Fix and Flip Loan: 7 Proven Strategies to Finance Your Real Estate Investments

How a Fix and Flip Loan Provides Fast Funding for Property Renovation and Resale

Real estate investors targeting distressed properties for rapid renovation and resale need short-term financing that accounts for after-repair value rather than current condition. Fix-and-flip loans provide acquisition and renovation capital with terms designed for properties you’ll improve and sell within 12-18 months. Whether you’re an experienced flipper or entering the renovation-for-profit space, this specialized financing structure aligns with your business model’s timeline and profit expectations.

Key Details: What You’ll Learn About Fix and Flip Loans

- A fix and flip loan provides short-term financing specifically designed for real estate investors purchasing distressed properties, funding renovations, and reselling for profit within 6-18 months (CFPB real estate investment loan information)

- Investors can secure funding based primarily on the property’s after-repair value rather than personal income, using asset-based qualification methods that bypass traditional employment verification (IRS real estate investor tax guidelines)

- Property types including single-family homes, multi-unit buildings, townhomes, and condominiums qualify when renovation plans demonstrate clear value-add strategies and profitable exit scenarios

- Loan structures provide both acquisition financing and renovation funding through draw schedules that release improvement funds as contractors complete work milestones

- A fix and flip loan accommodates experienced investors scaling portfolios and new investors completing first renovation projects with appropriate mentorship or experience

- Approval timelines compress to days or weeks rather than months, enabling investors to compete with cash buyers and secure time-sensitive investment opportunities

- Interest-only payment structures during renovation periods keep carrying costs manageable before properties sell and investors repay financing from sale proceeds (Federal Reserve real estate investment lending data)

Ready to explore your options? Schedule a call with a loan advisor.

What Is a Fix and Flip Loan?

A fix and flip loan represents specialized short-term financing designed specifically for real estate investors who purchase distressed properties, complete renovations or improvements, and resell quickly for profit. Unlike traditional mortgages serving owner-occupants holding properties long-term, a fix and flip loan provides temporary funding aligned with the 6-18 month investment timeline typical of renovation-and-resale strategies.

How does a fix and flip loan work? Lenders advance funds based on the property’s after-repair value (ARV)—what the property will be worth after renovations complete—rather than current distressed condition value. This approach enables investors to finance both acquisition costs and renovation expenses in single transactions, eliminating the need for separate purchase financing followed by cash or credit line funding for improvements.

The structure recognizes the unique cash flow reality of fix and flip investments: properties generate no income during renovation periods, but create substantial returns upon sale. Monthly payment structures typically involve interest-only obligations on disbursed funds, keeping carrying costs manageable during renovation periods when properties produce no cash flow. The expectation is that sale proceeds will repay the entire loan balance once renovations complete and properties resell.

A fix and flip loan serves active real estate investors implementing value-add strategies—not homeowners seeking primary residences or traditional rental property landlords holding assets long-term. The program specifically accommodates the acquisition-renovation-sale cycle that defines successful property flipping businesses.

Who Benefits Most from a Fix and Flip Loan?

Several investor profiles find exceptional value in fix and flip loan structures. These programs serve real estate entrepreneurs implementing strategic renovation-and-resale investment models.

Experienced real estate investors with proven track records of successful flips represent ideal candidates for fix and flip loans. Your history of profitable renovations and timely resales demonstrates execution capability that lenders reward with favorable terms, larger loan amounts, and streamlined approvals.

New investors entering the fix and flip market can access financing when they demonstrate renovation plans, realistic budgets, and clear profit strategies. Many lenders accommodate first-time flippers when projects show strong fundamentals, conservative leverage, and appropriate professional guidance through contractor relationships or experienced partners.

Real estate professionals including agents, contractors, and property managers transitioning from service roles to investment activities find fix and flip loans enable deploying industry knowledge into profitable property investments. Your professional experience provides lender confidence even when you lack extensive flipping history.

Investors scaling portfolio businesses use fix and flip loans to increase deal volume beyond what personal capital alone would support. Rather than completing one flip at a time with cash, leverage enables simultaneous projects multiplying annual transaction volume and total returns.

Partnerships and investment groups pooling resources to flip properties benefit from fix and flip loan leverage that allows purchasing larger properties, completing more ambitious renovations, or executing multiple projects simultaneously across partnership members.

Explore all loan programs to understand your full range of options.

What Are the Requirements for a Fix and Flip Loan?

Understanding the specific qualification criteria helps you assess whether a fix and flip loan fits your investment strategy and experience level. While requirements vary significantly between lenders, certain standards commonly apply across most programs.

Property evaluation standards – Lenders evaluate the property’s current condition, required renovation scope, after-repair value potential, and exit timeline feasibility. Properties must demonstrate clear value-add opportunities where renovation investments create profitable resale scenarios. Overly ambitious renovations exceeding neighborhood values or properties in severely declining markets may face rejection.

After-repair value documentation – Comparable sales analysis supporting your projected ARV is critical. Lenders need confidence that renovated properties will command prices justifying the total investment (purchase price plus renovation costs plus financing expenses plus profit margin). Conservative ARV estimates based on recent comparable sales strengthen applications.

Renovation budget and timeline – Detailed line-item renovation budgets showing materials, labor, contractor costs, and project timelines demonstrate planning capability. Realistic budgets accounting for contingencies and conservative timelines reflecting construction realities improve approval likelihood.

Investor experience requirements – Experience expectations vary dramatically between lenders. Some require documented successful flip completions, while others accommodate new investors with strong renovation plans, contractor relationships, or experienced partners. First-time flippers typically face lower leverage limits and higher costs.

Credit score minimums – Most fix and flip loans require credit scores of 600-680 minimum depending on experience level and deal strength. Higher scores provide access to better terms and higher leverage. Credit history demonstrating financial responsibility strengthens applications even when income documentation isn’t required.

Equity contribution expectations – Typical programs require equity contributions depending on experience, property type, and deal specifics. Experienced investors with strong track records access higher leverage than new investors completing first projects. Conservative deals in strong markets justify higher loan-to-value ratios.

Exit strategy clarity – Lenders need clear, realistic exit strategies showing how and when you’ll repay the loan. Most investors exit through property sales after renovations, though some refinance into long-term rental financing if market conditions change. Documented exit plans with timeline projections and backup strategies improve approval odds.

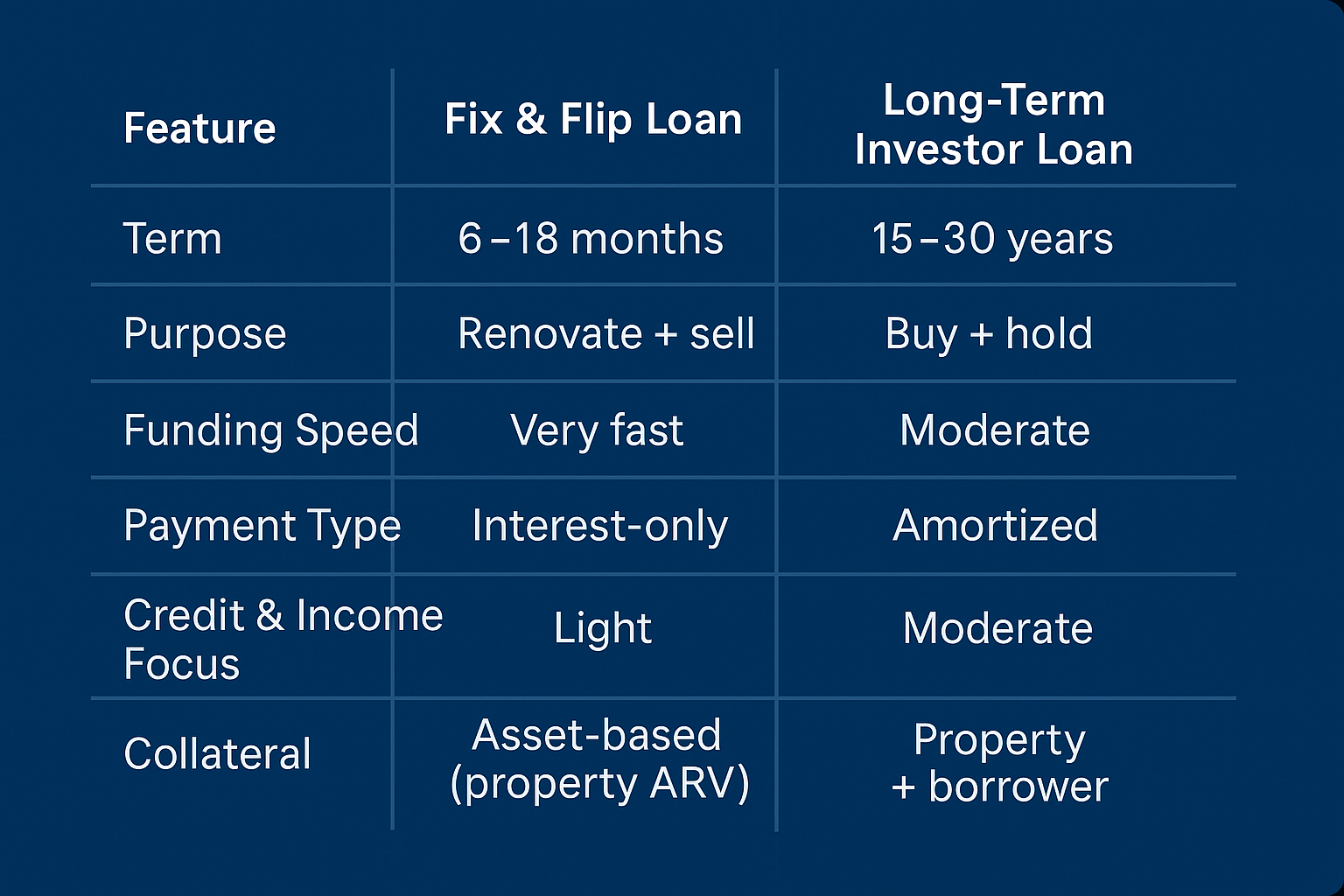

How Does a Fix and Flip Loan Differ from Traditional Mortgage Financing?

The fundamental distinction lies in the loan purpose, qualification methodology, and repayment structure. Understanding these differences helps you evaluate when fix and flip loans versus traditional mortgages better serve your investment goals.

Traditional mortgage characteristics:

- Long-term financing spanning significant periods

- Requires personal income verification and employment documentation

- Focuses on borrower’s ability to make monthly payments long-term

- Emphasizes debt-to-income ratios and payment capacity

- Standard appraisals based on current property condition

- Principal and interest payments amortizing loan over term

Fix and flip loan characteristics:

- Short-term financing typically 6-18 months

- Minimal or no personal income verification required

- Focuses on property’s profit potential and ARV

- Emphasizes deal strength and exit strategy over personal income

- ARV-based valuations assuming completed renovations

- Interest-only payments with balloon repayment at sale

Qualification methodology differences:

- Traditional mortgages analyze your income and employment extensively

- Fix and flip loans focus on property fundamentals and your exit strategy

- Traditional mortgages scrutinize debt-to-income ratios carefully

- Fix and flip loans care more about deal profit margins than personal ratios

- Traditional mortgages require extensive documentation

- Fix and flip loans streamline paperwork focusing on property analysis

Why choose fix and flip financing over traditional mortgages? Traditional mortgages cannot accommodate investment property purchases requiring significant renovations before generating income or value. The combination of long approval timelines, extensive personal income documentation, and as-is property valuations makes traditional financing impractical for time-sensitive renovation-and-resale investment strategies.

Ready to discuss your purchase scenario? Submit a purchase inquiry to explore your options.

What Property Types Qualify for a Fix and Flip Loan?

A fix and flip loan program accommodates various property categories suitable for renovation-and-resale investment strategies. Understanding eligibility helps you identify appropriate investment opportunities.

Eligible property types:

- Single-family detached homes in various conditions

- Townhomes and row houses needing rehabilitation

- Condominiums in approved developments

- Multi-unit properties including duplexes, triplexes, and fourplexes

- Mixed-use properties with residential components

- Properties in various condition levels from cosmetic updates to extensive rehabilitation

What property conditions qualify? Fix and flip loans accommodate properties ranging from cosmetic fixer-uppers requiring paint and carpet to severe distress involving structural repairs, system replacements, or extensive rehabilitation. The key requirement is demonstrating clear value-add strategies where renovation investments create profitable outcomes.

Are there property location restrictions? Most fix and flip lenders work in major metropolitan areas and established suburbs with active real estate markets. Remote rural properties, declining markets with limited buyer demand, or areas with very slow sales velocity may face restrictions or require additional equity contributions.

Can you flip luxury properties? High-value properties exceeding typical residential price ranges can qualify for fix and flip financing when ARV analysis demonstrates appropriate buyer demand and lenders specializing in luxury property flips provide programs accommodating higher loan amounts.

What about properties with title issues or code violations? Properties with clear title problems, outstanding liens, or significant code violations require resolution before most lenders approve fix and flip financing. Some specialized lenders accommodate these challenges with appropriate plans for clearing issues during the renovation timeline.

See how other real estate investors have successfully used fix and flip financing:

How Are Renovation Funds Disbursed in Fix and Flip Loans?

Understanding the draw schedule and renovation fund release process helps you manage cash flow and contractor payments effectively. The systematic disbursement protects both lenders and borrowers throughout renovation execution.

What are typical draw stages? Most fix and flip loans establish 3-5 draw periods aligned with renovation milestones:

- Acquisition closing (purchase price funds)

- Demolition and site preparation completion

- Rough-in completion (framing, electrical, plumbing, HVAC)

- Finish work completion (drywall, flooring, fixtures, appliances)

- Final completion and cleanup

How do renovation draws work? After contractors complete each milestone phase, you submit draw requests including contractor invoices, photos documenting completed work, and lien waivers from subcontractors. Lenders schedule inspections to verify work completion and quality before releasing the next installment.

What happens during draw inspections? Third-party inspectors verify that completed work matches draw requests, materials meet specifications, workmanship follows industry standards, and progress justifies the requested draw amount. After satisfactory inspection, lenders release funds—typically directly to your account for contractor payment.

How long does draw approval take? Draw processing typically requires 3-7 business days from request submission through inspection and fund release. Efficient draw management—submitting requests promptly when milestones complete with thorough documentation—maintains renovation momentum.

What if renovation costs exceed initial budgets? Most fix and flip loans include contingency reserves (typically 10-15% of renovation budget) for unexpected expenses. If costs exceed your loan amount plus reserves, you must provide additional capital from personal funds to complete renovations. Conservative initial budgeting minimizes this risk.

Can you hold renovation reserves? Some lenders allow holding initial renovation reserves rather than disbursing at closing, paying interest only on drawn amounts. This approach reduces carrying costs but requires adequate personal capital or credit access to fund initial construction expenses before first draw releases.

Calculate your fix and flip loan scenario:

What Documentation Does a Fix and Flip Loan Require?

Understanding the specific documentation requirements helps you prepare for streamlined application processes. While fix and flip loans reduce personal income documentation compared to traditional mortgages, specific property and experience documentation remains necessary.

Required documentation typically includes:

- Property purchase contract showing acquisition price

- Detailed renovation budget with line-item costs

- Scope of work describing planned improvements

- After-repair value analysis with comparable sales

- Contractor estimates or bids (if using contractors)

- Renovation timeline showing project phases and durations

- Credit report authorization

- Proof of funds for equity contribution

- Property photos documenting current condition

- Prior fix and flip experience documentation (if applicable)

What about personal income verification? Most fix and flip lenders minimize or eliminate income documentation, focusing instead on deal fundamentals and property profit potential. You typically won’t need tax returns, W-2s, pay stubs, or employment verification letters. This streamlined approach accommodates investors whose personal income documentation is complex or who prefer privacy regarding personal finances.

How do you document renovation experience? Experienced investors provide details on previous flips including purchase prices, renovation costs, sale prices, and timelines. Photos of completed projects, settlement statements showing profitable sales, or references from previous lenders strengthen applications. New investors emphasize relevant experience (construction background, real estate licensing, property management) and strong deal fundamentals compensating for limited flip history.

What contractor documentation is necessary? If hiring contractors for renovations, provide their licenses, insurance certificates, references from previous projects, and detailed bid documents. Owner-operators planning to complete work themselves may face additional scrutiny and potentially higher equity requirements, though some lenders accommodate experienced investor-contractors.

Do you need purchase contracts before approval? Many lenders provide pre-approvals based on your general investment criteria and financial capacity before you identify specific properties. However, final approval requires executed purchase contracts enabling lenders to evaluate specific deal fundamentals.

Common Fix and Flip Loan Questions

Can you do multiple flips simultaneously with fix and flip loans?

Yes, experienced investors commonly finance multiple properties simultaneously using separate fix and flip loans for each project. This strategy accelerates business growth and increases annual transaction volume beyond what sequential single-project investing enables.

Multiple property considerations:

- Each property secures its own separate loan

- Lenders evaluate your capacity to manage multiple projects

- Strong track record enables higher total exposure limits

- Project management capability becomes critical success factor

- Some lenders restrict total number of simultaneous projects

What if you want to convert a flip to a rental property?

Market condition changes sometimes make holding properties as rentals more attractive than selling. Most fix and flip loans include prepayment penalties or higher interest discouraging early payoff, but refinancing into long-term rental property financing (like DSCR loans) provides exit strategies when selling becomes less desirable.

Flip-to-rental conversion considerations:

- Notify your fix and flip lender of strategy changes

- Research refinancing options into rental property loans

- Ensure property will cash flow as rental justifying hold strategy

- Account for prepayment penalties or extension fees

- Consider market timing for eventual sale vs immediate rental conversion

Can new investors qualify without previous flip experience?

Yes, many fix and flip lenders accommodate first-time flippers when deals demonstrate strong fundamentals, conservative budgets, realistic timelines, and clear profit margins. Factors strengthening new investor applications include:

New investor success factors:

- Related experience (construction, real estate, property management)

- Conservative deal structure with significant equity contribution

- Experienced contractor relationships or partnerships

- Mentorship from experienced investors

- Strong credit history and adequate reserves

- Properties in strong markets with proven demand

How do partnership structures work with fix and flip loans?

Partnerships pooling resources, expertise, or capital commonly finance flips jointly. Lenders evaluate partnership structures, each partner’s role and contribution, decision-making authority, and collective experience. Clear partnership agreements defining responsibilities, profit splits, and dissolution terms protect all parties.

Partnership lending considerations:

- All partners typically sign loan documents

- Lenders evaluate collective experience and resources

- Clear agreements prevent conflicts during projects

- Capital contribution expectations clarify upfront

- Exit strategy addresses partnership dissolution scenarios

How Do Fix and Flip Loan Rates Compare to Traditional Financing?

Understanding the pricing framework helps you evaluate whether fix and flip financing fits your investment return requirements. Interest rates represent only one component of the total cost analysis.

What factors influence fix and flip loan pricing? Several elements affect your specific rate and fees:

- Your renovation experience and track record

- Deal strength and profit margin projections

- Property location and market conditions

- Loan-to-value ratio and equity contribution

- Property type and condition

- Renovation scope and timeline

- Overall financial profile and creditworthiness

Are fix and flip rates higher than traditional mortgages? Yes, fix and flip financing typically carries higher interest rates than traditional mortgages—often ranging from competitive market rates to premium pricing depending on deal specifics and lender programs. This premium reflects the short-term nature, higher risk profile, and streamlined qualification processes compared to traditional owner-occupied mortgages.

What about origination fees and points? Fix and flip lenders commonly charge origination fees or points. These upfront costs compensate for the abbreviated interest collection period compared to long-term mortgages. Calculate total financing costs including points, interest, and prepayment penalties when evaluating deal profitability.

How do you calculate total financing costs? Consider the interest charges over your projected hold period plus origination fees to determine total cost. These costs must fit within your profit margin while leaving acceptable returns. Accurate cost projection prevents surprises that erode investment returns.

Can you reduce costs through experience or deal strength? Yes, demonstrated track records of successful flips, conservative deal structures with higher equity contributions, and properties in strong markets with quick exit potential all improve pricing. Building relationships with lenders through repeated successful projects often provides better terms on subsequent financing.

What Are the Advantages of a Fix and Flip Loan?

Understanding the specific benefits helps you evaluate whether this financing approach aligns with your real estate investment strategy. A fix and flip loan offers distinct advantages for investors executing renovation-and-resale models.

Key advantages include:

Fast approval and closing timelines – Fix and flip lenders compress underwriting to days or weeks rather than the months traditional mortgages require. This speed enables competing with cash buyers, securing time-sensitive opportunities, and maintaining deal flow momentum essential to professional flipping businesses.

Asset-based qualification – Focus on property fundamentals and profit potential rather than extensive personal income documentation enables investors with complex tax returns, minimal W-2 income, or privacy preferences to access financing. Your deal strength matters more than your personal income statements.

Funds both acquisition and renovation – Single loans covering purchase price plus renovation costs eliminate the need for separate purchase financing followed by cash or credit line funding for improvements. This integrated approach simplifies financing and preserves capital for additional deals.

Interest-only payment structure – Paying only interest on disbursed funds during renovation periods keeps carrying costs manageable when properties generate no income. This structure aligns payment obligations with the zero-income reality of active renovation projects.

Enables portfolio scaling – Leverage allows completing multiple simultaneous projects rather than one sequential flip at a time with cash. This acceleration multiplies annual transaction volume, learning opportunities, and total profits compared to cash-only investing.

Accommodates various experience levels – While experienced investors access best terms, many programs accommodate new flippers with strong deals, demonstrating that financing availability extends beyond seasoned professionals to aspiring investors with solid fundamentals.

Alternative Loan Programs for Real Estate Investment Strategies

If a fix and flip loan isn’t the right fit, consider these alternatives:

- DSCR Loan – For rental properties qualifying based on cash flow without personal income documentation

- Bridge Loan – Short-term financing for quick purchases or transitions between properties

- Home Improvement Loan – Finance renovations on properties you plan to hold rather than flip quickly

- Construction Loan – Build new construction for spec homes rather than renovating existing properties

- Conventional Loan – Traditional investment property financing when you plan to hold long-term

Explore all 30+ loan programs to find your best option.

Not sure which program is right for you? Take our discovery quiz to find your path.

Advanced Fix and Flip Loan Questions

Can you use fix and flip loans for wholesale assignments?

Wholesale strategies where investors contract properties then assign contracts to other buyers typically don’t require fix and flip financing since wholesalers never take title. However, investors doing “double closes” where they briefly hold title during back-to-back closings may use transactional funding or flash cash rather than traditional fix and flip loans.

Some investors use fix and flip loans as backup plans for wholesale deals—if they cannot assign contracts to buyers, they can close using fix and flip financing and complete renovations themselves rather than losing earnest money.

What if the property doesn’t sell within the loan term?

Properties not selling within the initial 6-18 month loan term require extensions, though these carry additional fees and potentially higher interest rates. Extension requirements typically include demonstrating active marketing efforts, price adjustments reflecting market feedback, continued property maintenance, and financial capacity to carry additional holding costs.

Exit timeline management strategies:

- Begin marketing before renovation completion

- Price properties competitively based on current comps

- Adjust pricing quickly if initial market feedback is weak

- Consider creative exits including lease-options or owner financing

- Refinance into rental property financing if market conditions deteriorate

How do fix and flip loans handle properties purchased at auction?

Auction purchases requiring fast closing (often 30 days or less) and sometimes prohibiting financing contingencies create unique challenges. Some fix and flip lenders accommodate auction scenarios with expedited approvals and proof-of-funds letters enabling competitive bidding, though compressed timelines may limit lender options.

Hard money loans or transactional funding often better serve auction purchases given extreme timeline compression, with subsequent refinancing into fix and flip loans after closing if needed for renovation funding.

Can you do live-in flips with fix and flip loans?

Living in properties during renovations—so-called “live-in flips”—typically doesn’t align with fix and flip loan structures designed for investment properties without owner occupancy. FHA 203k construction loans or conventional renovation loans better serve owner-occupant scenarios where you’ll live in properties during and after improvements.

However, if you purchase through fix and flip financing, complete renovations without occupying, then decide to live in the property rather than selling, this sequence may work though it complicates the original investment thesis and exit strategy.

What happens if renovation quality doesn’t meet buyer expectations?

Properties not attracting buyers due to quality concerns, design issues, or over-improvement mistakes require strategic responses. Options include price reductions reflecting actual condition versus initial expectations, corrective work addressing quality issues, or holding properties longer while marketing to appropriate buyer segments.

Quality control throughout renovation—working with reputable contractors, inspecting work regularly, and following market-appropriate finish levels—prevents most quality problems. Understanding your target buyer and finishing appropriately for that market segment ensures renovations align with buyer expectations.

Can foreign nationals use fix and flip loans?

Foreign national investors purchasing U.S. properties for flipping may qualify for specialized fix and flip programs when they provide appropriate documentation, larger equity contributions, and demonstrate investment experience. Requirements typically include valid passports, U.S. tax identification numbers, bank account establishment, and clear source of funds documentation.

Some lenders specialize in international investor financing, providing programs accommodating foreign nationals implementing U.S. fix and flip strategies despite lack of domestic credit history or income documentation.

How do market downturns affect fix and flip financing?

Declining real estate markets create challenges for fix and flip strategies since profit margins compress or disappear when exit values drop below projections. During downturns, lenders tighten standards requiring larger equity contributions, conservative ARV projections, and demonstrated experience managing through difficult markets.

Successful investors navigate downturns by targeting properties with deeper discounts creating larger margin cushions, focusing on markets with stable or growing demand, completing faster renovations reducing market exposure, or pivoting to rental hold strategies when selling becomes challenging.

Can you bundle multiple properties into single fix and flip loans?

Some institutional fix and flip lenders offer portfolio programs bundling multiple properties into single loans with combined credit facilities. These structures benefit experienced investors completing numerous simultaneous projects by simplifying administration, potentially improving pricing, and creating revolving credit arrangements enabling continuous deal flow.

However, most fix and flip lenders structure separate loans for each property, providing clearer collateral separation, simpler documentation, and more straightforward management despite higher administrative overhead.

What if contractors abandon projects or deliver poor quality work?

Contractor problems—abandonment, poor workmanship, missed deadlines, or cost overruns—represent common fix and flip challenges. Protections include hiring licensed, insured contractors with strong references, establishing clear contracts with milestone payments tied to completion, holding final payments pending quality verification, and maintaining contingency reserves for contractor replacement if necessary.

When contractor issues arise, promptly addressing problems through documented communications, withholding payments for incomplete work, and engaging replacement contractors prevents minor issues from becoming project-killing catastrophes.

How do you transition from small flips to larger projects?

Scaling from modest single-family flips to larger multi-unit or higher-value properties requires demonstrating progressive success. Build track records through several smaller successful flips, document increasing project complexity and profit margins, develop contractor relationships capable of larger renovations, and establish lender relationships providing access to higher loan amounts.

Many investors build portfolios progressing from cosmetic rehabs to substantial renovations, small single-families to larger homes, and eventually to multi-unit or commercial properties as experience and capital grow.

Ready to get started? Apply now or schedule a call to discuss your situation.

Helpful Fix and Flip Loan Resources

Official Government Guidance:

CFPB Real Estate Investment Loan Information – Consumer Financial Protection Bureau guidance explaining fix and flip financing structures, investor protections, qualification standards, and comparison to traditional mortgage products for property investment.

IRS Real Estate Investor Tax Guidelines – Internal Revenue Service comprehensive guidance on real estate investment taxation, property flipping income treatment, deductible expenses, and tax obligations for investors conducting renovation-and-resale businesses.

IRS Business Income Reporting for Flippers – Internal Revenue Service resource on reporting income from property flipping activities, distinguishing investment from dealer status, and proper tax treatment of renovation-and-resale profits.

Industry Organizations:

Federal Reserve Real Estate Investment Lending Data – Federal Reserve statistical releases on consumer and real estate credit providing context for investment property lending trends, market conditions, and financing availability.

SBA Real Estate Investment Business Resources – Small Business Administration guidance for entrepreneurs building real estate investment businesses including business planning, financial management, and operational strategies for property flipping enterprises.

Educational Resources:

IRS Passive Activity Loss Rules for Real Estate – Internal Revenue Service guidance on passive activity loss limitations affecting real estate investors, rental property rules, and tax treatment considerations for various investment strategies.

HUD Housing Market Conditions Reports – Department of Housing and Urban Development market analysis reports providing data on regional housing markets, sales trends, and conditions affecting property investment strategies.

Need local expertise? Get introduced to trusted partners including loan officers, contractors, and real estate investors in your area.

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Not Sure About Your Next Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Related Posts

Subscribe to our newsletter

Get program updates and rate insights in your inbox.