Physician Mortgage Loans: Complete Guide for Medical Professionals

Physician Mortgage Loans: Complete Guide for Medical Professionals

Achieving homeownership as a medical professional presents unique challenges that traditional mortgage programs weren’t designed to address. Medical doctors, dentists, veterinarians, and other healthcare providers face a distinctive financial paradox: high earning potential coupled with substantial educational debt and delayed career starts. Physician mortgage loans offer specialized financing solutions that recognize your professional trajectory rather than penalizing you for the investments required to enter medicine.

These specialized lending programs acknowledge that medical professionals represent exceptionally low default risk despite carrying student loan balances that would disqualify most borrowers under conventional underwriting standards. Your years of rigorous training, stable career prospects, and significant income growth potential make you an attractive borrower once lenders properly evaluate your complete financial picture. Physician mortgage loans emerged specifically to bridge the gap between traditional mortgage qualification requirements and the realities of medical career paths.

Whether you’re completing residency, establishing your first practice, or building wealth through investment properties, understanding how physician mortgage loans work can save you hundreds of thousands of dollars over your lifetime. This comprehensive guide examines every aspect of medical professional financing, from qualification requirements and program comparisons to advanced wealth-building strategies using specialized lending. Medical professionals who leverage these programs strategically can purchase their primary residence years earlier and build investment portfolios faster than peers using conventional financing.

The financial advantages extend far beyond simple approval flexibility. Physician lending programs typically waive private mortgage insurance requirements, reduce documentation burdens, and offer competitive interest rates despite higher debt-to-income ratios. These benefits compound over decades of homeownership and investment property acquisition, creating substantial wealth-building opportunities for medical professionals who understand how to navigate specialized lending markets effectively.

Key Summary

This comprehensive guide explores physician mortgage loans and specialized financing for medical professionals:

- Federal mortgage regulations govern lending practices (HUD fair lending requirements) ensuring equal access to credit for qualified medical professionals

- Healthcare employment statistics demonstrate strong career stability (Bureau of Labor Statistics physician employment data) supporting specialized lending programs

- Student loan debt among medical professionals continues rising (Association of American Medical Colleges debt statistics) creating need for alternative qualification methods

- Real estate investment principles apply to medical professionals (National Association of Realtors investment property research) building long-term wealth through property ownership

- Tax advantages for rental property owners benefit high-income professionals (IRS real estate tax guidelines) creating additional income streams

Understanding Physician Mortgage Loans and How They Work for Medical Professionals

Physician mortgage loans represent specialized financing products designed exclusively for medical professionals including doctors, dentists, veterinarians, and sometimes other healthcare providers. These programs differ fundamentally from conventional mortgage products by recognizing the unique financial profiles of medical professionals. Traditional lenders view massive student loan debt as significant risk, but physician lending programs acknowledge that medical degrees typically lead to substantial long-term earning potential.

The core advantage lies in how these programs calculate debt-to-income ratios. Conventional mortgages include full student loan payments in qualification calculations, which can disqualify medical professionals carrying $200,000+ in educational debt. Physician mortgage programs either exclude student loans entirely from debt calculations or use dramatically reduced payment amounts, recognizing that income-based repayment plans don’t reflect actual payment obligations for high-earning professionals.

Most physician lending programs require zero to minimal down payments, often allowing medical professionals to finance 100% of purchase prices up to specific loan limits. This contrasts sharply with conventional loan programs requiring 5-20% down payments. The elimination of private mortgage insurance despite minimal down payments represents another substantial benefit, potentially saving thousands annually compared to traditional financing.

What Qualifies Someone for Physician Mortgage Programs?

Eligibility requirements vary between lenders but generally include specific professional credentials and career milestones. Most programs require an MD, DO, DDS, DMD, DPM, or DVM degree, though some lenders extend coverage to dentists, veterinarians, and occasionally other healthcare professionals. Physicians typically qualify during residency, fellowship, or within their first several years of attending physician status, with exact timeframes varying by lender.

Employment documentation plays a critical role in approval, with most programs accepting signed employment contracts even before starting positions. This unique feature allows medical professionals to secure home financing before receiving their first paychecks, dramatically accelerating homeownership timelines. Lenders verify credentials through medical license verification and may require proof of board certification or residency completion depending on career stage.

Credit score requirements generally align with conventional mortgage standards, typically requiring minimum scores of 680-700 for physician mortgage loans. However, some lenders offer more flexible credit evaluation recognizing that medical training often limits credit history development. Late payments related to student loans during training periods may receive more lenient treatment than similar infractions in conventional underwriting.

How Do Physician Loans Handle Student Debt Differently?

The revolutionary aspect of physician lending lies in student loan treatment during qualification. Conventional mortgages calculate debt-to-income ratios using either actual monthly student loan payments or 1% of total outstanding balance if actual payments seem artificially low. For medical professionals on income-based repayment plans, this standard approach makes homeownership virtually impossible despite six-figure incomes.

Physician mortgage programs typically use one of several alternative calculation methods. Some lenders completely exclude student loans from debt-to-income calculations, treating medical education debt as fundamentally different from consumer debt. Other programs calculate student loan obligations using minimal percentages of outstanding balances, often as low as 0.5%, or simply verify enrollment in income-based repayment programs and use actual monthly payments regardless of how small they appear.

This specialized treatment dramatically expands purchasing power for medical professionals. A physician earning $250,000 annually with $300,000 in student loans might qualify for only a $200,000 mortgage under conventional standards due to calculated student loan payments exceeding $3,000 monthly. The same physician could qualify for $600,000+ using physician mortgage financing that excludes or minimizes student debt impact.

What Are the Typical Interest Rates and Terms?

Interest rates on physician mortgage loans generally remain competitive with conventional mortgage pricing despite the reduced documentation and flexible qualification requirements. Most medical professionals secure rates within 0.125% to 0.5% of standard conventional mortgage rates, with exact pricing depending on credit scores, loan amounts, down payments, and individual lender programs. The lack of private mortgage insurance often makes total monthly costs lower than conventional financing even if base rates run slightly higher.

Loan terms typically mirror conventional mortgage options, offering 15-year, 20-year, and 30-year fixed-rate mortgages as well as various adjustable-rate mortgage products. Some physician lending programs also offer interest-only payment periods during the first 5-10 years, allowing medical professionals to minimize payments during early career years when income growth accelerates rapidly. These interest-only loan structures can create substantial cash flow advantages for physicians building investment portfolios.

Loan limits vary significantly between lenders and geographic markets. Many programs cap physician mortgages at conventional conforming limits, currently $806,500 in most markets for 2025. However, specialized jumbo loan programs for physicians extend financing up to $2-3 million in high-cost areas, recognizing that successful medical professionals often purchase homes exceeding standard price ranges. Calculate potential costs using our jumbo loan calculator to evaluate different scenarios.

Why Do Lenders Offer These Special Programs?

Financial institutions developed physician mortgage products based on decades of default data demonstrating that medical professionals represent exceptionally low credit risk despite high debt-to-income ratios. Historical loan performance shows physician default rates significantly below general population averages, even when underwriting standards appear more lenient. This strong performance record allows lenders to price these loans competitively while maintaining acceptable risk profiles.

The lifetime value of medical professional relationships motivates lender investment in physician programs. Doctors, dentists, and veterinarians typically maintain high incomes for decades, generating opportunities for refinancing, investment property financing, and various banking services over long timeframes. Establishing relationships with medical professionals early in their careers often yields profitable long-term customer relationships extending across multiple financial products.

Competitive dynamics also drive physician lending program availability. As more institutions recognized the profit potential in medical professional lending, program proliferation accelerated. Medical professionals now enjoy substantial leverage when comparing physician mortgage lenders, shopping for optimal terms across multiple institutions. This competition benefits borrowers through improved rates, reduced fees, and more flexible qualification requirements.

Physician Mortgage Programs Compared to Conventional Lending Options

Understanding how physician home loans differ from traditional mortgage products empowers medical professionals to make informed financing decisions. While physician mortgages offer compelling advantages for many doctors, they don’t always represent the optimal choice depending on individual circumstances. Comprehensive comparison requires examining down payment requirements, interest rates, private mortgage insurance, student loan treatment, and total cost over time.

The most immediate distinction involves down payment flexibility. Physician programs typically allow zero to 5% down payments on primary residences, with some lenders financing 100% of purchase prices up to $1 million or more. Conventional mortgages generally require minimum 5% down payments for owner-occupied properties, with private mortgage insurance mandated on loans exceeding 80% loan-to-value ratios. This PMI adds $50-200+ monthly to conventional loan costs, creating thousands in additional expenses annually.

Student loan treatment creates the most dramatic qualification differences. Calculate your purchasing power under both scenarios using our debt ratio calculator to see exactly how physician mortgage programs expand affordability. Medical professionals carrying substantial educational debt often qualify for 2-3x higher loan amounts through specialized programs compared to conventional financing, dramatically impacting home selection and investment opportunities.

When Does Conventional Financing Make More Sense?

Despite physician mortgage advantages, certain circumstances favor conventional financing for medical professionals. Doctors with substantial down payment savings may secure better interest rates and terms through conventional programs, particularly when putting 20%+ down eliminates private mortgage insurance requirements. The larger down payment reduces loan amounts, lowers monthly payments, and accelerates equity building compared to zero-down physician loans.

Medical professionals beyond their first 5-7 years of practice often find conventional financing more attractive as incomes rise and student debt diminishes. Once debt-to-income ratios fall within conventional lending guidelines without special treatment, standard mortgage programs offer broader lender selection and potentially superior terms. Established physicians with excellent credit and substantial assets sometimes access better pricing through conventional loan programs than physician-specific products.

Investment property purchases almost always require conventional or alternative financing since most physician mortgage programs restrict usage to primary residences. Medical professionals building rental portfolios typically transition to DSCR loans, conventional investment property financing, or portfolio lending products designed for real estate investors. Understanding when to use specialized physician financing versus broader lending options maximizes wealth-building potential across multiple properties.

How Do Jumbo Physician Mortgages Work?

High-earning medical professionals purchasing luxury properties or homes in expensive markets often require financing exceeding conventional loan limits. Jumbo physician mortgage programs extend specialized lending benefits to loan amounts ranging from $800,000 to $3+ million depending on lender and market. These products maintain core physician loan advantages including minimal down payments, no PMI, and flexible student debt treatment while accommodating higher purchase prices.

Qualification requirements for jumbo physician mortgages typically demand higher credit scores and more thorough income documentation than standard physician loans. Lenders may require minimum credit scores of 720-740 and prefer seeing established attending physician income rather than simply employment contracts. Some programs allow as little as 10% down on jumbo amounts while others require 15-20% for loans exceeding certain thresholds.

Interest rate pricing on jumbo physician mortgages runs 0.25% to 0.75% higher than conforming loan rates, though the elimination of PMI and down payment flexibility often makes total costs competitive with conventional jumbo financing requiring 20% down. Medical professionals purchasing $1.5-2 million homes can evaluate total costs using our jumbo loan calculator comparing various down payment scenarios and loan structures.

What About FHA and VA Loan Options?

Some medical professionals qualify for government-backed mortgage programs offering unique advantages. Veterans with military service can access VA loan programs providing zero-down financing with no PMI requirements, often representing superior options to physician mortgages for eligible doctors. VA loans accommodate any loan amount within conforming limits and offer streamlined refinancing through IRRRL programs when rates drop.

FHA financing occasionally benefits medical professionals with limited credit history or lower credit scores falling below physician mortgage minimums. FHA loan programs require only 3.5% down for borrowers with 580+ credit scores and allow higher debt-to-income ratios than many conventional programs. However, FHA’s mandatory mortgage insurance adds significant long-term costs that typically make physician mortgages more economical for doctors who qualify for both.

Rural medical professionals may access USDA loan programs offering zero-down financing on properties in eligible areas, which encompass surprisingly large geographic territories including many suburban communities. USDA loans require no private mortgage insurance though they charge annual guarantee fees similar to FHA. Medical professionals practicing in qualifying locations should compare USDA against physician mortgage terms before committing.

Doctor Mortgage Loan Qualification Requirements and Application Process

Securing doctor mortgage loans requires understanding specific eligibility criteria and navigating specialized application processes that differ from conventional mortgage procedures. While physician loans offer more flexible qualification standards in many respects, lenders maintain rigorous requirements around professional credentials, employment verification, and financial documentation. Medical professionals who understand these requirements can streamline their applications and avoid common delays that frustrate first-time physician borrowers.

The application timeline for doctor mortgage loans typically spans 30-45 days from initial application to closing, comparable to conventional mortgage processing. However, credential verification and employment contract review add unique steps not present in standard mortgage applications. Medical professionals should begin gathering documentation 60-90 days before desired closing dates, particularly if purchasing homes before starting new positions or during training transitions.

Lenders evaluate physician loan applications through specialized underwriting departments familiar with medical career progressions and compensation structures. These teams understand that employment contracts often include complex compensation arrangements with base salaries, productivity bonuses, call pay, and other components. They also recognize that resident and fellow incomes don’t reflect long-term earning potential, allowing approval based on pending attending physician positions.

What Documentation Do Medical Professionals Need to Provide?

Doctor mortgage loan applications require standard mortgage documentation plus medical credential verification. Financial documents typically include 30 days of pay stubs or employment contracts, two years of tax returns if already practicing, and 60-90 days of bank statements showing funds for down payment and closing costs. Self-employed physicians may need additional business documentation, though some bank statement loan programs simplify requirements for practice owners.

Medical credential documentation represents the unique component of physician mortgage applications. Lenders require copies of medical licenses, DEA certificates if applicable, and proof of board certification or board eligibility. Residents and fellows provide program completion letters or upcoming graduation documentation along with signed employment contracts for attending positions. Some lenders verify credentials directly through state medical boards or specialty certification organizations.

Student loan documentation varies by lender but typically includes statements showing current balances and payment status. Physicians on income-driven repayment plans should provide enrollment documentation even if monthly payments seem artificially low. Some lenders request student loan payoff statements to verify total outstanding debt, while others simply accept information reported on credit reports through their normal mortgage evaluation processes.

How Does the Pre-Approval Process Work?

Obtaining mortgage pre-approval provides crucial advantages when purchasing homes, particularly in competitive markets where sellers favor buyers with verified financing. Physician mortgage pre-approvals involve submitting complete financial and credential documentation to lenders who then issue approval letters specifying maximum loan amounts. These letters demonstrate serious buyer intent and financial capability, strengthening purchase offers significantly compared to pre-qualification letters based on verbal information only.

The pre-approval process typically takes 3-7 business days once lenders receive complete documentation packages. Medical professionals should request pre-approval letters from multiple institutions to compare physician mortgage lenders and secure optimal terms. Each lender evaluates qualification slightly differently, with some offering more favorable student debt treatment or higher loan amounts than competitors despite similar financial profiles.

Pre-approval letters remain valid for 60-90 days depending on lender policies, requiring updates if home searches extend beyond these timeframes. Rate locks typically occur after identifying specific properties and entering purchase contracts rather than during pre-approval, though some lenders allow extended rate locks for additional fees. Calculate potential monthly costs using our mortgage payment estimator once you know approximate purchase prices and loan amounts.

What Credit Score Requirements Apply?

Minimum credit score requirements for medical doctor mortgage programs typically range from 680-720 depending on lender, down payment amount, and loan size. Most physician lenders prefer credit scores of 700+ for optimal terms, though some programs accommodate scores as low as 660-680 with compensating factors like substantial income or larger down payments. Jumbo physician mortgages generally require minimum scores of 720-740 given higher loan amounts and increased lender risk.

Medical professionals with limited credit history rather than negative credit often qualify more easily than those with past delinquencies. Lenders understand that medical training limits opportunities to establish extensive credit profiles, making shorter credit histories acceptable if available accounts show responsible management. Building credit during residency through strategic use of credit cards and maintaining clean payment records on all obligations improves qualification odds and secures better interest rates.

Late payments on student loans during medical school receive more lenient treatment from physician mortgage lenders than similar issues on credit cards or auto loans. Many underwriters acknowledge that deferrals, forbearances, and payment adjustments occur commonly during training without indicating future payment problems. However, recent late payments on any obligations raise concerns and may require written explanations or denial depending on severity and timing.

Can Residents and Fellows Qualify for Physician Loans?

Most physician mortgage programs extend eligibility to residents and fellows, recognizing that these training positions represent stepping stones toward high-income attending physician careers. Lenders typically require signed employment contracts for attending positions starting within 60-90 days of mortgage closing, allowing trainees to purchase homes before completing training. This unique feature enables medical professionals to secure housing in new cities before relocation while interest rates and property availability favor purchases.

Qualification for residents and fellows typically requires documented proof of current training position and signed employment agreements for upcoming attending roles. Lenders verify start dates, salary details, and employment terms to confirm ability to afford mortgage payments once attending positions begin. Some programs allow qualification based on resident/fellow income alone if purchasing during training periods, though loan amounts typically stay lower given current earning levels.

Geographic relocation presents common challenges for physicians transitioning between training and attending positions. Medical professionals purchasing homes in new markets without established local banking relationships should explore physician lending options from national lenders with multi-state licensing rather than regional banks limited to specific areas. This flexibility proves particularly valuable for doctors matching into competitive specialties requiring moves to different regions.

Medical Doctor Home Loan Strategies for Investment Property Acquisition

High-income medical professionals frequently leverage their financial capacity to build wealth through real estate investment properties alongside primary residence ownership. While traditional physician mortgage programs typically restrict usage to owner-occupied homes, medical doctors can access various financing strategies to acquire rental properties, vacation homes, and multi-unit buildings. Understanding which medical doctor home loan options work for different property types maximizes wealth-building potential while maintaining manageable debt levels.

The transition from primary residence financing to investment property lending requires different underwriting approaches and loan products. Conventional investment property loans demand higher down payments, typically 15-25% depending on property type and borrower qualifications. Interest rates run 0.5% to 1% higher for investment properties compared to owner-occupied financing, reflecting increased lender risk when borrowers maintain multiple mortgage obligations simultaneously.

Medical professionals purchasing investment properties benefit from strong debt-servicing capacity given high incomes, making qualification relatively straightforward compared to investors with more modest earnings. However, lenders scrutinize debt-to-income ratios more carefully when borrowers carry multiple mortgages, student loans, and other obligations. Strategic use of specialized lending programs helps physicians overcome qualification challenges while building substantial real estate portfolios generating passive income streams.

What Financing Options Work for Rental Properties?

Conventional investment property mortgages represent the most common financing vehicle for physician real estate investors purchasing single-family homes, condos, and small multi-family properties. These loans require 15-25% down payments with exact requirements varying by property type, loan amount, and borrower credit profiles. Conventional financing allows medical professionals to leverage their primary residence equity through cash-out refinancing to fund rental property down payments, creating powerful wealth multiplication strategies.

DSCR loan programs offer attractive alternatives for physicians building larger portfolios or those with complex income documentation. These investment property mortgages qualify borrowers based on rental income coverage rather than personal income, eliminating debt-to-income ratio concerns that constrain conventional financing approval. Medical professionals can acquire multiple rental properties using DSCR financing without exhausting personal income qualification capacity, enabling faster portfolio scaling.

Portfolio lending relationships provide additional flexibility for physicians accumulating multiple investment properties. Some banks offer portfolio loan programs evaluating total financial relationships rather than individual property underwriting, allowing higher leverage and streamlined approval processes for established medical professional clients. These relationships become increasingly valuable as physicians expand beyond 4-6 financed properties, exceeding conventional lending maximums.

How Do Medical Professionals Use Home Equity Strategically?

Primary residence equity represents powerful leverage for building investment property portfolios, particularly for physicians whose homes appreciate significantly while mortgages amortize over decades. Cash-out refinancing allows medical professionals to extract equity at relatively low interest rates, using proceeds as down payments on rental properties generating returns exceeding borrowed capital costs. This strategy creates substantial wealth multiplication for doctors with significant home equity and stable income supporting multiple mortgage obligations.

Home equity lines of credit (HELOCs) provide flexible alternatives to cash-out refinancing, offering revolving credit access secured by home equity without replacing existing first mortgages. Medical professionals use HELOC financing to fund rental property down payments, renovation projects, or bridge temporary cash flow gaps between property purchases and rental income stabilization. HELOC interest rates typically run higher than first mortgage rates but provide valuable flexibility for active real estate investors.

The decision between cash-out refinancing and HELOCs depends on current interest rate environments and existing mortgage terms. Physicians with low-rate first mortgages often prefer HELOCs preserving favorable primary financing, while those with higher existing rates benefit from cash-out refinancing that simultaneously improves primary residence loan terms while extracting equity. Calculate comparative costs using our cash-out refinance calculator versus HELOC scenarios.

What Are the Tax Benefits of Physician-Owned Rental Properties?

Real estate investment tax advantages create substantial value for high-income medical professionals in elevated tax brackets. Rental property ownership generates multiple deduction opportunities including mortgage interest, property taxes, insurance, maintenance, repairs, property management fees, and travel expenses for property oversight. These deductions offset rental income, often creating losses on paper despite positive cash flow from debt service coverage.

Depreciation represents the most powerful tax benefit for physician real estate investors, allowing annual deductions of approximately 3.64% of building value (excluding land) over 27.5 years for residential rentals. A physician purchasing a $400,000 rental property with $300,000 in depreciable improvements can claim roughly $10,900 annually in depreciation deductions, reducing taxable income without actual cash outflow. These deductions prove particularly valuable for doctors in the 35-37% federal tax brackets plus state income taxes.

Advanced strategies like cost segregation studies accelerate depreciation benefits by identifying building components depreciable over 5, 7, or 15 years rather than the standard 27.5-year residential schedule. Medical professionals working with specialized real estate tax advisors can substantially increase early-year deductions through cost segregation, creating immediate tax savings funding additional property acquisitions. These sophisticated approaches work best for physicians with multiple properties and significant real estate income.

How Does the BRRRR Method Work for Medical Professionals?

The BRRRR strategy (Buy, Rehab, Rent, Refinance, Repeat) enables medical professionals to build substantial rental property portfolios with limited capital by recycling initial investments through forced appreciation. Physicians purchase undervalued properties requiring renovation, complete improvements increasing property values, secure tenants at market rents, then refinance based on higher post-renovation values. The refinancing extracts most or all initial capital, which gets redeployed into additional property acquisitions.

This powerful wealth-building approach works particularly well for high-income medical professionals who can qualify for financing throughout the cycle despite temporary dips in debt-to-income ratios during rehab periods. Physicians typically partner with contractors for renovation execution given limited personal time for property management and construction oversight. Calculate potential returns using our BRRRR method calculator to evaluate deal viability before committing capital.

BRRRR success requires accurate property valuation and renovation cost estimation, skills that improve with experience. Medical professionals should start with single-family homes in familiar neighborhoods before attempting more complex multi-family renovations or emerging market investments. Assembling a strong real estate investment team including realtors, contractors, property managers, and lenders proves essential for BRRRR execution, particularly for busy physicians lacking time for direct property management.

Physician Lending Requirements and Income Verification Methods

Understanding how physician lending programs evaluate income and employment differs fundamentally from conventional mortgage underwriting approaches. Medical professionals face unique income documentation challenges including complex compensation structures, transition periods between training positions, and startup phases when establishing private practices. Lenders specializing in physician lending have developed sophisticated methods for verifying earning capacity that recognize medical career realities rather than penalizing doctors for circumstances inherent to healthcare professions.

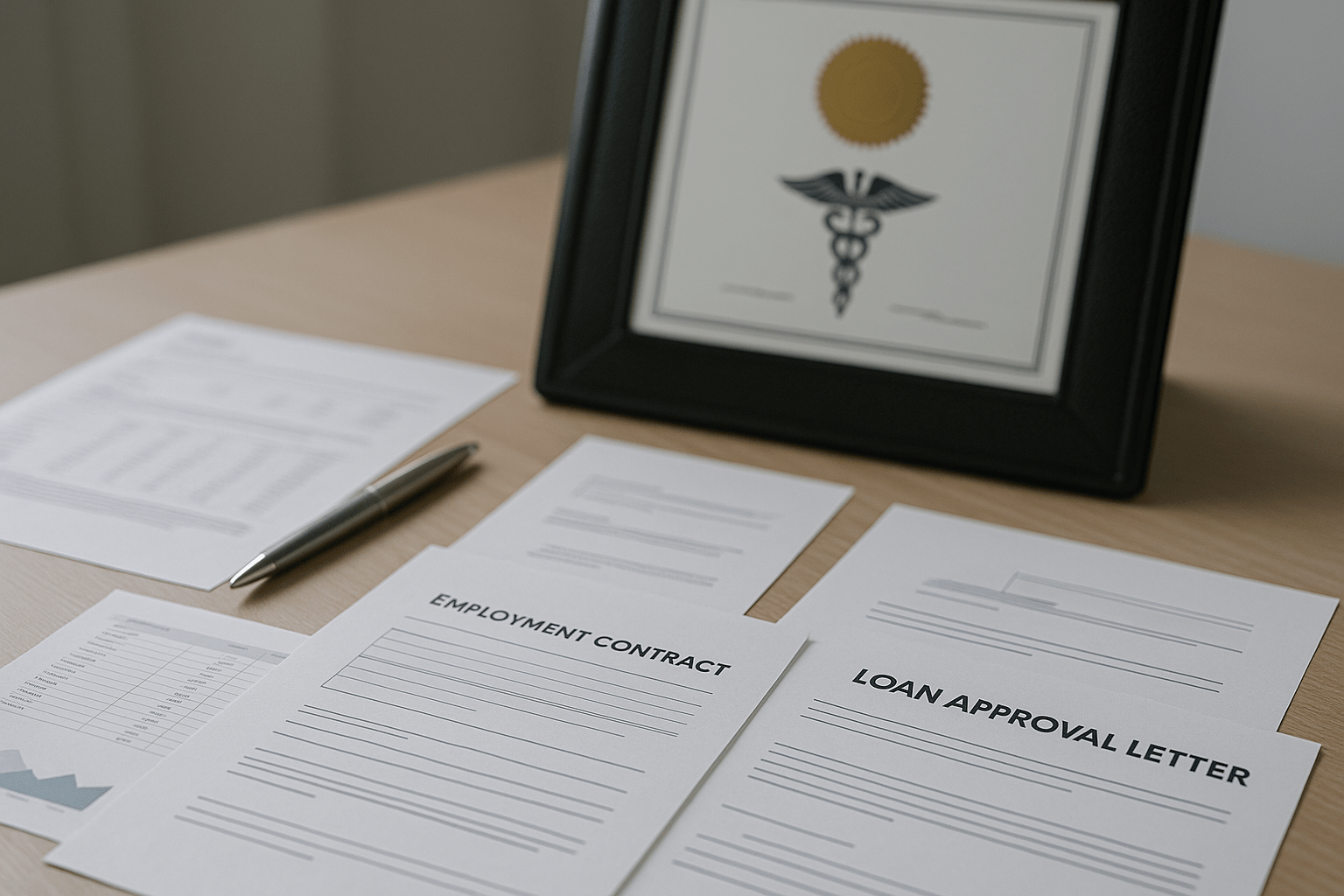

Traditional mortgage underwriting requires two years of consistent income history documented through tax returns and W-2 forms. This approach fails catastrophically for physicians transitioning from residency to attending positions, often showing dramatic income increases that standard underwriting cannot properly evaluate. Physician lending programs address this gap by accepting signed employment contracts as primary income documentation, allowing approval based on future earning potential rather than historical tax returns.

Self-employed physicians and practice owners face additional documentation complexity since business ownership introduces tax strategies that minimize reported income for optimization purposes. Savvy medical professionals often show modest taxable income through legitimate deductions while maintaining substantial cash flow supporting comfortable lifestyles and mortgage obligations. Bank statement loan programs designed for self-employed borrowers offer solutions by evaluating gross business deposits rather than net taxable income, dramatically expanding qualification for practice-owning physicians.

How Do Lenders Evaluate Employment Contracts?

Employment contract review represents the cornerstone of physician lending approval for medical professionals starting new positions. Lenders examine contracts for base salary, guaranteed compensation periods, productivity bonuses, call pay, and other income components. Most programs require contracts showing position start dates within 60-90 days of mortgage closing, though some lenders extend this window to 120 days for physicians with substantial savings covering interim housing costs.

Contract verification includes confirming employer legitimacy through direct communication with hospital systems, medical groups, or practice administrators. Lenders may request additional documentation including offer letters, credentialing confirmations, and privilege applications demonstrating genuine employment relationships. This thorough vetting protects both lenders and borrowers from fraudulent schemes while ensuring physicians can actually afford contracted loan obligations once positions commence.

Bonus and incentive compensation receive varying treatment across physician lending programs. Conservative lenders may exclude productivity bonuses from income calculations entirely, considering only guaranteed base salaries for qualification purposes. More aggressive programs include projected bonus income at 50-100% of amounts, particularly when contracts specify reasonable productivity targets commonly achieved by similarly situated physicians. Understanding each lender’s approach to physician home loans bonus treatment proves essential when contracts show significant incentive components.

What Documentation Works for Self-Employed Physicians?

Practice-owning physicians navigate more complex income verification requirements than employed doctors since business ownership introduces numerous documentation variables. Traditional approaches requiring two years of tax returns and full income consideration create substantial qualification challenges for medical professionals who minimize taxable income through retirement contributions, business expenses, and other legitimate deductions. These strategies reduce tax obligations but artificially lower income appearing on applications.

Bank statement loan programs revolutionize qualification for self-employed physicians by evaluating 12-24 months of business account deposits rather than tax returns. Lenders apply expense factors of 25-50% to gross deposits, calculating qualifying income substantially higher than taxable earnings shown on tax documents. A physician generating $800,000 in annual gross deposits might show only $300,000 in taxable income after deductions, yet qualify based on $400,000-600,000 using bank statement methodology.

Alternative documentation approaches include profit and loss statement analysis for physicians with newer practices lacking extensive bank statement history. Some specialized lenders accept CPA-prepared financial statements showing practice profitability and cash flow, providing middle-ground options between full tax return documentation and bank statement programs. Medical professionals should consult with mortgage professionals experienced in physician financing to identify optimal documentation strategies given individual practice structures.

How Does Locum Tenens Income Get Treated?

Physicians working locum tenens assignments face unique income verification challenges since this employment model involves temporary positions across multiple facilities rather than stable single-employer relationships. Lenders typically require two years of documented locum income through tax returns and 1099 forms, demonstrating consistency and reliability despite the contract-based nature of work. Recent trend analysis showing increasing locum assignments and strong earnings history strengthens applications compared to sporadic or declining engagement patterns.

Gap analysis becomes critical for locum physicians since periods without assignments raise red flags about earning reliability. Lenders prefer seeing continuous work streams without extended breaks, though scheduled time off for personal reasons receives understanding when appropriately documented. Physicians should maintain detailed records of completed assignments, upcoming bookings, and agency relationships demonstrating ongoing work availability and placement assistance.

Some physician lending programs accommodate locum income more flexibly than conventional mortgages, recognizing that many doctors strategically choose locum work for lifestyle flexibility while maintaining strong earning capacity. Calculate potential approval amounts using our mortgage income calculator to estimate qualification based on locum earnings patterns. Physicians with strong credit profiles and substantial assets may qualify with shorter income histories than typical two-year requirements.

What Happens During Income Transition Periods?

Career transitions create documentation challenges for physicians moving between positions, graduating from training programs, or launching private practices. Conventional lenders view employment gaps as significant risk factors, often requiring explanation letters and additional documentation. Physician lending programs recognize that transitions represent normal career progression rather than instability, providing more accommodating evaluation approaches for doctors between positions.

The most common transition involves physicians completing residency or fellowship training and starting attending positions. As long as employment contracts specify start dates within acceptable timeframes and gap durations don’t exceed 60-90 days, most physician lenders approve loans without difficulty. Physicians should time home purchases to minimize gaps when possible, though sometimes strategic delays improve qualification by allowing income establishment at new positions before applying.

Practice purchase or partnership buy-in transitions require careful documentation showing business continuity and income stability throughout ownership changes. Lenders may request partnership agreements, buy-in documentation, and practice financial statements demonstrating that ownership transitions won’t disrupt income streams. Working with experienced mortgage advisors who understand medical practice structures proves invaluable when navigating these complex transition scenarios.

Physician Loan Mortgage Rates and How to Secure the Best Terms

Understanding physician loan mortgage rates and how lenders price specialized medical professional financing empowers doctors to secure optimal terms while building wealth through homeownership and real estate investment. Interest rates on physician mortgages typically fall within 0.125% to 0.5% of conventional mortgage pricing, with exact spreads varying based on loan amounts, down payments, credit scores, and lender competition. The elimination of private mortgage insurance despite minimal down payments often makes total monthly costs lower than conventional financing even when base rates run slightly higher.

Rate shopping represents the single most important action medical professionals can take to optimize physician loan mortgage rates and save substantial money over loan lifetimes. A seemingly modest 0.25% rate difference on a $600,000 mortgage creates $30,000+ in additional interest costs over 30 years, while 0.5% differences approach $60,000 in extra payments. Physicians should obtain rate quotes from at least 3-5 lenders specializing in medical professional mortgages, comparing not just interest rates but also closing costs, origination fees, and total loan expenses.

Timing plays crucial roles in securing favorable physician loan mortgage rates since interest rate environments fluctuate based on Federal Reserve policy, inflation expectations, and bond market dynamics. Medical professionals purchasing homes during low-rate environments can lock historically favorable terms for decades, while those buying during rate spikes may benefit from refinancing when conditions improve. Understanding rate trends and implementing strategic timing helps physicians minimize borrowing costs throughout homeownership journeys.

What Factors Influence Interest Rate Pricing?

Credit scores represent the most significant factor affecting physician loan mortgage rates beyond baseline market conditions. Physicians with 760+ credit scores typically qualify for lowest advertised rates, while those with 680-720 scores might pay 0.25% to 0.75% premium pricing depending on lender programs. Every 20-point increment in credit scores can influence rates by 0.125% to 0.25%, creating powerful incentives for medical professionals to optimize credit profiles before applying for mortgages.

Loan-to-value ratios also impact physician loan mortgage rates since higher leverage increases lender risk exposure. Physicians making 10-20% down payments usually secure better rates than those financing 100% of purchase prices, though the elimination of PMI on physician loans maintains cost competitiveness. Some programs offer rate reductions of 0.125% to 0.375% for down payments exceeding specific thresholds, creating opportunities for doctors with savings to negotiate improved pricing.

Loan amounts influence rate structure through conforming versus jumbo loan classifications. Physicians borrowing within conventional conforming limits ($806,500 in most markets for 2025) typically access lower rates than those requiring jumbo financing for expensive properties. However, specialized jumbo physician mortgage programs minimize these premiums compared to standard jumbo lending, often maintaining competitive pricing on loans up to $1-2 million for well-qualified medical professionals.

How Do Points and Rate Buydowns Work?

Discount points allow physicians to prepay interest in exchange for lower mortgage rates, with each point costing 1% of loan amount and typically reducing rates by 0.25%. A physician borrowing $500,000 could pay $5,000 in points to reduce rates from 6.5% to 6.25%, creating $31 monthly savings and $11,160 total interest savings over 30 years. The break-even period occurs at approximately 161 months, making points worthwhile for doctors planning extended ownership periods.

The decision to purchase points depends on planned ownership duration and opportunity costs of capital deployed for rate reduction versus alternative investments. Medical professionals planning to remain in homes for 7-10+ years generally benefit from buying points, while those anticipating relocations within 5 years typically avoid points given insufficient time for break-even payback. Calculate scenarios using our rate buydown calculator to evaluate whether points make financial sense for specific situations.

Lender credits represent the opposite approach, where physicians accept slightly higher rates in exchange for lenders covering closing costs. This strategy benefits doctors with limited down payment savings who prefer minimizing upfront costs despite higher monthly payments. A physician might accept a 6.75% rate instead of 6.5% in exchange for $6,000 in lender credits covering appraisal, title, and other closing expenses, improving near-term cash flow at the expense of long-term interest costs.

Should Physicians Choose Fixed or Adjustable Rates?

Fixed-rate mortgages provide payment stability over entire loan terms, protecting physicians from interest rate volatility and simplifying financial planning. The overwhelming majority of medical professionals select 30-year fixed-rate mortgages for primary residences, valuing predictability over potential savings from adjustable-rate structures. This conservative approach makes sense for most physicians given stable career incomes supporting consistent housing budgets without requiring payment flexibility.

Adjustable-rate mortgages (ARMs) offer lower initial rates than fixed mortgages, potentially saving physicians substantial interest during early ownership years. Common ARM structures include 5/1, 7/1, and 10/1 options where rates remain fixed for initial periods before adjusting annually based on index rates plus margins. A physician planning to relocate within 5-7 years might save $15,000-25,000 through 5/1 or 7/1 ARM selection compared to 30-year fixed rates.

Interest-only loan structures represent another option for physicians prioritizing cash flow flexibility over accelerated equity building. These mortgages allow interest-only payments for initial 5-10 years, dramatically reducing monthly obligations while income grows during early career stages. Medical professionals should carefully evaluate total costs since interest-only periods extend loan payoff timelines and increase total interest paid compared to traditional amortizing mortgages.

How Can Physicians Secure Rate Locks and Time Purchases?

Rate locks protect physicians from interest rate increases between application and closing, providing certainty about borrowing costs when purchasing homes or refinancing mortgages. Standard rate locks cover 30-45 days, sufficient for most transactions proceeding smoothly through underwriting and closing processes. Extended locks lasting 60-90 days cost approximately 0.125% to 0.375% additional in rate premiums, creating tradeoffs between protection duration and borrowing costs.

Timing strategies for physician loan mortgage rates involve monitoring interest rate trends and acting decisively when favorable conditions emerge. Medical professionals purchasing during historically low rate environments should prioritize locking rates quickly rather than attempting to time absolute bottoms, since modest improvements rarely justify risks of missing broader favorable conditions. Conversely, physicians buying during elevated rate periods may benefit from ARM selection with refinancing plans when rates eventually decline.

Float-down options allow physicians to capture rate improvements between lock and closing if market conditions improve unexpectedly. These provisions typically cost 0.125% to 0.25% in upfront fees or rate premium, providing one-time opportunities to reset locked rates if improvements exceed specific thresholds. Float-down makes sense for physicians with extended closing timelines or when purchasing during volatile rate environments with significant downward movement potential.

Home Loans for Medical Doctors Across Different Specialties and Career Stages

Medical professionals across diverse specialties and career stages access home loans for medical doctors tailored to their unique circumstances, from residents and fellows just beginning careers to established practitioners building investment portfolios. Lenders recognize that compensation structures, practice patterns, and financial profiles vary dramatically between emergency physicians, surgeons, primary care doctors, and other specialties. Understanding how different medical careers interact with physician lending programs helps doctors optimize financing strategies throughout professional evolution.

Resident and fellow compensation creates entry-level challenges since training salaries typically range from $60,000-75,000 annually, limiting conventional mortgage qualification. However, physician mortgage programs specifically designed for trainees allow approval based on signed employment contracts showing substantially higher attending incomes. This unique feature enables residents to purchase homes months before training completion, establishing homeownership early and building equity during critical career transition periods.

Established physicians often transition focus from primary residence financing toward building investment property portfolios generating passive income and wealth accumulation. Successful medical professionals leverage strong incomes to qualify for multiple mortgages simultaneously, though loan count limitations and debt-to-income constraints eventually require alternative strategies. Understanding how to scale real estate investing while managing primary practice responsibilities creates powerful wealth-building opportunities for high-earning doctors.

How Do Primary Care Physicians Approach Mortgages?

Primary care physicians including family medicine doctors, internists, and pediatricians typically earn $200,000-280,000 annually depending on practice settings and geographic locations. These stable income levels support comfortable homeownership through conventional or physician mortgage financing, though primary care compensation generally runs lower than procedure-based specialties. Strategic home loans for medical doctors in primary care focus on maximizing affordability through minimal down payments and PMI elimination rather than jumbo financing for luxury properties.

Geographic considerations prove particularly important for primary care physicians since compensation varies dramatically between rural, suburban, and urban practice locations. Doctors serving underserved areas may access additional benefits through loan forgiveness programs and community development incentives designed to attract healthcare providers. Rural primary care physicians should explore USDA loan options alongside physician mortgages when purchasing in eligible areas, potentially securing even more favorable terms.

Primary care practice ownership creates opportunities for wealth building beyond clinical compensation through business value appreciation and equity accumulation. Physicians purchasing or developing practices generate dual income streams from clinical work and practice ownership, supporting larger mortgages and investment property acquisition. Calculate qualification potential using our self-employed income calculator when practice ownership contributes to total earnings.

What Works Best for Surgical Specialists?

Surgical specialists including orthopedic surgeons, neurosurgeons, cardiovascular surgeons, and plastic surgeons often command highest physician compensation ranging from $400,000 to $600,000+ annually in many markets. These substantial incomes support aggressive wealth-building strategies including luxury primary residences, vacation properties, and extensive investment portfolios. Home loans for medical doctors in surgical specialties frequently involve jumbo financing exceeding conventional loan limits given expensive housing preferences.

Call pay and productivity bonuses represent significant income components for many surgical specialists, sometimes comprising 30-50% of total compensation. Lenders must carefully evaluate contract structures to determine how much bonus income qualifies for mortgage approval. Conservative underwriting might exclude variable compensation entirely, while aggressive physician lending programs include projected bonuses at full value when supported by reasonable productivity expectations and specialty norms.

Partnership track timing influences mortgage planning for surgical specialists since compensation often increases dramatically upon partnership admission. Surgeons approaching partnership decisions may benefit from delaying major home purchases until elevated income levels become guaranteed through partnership agreements. Alternatively, physicians can qualify based on existing compensation then upgrade homes through refinancing or home equity access once partnership income stabilizes.

How Do Emergency Medicine and Hospitalist Physicians Qualify?

Emergency physicians and hospitalists often work as independent contractors or through locum arrangements rather than traditional employment relationships. This creates unique documentation challenges for home loans for medical doctors since 1099 income requires more extensive verification than W-2 employment. Lenders typically require two years of 1099 income history for independent contractor physicians, though specialized 1099 loan programs may accommodate shorter timeframes with strong credentials.

Shift-based compensation models in emergency medicine create income consistency questions since schedules fluctuate and earnings vary monthly. Physicians must demonstrate stable annual income trends rather than uniform monthly deposits, requiring careful documentation of work patterns and compensation rates. Maintaining detailed records of completed shifts, upcoming schedule commitments, and average hourly rates strengthens applications when conventional documentation approaches prove challenging.

Multiple employer relationships common among emergency physicians and hospitalists require thorough income verification from each source. Lenders may request employment letters or contracts from all facilities where physicians maintain credentials, aggregating income across relationships to determine total qualifying earnings. This comprehensive approach recognizes modern emergency medicine practice patterns while ensuring adequate income exists to support mortgage obligations.

What About Physician Assistants and Nurse Practitioners?

While not physicians, physician assistants and nurse practitioners often qualify for medical professional mortgage programs given similar career stability and income profiles. These advanced practice providers typically earn $100,000-150,000 annually, supporting comfortable homeownership through specialized lending or conventional mortgage products. Some lenders extend physician mortgage benefits including flexible student debt treatment and minimal down payments to PAs and NPs, while others restrict programs to medical doctors only.

Qualification approaches for advanced practice providers vary significantly between lenders, making rate shopping essential for PAs and NPs seeking optimal terms. Institutions emphasizing medical degree requirements typically redirect advanced practice providers toward conventional mortgages, while those focusing on healthcare career stability extend physician loan benefits more broadly. Understanding each lender’s eligibility criteria prevents wasted application efforts and identifies most favorable financing sources.

Student loan considerations prove important for physician assistants and nurse practitioners since many carry substantial educational debt from accelerated training programs. While total debt loads typically run lower than physician obligations, PA and NP incomes also sit below MD compensation, creating proportional debt-to-income challenges. Lenders offering flexible student debt treatment for advanced practice providers dramatically improve qualification capacity compared to conventional underwriting approaches.

Physician Mortgage Lenders and How to Choose the Right Institution

Selecting among physician mortgage lenders represents one of the most consequential decisions medical professionals make when securing home financing. Lenders vary dramatically in program structures, rate competitiveness, service quality, and medical professional expertise. National banks, regional institutions, credit unions, and specialized medical lending firms all offer physician mortgages with different advantages and limitations. Understanding how to evaluate these options ensures doctors work with lenders providing optimal terms and seamless experiences.

The physician mortgage lending landscape includes diverse participants from massive money-center banks with dedicated medical professional divisions to small credit unions serving local healthcare communities. Large national lenders offer sophisticated programs with high loan limits and multi-state licensing, supporting physicians relocating between markets or purchasing in multiple locations. Regional institutions sometimes provide more personalized service and aggressive pricing for local medical professionals, though geographic restrictions limit utility for doctors moving between states.

Reputation and experience with medical professional financing should weigh heavily when comparing physician mortgage lenders. Institutions with established track records successfully closing physician loans understand unique documentation requirements, credential verification processes, and timing sensitivities around training completion and position transitions. Inexperienced lenders often create frustrating delays through unfamiliar procedures or inappropriate application of conventional underwriting standards to physician-specific situations.

What Questions Should Physicians Ask Lenders?

Medical professionals evaluating physician mortgage lenders should begin with comprehensive questions about program eligibility and structure. Key inquiries include which specialties and credentials qualify, whether residents and fellows receive approval, how student loans get treated in qualification calculations, and what maximum loan amounts the lender supports. Understanding these fundamentals immediately identifies whether specific lenders can serve individual physician situations before investing time in detailed applications.

Interest rate competitiveness requires direct comparison across multiple lenders through formal rate quotes based on specific scenarios. Physicians should request quotes assuming identical loan amounts, down payments, credit scores, and property types to enable apples-to-apples rate comparisons. Important follow-up questions include whether quoted rates include discount points, what fees apply, and how rates compare for different down payment scenarios. Use our mortgage rate comparison calculator to evaluate total costs across lenders.

Closing timeline expectations and service quality indicators deserve careful attention when selecting physician mortgage lenders. Doctors should inquire about average days from application to closing, whether lenders accommodate accelerated timelines when necessary, and what dedicated support exists for physician clients. Reading online reviews and requesting references from other medical professionals who used specific lenders provides valuable insight into actual service experiences beyond marketing promises.

How Do Credit Unions Compare to National Banks?

Credit unions serving medical professionals often offer competitive physician mortgage rates and personalized service surpassing large national institutions. Membership typically requires employment at affiliated hospitals or healthcare organizations, though some medical credit unions accept any licensed physician regardless of practice location. These member-owned cooperatives sometimes provide more flexible underwriting and lower fees than profit-driven banks, though loan limits and geographic licensing may restrict options.

National banks bring substantial lending capacity and sophisticated physician mortgage programs developed through decades serving medical professionals. Large institutions typically support higher loan amounts up to $2-3 million and maintain licensing across all states, accommodating physicians relocating or purchasing investment properties in multiple markets. However, bureaucratic processes and less personalized service sometimes frustrate doctors accustomed to relationship-based banking experiences.

The optimal choice between credit union and national bank physician mortgage lenders depends on individual priorities around relationship importance, loan complexity, and geographic scope. Physicians purchasing conventional loan amounts for primary residences in single states may prefer credit union intimacy and competitive pricing. Doctors building multi-state investment portfolios or requiring jumbo financing often benefit from national bank capabilities despite potential service tradeoffs. Many savvy physicians maintain relationships with both institution types, selecting appropriate lenders for specific transactions.

What Role Do Mortgage Brokers Play in Physician Lending?

Mortgage brokers specializing in medical professional financing access physician mortgage products from dozens of lenders simultaneously, creating powerful comparison shopping advantages for busy doctors. Rather than separately contacting multiple banks and credit unions, physicians work with single broker contacts who source optimal programs across extensive lender networks. This approach saves substantial time while ensuring comprehensive market coverage identifying best available terms.

Broker compensation structures warrant understanding since these professionals earn commissions from lenders rather than charging physicians directly. This creates alignment where brokers succeed by successfully closing loans for medical professional clients, motivating strong advocacy throughout application and underwriting processes. However, physicians should verify that brokers present truly competitive options rather than steering toward lenders paying highest commissions regardless of physician benefit.

Finding experienced mortgage brokers with established physician lending expertise proves essential for optimal outcomes. The best brokers maintain deep lender relationships built through consistent physician loan volume, enabling efficient processing and problem resolution when documentation or underwriting challenges emerge. Medical professionals should interview multiple brokers, asking about physician loan specialization, lender access, and references from satisfied doctor clients before committing to specific partnerships.

How Do Online Lenders Fit into Physician Mortgages?

Digital mortgage platforms have entered physician lending markets offering streamlined applications, rapid approvals, and competitive pricing through technology-driven efficiency. These online lenders typically provide 24/7 application access, automated document upload, and real-time status tracking appealing to tech-savvy medical professionals. However, physician mortgage complexity sometimes exceeds online platform capabilities, creating situations where human expertise and relationship management prove valuable despite digital convenience.

The hybrid approach combining online efficiency with dedicated human support represents emerging best practice in physician mortgage lending. Leading institutions offer digital application portals and document management while assigning experienced loan officers who understand medical professional financing nuances. This balanced model delivers technology convenience without sacrificing expertise required for complex physician transactions involving employment contracts, student debt, and credential verification.

Physicians should evaluate online lenders carefully, focusing on physician program specifics rather than general mortgage rates advertised for conventional borrowers. Many digital platforms offer physician loans as additions to core conventional lending businesses rather than specialized focuses. Doctors benefit most from lenders—whether traditional or digital—demonstrating genuine physician lending expertise through dedicated programs, experienced teams, and track records successfully serving medical professionals.

Physician Mortgage Rates and Long-Term Financial Planning Integration

Strategic integration of physician mortgage rates into comprehensive financial planning creates substantial wealth-building advantages for medical professionals beyond simple homeownership cost considerations. Interest rates influence not only monthly housing expenses but also opportunity costs of capital allocation, investment portfolio construction, and debt versus equity balance decisions that compound over decades. High-income physicians who understand these connections make significantly better financial decisions than those viewing mortgages in isolation from broader wealth strategies.

The fundamental question facing medical professionals involves debt payoff prioritization versus investment portfolio building given finite resources available for both objectives. Physicians carrying mortgages at 6-7% interest rates face compelling arguments for accelerated payoff, particularly those with conservative risk tolerance preferring guaranteed returns from debt elimination. Conversely, doctors comfortable with market volatility might achieve superior long-term wealth building by maintaining mortgages while directing surplus income toward diversified investment portfolios.

Historical market returns averaging 10-11% annually suggest physicians with physician mortgage rates below 7% may build more wealth through investing rather than prepaying mortgages. This mathematical advantage compounds substantially over 20-30 year homeownership periods, potentially creating hundreds of thousands in additional net worth. However, actual outcomes depend on market performance, investment discipline, and individual risk tolerance factors requiring personalized analysis rather than one-size-fits-all recommendations.

Should Physicians Pay Off Mortgages Early or Invest?

The debate between mortgage prepayment versus investing involves multiple considerations beyond simple return comparisons. Psychological factors prove important since many physicians value debt-free living and guaranteed returns from mortgage elimination despite potentially superior investment alternatives. Risk-averse doctors often sleep better knowing homes are fully owned regardless of market volatility, creating quality-of-life benefits that raw financial calculations might not fully capture.

Tax considerations complicate mortgage prepayment analysis since interest deductibility reduces effective borrowing costs for physicians in elevated tax brackets. A doctor in the 37% federal tax bracket plus state taxes might enjoy effective mortgage costs near 4% on loans charging 6.5% nominal rates after deducting interest expenses. This tax benefit strengthens arguments for maintaining mortgages while investing, particularly when combined with opportunities to access home equity later through cash-out refinancing or HELOCs if circumstances require.

Liquidity represents another crucial factor in the prepayment decision since aggressively paying off mortgages ties up capital in home equity that cannot be easily accessed without refinancing or selling. Medical professionals facing unexpected expenses, practice opportunities, or investment deals benefit from maintaining liquid investment portfolios rather than concentrating wealth in primary residence equity. Calculate various scenarios using our mortgage payoff calculator to evaluate prepayment timelines and opportunity costs.

How Do Physician Mortgage Rates Influence Refinancing Decisions?

Refinancing decisions for medical professionals require careful analysis of interest rate differentials, closing costs, planned ownership duration, and opportunity costs of cash deployed in transactions. The traditional rule suggesting refinancing when rates drop 0.75% to 1% provides rough guidance but oversimplifies complex tradeoffs physicians face. More sophisticated approaches compare total interest savings against refinancing costs, calculating break-even periods determining whether transactions make financial sense.

Current physician mortgage rates must drop sufficiently below existing loans to justify refinancing expenses typically ranging from 2-3% of loan amounts. A physician with a $500,000 mortgage at 6.5% facing $10,000-15,000 in refinancing costs needs new rates below 5.75% to break even within reasonable timeframes. Higher-balance mortgages create more compelling refinancing opportunities since interest savings apply to larger principal amounts, justifying transaction expenses more readily than smaller loans.

Physicians with short remaining ownership timelines should carefully evaluate whether refinancing makes sense given limited time periods for recouping closing costs through reduced interest payments. Doctors planning relocations within 2-3 years rarely benefit from refinancing unless rate reductions exceed 1.5-2%, creating rapid payback through substantial monthly savings. Conversely, medical professionals with decades remaining in homes can justify refinancing for smaller rate improvements given extended benefit periods.

What Are the Implications for Retirement Planning?

Mortgage obligations in retirement create fixed expenses that retirees must cover through savings withdrawals, pensions, Social Security, and investment income. Many financial planners recommend physicians eliminate mortgages before retirement to minimize required spending levels and preserve portfolio longevity. Debt-free retirement living reduces withdrawal needs by thousands monthly, creating substantial financial security benefits particularly during market downturns when portfolio drawdowns prove costly.

Alternative perspectives suggest maintaining low-rate mortgages into retirement preserves investment portfolio capital that generates income exceeding mortgage costs. A physician holding a $400,000 mortgage at 4% could maintain the loan through retirement, keeping portfolio investments earning 8-10% returns while making tax-deductible interest payments. This leveraged approach creates higher net worth over time but requires comfort with debt and confidence in market returns exceeding borrowing costs.

The optimal retirement mortgage strategy depends on individual circumstances including retirement income sources, risk tolerance, estate planning objectives, and healthcare costs. Medical professionals with substantial pensions and Social Security income may comfortably maintain mortgages through retirement, while those relying primarily on investment portfolio withdrawals often benefit from debt elimination. Working with financial advisors experienced in physician planning helps integrate mortgage decisions into comprehensive retirement strategies.

How Do Rate Environments Impact Real Estate Investment Timing?

Interest rate environments dramatically influence real estate investment timing and strategy selection for physician investors building rental property portfolios. Low-rate periods favor aggressive acquisition since cheap financing maximizes cash-on-cash returns and creates powerful leveraged appreciation. Physicians purchasing investment properties at 4-5% mortgage rates enjoy substantial competitive advantages over later buyers financing identical properties at 7-8% rates.

High-rate environments require more selective investment property acquisition focusing on properties offering exceptional cash flow or forced appreciation potential through renovations. Medical professionals may slow portfolio expansion during elevated rate periods, concentrating on optimizing existing properties, building reserves, and identifying off-market opportunities unavailable to typical buyers. Understanding that real estate cycles include both acquisition and consolidation phases prevents poor timing decisions that destroy wealth.

Rate forecasting proves nearly impossible with consistent accuracy, suggesting physicians should focus on deal quality rather than attempting perfect market timing. Strong investment properties generating positive cash flow with reasonable leverage work across rate environments, while marginal deals relying on appreciation or minimal margins fail when conditions deteriorate. Calculate investment property returns using our rental property calculator to evaluate whether specific deals make sense regardless of rate environment speculation.

Doctor Lending Programs for Practice Acquisition and Business Financing

Medical professionals expanding beyond personal real estate into practice ownership and business development require specialized doctor lending programs addressing unique healthcare industry circumstances. Practice acquisitions involve complex valuations, accounts receivable considerations, equipment financing, and real estate components when purchasing buildings housing medical operations. Understanding how lenders approach medical practice financing enables physicians to structure deals optimally while securing favorable terms supporting business growth objectives.

Traditional small business lending often proves inadequate for medical practice acquisitions since conventional business loan underwriting doesn’t accommodate healthcare industry nuances including billing cycles, insurance reimbursement structures, and credentialing requirements. Specialized medical practice lenders understand these dynamics, offering tailored financing solutions recognizing that established practices with solid patient bases represent lower risk than lenders might initially perceive through generic small business evaluation approaches.

Separating real estate from practice purchase considerations often creates optimal financing structures since commercial real estate loans and practice acquisition financing serve different purposes with distinct qualification requirements. Physicians purchasing both practices and associated buildings may benefit from parallel financing tracks with commercial mortgages covering real estate and working capital loans addressing practice purchase prices, equipment, and initial operating expenses.

How Do Medical Practice Acquisition Loans Work?

Practice acquisition financing for physicians typically involves term loans repaid over 7-15 years through practice cash flows, with loan amounts based on practice valuations and revenue multiples. Lenders generally finance 60-90% of purchase prices depending on practice financial performance, down payment capacity, and buyer qualifications. Physicians provide down payments from personal savings, often 10-25% of acquisition costs, demonstrating financial commitment while reducing lender risk exposure.

Due diligence becomes critical in practice acquisition lending as lenders evaluate historical financial performance, patient retention rates, payer mix, and transition risks when ownership changes. Medical professionals should engage accountants and attorneys experienced in practice acquisitions to review financial statements, contracts, and operational structures before committing to purchases. Lenders may require seller financing or earn-out structures where portions of purchase prices depend on future practice performance, sharing transition risk between buyers, sellers, and lenders.

Interest rates on practice acquisition loans typically run 2-4 percentage points above residential mortgage rates, reflecting higher risk profiles and lack of government guarantees supporting conventional home loans. However, medical practice lending remains relatively attractive compared to generic small business financing given healthcare industry stability and physician income potential. Physicians should shop multiple lenders specializing in medical practice financing to identify competitive terms and favorable structures supporting successful transitions.

What Commercial Real Estate Options Exist for Medical Buildings?

Physicians purchasing buildings housing their practices access commercial real estate financing distinct from residential mortgages but with some parallel features. Commercial loans typically amortize over 20-25 years with 5-10 year terms requiring refinancing or balloon payments at maturity, creating periodic opportunities to adjust rates and terms based on market conditions. Down payment requirements generally run 20-30% for medical office buildings, higher than residential mortgages but manageable for successful physicians.

Small Business Administration 504 loans provide attractive alternatives for medical professionals purchasing owner-occupied commercial real estate including medical office buildings. These government-backed programs offer long-term fixed-rate financing up to $5-5.5 million with down payments as low as 10%, substantially better than conventional commercial lending terms. However, SBA programs involve more paperwork and longer closing timelines than traditional commercial mortgages, requiring advance planning.