HomeStyle Renovation Loan: 7 Smart Ways to Buy and Renovate in One Mortgage

How a HomeStyle Renovation Loan Finances Purchase and Improvements with Just 3% Down

Buying a fixer-upper or renovating your current home doesn’t have to mean juggling multiple loans, contractors, and financial headaches. A HomeStyle Renovation loan combines your purchase or refinance with renovation costs into one convenient mortgage, giving you access to properties with incredible potential that other buyers might overlook.

Key Details: What You’ll Learn About HomeStyle Renovation Financing

- How HomeStyle Renovation loans work for both purchase and refinance scenarios, including eligible improvement types (Fannie Mae HomeStyle Renovation guidelines)

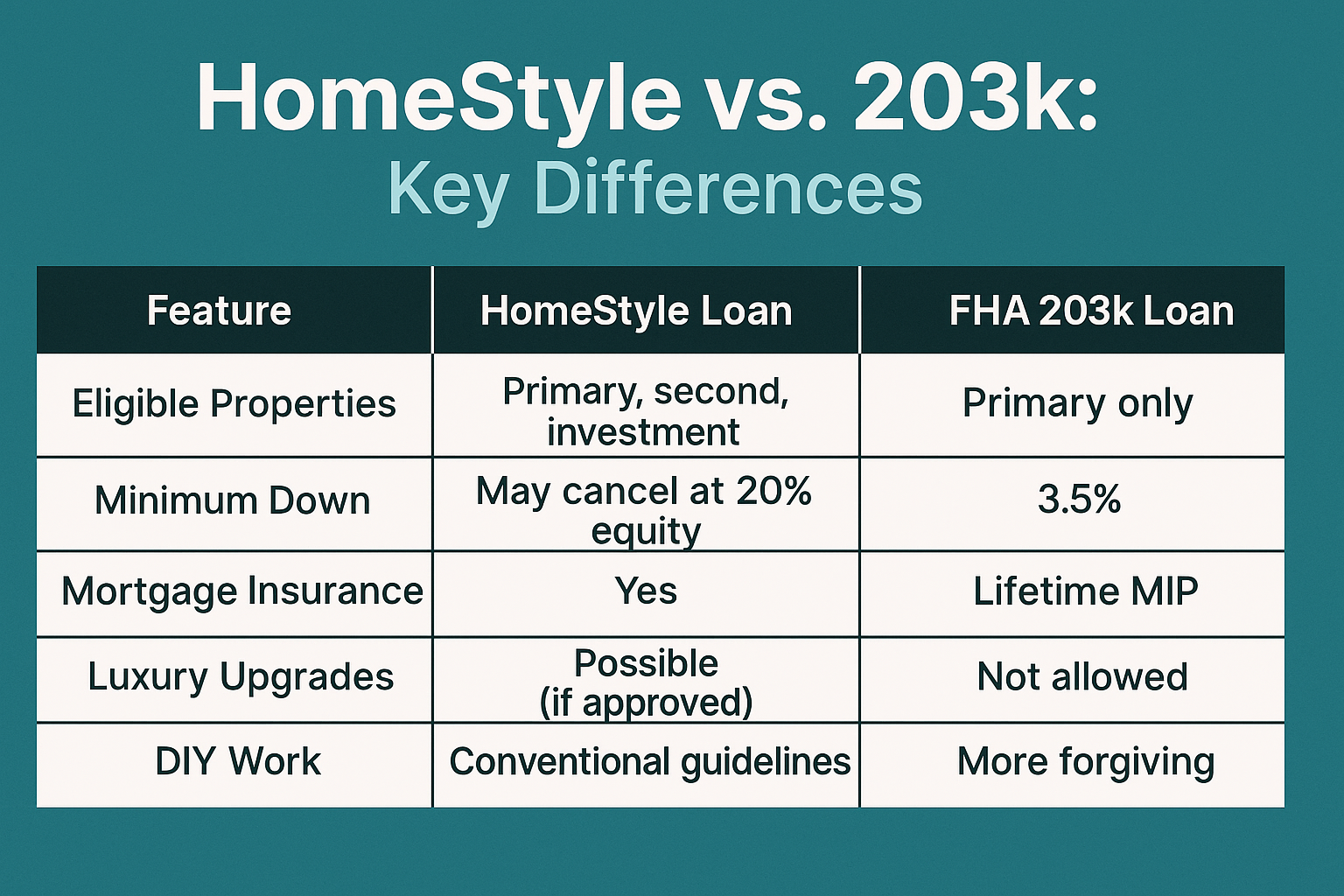

- The differences between HomeStyle Renovation and FHA 203(k) loans for renovation financing (HUD 203(k) rehabilitation mortgage insurance program)

- Eligible property types and renovation projects, from minor updates to major structural changes (Freddie Mac CHOICERenovation loan overview)

- How the loan process works with contractors, inspections, and fund disbursement timelines

- Credit and financial qualification requirements for renovation loan approval (Consumer Financial Protection Bureau mortgage shopping guide)

- Maximum loan limits and how renovation costs factor into your total borrowing capacity (FHFA conforming loan limits)

- Smart strategies to maximize your renovation budget while maintaining equity and home value

Ready to explore your options? Schedule a call with a loan advisor.

What Is a HomeStyle Renovation Loan?

A HomeStyle Renovation loan is a conventional mortgage product backed by Fannie Mae that allows you to finance both the purchase price (or current value for refinances) and renovation costs into a single mortgage. Instead of taking out a home equity loan or personal loan after closing, you can bundle everything together from the start.

Why consider a HomeStyle Renovation loan instead of traditional financing? This approach offers several distinct advantages that can save you time, money, and considerable hassle during the renovation process.

The loan is based on the “as-completed” value of your home—meaning lenders evaluate what your property will be worth after renovations are finished, not just its current condition. This allows you to borrow more than you could with a traditional mortgage and access properties that might otherwise be out of reach.

How Does a HomeStyle Renovation Loan Differ from Standard Mortgages?

Traditional mortgages require you to complete renovations with separate financing, typically through:

- Home equity loans or lines of credit

- Personal loans with higher interest rates

- Cash reserves that drain your savings

- Credit cards with expensive terms

HomeStyle Renovation loans eliminate this complexity by providing a comprehensive financing solution that covers:

- The purchase price or existing mortgage balance

- Renovation and improvement costs

- Contractor labor and materials

- Permits, inspections, and professional fees

- Up to six months of mortgage payments during major renovations

- Contingency reserves for unexpected costs

This streamlined approach means you’ll have one monthly payment, one interest rate, and one closing process instead of coordinating multiple financial products.

7 Smart Ways to Use a HomeStyle Renovation Loan

1. Buy a Fixer-Upper Below Market Value

Can you really save money buying a home that needs work? Absolutely—and a HomeStyle Renovation loan makes this strategy accessible to more buyers.

Properties requiring significant updates typically sell at a discount compared to move-in ready homes in the same neighborhood. By purchasing below market value and financing renovations through your mortgage, you can:

- Access neighborhoods that might otherwise be unaffordable

- Build instant equity through strategic improvements

- Customize finishes and layouts to your exact preferences

- Compete with fewer buyers who need turnkey properties

- Create a home perfectly suited to your lifestyle

The key is identifying properties with good bones—solid structure, desirable location, and renovation needs that align with your budget and timeline. Your lender will require a detailed renovation plan and contractor estimates before approval, ensuring your project is feasible and financially sound.

2. Renovate Your Current Home Without Equity Requirements

Unlike home equity loans or HELOCs that require substantial existing equity, a HomeStyle Renovation refinance allows you to tap into your home’s future value. This is particularly valuable when:

- You recently purchased and haven’t built significant equity yet

- Your home’s current condition limits its appraised value

- You want to make improvements that will substantially increase value

- You’re consolidating higher-interest debt while upgrading your home

The refinance pays off your existing mortgage and adds your renovation costs, all based on the projected “as-completed” value. This approach often results in better interest rates than alternative financing options while preserving your cash reserves for other financial goals.

3. Make Structural Repairs That Add Long-Term Value

What types of major repairs qualify for HomeStyle Renovation financing? The program covers a comprehensive range of structural improvements that enhance safety, functionality, and value:

Eligible structural projects include:

- Foundation repairs and stabilization

- Roof replacement and structural enhancements

- Electrical system upgrades and panel replacements

- Plumbing system modernization

- HVAC system installation and replacement

- Load-bearing wall removal or reinforcement

- Structural additions like room additions or second stories

- Window and door replacements

- Siding and exterior envelope improvements

These aren’t just cosmetic updates—they’re investments that protect and enhance your property for decades. By financing these projects through your mortgage, you spread the cost over the life of the loan at competitive interest rates rather than depleting savings or using expensive short-term financing.

4. Create Energy-Efficient Upgrades That Lower Utility Bills

Sustainability and cost savings go hand-in-hand with HomeStyle Renovation loans. You can finance eco-friendly improvements that reduce your environmental footprint while decreasing monthly expenses:

- Solar panel installation and battery storage systems

- Energy-efficient windows and insulation upgrades

- High-efficiency HVAC systems with smart thermostats

- LED lighting and energy-efficient appliances

- Low-flow plumbing fixtures and water-saving systems

- Green building materials and sustainable construction practices

Many of these improvements qualify for federal, state, or local tax incentives and rebates, further enhancing your return on investment. Lower utility bills mean more money available for other expenses or savings goals, making your renovation pay dividends long after completion.

Want to explore if a HomeStyle Renovation loan fits your renovation plans? Submit a purchase inquiry to discuss your specific scenario.

5. Customize Layouts for Accessibility and Aging in Place

How can you make your home more accessible for long-term living? HomeStyle Renovation loans cover modifications that improve accessibility and support aging in place, allowing you to create a home that adapts to changing mobility needs:

Qualifying accessibility improvements:

- Wheelchair ramps and wider doorways

- Walk-in showers and roll-in bathtubs

- Grab bars and reinforced bathroom fixtures

- Stairlifts and residential elevators

- Lowered countertops and accessible kitchen layouts

- Lever-style door handles and touchless faucets

- Improved lighting and slip-resistant flooring

- First-floor bedroom and bathroom additions

These modifications not only enhance quality of life but also increase your home’s marketability to a broader range of buyers when you eventually sell. Planning for accessibility now can prevent the need for costly emergency modifications later.

6. Combine Multiple Projects into One Comprehensive Renovation

Rather than tackling improvements piecemeal over several years, a HomeStyle Renovation loan allows you to complete multiple projects simultaneously. This approach offers significant advantages:

Time efficiency: Completing all work at once minimizes disruption to your daily life and reduces the total time contractors need on-site.

Cost savings: Contractors typically offer better pricing for comprehensive projects than for multiple small jobs, and you’ll only pay for mobilization, permits, and dumpsters once.

Design cohesion: Planning all improvements together ensures consistent style, quality, and functionality throughout your home rather than a patchwork of updates completed at different times.

Single financing event: You’ll only go through underwriting, appraisal, and closing once instead of seeking additional financing for each subsequent project.

Common comprehensive renovation packages include:

- Kitchen and bathroom remodels

- Flooring replacement throughout

- Interior and exterior painting

- Landscaping and outdoor living spaces

- Garage conversions or additions

- Basement finishing or waterproofing

7. Invest in Luxury Amenities That Enhance Your Lifestyle

HomeStyle Renovation loans aren’t limited to basic repairs—you can also finance luxury upgrades that transform your house into your dream home:

- Gourmet kitchen renovations with professional-grade appliances

- Spa-inspired bathroom retreats with custom fixtures

- Home theaters and entertainment spaces

- Wine cellars and wet bars

- Swimming pools, hot tubs, and outdoor kitchens

- Smart home technology and integrated systems

- Custom closets and storage solutions

- Home offices and dedicated workspaces

While luxury amenities should align with your neighborhood’s value range to ensure good return on investment, they can dramatically improve your enjoyment of your home and make it a true reflection of your lifestyle and priorities.

Explore all loan programs to compare renovation financing options.

What Are the HomeStyle Renovation Loan Requirements?

Who qualifies for HomeStyle Renovation financing? The program has specific requirements that balance accessibility with responsible lending practices.

Credit and Financial Qualifications

HomeStyle Renovation loans follow conventional mortgage guidelines with some additional considerations:

Credit requirements:

- Competitive credit profiles typically required

- Credit history demonstrating responsible financial management

- Any credit issues should be adequately explained and resolved

Financial stability factors:

- Stable employment or income history

- Debt-to-income ratios within acceptable ranges

- Sufficient reserves to cover mortgage payments and unexpected costs

- Down payment funds from acceptable sources

Income documentation:

- W-2 employees: Recent pay stubs and tax returns

- Self-employed borrowers: Business and personal tax returns

- Additional income sources must be verified and deemed stable

The exact requirements vary based on your overall financial profile, the property type, and the scope of renovations. Working with an experienced loan advisor helps you understand where you stand and what steps might strengthen your application.

Property Eligibility and Renovation Scope

HomeStyle Renovation loans can be used for various property types:

- Primary residences (owner-occupied homes)

- Second homes and vacation properties

- Investment properties (with different qualification requirements)

- Single-family homes, condominiums, and townhomes

- Multi-unit properties (up to four units)

What renovation projects are allowed? The program offers remarkable flexibility:

Permitted improvements include:

- Structural repairs and additions

- Kitchen and bathroom remodels

- Flooring, painting, and interior finishes

- Landscaping and outdoor improvements

- Energy efficiency upgrades

- Accessibility modifications

- Luxury amenities and custom features

- Basement finishing and attic conversions

- Garage additions and conversions

- Pool installation and outdoor living spaces

The renovation budget must be reasonable relative to the property’s after-renovation value, and all work must be completed by licensed contractors (with some exceptions for landscaping and non-structural cosmetic work).

How Does the HomeStyle Renovation Loan Process Work?

Finding and Evaluating Properties

Your HomeStyle Renovation journey begins with identifying the right property and understanding its potential. This involves:

For purchases:

- Working with a real estate agent experienced in fixer-upper properties

- Conducting thorough home inspections to identify needed repairs

- Obtaining contractor estimates for all planned improvements

- Ensuring the property’s location and structure justify your investment

- Negotiating purchase price accounting for renovation needs

For refinances:

- Determining which improvements will provide the best return

- Getting detailed contractor proposals and timelines

- Understanding your home’s current and projected values

- Planning renovations that align with neighborhood standards

- Timing your refinance to maximize benefits

Early consultation with your lender helps you understand budget constraints and ensures you’re evaluating properties or planning renovations that fit within program guidelines.

Working with Contractors and Creating Renovation Plans

How do you select the right contractor for a HomeStyle Renovation project? Your contractor choice significantly impacts your project’s success and loan approval.

Contractor requirements and selection criteria:

- Licensed and insured professionals with verifiable credentials

- Experience with similar projects and renovation types

- Detailed written estimates including materials, labor, and timelines

- References from previous clients and portfolio of completed work

- Clear communication style and professional business practices

- Understanding of HomeStyle Renovation loan requirements and draw processes

Your lender will review all contractor bids and renovation plans during underwriting. This typically includes:

- Detailed scope of work describing each improvement

- Itemized cost estimates for materials and labor

- Project timeline with milestone completion dates

- Contractor licensing and insurance documentation

- Architectural drawings or permits (when required)

Having comprehensive, professional documentation strengthens your application and demonstrates the project’s feasibility.

Appraisal and Loan Approval Process

HomeStyle Renovation loans require specialized appraisals that consider both current condition and planned improvements:

“As-is” appraisal: Determines the property’s current market value in its existing condition.

“As-completed” appraisal: Estimates the property’s value after all renovations are finished, based on contractor plans and comparable sales of similar upgraded properties.

The lender uses the as-completed value to determine your maximum loan amount. This means you can borrow based on your home’s future potential, not just its current state—a powerful advantage for buyers and homeowners with renovation vision.

Underwriters review your:

- Credit profile and financial documentation

- Income stability and debt obligations

- Renovation plans and contractor estimates

- Property appraisals and feasibility

- Cash reserves and down payment sources

Once approved, you’ll close on the full loan amount (purchase price or existing mortgage plus renovation costs), but renovation funds are held in escrow and released as work is completed.

Fund Disbursement and Renovation Timeline

How do contractors get paid during a HomeStyle Renovation project? The loan includes a structured draw schedule that protects both you and your lender:

Typical draw process:

- Initial disbursement: Contractors may receive an upfront payment (typically limited to a percentage) to purchase materials and begin work

- Progress inspections: An independent inspector verifies completed work at predetermined milestones

- Draw requests: Contractors submit invoices for completed work portions

- Fund releases: Lender releases payment directly to contractors after inspection approval

- Final disbursement: Remaining funds released upon project completion and final inspection

This structure ensures work is completed properly before contractors receive payment, providing quality control throughout the project. Most HomeStyle Renovation projects include a contingency reserve (typically around 10-15% of renovation costs) for unexpected issues that arise during construction.

During major renovations that make the property uninhabitable, the loan can include up to six months of mortgage payments, giving you financial breathing room while work is completed.

Frequently Asked Questions About HomeStyle Renovation Loans

What’s the maximum amount I can borrow for renovations?

The total loan amount depends on several factors working together. Your borrowing capacity is based on the lesser of:

- The as-completed appraised value

- The purchase price plus renovation costs

- Maximum conforming loan limits for your area

Renovation costs typically have no specific dollar cap but must be reasonable relative to the property’s value. Lenders generally expect renovation costs to fall within a certain percentage of the total project value to ensure the improvements make financial sense.

Your loan advisor can help you understand realistic renovation budgets for your specific property and location.

Calculate your HomeStyle renovation loan scenarios:

Can I do any of the renovation work myself?

DIY work faces significant limitations with HomeStyle Renovation loans. Lenders require licensed contractors for most improvements to ensure quality, compliance with building codes, and proper inspections.

Generally prohibited for DIY:

- Structural work, electrical, and plumbing

- Roofing and foundation repairs

- Major remodeling projects

- Anything requiring permits

Sometimes allowed with restrictions:

- Landscaping and yard work

- Interior painting

- Minor cosmetic updates

- Finish carpentry in some cases

Even when DIY work is permitted, you cannot include sweat equity in your renovation budget—only actual material costs can be financed. The lender’s primary concern is ensuring work is completed safely, properly, and in a way that maintains or increases the property’s value.

How long does the renovation period last?

What timeline should you expect for completing HomeStyle Renovation projects? Standard renovation periods typically span six months, though extensions may be granted for complex projects or circumstances beyond your control.

Timeline considerations:

- Simpler cosmetic updates may complete in weeks or a few months

- Major structural work or additions often require the full six-month period

- Permit delays, material availability, and weather can impact schedules

- Lenders may grant extensions for documented delays with valid reasons

Your contractor’s detailed timeline becomes part of your loan documentation, and inspectors verify progress against these milestones. Building realistic buffer time into your schedule helps accommodate unexpected issues without stress or deadline pressure.

Can I roll closing costs into a HomeStyle Renovation loan?

Yes, closing costs can typically be included in your total loan amount, subject to the same maximum borrowing limits based on the as-completed value. This is particularly helpful for buyers who want to minimize cash needed at closing or homeowners refinancing who prefer to finance all costs.

Financed closing costs become part of your total mortgage balance and are repaid over the life of the loan. Your loan advisor can provide detailed breakdowns showing scenarios with different combinations of down payment, renovation costs, and closing costs to help you optimize your financial strategy.

What happens if renovation costs exceed initial estimates?

How do you handle cost overruns during a HomeStyle Renovation project? Budget surprises can occur despite careful planning, especially when renovating older homes.

Options for managing additional costs:

- Contingency reserves: Most renovation budgets include a reserve fund (typically 10-15%) for unexpected expenses that can cover moderate cost increases

- Scope adjustments: Reducing or eliminating lower-priority improvements to stay within budget

- Out-of-pocket payment: Using personal funds to cover overages while keeping the loan amount unchanged

- Project delays: Pausing work to save additional funds or seek supplemental financing

Setting realistic budgets with experienced contractors and including adequate contingency reserves minimizes the risk of problematic cost overruns. Thorough inspections before creating renovation plans help identify potential issues that might increase costs.

How does this compare to an FHA 203(k) loan?

Both HomeStyle Renovation and FHA 203(k) loans serve similar purposes, but they have distinct differences that make each better suited for different situations:

HomeStyle Renovation advantages:

- Often available with more competitive initial investment requirements

- Can be used for second homes and investment properties

- Fewer restrictions on contractor requirements

- Greater flexibility in renovation scope and luxury improvements

- Generally faster processing and simpler documentation

FHA 203(k) considerations:

- May accommodate lower credit profiles in some cases

- Requires FHA mortgage insurance throughout the loan

- More stringent contractor and project requirements

- Limited to primary residences only

- Includes mandatory consultant fees for project oversight

Your specific financial situation, credit profile, property type, and renovation goals determine which program offers the best fit. Many borrowers find HomeStyle Renovation loans more flexible and cost-effective, particularly when they qualify for conventional financing.

See how other borrowers have successfully used HomeStyle renovation financing:

Alternative Loan Programs for Renovation Financing

If a HomeStyle renovation loan isn’t the right fit, consider these alternatives:

- FHA 203k Loan – Government-backed purchase-plus-renovation financing with flexible qualification standards

- Home Improvement Loan – Finance renovations on properties you already own

- Conventional Loan – Standard financing for properties in move-in ready condition

- Construction Loan – Build new construction from the ground up rather than renovating existing properties

- HELOC – Access equity from your current home to fund renovations after purchase

Explore all 30+ loan programs to find your best option.

Not sure which program is right for you? Take our discovery quiz to find your path.

Advanced HomeStyle Renovation Loan Questions

Can I use a HomeStyle Renovation loan for investment properties?

Yes, HomeStyle Renovation loans can finance investment properties, though requirements become more stringent. Investment property considerations include:

Different qualification standards:

- Higher initial investment requirements than primary residences

- Lower maximum loan-to-value ratios

- Stricter credit and reserve requirements

- Documentation of rental income potential

Expanded opportunities:

- Finance fix-and-flip projects with long-term rental plans

- Renovate and hold for cash flow properties

- Improve vacation rentals and short-term rental properties

- Build equity through strategic value-add improvements

The ability to base your loan on after-renovation value makes HomeStyle financing particularly attractive for real estate investors who see potential in undervalued properties. The renovated property can generate rental income while you repay a single mortgage at competitive rates.

What role does the renovation consultant play?

Do HomeStyle Renovation loans require a consultant? Unlike FHA 203(k) loans, HomeStyle financing doesn’t mandate a renovation consultant, though some borrowers choose to hire one for complex projects.

When you might want a consultant:

- Managing extensive multi-phase renovations

- Coordinating multiple contractors and trades

- Ensuring compliance with local building codes

- Providing expert oversight for structural work

- Mediating disputes or quality concerns

- First-time renovation project management

Consultants typically charge fees based on project complexity and scope. While not required, their expertise can prevent costly mistakes and ensure smooth project execution, particularly for borrowers undertaking significant renovations for the first time.

How do property taxes factor into renovation loans?

Will your property taxes increase after renovations? Almost certainly, but timing and amounts vary by jurisdiction.

Tax assessment considerations:

- Assessors typically reevaluate properties after substantial improvements

- Tax increases generally correspond to added value

- Some jurisdictions offer temporary exemptions or phase-in periods

- Improved home value still typically justifies the tax increase through equity gains

Your lender factors projected property taxes into your debt-to-income ratio during underwriting, ensuring you can afford the full cost of ownership after improvements. Discussing potential tax implications with your loan advisor and local assessor helps you budget appropriately.

Can you purchase and renovate a property that’s currently uninhabitable?

Yes, HomeStyle Renovation loans can finance properties in poor condition, including those deemed uninhabitable—a significant advantage over traditional financing that typically requires properties to meet minimum condition standards.

Uninhabitable property scenarios:

- Homes needing extensive structural repairs

- Properties with failed major systems (plumbing, electrical, HVAC)

- Homes requiring foundation or roof work before occupancy

- Fire or flood-damaged properties needing comprehensive restoration

- Severely dated properties requiring full modernization

The program can include up to six months of mortgage payments if renovations prevent occupancy, giving you breathing room during construction. This capability opens opportunities to purchase properties at significant discounts that other buyers cannot finance.

What insurance requirements apply during renovations?

Insurance coverage requires careful attention during HomeStyle Renovation projects. You’ll need:

Homeowners insurance:

- Required from closing day forward

- Coverage limits must reflect as-completed value

- Policy should include renovation endorsements

- Protects against loss during construction period

Builder’s risk insurance:

- Sometimes required for major renovations

- Covers materials and work in progress

- Protects against theft, weather damage, and vandalism

- Typically required by contractors or lenders

Contractor liability insurance:

- All contractors must carry adequate coverage

- Protects you from liability for on-site injuries

- Verification required before fund disbursement

- Should include worker’s compensation coverage

Your lender provides specific insurance requirements during the approval process. Adequate coverage protects your investment and ensures you’re not exposed to financial risk during the renovation period.

How do HomeStyle loans work for condos and townhomes?

Can you use HomeStyle Renovation financing for attached properties? Yes, but additional considerations apply:

Condo and townhome specifics:

- Property must be in an approved condominium project

- Renovation plans must comply with HOA rules and architectural guidelines

- Some improvements may require HOA approval before starting

- Exterior work often faces greater restrictions than interior updates

- Common area improvements are generally not eligible

Interior renovations typically face fewer restrictions than exterior changes. Kitchen remodels, bathroom upgrades, flooring replacement, and similar improvements usually proceed smoothly. Exterior modifications like deck additions, window replacements, or landscaping may require HOA review and approval.

Working with your HOA early in the planning process prevents delays and ensures your renovation plans align with community standards and regulations.

What happens if the project isn’t completed within the renovation period?

Can you get extensions if renovations take longer than expected? Most lenders offer extension options for legitimate delays, though requirements vary.

Extension scenarios and solutions:

- Weather delays: Natural disasters, extreme weather, or seasonal issues often qualify for automatic extensions

- Permit delays: Government bureaucracy and approval timeline overruns may justify extensions

- Material shortages: Supply chain issues affecting project timeline can warrant additional time

- Contractor issues: Problems beyond your control may qualify with proper documentation

Extensions typically require:

- Written request explaining delay reasons

- Documentation supporting the delay (permits, weather records, etc.)

- Revised contractor timeline showing completion plan

- Updated budget and draw schedule

- Additional inspection or administrative fees

Most lenders want to see projects completed successfully and work reasonably with borrowers facing legitimate obstacles. However, extensions aren’t guaranteed and shouldn’t be counted on when planning your timeline.

Can luxury upgrades hurt your appraisal or loan approval?

Should you worry about over-improving for your neighborhood? This legitimate concern requires thoughtful consideration during renovation planning.

Appraisers evaluate whether improvements are appropriate for the neighborhood by:

- Comparing your renovated home to recent sales of similar upgraded properties

- Assessing whether your improvements exceed neighborhood standards

- Determining if luxury features align with local market preferences

- Considering whether the upgrades will maintain value long-term

Strategic luxury upgrade approach:

- Research comparable properties to understand neighborhood expectations

- Focus on improvements that appeal broadly rather than ultra-specific taste

- Ensure your renovated value aligns with surrounding properties

- Consider resale appeal even if you plan to stay long-term

- Balance personal preferences with market reality

Quality improvements within your neighborhood’s range almost always make sense. Ultra-luxury upgrades that substantially exceed area norms may not appraise for their full cost but can still be worthwhile if you plan to enjoy them for many years.

How does HomeStyle Renovation financing work for multi-unit properties?

HomeStyle loans can finance two- to four-unit properties, offering unique opportunities for owner-occupants and investors:

Multi-unit advantages:

- Rental income from additional units can help qualify for financing

- Renovate multiple units simultaneously with one loan

- Improve both your living space and rental units

- Maximize property value through comprehensive improvements

- Generate income while building equity

Multi-unit considerations:

- Must occupy one unit as your primary residence (for owner-occupied financing)

- Rental income requires documentation and verification

- Higher initial investment and reserve requirements than single-family homes

- More complex appraisal process accounting for income potential

- Renovation plans must address all units appropriately

Multi-unit HomeStyle Renovation financing can be particularly attractive for house-hackers who want to improve their property while building a real estate portfolio.

What documentation should you save during the renovation?

Why is thorough documentation critical during HomeStyle Renovation projects? Proper records protect your interests and ensure smooth processing.

Essential documentation to maintain:

- All contractor invoices and receipts

- Proof of payment and disbursement records

- Before, during, and after photographs

- Permit applications and approvals

- Inspection reports and approvals

- Change order documentation

- Material purchase receipts

- Warranty information for new systems and materials

This documentation serves multiple purposes:

- Loan compliance: Proving work was completed as planned

- Tax purposes: Substantiating home improvement costs for capital gains

- Insurance claims: Documenting improvements if future damage occurs

- Resale value: Showing buyers the quality and scope of renovations

- Future maintenance: Tracking warranties and system specifications

Creating an organized filing system (physical or digital) from day one makes managing documentation much simpler than trying to compile everything at project completion.

Ready to get started? Apply now or schedule a call to discuss your situation.

Helpful HomeStyle Renovation Loan Resources

Official Government Guidance

Fannie Mae HomeStyle Renovation Mortgage Overview – Comprehensive guide covering program guidelines, eligible improvements, property requirements, and underwriting standards for HomeStyle Renovation financing.

Consumer Financial Protection Bureau Mortgage Resources – Federal resources explaining mortgage types, the home buying process, and your rights as a borrower throughout the transaction.

FHFA Conforming Loan Limit Information – Official Federal Housing Finance Agency data on maximum conventional loan amounts by county, updated annually to reflect market conditions.

Industry Organizations

Freddie Mac CHOICERenovation Program Details – Alternative renovation financing option with similar features to HomeStyle, including eligible properties and improvement types.

National Association of Home Builders Remodeling Resources – Industry insights on renovation trends, best practices, contractor selection, and home improvement ROI analysis.

Educational Resources

HUD 203(k) Rehabilitation Mortgage Program – Information about FHA’s renovation loan alternative, useful for comparing program features and determining the best fit for your situation.

EPA Lead-Safe Renovation Requirements – Critical information about lead paint regulations for renovation projects in homes built before 1978, including contractor certification requirements.

Qualified Services

Need local expertise? Get introduced to trusted partners including loan officers, realtors, contractors, and home inspectors in your area.

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Not Sure About Your Next Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Related Posts

Subscribe to our newsletter

Get program updates and rate insights in your inbox.