Vision Board Examples: Complete Comprehensive Guide

Vision Board Examples: Complete Comprehensive Guide

Creating visual representations of your goals transforms abstract dreams into tangible targets. Vision boards serve as daily reminders of what you’re working toward, keeping motivation high when challenges arise. Whether you’re pursuing homeownership, building investment wealth, or planning your legacy, the right vision board examples can accelerate your journey from aspiration to achievement.

This comprehensive guide explores proven vision board strategies that real people use to manifest their financial goals. You’ll discover specific examples for every stage of wealth building, from first-time homebuyers to multi-generational legacy planners. More importantly, you’ll learn how to connect your visual goals with actionable financial steps that turn pictures into reality.

Key Summary

In this comprehensive guide to vision board examples:

- Discover psychological research on visualization and goal achievement effectiveness from leading behavioral scientists

- Explore evidence-based goal setting frameworks from business leadership experts

- Learn proven wealth building visualization techniques from financial educators

- Access financial literacy resources for turning vision into action

- Review comprehensive financial planning strategies that complement visualization

Vision Board Examples: Why Visual Goal Setting Works

The human brain processes visual information 60,000 times faster than text. When you look at vision board examples every day, you’re activating the same neural pathways that fire when you actually experience those outcomes. This isn’t wishful thinking; it’s neuroscience backed by decades of research on goal achievement and behavioral change.

What Makes Vision Board Real Estate Goals Effective?

Vision board real estate strategies work because they create what psychologists call “cognitive priming.” Every time you see an image of your dream home or investment portfolio, your brain begins identifying opportunities and resources that align with that goal. You start noticing real estate trends, recognizing potential deals, and taking actions that move you closer to ownership.

Traditional goal-setting often stays trapped in abstract thoughts. Writing “I want to buy investment property” creates far less motivation than displaying actual photos of the neighborhoods you’re targeting, rental properties generating cash flow, or families you’ll help house. Vision boards translate vague intentions into specific, emotionally resonant targets.

Research from Dominican University revealed that people who create visual representations of their goals are 42% more likely to achieve them compared to those who simply think about what they want. The difference comes from three factors: clarity of vision, emotional connection to outcomes, and daily reinforcement through repetition.

How Does Visualization Connect to Financial Action?

The gap between dreaming and achieving lies in action planning. Effective vision board examples don’t just show destination pictures—they include interim milestones that create a roadmap. Your vision board should display both the end goal (paid-off home, portfolio of rental properties, legacy wealth) and the stepping stones that get you there (credit score targets, savings milestones, first property acquisition).

When creating your real estate investment vision, combine aspirational imagery with concrete financial metrics. Place photos of properties alongside numbers that matter: target acquisition costs, expected rental income, equity growth projections, and portfolio expansion timelines. This fusion of emotional appeal and analytical planning creates both motivation and direction.

Many aspiring homeowners and investors struggle because their vision stays disconnected from their financial reality. They picture million-dollar estates while earning $50,000 annually, creating cognitive dissonance that breeds discouragement. Better vision board examples show realistic first steps: qualifying for FHA financing, saving for initial capital through the wealth building vision approach, or house-hacking your way into homeownership.

What Does Goal Setting Real Estate Actually Look Like?

Goal setting real estate practices distinguish between outcome goals (own five rental properties) and process goals (review three properties weekly, save $500 monthly toward initial capital, improve credit score by 50 points). Your vision board should showcase both. The outcome goals inspire you emotionally; the process goals direct your daily behavior.

Consider how professional investors approach goal setting real estate planning. They don’t just visualize their portfolio’s future state—they create acquisition timelines, target specific markets, identify financing strategies, and schedule regular reviews of progress. Their vision boards include market data, DSCR loan qualifications, networking contacts, and education milestones alongside property photos.

First-time homebuyers benefit from vision boards that display the complete journey: pre-approval achievement, home inspection completion, closing day celebration, and first-night memories in the new home. Each milestone becomes a micro-goal that builds momentum. Breaking down the massive objective of homeownership into smaller, visualized victories prevents overwhelm and maintains motivation through challenges.

Smart stewards begin their vision boards by focusing on financial fundamentals, using resources from the Smart Stewards Journey to build credit, eliminate debt, and establish savings patterns that support future real estate goals.

Smart Stewards: Building Financial Foundations with Vision

For those following the Smart Stewards path, vision boards emphasize spiritual alignment with financial goals. These boards integrate scripture about stewardship, generosity, and diligence alongside practical financial metrics like debt reduction, emergency fund growth, and credit score improvement.

How Do Smart Stewards Approach Vision Board Creation?

Smart Stewards recognize that financial success without spiritual grounding leads to emptiness. Their vision boards prominently feature verses like “The plans of the diligent lead to profit” (Proverbs 21:5) alongside savings targets and debt elimination timelines. This integration ensures wealth building serves Kingdom purposes rather than mere material accumulation.

The Smart Stewards Journey provides a framework for aligning financial decisions with faith values. Vision boards following this path display not just what you’ll accumulate, but how you’ll bless others through your resources. Include images representing generosity goals: percentage of income you’ll tithe at different wealth levels, ministries you’ll support more substantially, or family members you’ll help achieve their own financial freedom.

Credit building represents a crucial early milestone for Smart Stewards. Display your credit score journey on your vision board, showing progress from current score toward targets that qualify you for conventional financing or FHA programs. Celebrate each 50-point improvement as evidence of faithful stewardship creating new opportunities.

Smart Stewards understand that debt elimination precedes wealth building. Create a visual debt payoff tracker showing balances declining toward zero. For many, clearing consumer debt represents the essential first step before pursuing real estate investment. Your vision board can display the month you’ll make that final payment, liberating cash flow for investment property financing instead of interest payments.

First-Time Buyers: Visualizing the Path to Homeownership

First-time buyers need vision boards that balance aspiration with preparation. While it’s important to display your dream home, equally vital are the qualification milestones that make that home achievable: credit score targets, savings accumulation, debt-to-income ratio improvements, and pre-approval completion.

What Should First-Time Buyer Vision Boards Emphasize?

The First-Time Buyers Journey breaks homeownership into manageable phases. Your vision board should reflect this progression: financial preparation, home search, offer and negotiation, inspection and appraisal, closing preparation, and move-in celebration. Display images representing each phase so you see not just the destination but the clear pathway.

Include specific neighborhood research on your first-time buyer vision board. Drive through areas you’re considering, photograph streets that appeal to you, snap pictures of homes displaying architectural styles you love, and document community features like parks, schools, and amenities. This specificity keeps your search focused and prevents overwhelming paralysis from too many options.

Financial qualification deserves prominent placement on first-time buyer boards. Show your savings account climbing toward your initial capital target. Display your credit score progression using calculation tools that project when you’ll qualify. Include pre-approval timelines and document gathering checklists. These process elements maintain focus on achievable steps rather than just dreaming about outcomes.

Many first-time buyers benefit from assistance programs they don’t know exist. Research grants, forgivable loans, and tax credits available in your area. Display program names, eligibility requirements, and application deadlines on your vision board so you take full advantage of available help.

Homeowners: Leveraging Equity and Planning Next Steps

Current homeowners use vision boards differently than first-time buyers. Their boards emphasize equity accumulation, strategic improvements that increase value, potential refinancing opportunities, and decisions about whether to upgrade, downsize, or transition into real estate investing through their existing home.

How Should Homeowners Visualize Their Next Phase?

The Homeowners Journey addresses questions about staying versus selling, accessing equity for other purposes, and potentially converting personal residences into rental properties. Your homeowner vision board should clarify which path you’re pursuing and display the specific steps involved.

If you’re considering accessing equity, your vision board might show cash-out refinancing projections or HELOC calculations that demonstrate available funds. Display what you’ll do with that equity: initial capital for investment property, home improvements that increase value, or debt consolidation that improves cash flow.

Many homeowners discover their path to real estate investing starts with house-hacking or converting their current residence into a rental while moving to a new property. If this interests you, display the numbers: expected rental income on your current home, financing options for your next purchase using FHA or conventional programs, and the monthly cash flow this strategy could generate.

Strategic home improvements deserve space on homeowner vision boards. Display renovation projects that provide the best return on investment: kitchen updates, bathroom remodels, curb appeal improvements, or energy efficiency upgrades. Show both the cost projections and the expected value increase, ensuring improvements make financial sense rather than just emotional appeal.

Senior Homeowners: Converting Equity to Retirement Security

Senior homeowners face unique decisions about converting home equity into retirement income, planning estate transfers to heirs, and potentially using reverse mortgages to maintain lifestyle without monthly mortgage payments. Vision boards for this stage emphasize both current quality of life and legacy planning.

What Goals Should Senior Vision Boards Display?

The Senior Homeowners Journey addresses aging-in-place decisions, equity conversion strategies, and legacy transfer planning. Your senior vision board should reflect your chosen priorities: maximizing retirement income, ensuring lifetime occupancy, leaving inheritance for heirs, or some combination of these objectives.

Reverse mortgage visualization belongs on senior boards when appropriate. Display how reverse mortgages work: converting equity to cash without monthly payments, maintaining homeownership and occupancy rights, and preserving remaining equity for heirs. Show what that cash enables: travel during retirement, helping grandchildren with education, maintaining home without budget stress, or supporting ministry commitments.

Aging-in-place modifications deserve prominent placement if you plan to remain in your longtime home. Show the renovations that enable safe aging: wheelchair ramps, zero-step entries, widened doorways, accessible bathrooms, or first-floor primary suites. Display both the modifications and the funding strategies that pay for improvements without depleting liquid reserves.

Legacy planning components should appear on senior vision boards. Display estate planning documentation: completed wills, established trusts, beneficiary designations, and charitable giving plans. Show photos of children benefiting from down payment assistance, grandchildren attending college debt-free, or great-grandchildren who’ll benefit from dynasty trusts you’re structuring.

First-Time Investors: Building Your Rental Property Foundation

First-time investors need vision boards that demystify the path from homeowner or aspiring buyer to rental property owner. These boards emphasize education, property selection criteria, financing strategies, and realistic first-year cash flow expectations rather than overnight wealth fantasies.

How Should First-Time Investors Visualize Success?

The First-Time Investors Journey provides a step-by-step framework for acquiring your first rental property. Your investor vision board should display this progression: real estate education completion, market research and neighborhood selection, property analysis mastery, financing qualification, offer and acquisition, and first-year operations management.

Financing education belongs prominently on first-time investor vision boards. Display the various programs available: DSCR loans that qualify based on property income, conventional financing with investor terms, FHA house-hacking strategies, or portfolio lending approaches. Understanding your financing options determines which properties you can pursue.

Property analysis frameworks should appear on your first-time investor board. Show the rental property calculator results for properties you’re analyzing: expected cash flow, cap rates, cash-on-cash returns, and total return projections. Display deal criteria that guide your search: minimum cash flow thresholds, maximum price-to-rent ratios, required cap rates, or target cash-on-cash returns.

Many first-time investors benefit from seeing the complete first-year timeline: property search (months 1-2), offer and due diligence (month 3), closing and possession (month 4), any repairs or improvements (months 4-5), tenant placement (month 5-6), and operations management (months 6-12). Breaking the journey into monthly milestones makes the process feel achievable rather than overwhelming.

Active Investors: Scaling Your Portfolio with Systems

Active investors move beyond individual property focus to portfolio-level thinking. Their vision boards emphasize systems, team building, financing strategies that enable rapid scaling, and operational efficiencies that maintain quality while increasing property count.

What Should Active Investor Vision Boards Feature?

The Active Investors Journey addresses portfolio expansion from 2-3 properties toward 10-20 or more. Your active investor vision board should display both the target portfolio size and the systems that enable you to manage that scale without working 80-hour weeks or experiencing constant stress.

Portfolio acquisition timelines belong prominently on active investor boards. Show your growth plan: current property count, target properties by year-end, 3-year portfolio goals, and 5-year vision. Include the financing strategies enabling this growth: portfolio loans that finance multiple properties together, DSCR programs that qualify based on property performance, or cash-out refinancing that recycles equity into new acquisitions.

The BRRRR method deserves dedicated space if you’re using this strategy to scale. Display the full cycle: Buy below-market properties, Rehab to force appreciation, Rent to qualified tenants, Refinance to recapture capital, Repeat with lesson-learned improvements. Show your BRRRR calculator results projecting how much capital you’ll recapture and how quickly you can acquire property numbers 2, 3, 4, and beyond.

Operational systems distinguish successful active investors from overwhelmed landlords who quit after a few properties. Your vision board should display the systems you’re implementing: property management software, tenant screening frameworks, maintenance coordination processes, financial tracking methods, and team development plans. Show your professional partners: property managers, contractors, lenders specializing in investor financing, accountants, and attorneys.

Passive Investors: Wealth Without Landlord Duties

Passive investors seek real estate returns without the time demands of active property management. Their vision boards emphasize lifestyle freedom, partnership opportunities, due diligence frameworks for evaluating operators, and the passive income streams that fund the lives they want to live.

How Do Passive Investors Visualize Their Path?

The Passive Investors Journey explores turnkey rentals, syndication partnerships, REITs, and crowdfunding platforms that generate returns without landlord responsibilities. Your passive investor vision board should clarify which passive vehicles you’re pursuing and display the due diligence process ensuring you partner with quality operators.

Lifestyle freedom deserves prominent placement on passive investor boards. Rather than focusing primarily on properties (which you won’t manage anyway), emphasize what passive income enables: travel adventures, volunteer work, family time, hobby pursuit, or early retirement. Display these lifestyle images alongside the passive income calculator results showing monthly cash flow at different investment levels.

Syndication partnerships require sophisticated due diligence. Your vision board might include checklists for evaluating sponsors: track record verification, reference checks, legal document review, market analysis validation, and projected returns assessment. Display information about operators you’re researching, target markets you’re considering, and minimum investment amounts for opportunities you’re pursuing.

Turnkey rental strategies offer property ownership without day-to-day management. If this interests you, display your target turnkey markets—typically cash flow-focused metros with strong fundamentals: population growth, job diversity, landlord-friendly regulations, and established property management infrastructure. Show projected cash flow from turnkey properties financed through DSCR programs or portfolio lending.

Legacy Angels: Multi-Generational Wealth Transfer Vision

Legacy Angels focus on wealth that extends beyond their lifetime, creating financial security and opportunity for children, grandchildren, and even great-grandchildren. Their vision boards emphasize estate planning, tax-efficient wealth transfer, charitable giving, and the values they want to pass down alongside financial assets.

How Should Legacy Angels Approach Vision Board Creation?

The Legacy Angels Journey addresses sophisticated estate planning, generational wealth transfer, and creating lasting impact through strategic giving. Your Legacy Angels vision board should display not just what you’ll accumulate, but how you’ll transfer it efficiently and the legacy values you want your wealth to represent.

Multi-generational family photos belong prominently on Legacy Angels boards. Display images of children, grandchildren, and even future generations who will benefit from the wealth structures you’re creating. Show family gatherings funded by trust income, grandchildren attending college debt-free through education trusts, or great-grandchildren you’ll never meet who’ll benefit from dynasty trusts established through your foresight.

Estate planning milestones deserve prominent placement: completed wills, established revocable living trusts, funded irrevocable life insurance trusts, implemented charitable remainder trusts, or created family limited partnerships. Each milestone represents progress toward ensuring your wealth serves your family for generations rather than being diminished by taxes or lost to poor planning.

Legacy Angels often display their charitable giving vision alongside family wealth transfer. Show ministries you’ll support more substantially as wealth grows, scholarships you’ll establish in your family name, or foundations you’ll create to fund causes aligned with your values. This philanthropic dimension ensures wealth serves purposes beyond family consumption while potentially providing significant tax advantages through strategic legacy planning structures.

Include visual representations of the professional team required for sophisticated estate planning: estate attorneys who draft trust documents, CPAs who optimize tax strategies, financial advisors who coordinate wealth management, life insurance professionals who fund estate tax liquidity, and family advisors who facilitate difficult conversations about wealth values and transfer timing.

Vision Board Real Estate: Creating Property-Focused Boards

Vision board real estate strategies differ from general visualization because they require specificity about location, property type, financing strategy, and timeline. Generic real estate imagery provides weak motivation compared to actual photos of neighborhoods you’re targeting, property styles that fit your investment thesis, or renovation projects that match your skill level.

What Specific Elements Should Real Estate Vision Boards Include?

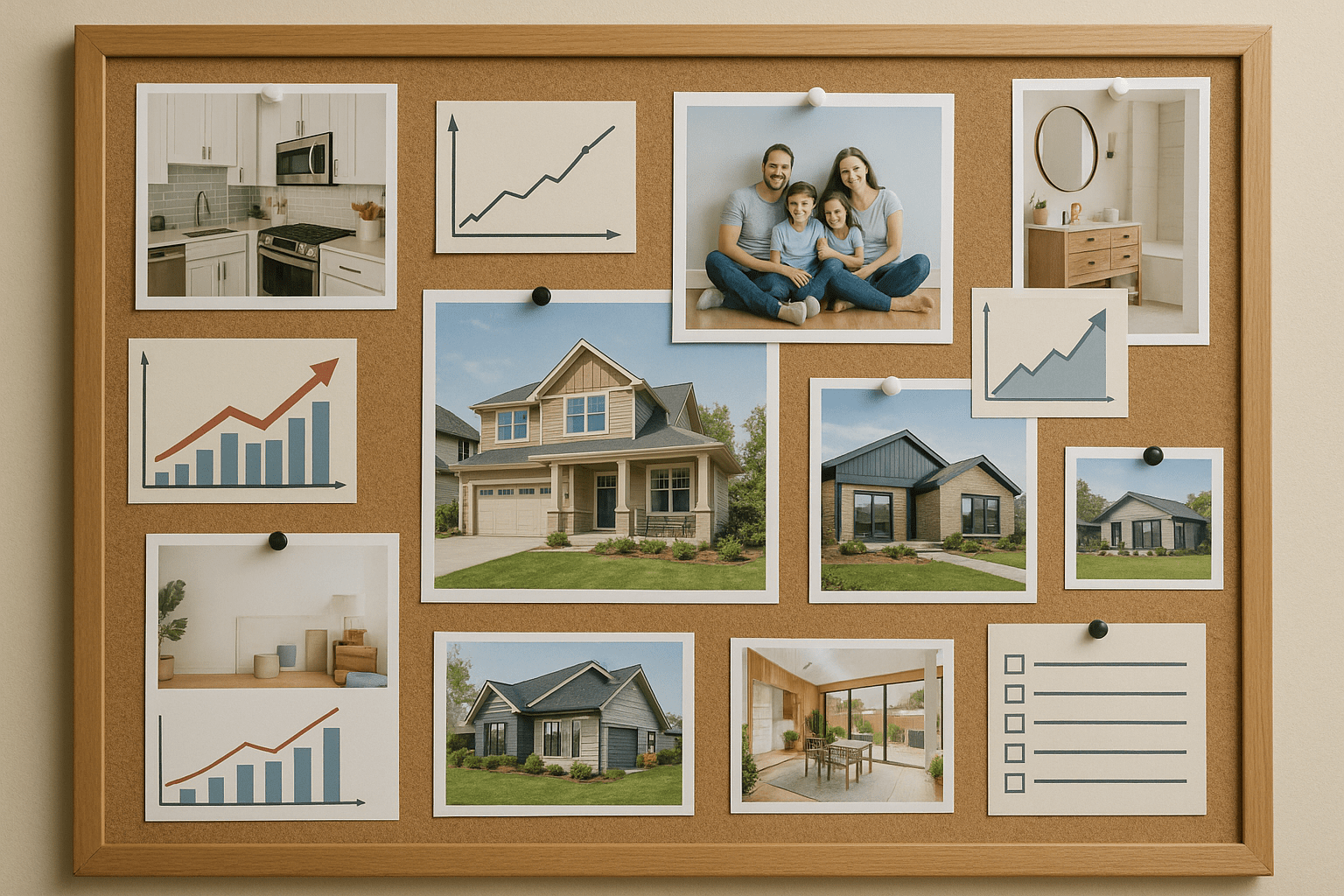

Successful vision board real estate examples incorporate six essential categories: target properties, financing milestones, market research, team building, operational systems, and exit strategies. Each category needs visual representation that triggers both emotional connection and strategic thinking.

Target properties should include actual listings or comparable sales from your focus areas. Print MLS sheets, photograph neighborhoods during drive-throughs, or create collages showing property features you’re seeking. Specificity matters—displaying generic stock photos of mansions won’t motivate you as effectively as real properties within your actual budget and target market.

Financing milestones transform abstract qualification requirements into visible checkpoints. Create visual representations of your credit score progress, showing movement from your current score toward your target. Display savings account balances growing toward your initial capital goal. Include calculator results showing your qualification potential at different income and debt levels.

How Do Investors Use Vision Boards for Portfolio Growth?

Active real estate investors maintain dynamic vision boards that evolve as their portfolios expand. Initial boards might focus entirely on acquiring the first property through conventional financing or FHA house-hacking strategies. Once that property closes, the board shifts focus toward property management systems, cash flow optimization, and acquisition of property number two.

Multi-property investors often maintain separate vision board sections for different aspects of their business. One section might display acquisition targets and financing strategies using portfolio loans or DSCR financing. Another section shows operational improvements: property management software, contractor relationships, tenant screening systems. A third section tracks long-term wealth goals: equity accumulation, cash flow targets, and exit planning.

The most effective vision board real estate approaches include both quantitative and qualitative elements. Yes, display your target number of properties and expected cash flow. But also include images representing the lifestyle those investments will fund: family vacations financed by rental income, freedom from traditional employment, ability to help family members achieve their own homeownership, or legacy wealth passing to future generations through the manifestation real estate goals framework.

Financial Vision Board: Money and Wealth Visualization

Financial vision board strategies extend beyond real estate to encompass comprehensive wealth building across all asset classes. However, real estate often serves as the foundation because property provides multiple simultaneous profit centers: cash flow, appreciation, principal paydown, tax advantages, and inflation hedging. Your financial vision board should position real estate within your broader wealth-building framework.

How Do You Visualize Financial Goals Effectively?

Effective financial visualization balances aspirational images with concrete metrics. Display photos representing financial freedom—early retirement, travel, philanthropy, family support—alongside the numbers that make those experiences possible: net worth targets, passive income levels, investment returns, and debt elimination timelines.

Create a financial vision board section dedicated to debt elimination if you’re carrying high-interest obligations. Show declining credit card balances, student loan payoff dates, and the increased cash flow that results from removing these burdens. For many aspiring homeowners and investors, clearing consumer debt represents the essential first step toward real estate ownership. Resources from the Smart Stewards Journey can guide this debt elimination process.

Include visual representations of your emergency fund growing toward three-to-six months of expenses. This foundation provides the financial stability necessary for real estate investing. When unexpected property repairs arise or tenants miss payments, adequate reserves prevent these challenges from becoming crises. Display your reserve account balance climbing toward targets that enable confident property ownership.

What Role Does Real Estate Play in Wealth Building Vision?

Real estate deserves prominent placement on any wealth building vision board because property delivers returns that stocks, bonds, and cash can’t match. The combination of leverage, tax advantages, cash flow, and forced appreciation through improvements creates wealth acceleration unavailable through passive index investing.

Most millionaires built their wealth through real estate ownership. They didn’t achieve financial independence by saving $500 monthly into mutual funds—they leveraged those savings as initial capital on income-producing properties that generated returns far exceeding stock market averages. Your wealth building vision should prominently feature real estate as an engine of financial freedom rather than a distant secondary consideration.

Consider displaying actual investment property analysis on your vision board. Show cash-on-cash returns, equity accumulation schedules, and tax advantage calculations. These numbers transform real estate from abstract aspiration into concrete investment thesis. When you see that a $40,000 initial investment can control a $200,000 asset generating $15,000 annual cash flow while building $8,000 in equity annually, the path to wealth becomes clear.

Wealth Building Vision: Long-Term Financial Freedom Boards

Wealth building vision extends beyond acquiring assets to encompass the freedom those assets provide. The ultimate goal isn’t owning ten rental properties—it’s achieving the financial independence, time freedom, and lifestyle flexibility that those properties fund. Your vision board should display both the means (real estate portfolio) and the ends (life those investments enable).

What Does True Wealth Building Look Like Visually?

True wealth building vision boards showcase lifestyle design as much as asset accumulation. Yes, display your target portfolio: the properties you’ll own, the equity you’ll build, the cash flow you’ll generate. But give equal prominence to what that portfolio enables: working by choice rather than necessity, spending time with family without financial stress, pursuing passions and hobbies guilt-free, providing for others through generosity, or building multi-generational wealth that serves your family for decades.

Include images representing time freedom—the ultimate luxury that wealth provides. Show yourself volunteering for causes you care about, attending children’s school events during traditional work hours, traveling during off-peak seasons when crowds thin and prices drop, or simply reading a book on a Tuesday afternoon because you can. These lifestyle images transform wealth from abstract numbers into emotionally resonant outcomes worth pursuing.

Don’t neglect the impact dimension of wealth building. Many high-achievers find their greatest satisfaction comes not from personal consumption but from the positive influence their resources enable. Display images representing the good you’ll do: family members you’ll help with initial capital, scholarships you’ll fund, ministries you’ll support, or communities you’ll improve through quality housing provision. This purpose-driven approach to wealth building sustains motivation through inevitable challenges.

How Should Wealth Building Timelines Extend?

Effective wealth building vision balances near-term milestones with long-term aspirations. Your vision board might include goals spanning from next quarter (save $5,000 for initial capital, improve credit score 30 points) to next decade (achieve $10 million net worth, generate $200,000 annual passive income). Breaking ambitious long-term goals into interim markers maintains motivation through visible progress.

Consider creating a timeline visual on your board showing your wealth progression across different life stages. In your 30s: acquire first few rental properties using conventional financing while building portfolio foundation. In your 40s: accelerate acquisitions using portfolio strategies and cash-out refinancing from existing equity. In your 50s: transition from aggressive growth to cash flow optimization and legacy planning. In your 60s and beyond: implement generational wealth transfer strategies while maintaining income generation.

Multi-decade wealth building requires periodic vision board evolution. Your 30-year-old self prioritizes different outcomes than your 60-year-old self will. Early boards emphasize acquisition and growth; later boards focus on optimization, tax efficiency, and legacy transfer. Review and refresh your vision annually to ensure it remains aligned with your current life stage, values, and circumstances.

Manifestation Real Estate Goals: Turning Vision Into Reality

Manifestation real estate goals require more than positive thinking—they demand strategic action aligned with clear vision. While skeptics dismiss manifestation as magical thinking, successful practitioners understand it as the process of clarifying objectives, identifying required resources, eliminating obstacles, and taking consistent action until goals materialize. Your vision board serves as the navigational instrument guiding this process.

How Does Manifestation Actually Work for Real Estate?

Real manifestation operates through psychological priming and pattern recognition rather than mystical attraction. When you consistently expose yourself to images of your real estate goals, your brain begins identifying opportunities and resources that support those objectives. You notice property listings you would have previously overlooked, recognize financing strategies you weren’t aware existed, and initiate conversations with people who can help you progress.

Neuroscientists call this phenomenon the Reticular Activating System—the brain’s filtering mechanism that determines what information receives conscious attention. When you program your RAS through daily vision board exposure, you essentially tell your brain: “These real estate goals matter; prioritize information relevant to their achievement.” Your conscious mind then receives more opportunities, ideas, and resources aligned with your stated objectives.

Effective manifestation real estate goals strategies combine visualization with action planning. Display your target properties prominently, but also include the specific steps required for acquisition: pre-approval completion, property inspection scheduling, offer preparation, financing finalization, and closing coordination. This merger of aspiration and implementation transforms wishes into results. The First-Time Investors Journey provides a detailed roadmap for taking these essential action steps.

What Action Steps Should Manifestation Boards Include?

Manifestation without action produces nothing. Your vision board should display both destinations and pathways. For each major goal, identify the 3-5 most important actions that move you toward achievement. These might include: completing real estate education courses, attending investor networking events, analyzing ten properties weekly, improving your credit score to loan qualification thresholds, or saving specific amounts monthly toward initial capital.

Create a visual action tracker alongside your aspirational images. Use a simple grid showing weekly or monthly commitment to your key activities. When you complete that week’s property analysis requirement, mark it on your vision board. When you attend that month’s networking event, highlight it visually. These completion indicators provide motivation through visible progress while maintaining focus on activities that produce results.

Many aspiring investors create manifestation boards heavy on outcomes but light on process. They display dozens of property photos without any representation of how they’ll qualify for financing, perform due diligence, manage operations, or handle inevitable challenges. Better manifestation real estate goals boards show the complete journey: preparation phase activities, acquisition process steps, operational management requirements, and portfolio growth stages. The Active Investors Journey offers insights into the systems and processes that turn vision into portfolio reality.

Goal Setting Real Estate: Strategic Planning Approaches

Goal setting real estate strategies separate dreamers from achievers. While vision boards provide motivation and direction, systematic goal-setting frameworks ensure that motivation translates into measurable progress. Your vision board should incorporate proven goal-setting methodologies that transform aspiration into achievement.

What Makes Real Estate Goals Achievable?

Achievable real estate goals share five characteristics captured by the SMART framework: Specific, Measurable, Achievable, Relevant, and Time-bound. Vague intentions like “buy investment property someday” lack the precision necessary for action. Better: “Acquire one single-family rental property in Tampa’s Brandon neighborhood by December 31, 2025, using FHA financing with 3.5% initial capital.”

Specificity matters because your brain needs clear targets for pattern recognition. “Buy rental property” could mean anything: single-family or multifamily, local or out-of-state, value-add or turnkey, residential or commercial. Each strategy requires different knowledge, resources, and action steps. Your vision board should display precisely what you’re pursuing, where you’re targeting, and how you plan to structure the deal.

Measurability allows progress tracking. Include quantitative metrics on your goal setting real estate board: target acquisition cost, required initial capital, expected cash flow, projected appreciation, and timeline milestones. These numbers transform abstract intentions into concrete targets you can track, measure, and adjust based on actual results versus projections.

The Homeowners Journey helps current homeowners set specific goals around leveraging existing equity for investment purposes or upgrading to properties that better serve their evolving needs.

How Should You Sequence Real Estate Goals?

Proper goal sequencing creates momentum rather than overwhelm. Your vision board should display a logical progression: foundation-building activities before property acquisition, first property mastery before portfolio expansion, operational systems development before scale attempts, and proven profitability before aggressive growth.

Many aspiring investors sabotage themselves through poor sequencing. They attempt to acquire multiple properties simultaneously before demonstrating ability to successfully manage one. They pursue complex strategies like value-add multifamily syndications before mastering simple buy-and-hold single-family rentals. They expand geographically before proving their investing thesis works in their home market.

Better goal setting real estate approaches respect the learning curve. Your first property goal should emphasize education and experience over maximum returns. Choose a straightforward deal that teaches fundamental skills: tenant screening, maintenance coordination, lease enforcement, and financial management. Once you’ve successfully operated that property for twelve months, apply those lessons to property two. Repeat this mastery-before-expansion approach throughout your investing career.

Frequently Asked Questions About Vision Board Examples

What exactly are vision board examples and how do they help with real estate goals?

Vision board examples are collections of images, words, and symbols representing specific goals you want to achieve. For real estate, they help by clarifying your exact property targets, keeping you motivated during the qualification process, and reminding you daily why you’re working toward ownership.

They transform abstract goals into concrete visual targets that your brain naturally moves toward. The Smart Stewards Journey demonstrates how vision boards complement biblical financial principles in achieving homeownership.

How do vision board real estate strategies differ from regular goal setting?

Vision board real estate approaches emphasize visual imagery over written text, creating emotional connection to goals that written lists can’t match. They keep your real estate objectives constantly visible in your environment, providing 20-30 daily reminders versus the single weekly review that written goals might receive.

This repetition trains your brain to identify opportunities and resources aligned with your property acquisition targets. Explore rental property calculator tools to add concrete numbers to your visual planning.

What’s the difference between financial vision board and wealth building vision approaches?

Financial vision boards focus on money management, savings, debt reduction, and spending control. Wealth building vision boards emphasize asset acquisition, passive income generation, and net worth growth. While financial boards help you get money in order, wealth boards guide you toward using that money to acquire income-producing assets.

Ideally, you’d incorporate both: financial discipline that creates capital for wealth-building investments. Learn how DSCR loan programs enable portfolio expansion once financial foundations are established.

Can manifestation real estate goals actually work or is it just positive thinking?

Manifestation works through psychological priming, not magical attraction. When you consistently view images of your real estate goals, your brain’s reticular activating system begins noticing relevant opportunities you’d otherwise miss. You don’t “attract” properties through universal laws—you recognize them through enhanced pattern recognition.

Combine visualization with concrete action planning and you’ll achieve goals faster than through either approach alone. The First-Time Buyers Journey combines visualization with actionable steps for homeownership success.

What should goal setting real estate boards include for first-time investors?

First-time investor vision boards should display target properties in specific neighborhoods, financing qualification requirements showing your progress toward approval, property analysis frameworks you’re learning, professional team members you’re assembling, and lifestyle outcomes your rental income will fund.

Include both the end goal (property owned) and interim steps (education completed, pre-approval secured, offers submitted). Visit the First-Time Investors Journey for comprehensive guidance on building your rental property foundation.

How specific should vision board real estate images be?

As specific as possible. Rather than generic property photos, display actual listings from your target neighborhoods. Rather than abstract wealth concepts, show your specific financial calculator results projecting your portfolio’s performance.

Specificity creates clarity that guides action. Generic inspiration provides weak motivation compared to precise targets. The Passive Investors Journey helps you identify specific partnership opportunities worth visualizing.

What makes financial vision board strategies effective for homebuyers?

Financial vision boards work for homebuyers because they convert intangible qualification requirements into visible progress markers. Seeing your credit score climb from 620 toward 680, watching savings grow from $5,000 toward $15,000, or tracking debt-to-income improvement from 48% toward 40% provides motivation that abstract goals lack.

Each visible milestone achievement builds momentum toward the ultimate goal of homeownership. Explore FHA loan options that may be more achievable than you realize.

Should wealth building vision boards focus more on real estate or diversification?

That depends on your strategy. Many wealth builders focus primarily on real estate because property provides unique advantages: leverage, tax benefits, cash flow, and forced appreciation through improvements. However, mature wealth building incorporates diversification across real estate, businesses, stocks, and bonds.

Early-stage boards might emphasize real estate heavily; later-stage boards should show broader asset allocation. Calculate your investment growth potential across different asset classes.

How do manifestation real estate goals relate to actual property acquisition?

Manifestation enhances acquisition by keeping your objectives top-of-mind, which makes you notice opportunities faster, take action more consistently, and persist through challenges. But manifestation alone achieves nothing—you must couple visualization with analysis, offers, financing, due diligence, and closing.

Think of manifestation as the motivation engine that powers the action vehicle. The Active Investors Journey provides the systems and strategies that turn manifested vision into portfolio reality.

What’s the connection between goal setting real estate and financing options?

Every real estate goal requires matching financing strategies. Your vision board should display not just target properties but also the financing vehicles enabling acquisition: FHA loans for first properties, DSCR loans for portfolio growth, portfolio financing for scale.

Goals without financing plans remain wishes. Research your conventional loan options to understand which properties you can realistically pursue.

How often should I update my vision board examples?

Review quarterly at minimum, updating based on achieved milestones, changed circumstances, or evolved priorities. Some elements might remain constant for years (ultimate net worth target), while others change quarterly (current property acquisition focus).

Annual comprehensive reviews ensure your vision board reflects current life stage rather than outdated objectives from different circumstances. The Homeowners Journey addresses how vision evolves as you transition from owner to investor.

Can digital vision boards be as effective as physical ones?

Digital boards offer advantages (live data integration, portability, easy updates) that physical boards can’t match. However, physical boards displayed prominently often generate more daily engagement since they don’t require deliberate device opening.

Ideal approach: maintain primary physical board in high-visibility location, supplemented by digital versions providing on-the-go motivation and detailed progress tracking. Use HELOC calculators to integrate live financial data into digital boards.

What role do vision board real estate strategies play for passive investors?

Passive investors’ vision boards emphasize partnership opportunities over direct property management. Display operators you’re researching, syndication deals you’re evaluating, expected returns from partnership investments, and the lifestyle freedom passive income enables.

Include due diligence frameworks proving you’re investing intelligently rather than just hoping operators perform. The Passive Investors Journey teaches sophisticated evaluation techniques for syndication opportunities.

How do I avoid vision board mistakes that waste time and money?

Focus on production over consumption imagery, include interim milestones alongside ultimate destinations, connect vision to action plans showing daily execution steps, review and update regularly preventing staleness, and measure results objectively rather than just feeling good about pretty pictures.

Vision boards work when they drive behavior change, not when they become decorative background art. Pair your vision board with rental property analysis tools ensuring financial viability.

Should financial vision board content include specific dollar amounts?

Yes. Specific numbers create accountability that vague goals lack. Display exact savings targets, precise property acquisition costs, defined cash flow objectives, and clear net worth milestones. Include target achievement dates so you can measure actual progress versus projections.

Specificity enables tracking; vagueness prevents it. Use investment growth calculators to project specific dollar outcomes over time.

How does wealth building vision differ between ages 30, 40, and 50?

At 30, emphasize aggressive acquisition and portfolio building using maximum leverage. At 40, balance acquisition with operations optimization and tax efficiency. At 50, shift toward cash flow maximization, portfolio protection, and legacy planning.

Your vision board should reflect appropriate strategies for your life stage rather than generic one-size-fits-all approaches. Explore reverse mortgage options for retirement-focused strategies after age 55 through the Senior Homeowners Journey.

What makes manifestation real estate goals more than just wishful thinking?

Manifestation works through concrete psychological mechanisms: enhanced pattern recognition, increased motivation, consistent action, and persistence through obstacles. It’s not wishful thinking when you combine visualization with education, analysis, offers, financing, and closing.

It becomes wishful thinking when you expect visualization alone to produce results without corresponding action. Join the First-Time Investors Journey to combine vision with proven action frameworks.

How do goal setting real estate approaches integrate with actual market conditions?

Your vision board should acknowledge market realities. In seller’s markets, emphasize creative acquisition strategies, networking for off-market deals, and patience over urgency. In buyer’s markets, focus on opportunistic acquisition and negotiation leverage.

Adjust timelines and strategies based on actual conditions rather than hoping markets conform to your preferred timelines. Research portfolio lending options that work in various market conditions.

Should I share my vision board examples publicly or keep them private?

Share selectively with accountability partners, mentors, and supportive friends who understand your goals and can provide informed encouragement. Avoid broadcasting to social media where criticism, jealousy, or misunderstanding might undermine motivation.

Strategic selective sharing provides accountability benefits while avoiding unnecessary skepticism from those who don’t understand your vision. The journeys at Stairway Mortgage connect you with like-minded individuals pursuing similar goals.

What’s the relationship between vision board real estate focus and diversification?

Early wealth building often benefits from concentrated real estate focus since property provides unique leverage advantages over diversified index investing. Once you’ve built substantial real estate wealth ($1M+ net worth), gradually diversify into other assets providing uncorrelated returns.

Your vision board should reflect appropriate concentration-then-diversification progression. Calculate potential passive income streams from diversified portfolio allocations.

How do financial vision board strategies help with debt elimination?

Debt reduction boards display declining balances visually, celebrate payoff milestones with prominent markers, show the increased cash flow debt elimination creates, and remind you daily why you’re sacrificing current consumption for future freedom.

Seeing credit card balances dropping from $15,000 toward zero provides motivation that spreadsheet tracking alone can’t match. The Smart Stewards Journey provides biblical principles and practical strategies for debt freedom.

What role does wealth building vision play in retirement planning?

Retirement-focused wealth building emphasizes cash flow generation over asset accumulation. Display monthly passive income targets at different ages, expected living expenses throughout retirement, legacy transfers you’ll make, and lifestyle activities retirement income will fund.

Include specific reverse mortgage strategies or passive investment vehicles enabling comfortable retirement without portfolio liquidation. The Senior Homeowners Journey addresses these retirement planning considerations.

How specific should manifestation real estate goals be regarding property types?

Very specific. Rather than “buy rental property,” specify “acquire 3-bedroom, 2-bath single-family home in Highland Park, Tampa, built 1990-2010, needing $15K-$25K cosmetic renovation, purchased at $220K-$240K, financed with DSCR loan at 20% down, renting for $2,000-$2,200 monthly.”

This specificity guides action far better than vague intentions. Use rental property calculators to validate your specific target criteria.

What mistakes do people make when creating goal setting real estate vision boards?

Common errors include: displaying only outcomes without process steps, neglecting financing requirements necessary for acquisition, focusing on personal residences over income-producing properties, avoiding specific timelines that create accountability, neglecting property management and operational considerations, ignoring market research indicating where to focus, and failing to update boards as circumstances evolve.

Better boards show complete acquisition-to-operations journey. The Active Investors Journey reveals the systems successful investors use to scale portfolios systematically.

How do vision board examples connect to actual loan qualification processes?

Effective boards display qualification requirements visually: minimum credit scores for different loan types, maximum debt-to-income ratios, required reserve amounts, and employment verification needs. Show your progress toward these thresholds: credit score climbing from 650 toward 680, DTI improving from 45% toward 40%, or reserves growing from $10K toward $25K.

This visible progress maintains motivation through potentially lengthy qualification periods. Research various loan program requirements to understand qualification paths available to you.

Conclusion: Transform Your Vision Into Reality

Vision boards work not through magical thinking but through focused intention translated into consistent action. The examples explored throughout this guide demonstrate that successful wealth builders don’t just dream differently—they visualize differently, plan differently, and act differently based on clear visual targets guiding daily decisions.

Your vision board journey begins with honest assessment of where you currently stand financially. From that realistic starting point, create specific, measurable targets showing your desired destination. Then, crucially, display the pathway connecting present reality to future aspiration. This combination of current state awareness, clear destination definition, and visible pathway mapping creates vision boards that actually produce results rather than just inspiring temporary motivation.

Remember that vision boards serve as tools, not solutions. They focus attention, guide planning, and maintain motivation—but they don’t substitute for education, analysis, offers, financing, closing, and management. The most elaborate vision board accomplishes nothing without corresponding action. Commit to reviewing your board daily, adjusting quarterly, and most importantly, taking actions aligned with displayed priorities.

Whether you’re building financial foundations through the Smart Stewards Journey, pursuing your first home via the First-Time Buyers Journey, leveraging existing equity through the Homeowners Journey, optimizing retirement with the Senior Homeowners Journey, acquiring rental properties through the First-Time Investors Journey, scaling portfolios via the Active Investors Journey, or generating hands-off income through the Passive Investors Journey, your vision board should reflect your unique goals, resources, and timeline.

Start today. Gather images representing your real estate goals. Display them prominently where you’ll see them daily. Connect each image to specific actions you’ll take this week, this month, this quarter toward achievement. Review progress regularly and celebrate milestones along the way.

Your wealth building journey begins with vision. Make yours clear, compelling, and actionable. The future you’ve visualized awaits your committed action to make it real.

Ready to transform your real estate vision into reality? Explore your financing options and schedule a strategy consultation to discuss how various loan programs can support your property acquisition goals.

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a CallNot Sure About Your Next Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Related Posts

Subscribe to our newsletter

Get new posts and insights in your inbox.