ITIN Loan Cash-Out Refinance: Restaurant Owner Accesses $92K Equity for Business Expansion Without SSN

- By Jim Blackburn

- on

- Cash Out Refinance, Debt Consolidation, ITIN Loan, No Social Security Number, Wealth Building

Educational Case Study Disclosure

This case study is hypothetical and for educational purposes only. Scenarios, borrower profiles, loan terms, interest rates, and APRs are illustrative examples and do not represent current offers or guaranteed terms.

If specific loan terms (e.g., down payment %, payment amount, rate/APR, points, or repayment period) appear in this article, required disclosures will be shown immediately next to those terms per Regulation Z.

For specific details including down payment incentives, closing cost incentives, interest rate details, closing cost breakdowns, payment calculations, cash-to-close estimates, or an official Loan Estimate, it is highly recommended you schedule a meeting with one of our licensed mortgage advisors.

Learn more:

- Reg Z – Advertising (§1026.24) – CFPB official regulation

- Reg Z Full Text – Electronic Code of Federal Regulations

- Official Interpretations to §1026.24 – CFPB interpretations

- MAP Rule (Reg N), 12 CFR Part 1014 – Mortgage advertising rules

- NMLS Consumer Access – Verify licensure

Actual loan terms vary by credit profile, property, occupancy, location, market conditions, and lender guidelines. For current options tailored to you, schedule a consultation or apply online.

Ready to explore your options? Schedule a call with a loan advisor.

How This ITIN Loan Cash-Out Refinance Leveraged Home Equity for Growth Capital

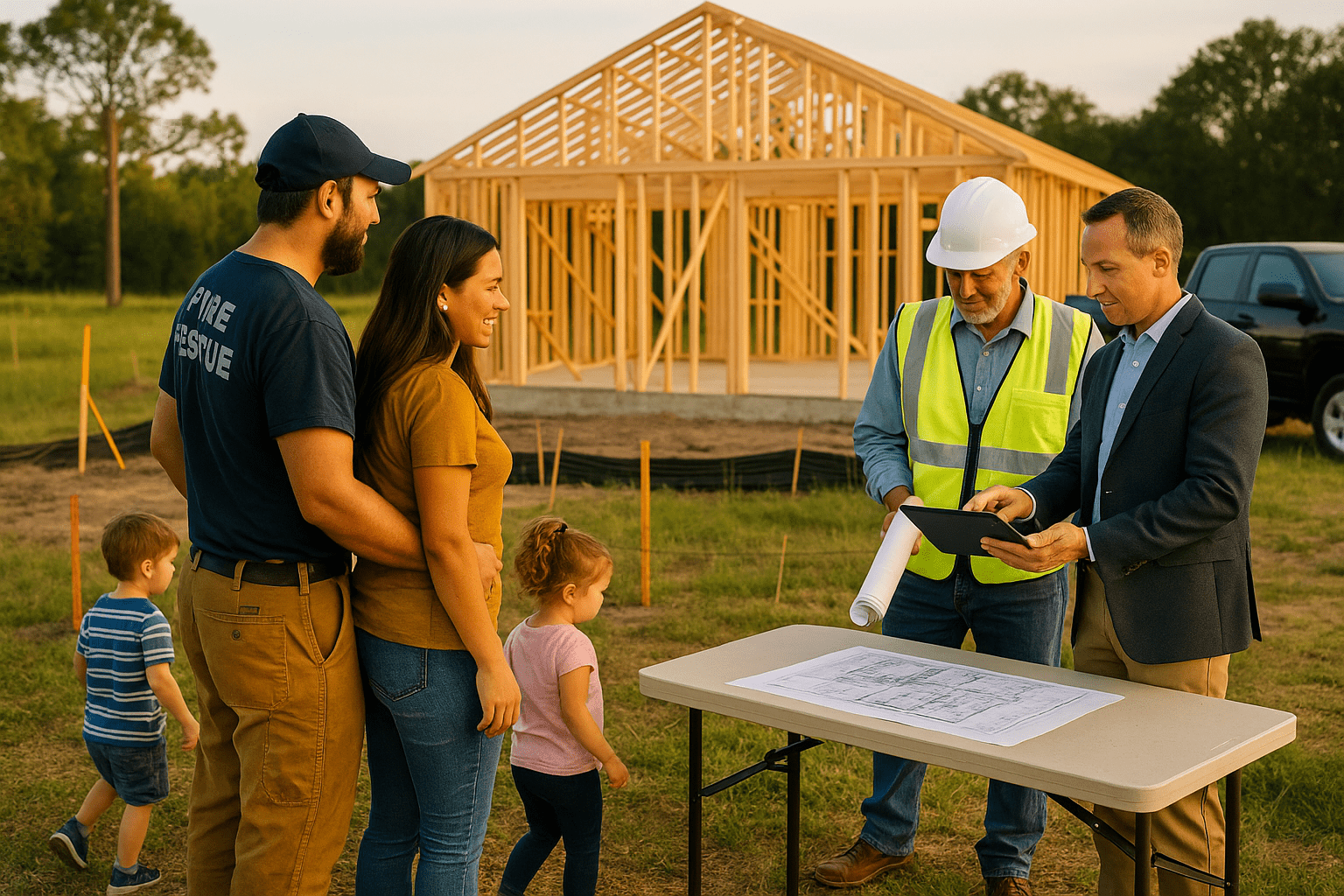

Maria G., a 45-year-old restaurant owner in Fort Lauderdale, had built a thriving family business over 15 years serving authentic cuisine to her community while establishing financial stability. She filed US tax returns every year using her Individual Taxpayer Identification Number (ITIN), owned her primary residence in Plantation (purchased seven years earlier through an ITIN loan), and had successfully built substantial equity as her home appreciated from $425,000 to approximately $615,000. As a business owner and homeowner (Step 3 in her financial journey), Maria was ready to expand her restaurant—adding outdoor seating, upgrading the kitchen equipment, and renovating the dining space—improvements that would increase capacity, enhance customer experience, and generate additional revenue.

The restaurant expansion required approximately $92,000 in capital for construction, equipment, licensing, and working capital during the transition. Maria had built substantial home equity ($260,000 available with current mortgage balance of $355,000), providing an opportunity to leverage her residential real estate to fund her business growth. However, as an ITIN taxpayer without a Social Security Number, Maria faced the same structural barriers that had complicated her original home purchase: traditional lenders’ systems couldn’t process applications from borrowers without SSNs, regardless of their creditworthiness or financial qualifications.

“I own my home with $260,000 in equity that’s generating no returns,” Maria explained. “My restaurant has proven successful for 15 years, and expansion would generate substantial additional revenue. I needed to access my home equity to fund the restaurant improvements, but traditional lenders told me their systems require Social Security Numbers—they couldn’t process cash-out refinancing for ITIN taxpayers. Once again, I was being excluded despite having perfect qualifications: stable business income, substantial equity, seven years of perfect mortgage payments, and genuine business expansion needs.”

Maria needed an ITIN loan cash-out refinance—specialized refinancing designed for ITIN taxpayers who need to access home equity for business expansion, debt consolidation, home improvements, or other financial needs, evaluating creditworthiness based on ITIN tax return history and payment behavior rather than SSN-based documentation. This financing would allow Maria to leverage her residential equity to fund her restaurant expansion while maintaining her successful homeownership record.

Facing similar challenges? Schedule a call to explore your options.

Why Was an ITIN Cash-Out Refinance Essential for Maria’s Business Expansion?

Maria researched financing options for her restaurant expansion and understood why an ITIN loan cash-out refinance was her most strategic path forward:

Business loan challenges for ITIN taxpayers:

- SBA loans require Social Security Numbers or permanent residency

- Traditional business loans charge higher interest rates than mortgage financing

- Short repayment terms create cash flow pressure

- Extensive business documentation and collateral requirements

- Many lenders unwilling to work with ITIN taxpayers

ITIN cash-out refinance advantages:

- Leverages existing home equity at mortgage rates (lower than business loans)

- Longer repayment terms reduce monthly obligations

- No SSN required (uses ITIN documentation)

- Evaluates based on tax return history and mortgage payment record

- Provides substantial capital ($92,000) for business expansion

- One refinanced mortgage replaces old mortgage plus provides cash

- Fixed rate provides predictable business planning

“The ITIN cash-out refinance offered business expansion capital at mortgage rates with manageable long-term repayment,” Maria said. “Business loans would charge 8-12%+ interest with 5-7 year terms creating high monthly payments. The ITIN cash-out refinance would provide $92,000 at mortgage rates with standard amortization—dramatically lower monthly costs that my restaurant cash flow could easily support. This allowed me to fund substantial expansion without crippling short-term debt obligations.”

Maria appreciated that ITIN lenders understood small business realities. Many ITIN taxpayers are entrepreneurs who’ve built successful businesses serving their communities. Their businesses generate strong cash flow documented through tax returns, they maintain responsible payment records, and they deserve access to capital for growth—regardless of citizenship status. ITIN cash-out refinancing recognizes these realities and provides fair access to equity that business owners have rightfully built through responsible homeownership.

The cash-out refinance would pay off Maria’s existing $355,000 mortgage and provide $92,000 in cash for her restaurant expansion, creating a new mortgage of $447,000 secured by her $615,000 home. The increased mortgage payment would be manageable given her strong restaurant income, and the business improvements would generate additional revenue that would far exceed the modest payment increase.

Ready to access your equity as an ITIN taxpayer? Schedule a call to discuss ITIN cash-out refinancing.

What Documentation Was Required for This ITIN Loan Cash-Out Refinance?

Maria worked with her ITIN loan specialist to assemble documentation for cash-out refinancing without Social Security-based verification.

Documentation provided:

- Valid Individual Taxpayer Identification Number (ITIN)

- Two years of personal tax returns filed with ITIN

- Two years of business tax returns (restaurant Schedule C)

- Business bank statements showing restaurant income

- Seven years of perfect mortgage payment history

- Current mortgage statement showing $355,000 balance

- Business plan for restaurant expansion with budget ($92,000)

- Contractor estimates for construction work

- Equipment purchase quotes

- Valid government-issued identification

- Homeowners insurance documentation

The approval process:

- Initial consultation (Day 1) – Discussed ITIN cash-out refinance for business expansion

- Application submission (Day 2) – Applied using ITIN documentation

- Tax return analysis (Days 3-10) – Reviewed personal and business tax returns

- Business income verification (Days 11-14) – Analyzed restaurant cash flow

- Mortgage payment history review (Day 15) – Confirmed seven years perfect payments

- Property appraisal ordered (Day 16) – Plantation home appraisal

- Business plan review (Days 17-20) – Evaluated expansion feasibility

- Appraisal completed (Day 24) – Home appraised at $615,000

- Underwriting review (Days 25-35) – Comprehensive ITIN cash-out analysis

- Conditional approval (Day 36) – Approved pending minor documentation

- Final approval (Day 42) – Clear to close

- Closing (Day 48) – Funded ITIN cash-out refinance

The lender approved Maria’s ITIN cash-out refinance based on her 15 years of consistent ITIN tax filing, strong restaurant business income documented through tax returns and bank statements, seven years of perfect mortgage payment history, substantial remaining equity after cash-out ($615,000 value minus $447,000 new loan = $168,000 equity cushion), and detailed business expansion plan demonstrating sound use of proceeds. The lender evaluated her demonstrated financial responsibility and business success rather than excluding her for lack of SSN.

“The approval recognized my track record as a responsible homeowner and successful business owner,” Maria said. “Seven years of perfect mortgage payments proved I manage housing obligations reliably. Fifteen years of business tax returns showed consistent restaurant income. The business expansion plan demonstrated I’d use the cash-out proceeds wisely for revenue-generating improvements. The lender evaluated my actual qualifications—not arbitrary documentation I can’t obtain.”

Within 48 days, Maria closed on her ITIN cash-out refinance and received $92,000 to fund her restaurant expansion.

Ready to access equity for your business? Submit a refinance inquiry to explore ITIN cash-out options.

What Were the Final Results of Maria’s ITIN Loan Cash-Out Refinance?

Maria successfully closed on her ITIN cash-out refinance, accessing $92,000 for restaurant expansion while maintaining her responsible homeownership record.

Final ITIN cash-out refinance details:

- Previous mortgage balance: $355,000

- Cash-out received: $92,000 (for restaurant expansion)

- New mortgage total: $447,000

- Property appraised value: $615,000

- Remaining equity: $168,000+ after cash-out

- Competitive ITIN rates – Use ITIN Laon Cashout Refinance Calculatorto explore scenarios

- Application to closing: 48 days

- Property: 3BR/2.5BA single-family home, Plantation, FL

Restaurant expansion completed:

- Outdoor seating addition: Expanded capacity by 35 seats ($45,000)

- Kitchen equipment upgrade: Commercial-grade equipment improving efficiency ($28,000)

- Dining room renovation: Updated interior enhancing ambiance ($12,000)

- Licensing and permits: Required approvals for expansion ($4,000)

- Working capital reserve: Funds for transition period ($3,000)

Business results six months after expansion:

- Revenue increase: 40%+ from additional capacity and improved efficiency

- Customer satisfaction: Enhanced experience driving repeat business

- Employee expansion: Added 4 staff members serving additional patrons

- Profitability improvement: Higher margins from efficient kitchen equipment

- Business valuation: Increased enterprise value through physical improvements

- Mortgage payment: Easily covered by increased restaurant cash flow

Maria’s restaurant expansion transformed her business. The additional outdoor seating accommodated 35 more diners, particularly valuable in Florida’s pleasant weather. The upgraded kitchen equipment reduced cooking times and improved food quality. The refreshed dining room created an inviting atmosphere that attracted new customers and encouraged repeat visits. Within six months, revenue increased 40%+, easily covering the modest mortgage payment increase while generating substantial additional profit.

“The ITIN cash-out refinance made my restaurant expansion possible,” Maria explained. “The $92,000 in equity I accessed funded comprehensive improvements that increased capacity, enhanced efficiency, and elevated customer experience. Revenue jumped 40%+ within six months—easily covering the slightly higher mortgage payment while generating substantial additional profit. I used residential equity strategically to grow my business, and both my home and my restaurant are now more valuable. That’s smart capital deployment that builds wealth across multiple assets.”

Maria views this transaction as strategic portfolio management. Her home continues providing housing security while also serving as financial leverage for business growth. The restaurant expansion increased enterprise value and cash flow. As she continues building wealth through both residential equity and business success, Maria may eventually explore additional strategies like purchasing the commercial property where her restaurant operates or acquiring a second location.

“The best part is proving that ITIN taxpayers can build substantial wealth when given fair opportunities,” Maria added. “I’ve owned my home for seven years, built substantial equity, paid every mortgage payment perfectly, and run a successful restaurant for 15 years contributing to my community. The ITIN cash-out refinance recognized my demonstrated success and gave me access to capital I’d rightfully earned through responsible homeownership. This equity allowed me to expand my business, create jobs, serve more customers, and continue building wealth for my family. That’s what happens when lenders evaluate actual creditworthiness rather than excluding people based on citizenship status.”

Ready to leverage your equity for business or personal needs? Get approved or schedule a call to discuss ITIN cash-out refinancing.

What Can ITIN Homeowners Learn from This Cash-Out Refinance Success?

- ITIN cash-out refinancing provides equity access without Social Security Numbers—Maria accessed $92,000 using Individual Taxpayer Identification Number documentation

- Perfect mortgage payment history strengthens ITIN refinance applications—seven years of flawless payments proved reliability

- Business tax returns document income for self-employed ITIN borrowers—Schedule C demonstrated restaurant profitability

- Home equity can strategically fund business expansion at lower rates than business loans—mortgage rates versus 8-12%+ business loan rates

- ITIN taxpayers build wealth through homeownership and business ownership—leveraging one asset to grow another compounds wealth

- Responsible ITIN homeowners deserve equity access for legitimate financial needs—demonstrated creditworthiness qualifies borrowers regardless of citizenship

Have questions about ITIN cash-out refinancing? Schedule a call with a loan advisor today.

Alternative Loan Programs for ITIN Taxpayers Seeking Equity Access

If an ITIN loan cash-out refinance isn’t the perfect fit, consider these alternatives:

- ITIN Loan Refinance – Rate-and-term refinancing without accessing equity

- Bank Statement Loan – For ITIN taxpayers with strong deposit history

- HELOC – Revolving credit line (may require SSN depending on lender)

- Home Equity Loan – Fixed-rate second lien (may require SSN)

- Asset-Based Loan – For high-net-worth ITIN taxpayers with substantial portfolios

Explore all loan programs to find your best option.

Want to assess your equity access strategy? Take our discovery quiz to clarify your goals.

Helpful ITIN Loan Cash-Out Refinance Resources

Learn more about this program:

- Complete ITIN Loan Guide – Cash-out refinancing for ITIN taxpayers

- ITIN Cash-Out Calculator – Estimate equity access

Similar success stories:

- ITIN loan purchase – First-time homeownership without SSN

- ITIN loan refinance – Rate improvement

- Browse all case studies by journey stage

External authoritative resources:

- IRS ITIN Information – Official ITIN program

- SBA Business Resources – Small business planning

- CFPB Fair Lending – Know your rights

Ready to take action?

- Apply online – Start ITIN cash-out application

- Schedule consultation – Discuss equity access goals

- Take discovery quiz – Clarify wealth-building strategy

Need local expertise? Get introduced to partners including renovation contractors and interior designers.

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Not Sure About Your Next Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required