FHA Streamline Refinance: 7 Smart Ways to Lower Your Mortgage Payment

How an FHA Streamline Refinance Reduces Costs Without Appraisals or Income Verification

FHA borrowers seeking to reduce their monthly payment or move from adjustable to fixed-rate financing face a simplified refinance path with minimal documentation. The FHA Streamline Refinance program eliminates appraisal requirements and reduces verification steps for existing FHA loans. Whether rates have dropped since your original mortgage or you want payment stability, this expedited process delivers benefits to current FHA homeowners without the complexity of traditional refinancing.

Key Details: What You’ll Learn About FHA Streamline Refinance Loans

- An FHA streamline refinance provides simplified refinancing for existing FHA borrowers to reduce interest rates or monthly payments without extensive documentation (HUD FHA streamline refinance guidance)

- Borrowers can refinance without home appraisals, income verification, employment documentation, or credit underwriting in most scenarios (FHA streamline refinance requirements)

- An FHA streamline refinance accommodates borrowers with any credit score, recent income changes, or employment transitions since lenders don’t re-verify these factors

- Two program variations exist: credit qualifying streamline with full underwriting and non-credit qualifying streamline with minimal documentation requirements

- The net tangible benefit test requires demonstrating meaningful payment reduction, rate decrease, or mortgage term improvement to protect borrowers from unnecessary refinancing

- Properties with declining values, underwater mortgages, or challenging appraisal scenarios qualify since the program doesn’t require new property valuations

- Seasoning requirements mandate waiting at least 210 days from your previous FHA loan closing and making six monthly payments before streamline refinance eligibility (CFPB FHA refinance information)

Ready to explore your options? Schedule a call with a loan advisor.

What Is an FHA Streamline Refinance?

An FHA streamline refinance represents a simplified refinancing program exclusively for borrowers with existing FHA mortgages who want to reduce interest rates, lower monthly payments, or modify loan terms. The “streamline” designation reflects the reduced documentation, expedited processing, and minimal underwriting compared to traditional refinances.

How does an FHA streamline refinance work? The program focuses solely on whether refinancing provides tangible benefits—primarily through lower monthly payments or reduced interest rates. Unlike standard refinances requiring property appraisals, income verification, employment documentation, and credit underwriting, an FHA streamline refinance can proceed with minimal documentation proving only that you’ve made timely payments and will benefit from the refinance.

The program recognizes that borrowers with existing FHA loans who’ve demonstrated payment reliability should access rate reductions without the expense, time, and documentation burden of full refinances. This streamlined approach reduces costs, accelerates timelines, and extends refinancing opportunities to borrowers whose circumstances might complicate traditional refinancing.

An FHA streamline refinance doesn’t allow cash-out—you cannot access equity through this program. It serves purely to reduce costs or improve terms on existing FHA mortgages, not to provide liquidity for other purposes.

Who Benefits Most from an FHA Streamline Refinance?

Several borrower profiles find exceptional value in an FHA streamline refinance structure. These programs serve existing FHA mortgage holders seeking to capitalize on rate reductions or payment relief.

Borrowers whose income has declined represent ideal candidates for an FHA streamline refinance. If you’ve experienced job changes, income reductions, career transitions, or other circumstances affecting earnings, traditional refinancing requires re-proving income qualification. An FHA streamline refinance allows refinancing without income verification, enabling rate reductions regardless of current income levels.

Homeowners with credit score decreases find FHA streamline refinancing particularly valuable. If your credit has declined since your original FHA loan originated—perhaps due to medical collections, credit card issues, or other challenges—traditional refinancing might deny you despite payment history on your mortgage. An FHA streamline refinance can proceed without credit score requirements when using the non-credit qualifying option.

Properties with declining values or underwater mortgages benefit from FHA streamline refinancing’s no-appraisal structure. If your home’s value has decreased below your loan balance or declined significantly since purchase, traditional refinancing becomes impossible or expensive. An FHA streamline refinance ignores current property values, enabling refinancing based solely on your existing FHA loan and payment benefits.

Self-employed borrowers or those with complicated income appreciate the streamlined approach eliminating tax return analysis, business documentation, or complex income reconstruction. Whether you’ve changed business structures, experienced income fluctuations, or face complicated self-employment scenarios, an FHA streamline refinance bypasses these documentation challenges.

Borrowers seeking maximum simplicity and speed who want to reduce rates without extensive paperwork, appraisals, or underwriting find FHA streamline refinancing ideal. The minimal requirements and expedited processing create efficient refinancing experiences compared to traditional programs.

Explore all loan programs to understand your full range of options.

What Are the Requirements for an FHA Streamline Refinance?

Understanding the specific qualification criteria helps you assess whether an FHA streamline refinance fits your situation. While requirements are minimal compared to traditional refinancing, specific standards ensure program integrity.

Existing FHA loan requirement – You must currently have an FHA-insured mortgage to qualify for FHA streamline refinancing. The program serves only existing FHA borrowers, not conventional, VA, USDA, or other mortgage holders seeking to refinance into FHA products.

Seasoning requirements – You must wait at least 210 days (approximately seven months) from your original FHA loan closing and make at least six monthly payments before streamline refinance eligibility. This seasoning period ensures borrowers establish payment patterns before refinancing.

Payment history standards – The program requires demonstrating satisfactory payment history—typically no more than one 30-day late payment in the past 12 months and no late payments in the most recent three months. This payment reliability demonstrates that you’ve managed your existing FHA loan responsibly.

Net tangible benefit requirement – Your refinance must provide meaningful improvement through specific measurable benefits. Generally, this means reducing your principal and interest payment by at least 5% when refinancing into another fixed-rate mortgage, or meeting other benefit tests for adjustable-rate scenarios.

No cash-out restriction – FHA streamline refinances prohibit accessing equity. You can refinance only the existing principal balance plus allowable closing costs and fees. Any equity beyond closing costs remains in the property rather than being extracted as cash.

Current on mortgage requirement – You must be current on your FHA mortgage at application and throughout the refinance process. Borrowers in default, forbearance, or loan modification scenarios typically cannot pursue streamline refinancing until they re-establish satisfactory payment patterns.

Property occupancy continuation – The property must remain your primary residence (or maintain the same occupancy status as your original FHA loan). Converting primary residences to rental properties may complicate or disqualify streamline refinancing.

What Are the Two Types of FHA Streamline Refinances?

Understanding the distinction between credit qualifying and non-credit qualifying FHA streamline refinances helps you select the appropriate structure for your situation and goals.

Non-credit qualifying streamline refinance represents the most streamlined version with absolute minimum documentation and underwriting. This option requires:

- No credit report or credit score evaluation

- No income verification or employment documentation

- No property appraisal

- No debt-to-income ratio calculations

- Verification of payment history on existing FHA loan only

- Proof that refinancing provides net tangible benefit

Non-credit qualifying advantages:

- Maximum simplicity and speed

- Accessible regardless of credit score changes

- No income verification despite changes since original loan

- Minimal lender costs and fees

- Fastest processing timelines

Non-credit qualifying limitations:

- Cannot add or remove borrowers from the loan

- Cannot refinance delinquent loans

- Cannot exceed specific upfront mortgage insurance premium financing limits

Credit qualifying streamline refinance includes credit report review and basic underwriting while still avoiding appraisals and reducing documentation compared to traditional refinances. This option allows:

- Adding or removing borrowers from the loan

- Refinancing after recent late payments (with lender approval)

- Greater flexibility in specific scenarios

- Full credit evaluation and debt-to-income analysis

Credit qualifying requirements:

- Credit report review (though minimum score requirements are flexible)

- Income and employment verification

- Debt-to-income ratio analysis

- More extensive underwriting review

Why choose credit qualifying over non-credit qualifying? Most borrowers prefer the simpler non-credit qualifying option unless they need to add or remove borrowers, or their situation requires the additional flexibility credit qualifying provides.

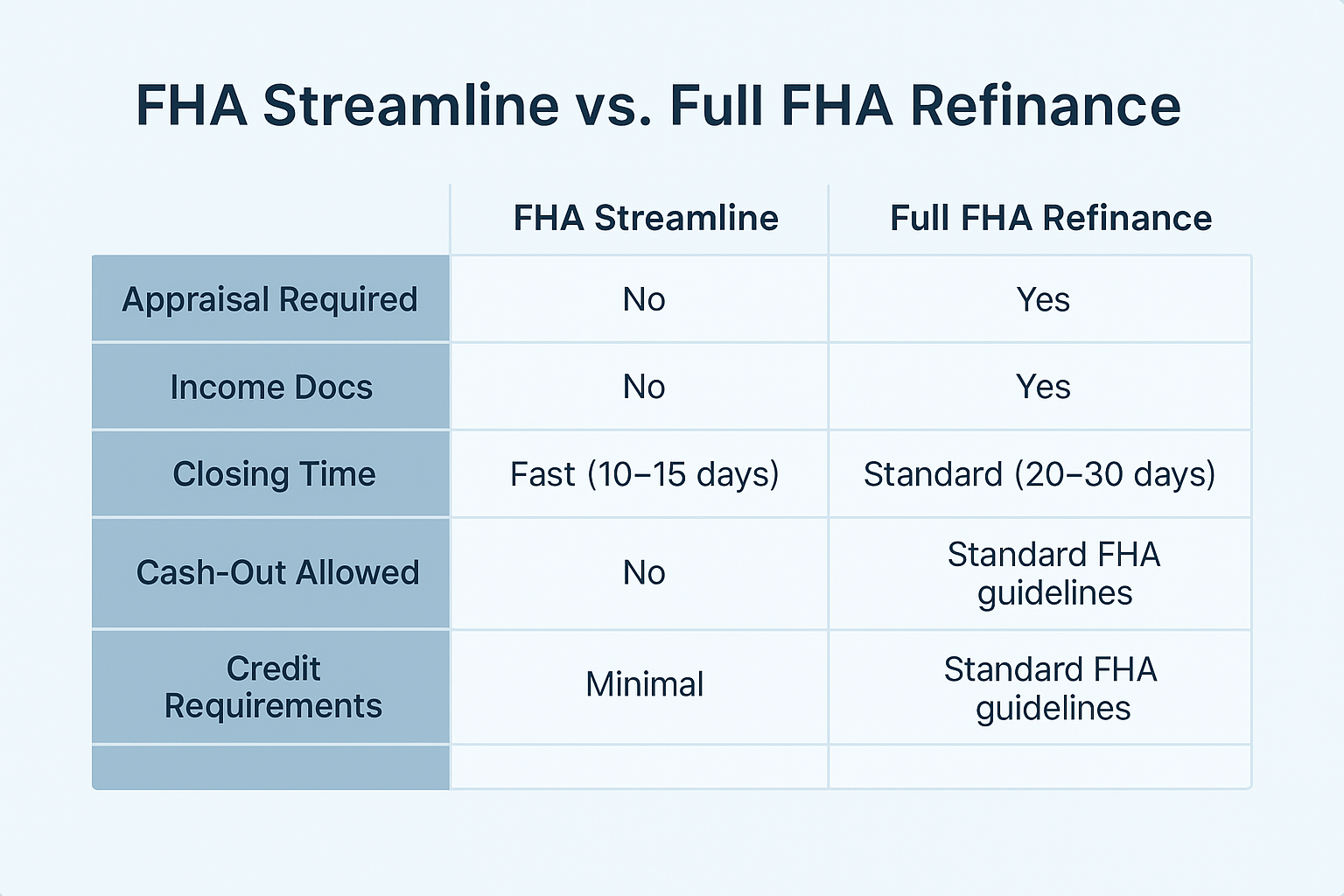

How Does an FHA Streamline Refinance Differ from Traditional Refinancing?

The fundamental distinction lies in the documentation requirements, underwriting depth, and program restrictions. Understanding these differences helps you evaluate whether streamline refinancing or traditional approaches better serve your goals.

FHA streamline refinance characteristics:

- No property appraisal required

- Minimal or no income verification

- No credit review (non-credit qualifying version)

- No cash-out permitted

- Net tangible benefit requirement

- Existing FHA loan required

- Simplified documentation and processing

Traditional refinance (FHA or conventional) characteristics:

- Full property appraisal required

- Complete income and employment verification

- Credit report review and score requirements

- Cash-out options available

- Debt-to-income ratio analysis

- Can refinance any existing mortgage type

- Standard documentation and underwriting

What are the cost differences? FHA streamline refinances often cost less than traditional refinances due to eliminated appraisal expenses, reduced underwriting fees, and streamlined processing. The upfront mortgage insurance premium (1.75% of loan amount) still applies, though you may finance this cost into your new loan balance.

When would traditional refinancing make more sense? If you want to access cash equity, switch from FHA to conventional financing to eliminate mortgage insurance, significantly shorten your loan term, or refinance a non-FHA mortgage, traditional refinancing becomes necessary since streamline programs don’t accommodate these scenarios.

Ready to discuss your refinance scenario? Submit a refinance inquiry to explore your options.

What Is the Net Tangible Benefit Test?

Understanding the net tangible benefit requirement helps you determine whether your refinance scenario qualifies under FHA streamline guidelines. This consumer protection ensures refinancing provides meaningful value rather than just generating lender fees.

What qualifies as net tangible benefit? The specific requirements vary based on your refinance scenario:

Fixed-rate to fixed-rate refinancing:

- Reduce principal and interest payment by at least 5%

- This calculation excludes taxes, insurance, and mortgage insurance

- Only the principal and interest portion must decrease by 5%

ARM to fixed-rate refinancing:

- Any reduction in interest rate qualifies

- The benefit focuses on rate stability rather than payment reduction

- Converting ARM uncertainty to fixed-rate security provides inherent benefit

Fixed-rate to ARM refinancing:

- Interest rate must decrease by at least 2%

- The substantial rate reduction offsets the risk of future adjustments

- This scenario is less common than ARM to fixed conversions

ARM to ARM refinancing:

- Interest rate must decrease by at least 2%

- Monthly payment must decrease

- Remaining amortization period cannot increase by more than one year

Term reduction scenarios:

- Refinancing into substantially shorter terms (30-year to 15-year for example)

- May not need to meet standard payment reduction thresholds

- The term reduction benefit justifies the refinance

How do lenders verify net tangible benefit? Lenders complete worksheets comparing your current FHA mortgage terms to your proposed new FHA streamline refinance terms, documenting that the transaction meets applicable benefit tests. This documentation becomes part of your loan file demonstrating program compliance.

Can You Add or Remove Borrowers During FHA Streamline Refinancing?

Borrower changes significantly affect which FHA streamline refinance option you must use and what documentation becomes necessary. Understanding these restrictions helps you plan appropriately.

Non-credit qualifying streamline refinance borrower rules:

- Cannot add new borrowers to the loan

- Cannot remove existing borrowers from the loan

- All original FHA loan borrowers must remain on the streamline refinance

- This restriction maintains the streamlined nature and minimal underwriting

Credit qualifying streamline refinance borrower rules:

- Can add new borrowers with full credit qualification

- Can remove existing borrowers from the loan

- Requires credit, income, and employment verification for all borrowers

- Maintains more flexibility but increases documentation requirements

Common scenarios requiring borrower changes:

- Divorce requiring one spouse to refinance solely in their name

- Marriage where spouses want joint ownership

- Death of a co-borrower requiring surviving borrower sole ownership

- Adding adult children or family members to assist with qualification

What if you’ve experienced divorce since your FHA loan originated? Divorce scenarios requiring one spouse to refinance individually typically mandate credit qualifying streamline refinances since you’re removing a borrower. This requires income verification proving the remaining borrower can support the mortgage independently, plus credit review and standard underwriting despite the streamline designation.

Can you add a non-occupant co-borrower? Adding non-occupant co-borrowers who won’t live in the property but will support qualification requires credit qualifying streamline refinancing with full documentation for the new co-borrower. This strategy helps borrowers whose income decreased qualify for refinancing by adding family members who strengthen the application.

See how other FHA borrowers have successfully used streamline refinancing:

What Documentation Does an FHA Streamline Refinance Require?

Understanding the specific documentation requirements helps you prepare for a smooth refinancing process. Documentation varies significantly based on whether you pursue non-credit qualifying or credit qualifying streamline refinancing.

Non-credit qualifying streamline refinance documentation:

- Current mortgage statement showing FHA case number

- Payment history verification from servicer

- Proof of property insurance

- Net tangible benefit documentation from lender

- Property occupancy certification

- Minimal personal identification

Credit qualifying streamline refinance documentation:

- All non-credit qualifying items listed above

- Credit report (lender obtains)

- Income verification (W-2s, pay stubs, or tax returns)

- Employment verification

- Bank statements for reserves (if required)

- Debt documentation for ratio calculations

What about property appraisals? Neither version of FHA streamline refinancing requires property appraisals in most scenarios. The program’s appeal lies partly in eliminating appraisal expenses and complications. This benefit proves particularly valuable when property values have declined or when obtaining appraisals would be difficult.

Do you need to prove property occupancy? You must certify that you occupy the property as your primary residence (or that occupancy status matches your original FHA loan). This certification typically involves signing documentation rather than providing extensive proof, though lenders may verify occupancy through various methods.

What if you’re self-employed? Self-employed borrowers pursuing non-credit qualifying streamline refinances avoid providing business tax returns, profit and loss statements, or other self-employment documentation. Credit qualifying streamlines require standard self-employment income verification despite the streamline designation.

Are there any situations requiring appraisals? Limited circumstances may trigger appraisal requirements including properties with significant modifications since the original FHA loan, properties with substantial condition concerns, or lender-specific requirements for unique situations. However, the vast majority of FHA streamline refinances proceed without appraisals.

Common FHA Streamline Refinance Questions

How soon can you refinance after getting an FHA loan?

You must wait at least 210 days from your original FHA loan closing date and make at least six monthly mortgage payments before FHA streamline refinance eligibility. Most borrowers meet these requirements approximately seven months after closing their FHA purchase or previous refinance.

The seasoning requirement ensures you establish payment history before refinancing and prevents excessive churning where borrowers refinance immediately without demonstrating mortgage management capability.

Can you refinance if your home is underwater?

Yes, FHA streamline refinancing’s no-appraisal structure enables refinancing regardless of current property value. If you owe more than your home’s current worth—whether due to market declines, minimal initial equity, or other factors—you can still pursue streamline refinancing as long as you meet payment history and benefit requirements.

This feature proved particularly valuable during housing market downturns when many FHA borrowers found themselves underwater. The program enabled rate reductions and payment relief despite negative equity positions that would disqualify traditional refinancing.

What if you’ve had late payments recently?

Payment history standards for FHA streamline refinancing require generally no more than one 30-day late payment in the past 12 months and zero late payments in the most recent three months. Borrowers with recent late payments may need to wait until they re-establish satisfactory payment patterns before streamline refinance eligibility.

Some lenders may approve credit qualifying streamline refinances despite recent late payments when borrowers provide satisfactory explanations for temporary payment issues, demonstrate current income supporting the mortgage, and show resolution of circumstances that caused late payments.

Can you roll closing costs into an FHA streamline refinance?

Yes, FHA streamline refinancing allows financing closing costs and fees into your new loan balance, avoiding out-of-pocket expenses at closing. However, the total new loan amount (existing balance plus closing costs and upfront mortgage insurance premium) cannot exceed specific limits tied to your original loan amount and FHA maximums.

This financing capability makes FHA streamline refinancing accessible to borrowers who benefit from rate reductions but lack cash reserves for closing costs. The marginally higher loan balance is typically offset by the payment reduction achieved through lower interest rates.

How Much Can You Save with an FHA Streamline Refinance?

Understanding potential savings helps you evaluate whether refinancing makes financial sense given the costs involved. Savings vary dramatically based on your current rate, market rates, remaining loan balance, and remaining term.

What factors determine your savings? Several elements affect the total benefit:

- Interest rate differential between current and new rate

- Remaining loan balance to be refinanced

- Remaining term on your current mortgage

- Current monthly payment including mortgage insurance

- New monthly payment after refinance

- Closing costs and upfront mortgage insurance premium

How do you calculate break-even timing? Divide your total closing costs (including financed costs) by your monthly payment reduction to determine how many months until you recoup refinancing expenses. If closing costs total a certain amount and you reduce payments by a given monthly amount, your break-even occurs at the calculated timeframe.

What about long-term savings? Beyond monthly payment reductions, consider total interest savings over your remaining loan term. A modest rate reduction on a substantial balance over many remaining years creates significant cumulative savings even if monthly payment reductions seem modest.

Does the upfront mortgage insurance premium reduce savings? The 1.75% upfront FHA mortgage insurance premium adds to your costs, though you typically finance this amount rather than paying cash. When calculating savings, consider this premium as part of your new loan balance and its effect on long-term interest costs.

When does refinancing not make sense? If you plan to sell soon (before reaching break-even), if rate reductions are minimal, or if you’ve recently refinanced, the costs may outweigh benefits. Calculate specific scenarios using your actual numbers before committing to refinancing.

Calculate your FHA streamline refinance scenario:

What Are the Advantages of an FHA Streamline Refinance?

Understanding the specific benefits helps you evaluate whether this refinancing approach aligns with your financial goals and situation. An FHA streamline refinance offers distinct advantages for existing FHA borrowers seeking rate reductions.

Key advantages include:

No appraisal requirement – Eliminate appraisal costs (typically several hundred dollars) and avoid complications from declining property values, difficult-to-appraise properties, or unique characteristics that challenge valuation. The no-appraisal feature enables refinancing regardless of current equity position.

Minimal income verification – Non-credit qualifying streamlines avoid employment verification, income documentation, or tax return analysis. Whether your income has decreased, your employment situation changed, or your self-employment income appears complicated, the streamlined approach ignores these factors.

No credit score requirements (non-credit qualifying) – Refinance regardless of credit score changes since your original FHA loan. Recent credit challenges, collections, medical bills, or other issues that might disqualify traditional refinancing don’t prevent FHA streamline refinancing when using non-credit qualifying options.

Reduced closing costs – The simplified underwriting, eliminated appraisal, and streamlined processing typically reduce total closing costs compared to traditional refinancing. Lower costs improve your break-even calculation and make refinancing beneficial in more scenarios.

Faster processing timelines – Without appraisals, extensive underwriting, or complex documentation review, FHA streamline refinances often close faster than traditional refinances. Many borrowers complete the process in 30-45 days rather than 60-90 days for standard refinances.

Works with underwater mortgages – Properties worth less than current loan balances qualify for FHA streamline refinancing despite negative equity that would disqualify virtually all other refinancing programs. This feature provides relief to borrowers in declining markets or with minimal initial equity.

Alternative Loan Programs for Refinancing Scenarios

If an FHA streamline refinance isn’t the right fit, consider these alternatives:

- FHA Loan Refinance – Standard FHA refinance when you need to add/remove borrowers or access equity beyond streamline limits

- FHA Cash-Out Refinance – Access home equity while maintaining FHA financing structure

- Conventional Loan Refinance – Refinance to conventional financing to eliminate FHA mortgage insurance with adequate equity

- VA IRRRL – Streamlined refinancing for eligible veterans with existing VA loans

- HELOC – Access equity through a second lien without refinancing your primary mortgage

Explore all 30+ loan programs to find your best option.

Not sure which program is right for you? Take our discovery quiz to find your path.

Advanced FHA Streamline Refinance Questions

Can you refinance an FHA loan into a conventional loan through streamline refinancing?

No, FHA streamline refinancing maintains FHA insurance rather than converting to conventional mortgages. If you want to eliminate FHA mortgage insurance by refinancing into conventional financing, you must pursue traditional conventional refinancing with full documentation, appraisals, and underwriting.

This distinction matters because FHA mortgage insurance continues for the loan’s life, while conventional private mortgage insurance can be removed once you reach 20% equity. Many borrowers use FHA streamline refinancing for immediate rate relief, then later refinance into conventional loans once they build sufficient equity and improve financial profiles.

What if you’ve made improvements since your original FHA loan?

Property improvements, additions, or modifications since your original FHA loan don’t affect FHA streamline refinance eligibility since the program doesn’t require appraisals. Whether you’ve completed kitchen remodels, added bathrooms, finished basements, or made other improvements, these changes remain invisible to the streamline refinance process.

However, if improvements substantially changed your property’s structure, configuration, or value, lenders might require appraisals to verify that the collateral still meets FHA standards. Major additions or structural changes could trigger additional documentation requirements.

Can you streamline refinance an FHA loan that’s been assumed?

FHA loan assumptions—where new borrowers take over existing FHA mortgages from sellers—can be streamline refinanced by the assuming borrowers. However, the seasoning requirements apply from the original FHA loan origination date, not from the assumption date.

If you assumed an FHA mortgage recently, you might immediately qualify for streamline refinancing if the loan is seasoned from its original origination. Conversely, assuming a very recent FHA loan might require waiting for the 210-day seasoning period even though you just assumed the mortgage.

How does mortgage insurance change with FHA streamline refinancing?

Your new FHA streamline refinance includes new upfront mortgage insurance premiums (1.75% of loan amount) and establishes new annual mortgage insurance premium rates based on current FHA schedules. Your annual mortgage insurance may increase, decrease, or remain similar depending on how current rates compare to your original loan’s rates.

Unfortunately, refinancing resets your mortgage insurance clock. Even if your original FHA loan would have reached 78% loan-to-value enabling insurance removal under old rules, streamline refinancing into a new FHA loan means mortgage insurance continues for the new loan’s life under current guidelines.

Can investment properties or second homes qualify for FHA streamline refinancing?

Properties that were primary residences when you obtained your original FHA loan but subsequently converted to investment properties or second homes face complicated streamline refinance eligibility. FHA requires properties to maintain primary residence status, though some lenders allow streamline refinancing when occupancy changed for legitimate reasons like job relocation or family circumstances.

Properties purchased as investment properties or second homes with FHA financing (which would violate FHA occupancy requirements) obviously cannot streamline refinance. However, legitimate occupancy changes after proper FHA primary residence purchases may qualify with documentation explaining circumstances.

What if interest rates have increased since your original FHA loan?

When current market rates exceed your existing FHA loan rate, streamline refinancing doesn’t make financial sense since you cannot achieve the required net tangible benefit. The program requires demonstrating meaningful improvement—typically 5% payment reduction or other benefit tests—which becomes impossible when refinancing into higher rates.

Some borrowers in this situation might benefit from credit qualifying streamlines that allow adding co-borrowers to strengthen payment capacity, or from adjusting terms in other ways, but generally rising rate environments eliminate streamline refinance opportunities.

Can you streamline refinance multiple times?

Yes, you can complete multiple FHA streamline refinances over time as long as you meet seasoning requirements between each refinance. Each streamline refinance must wait 210 days from the previous closing and include six monthly payments before the next refinance.

Repeated refinancing makes sense when rates decrease incrementally over time. As long as each refinance provides net tangible benefit and you pay minimal closing costs (particularly if your lender offers low or no-cost refinancing), multiple streamline refinances can continuously optimize your mortgage costs.

How do FHA streamline refinances handle manufactured homes?

Manufactured homes financed with FHA mortgages can qualify for FHA streamline refinancing following the same guidelines as site-built homes. The manufactured home must have been eligible for FHA financing originally (meeting FHA manufactured home standards), must remain on permanent foundations, and must continue meeting property eligibility requirements.

Documentation proving the manufactured home qualifies as real property rather than personal property must be maintained throughout the streamline refinance process.

What happens if you discover title issues during streamline refinancing?

Even though FHA streamline refinancing doesn’t require appraisals, full title work is still necessary. If title searches reveal liens, judgments, easement problems, or other title defects, these must be resolved before streamline refinancing can close.

Title issues that didn’t affect your original FHA loan—perhaps recorded after your purchase—must be cleared through standard title curative processes. The streamlined refinance process doesn’t waive title insurance requirements or enable closing with defective title.

Can you refinance FHA loans originated under different mortgage insurance rules?

FHA loans originated before mortgage insurance rule changes in 2013 operate under different mortgage insurance structures—some allow insurance removal at 78% LTV after five years. Streamline refinancing these loans into new FHA mortgages means accepting current mortgage insurance rules requiring permanent insurance.

This trade-off requires careful analysis. The rate reduction benefits from streamline refinancing must outweigh the lost potential to remove mortgage insurance on your original loan. In some cases, waiting to remove mortgage insurance on your old loan rather than streamline refinancing into permanent insurance makes more financial sense.

Ready to get started? Apply now or schedule a call to discuss your situation.

Helpful FHA Streamline Refinance Resources

Official Government Guidance:

HUD FHA Streamline Refinance Guidance – Department of Housing and Urban Development official resource on FHA streamline refinance programs, eligibility requirements, net tangible benefit tests, and simplified documentation standards for existing FHA borrowers.

FHA Streamline Refinance Requirements Handbook – HUD comprehensive handbook section on streamline refinance underwriting standards, credit qualifying versus non-credit qualifying options, and program administration guidelines.

CFPB FHA Refinance Information – Consumer Financial Protection Bureau guidance explaining FHA streamline refinancing basics, comparison to traditional refinancing, qualification standards, and borrower protections.

Industry Organizations:

FHA Mortgage Insurance Premium Updates – HUD resource providing current FHA mortgage insurance premium rates, calculation methods, and policy updates affecting both new FHA loans and streamline refinances.

HUD Approved Lender List – Department of Housing and Urban Development directory of FHA-approved mortgage lenders authorized to originate government-insured loans including streamline refinance programs.

Educational Resources:

HUD Homeowner Assistance Resources – Department of Housing and Urban Development guidance on refinancing options, foreclosure prevention, and homeowner assistance programs for FHA borrowers facing financial challenges.

CFPB Refinancing Decision Tools – Consumer Financial Protection Bureau interactive tools helping homeowners evaluate whether refinancing makes financial sense, compare refinancing options, and understand costs versus benefits.

Need local expertise? Get introduced to trusted partners including loan officers, housing counselors, and mortgage advisors in your area.

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Not Sure About Your Next Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Related Posts

Subscribe to our newsletter

Get program updates and rate insights in your inbox.