HomeStyle Renovation Loan: Couple Purchases $425K Fixer-Upper with $95K Renovation Budget in Single Mortgage

- By Jim Blackburn

- on

- Buy A House, Conventional Loan, Renovation Loan

Educational Case Study Disclosure

This case study is hypothetical and for educational purposes only. Scenarios, borrower profiles, loan terms, interest rates, and APRs are illustrative examples and do not represent current offers or guaranteed terms.

If specific loan terms (e.g., down payment %, payment amount, rate/APR, points, or repayment period) appear in this article, required disclosures will be shown immediately next to those terms per Regulation Z.

For specific details including down payment incentives, closing cost incentives, interest rate details, closing cost breakdowns, payment calculations, cash-to-close estimates, or an official Loan Estimate, it is highly recommended you schedule a meeting with one of our licensed mortgage advisors.

Learn more:

- Reg Z – Advertising (§1026.24) – CFPB official regulation

- Reg Z Full Text – Electronic Code of Federal Regulations

- Official Interpretations to §1026.24 – CFPB interpretations

- MAP Rule (Reg N), 12 CFR Part 1014 – Mortgage advertising rules

- NMLS Consumer Access – Verify licensure

Actual loan terms vary by credit profile, property, occupancy, location, market conditions, and lender guidelines. For current options tailored to you, schedule a consultation or apply online.

Ready to explore your options? Schedule a call with a loan advisor.

How This HomeStyle Renovation Loan Financed Purchase Plus Complete Renovation Without Two Separate Loans

David and Sarah M., a married couple ages 36 and 34 respectively, had spent years saving for their first home in South Florida’s competitive real estate market. David worked as a software engineer earning $115,000 annually, and Sarah worked as a registered nurse earning $82,000 annually—combined W-2 income of $197,000 with excellent employment stability. As first-time home buyers (Step 2 in their financial journey), they had saved $125,000 for down payment and reserves, maintained excellent credit (742 and 738 scores), and were ready to purchase their forever home where they could build equity, raise their family, and establish roots in Fort Lauderdale.

However, the South Florida housing market presented challenges. Move-in-ready homes in their desired neighborhoods were priced at $625,000-$675,000—stretching their budget uncomfortably. Meanwhile, they noticed that dated homes needing renovations were selling for $425,000-$475,000 in the same neighborhoods—significantly more affordable but requiring substantial updates to meet their needs. One property particularly caught their attention: a four-bedroom, three-bathroom home in Coral Springs listed at $425,000 with solid bones but needing complete kitchen renovation, bathroom updates, new flooring throughout, updated electrical and plumbing, fresh paint, and landscaping improvements—approximately $95,000 in total renovations.

If they could purchase the $425,000 fixer-upper and complete $95,000 in renovations (total investment $520,000), they’d own a fully updated home worth $625,000+—building instant equity while staying within their comfortable budget. The challenge was financing: how could they purchase the home and fund renovations in a coordinated way without juggling multiple loans, complex construction financing, or depleting their entire savings?

“We found the perfect house in the perfect neighborhood at a price we could actually afford,” Sarah explained. “But it needed significant work—updated kitchen, renovated bathrooms, new flooring, electrical upgrades. We didn’t have $95,000 in cash beyond our down payment to fund renovations. Traditional mortgages would only finance the purchase price, leaving us unable to afford the improvements. Construction loans seemed complicated and expensive. We needed a solution that would finance both the purchase and the renovations in one coordinated mortgage.”

David and Sarah needed a HomeStyle Renovation Loan—a conventional Fannie Mae program that finances both property purchase and planned renovations in a single mortgage based on the home’s after-renovation value (ARV). HomeStyle loans eliminate the complexity of juggling purchase mortgages plus separate construction financing, provide competitive conventional rates, and allow first-time buyers to purchase fixer-uppers they can afford while financing necessary updates that make properties livable and valuable.

Facing similar challenges? Schedule a call to explore your HomeStyle Renovation Loan options.

Why Was a HomeStyle Renovation Loan Essential for Purchasing a Fixer-Upper?

David and Sarah researched multiple financing options for purchasing and renovating the Coral Springs fixer-upper and quickly understood why a HomeStyle Renovation Loan was the only practical solution:

Traditional mortgage limitations:

- Only finances purchase price ($425,000), not renovation costs

- Leaves buyers without funds for necessary updates

- Properties often need to be habitable to qualify

- Buyers must use cash for all renovations after closing

Separate construction loan approach problems:

- Requires two separate closings (purchase mortgage, then construction loan)

- Double closing costs and fees

- Complex coordination between lenders

- Higher combined interest costs

- Construction loans often have higher rates than conventional mortgages

HomeStyle Renovation Loan advantages:

- Single mortgage finances both purchase AND renovations

- Based on after-renovation value (ARV), not just purchase price

- One closing, one set of fees, one mortgage payment

- Competitive conventional mortgage rates

- Renovation funds held in escrow, released as work completes

- Streamlined process designed for purchase-plus-renovation scenarios

- Available for primary residences with conventional down payments

“The HomeStyle Renovation Loan was literally the only way we could afford to buy in our target neighborhood,” David said. “Move-in-ready homes were $625,000-$675,000—completely stretching our budget. The fixer-upper at $425,000 was affordable, but we didn’t have $95,000 cash beyond our down payment to fund renovations. The HomeStyle loan financed both the $425,000 purchase and the $95,000 in renovations based on the home’s after-renovation value of $625,000+. We closed once, got one mortgage with conventional rates, and had renovation funds held in escrow released as contractors completed work. It was the perfect solution for first-time buyers purchasing fixer-uppers.”

David and Sarah appreciated that HomeStyle loans recognize a fundamental reality: many buyers—especially first-time buyers—can afford fixer-uppers in desirable neighborhoods but lack cash beyond down payments to fund renovations. By financing renovations based on ARV rather than just purchase price, HomeStyle loans make home ownership accessible while ensuring properties get necessary updates. The program benefits everyone: buyers access homes they can afford, neighborhoods improve through renovations, and lenders finance properties secured by higher after-renovation values.

The HomeStyle structure would finance their purchase ($425,000) plus renovations ($95,000) in a single mortgage totaling $520,000. They’d provide their down payment, and the lender would hold renovation funds in escrow, releasing them as contractors completed work and inspections verified quality. Once renovations finished, they’d own a fully updated $625,000+ home with substantial instant equity—all financed through one conventional mortgage.

Ready to purchase your fixer-upper? Schedule a call to discuss HomeStyle Renovation Loan options.

What Documentation Was Required for David and Sarah’s HomeStyle Renovation Loan?

David and Sarah worked with their loan advisor to assemble documentation for a HomeStyle Renovation Loan combining purchase financing and renovation funding in a single conventional mortgage.

Documentation provided:

- Two years of W-2 forms (both borrowers)

- Two years of tax returns

- Recent pay stubs from both employers

- Employment verification letters

- 742 and 738 credit scores

- Bank statements showing $125,000 available funds

- Purchase contract for Coral Springs home at $425,000

- Detailed renovation scope of work and budget ($95,000)

- Licensed contractor credentials and contract

- Architect/designer plans for kitchen and bathroom layouts

- After-renovation value (ARV) appraisal estimate ($625,000+)

- Renovation timeline (4-5 months estimated)

- Homeowners insurance quote

The approval process:

- Initial consultation (Day 1) – Discussed HomeStyle loan for purchase plus renovation

- Pre-approval (Days 2-7) – Income, credit, and asset verification for pre-qualification

- Home search and offer (Weeks 2-4) – Found Coral Springs fixer-upper, offer accepted

- Formal application (Day 1 after contract) – Full HomeStyle loan application submitted

- Renovation planning (Days 2-10) – Detailed scope of work and contractor agreements

- As-is and ARV appraisal (Days 11-18) – Appraiser evaluated current and after-renovation values

- Underwriting review (Days 19-28) – Comprehensive analysis of purchase and renovation plans

- Conditional approval (Day 29) – Approved pending minor documentation

- Final approval (Day 38) – Clear to close on HomeStyle loan

- Closing (Day 45) – Funded purchase, renovation funds placed in escrow

- Renovation period (Months 1-5) – Contractors completed work with escrow draw releases

- Final inspection (Month 5) – Work verified complete, final funds released

- Certificate of completion (Month 5) – All renovations finished and verified

The lender approved David and Sarah’s HomeStyle Renovation Loan based on their strong combined W-2 income ($197,000 annually), excellent credit scores (742/738), substantial down payment and reserves ($125,000 available), detailed renovation plans with licensed contractor, and appraiser-verified ARV showing $625,000+ value after planned $95,000 renovations. The appraisal confirmed their purchase price of $425,000 was excellent value, and completed renovations would create a home worth $625,000+—providing substantial equity position and conservative loan-to-value ratio protecting both borrowers and lender.

“The HomeStyle approval process was thorough but logical,” Sarah said. “The lender verified our income and assets like any conventional mortgage, then carefully reviewed our renovation plans—budget, scope of work, contractor credentials, timeline. The appraiser evaluated the home’s current condition and estimated after-renovation value based on comparable sales of updated homes in the neighborhood. Everything confirmed that our $520,000 total investment (purchase plus renovation) would create a home worth $625,000+—building substantial equity immediately. That analysis gave us and the lender confidence the project made financial sense.”

The entire process from application to closing took 45 days—similar to conventional mortgages. David and Sarah closed on their home, and renovation funds ($95,000) were placed in escrow. As their licensed contractor completed phases of work and inspections verified quality, the lender released escrow funds directly to contractors—ensuring work quality and proper fund deployment.

Ready to purchase and renovate? Submit a purchase inquiry to explore HomeStyle options.

What Were the Final Results of David and Sarah’s HomeStyle Renovation Loan?

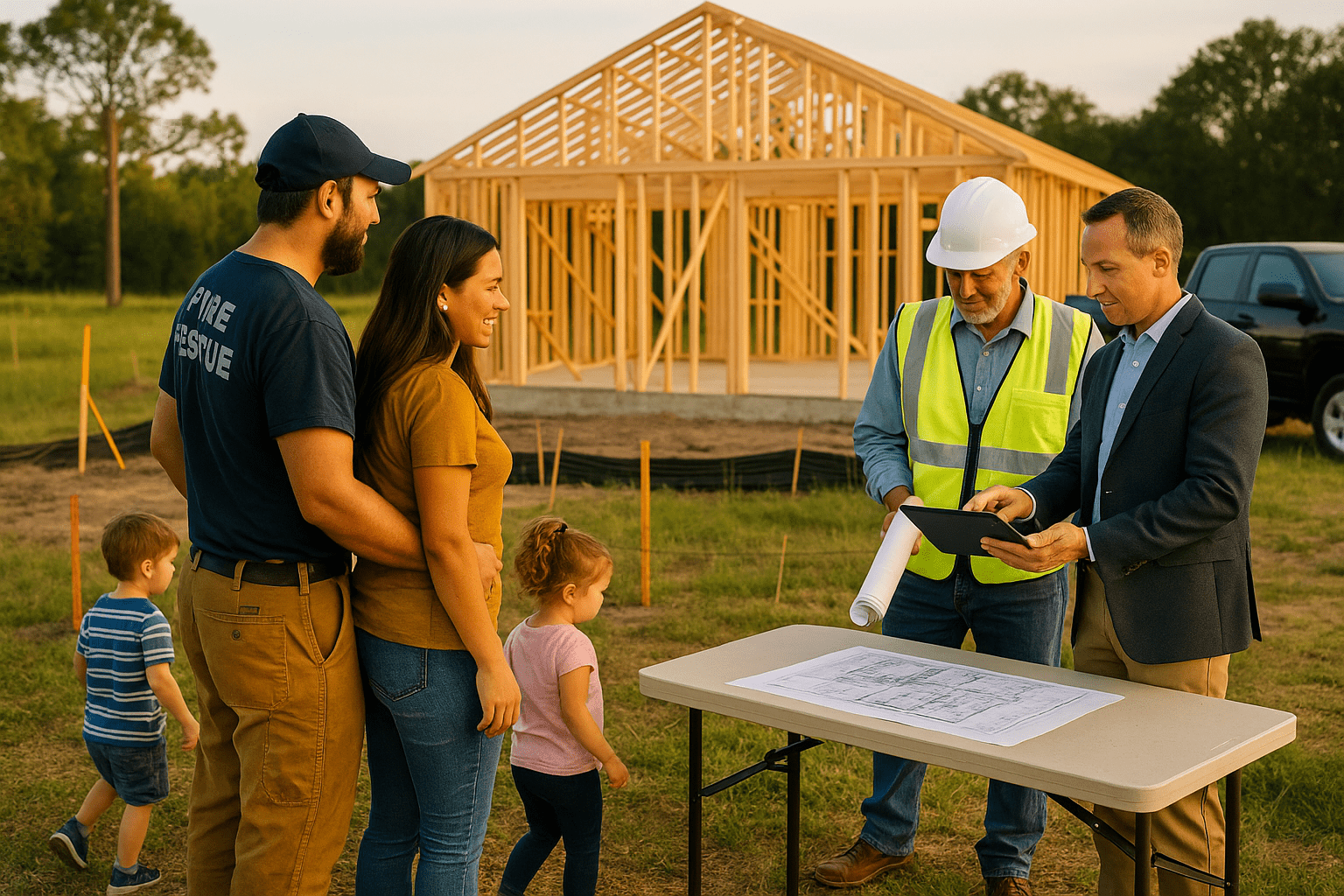

David and Sarah successfully closed on their Coral Springs fixer-upper using HomeStyle Renovation Loan financing, transforming the dated property into their dream home over five months.

Final HomeStyle Renovation Loan details:

- Purchase price: $425,000

- Renovation budget: $95,000

- Total financed: $520,000 (purchase + renovation in single mortgage)

- Down payment: Substantial equity position meeting conventional requirements

- Competitive conventional rates –Try this Homestyle renovation loan calculator to explore scenarios

- After-renovation value (ARV): $625,000+ (appraiser-verified)

- Instant equity created: $105,000+ from day one

- Renovation timeline: 5 months from closing to completion

- Single mortgage: One closing, one payment, competitive conventional terms

- Property: 4BR/3BA single-family home, Coral Springs, Fort Lauderdale, FL

Renovations completed:

Kitchen (Month 1-2):

- Complete gut renovation

- Custom white shaker cabinets with soft-close hardware

- Quartz countertops and waterfall island

- Stainless steel appliance package

- Subway tile backsplash with designer accent

- Updated lighting and modern fixtures

- Open layout connecting to living space

Bathrooms (Month 2-3):

- Primary bathroom: Complete renovation with spa features, frameless glass shower, dual vanity

- Guest bathrooms (2): Updated vanities, tile surrounds, modern fixtures

- All new plumbing fixtures throughout

Flooring and Finishes (Month 3-4):

- Luxury vinyl plank flooring throughout main living areas

- New carpet in bedrooms

- Fresh paint interior (modern neutral palette)

- Updated lighting fixtures and hardware throughout

- New window treatments

Systems and Exterior (Month 4-5):

- Electrical updates and additional outlets

- Plumbing improvements

- HVAC system servicing

- Exterior paint and pressure washing

- Landscaping improvements and curb appeal enhancement

Strategic outcome:

- Instant equity: Purchased for $425,000, renovated for $95,000, valued at $625,000+ = $105,000+ equity immediately

- Affordable entry: Bought in target neighborhood for $200,000 less than move-in-ready homes

- Custom updates: Renovated exactly to their tastes rather than accepting someone else’s choices

- Single mortgage: One closing, one payment, conventional rates

- First-time buyer success: Achieved homeownership in competitive market through strategic fixer-upper purchase

- Forever home created: Property meets all their needs for long-term occupancy

David and Sarah moved into their completed home five months after closing, having transformed the dated fixer-upper into a modern, beautiful space perfect for their family. The kitchen became the heart of their home where they gather and entertain. The updated bathrooms provide spa-like comfort. The fresh finishes throughout feel new and contemporary. Most importantly, they own a $625,000+ home in their ideal neighborhood—achieved through strategic fixer-upper purchase and HomeStyle financing that made it all possible.

“The HomeStyle Renovation Loan turned an impossible dream into reality,” David explained. “We couldn’t afford $625,000 for move-in-ready homes in Coral Springs. But we could afford $425,000 for a fixer-upper, and the HomeStyle loan financed the $95,000 in renovations we needed. Five months of contractor work transformed a dated house into our dream home. We now own property worth $625,000+ with substantial instant equity, pay one affordable mortgage with conventional rates, and live exactly where we wanted in a home customized perfectly for our needs. Without HomeStyle financing, we’d still be renting or forced to buy in less desirable neighborhoods.”

David and Sarah’s HomeStyle success demonstrates how purchase-plus-renovation financing makes homeownership accessible in competitive markets. They built $105,000+ in instant equity through strategic buying and smart renovations. As they build more equity through appreciation and mortgage paydown, they may eventually leverage that equity through a HomeStyle Renovation Loan refinance to fund additional updates, or use a HELOC or Home Equity Loan for future projects.

“The best part is understanding we made a smart financial decision while getting everything we wanted,” Sarah added. “We built substantial equity immediately through below-market purchase and value-add renovations. We’re in a neighborhood we love with a home we designed to our tastes. We have one simple conventional mortgage we can easily afford. And we’re building wealth from day one through equity appreciation in an area that continues growing. That’s smart first-time home buying—using programs like HomeStyle that level the playing field and help buyers compete in expensive markets by making fixer-uppers financially viable.”

Ready to buy and renovate your dream home? Get approved or schedule a call to discuss HomeStyle Renovation Loans.

What Can First-Time Buyers Learn from This HomeStyle Renovation Loan Success?

- HomeStyle Renovation Loans finance purchase plus renovations in single conventional mortgage—David and Sarah financed $425,000 purchase + $95,000 renovation = $520,000 total (Fannie Mae HomeStyle information)

- After-renovation value (ARV) determines financing amount, not just purchase price—lender financed based on $625,000+ ARV, creating instant equity

- Fixer-uppers provide affordable entry in expensive markets—$425,000 fixer vs. $625,000 move-in-ready in same neighborhood

- Single closing with one mortgage simplifies purchase-plus-renovation financing—avoided complex two-loan structures

- Escrow-controlled renovation funds ensure quality and proper deployment—draws released as inspections verified work completion

- First-time buyers can compete in competitive markets through strategic fixer-upper purchases—HomeStyle financing levels playing field

Have questions about HomeStyle Renovation Loans? Schedule a call with a loan advisor today.

Alternative Loan Programs for Purchase-Plus-Renovation Financing

If a HomeStyle Renovation Loan isn’t the perfect fit, consider these alternatives:

- FHA 203k Loan – Government-backed purchase-plus-renovation with lower down payments

- Conventional Loan – Traditional purchase financing (if you have cash for renovations)

- Construction Loan – For major structural work or additions

- Home Improvement Loan – Post-purchase unsecured financing for smaller projects

- HELOC – Post-purchase equity access (requires waiting period after purchase)

- Down Payment Assistance – Programs helping first-time buyers with down payments

Explore all loan programs to find your best option.

Want to assess your homebuying readiness? Take our discovery quiz to clarify your path to homeownership.

Helpful HomeStyle Renovation Loan Resources

Learn more about this program:

- Complete HomeStyle Renovation Loan Guide – Purchase-plus-renovation requirements

- HomeStyle Calculator – Estimate financing for fixer-uppers

Similar success stories:

- FHA 203k for lower down payment – Government-backed alternative

- HomeStyle refinance for additional projects – Refinancing with more renovations

- Browse all case studies by journey stage

External authoritative resources:

- Fannie Mae HomeStyle Program – Official program details

- HUD Renovation Loan Comparison – Compare renovation programs

- NARI Contractor Credentials – Finding qualified contractors

- This Old House Renovation Guide – Home improvement resources

Ready to take action?

- Apply online – Start HomeStyle application

- Schedule consultation – Discuss your fixer-upper purchase

- Take discovery quiz – Clarify homebuying goals

Need local expertise? Get introduced to partners including buyer agents specializing in fixer-uppers and renovation contractors.

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Not Sure About Your Next Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required