FHA Loan: 7 Key Advantages for First-Time Home Buyers

How an FHA Loan Makes Homeownership Accessible with Flexible Qualification Standards

FHA loans make homeownership accessible for borrowers who may not qualify for conventional financing due to limited down payment funds or credit challenges. Backed by the Federal Housing Administration, these mortgages offer flexible qualification standards and competitive financing structures. Whether you’re establishing credit, rebuilding after financial setbacks, or working with limited savings, FHA financing provides a government-supported pathway that evaluates your complete financial picture.

Key Details: What You’ll Learn About FHA Loans

- An FHA loan is a government-insured mortgage backed by the Federal Housing Administration, offering flexible qualification standards for borrowers with limited savings or credit challenges (HUD FHA loan program information)

- First-time buyers and repeat purchasers can qualify with credit scores as low as 580 and modest initial investment requirements (FHA mortgage insurance premiums guidance)

- Property types including single-family homes, multi-unit properties up to four units, condominiums, and manufactured homes qualify under an FHA loan structure

- Mortgage insurance protects lenders against default risk, enabling FHA loans to accommodate borrowers who don’t meet conventional loan standards

- An FHA loan allows higher debt-to-income ratios than conventional programs, helping buyers with existing obligations qualify for homeownership

- Sellers, builders, and non-profit organizations can contribute significantly toward buyer closing costs, reducing out-of-pocket expenses substantially

- Borrowers with past credit events including bankruptcy or foreclosure can qualify after waiting periods shorter than conventional loan requirements (CFPB FHA loan qualification information)

Ready to explore your options? Schedule a call with a loan advisor.

What Is an FHA Loan?

An FHA loan represents a mortgage insured by the Federal Housing Administration, a government agency within the Department of Housing and Urban Development. This insurance protects lenders against losses if borrowers default, enabling lenders to offer mortgages with more flexible qualification standards than conventional programs.

How does FHA insurance work? Borrowers pay mortgage insurance premiums—both upfront at closing and monthly throughout the loan term—that fund the insurance pool protecting lenders. This insurance structure allows FHA loans to accommodate borrowers with lower credit scores, smaller equity contributions, and higher debt-to-income ratios than conventional mortgages would permit.

The FHA doesn’t directly lend money to home buyers. Instead, approved lenders originate FHA loans following FHA guidelines, with the government insurance providing security that encourages lenders to serve borrowers who might not qualify for conventional financing. This public-private partnership expands homeownership access while maintaining lending standards that protect both borrowers and the housing finance system.

An FHA loan serves primarily first-time home buyers and borrowers with limited savings, moderate credit histories, or existing debt obligations that complicate conventional qualification. However, repeat buyers also use FHA financing when its flexible standards provide advantages over conventional alternatives.

Who Benefits Most from an FHA Loan?

Several borrower profiles find exceptional value in an FHA loan structure. These programs serve individuals for whom conventional loan qualification presents challenges despite stable income and genuine capacity for homeownership.

First-time home buyers with limited savings represent the primary demographic for FHA loans. If you’ve been paying rent and building career stability but haven’t accumulated substantial savings, an FHA loan provides an accessible path to homeownership with modest initial investment requirements.

Borrowers with credit scores below conventional thresholds find FHA loans particularly valuable. While conventional mortgages typically require scores of 620-640 minimum (with higher scores for optimal terms), an FHA loan accommodates scores as low as 580—or even 500 with larger initial investments.

Buyers with higher debt-to-income ratios benefit from FHA’s more flexible debt tolerance. If you have student loans, auto payments, or other obligations that push your debt ratios beyond conventional limits, an FHA loan’s higher allowable ratios may enable qualification when conventional programs would decline.

Borrowers recovering from financial setbacks including bankruptcy, foreclosure, or significant credit events can access FHA financing after shorter waiting periods than conventional programs require. An FHA loan recognizes that past financial difficulties don’t necessarily predict future performance when borrowers have demonstrated recovery.

Multi-unit property buyers seeking to house hack—living in one unit while renting others—find FHA loans accommodate 2-4 unit properties with the same low equity contributions as single-family homes. This strategy enables building rental income while establishing homeownership.

Explore all loan programs to understand your full range of options.

What Are the Requirements for an FHA Loan?

Understanding the specific qualification criteria helps you assess whether an FHA loan fits your financial profile. While FHA standards are more flexible than conventional requirements, specific guidelines still apply.

Credit score minimums – FHA loans accept credit scores as low as 580 for borrowers making modest initial investments. Scores between 500-579 may qualify with larger equity contributions. These thresholds significantly lower than conventional standards make FHA accessible to borrowers still building credit or recovering from past challenges.

Initial investment requirements – The minimum required investment is modest with credit scores of 580 or higher. This accessible threshold enables homeownership for buyers without substantial savings, particularly when combined with gift funds from family members or down payment assistance programs.

Debt-to-income ratio limits – FHA loans typically allow debt-to-income ratios up to 43-50%, though some scenarios with strong compensating factors may exceed these thresholds. Your total monthly debt obligations divided by gross monthly income must fall within acceptable parameters, but FHA’s flexibility accommodates buyers with existing debts.

Employment and income documentation – FHA loans require stable employment history, typically two years in the same field or profession. Income verification follows standard mortgage practices including W-2s, pay stubs, tax returns, or alternative documentation for self-employed borrowers. The focus remains on income stability and continuity.

Property appraisal standards – FHA requires properties meet minimum property standards addressing safety, security, and soundness. The property must be safe for occupancy without hazards, have functional systems, and meet local building codes. These standards protect borrowers from purchasing problematic properties.

Primary residence requirement – FHA loans serve primary residences only. You must occupy the property as your main home, typically moving in within 60 days of closing. Investment properties and second homes don’t qualify for FHA financing, though multi-unit properties where you occupy one unit qualify.

Mortgage insurance premiums – All FHA loans require both upfront mortgage insurance premiums and annual mortgage insurance premiums divided into monthly payments. These premiums fund the insurance pool protecting lenders and enable FHA’s flexible standards.

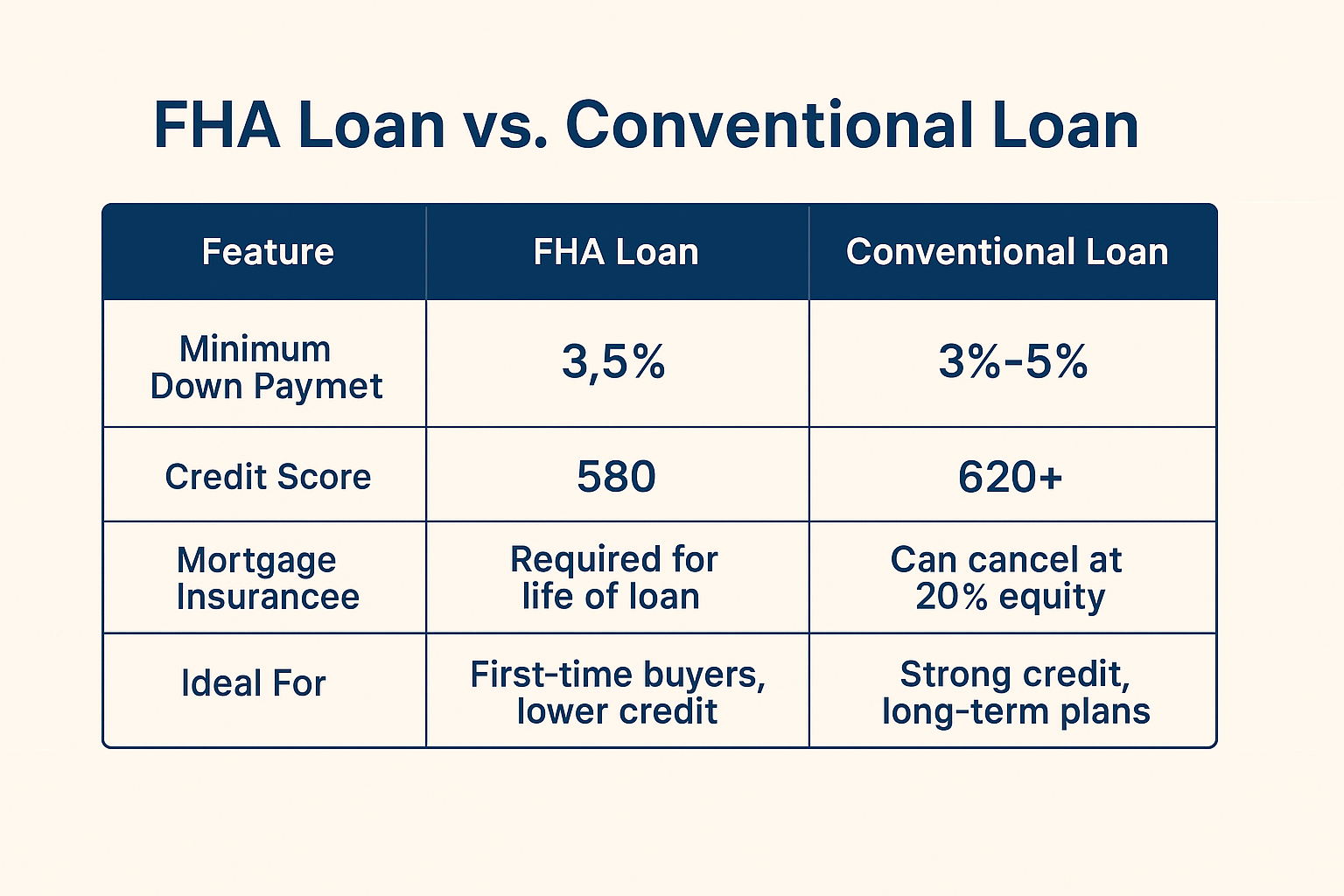

How Does an FHA Loan Differ from a Conventional Loan?

The fundamental distinction lies in the government insurance structure and resulting qualification flexibility. Understanding these differences helps you select the optimal financing approach for your situation.

Credit score flexibility:

- FHA accepts scores as low as 580 (or 500 with larger equity)

- Conventional typically requires 620-640 minimum

- FHA accommodates credit rebuilding more readily

- Conventional rewards strong credit with better pricing

Initial investment requirements:

- FHA requires modest minimums with qualifying credit

- Conventional often requires larger contributions depending on programs

- FHA enables homeownership with limited savings

- Conventional rewards larger equity with no mortgage insurance

Mortgage insurance structure:

- FHA requires insurance for the loan’s life

- Conventional allows removing insurance at specific equity levels

- FHA insurance costs are often higher

- Conventional provides long-term cost savings when insurance removes

Property condition standards:

- FHA requires properties meeting minimum property standards

- Conventional accepts properties in various conditions

- FHA mandates specific safety and soundness requirements

- Conventional focuses primarily on value and marketability

Debt-to-income flexibility:

- FHA accommodates higher debt ratios (43-50%)

- Conventional typically limits ratios to 43-45%

- FHA serves buyers with existing obligations

- Conventional requires more conservative debt positions

Why might you choose an FHA loan over conventional? Despite potentially higher long-term costs from permanent mortgage insurance, an FHA loan provides accessible homeownership for buyers who cannot meet conventional standards or who benefit from FHA’s lower initial requirements. The path to homeownership now often outweighs the cost of insurance throughout the loan term.

Ready to discuss your purchase scenario? Submit a purchase inquiry to explore your options.

What Property Types Qualify for an FHA Loan?

An FHA loan program accommodates various property categories for primary residence purposes. Understanding eligibility across different property types helps you plan your home search appropriately.

Eligible property types:

- Single-family detached homes

- Townhomes and row houses

- Condominiums in FHA-approved developments

- Planned unit developments (PUDs)

- Multi-unit properties (2-4 units) with owner occupancy

- Manufactured homes meeting FHA standards

Can you purchase investment properties with an FHA loan? No, FHA financing serves primary residences only. However, multi-unit properties (duplexes, triplexes, fourplexes) qualify when you occupy one unit as your primary residence. The rental income from non-occupied units can help you qualify for the mortgage, creating an accessible real estate investment strategy.

What about condominium requirements? Condominiums must appear on FHA’s approved condominium list or qualify through the FHA approval process. These requirements ensure the condominium development maintains adequate financial health, appropriate insurance, and meets legal standards. Your lender can verify whether specific developments qualify.

Are there property location restrictions? FHA loans work nationwide without geographic limitations beyond property condition standards. Urban homes, suburban properties, small town houses, and even some rural properties qualify as long as they meet FHA property standards and appraisal requirements.

What property condition requirements apply? FHA minimum property standards require homes to be safe, sound, and secure. Properties must have:

- Functioning heating, plumbing, electrical, and roofing systems

- Safe access to the property

- No health or safety hazards

- Structural soundness without significant defects

- Adequate drainage and foundation integrity

Properties needing repairs to meet these standards may require FHA 203(k) renovation loans combining purchase financing with repair funding in single transactions.

See how other borrowers have successfully used FHA financing:

How Does FHA Mortgage Insurance Work?

Understanding mortgage insurance costs and requirements helps you evaluate total FHA loan expenses. Mortgage insurance represents a significant component of FHA financing throughout the loan term.

What is the upfront mortgage insurance premium? All FHA loans require an upfront mortgage insurance premium equal to a percentage of the loan amount. This premium typically finances into your loan balance rather than requiring cash payment at closing, though paying it upfront reduces your ongoing loan balance and monthly obligations.

How much is the annual mortgage insurance premium? Annual mortgage insurance premiums vary based on your loan amount, equity contribution, and loan term. These premiums divide into monthly payments added to your mortgage obligation. Current rates vary, so confirm specific costs with your lender.

Can you ever remove FHA mortgage insurance? For loans originated after June 2013, FHA mortgage insurance remains for the life of the loan regardless of equity growth. The only ways to eliminate this insurance are paying off the loan, refinancing into conventional financing once you build sufficient equity, or making larger initial investments (which reduces insurance to a limited period).

Why does FHA require permanent mortgage insurance? The permanent insurance structure funds the insurance pool protecting lenders and enables FHA’s flexible qualification standards. While this increases long-term costs compared to conventional mortgages with removable insurance, it makes homeownership accessible to borrowers who benefit from FHA’s lower barriers.

How does FHA insurance compare to conventional PMI? FHA mortgage insurance often costs more than conventional private mortgage insurance, particularly for borrowers with strong credit. However, FHA accommodates borrowers who wouldn’t qualify for conventional financing, making direct cost comparisons less relevant when FHA provides the only accessible qualification path.

Calculate your FHA loan scenarios:

What Documentation Does an FHA Loan Require?

Understanding the specific documentation requirements helps you prepare for a smooth application process. An FHA loan follows standard mortgage verification procedures with some additional FHA-specific requirements.

Required documentation typically includes:

- W-2 forms from the most recent two years

- Pay stubs covering the most recent 30 days

- Personal tax returns for the past two years

- Bank statements covering the most recent 2-3 months

- Government-issued identification (driver’s license or passport)

- Social Security number verification

- Credit report authorization

- Property appraisal by FHA-approved appraiser

- Homeowner’s insurance information

- Purchase contract for the subject property

- Gift letters if using gift funds for equity contribution

How do self-employed borrowers document income? Self-employment income requires business tax returns (typically two years), profit and loss statements, verification of business continuity, and documentation proving self-employment status. The qualification process mirrors conventional self-employment verification but applies to FHA-eligible borrowers.

What about investment source verification? FHA requires documenting equity contribution sources ensuring funds come from acceptable sources including savings, gift funds from family members, down payment assistance programs, or proceeds from property sales. Large deposits require explanation and documentation.

Do you need special documentation for gift funds? Gift funds from family members require gift letters stating the funds are gifts with no repayment expectation, documentation showing fund transfer from donor to borrower, and verification of the donor’s capacity to provide the gift. FHA allows gifts to cover the entire equity contribution.

Are there special appraisal requirements? FHA appraisers must be FHA-approved and follow FHA appraisal protocols. The appraisal includes both value assessment and property condition evaluation, ensuring properties meet minimum property standards. Identified deficiencies may require repairs before closing.

Common FHA Loan Questions

Can you qualify for an FHA loan immediately after bankruptcy?

FHA requires waiting periods after bankruptcy discharge—typically two years for Chapter 7 bankruptcy and one year into a Chapter 13 repayment plan. These periods are significantly shorter than conventional loan requirements (typically four years for Chapter 7).

Post-bankruptcy qualification requirements:

- Demonstrated credit re-establishment after discharge

- Explanation of circumstances leading to bankruptcy

- Evidence of changed financial circumstances or habits

- On-time payments since bankruptcy on any new credit

- Stable employment and income

Some circumstances involving job loss, serious illness, or other extenuating factors may enable qualification with shorter waiting periods when borrowers demonstrate recovery.

What if you had a previous foreclosure?

FHA typically requires three years from a foreclosure completion date before new FHA loan eligibility. This waiting period is substantially shorter than conventional requirements (typically seven years). Borrowers must demonstrate credit re-establishment and provide documentation explaining the foreclosure circumstances.

Extenuating circumstances like job loss, medical emergencies, or economic events beyond your control may reduce waiting periods to as little as one year when properly documented and when your current situation demonstrates stability.

Can you use an FHA loan for a second home or investment property?

No, FHA loans serve primary residences only. You must occupy the property as your main home and certify your occupancy intentions. However, you can use an FHA loan to purchase multi-unit properties (2-4 units) where you occupy one unit while renting the others, creating an accessible investment strategy.

If you currently have an FHA loan on your primary residence, obtaining another FHA loan requires meeting specific circumstances like job relocation, family size changes, or other legitimate needs for housing in different locations.

What are FHA loan limits?

FHA establishes loan limits varying by county based on local housing costs. Standard limits are tied to conforming loan limits established by the Federal Housing Finance Agency. High-cost areas receive higher limits than standard counties.

Current FHA limits enable most buyers to purchase median-priced homes in their markets. High-cost area limits accommodate expensive markets in places like California, New York, and Hawaii. Check specific limits for your target county as they affect your maximum purchase price.

How Do FHA Loan Rates Compare to Conventional Mortgages?

Understanding the pricing framework helps you evaluate total FHA loan costs. Interest rates represent only one component of the complete cost analysis.

What factors influence FHA loan pricing? Several elements affect your specific rate:

- Credit score (though rates vary less by credit than conventional loans)

- Loan amount relative to FHA limits

- Property type and location

- Initial investment percentage

- Overall financial profile

Are FHA rates competitive with conventional mortgages? FHA interest rates for borrowers with lower credit scores often compare favorably to conventional rates, sometimes even beating conventional pricing. However, the permanent mortgage insurance significantly impacts total costs. Well-qualified borrowers typically find conventional financing provides lower total costs long-term.

How does mortgage insurance affect the total cost? While FHA rates may be competitive, the combination of upfront mortgage insurance premium plus permanent annual insurance premiums substantially increases total financing costs compared to conventional loans where insurance eventually removes. This trade-off enables accessible qualification for borrowers who couldn’t obtain conventional financing.

Can you refinance out of FHA later? Many borrowers use FHA financing to enter homeownership, then refinance into conventional mortgages once they build sufficient equity and improve credit profiles. This strategy captures FHA’s accessible qualification while transitioning to conventional loans’ lower long-term costs once circumstances improve.

Considering a refinance? Submit a refinance inquiry to see if this makes sense for you.

What Are the Advantages of an FHA Loan?

Understanding the specific benefits helps you evaluate whether this financing approach aligns with your homeownership goals and financial profile. An FHA loan offers distinct advantages for borrowers benefiting from flexible qualification standards.

Key advantages include:

Low minimum equity contribution – With modest requirements for qualifying credit scores, FHA loans enable homeownership without years of savings accumulation. This accessible threshold helps first-time buyers enter homeownership sooner while still requiring meaningful financial investment.

Flexible credit requirements – FHA accepts credit scores as low as 580, accommodating borrowers still building credit or recovering from past challenges. This flexibility recognizes that credit scores don’t always reflect current financial capability or future payment reliability.

Higher debt-to-income tolerance – FHA accommodates debt-to-income ratios up to 43-50%, helping buyers with student loans, auto payments, or other obligations qualify when conventional programs would decline. This flexibility enables homeownership for borrowers managing existing debts responsibly.

Generous seller concession allowances – FHA allows sellers to contribute substantially toward buyer closing costs. This provision reduces cash needed at closing significantly, making homeownership more accessible when combined with the low equity requirement.

Shorter post-bankruptcy waiting periods – FHA requires just two years after Chapter 7 bankruptcy or one year into Chapter 13 repayment plans, helping borrowers recover from financial setbacks faster than conventional requirements permit.

Multi-unit property qualification – FHA loans accommodate 2-4 unit properties with the same low equity contributions as single-family homes, enabling house hacking strategies where rental income from non-occupied units supports mortgage payments while building homeownership.

Alternative Loan Programs for First-Time Buyers

If an FHA loan isn’t the right fit, consider these alternatives:

- VA Loan – Competitive financing for eligible military families with flexible initial investment structures and no mortgage insurance

- USDA Loan – Rural property financing with competitive terms for eligible areas

- Conventional Loan – Traditional financing that may eliminate mortgage insurance faster with adequate equity

- Down Payment Assistance – Programs providing grants or low-interest loans to help with upfront costs

- Section 184 Loan – Federal loan program for Native Americans with flexible qualification standards

Explore all 30+ loan programs to find your best option.

Not sure which program is right for you? Take our discovery quiz to find your path.

Advanced FHA Loan Questions

Can you have two FHA loans simultaneously?

Generally, FHA restricts borrowers to one FHA loan at a time. However, specific exceptions exist including job relocation requiring housing in new locations, family size increases necessitating larger homes, or other legitimate circumstances justifying multiple FHA-financed properties.

Documentation supporting these exceptions must demonstrate genuine need rather than investment intentions, since FHA serves primary residence homeownership exclusively.

What is FHA’s flip rule and how does it affect purchases?

FHA’s anti-flipping rule restricts purchasing properties recently acquired by sellers, protecting buyers from predatory flipping schemes. Properties owned by sellers less than 90 days typically cannot finance with FHA loans. Properties owned 91-180 days may face additional scrutiny and appraisal requirements.

These rules protect buyers from purchasing properties at inflated values shortly after sellers acquired them at much lower prices. Legitimate renovations and improvements can justify value increases when properly documented.

Can non-occupant co-borrowers strengthen FHA applications?

Yes, FHA allows non-occupant co-borrowers—family members who don’t live in the property but co-sign the mortgage and contribute to qualification. The co-borrower’s income strengthens qualifying capacity while they assume equal mortgage liability despite not occupying the home.

This arrangement particularly benefits first-time buyers with sufficient income but credit challenges, or buyers needing additional income to qualify when their individual income falls short.

How does FHA handle student loan debt?

FHA considers student loan obligations in debt-to-income calculations even when loans are in deferment or income-driven repayment plans. Recent guidance provides specific calculation methods using actual payment amounts when documented, or percentage-based calculations when payments aren’t established.

Large student loan balances significantly impact FHA qualification for many buyers. Understanding calculation methods helps you prepare documentation showing the most favorable payment treatment.

Can you use FHA 203(k) loans for properties needing repairs?

Yes, FHA 203(k) renovation loans combine purchase financing with repair funding in single transactions. These programs accommodate properties needing repairs to meet FHA minimum property standards or buyers wanting to customize properties through renovations.

FHA 203(k) variations include:

- Limited 203(k) for repairs under specific dollar thresholds

- Standard 203(k) for major renovations including structural improvements

- Streamlined processing for qualifying improvements

- Single closing covering both purchase and renovation costs

What if you’re self-employed with minimal taxable income?

Self-employed FHA applicants face the same challenge as other mortgage programs—tax return income drives qualification despite tax strategies minimizing reported income. FHA follows standard self-employment documentation protocols analyzing net income after business expenses.

Alternative programs like bank statement loans may better serve self-employed borrowers who strategically minimize taxable income. However, FHA remains accessible when your tax returns show adequate net income supporting the mortgage obligation.

How do FHA loans handle non-traditional credit?

Borrowers lacking traditional credit—credit cards, auto loans, or prior mortgages—can qualify through alternative credit documentation including rental payment history, utility bills, insurance payments, and other regular financial obligations demonstrating payment reliability.

This flexibility accommodates borrowers who avoid traditional credit but demonstrate financial responsibility through consistent payment of regular obligations.

Can foreign nationals qualify for FHA loans?

FHA loans generally require U.S. citizenship or lawful permanent resident status (green card holders). Non-permanent resident aliens may qualify when working in the United States with appropriate visa documentation authorizing extended presence and employment.

Specific documentation requirements vary based on visa type and employment authorization. Traditional work visas like H-1B may enable FHA qualification, while other visa categories face restrictions or require additional documentation.

What happens if the appraisal comes in lower than the purchase price?

When appraisals fall below purchase prices, buyers face several options. The appraised value becomes the maximum value for FHA loan calculation purposes, affecting your financing structure.

Low appraisal resolution strategies:

- Negotiate purchase price reductions with sellers

- Increase your equity contribution to maintain planned financing

- Challenge the appraisal with supporting comparable sales

- Request second appraisals through FHA’s reconsideration process

- Walk away if contract contingencies allow

How do FHA loans handle inherited properties?

You cannot use an FHA loan to purchase inherited properties from estate beneficiaries because FHA serves primary residence purchases at arm’s length prices. However, if you inherit a property outright through estate settlement, you can refinance any existing mortgage with FHA financing once you establish ownership and occupancy.

The distinction lies between purchasing from estates (not allowed) and refinancing properties you inherit directly (permitted once you establish clear ownership).

Ready to get started? Apply now or schedule a call to discuss your situation.

Helpful FHA Loan Resources

Official Government Guidance:

HUD FHA Loan Program Information – Department of Housing and Urban Development official resource on FHA loan programs, qualification requirements, mortgage insurance premiums, and approved lender directories for government-insured home financing.

FHA Mortgage Insurance Premiums Guidance – HUD resource explaining FHA mortgage insurance premium calculations, upfront and annual premium rates, and insurance requirements for various FHA loan scenarios and property types.

CFPB FHA Loan Qualification Information – Consumer Financial Protection Bureau guidance on FHA loan basics, comparison to conventional mortgages, qualification standards, and borrower protections under FHA lending programs.

Industry Organizations:

FHA Connection Mortgagee Letters – Official HUD mortgagee letters providing policy updates, guideline changes, and program announcements for FHA-approved lenders and mortgage professionals.

HUD Approved Lender List – Department of Housing and Urban Development directory of FHA-approved mortgage lenders authorized to originate government-insured home loans under FHA programs.

Educational Resources:

HUD Homebuying Process Guide – Department of Housing and Urban Development comprehensive homebuyer education covering mortgage types, qualification preparation, FHA loan benefits, and step-by-step purchase process guidance.

FHA Approved Condominium List – HUD searchable database of FHA-approved condominium developments, allowing buyers to verify whether specific condo projects qualify for FHA financing before making offers.

Need local expertise? Get introduced to trusted partners including loan officers, realtors, and housing counselors in your area

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Not Sure About Your Next Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Related Posts

Subscribe to our newsletter

Get program updates and rate insights in your inbox.