Non Warrantable Condo Loan: 7 Ways to Finance Condominiums Rejected by Fannie Mae and Freddie Mac Due to Investor Concentration, Litigation, or Commercial Use

Secure Financing for Condominiums That Don't Meet Conventional Lending Standards

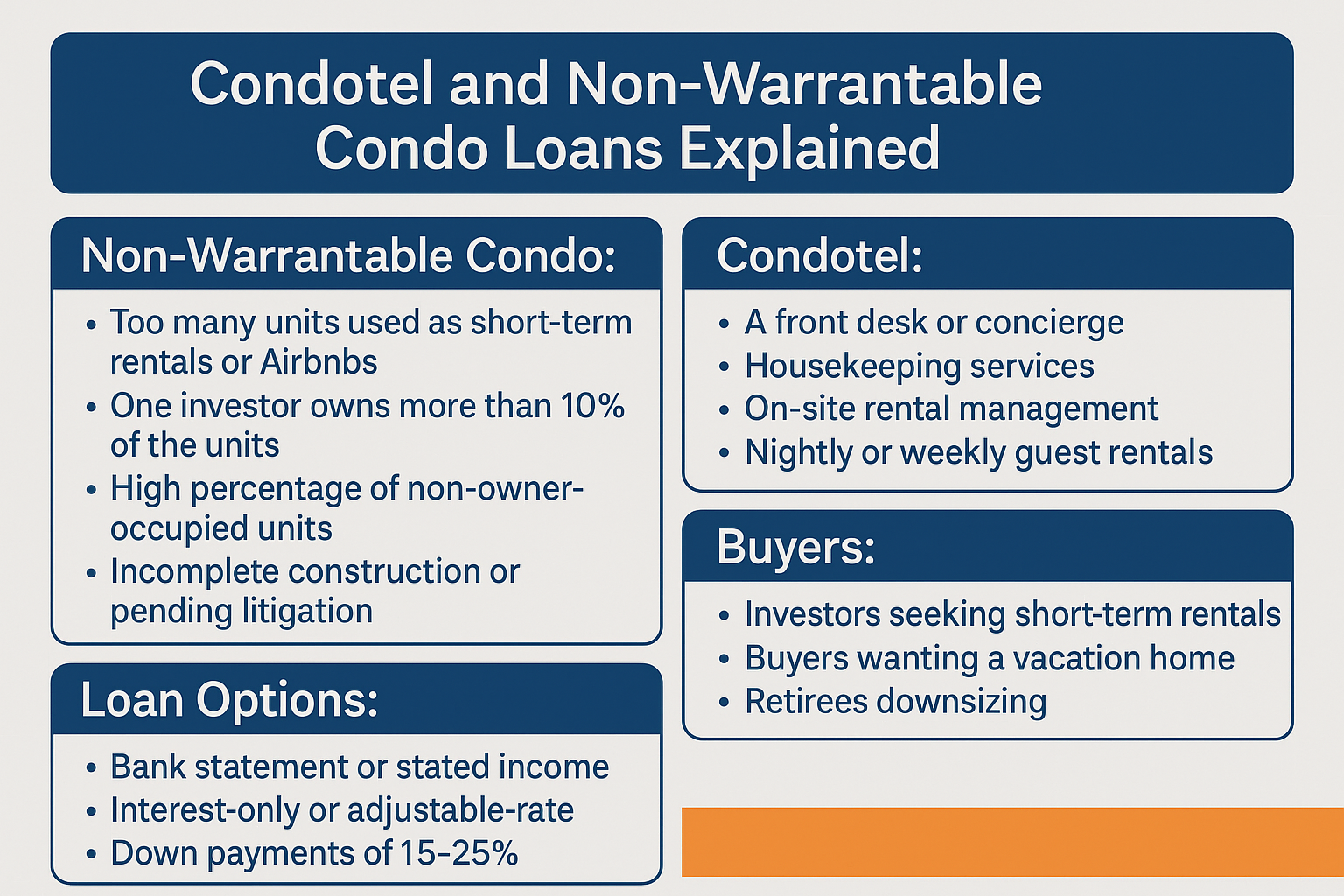

Purchasing or refinancing a condominium becomes complicated when the property doesn’t meet standard “warrantable” status required by conventional lenders. Non-warrantable condo loans provide financing solutions for properties rejected by traditional programs due to high investor concentrations, pending litigation, commercial space percentages, inadequate reserves, or other factors that disqualify them from Fannie Mae and Freddie Mac guidelines. Understanding what makes condos non-warrantable, how alternative financing works, and how to position yourself for approval helps you access properties in buildings that most buyers can’t finance, potentially creating value opportunities in desirable locations.

Key Details You’ll Learn About Non-Warrantable Condo Loans:

- What makes a condo “non-warrantable” and the specific factors that disqualify properties from conventional financing approval (Fannie Mae condo project standards)

- How non-warrantable condo loans differ from traditional condominium financing in terms of qualification requirements and program structure

- The various non-warrantable conditions including investor concentration ratios, litigation status, commercial space limitations, and financial reserve requirements

- Documentation requirements that lenders evaluate when underwriting non-warrantable condo financing beyond standard mortgage applications

- Credit score, equity contribution, and reserve requirements that typically exceed warrantable condo loan standards

- Interest rate and fee structures for non-warrantable financing compared to conventional condo loans (Consumer Financial Protection Bureau mortgage resources)

- How HOA financial health, special assessments, and association management affect non-warrantable condo loan approval odds

- Portfolio lender advantages for complex condo situations requiring individualized underwriting and flexible guidelines

- Strategic approaches to improving your approval odds when financing condos with warrantability challenges

Ready to explore your options? Schedule a call with a loan advisor.

What Is a Non-Warrantable Condo and Why Does It Matter?

A non-warrantable condo is a condominium property that doesn’t meet the eligibility requirements established by Fannie Mae and Freddie Mac for purchase on the secondary mortgage market. These government-sponsored enterprises set specific standards for condo projects they’ll accept as collateral, and properties failing to meet any of these criteria become “non-warrantable,” requiring alternative financing outside conventional lending channels.

Why do Fannie Mae and Freddie Mac have condo warrantability requirements? These standards manage risk in their mortgage portfolios by ensuring condo projects maintain financial stability, adequate insurance, appropriate owner-occupancy levels, and sound governance—properties meeting these criteria demonstrate lower default risk and more stable collateral values than projects with financial problems, governance issues, or unfavorable unit compositions.

The warrantability distinction creates a two-tier condo financing market. Warrantable condos access conventional financing with competitive terms, broad lender participation, and streamlined approval processes. Non-warrantable condos require specialized lending programs with stricter requirements, fewer participating lenders, and typically higher costs reflecting increased risk.

Common Non-Warrantable Characteristics

Multiple factors can render a condo project non-warrantable:

- High investor concentration – Too many units owned by non-owner occupants or investors renting their units

- Inadequate insurance coverage – Insufficient property, liability, or hazard insurance for the project

- Pending or active litigation – Lawsuits involving the homeowners association, developer, or management company

- Excessive commercial space – Commercial uses exceeding allowable percentages of total project square footage

- Insufficient HOA reserves – Inadequate funds set aside for major repairs, maintenance, or unexpected expenses

- Single entity ownership – One person or entity controlling too many units in the project

- Incomplete construction – Developer still owns unsold units or construction hasn’t reached substantial completion

- Deferred maintenance – Significant maintenance issues or capital improvements needed but not addressed

- Short-term rental prevalence – Many units operating as vacation rentals or Airbnb properties

- Mixed-use buildings – Projects combining residential condos with hotel, retail, or other commercial operations

Can a condo project become non-warrantable after you purchase? Yes, projects can lose warrantable status due to changing conditions like declining owner-occupancy, financial deterioration, litigation filing, insurance lapses, or increased commercial activity—this shift affects refinancing options and future buyer pool since fewer people can obtain financing.

Impact on Buyers and Owners

Non-warrantable status creates specific challenges:

- Limited buyer pool – Fewer potential purchasers can obtain financing, affecting marketability

- Lower property values – Reduced demand from financing challenges may depress prices below comparable warrantable condos

- Refinancing difficulties – Existing owners struggle to refinance if the project loses warrantable status

- Higher financing costs – Alternative loans typically carry premium pricing compared to conventional mortgages

- Stricter qualification – Borrowers need stronger credit, more equity, and larger reserves

- Fewer lender options – Only specialized lenders offer non-warrantable financing

Understanding these implications helps you evaluate whether a non-warrantable condo purchase makes sense for your situation and how to position yourself for successful financing.

Non-Warrantable Condo Loan Strategy #1: Identify Warrantability Issues Before Making Offers

How can you determine if a condo is non-warrantable before committing to purchase? Request the condominium questionnaire or project certification documents from the seller or HOA, review HOA financial statements and meeting minutes, research litigation records, evaluate owner-occupancy ratios, and work with lenders experienced in condo financing who can provide preliminary warrantability assessments before you make binding purchase commitments.

Discovering warrantability issues early prevents surprises during the mortgage approval process when you’ve already invested time and money in a property you may struggle to finance.

Key Warrantability Factors to Investigate

Research these critical elements before making offers:

Owner-occupancy ratio:

- Most conventional programs require at least 50% owner-occupancy (units occupied by owners, not renters)

- Some programs have stricter thresholds requiring 51% or higher

- Investment property financing may require even higher owner-occupancy percentages

- Projects trending toward higher rental ratios may soon become non-warrantable

Commercial space percentage:

- Conventional guidelines typically limit commercial space to 25-35% of total project square footage

- Includes retail, office, restaurants, gyms, and other non-residential uses

- Mixed-use buildings with substantial commercial components often become non-warrantable

- Ground-floor retail in otherwise residential buildings may still qualify if within limits

HOA financial reserves:

- Associations should maintain reserves covering 10% or more of annual budget

- Underfunded reserves signal potential special assessments or deferred maintenance

- Review reserve study showing planned major repairs and capital improvements

- Declining reserves or repeated special assessments indicate financial problems

Litigation status:

- Any active lawsuits involving the HOA, developer, or management company

- Common litigation includes construction defects, contractor disputes, or owner disputes

- Even meritless lawsuits can render projects non-warrantable until resolved

- Settled litigation may still affect warrantability for specific timeframes

Insurance coverage:

- Master policy must provide adequate property and liability coverage

- Projects in flood zones need proper flood insurance

- Gaps in coverage or inability to obtain insurance creates non-warrantable status

- Premium increases or coverage reductions signal insurability problems

How do you obtain condo project documentation? Request condominium questionnaires directly from the HOA management company, ask the seller to provide recent HOA documents, review public litigation records through county court systems, and work with your real estate agent to gather comprehensive project information early in your search process.

Red Flags Indicating Non-Warrantable Status

Watch for warning signs during property research:

- HOA disclosures mentioning ongoing lawsuits or legal proceedings

- High percentage of “For Rent” listings within the building

- Special assessments recently imposed or being discussed

- Significant deferred maintenance visible in common areas

- Mixed-use buildings with extensive ground-floor commercial space

- New construction with many unsold developer-owned units

- Buildings marketed heavily to investors or short-term rental operators

- Difficulty obtaining documentation from HOA or management company

- Online reviews mentioning management problems or association conflicts

Should non-warrantable status automatically disqualify a condo from consideration? Not necessarily—non-warrantable properties may offer value opportunities with lower prices offsetting financing challenges, particularly if you have strong financial profile, substantial equity contribution, and plan long-term ownership, though you should understand the financing implications and ensure you can qualify for available programs.

What Are the Qualification Requirements for Non-Warrantable Condo Loans?

Do non-warrantable condo loans have stricter requirements than conventional financing? Yes, alternative financing for non-warrantable condos typically requires higher credit scores, larger equity contributions, more substantial reserves, lower maximum debt-to-income ratios, and comprehensive documentation compared to warrantable condo loans—lenders offset the increased project risk through stronger borrower qualification standards.

Understanding these elevated requirements helps you assess whether you can qualify and what financial positioning might improve your approval odds.

Credit Score Requirements

Non-warrantable financing demands excellent credit profiles:

- Minimum credit scores – Most programs establish thresholds significantly above conventional minimums

- Recent payment history – Perfect or near-perfect payment records, especially on housing debt

- Credit depth – Established credit history with multiple accounts successfully managed over time

- Limited inquiries – Few recent credit applications suggesting financial stability

- Clean public records – No recent bankruptcies, foreclosures, judgments, or significant collections

How do recent late payments affect non-warrantable condo loan approval? Even single late payments within recent timeframes can create approval challenges or affect pricing—lenders scrutinize payment history intensely since you’re combining higher project risk with mortgage obligations, requiring confidence in your financial discipline.

Equity and Down Payment Standards

Larger equity contributions are standard for non-warrantable financing:

Typical equity requirements:

- Primary residence purchases commonly require substantially higher contributions than warrantable condos

- Second homes need even larger equity positions due to higher perceived risk

- Investment properties demand the most substantial equity contributions

- Cash-out refinances face stricter loan-to-value limitations

- Specific non-warrantable factors may increase equity requirements further

Why do non-warrantable condo loans require more equity? The combination of project-level risk (non-warrantable factors) and individual unit risk creates elevated lender exposure—larger borrower investment through substantial equity reduces potential losses if values decline or borrowers default, while demonstrating financial commitment and capacity.

Benefits of larger equity contributions:

- Improved approval odds for challenging projects

- Better pricing tiers as equity increases

- Reduced monthly payment obligations

- Greater negotiating flexibility with underwriters

- Buffer against market value fluctuations

Reserve Requirements

Substantial liquid reserves beyond down payment are critical:

Minimum reserve expectations:

- Many non-warrantable programs require 6-12+ months of total housing payments in reserves after closing

- Calculation includes principal, interest, property taxes, insurance, and HOA fees

- Multiple financed properties require reserves covering all properties

- Pending special assessments may require additional reserves

- Some lenders increase requirements for projects with specific risk factors

What assets count toward non-warrantable condo loan reserves? Checking accounts, savings accounts, money market funds, stocks, bonds, mutual funds in liquid brokerage accounts typically count at full value, while retirement accounts may receive discounted valuation (60-70%), and illiquid assets like real estate equity or business interests generally don’t qualify.

Debt-to-Income Ratio Standards

Conservative leverage improves non-warrantable approval odds:

- Many programs establish maximum debt-to-income ratios below conventional lending thresholds

- Front-end ratios measuring housing payment against income face specific limits

- Back-end ratios including all debt obligations have maximum thresholds

- HOA fees count toward housing payment calculations

- Pending special assessments may need inclusion in debt calculations

How do high HOA fees affect non-warrantable condo loan qualification? Substantial association fees increase your total housing payment, potentially pushing you over debt-to-income limits even if the mortgage payment alone seems manageable—include the complete PITI+HOA payment when evaluating affordability and qualification capacity.

Non-Warrantable Condo Loan Strategy #2: Understand Specific Disqualifying Factors

What specific issues most commonly cause non-warrantable status? Investor concentration exceeding limits, active litigation involving the association, commercial space percentages above thresholds, insufficient HOA reserves, and insurance coverage problems represent the most frequent disqualifiers—understanding which factors affect your target property helps you pursue appropriate financing and set realistic expectations.

Different non-warrantable factors create varying levels of financing difficulty, with some issues having workarounds while others create more substantial barriers.

High Investor Concentration

What owner-occupancy ratio makes a condo non-warrantable? Most conventional programs require at least 50% of units be owner-occupied or sold to owner-occupants, with some programs requiring 51% or higher—projects falling below these thresholds where too many units are investor-owned or operated as rentals lose warrantable status.

Why investor concentration matters:

- High rental percentages correlate with increased default rates historically

- Owner-occupants typically maintain properties better than absentee investors

- Communities with high rentals may experience more turnover and less stability

- GSEs limit exposure to projects dominated by investment ownership

Can you finance a unit in a project with high investor concentration? Yes, through non-warrantable condo loan programs specifically designed for projects exceeding investor concentration limits—these programs evaluate the specific unit and project fundamentals rather than rejecting properties solely based on owner-occupancy ratios.

Factors lenders consider in high-investor projects:

- HOA financial health despite high rental concentration

- Property management quality and reputation

- Rental market strength in the area

- Unit condition and marketability

- Your credit and financial strength as borrower

Active Litigation

Lawsuits involving the HOA create significant warrantability challenges:

What types of litigation affect condo warrantability? Construction defect cases, disputes with developers or builders, conflicts with management companies, environmental issues, accessibility claims, or significant disputes between unit owners and the association can all render projects non-warrantable—even meritless lawsuits disqualify projects until resolution or dismissal.

Litigation considerations:

- Active lawsuits almost universally create non-warrantable status

- Severity and type of litigation affect lender concern levels

- Potential liability amounts and insurance coverage matter

- Recently settled litigation may still affect financing for specific periods

- Documentation showing litigation resolution helps with approval

How long does resolved litigation affect condo financing? Timeframes vary by lender and situation, but projects typically need 6-12+ months after litigation settlement before regaining warrantable status—lenders want certainty that issues are truly resolved and no related problems will emerge.

Insufficient HOA Reserves

Financial health significantly affects project warrantability:

What HOA reserve percentage is considered adequate? Most guidelines suggest associations maintain reserves equal to at least 10% of the annual budget, though more complex or older projects may need higher percentages—associations with inadequate reserves or reserves declining over time signal financial stress affecting warrantability.

Reserve-related concerns:

- Underfunded reserves often lead to special assessments

- Deferred maintenance from inadequate reserves affects property values

- Declining reserves suggest revenue problems or mismanagement

- Recent special assessments indicate reserve insufficiency

- Upcoming major repairs without adequate reserves create exposure

Can you get financing if the HOA has low reserves? Non-warrantable condo loans can finance units in projects with reserve deficiencies, though lenders evaluate whether reserve levels create material risk of special assessments that would affect your ability to make mortgage payments—extremely low reserves or projects facing imminent major expenses create greater challenges.

Commercial Space Limitations

Mixed-use projects frequently exceed commercial space thresholds:

What percentage of commercial space disqualifies a condo project? Conventional guidelines typically allow up to 25-35% commercial space depending on the specific program—projects exceeding these limits where commercial uses represent too much of the building become non-warrantable.

Commercial space includes:

- Ground-floor retail shops and restaurants

- Office space leased to businesses

- Hotel operations within the building

- Gyms, spas, or recreational facilities operated commercially

- Conference centers or event spaces

- Any non-residential revenue-generating uses

Are condos in mixed-use buildings automatically non-warrantable? Not necessarily—if commercial space stays within the allowable percentage range, the project may maintain warrantable status, though projects marketed primarily as mixed-use developments often exceed these thresholds and require non-warrantable financing.

Ready to discuss your purchase scenario? Submit a purchase inquiry to explore your options.

How Do Non-Warrantable Condo Loan Interest Rates Compare?

Are non-warrantable condo loan rates higher than conventional financing? Yes, alternative financing for non-warrantable condos typically carries pricing premiums through higher interest rates, additional fees, or both—the increased project-level risk beyond standard underwriting factors reflects in program costs, though exact pricing varies significantly based on your credit profile, equity contribution, specific project issues, and chosen lender.

Understanding cost implications helps you evaluate whether a non-warrantable condo purchase makes financial sense and what pricing to expect during your search.

Rate Premium Factors

Multiple variables influence your specific pricing:

- Severity of non-warrantable factors – Serious issues like major litigation carry larger premiums than minor technicalities

- Credit score – Your credit profile significantly affects pricing within non-warrantable programs

- Equity contribution – Larger down payments typically reduce rates through improved risk profiles

- Reserve levels – Substantial liquid reserves may improve pricing

- Property type and use – Primary residences generally receive better pricing than investment properties

- Loan amount – Some programs have pricing tiers based on loan size

- Lender and program selection – Different non-warrantable programs have varying rate structures

What’s a typical rate premium for non-warrantable condo financing? Premiums vary significantly but commonly range from fractions of a percentage point to multiple percentage points above comparable conventional financing depending on all risk factors—projects with minor warrantability issues and borrowers with excellent profiles see smaller premiums, while complex situations face larger spreads.

Fee Structures

Beyond rate differences, additional costs may apply:

- Origination fees – Some non-warrantable programs charge higher origination fees

- Underwriting fees – Additional analysis of project documentation may involve premium fees

- Condo project review fees – Detailed project evaluation beyond standard condo questionnaires

- Document review charges – Analysis of HOA financials, litigation documents, or other project materials

- Appraisal costs – Generally similar to standard condo appraisals

- Third-party fees – Title, escrow, and recording fees align with traditional mortgages

Are non-warrantable condo loan closing costs significantly higher? Total closing costs depend on specific lender fee structures—while some lenders charge premium fees for project review and additional underwriting, others maintain fee structures competitive with standard condo financing, making lender comparison important.

Total Cost Analysis

Evaluate the complete financial picture:

- Calculate total interest over expected ownership period – Not just the rate but total interest paid

- Include all upfront fees and costs – Origination, underwriting, project review charges

- Factor in opportunity cost – Alternative uses for larger down payment funds

- Consider property value discount – Non-warrantable condos may sell below comparable warrantable units

- Evaluate refinancing potential – Could you refinance to better terms if the project regains warrantable status?

- Compare against alternatives – Financing premium versus purchasing a warrantable condo in different location

When do non-warrantable condo costs justify the expense? If the property offers significant value below comparable warrantable condos, provides unique location or amenity advantages worth the premium, represents excellent investment potential despite financing challenges, or fits your specific needs better than available warrantable alternatives.

Calculate your non-warrantable condo loan scenarios:

See how other condo buyers have successfully used non-warrantable condo financing:

- View non-warrantable condo loan purchase case studies

- View non-warrantable condo loan refinance case studies

- View non-warrantable condo loan cash-out refinance case studies

Non-Warrantable Condo Loan Strategy #3: Evaluate HOA Financial Health Beyond Warrantability

What HOA financial factors should you evaluate beyond standard warrantability requirements? Association budget adequacy, special assessment history and likelihood, reserve study quality and age, delinquency rates among unit owners, insurance coverage limits and premiums, management company reputation, and pending major repairs all affect both financing approval and your long-term ownership costs regardless of technical warrantability status.

Thorough HOA financial analysis protects you from purchasing into projects with serious underlying problems that could create ongoing financial stress even if you successfully obtain financing.

Critical HOA Financial Documents

Request and review these essential documents:

HOA budget and financial statements:

- Annual operating budget with income and expense projections

- Monthly or quarterly financial statements showing actual performance

- Balance sheet showing association assets and liabilities

- Income statements revealing revenue sources and expense categories

- Reserve fund balances and recent activity

- Accounts receivable aging showing delinquent owner payments

Reserve study:

- Professional assessment of future major repair and replacement needs

- Projected timelines for capital improvements

- Cost estimates for anticipated major expenses

- Recommended reserve funding levels

- Analysis of current funding versus recommended levels

- Update frequency (should be revised every 3-5 years)

Meeting minutes:

- Recent board meeting minutes revealing issues, decisions, and conflicts

- Discussion of financial challenges or special assessments

- Maintenance issues under consideration

- Insurance matters or coverage changes

- Management company performance or changes

What red flags in HOA financials should concern you? Declining reserves over time, repeated special assessments, high delinquency rates, expenses consistently exceeding budget, minimal reserve contributions, deferred maintenance documented in minutes, insurance premium spikes or coverage reductions, and management company turnover all signal potential problems.

Special Assessment Risk

Evaluate likelihood of future assessments:

- Reserve adequacy relative to reserve study – Are current reserves sufficient for projected needs?

- Age and condition of major systems – Are roofs, elevators, HVAC, or parking structures nearing replacement?

- Deferred maintenance – Have routine repairs been postponed due to budget constraints?

- Recent assessment history – Have owners faced multiple assessments recently?

- Upcoming known projects – Are major renovations or repairs being discussed?

How do special assessments affect non-warrantable condo loan qualification? Pending or recently imposed special assessments must typically be paid before closing or included in your debt-to-income calculations—large assessments can affect both qualification and appraisal values, while recurring assessments signal chronic financial problems.

Insurance Coverage Analysis

Adequate insurance protects your investment:

Master policy review:

- Property coverage limits covering full replacement cost

- Liability coverage protecting the association adequately

- Flood insurance if in designated flood zones

- Earthquake insurance in seismically active areas

- Directors and officers liability coverage

- Fidelity bond protecting against fraud or theft

Coverage concerns:

- Insufficient limits leaving unit owners exposed

- Increasing premiums indicating insurability problems

- Difficulty obtaining coverage due to claims history

- High deductibles creating special assessment risk after losses

- Coverage gaps or exclusions for known building issues

Why does HOA insurance matter if you have your own HO-6 policy? Your individual condo insurance (HO-6) provides secondary coverage after the master policy—inadequate master coverage creates gaps leaving you personally liable, while uninsurable buildings prevent you from obtaining financing regardless of other factors.

What Documentation Do Non-Warrantable Condo Lenders Require?

What condo project documents must you provide for non-warrantable financing? Comprehensive project documentation including complete condo questionnaires, HOA financial statements and budgets, reserve studies, meeting minutes, master insurance policies, declarations and bylaws, litigation details if applicable, and property management information—non-warrantable lending requires more extensive project analysis than warrantable financing due to increased complexity.

Thorough documentation helps underwriters understand project specifics and assess whether issues creating non-warrantable status represent manageable risk or significant concern.

Standard Condo Project Documentation

All condo financing requires baseline project documents:

- Condominium questionnaire – Standardized form completed by HOA providing project details

- Master insurance policy – Complete policy with all declarations, endorsements, and coverage details

- HOA budget – Current year operating budget with income and expense projections

- Financial statements – Recent balance sheet and income statement

- Reserve study – Professional assessment of future major repairs and recommended funding

- Declarations and bylaws – Governing documents establishing HOA rules and unit owner rights

- Articles of incorporation – Formation documents for the homeowners association

How current must condo documents be for loan approval? Most lenders require documents dated within specific timeframes (commonly 90-180 days), with financial statements ideally from the current or most recent fiscal year—outdated documentation requires updates before underwriting can proceed.

Additional Non-Warrantable Documentation

Projects with warrantability issues need supplemental documentation:

For litigation matters:

- Complete complaint and answer documents

- Status updates on case progress

- Settlement agreements if litigation resolved

- Documentation of any pending appeals

- Insurance coverage details for liability claims

- Financial impact assessment on HOA

For investor concentration:

- Current owner-occupancy certification showing unit breakdown

- Rental unit documentation from property management

- Analysis of occupancy trends over time

- Evidence of stable rental management

For commercial space:

- Site plan showing residential versus commercial areas

- Lease agreements for commercial tenants

- Revenue contribution from commercial operations

- Percentage calculations of commercial square footage

For reserve deficiencies:

- Explanation of reserve funding policies

- Special assessment history and amounts

- Plan for improving reserve funding levels

- Recent reserve study with updated projections

Can you proceed with incomplete condo documentation? No, lenders require complete project documentation before approving non-warrantable loans—missing documents delay underwriting, while HOAs that can’t or won’t provide required documentation may prevent financing entirely, requiring you to consider alternative properties.

Personal Financial Documentation

Beyond project documents, expect standard mortgage documentation:

- Income verification appropriate to your employment situation

- Asset statements showing reserves and down payment funds

- Credit report authorization

- Employment verification

- Tax returns (number of years varies by program)

- Explanation letters for any unusual financial patterns

Self-employed borrowers may access alternative documentation:

Frequently Asked Questions About Non-Warrantable Condo Loans

Can You Refinance a Non-Warrantable Condo?

Yes, refinancing non-warrantable condos follows similar underwriting to purchases, requiring evaluation of both current project status and your financial profile—rate-and-term refinances and cash-out refinances are both available through non-warrantable programs, though cash-out refinancing typically faces stricter loan-to-value limitations than rate-and-term transactions.

Does the condo need to remain non-warrantable to refinance? Not necessarily—if the project regains warrantable status by resolving previous issues, you may qualify for conventional refinancing with better terms, while projects remaining non-warrantable require continued alternative financing through specialized programs.

Refinance considerations:

- Project status may have changed since purchase affecting options

- Your credit and financial profile changes affect qualification

- Market conditions influence whether refinancing makes financial sense

- Cash-out limitations may prevent accessing all available equity

- Reserve requirements apply similar to purchase transactions

Considering a refinance? Submit a refinance inquiry to see if this makes sense for you.

How Do You Find Non-Warrantable Condo Lenders?

What types of lenders offer non-warrantable condo financing? Portfolio lenders holding loans on their balance sheets, non-QM specialists focusing on alternative lending, some credit unions with flexible underwriting, and private lending sources provide most non-warrantable financing—conventional mortgage companies selling loans to Fannie Mae and Freddie Mac generally can’t help with non-warrantable properties.

Finding specialized lenders:

- Work with mortgage brokers – Brokers maintain relationships with multiple non-warrantable lenders

- Research portfolio lenders – Local and regional banks often hold condo loans in portfolio

- Explore credit unions – Some credit unions offer flexible condo financing

- Contact non-QM specialists – Companies focusing on alternative lending typically offer non-warrantable programs

- Ask for referrals – Real estate agents experienced with condos know specialized lenders

Should you tell your lender early that a condo is non-warrantable? Yes, disclose known warrantability issues immediately—working with lenders experienced in non-warrantable financing from the start prevents wasted time with lenders who can’t help, ensures realistic expectations on requirements and pricing, and allows proper structuring of your purchase contract timeline.

Can First-Time Buyers Get Non-Warrantable Condo Loans?

Yes, first-time homebuyers can qualify for non-warrantable condo financing, though the combination of first-time buyer and non-warrantable property creates challenges requiring particularly strong financial profiles—expect lenders to emphasize larger equity contributions, substantial reserves, excellent credit scores, and stable income when both factors are present.

What makes first-time buyers more challenging for non-warrantable financing? Lenders prefer borrowers with previous mortgage payment history demonstrating ability to manage housing debt, making first-time buyers inherently higher risk—combining this with non-warrantable project risk requires compensating factors through other underwriting elements.

First-time buyer strategies:

- Build credit to excellent range before applying

- Save larger down payment than typical requirements

- Accumulate substantial reserve cushions beyond minimums

- Consider less challenging non-warrantable properties for first purchase

- Work with lenders experienced with both first-time buyers and non-warrantable condos

- Provide thorough documentation and professional presentation

Do All Condos With HOA Lawsuits Become Non-Warrantable?

Not necessarily—the nature, severity, and potential impact of litigation determine warrantability more than mere existence of lawsuits—minor disputes with limited financial exposure may not affect warrantable status, while major construction defect cases, significant liability claims, or lawsuits threatening association financial stability typically create non-warrantable status.

What types of litigation are most concerning to lenders? Construction defect cases with potential large remediation costs, environmental hazards like mold or contamination, accessibility compliance lawsuits, structural integrity issues, or any litigation where potential judgments could create special assessments or materially affect property values.

Litigation evaluation factors:

- Type and severity of claims

- Potential financial exposure and settlement amounts

- Insurance coverage for claims

- Timeline and current status

- Impact on HOA operations and finances

- Whether issues affect entire building or isolated units

Can you finance a condo if litigation recently settled? Possibly, though many lenders require waiting periods after settlement before approving financing—the wait period allows certainty that issues are resolved, no related problems emerge, and the association’s financial position stabilizes post-settlement.

What Happens If Your Condo Becomes Non-Warrantable After Purchase?

Can a warrantable condo become non-warrantable after you own it? Yes, changing project conditions like declining owner-occupancy, new litigation, insurance problems, financial deterioration, or increased commercial activity can shift previously warrantable projects to non-warrantable status—this affects your ability to refinance and the future buyer pool when you decide to sell.

Impact on existing owners:

- Conventional refinancing becomes unavailable requiring non-warrantable programs

- Property values may decline as fewer buyers can obtain financing

- Selling becomes more challenging with limited buyer financing options

- Home equity line of credit approval may become difficult or impossible

What can unit owners do about declining project status? Actively participate in HOA governance to prevent problems, vote for boards prioritizing financial health and proper management, oppose policies that might create non-warrantable factors, maintain adequate reserves through appropriate assessments, ensure quality property management, and address issues promptly before they become material problems.

Mitigation strategies:

- Monitor HOA financial health and meeting minutes regularly

- Participate in owner meetings and board elections

- Advocate for policies maintaining warrantable status

- Support adequate reserve funding and maintenance budgets

- Address potential litigation matters promptly and professionally

Are Condotels and Vacation Condos Always Non-Warrantable?

What are condotels and why are they typically non-warrantable? Condotels are condominium properties operated partially or primarily as hotels with units entering rental pools, offered to hotel guests, or managed by hotel operators—these properties almost universally fail warrantability requirements due to commercial operation, lack of owner-occupancy, hotel-style amenities and services, and business structures mixing residential ownership with hospitality operations.

Condotel characteristics:

- Units participate in hotel rental programs

- Front desk and concierge services

- Daily housekeeping and hotel-style amenities

- Professional hotel management and marketing

- Revenue sharing between owners and operators

- Limited personal use periods for owners

- High investor concentration with minimal owner-occupancy

Can you get financing for condotel units? Yes, through specialized non-warrantable programs designed specifically for these properties—requirements typically include substantial equity contributions (often 30-40%+), excellent credit profiles, significant reserves, and documentation acknowledging the property’s commercial nature and rental program participation.

Vacation condo considerations:

- Projects marketed primarily to investors or vacation rental operators

- High concentration of short-term rental units

- Limited long-term owner-occupancy

- Seasonal usage patterns

- Potential for declining owner-occupancy over time

Non-Warrantable Condo Loan Strategy #4: Leverage Portfolio Lenders for Complex Situations

What advantages do portfolio lenders offer for non-warrantable condo financing? Banks and credit unions holding loans on their balance sheets rather than selling them can offer more flexible underwriting for complex projects, individualized risk assessment, accommodation of unique situations not fitting standardized guidelines, relationship-based decision making, and creative solutions for particularly challenging non-warrantable scenarios.

Portfolio lending provides customized approaches where standardized non-QM programs might still struggle with unusually complex situations.

Portfolio Lender Benefits

These institutions provide unique advantages:

- Individualized underwriting – Evaluate complete project picture rather than applying rigid rules

- Relationship consideration – Deposit accounts and banking relationships may influence decisions

- Local market expertise – Regional banks often understand local condo markets intimately

- Unique project acceptance – May finance properties other non-warrantable lenders decline

- Flexible pricing – Can structure competitive pricing for quality projects despite issues

- Long-term servicing – You’ll work with the same lender throughout loan life

How do you identify portfolio lenders for non-warrantable condos? Research regional and community banks in your market, explore credit unions with real estate lending programs, ask real estate attorneys and CPAs for referrals to portfolio lenders, contact banks advertising “portfolio lending” or “balance sheet lending,” and work with mortgage brokers who maintain portfolio lender relationships.

Building Portfolio Lender Relationships

Maximize portfolio lender benefits through strategic relationship development:

- Establish banking relationship before applying – Open accounts and build history before needing mortgage

- Consolidate banking services – Bring checking, savings, and other accounts to the institution

- Use multiple services – Business banking, personal banking, investment services create deeper relationships

- Demonstrate financial sophistication – Professional interaction and comprehensive documentation

- Explain project strengths – Help lender understand why the property makes good sense despite non-warrantable status

Can banking relationships actually affect non-warrantable condo approval? Yes, particularly with portfolio lenders who evaluate relationships holistically—substantial deposit relationships, existing loan performance, or multiple service usage can provide flexibility or improved pricing compared to applicants without institutional relationships.

When Portfolio Lending Makes Most Sense

Certain non-warrantable scenarios particularly benefit from portfolio approaches:

- Projects with multiple non-warrantable factors creating cumulative complexity

- Unique local properties that regional lenders understand better than national programs

- Situations requiring customized underwriting beyond standard guidelines

- Properties in portfolio lender’s backyard where they have market expertise

- Complex borrower situations requiring individualized income analysis

- High-value properties exceeding many non-warrantable program limits

Explore portfolio lending options:

Strategy #5: Understand FHA and VA Condo Financing Alternatives

Can you use FHA or VA loans for non-warrantable condos? Generally no—FHA and VA have their own condo project approval processes separate from conventional warrantability, and projects failing Fannie/Freddie standards typically also fail FHA or VA requirements, though occasionally projects might qualify for FHA or VA despite being conventionally non-warrantable if specific issues don’t violate government program rules.

Understanding government-backed options helps you explore all potential financing avenues, particularly if you’re a first-time buyer or veteran who might otherwise benefit from these programs.

FHA Condo Approval Process

FHA maintains separate condo project certification:

FHA condo project requirements:

- 50% or more units must be owner-occupied

- Commercial space limited to 25% or less

- No pending litigation with material financial impact

- Adequate insurance coverage meeting FHA standards

- Financial reserves meeting FHA guidelines

- Proper budgeting and no significant delinquencies

- Projects must be complete with no remaining developer control

How do FHA condo requirements differ from conventional warrantability? Standards are similar in many respects, though specific thresholds and evaluation criteria differ—FHA maintains an approved condo project list where projects meeting standards receive certification streamlining individual unit financing, while projects not on the approved list face spot approval processes.

FHA spot approval (single-unit approval):

- Available in some cases for individual units in uncertified projects

- Requires comprehensive project review similar to full certification

- May involve additional documentation and underwriting

- Typically slower process than certified project financing

- Not all lenders offer spot approval processing

Can veterans use VA loans for non-warrantable condos? VA has its own condo project approval separate from conventional warrantability—occasionally projects might qualify for VA despite Fannie/Freddie non-warrantable status, though most projects failing conventional standards also fail VA requirements due to similar financial, legal, and composition standards.

When Government Loans Might Work

Consider FHA or VA for specific situations:

- Projects failing conventional warrantability on technicalities that don’t violate FHA/VA rules

- Situations where you’d benefit from FHA or VA low down payment advantages

- Properties in FHA or VA approved project lists despite conventional challenges

- First-time buyers or veterans who could use government backing

Research government loan eligibility early in your condo search to understand whether these alternatives might provide better terms than non-warrantable conventional financing.

Strategy #6: Evaluate the Investment Potential Despite Financing Challenges

Should you purchase a non-warrantable condo as an investment property? Investment potential depends on multiple factors including purchase price discount versus warrantable comparables, rental income relative to financing costs, local rental demand, your ability to hold long-term if resale proves challenging, tax implications, and your overall investment strategy—non-warrantable status creates both challenges and potential opportunities.

Understanding investment dynamics helps you assess whether a non-warrantable condo represents a good opportunity or a potential problem.

Purchase Price Considerations

Non-warrantable status affects pricing:

Typical price dynamics:

- Non-warrantable condos often sell at discounts to comparable warrantable units

- Limited buyer pool from financing challenges reduces competition

- Motivated sellers may negotiate more favorably

- Discounts vary significantly based on severity of non-warrantable factors

- Properties with temporary issues may offer better value than chronic problem projects

How much discount justifies non-warrantable challenges? No universal answer exists, but substantial discounts (10-20%+ below comparable warrantable condos) may offset higher financing costs and limited resale pool—evaluate whether the discount plus rental income or personal use value exceeds the premium you’ll pay through higher financing costs and potential difficulty selling.

Rental Income Analysis

For investment properties, cash flow drives decisions:

- Market rent analysis – What can the unit realistically command in rental market?

- Vacancy expectations – How much vacancy should you anticipate annually?

- Operating expenses – HOA fees, property taxes, insurance, management, maintenance

- Financing costs – Higher non-warrantable rates affect cash flow calculations

- Cash-on-cash return – Return on your actual invested capital (down payment and costs)

Do DSCR loans work for non-warrantable condos? Yes, DSCR investment property loans focusing on rental income coverage can finance non-warrantable condos—this combination works particularly well since DSCR loans already use alternative underwriting, and rental income-focused qualification aligns well with investment property analysis.

Explore DSCR financing for non-warrantable investment condos:

Exit Strategy Planning

Consider your eventual exit:

Resale challenges:

- Limited buyer pool due to financing restrictions

- Potentially longer marketing times

- May need to price attractively to overcome financing barriers

- Future buyer may need non-warrantable financing with current requirements

Resale opportunities:

- If project regains warrantable status, property values may increase

- Strong rental income can attract cash buyers or sophisticated investors

- Some investors specifically target non-warrantable properties for deals

Hold strategy:

- Strong long-term rental income may justify indefinite holding

- Property appreciation over extended periods can offset financing premium

- Tax benefits of real estate investing continue regardless of warrantability

Should you expect non-warrantable condos to appreciate normally? Not necessarily—limited buyer pools from financing challenges may constrain appreciation relative to warrantable comparables, though well-located properties with strong fundamentals can still appreciate significantly over time, and projects resolving their non-warrantable issues may see value increases.

Calculate investment scenarios:

Strategy #7: Time Your Purchase Around Project Status Improvements

Can you improve your financing options by waiting for project status changes? Sometimes yes—if non-warrantable issues appear temporary or in the process of resolution, waiting until problems resolve may provide access to conventional financing with better terms, though you risk missing purchase opportunities or price increases if the property appreciates while you wait.

Strategic timing balances securing a good property against optimizing financing terms.

Temporary vs. Permanent Issues

Evaluate the nature of non-warrantable factors:

Potentially temporary issues:

- Litigation approaching settlement or recently settled

- Owner-occupancy trending positive from recent sales to owner-occupants

- Developer nearing complete unit sell-out

- Insurance coverage gaps being addressed

- Reserve funding plans recently improved

- Commercial space transitioning to residential

Likely permanent characteristics:

- Projects fundamentally designed as condotels or hotel operations

- Mixed-use buildings with substantial commercial components by design

- Buildings in declining areas with structural market challenges

- Projects with chronic management or governance problems

- Properties with difficult-to-resolve legal or structural issues

How long does it typically take for projects to regain warrantable status? Timelines vary dramatically—litigation settlement might clear in months, while owner-occupancy improvements could take years of turnover, developer sell-out depends on market conditions and inventory, and some issues may never fully resolve.

Monitoring Project Improvements

Track progress if you’re waiting:

- Regular HOA contact – Maintain communication with management about issue status

- Court records – Monitor litigation progress through public records

- Sales data – Track unit sales and owner-occupancy trends

- HOA meetings – Attend meetings if possible to understand progress

- Lender check-ins – Periodically ask lenders about current project status

- Condo questionnaires – Request updated questionnaires showing current conditions

Should you make offers contingent on warrantable status improvement? This typically doesn’t work well—sellers won’t accept offers contingent on future events outside their control, and warrantability determinations can take time—instead, structure normal contingencies protecting your earnest money while you evaluate financing options during due diligence periods.

Balancing Opportunity vs. Optimization

Consider the tradeoffs:

Reasons to purchase despite non-warrantable status:

- Exceptional property value or location justifying premium financing costs

- Strong rental income covering elevated financing expenses

- Limited alternative inventory in your target market

- Risk of price appreciation while waiting for status improvement

- Personal use value exceeding financial optimization concerns

- Long-term hold plans minimizing resale concern importance

Reasons to wait or look elsewhere:

- Multiple warrantable alternatives available in your market

- Temporary issues likely resolving within reasonable timeframes

- Price premium insufficient to justify financing disadvantages

- Project status trending worse rather than improving

- Significant resale concerns from permanent non-warrantable factors

- Financing costs materially affecting your overall returns or affordability

Alternative Loan Programs for Challenging Properties

If a non-warrantable condo loan isn’t the right fit, consider these alternatives:

- Conventional Loan – Traditional financing for condos meeting Fannie Mae/Freddie Mac warrantable standards

- FHA Loan – Government-backed financing for FHA-approved condo projects

- Jumbo Loan – For high-value condos exceeding conforming loan limits

- Bank Statement Loan – Alternative documentation for self-employed condo buyers

- Asset-Based Loan – Leverage investment portfolios for condo purchases with complex qualification scenarios

Explore all 30+ loan programs to find your best option.

Not sure which program is right for you? Take our discovery quiz to find your path.

Helpful Non-Warrantable Condo Loan Resources

Official Government Guidance

Fannie Mae Condo Project Standards – Official Fannie Mae resource detailing condominium project eligibility requirements, warrantability standards, and guidelines that determine whether projects qualify for conventional financing purchase on the secondary market.

Consumer Financial Protection Bureau Mortgage Resources – Federal consumer protection agency offering educational resources on mortgages, homebuying, and borrower rights that apply to all mortgage types including non-warrantable condo financing.

FHA Condominium Project Approval Process – Department of Housing and Urban Development resource explaining FHA condo project certification requirements, approval processes, and guidelines for government-backed condo financing.

Industry Organizations

Community Associations Institute Resources – National organization serving community associations providing educational resources on HOA governance, financial management, legal issues, and best practices for condominium association operations and oversight.

National Association of Realtors Condo and Co-op Resources – Real estate professional organization offering condo market data, buying guidance, legal considerations, and resources for buyers, sellers, and agents working with condominium properties.

Educational Resources

Mortgage Bankers Association Non-QM Lending Information – National trade association providing research, market trends, and industry perspective on non-qualified mortgage lending including non-warrantable condo financing and alternative documentation programs.

American Bar Association Real Estate Law Resources – Legal organization providing educational materials on real estate law, condominium governance, HOA legal issues, and property rights relevant to condo ownership and financing.

Federal Reserve Consumer Credit Resources – Central bank educational materials explaining mortgage markets, interest rate factors, and economic conditions influencing lending availability and pricing for all mortgage types.

Need local expertise? Get introduced to trusted partners including loan officers, realtors, and contractors in your area.

Ready to get started? Apply now or schedule a call to discuss your situation.

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Not Sure About Your Next Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Related Posts

Subscribe to our newsletter

Get program updates and rate insights in your inbox.