FHA 203k Loan: 7 Essential Steps to Buy and Renovate in One Transaction

How an FHA 203k Loan Combines Purchase Financing with Renovation Funding

Purchasing a fixer-upper or undertaking substantial renovations typically requires separate financing for acquisition and improvements, creating qualification complications and multiple closings. The FHA 203(k) loan combines purchase price and renovation costs into a single mortgage, streamlining financing while allowing you to buy properties that traditional lenders might reject. Whether you’re updating a dated property or transforming a distressed home, this rehabilitation financing turns your vision into reality with one loan, one closing, and one monthly payment.

Key Details: What You’ll Learn About FHA 203k Loans

- An FHA 203k loan provides single-close financing that combines home purchase costs with renovation expenses, enabling buyers to finance properties needing repairs (HUD 203k loan program information)

- Borrowers can purchase properties below market value, fund necessary improvements, and build instant equity through strategic renovations with government-insured financing (FHA 203k handbook guidance)

- Property types including single-family homes, multi-unit buildings up to four units, and condominiums qualify when renovations meet FHA guidelines

- Two program variations exist: Limited 203k for repairs under specific thresholds and Standard 203k for major renovations including structural improvements

- An FHA 203k loan accommodates first-time buyers, investors purchasing multi-unit properties, and buyers seeking homes in neighborhoods with limited move-in ready inventory

- Renovation funds release through draw schedules as contractors complete work, protecting borrowers and ensuring proper fund usage throughout the project

- Credit requirements mirror standard FHA loans with scores as low as 580, making renovation financing accessible to borrowers who wouldn’t qualify for conventional rehab programs (CFPB renovation loan information)

Ready to explore your options? Schedule a call with a loan advisor.

What Is an FHA 203k Loan?

An FHA 203k loan represents a specialized government-insured mortgage that enables borrowers to finance both property purchase and renovation costs through a single transaction. This program eliminates the need for separate purchase mortgages followed by home equity loans, personal loans, or cash funding for improvements.

How does an FHA 203k loan work? The lender calculates your loan amount based on the property’s after-improved value rather than current condition value. You finance the purchase price plus renovation costs plus applicable fees in one mortgage. During renovations, you make mortgage payments while contractors complete improvements using funds disbursed through a controlled draw process.

The program addresses a common homebuyer dilemma: finding affordable properties that need work but lacking the cash or access to additional financing for improvements. An FHA 203k loan enables purchasing fixer-uppers that might otherwise remain out of reach, potentially building substantial equity through strategic renovations funded within your mortgage.

This government-backed financing extends FHA’s accessible qualification standards to renovation scenarios, making comprehensive property improvements possible for borrowers with limited savings, moderate credit, or higher debt-to-income ratios who wouldn’t qualify for conventional renovation financing.

Who Benefits Most from an FHA 203k Loan?

Several borrower profiles find exceptional value in an FHA 203k loan structure. These programs serve individuals seeking homeownership in markets where move-in ready properties exceed budgets or availability.

First-time home buyers in competitive markets represent ideal candidates for an FHA 203k loan. When desirable homes in your budget are scarce but fixers are plentiful, combining purchase and renovation financing enables buying below market value and customizing homes to your preferences while building equity through improvements.

Buyers seeking to maximize purchasing power can stretch budgets further by targeting properties needing cosmetic or functional improvements. A home requiring updates might sell substantially below comparable updated properties. An FHA 203k loan funds those improvements, creating market-value homes at below-market total investments.

Investors purchasing multi-unit properties can use an FHA 203k loan for 2-4 unit buildings where they occupy one unit. This strategy—house hacking with renovations—enables building rental income while improving properties that may have been neglected by previous owners, all with accessible FHA equity contributions.

Buyers in transitional neighborhoods where properties need rehabilitation but values are rising benefit from FHA 203k financing. Renovating in improving areas captures appreciation potential while FHA’s government backing provides lender confidence despite current property conditions.

Families with specific accessibility needs requiring modifications like wheelchair ramps, wider doorways, or accessible bathrooms can finance these improvements through an FHA 203k loan rather than paying cash after purchase. The program accommodates modifications improving usability for family members with disabilities.

Explore all loan programs to understand your full range of options.

What Are the Two Types of FHA 203k Loans?

Understanding the distinction between Limited and Standard FHA 203k programs helps you select the appropriate structure for your renovation scope. The two variations serve different project scales and complexity levels.

Limited 203k (formerly Streamline 203k) accommodates non-structural renovations with repair costs capped at specific dollar limits. This streamlined version works for cosmetic improvements, minor repairs, and updates not involving structural changes or major systems.

Limited 203k eligible improvements include:

- Painting, flooring, and cosmetic updates

- Kitchen and bathroom modernization without structural changes

- Appliance replacement and upgrades

- Minor plumbing or electrical repairs

- HVAC system replacement

- Accessibility modifications

- Energy efficiency improvements

- Weatherization and insulation

Limited 203k restrictions:

- No structural repairs or additions

- No room additions or garage conversions

- No luxury improvements like pools or outdoor kitchens

- Consultant not required for most projects

Standard 203k accommodates comprehensive renovations including structural improvements, additions, major system replacements, and complex multi-phase projects. This full-featured program enables extensive rehabilitation transforming properties fundamentally.

Standard 203k eligible improvements include:

- All Limited 203k eligible improvements

- Structural repairs and modifications

- Foundation work and major structural changes

- Room additions and space conversions

- Complete system replacements (plumbing, electrical, HVAC)

- Roof replacement and structural repairs

- Major remodeling and reconfiguration

- Detached structure improvements (garages, sheds)

Standard 203k requirements:

- HUD-approved consultant required for all projects

- Detailed work write-ups and cost estimates

- Architectural plans for structural changes

- More extensive documentation and oversight

- Higher minimum renovation amounts

What Are the Requirements for an FHA 203k Loan?

Understanding the specific qualification criteria helps you assess whether an FHA 203k loan fits your renovation project and financial profile. Requirements mirror standard FHA loans with additional renovation-specific stipulations.

Credit score minimums – FHA 203k loans accept the same credit scores as standard FHA financing: 580 minimum for modest initial investments, or 500-579 with larger equity contributions. These accessible thresholds enable renovation financing for borrowers still building credit or recovering from past challenges.

Initial investment requirements – Minimum contributions follow standard FHA guidelines applied to the after-improved value. The after-improved value includes both purchase price and renovation costs, meaning your equity contribution applies to the complete project cost.

Property eligibility standards – Properties must be at least one year old (with exceptions for new construction needing repairs). The renovated property must meet all FHA minimum property standards after improvements complete. Properties in severe disrepair requiring extensive structural work may exceed program capabilities or feasibility.

Renovation scope requirements – All improvements must be eligible under FHA guidelines, completed within maximum timeframes (typically six months), and result in properties meeting or exceeding FHA minimum property standards. Luxury improvements that don’t add value proportionate to cost may face scrutiny.

Contractor qualifications – Standard 203k loans require licensed contractors for most work, with specific insurance and bonding requirements. Limited 203k loans may allow owner-builders for minor projects, though contractor completion typically proceeds more smoothly.

Reserve requirements – FHA 203k loans often require contingency reserves (typically 10-20% of renovation costs) for unexpected expenses during construction. These reserves protect against cost overruns, change orders, or unforeseen issues discovered during renovations.

Maximum renovation amounts – While no absolute caps exist, practical limits apply based on after-improved values relative to FHA loan limits for your area. Renovation costs must be reasonable relative to the resulting property value to ensure the investment makes financial sense.

How Does the FHA 203k Loan Process Work?

Understanding the step-by-step process helps you navigate FHA 203k financing successfully. The timeline extends beyond traditional home purchases due to renovation planning and execution phases.

Step 1: Find and offer on a property – Identify properties needing improvements within your budget and renovation scope. Work with real estate agents experienced with 203k transactions who understand renovation financing timelines and contingencies.

Step 2: Apply for FHA 203k financing – Submit loan applications including preliminary renovation plans, contractor estimates, and property information. Lenders evaluate both your borrower qualifications and the renovation project feasibility.

Step 3: Property appraisal (as-is and after-improved) – FHA-approved appraisers assess current property value and project after-improved value based on your renovation plans. The after-improved appraisal determines your maximum loan amount.

Step 4: Renovation planning and documentation – For Standard 203k, work with HUD-approved consultants to create detailed work write-ups, specifications, and timelines. Limited 203k projects may need less formal documentation but still require contractor proposals and scopes of work.

Step 5: Loan approval and closing – Once renovations are planned and documented, lenders finalize approval based on complete project details. Closings establish escrow accounts holding renovation funds pending work completion.

Step 6: Renovation execution – Contractors begin improvements following approved plans and timelines. Work proceeds through stages with inspections at completion milestones before fund releases.

Step 7: Draw requests and inspections – As contractors complete renovation phases, they request draws from the escrowed renovation funds. Consultants or lenders inspect completed work, verify quality and compliance, then release funds.

Step 8: Final inspection and project completion – After all improvements complete, final inspections verify the property meets FHA standards and matches approved plans. Remaining renovation funds (minus contingency reserves) release to contractors.

How long does the FHA 203k process take? Expect 45-90 days from application to closing, then 3-6 months for renovation completion depending on project scope. Total timelines from offer to move-in typically span 4-9 months, requiring patience and flexibility.

Ready to discuss your purchase scenario? Submit a purchase inquiry to explore your options.

What Renovations Qualify for FHA 203k Financing?

Understanding eligible improvements helps you plan renovation projects that maximize property value while meeting FHA guidelines. The program accommodates most improvements enhancing property value, functionality, or safety.

Eligible improvements include:

- Structural repairs including foundations, framing, and load-bearing walls

- Complete kitchen and bathroom remodeling

- Plumbing system repairs or replacements

- Electrical system upgrades and repairs

- HVAC system installation or replacement

- Roofing repairs or replacement

- Exterior improvements including siding, windows, and doors

- Interior improvements including flooring, painting, and finishes

- Accessibility modifications for disabled family members

- Energy efficiency improvements

- Septic system or well repairs

- Detached structure improvements (garages, sheds)

- Landscape improvements directly related to property value

Improvements with restrictions or limitations:

- Swimming pools (only when documented as value-adding in the market)

- Luxury items not standard in the neighborhood

- Temporary structures or improvements

- Commercial equipment or improvements

- Improvements benefiting adjacent properties

Prohibited improvements:

- Luxury improvements disproportionate to property value

- Personal property not affixed to real estate

- Recreational items like hot tubs or outdoor kitchens (unless standard in area)

- Improvements violating zoning or building codes

Can you handle some work yourself? Limited 203k may allow owner-completion of minor tasks like painting, landscaping, or cosmetic work with lender approval. Standard 203k typically requires licensed contractors for significant improvements, though you might handle non-structural finishing work with permission.

See how other borrowers have successfully used FHA 203k financing:

What Property Types Qualify for an FHA 203k Loan?

An FHA 203k loan program accommodates various property categories for primary residence purposes with renovation needs. Understanding eligibility helps you focus your property search appropriately.

Eligible property types:

- Single-family detached homes needing rehabilitation

- Townhomes and row houses requiring improvements

- Condominiums in FHA-approved developments (with restrictions)

- Multi-unit properties (2-4 units) with owner occupancy

- Mixed-use properties with residential primary use

- Properties requiring relocation onto new foundations

Can you purchase investment properties with an FHA 203k loan? No, FHA financing serves primary residences only. However, multi-unit properties (duplexes, triplexes, fourplexes) qualify when you occupy one unit. This house-hacking strategy enables renovation financing for rental properties while establishing homeownership.

What about properties with severe damage? FHA 203k loans can accommodate properties in significant disrepair including homes missing major systems, having structural issues, or requiring extensive rehabilitation. However, properties must be structurally sound enough that renovations are feasible and economically justifiable.

Are there location restrictions? FHA 203k financing works nationwide in urban, suburban, and rural markets. Properties must be permanent structures on permanent foundations. Mobile homes or properties on leased land face restrictions or prohibitions.

Can you demolish and rebuild? The program accommodates substantial renovations but generally prohibits complete demolition and rebuilding. The existing structure must remain with at least one wall standing throughout the renovation. Ground-up construction requires construction loan financing rather than 203k programs.

Calculate your FHA 203k loan scenario:

What Documentation Does an FHA 203k Loan Require?

Understanding the specific documentation requirements helps you prepare for a smooth application process. An FHA 203k loan requires standard FHA documentation plus renovation-specific materials.

Standard FHA documentation:

- W-2 forms and pay stubs for income verification

- Tax returns for the past two years

- Bank statements covering recent months

- Credit report authorization

- Government-issued identification

- Employment verification

- Purchase contract for the property

Renovation-specific documentation:

- Detailed contractor proposals with line-item costs

- Work specifications and scopes of work

- Architectural plans (for Standard 203k structural changes)

- Building permits and approvals

- Contractor licenses and insurance certificates

- Renovation timeline and schedule

- Material specifications for improvements

- Before photos documenting current condition

For Standard 203k:

- HUD consultant feasibility study

- Detailed work write-up prepared by consultant

- Architectural or engineering plans as needed

- Contractor bids based on consultant specifications

- Draw schedule showing payment milestones

For Limited 203k:

- Contractor proposals meeting minimum detail requirements

- Simplified renovation plan

- Cost breakdown by improvement category

- Timeline showing expected completion dates

How detailed must renovation plans be? Standard 203k requires comprehensive specifications enabling contractors to bid accurately and inspectors to verify completion. Limited 203k allows simpler documentation but still needs sufficient detail for appraisers to estimate after-improved values and lenders to approve projects.

Common FHA 203k Loan Questions

Can you live in the property during renovations?

Whether you can occupy properties during FHA 203k renovations depends on the scope and safety considerations. Limited 203k projects involving cosmetic improvements often allow occupancy during work. Standard 203k projects involving major systems, structural work, or health hazards typically require alternative housing during renovation periods.

Occupancy considerations:

- Safety requirements prohibiting occupancy during hazardous work

- Local building code requirements during construction

- Contractor access needs and work schedules

- Habitability standards for occupied properties

- Mortgage payment obligations beginning before occupancy

Many borrowers maintain current housing through renovation periods, moving into properties once substantial completion occurs and certificates of occupancy issue.

What happens if renovation costs exceed initial estimates?

Renovation projects frequently encounter unexpected issues—hidden damage, code compliance requirements, or material cost increases—causing budgets to exceed original estimates. The contingency reserve (typically 10-20% of renovation costs) addresses these overruns.

Cost overrun management:

- Draw from contingency reserves for unexpected expenses

- Request loan modifications if issues substantially exceed reserves

- Reduce renovation scope by eliminating non-essential improvements

- Contribute personal funds to cover excess costs

- Work with contractors to value-engineer solutions

Thorough pre-renovation inspections and conservative estimating help minimize surprise expenses, though some uncertainty is inevitable with older properties.

How long do you have to complete renovations?

FHA 203k loans establish maximum renovation completion timeframes—typically six months from closing. Extensions may be available with lender approval when circumstances justify delays, but the program requires timely completion.

Timeline considerations:

- Weather delays extending construction periods

- Material availability affecting project schedules

- Contractor scheduling and labor availability

- Complexity of improvements affecting timelines

- Permit and inspection delays from local authorities

Planning realistic timelines with experienced contractors and building buffer time into schedules helps ensure completion within required timeframes.

Can you change renovation plans after approval?

Change orders—modifications to approved renovation plans—are possible but require lender approval, potentially revised appraisals, and updated documentation. Minor changes like material substitutions typically process smoothly. Major scope changes may require substantial re-evaluation.

Change order requirements:

- Written documentation of proposed changes

- Revised cost estimates from contractors

- Lender review and approval

- Possible appraisal updates for significant changes

- Consultant review for Standard 203k projects

Minimizing change orders through thorough upfront planning saves time and maintains project momentum.

How Do FHA 203k Loan Costs Compare to Standard FHA Financing?

Understanding the cost implications helps you evaluate whether FHA 203k financing fits your budget and strategy. The program involves standard FHA costs plus renovation-specific expenses.

Standard FHA costs:

- Upfront mortgage insurance premium (a percentage of loan amount)

- Annual mortgage insurance premium (divided into monthly payments)

- Origination fees and lender charges

- Appraisal fees

- Title insurance and closing costs

Additional 203k-specific costs:

- Supplemental origination fees (typically higher than standard FHA)

- HUD consultant fees for Standard 203k

- Multiple inspection fees throughout renovation

- Contingency reserves (percentage of renovation budget)

- Architectural or engineering fees when required

- Additional appraisal fees for after-improved valuations

Are FHA 203k rates competitive with standard FHA loans? Interest rates on FHA 203k loans typically match or slightly exceed standard FHA rates. The modest rate premium reflects the additional complexity, administration, and risk inherent in renovation financing compared to standard purchase transactions.

Can you finance the additional costs? Most 203k-specific fees and costs can finance within your loan amount rather than requiring cash payment. This approach preserves capital for other needs though it increases your total loan balance and monthly payment obligations.

What’s the total cost premium? Expect FHA 203k total costs to exceed standard FHA purchases by several thousand dollars due to consultant fees, additional inspections, and administrative expenses. However, these costs are typically modest compared to the property value you create through strategic renovations.

What Are the Advantages of an FHA 203k Loan?

Understanding the specific benefits helps you evaluate whether this financing approach aligns with your homeownership strategy. An FHA 203k loan offers distinct advantages for buyers in specific market conditions or with renovation goals.

Key advantages include:

Single-close convenience – Complete your purchase and renovation financing in one transaction rather than navigating separate purchase mortgages followed by home equity loans, personal loans, or cash funding for improvements. This streamlined approach simplifies financing and reduces total closing costs.

Build instant equity through improvements – Purchase properties below market value, fund renovations that enhance value substantially, and create equity immediately upon completion. Strategic improvements in the right properties can generate equity exceeding renovation costs.

Accessible equity requirements – Access renovation financing with modest initial investments on the after-improved value. Traditional renovation financing often requires larger equity contributions, making FHA 203k far more accessible for buyers with limited savings.

Flexible credit requirements – FHA’s accessible credit score minimums extend to renovation scenarios, enabling borrowers with moderate credit to undertake improvement projects that conventional rehab programs wouldn’t accommodate.

Compete in tight markets – Make offers on properties other buyers avoid due to condition issues. While competitors focus on move-in ready homes creating bidding wars, you can target fixers with less competition and negotiate better purchase prices.

Customize homes during acquisition – Rather than purchasing homes then living with existing features while saving for future improvements, customize properties during initial acquisition. Move into homes reflecting your preferences rather than previous owners’ choices.

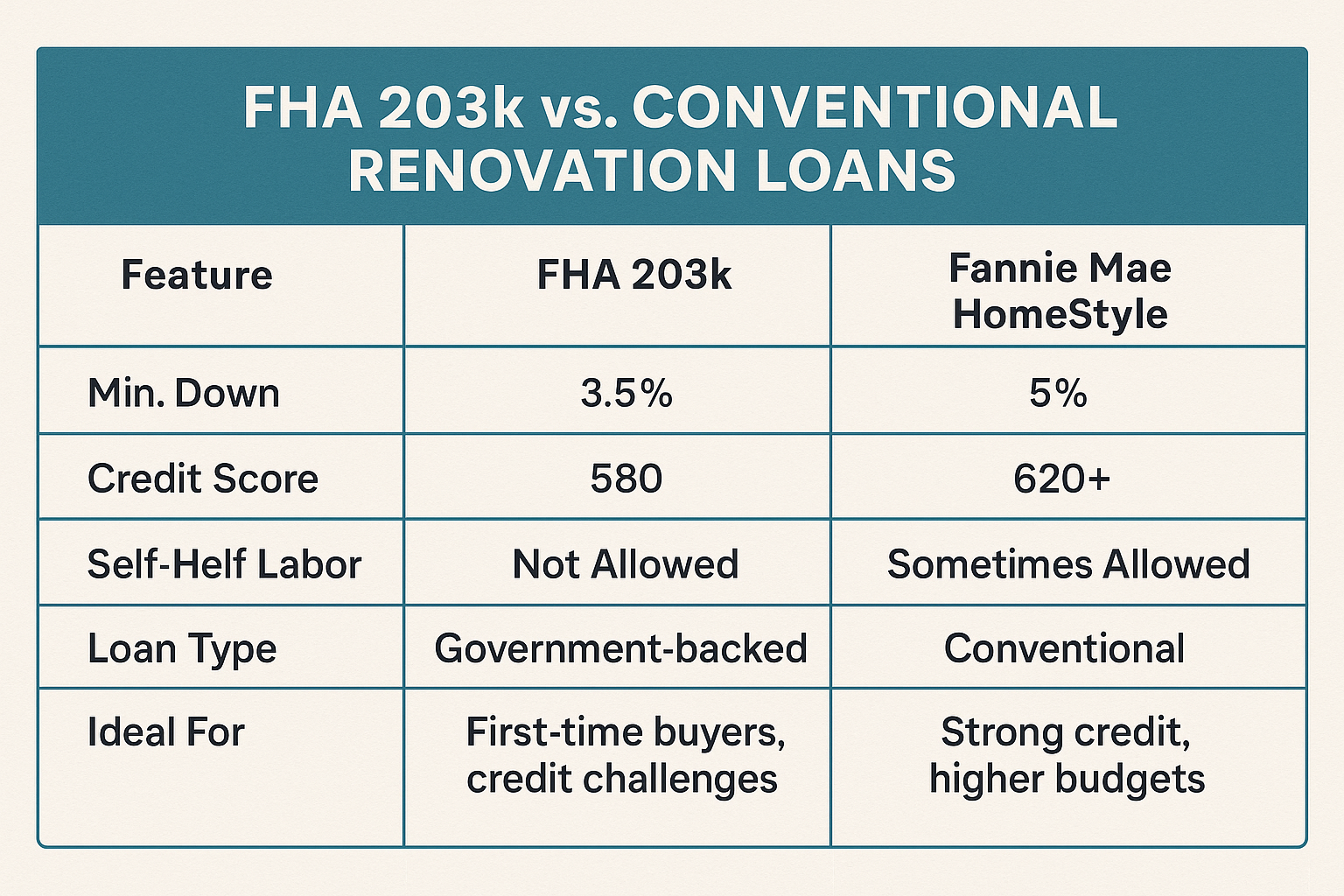

Alternative Loan Programs for Purchase-and-Renovate Scenarios

If an FHA 203k loan isn’t the right fit, consider these alternatives:

- HomeStyle Renovation Loan – Conventional purchase-plus-renovation financing with potentially lower mortgage insurance costs

- Home Improvement Loan – Finance renovations on properties you already own

- FHA Loan – Standard FHA financing for properties in move-in ready condition

- Construction Loan – Build new construction from the ground up rather than renovating existing properties

- HELOC – Access equity from your current home to fund renovations after purchase

Explore all 30+ loan programs to find your best option.

Not sure which program is right for you? Take our discovery quiz to find your path.

Advanced FHA 203k Loan Questions

Can you use FHA 203k for condo renovations?

Condominium renovation through FHA 203k programs faces significant restrictions. The condo development must be FHA-approved, renovations cannot alter exterior elements or common areas, and improvements must stay within your unit boundaries. Additionally, condo associations may restrict renovation types, timelines, or contractor access.

Many condo associations prohibit the extensive renovations FHA 203k typically funds, making this program less practical for condo purchases compared to single-family homes or multi-unit properties where you control renovation decisions.

What if you’re self-employed—can you still qualify?

Yes, self-employed borrowers qualify for FHA 203k loans using the same documentation requirements as standard FHA financing. You’ll provide business tax returns, profit and loss statements, and verification of business continuity. The renovation financing doesn’t change self-employment qualification standards.

The combination of self-employment documentation and renovation planning creates more extensive paperwork than standard purchases, but the program remains accessible when you meet FHA’s self-employment income verification requirements.

How do FHA 203k loans handle lead paint requirements?

Properties built before 1978 potentially contain lead-based paint requiring specific protocols during renovation. FHA 203k projects must comply with HUD lead-safe housing rules including:

- Lead hazard assessments before renovation

- Lead-safe work practices during improvements

- Certified contractor use for lead paint removal

- Clearance testing after lead paint work completes

- Disclosure and documentation requirements

These requirements protect occupants from lead exposure but add costs and complexity to pre-1978 property renovations.

Can you purchase foreclosures or short sales with FHA 203k?

Yes, FHA 203k loans work excellently for foreclosed or short-sale properties that often need repairs due to deferred maintenance or intentional damage. Banks and sellers motivated to sell distressed properties often accept offers contingent on 203k financing.

However, 203k timelines extend longer than conventional purchases, potentially making sellers prefer faster-closing offers. Strong offers, earnest money deposits, and proof of financing help overcome seller concerns about extended closings.

What happens to your mortgage payment during renovations?

Your full mortgage payment—including principal, interest, taxes, insurance, and mortgage insurance—begins immediately after closing even though renovations are incomplete. You’re paying the mortgage while living elsewhere (if the property is uninhabitable during work) and before you can move in.

This dual housing cost period—maintaining current housing plus paying the new mortgage—requires financial planning and reserves. Many borrowers time renovations to align with lease expirations or plan for this overlap expense.

Can you get FHA 203k for properties with foundation issues?

Foundation problems qualify as eligible improvements under Standard FHA 203k programs when repairs are feasible and cost-effective relative to property value. Severe foundation issues requiring extensive repairs may exceed program practicality or create situations where total renovation costs approach property values.

Foundation repairs require licensed engineers’ assessments, detailed specifications, and experienced contractors. These complex projects typically need Standard 203k consultant oversight rather than Limited 203k streamlined processes.

How do energy efficiency improvements affect FHA 203k financing?

Energy efficiency improvements including insulation, windows, HVAC systems, and weatherization qualify as eligible 203k improvements. Additionally, FHA offers Energy Efficient Mortgages (EEM) that can increase loan amounts above standard FHA limits when energy improvements create sufficient utility cost savings.

Documenting projected energy savings through energy audits or professional assessments supports financing additional amounts for efficiency improvements that may exceed typical FHA limits.

What if you want to convert a property to different use?

Converting properties from one configuration to another—such as turning single-family homes into duplexes, converting garages to living space, or creating accessory dwelling units—requires careful review of:

- Local zoning allowing the conversion

- Building codes and permit requirements

- FHA eligibility after conversion

- Property value after conversion supporting loan amount

Many conversions are possible through Standard 203k programs when they comply with local regulations and create value. However, some conversions may violate zoning or create configurations ineligible for FHA financing.

Can foreign nationals qualify for FHA 203k loans?

Foreign nationals face the same restrictions for FHA 203k as standard FHA loans—generally requiring U.S. citizenship or lawful permanent resident status. Non-permanent resident aliens may qualify with appropriate work visas and employment authorization, but documentation requirements increase.

The complexity of combining foreign national financing with renovation lending makes these transactions uncommon. Alternative financing through portfolio lenders or conventional renovation programs may provide more accessible options for non-citizens.

How do you find contractors experienced with FHA 203k?

Finding contractors familiar with FHA 203k processes improves project success. Resources for locating qualified contractors include:

- HUD consultant referrals to contractors with 203k experience

- Local FHA-approved lenders maintaining contractor databases

- Contractor association directories emphasizing rehab specialization

- Real estate agents or property managers with renovation experience

- Online reviews and references from previous 203k projects

Interview multiple contractors, verify licenses and insurance, check references, and ensure they understand 203k draw processes, inspection requirements, and timeline expectations before engaging them for your project.

Ready to get started? Apply now or schedule a call to discuss your situation.

Helpful FHA 203k Loan Resources

Official Government Guidance:

HUD 203k Loan Program Information – Department of Housing and Urban Development official resource on FHA 203k rehabilitation mortgage programs, eligible improvements, consultant requirements, and application processes for purchase-and-renovate financing.

FHA 203k Handbook Guidance – HUD comprehensive handbook section on 203k loan underwriting standards, renovation requirements, draw processes, and program administration for borrowers and lenders.

CFPB Renovation Loan Information – Consumer Financial Protection Bureau guidance explaining renovation mortgage programs including FHA 203k, qualification requirements, and comparison to other rehab financing options.

Industry Organizations:

HUD 203k Consultant Directory – Department of Housing and Urban Development directory of HUD-approved 203k consultants required for Standard 203k projects, searchable by state and region.

National Association of Home Builders Remodeling Resources – Industry organization providing education on renovation standards, contractor qualifications, and best practices for residential rehabilitation projects.

Educational Resources:

HUD 203k Borrower Handbook – Department of Housing and Urban Development comprehensive borrower guide explaining 203k loan processes, renovation planning, contractor selection, and draw procedures step-by-step.

EPA Lead-Safe Renovation Information – Environmental Protection Agency guidance on lead-safe work practices for pre-1978 home renovations, contractor certification requirements, and compliance obligations for rehabilitation projects.

Need local expertise? Get introduced to trusted partners including loan officers, contractors, and renovation specialists in your area.

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Not Sure About Your Next Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required