FHA 203k Loan: Medical Technician Transforms Fixer-Upper into Dream Home with Renovation Financing

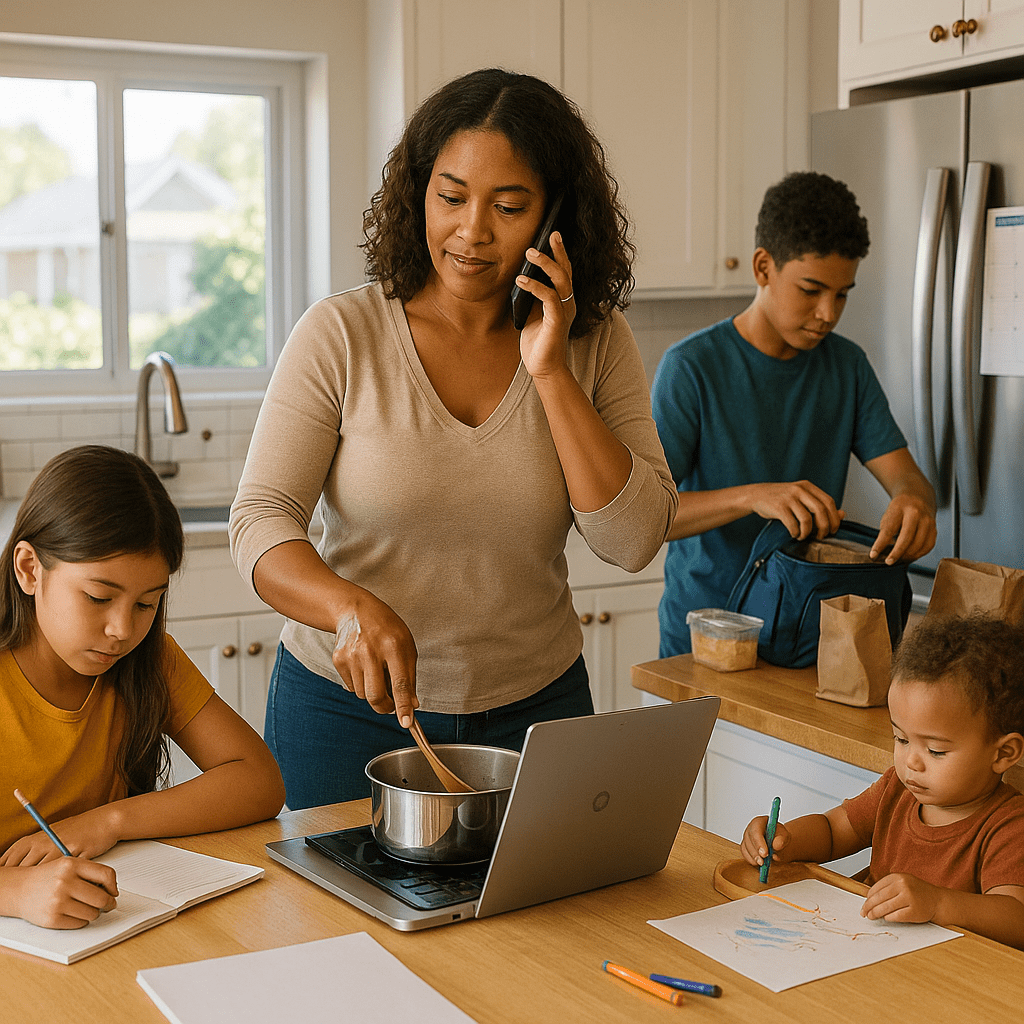

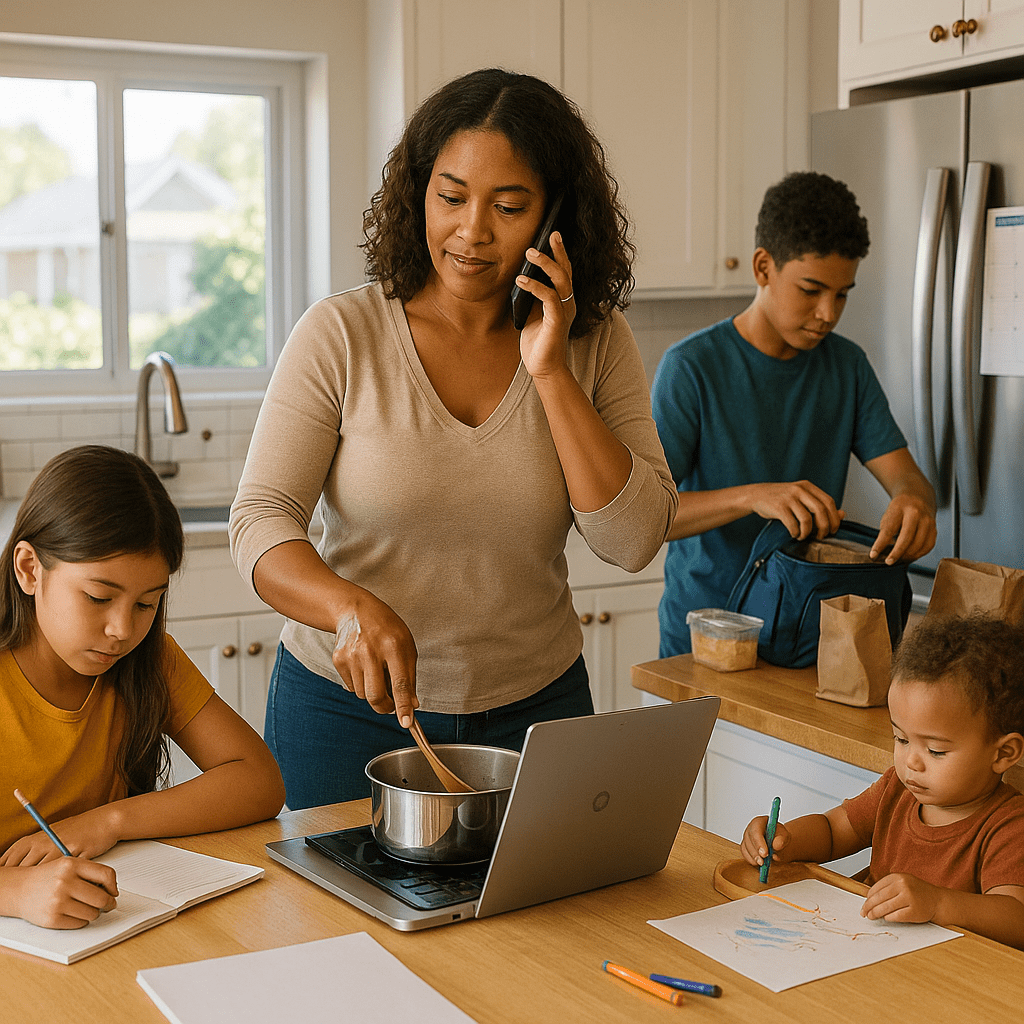

Learn how Sarah K., a 29-year-old medical technician, turned her fixer-upper into her dream home

Compare payments, explore possibilities, and discover the perfect loan fit—whether you’re going full-doc with the best rates or thinking outside the box with one of our 250+ custom lending solutions.

Learn how Sarah K., a 29-year-old medical technician, turned her fixer-upper into her dream home

Emily R. is an elementary school teacher in Tampa who struggled with buying a house

Carlos M., a successful restaurant owner in Miami, faced unexpected challenges when refinancing his mortgage despite a solid payment history and good income. Traditional lenders turned down his applications due to complicated income paperwork from his tax-efficient business setup. Find out how Carlos found stated income loan refinance programs, which assess income using bank statements instead of strict tax returns, helping him achieve significant monthly savings and better cash flow. This case study shows the benefits of alternative financing options for self-employed borrowers facing similar issues. Ready to explore your options?

David R., an architect, faced hurdles in refinancing his home to buy a commercial building for his growing firm. Despite his good income and perfect credit, traditional lenders declined due to complicated income documents. Discover how David accessed his home equity through a stated income loan cash-out refinance, allowing him to purchase the property and reduce rental costs. This case study highlights the benefits of alternative financing for business owners. Ready to explore your options?

Patricia M., a healthcare administrator, faced a financial nightmare after inheriting a property that quickly spiraled into a foreclosure crisis due to nightmare tenants. With traditional lenders offering no solutions, she discovered the transformative power of hard money loan cash-out refinance. This unique financing option not only stopped the foreclosure but also provided the funds needed for extensive repairs, allowing her to honor her aunt’s legacy. Dive into this compelling case study to learn how hard money financing can rescue distressed properties and preserve valuable equity when time is of the essence.

Discover how Jennifer S., a savvy financial advisor, transformed her investment strategy by refinancing her resort condo in Destin, Florida. Despite facing rejection from traditional lenders due to her property’s hotel management program, she found specialized lenders who understood the unique nature of resort condos. This case study reveals how Jennifer secured favorable refinancing terms, significantly improved her cash flow, and accelerated her path to financial independence. Learn about the challenges she faced, the innovative solutions she discovered, and how you too can optimize your resort property investments for greater profitability.

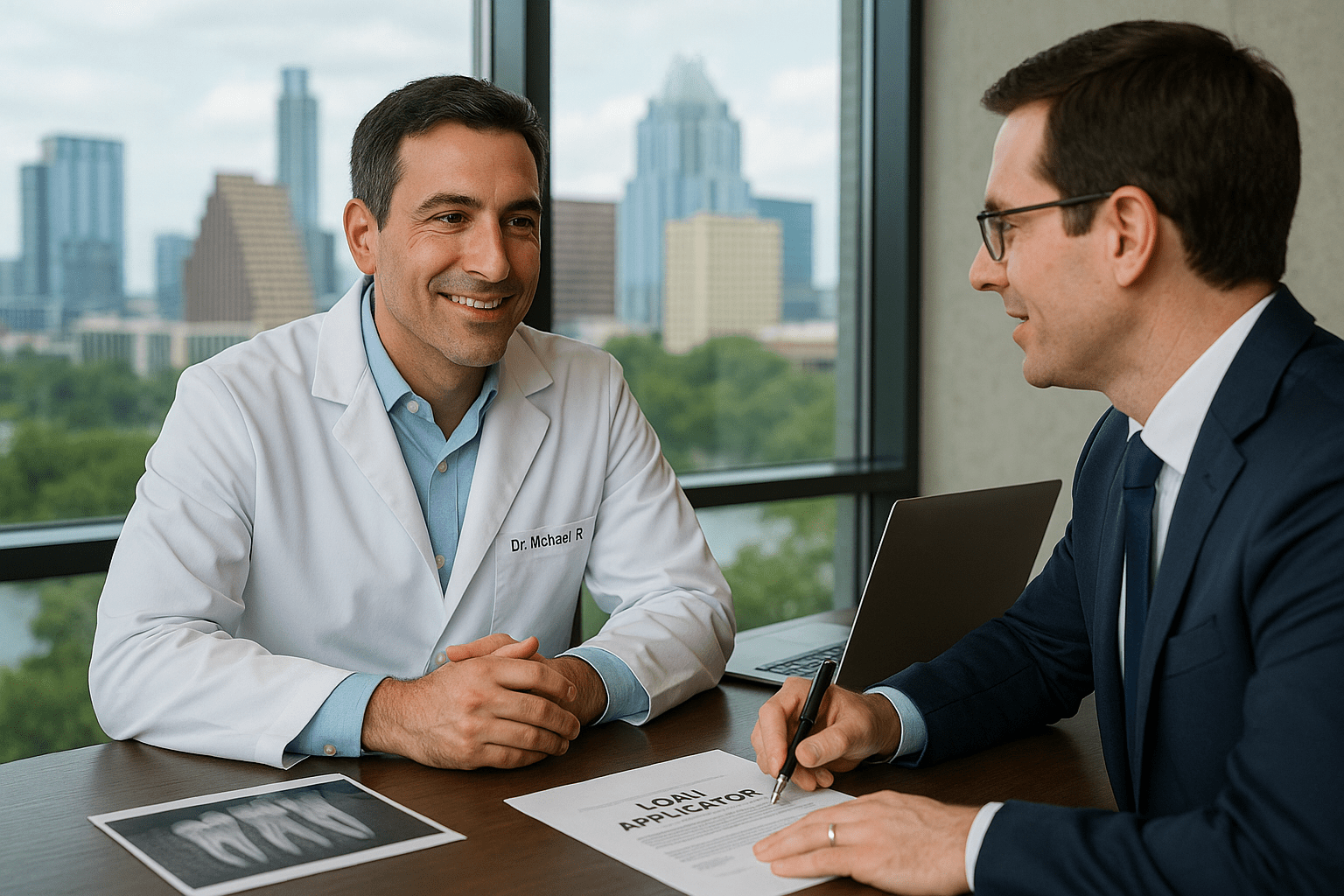

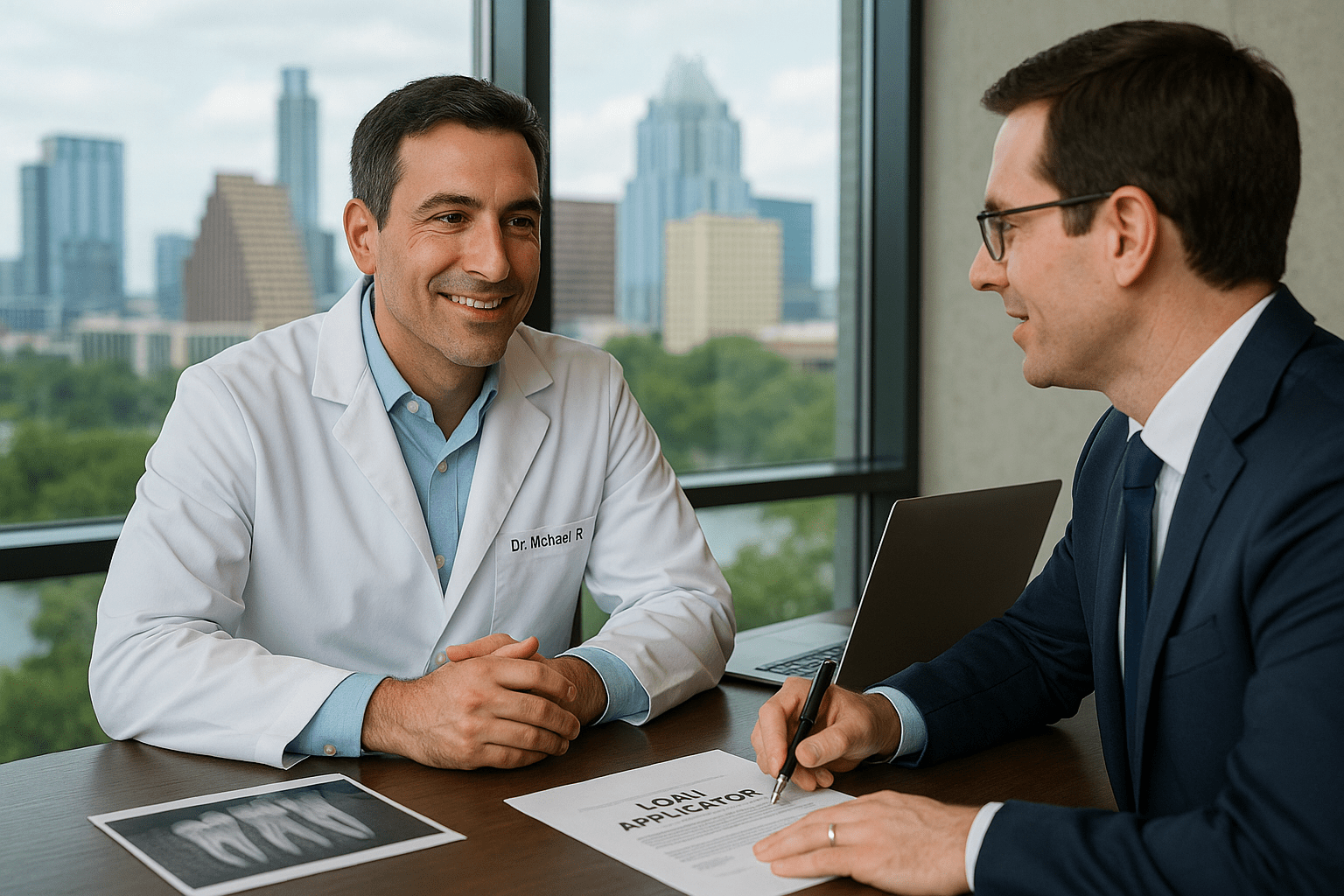

Dr. Michael R., a successful orthodontist, faced challenges when trying to refinance his resort condo to buy a fourth investment property. Even with a strong financial background, traditional lenders turned him down because the property was a “non-warrantable condo.” Determined to succeed, Michael found specialized lenders who understood resort condos. This case study shows how he accessed equity, grew his investment portfolio, and moved closer to financial independence. Want to see how specialized financing can boost your investments? Discover Michael’s journey and explore your options!

Rebecca L., a savvy real estate attorney, faced unexpected challenges when seeking a cash-out refinance on her successful condotel investment. Despite her strong financial profile and legal expertise, traditional lenders categorically rejected her application due to the unique nature of condotel properties. Frustrated but determined, Rebecca discovered specialized lenders who understood the value of hotel-condo investments. This pivotal moment unlocked the capital she needed to purchase a second vacation rental property, accelerating her wealth-building strategy. Dive into Rebecca’s journey and learn how specialized financing can transform your investment opportunities!

Carlos R., a successful restaurant owner in San Diego, faced a common challenge: traditional lenders couldn’t see past his tax returns, which showed artificially reduced income due to legitimate business deductions. Frustrated but determined, he discovered P&L loan refinance programs that evaluated his actual business profitability instead. This innovative approach allowed him to secure a significantly lower interest rate, reduce his monthly payments, and improve cash flow. Curious about how Carlos transformed his financial future and optimized his investment strategy? Read on to explore the powerful impact of P&L loan refinancing for self-employed business owners like him.

Master Sergeant (Ret.) David L., a 45-year-old Air Force veteran, faced a common challenge: accessing the equity in his home for much-needed renovations without taking on high-interest debt. After exploring traditional options like home equity loans and HELOCs, he discovered the VA loan cash-out refinance—a solution that allowed him to tap into his home’s value while maintaining a single, predictable monthly payment. This strategic move not only funded his kitchen remodel and pool installation but also positioned his home competitively for the future. Curious about how he did it? Read on to learn more about his journey!

Discover how Jason, a self-employed digital marketing consultant, unlocked his home equity through a P&L loan cash-out refinance, overcoming traditional lending hurdles. Faced with the challenge of accessing capital for a crucial business acquisition, Jason learned that conventional lenders couldn’t see past his tax returns. With the help of a specialized lender, he leveraged his current business performance instead, allowing him to secure the funds needed to double his agency’s capacity. Explore Jason’s journey and see how this innovative financing solution can empower self-employed homeowners to achieve their financial goals.

Discover how Michelle, a successful e-commerce entrepreneur, unlocked substantial equity from her home to fund a critical business expansion without the hassle of traditional income verification. Frustrated by conventional lenders’ demands for extensive documentation, she turned to a no-doc loan cash-out refinance, allowing her to access the capital she needed quickly. This innovative financing solution not only supported her growth strategy but also preserved her financial flexibility. Learn how Michelle leveraged her real estate equity to accelerate her wealth-building journey and explore if a no-doc loan could be the right fit for you!

Facing the challenges of divorce, Chief Petty Officer (Ret.) Jennifer K. found herself in a tough spot—she needed to refinance her home to remove her ex-husband from the mortgage. Conventional lenders complicated the process, treating it as a cash-out refinance, leading to higher rates and costs. However, a conversation with a fellow veteran opened her eyes to VA loan refinance options that could simplify her situation. Discover how Jennifer navigated this emotional journey and secured a fresh start for her and her daughter through a VA loan refinance tailored for life changes like divorce.

Discover how Robert, a successful HVAC business owner, transformed his financial future through a no-doc loan refinance. Faced with the challenges of traditional lenders requiring extensive income documentation, Robert found a solution that recognized his true financial strength without compromising his tax-efficient strategies. In just 26 days, he secured a significantly lower interest rate, resulting in substantial monthly savings. These savings are now fueling his retirement investments, children’s education, and dreams of a mountain vacation property. Ready to explore how a no-doc loan refinance can work for you? Read on to learn more!

Discover how Amanda, a successful e-commerce business owner, tackled mortgage challenges to buy her first home with a P&L loan.

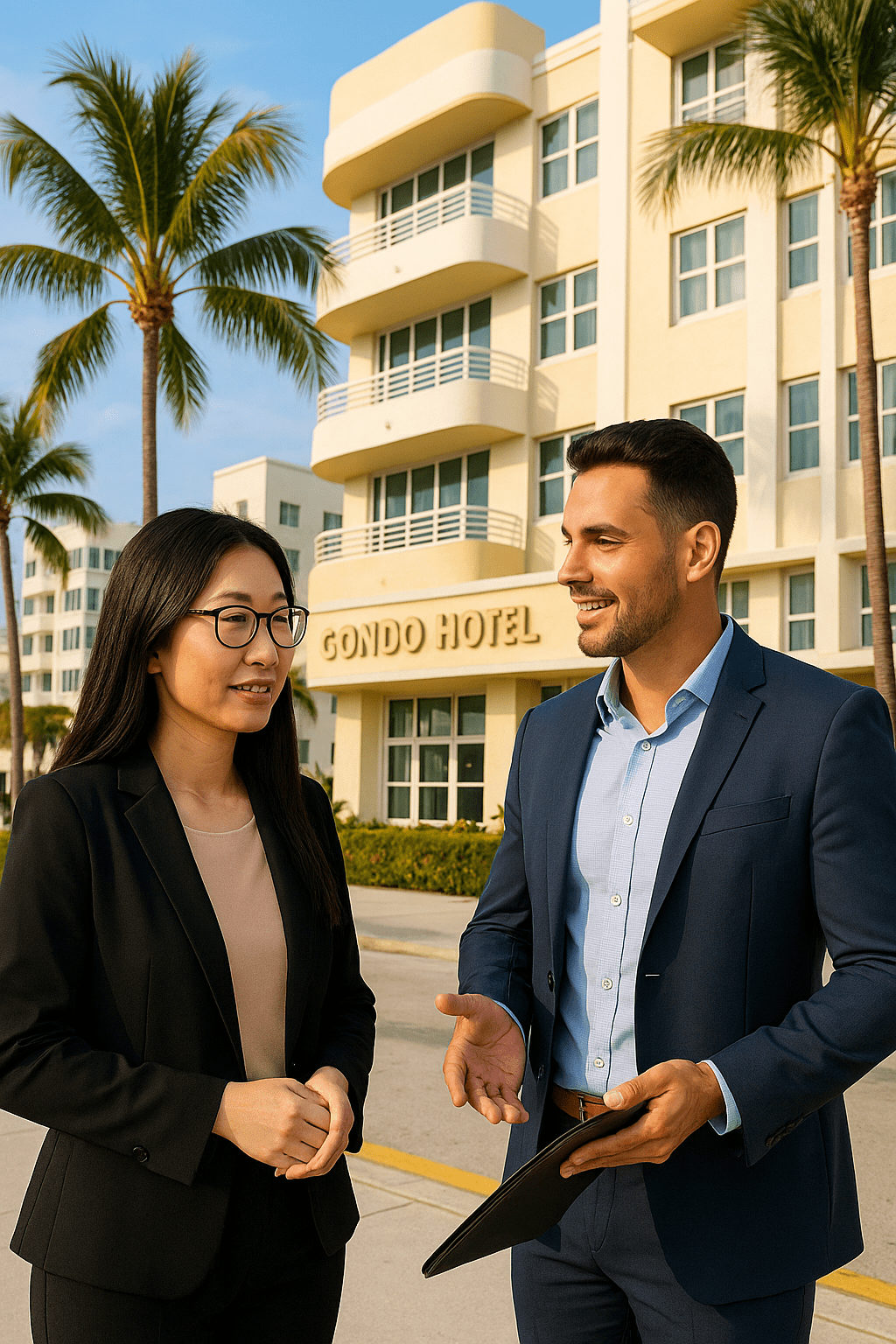

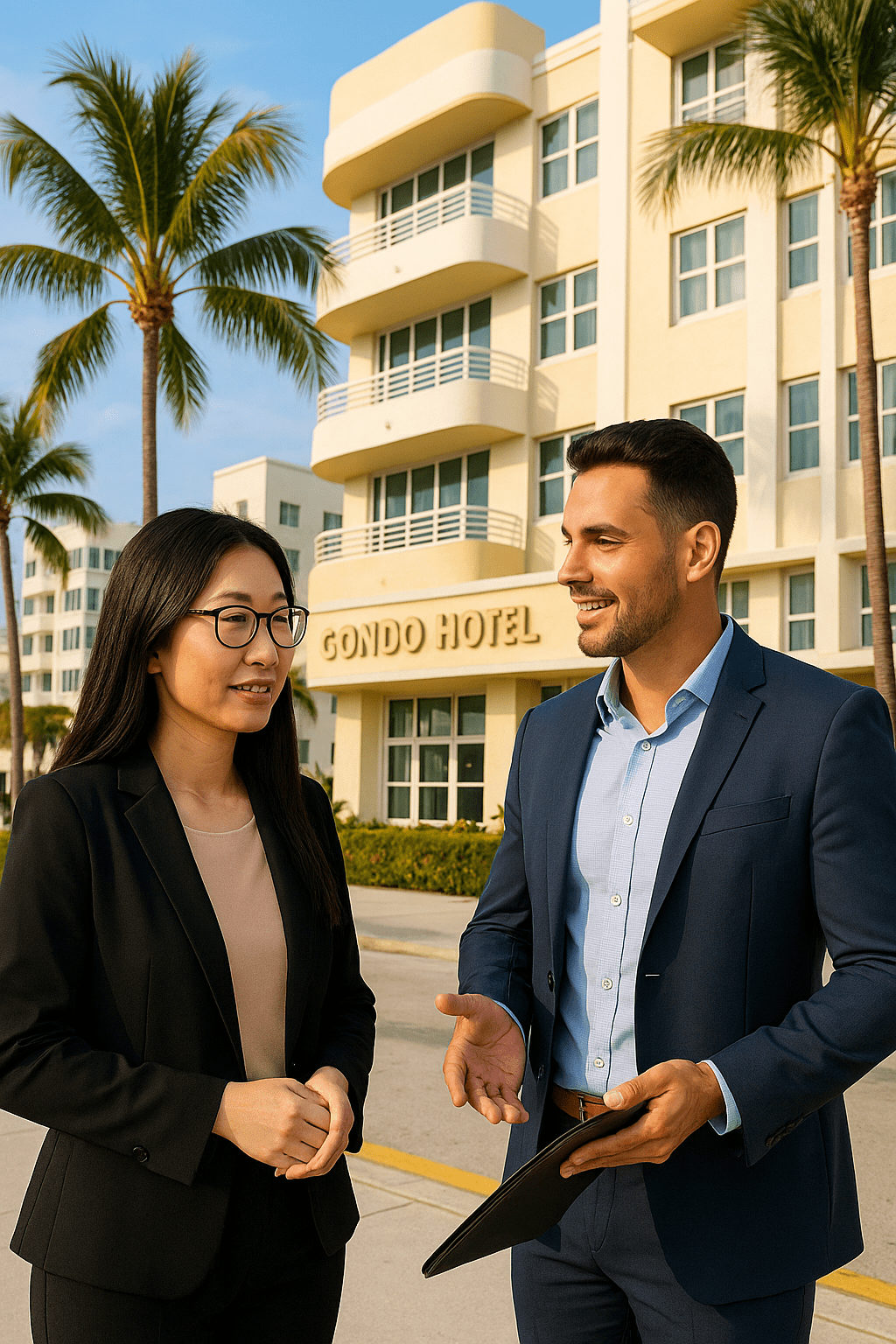

Discover how Jennifer K., a financial advisor, overcame the challenges of purchasing a non-warrantable condo in Miami despite facing rejection

Jennifer M. is a dedicated nurse who always wanted to build her own home on family land in St. Johns

Michael R., a 27-year-old physical therapist, faced the classic first-time buyer dilemma: he wanted to own a home but struggled

Elena S., a successful restaurant owner in Tampa, faced rejection from traditional lenders when trying to purchase her first rental

In the competitive Silicon Valley real estate market, David Martinez, a financial advisor, faced the daunting challenge of upgrading his

Learn how James R., a general contractor from Brooksville, Florida, made his dream of building a custom home come true

Discover how Commander James R., a Navy veteran, turned his dream of building a custom home into reality without a

Carlos M., a successful restaurant owner in Houston, faced a tough challenge: buying a home without a Social Security number.

Discover how Sarah, a dedicated teacher and enrolled member of the Seminole Tribe of Florida, overcame the challenges of conventional

Sarah M., a 29-year-old medical technician in Florida, faced the daunting challenge of homeownership with no savings for a down

By Jim blackburn By Jim blackburn Educational Case Study Disclosure This case study is hypothetical and for educational purposes only.

Discover how Amanda, a successful e-commerce business owner, tackled mortgage challenges to buy her first home with a P&L loan. Despite her business doing well and earning strong revenue, lenders rejected her because her tax returns showed lower income after deductions. Learn how P&L loans consider real business performance, helping self-employed people qualify based on their actual earnings. This creative financing option not only helped Amanda become a homeowner but also paved the way for her future real estate investment plans. Interested in your options? Check out Amanda’s inspiring story!

Discover how Jennifer K., a financial advisor, overcame the challenges of purchasing a non-warrantable condo in Miami despite facing rejection from traditional lenders. With a strong financial profile and a vision for building generational wealth, she found a specialized non-warrantable condo loan that recognized the property’s unique value. This case study highlights the importance of understanding alternative financing options and how they can unlock investment opportunities in desirable locations. Ready to explore your options and learn how to navigate the world of non-warrantable condo financing? Dive into Jennifer’s journey and uncover the strategies that made her investment dreams a reality.

Jennifer M. is a dedicated nurse who always wanted to build her own home on family land in St. Johns County. After struggling with traditional construction loans, she found the FHA construction loan program. This option provided a single-close process, lower down payment requirements, and allowed her to use her land’s value as equity. This smart financing choice helped her realize her dream, enabling her to design a custom home for her family. Discover how Jennifer achieved homeownership and built wealth through careful real estate decisions.

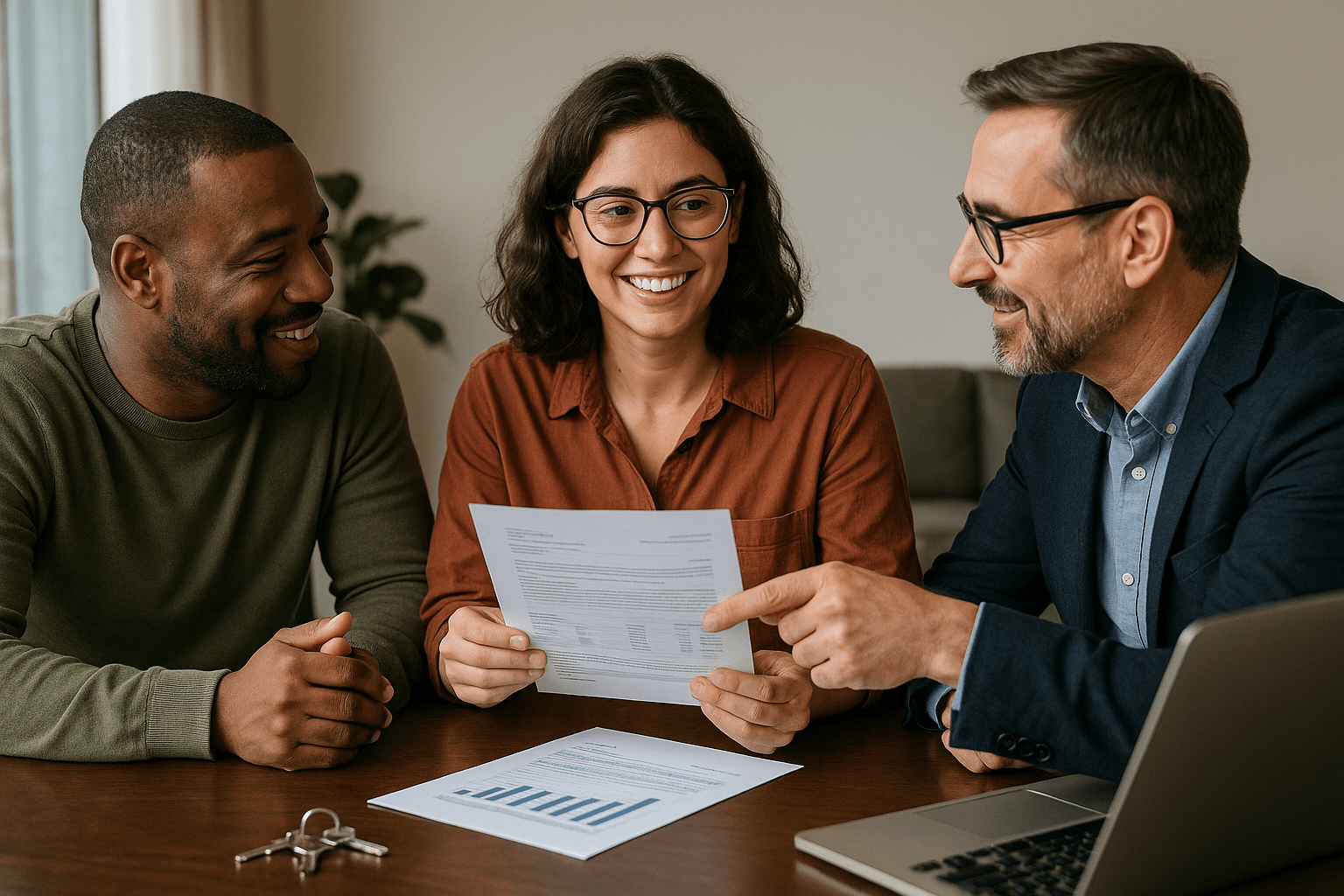

Learn how Sarah K., a 29-year-old medical technician, turned her fixer-upper into her dream home with an FHA 203k loan. In a tough housing market and needing to finance both the purchase and repairs, Sarah faced a dilemma. When traditional lenders couldn’t help her, a chat with a coworker revealed a financing option that combined everything into one simple mortgage. Discover how this loan program made homeownership possible for Sarah and put her on the path to building wealth through real estate.

Michael R., a 27-year-old physical therapist, faced the classic first-time buyer dilemma: he wanted to own a home but struggled to save a large down payment while paying rent. After encountering roadblocks with conventional lenders, he discovered FHA loans, which offered minimal down payment requirements and flexible credit criteria. This breakthrough allowed him to transition from renting to homeownership sooner than he thought possible. Join Michael on his journey to financial stability and learn how FHA financing can open doors for first-time buyers with modest savings and less-than-perfect credit.

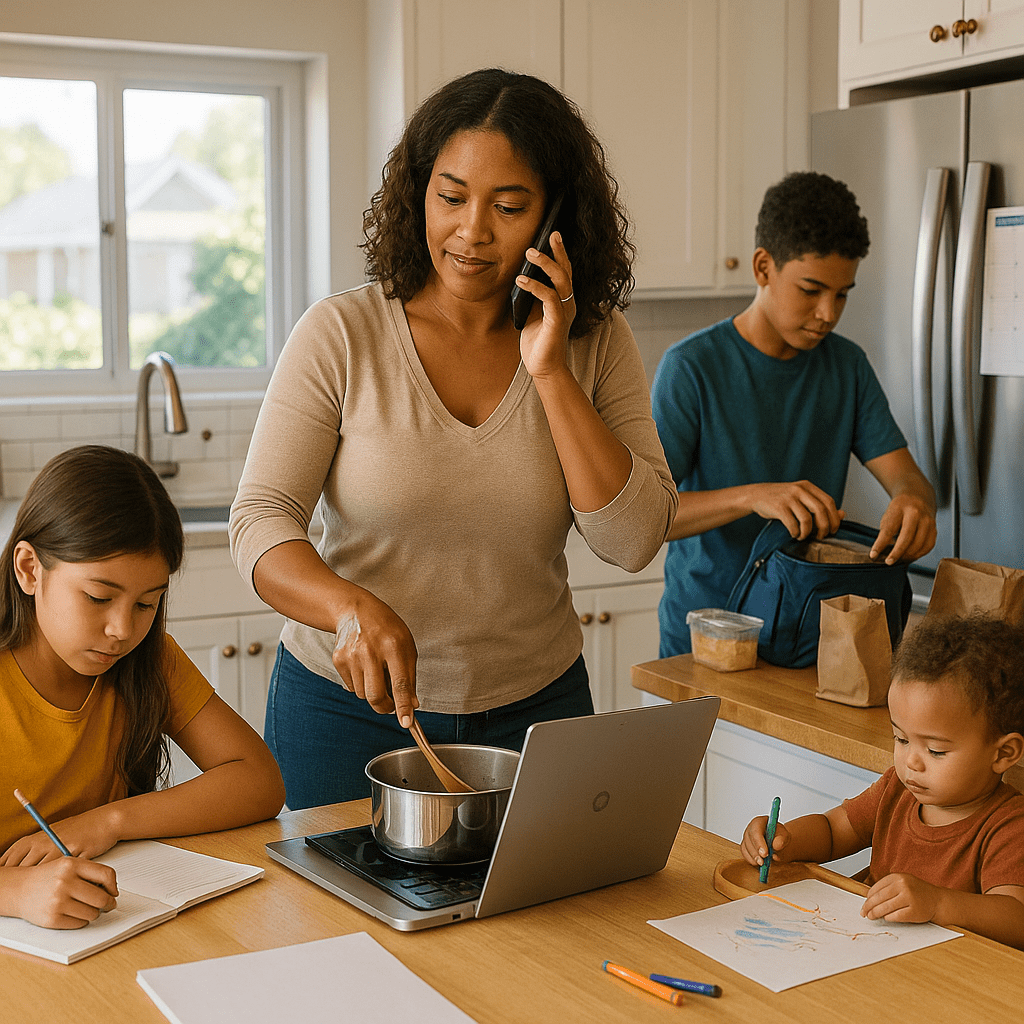

Emily R. is an elementary school teacher in Tampa who struggled with buying a house on her modest salary. Even though she had great credit and a steady income, rising home prices made it tough to save for a down payment. Everything changed when she found out about down payment assistance programs for teachers. With the help of a specialist, Emily learned about grants and loans that could help her afford her first home. Follow Emily’s journey from renting to owning, and see how she started building wealth through homeownership.

Elena S., a successful restaurant owner in Tampa, faced rejection from traditional lenders when trying to purchase her first rental property due to her tax returns. Despite strong cash flow and excellent credit, her legitimate business deductions minimized her taxable income, leaving her trapped. Discover how she turned her situation around by exploring bank statement loan programs designed for business owners like her. This innovative financing option allowed Elena to leverage her actual business deposits, unlocking the door to her real estate investment dreams and setting her on the path to building generational wealth for her family.

In the competitive Silicon Valley real estate market, David Martinez, a financial advisor, faced the daunting challenge of upgrading his family’s home. With multiple offers on desirable properties, he quickly learned that securing a jumbo loan pre-approval was crucial. After initial setbacks with traditional lenders, David discovered a specialized jumbo loan advisor who understood his unique financial profile. This partnership not only streamlined the approval process but also empowered him to make a compelling offer on his dream home. Discover how strategic jumbo financing helped David win a bidding war and secure his family’s forever home.

Learn how James R., a general contractor from Brooksville, Florida, made his dream of building a custom home come true with a USDA construction loan—requiring no down payment! After struggling with traditional lenders and their high down payment demands, James found a way to use his construction skills without draining his savings. Discover how he went through the approval process, built his dream home, and laid the groundwork for lasting wealth—all while living in a beautiful, energy-efficient home. Want to see your options? Check out James’s inspiring story!

Discover how Commander James R., a Navy veteran, turned his dream of building a custom home into reality without a down payment. After facing challenges with traditional construction loans, he learned about VA construction loans that offered zero down payment, a single closing process, and competitive rates. This innovative financing option enabled him and his family to create an energy-efficient home tailored to their needs, preserving their savings for the future. Ready to explore how a VA construction loan can work for you? Dive into James’s journey and unlock the potential of building your forever home!

Carlos M., a successful restaurant owner in Houston, faced a tough challenge: buying a home without a Social Security number. Even though his business was doing well and he paid rent on time, traditional lenders denied him. Learn how Carlos found ITIN loan programs that helped people in his situation. This case study shows his journey from rejection to acceptance, emphasizing the importance of different documentation and the chance to build wealth through homeownership. Join us to see how ITIN loans can help hardworking individuals and families achieve the American Dream.

Discover how Sarah, a dedicated teacher and enrolled member of the Seminole Tribe of Florida, overcame the challenges of conventional financing to achieve her dream of homeownership on tribal trust land. With limited savings and high down payment requirements, Sarah felt discouraged until she learned about the Section 184 loan program, specifically designed for Native Americans. This innovative financing solution not only made homeownership accessible but also allowed her to build equity and stay connected to her community. Read on to explore Sarah’s journey and how Section 184 loans can empower Native American families to achieve their homeownership goals.

Carlos M., a successful restaurant owner in Miami, faced unexpected challenges when refinancing his mortgage despite a solid payment history

David R., an architect, faced hurdles in refinancing his home to buy a commercial building for his growing firm. Despite

Patricia M., a healthcare administrator, faced a financial nightmare after inheriting a property that quickly spiraled into a foreclosure crisis

Discover how Jennifer S., a savvy financial advisor, transformed her investment strategy by refinancing her resort condo in Destin, Florida.

Dr. Michael R., a successful orthodontist, faced challenges when trying to refinance his resort condo to buy a fourth investment

Rebecca L., a savvy real estate attorney, faced unexpected challenges when seeking a cash-out refinance on her successful condotel investment.

Carlos R., a successful restaurant owner in San Diego, faced a common challenge: traditional lenders couldn’t see past his tax

Master Sergeant (Ret.) David L., a 45-year-old Air Force veteran, faced a common challenge: accessing the equity in his home

Discover how Jason, a self-employed digital marketing consultant, unlocked his home equity through a P&L loan cash-out refinance, overcoming traditional

Discover how Michelle, a successful e-commerce entrepreneur, unlocked substantial equity from her home to fund a critical business expansion without

Facing the challenges of divorce, Chief Petty Officer (Ret.) Jennifer K. found herself in a tough spot—she needed to refinance

Discover how Robert, a successful HVAC business owner, transformed his financial future through a no-doc loan refinance. Faced with the

Carlos M., a successful restaurant owner in Miami, faced unexpected challenges when refinancing his mortgage despite a solid payment history and good income. Traditional lenders turned down his applications due to complicated income paperwork from his tax-efficient business setup. Find out how Carlos found stated income loan refinance programs, which assess income using bank statements instead of strict tax returns, helping him achieve significant monthly savings and better cash flow. This case study shows the benefits of alternative financing options for self-employed borrowers facing similar issues. Ready to explore your options?

David R., an architect, faced hurdles in refinancing his home to buy a commercial building for his growing firm. Despite his good income and perfect credit, traditional lenders declined due to complicated income documents. Discover how David accessed his home equity through a stated income loan cash-out refinance, allowing him to purchase the property and reduce rental costs. This case study highlights the benefits of alternative financing for business owners. Ready to explore your options?

Patricia M., a healthcare administrator, faced a financial nightmare after inheriting a property that quickly spiraled into a foreclosure crisis due to nightmare tenants. With traditional lenders offering no solutions, she discovered the transformative power of hard money loan cash-out refinance. This unique financing option not only stopped the foreclosure but also provided the funds needed for extensive repairs, allowing her to honor her aunt’s legacy. Dive into this compelling case study to learn how hard money financing can rescue distressed properties and preserve valuable equity when time is of the essence.

Discover how Jennifer S., a savvy financial advisor, transformed her investment strategy by refinancing her resort condo in Destin, Florida. Despite facing rejection from traditional lenders due to her property’s hotel management program, she found specialized lenders who understood the unique nature of resort condos. This case study reveals how Jennifer secured favorable refinancing terms, significantly improved her cash flow, and accelerated her path to financial independence. Learn about the challenges she faced, the innovative solutions she discovered, and how you too can optimize your resort property investments for greater profitability.

Dr. Michael R., a successful orthodontist, faced challenges when trying to refinance his resort condo to buy a fourth investment property. Even with a strong financial background, traditional lenders turned him down because the property was a “non-warrantable condo.” Determined to succeed, Michael found specialized lenders who understood resort condos. This case study shows how he accessed equity, grew his investment portfolio, and moved closer to financial independence. Want to see how specialized financing can boost your investments? Discover Michael’s journey and explore your options!

Rebecca L., a savvy real estate attorney, faced unexpected challenges when seeking a cash-out refinance on her successful condotel investment. Despite her strong financial profile and legal expertise, traditional lenders categorically rejected her application due to the unique nature of condotel properties. Frustrated but determined, Rebecca discovered specialized lenders who understood the value of hotel-condo investments. This pivotal moment unlocked the capital she needed to purchase a second vacation rental property, accelerating her wealth-building strategy. Dive into Rebecca’s journey and learn how specialized financing can transform your investment opportunities!

Carlos R., a successful restaurant owner in San Diego, faced a common challenge: traditional lenders couldn’t see past his tax returns, which showed artificially reduced income due to legitimate business deductions. Frustrated but determined, he discovered P&L loan refinance programs that evaluated his actual business profitability instead. This innovative approach allowed him to secure a significantly lower interest rate, reduce his monthly payments, and improve cash flow. Curious about how Carlos transformed his financial future and optimized his investment strategy? Read on to explore the powerful impact of P&L loan refinancing for self-employed business owners like him.

Master Sergeant (Ret.) David L., a 45-year-old Air Force veteran, faced a common challenge: accessing the equity in his home for much-needed renovations without taking on high-interest debt. After exploring traditional options like home equity loans and HELOCs, he discovered the VA loan cash-out refinance—a solution that allowed him to tap into his home’s value while maintaining a single, predictable monthly payment. This strategic move not only funded his kitchen remodel and pool installation but also positioned his home competitively for the future. Curious about how he did it? Read on to learn more about his journey!

Discover how Jason, a self-employed digital marketing consultant, unlocked his home equity through a P&L loan cash-out refinance, overcoming traditional lending hurdles. Faced with the challenge of accessing capital for a crucial business acquisition, Jason learned that conventional lenders couldn’t see past his tax returns. With the help of a specialized lender, he leveraged his current business performance instead, allowing him to secure the funds needed to double his agency’s capacity. Explore Jason’s journey and see how this innovative financing solution can empower self-employed homeowners to achieve their financial goals.

Discover how Michelle, a successful e-commerce entrepreneur, unlocked substantial equity from her home to fund a critical business expansion without the hassle of traditional income verification. Frustrated by conventional lenders’ demands for extensive documentation, she turned to a no-doc loan cash-out refinance, allowing her to access the capital she needed quickly. This innovative financing solution not only supported her growth strategy but also preserved her financial flexibility. Learn how Michelle leveraged her real estate equity to accelerate her wealth-building journey and explore if a no-doc loan could be the right fit for you!

Facing the challenges of divorce, Chief Petty Officer (Ret.) Jennifer K. found herself in a tough spot—she needed to refinance her home to remove her ex-husband from the mortgage. Conventional lenders complicated the process, treating it as a cash-out refinance, leading to higher rates and costs. However, a conversation with a fellow veteran opened her eyes to VA loan refinance options that could simplify her situation. Discover how Jennifer navigated this emotional journey and secured a fresh start for her and her daughter through a VA loan refinance tailored for life changes like divorce.

Discover how Robert, a successful HVAC business owner, transformed his financial future through a no-doc loan refinance. Faced with the challenges of traditional lenders requiring extensive income documentation, Robert found a solution that recognized his true financial strength without compromising his tax-efficient strategies. In just 26 days, he secured a significantly lower interest rate, resulting in substantial monthly savings. These savings are now fueling his retirement investments, children’s education, and dreams of a mountain vacation property. Ready to explore how a no-doc loan refinance can work for you? Read on to learn more!

Patricia M., a 71-year-old retired registered nurse in Phoenix, had lived in her home for twenty-eight years and owned it free and clear after paying off her mortgage five years earlier. She’d worked hard throughout her nursing career,

Margaret S., a 66-year-old retired pharmaceutical sales representative in Charlotte, North Carolina, had been living in her home for eighteen years and still carried a traditional mortgage with substantial monthly payments.

Richard T., a 69-year-old retired accountant in Denver, had been living in his home for thirty-two years and owned it free and clear after paying off his mortgage six years earlier. His retirement income consisted of Social Security benefits and modest distributions from his retirement accounts—enough to cover basic expenses

Barbara H., a 68-year-old retired high school English teacher in Tampa, had spent thirty-five years in her family home—a large four-bedroom house where she’d raised her children and built decades of memories. Now, with her children grown and living in other states

Patricia M., a 71-year-old retired registered nurse in Phoenix, had lived in her home for twenty-eight years and owned it free and clear after paying off her mortgage five years earlier. She’d worked hard throughout her nursing career,

Margaret S., a 66-year-old retired pharmaceutical sales representative in Charlotte, North Carolina, had been living in her home for eighteen years and still carried a traditional mortgage with substantial monthly payments.

Richard T., a 69-year-old retired accountant in Denver, had been living in his home for thirty-two years and owned it free and clear after paying off his mortgage six years earlier. His retirement income consisted of Social Security benefits and modest distributions from his retirement accounts—enough to cover basic expenses

Barbara H., a 68-year-old retired high school English teacher in Tampa, had spent thirty-five years in her family home—a large four-bedroom house where she’d raised her children and built decades of memories. Now, with her children grown and living in other states

Sarah M., a 41-year-old freelance commercial photographer based in Fort Lauderdale, earned strong annual income from corporate clients, advertising agencies, and magazine publications. After purchasing her first rental property two years earlier, she was ready to acquire property #2

Jennifer S., a 45-year-old serial entrepreneur based in Tampa, had built three successful businesses over two decades—a software consulting firm, a digital marketing agency, and an e-commerce business selling specialty products

Robert H., a 42-year-old marketing consultant who had built a successful agency serving technology companies throughout South Florida, had been searching for the perfect property to combine his business operations with smart real estate investing.

Patricia M., a healthcare administrator, faced a financial nightmare after inheriting a property that quickly spiraled into a foreclosure crisis due to nightmare tenants. With traditional lenders offering no solutions, she discovered the transformative power of hard money loan cash-out refinance. This unique financing option not only stopped the foreclosure but also provided the funds needed for extensive repairs, allowing her to honor her aunt’s legacy. Dive into this compelling case study to learn how hard money financing can rescue distressed properties and preserve valuable equity when time is of the essence.

Sarah L., a 35-year-old real estate wholesaler based in Tampa, Florida, had built a thriving investment business connecting motivated sellers with cash buyers. After three years of successfully wholesaling properties

Jennifer K., a 39-year-old certified financial planner based in Charlotte, North Carolina, had built substantial equity in her primary residence over eight years of homeownership. She earned a strong six-figure income advising clients on wealth-building strategies

Marcus T., a 38-year-old independent IT consultant based in Fort Lauderdale, earned strong six-figure income annually from multiple long-term 1099 clients. After years of working in corporate IT before transitioning to independent consulting

Dr. Michael R., a 44-year-old dentist based in Austin, Texas, had built substantial equity in his primary residence over 12 years of homeownership. His thriving dental practice generated strong income, and he maintained excellent credit.

Sarah M., a 41-year-old freelance commercial photographer based in Fort Lauderdale, earned strong annual income from corporate clients, advertising agencies, and magazine publications. After purchasing her first rental property two years earlier, she was ready to acquire property #2

Jennifer S., a 45-year-old serial entrepreneur based in Tampa, had built three successful businesses over two decades—a software consulting firm, a digital marketing agency, and an e-commerce business selling specialty products

Robert H., a 42-year-old marketing consultant who had built a successful agency serving technology companies throughout South Florida, had been searching for the perfect property to combine his business operations with smart real estate investing.

Patricia M., a healthcare administrator, faced a financial nightmare after inheriting a property that quickly spiraled into a foreclosure crisis due to nightmare tenants. With traditional lenders offering no solutions, she discovered the transformative power of hard money loan cash-out refinance. This unique financing option not only stopped the foreclosure but also provided the funds needed for extensive repairs, allowing her to honor her aunt’s legacy. Dive into this compelling case study to learn how hard money financing can rescue distressed properties and preserve valuable equity when time is of the essence.

Sarah L., a 35-year-old real estate wholesaler based in Tampa, Florida, had built a thriving investment business connecting motivated sellers with cash buyers. After three years of successfully wholesaling properties

Jennifer K., a 39-year-old certified financial planner based in Charlotte, North Carolina, had built substantial equity in her primary residence over eight years of homeownership. She earned a strong six-figure income advising clients on wealth-building strategies

Marcus T., a 38-year-old independent IT consultant based in Fort Lauderdale, earned strong six-figure income annually from multiple long-term 1099 clients. After years of working in corporate IT before transitioning to independent consulting

Dr. Michael R., a 44-year-old dentist based in Austin, Texas, had built substantial equity in his primary residence over 12 years of homeownership. His thriving dental practice generated strong income, and he maintained excellent credit.

James K., a 43-year-old general contractor specializing in residential construction and renovation in Tampa, had built both a successful contracting business and a growing real estate investment portfolio over fifteen years.

Michelle T., a 51-year-old pharmaceutical sales representative living in Fort Lauderdale, had built a successful real estate investment portfolio over two decades alongside her corporate career. Her portfolio included four properties: her primary residence

Jennifer S., a 45-year-old serial entrepreneur based in Tampa, had built three successful businesses over two decades—a software consulting firm, a digital marketing agency, and an e-commerce business selling specialty products

Robert H., a 42-year-old marketing consultant who had built a successful agency serving technology companies throughout South Florida, had been searching for the perfect property to combine his business operations with smart real estate investing.

David K., a 36-year-old medical device sales representative based in Miami, traveled extensively for work throughout the Southeast. His career success had provided strong six-figure income, and three years ago he made his first real estate investment

James P., a 52-year-old real estate developer based in Naples, had successfully completed multiple residential development projects over his 20-year career in construction and real estate. As an experienced developer and Step 7

Katherine B., a 47-year-old corporate executive based in Atlanta, Georgia, had built substantial wealth through her successful technology career. She earned a strong six-figure income, maintained excellent credit, and owned her primary

Sarah L., a 35-year-old real estate wholesaler based in Tampa, Florida, had built a thriving investment business connecting motivated sellers with cash buyers. After three years of successfully wholesaling properties

Linda R., a 58-year-old successful business owner in Miami, had built substantial wealth over three decades operating multiple retail franchises throughout South Florida. As she approached her planned retirement transition,

Marcus D., a 48-year-old active real estate investor based in Tampa, had successfully built a portfolio of rental properties over 15 years. As a Step 6 investor with multiple properties generating positive cash flow,

James K., a 43-year-old general contractor specializing in residential construction and renovation in Tampa, had built both a successful contracting business and a growing real estate investment portfolio over fifteen years.

Michelle T., a 51-year-old pharmaceutical sales representative living in Fort Lauderdale, had built a successful real estate investment portfolio over two decades alongside her corporate career. Her portfolio included four properties: her primary residence

Jennifer S., a 45-year-old serial entrepreneur based in Tampa, had built three successful businesses over two decades—a software consulting firm, a digital marketing agency, and an e-commerce business selling specialty products

Robert H., a 42-year-old marketing consultant who had built a successful agency serving technology companies throughout South Florida, had been searching for the perfect property to combine his business operations with smart real estate investing.

David K., a 36-year-old medical device sales representative based in Miami, traveled extensively for work throughout the Southeast. His career success had provided strong six-figure income, and three years ago he made his first real estate investment

James P., a 52-year-old real estate developer based in Naples, had successfully completed multiple residential development projects over his 20-year career in construction and real estate. As an experienced developer and Step 7

Katherine B., a 47-year-old corporate executive based in Atlanta, Georgia, had built substantial wealth through her successful technology career. She earned a strong six-figure income, maintained excellent credit, and owned her primary

Sarah L., a 35-year-old real estate wholesaler based in Tampa, Florida, had built a thriving investment business connecting motivated sellers with cash buyers. After three years of successfully wholesaling properties

Linda R., a 58-year-old successful business owner in Miami, had built substantial wealth over three decades operating multiple retail franchises throughout South Florida. As she approached her planned retirement transition,

Marcus D., a 48-year-old active real estate investor based in Tampa, had successfully built a portfolio of rental properties over 15 years. As a Step 6 investor with multiple properties generating positive cash flow,

James R., a 47-year-old London-based e-commerce business owner, had purchased a rental property in Orlando three years earlier as his first U.S. real estate investment. The property had appreciated substantially, and the rental income covered

David M., a 42-year-old licensed general contractor based in the Phoenix metro area, had built a successful construction business over 15 years. After completing renovation projects for investors throughout Arizona, he was ready to transition from contractor-for-hire to property investor himself.

By Jim blackburn By Jim blackburn Educational Case Study Disclosure This case study is hypothetical and for educational purposes only. Scenarios, borrower profiles, loan terms,

By Jim blackburn By Jim blackburn Educational Case Study Disclosure This case study is hypothetical and for educational purposes only. Scenarios, borrower profiles, loan terms,

By Jim blackburn By Jim blackburn Educational Case Study Disclosure This case study is hypothetical and for educational purposes only. Scenarios, borrower profiles, loan terms,

Get the latest insights and mortgage case studies in your inbox.