eliminates appraisal requirements in most circumstances. This advantage provides:

- Faster processing without appraisal scheduling and completion delays

- Cost savings by avoiding appraisal fees

- Ability to refinance properties that may have declined in value

- Simplified process without property access or condition concerns

Appraisal waivers represent one of the IRRRL’s most valuable features, especially in markets where property values have decreased since your original purchase. You can refinance to reduce costs regardless of current property value, as long as your existing loan balance doesn’t exceed allowable refinancing limits.

Can You Get Cash Out With an IRRRL?

Limited cash back is possible, but IRRRLs aren’t designed for substantial equity access. Typical restrictions include:

- Maximum cash back typically capped at minimal amounts

- Cash limited to specific purposes like paying off the funding fee

- Cannot exceed accumulated equity in the property

- May trigger additional documentation requirements

When you need substantial cash from your equity:

Use a standard VA cash-out refinance instead of an IRRRL. Cash-out refinances allow you to:

- Access significant equity for any purpose

- Consolidate high-interest debts

- Fund home improvements or renovations

- Build emergency reserves or investment capital

View VA cash-out refinance case studies to understand this alternative approach when equity access is your primary goal.

Can You Add or Remove Someone From Your Loan With an IRRRL?

No. IRRRLs require the same borrowers on the new loan as the original. You cannot use an IRRRL to:

- Add a spouse after marriage

- Remove an ex-spouse after divorce

- Remove a deceased co-borrower

- Add adult children or other family members

- Make any changes to the borrower list

When you need to modify borrowers:

Use a standard VA refinance that allows complete flexibility to:

- Add spouses after marriage

- Remove ex-spouses after divorce settlements

- Remove deceased co-borrowers after inheritance

- Restructure borrowers for any valid reason

Standard VA refinances require full documentation but provide the flexibility to modify your borrower structure as life circumstances change.

View standard VA refinance case studies showing scenarios where borrower changes made standard refinancing the better choice.

How Does an IRRRL Affect Your VA Entitlement?

Does refinancing with an IRRRL consume additional VA entitlement?

No. IRRRLs don’t require new entitlement because you’re refinancing an existing VA loan, not taking out a new one. Your entitlement remains the same—the existing loan’s guarantee simply transfers to the new IRRRL.

This means you can:

- Complete IRRRLs without affecting your ability to obtain additional VA loans

- Maintain any remaining unused entitlement for future purchases

- Refinance multiple times without consuming additional benefits

If you have remaining entitlement beyond what’s securing your current VA loan, that excess remains available for purchasing additional properties or taking out new VA loans.

IRRRL vs. Standard VA Refinance: Which Should You Choose?

When should you use an IRRRL versus a standard VA refinance?

Understanding the key differences helps you select the right refinancing approach:

Choose an IRRRL When:

You want the fastest, simplest path to reduce costs on your existing VA loan and:

- Your sole objective is lowering interest expenses

- You want to convert from adjustable to fixed structure

- You don’t need cash out beyond minimal amounts

- No borrower changes are necessary

- Your current property value doesn’t matter

- You want minimal documentation requirements

The IRRRL’s streamlined processing makes it ideal when your only goal is cost reduction without any loan restructuring needs.

Choose a Standard VA Refinance When:

You need more flexibility than the IRRRL provides, including situations where you:

Currently have a non-VA loan – FHA, conventional, or USDA mortgages require standard VA refinancing to convert to VA financing

Need to modify borrowers – Marriage, divorce, inheritance, or other life changes requiring addition or removal of borrowers

Want substantial cash out – Need to access equity beyond the minimal amounts IRRRLs allow (typically up to a certain amount)

Need to remove private mortgage insurance – Currently pay PMI on a conventional loan and want to eliminate it through VA refinancing

Want property value considered – Have substantially increased equity that strengthens your qualification

Standard VA refinances require:

- Complete income and employment documentation

- Full credit review and underwriting

- Property appraisal

- Certificate of Eligibility verification

- More extensive processing timelines

However, they provide flexibility worth the additional documentation when your needs extend beyond simple interest reduction.

Comparison Example Scenarios:

Scenario 1: Pure cost reduction

- Currently have a VA loan at a higher structure

- Want to lower monthly obligations

- No borrower changes needed

- Don’t need cash out

- Best choice: IRRRL – Streamlined processing provides fastest savings

Scenario 2: Divorce situation

- Currently have a VA loan with ex-spouse as co-borrower

- Need to remove ex-spouse from the loan

- May also want to reduce interest expense

- Best choice: Standard VA Refinance – Allows borrower modification plus cost reduction

Scenario 3: Converting from FHA

- Currently have an FHA loan with mortgage insurance

- Want to eliminate ongoing insurance premiums

- May want to reduce overall monthly payment

- Best choice: Standard VA Refinance – Only option for refinancing non-VA loans

Scenario 4: Need cash for improvements

- Currently have a VA loan with substantial equity

- Want to fund major home renovations

- Also interested in reducing interest costs if possible

- Best choice: VA Cash-Out Refinance – Provides equity access plus potential cost reduction

Use these comparison tools to evaluate your options:

CHECKPOINT #3 – Re-reading REG Z compliance section before cost content…

IRRRL Costs and Closing Expenses

What costs should you expect when completing an IRRRL?

IRRRLs typically involve lower closing costs than standard refinances due to streamlined requirements:

Typical IRRRL Closing Costs

Lender fees – Origination charges for processing and underwriting your refinance

Title fees – Title search and insurance protecting the lender’s interest (though typically lower than purchase title work)

Recording fees – Government charges for recording your new mortgage

Credit report – Cost of pulling your credit history

Flood certification – Verification of flood zone status for the property

VA funding fee – One-time charge supporting the VA loan program (can be financed)

Items you typically DON’T pay with IRRRLs:

- Appraisal fees (no appraisal required in most cases)

- Full title insurance (typically use reissue pricing)

- Extensive underwriting fees (streamlined review)

- Certificate of Eligibility costs (existing VA loan proves eligibility)

Financing Closing Costs

Most IRRRL borrowers finance closing costs and funding fees into their new loan amount rather than paying them at closing. This approach:

- Minimizes upfront cash requirements

- Spreads costs over the loan life

- Slightly increases monthly payments due to higher loan balance

- Makes refinancing accessible without substantial cash reserves

Calculate whether the marginally higher monthly payment from financing costs still provides net benefit compared to your current loan.

No-Closing-Cost IRRRLs

Can you complete an IRRRL without paying closing costs?

Some lenders offer structures where closing costs are covered through slightly higher interest structures rather than upfront fees. This approach works when:

- You prefer not to finance costs into your loan balance

- You don’t have cash available for closing expenses

- You plan to refinance again relatively soon

- The slightly higher structure still provides net benefit

Evaluate total costs over your expected holding period to determine whether no-closing-cost structures provide better value than traditional approaches with upfront costs but lower structures.

Advanced IRRRL Considerations

Can You Do an IRRRL on a Rental Property?

Yes, provided you previously occupied the property as your primary residence when you obtained the original VA loan. The IRRRL’s occupancy requirement focuses on previous occupancy, not current use.

This flexibility particularly benefits military families who:

- Relocated due to military orders and converted former primary residences to rentals

- Purchased new homes in different locations while retaining previous properties

- Manage rental properties in markets where they previously lived

You must certify at closing that you previously occupied the property, but current rental use doesn’t disqualify you from IRRRL refinancing.

What Happens to Your Escrow Account During an IRRRL?

How do escrow accounts transfer when refinancing?

Your existing escrow account typically refunds to you within 20-30 days after your IRRRL closes. Simultaneously, your new lender establishes a new escrow account for property taxes and insurance on the refinanced loan.

This transition creates temporary overlap where:

- Your old lender refunds your previous escrow balance

- Your new lender collects initial escrow deposits at closing

- Both processes happen separately, creating brief cash flow considerations

Plan for this timing when budgeting your refinance. The refund from your old escrow eventually reimburses the new escrow deposits, but there’s typically a delay between collecting new escrow and receiving the old refund.

Can You Change Your Loan Duration With an IRRRL?

Is it possible to modify your remaining period when refinancing?

Yes. IRRRLs allow you to select different durations than your original loan, enabling you to:

Extend your period to:

- Reduce monthly payments by spreading costs over more time

- Improve monthly cash flow for other financial priorities

- Manage temporary income reductions or increased expenses

Shorten your period to:

- Build equity faster through larger monthly payments

- Reduce total interest paid over the loan life

- Eliminate mortgage obligations sooner for retirement planning

When changing durations, ensure you still meet the net tangible benefit requirement. Extending your period while lowering your structure easily demonstrates benefit through reduced monthly obligations. Shortening your period requires showing benefit through total interest savings or other valid advantages.

How Do IRRRLs Work With Energy-Efficient Mortgages?

Can you include energy improvements in your IRRRL?

The VA allows energy-efficient improvements in IRRRLs through the Energy Efficient Mortgage (EEM) program. This option lets you:

- Finance energy-efficient upgrades into your IRRRL

- Exceed your current loan balance by the cost of energy improvements

- Include improvements like insulation, solar panels, or efficient HVAC systems

- Reduce long-term utility costs while lowering interest expenses

Energy improvements must:

- Be cost-effective based on expected energy savings

- Be documented through energy audits or assessments

- Meet VA standards for acceptable improvements

- Be completed shortly after the IRRRL closes

This combination approach helps veterans reduce both mortgage costs and ongoing utility expenses simultaneously.

What Documentation Does an IRRRL Require?

What paperwork do you need for IRRRL applications?

The streamlined IRRRL requires minimal documentation compared to standard refinances:

Always required:

- Current VA loan information including lender and loan number

- Recent mortgage statement showing payment and balance

- Occupancy certification confirming previous residence

- Authorization for credit report

- Valid government-issued identification

Sometimes required depending on circumstances:

- Income documentation if payment increases significantly

- Employment verification if lender policies require it

- Explanations for any recent late payments

- Verification of current property use if not owner-occupied

Rarely or never required:

- Tax returns or W-2 forms

- Bank statements or asset documentation

- Pay stubs for employed borrowers

- Certificate of Eligibility (existing VA loan proves eligibility)

- Property appraisal (waived in most IRRRLs)

This minimal documentation makes IRRRLs accessible even for veterans whose income or employment circumstances have changed since obtaining their original loans.

Can You Do an IRRRL During a Chapter 13 Bankruptcy?

Refinancing during active Chapter 13 bankruptcy presents challenges but isn’t impossible. Requirements typically include:

- Trustee approval for refinancing the property

- Demonstration that refinancing benefits the bankruptcy estate

- At least 12 months of on-time bankruptcy plan payments

- Court approval for modifying the confirmed plan

- Lender willingness to work with bankruptcy situations

Most veterans wait until bankruptcy discharge before refinancing, as this eliminates complications and expands lender options. However, if refinancing during bankruptcy provides substantial benefits, work with both your bankruptcy attorney and lender to navigate the approval process.

What Are Common Reasons for IRRRL Denial?

Why do IRRRL applications get rejected?

Despite streamlined processing, IRRRLs can still be denied for specific reasons:

Insufficient seasoning – Haven’t made six months of payments on current VA loan

Poor payment history – Recent late payments on existing VA loan without acceptable explanations

No net tangible benefit – Cannot demonstrate that refinancing reduces costs or improves loan structure

Unacceptable recoupment period – Takes too long to recover closing costs through savings

Current loan isn’t VA-backed – The IRRRL exclusively refinances existing VA loans

Property title issues – Liens, judgments, or ownership problems discovered during title review

Inadequate credit standing – Even with streamlined review, seriously compromised credit may prevent approval

Occupancy certification problems – Cannot verify previous primary residence occupancy

Excessive existing debt – When combined with housing expenses, monthly obligations exceed acceptable thresholds

Address these potential issues before applying to increase approval probability and reduce processing delays.

Explore all loan programs to understand your complete range of options.

Final IRRRL Questions

Can You Skip Payments When Refinancing With an IRRRL?

What happens to your mortgage payments during IRRRL processing?

You don’t actually “skip” payments, but you often experience a payment gap due to refinancing timing:

- Continue making regular payments on your existing VA loan until your IRRRL closes

- Your current lender receives full payoff at closing

- Your first payment on the new IRRRL typically isn’t due for 30-45 days after closing

- This creates a brief period where you’re not making mortgage payments

If you made your regular payment shortly before closing, you might go 6-8 weeks without making a mortgage payment. This happens because:

- Your final payment on the old loan occurred within 30 days before closing

- Your new loan’s first payment isn’t due until 30-45 days after closing

- The gap between these creates the temporary payment holiday

This break provides brief cash flow relief but doesn’t represent forgiven obligations—you’re simply experiencing normal payment timing associated with refinancing.

How Does an IRRRL Affect Your Credit Score?

What credit impact should you expect from IRRRL refinancing?

IRRRLs typically have minimal credit impact:

Short-term effects:

- Hard inquiry when lender pulls your credit (typically minor impact)

- Closing your old loan account (usually minimal effect since you’re opening a new one simultaneously)

- New loan appearing on your credit report

Long-term effects:

- Positive impact from continued on-time payment history on the new loan

- Potential improvement if reduced payments make overall debt management easier

- Minimal long-term impact since you’re replacing one VA loan with another

Most veterans see negligible lasting credit effects from IRRRLs. Any temporary score reduction typically recovers within a few months as you establish positive payment history on the new loan.

Can You Do an IRRRL If You’re Behind on Payments?

No. IRRRLs require satisfactory payment history on your existing VA loan. If you’re currently behind on payments or in default:

First priority: Bring your loan current through:

- Making all missed payments plus any applicable late fees

- Establishing consistent on-time payment pattern for at least 6-12 months

- Working with your current lender on loss mitigation options if needed

Then explore refinancing once you’ve:

- Reestablished acceptable payment history

- Resolved any default or delinquency status

- Demonstrated ability to manage mortgage obligations responsibly

If you’re struggling with your current VA loan payments, contact your lender immediately to discuss options like:

- Forbearance agreements providing temporary payment relief

- Loan modifications adjusting terms to improve affordability

- Repayment plans spreading missed payments over future months

Address payment difficulties promptly rather than letting them escalate to foreclosure.

Does an IRRRL Reset Your Loan Start Date?

How does refinancing affect your mortgage timeline?

Yes, an IRRRL creates a new loan with a new start date. This affects your mortgage in several ways:

Amortization restarts – If you refinance to the same duration as your original loan, you’ll be paying for a longer total period:

- Example: You’re 5 years into a loan originally structured for 30 years

- You have 25 years remaining

- If you refinance to a new 30-year structure, you’ll pay for 35 total years

- Consider refinancing to a 25-year or shorter period to match your original payoff timeline

Equity building pace changes – Early loan years allocate more toward interest than principal. Restarting resets this amortization curve, potentially slowing equity accumulation temporarily.

Total interest considerations – Extending your timeline increases total interest paid even if your structure decreases. Calculate total costs over your entire holding period, not just monthly savings.

To avoid extending your overall mortgage timeline, choose a new period matching your remaining time on the original loan.

Can You Do an IRRRL on a Second Home?

IRRRLs require certification that you previously occupied the property as your primary residence. Second homes or vacation properties that never served as your primary residence don’t qualify for IRRRL refinancing.

However, former primary residences converted to second homes or vacation properties after establishing occupancy may qualify, provided you:

- Originally occupied the property as your primary residence when obtaining the VA loan

- Can certify this previous occupancy at closing

- Meet all other IRRRL requirements

The distinction matters: second homes you never occupied as primary residences don’t qualify, while former primary residences now used seasonally may qualify based on previous occupancy.

What Happens to Your Mortgage Insurance With an IRRRL?

Does refinancing affect mortgage insurance requirements?

VA loans don’t require private mortgage insurance regardless of your equity level—this benefit applies to both your original VA loan and any IRRRL refinances.

If you previously refinanced from a conventional or FHA loan to VA financing, you already eliminated mortgage insurance when you first obtained your VA loan. The IRRRL simply refinances your existing VA loan without any mortgage insurance considerations.

This represents one of the VA loan program’s most valuable features: no mortgage insurance regardless of your equity position, saving hundreds monthly compared to conventional financing with limited equity.

How Soon After Closing Your VA Loan Can You Do an IRRRL?

What is the minimum waiting period for IRRRL eligibility?

You must wait at least 210 days from the first payment due date on your current VA loan AND make at least six monthly payments before IRRRL eligibility. Both requirements must be satisfied:

Minimum 210 days – Calculated from your first payment due date, not your closing date

Minimum 6 payments – Actual monthly payments made, not just time elapsed

Example timeline:

- Close on VA loan January 15

- First payment due March 1

- 210 days from March 1 = September 27

- Six payments = March through August

- Earliest IRRRL eligibility = September 27 (assuming all six payments made on time)

This seasoning requirement ensures the IRRRL program serves veterans managing their loans responsibly rather than those constantly churning refinances.

Can You Use an IRRRL to Get Out of an ARM?

Does the IRRRL allow conversion from adjustable structures to fixed ones?

Yes. Converting from an adjustable structure to a fixed one represents a valid net tangible benefit even if it doesn’t immediately reduce your payment. The VA recognizes that predictability and protection from future increases provide valuable benefits justifying IRRRL refinancing.

This option particularly benefits veterans who:

- Obtained adjustable VA loans when rates were lower

- Face adjustment periods where rates could increase substantially

- Want payment predictability for budgeting and long-term planning

- Prefer certainty over potential future payment fluctuations

When converting from adjustable to fixed structures, demonstrate net tangible benefit by showing:

- Protection against potential future payment increases

- Improved payment predictability and financial planning

- Current market conditions making fixed structures attractive

- Long-term cost savings from avoiding potential future increases

This conversion strategy provides peace of mind and financial stability even if your immediate payment doesn’t decrease.

Ready to get started? Apply now or schedule a call to discuss your situation.

Alternative Loan Programs for Refinancing

If a VA IRRRL isn’t the right fit, consider these refinancing alternatives:

- VA Loan Refinance – Standard VA refinance with flexibility to add/remove borrowers, access equity up to certain limits, or refinance from non-VA loans while eliminating mortgage insurance

- VA Cash-Out Refinance – Access substantial equity for debt consolidation, home improvements, or other financial needs while potentially reducing interest costs

- Conventional Refinance – Traditional refinancing for non-VA properties or when specific conventional features better match your needs

- FHA Streamline Refinance – Simplified refinancing for existing FHA loans with minimal documentation requirements

- Cash-Out Refinance – Access equity from any existing mortgage type for various financial purposes

Explore all 30+ loan programs to find your best option.

Not sure which refinancing approach is right for you? Take our discovery quiz to find your path.

Helpful VA IRRRL Resources

Official VA IRRRL Guidance

VA IRRRL Program Overview and Requirements – Comprehensive Department of Veterans Affairs resource explaining IRRRL program benefits, eligibility requirements, and streamlined processing features for existing VA loan holders.

VA Net Tangible Benefit Standards for IRRRLs – Official VA guidance on net tangible benefit requirements ensuring refinancing provides clear financial advantages to veteran borrowers.

VA IRRRL Funding Fee Chart – Current funding fee schedules for IRRRL refinances showing amounts based on service type and whether this is your first or subsequent IRRRL.

General VA Loan Resources

VA Home Loans Main Page – Central hub for all VA loan programs including purchase loans, refinances, and specialized programs serving military families.

VA Loan Entitlement Information – Detailed guidance on VA loan entitlement including how refinancing affects your available benefits and restoration processes.

Educational Resources

Consumer Financial Protection Bureau Refinancing Guide – Federal consumer protection agency providing unbiased information about refinancing considerations, cost comparisons, and borrower rights.

HUD Housing Counseling Services – Directory of HUD-approved housing counselors offering free or low-cost assistance with refinancing questions, financial planning, and decision-making support.

Military Financial Resources

Military OneSource Financial Counseling – Department of Defense program offering free financial counseling and education specifically for military families evaluating refinancing options and managing mortgages.

Defense Finance and Accounting Service – Official military pay and benefits information helping service members understand income documentation requirements for refinancing applications.

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Not Sure About Your Next Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Related Posts

Subscribe to our newsletter

Get program updates and rate insights in your inbox.