Real Estate Investment Strategies: Complete Wealth-Building Strategy Guide

Real Estate Investment Strategies: Complete Wealth-Building Strategy Guide

Introduction

Real estate investment strategies represent the pathways through which investors build wealth, generate passive income, and achieve financial freedom through property ownership. Whether you’re considering your first rental property or planning to scale an existing portfolio, understanding the full spectrum of available approaches is essential for making informed decisions.

The right real estate investment strategies can transform your financial future within just a few years of consistent implementation. From house hacking strategies that eliminate housing costs to sophisticated commercial real estate investing in multifamily properties, each strategy offers distinct advantages and challenges.

This comprehensive guide explores proven real estate investment strategies used by successful investors to build substantial portfolios. You’ll discover how BRRRR method approaches enable rapid portfolio growth with limited capital.

Understanding these strategies helps you select the approach matching your goals, available capital, risk tolerance, and desired involvement level. Some investors prefer active strategies like fix and flip investments generating immediate profits through property transformation.

Others gravitate toward passive approaches including real estate syndication opportunities requiring zero management involvement. The key is matching strategy to situation through careful analysis of available options and honest self-assessment.

Key Summary

Understanding real estate investment strategies is crucial for building lasting wealth through property ownership. This comprehensive guide explores proven approaches that successful investors use to generate income and appreciation across various market cycles.

In this comprehensive guide:

- Learn proven BRRRR method strategies from BiggerPockets real estate experts for systematic portfolio expansion through capital recycling

- Discover fix and flip financing options through National Association of Realtors investment data that maximize profitability in property transformation

- Explore 1031 exchange tax deferral strategies outlined by IRS guidelines for portfolio optimization without tax consequences

- Master commercial real estate investing approaches from Urban Land Institute development research for large-scale investment opportunities

- Understand passive income investment structures analyzed by National Multifamily Housing Council data for hands-off wealth building

What Is the BRRRR Method in Real Estate Investing?

The BRRRR method represents one of the most powerful real estate investment strategies for building substantial portfolios with limited initial capital. BRRRR stands for Buy, Rehab, Rent, Refinance, Repeat – a systematic approach to recycling investment capital across multiple property acquisitions.

Unlike traditional buy-and-hold approaches where capital remains locked in properties indefinitely, BRRRR method investing uses strategic refinancing to pull initial capital back out after adding value. This enables investors to acquire multiple properties without continuously adding new funds from employment income or savings accounts.

The strategy gained popularity through real estate education platforms and has become the preferred approach for serious investors. By recycling the same initial capital repeatedly, BRRRR investors transform $100,000 into control of $1,000,000+ in real estate within 3-5 years.

How Does the BRRRR Method Create Wealth Through Capital Recycling?

The BRRRR method creates wealth through a systematic five-phase process that forces appreciation while establishing cash flow. Each phase builds upon the previous step, creating a repeatable system for portfolio expansion that doesn’t require constantly adding new capital from external sources.

Smart BRRRR investors develop detailed processes for each phase. These systems enable delegation to team members as portfolios scale beyond what individual investors can personally manage while maintaining quality standards and profitability targets.

Calculate your BRRRR method potential returns before purchasing properties to ensure adequate profit margins exist. The calculator helps determine maximum purchase prices that still allow capital recovery through refinancing after renovation completion.

What Properties Work Best for BRRRR Method Investing?

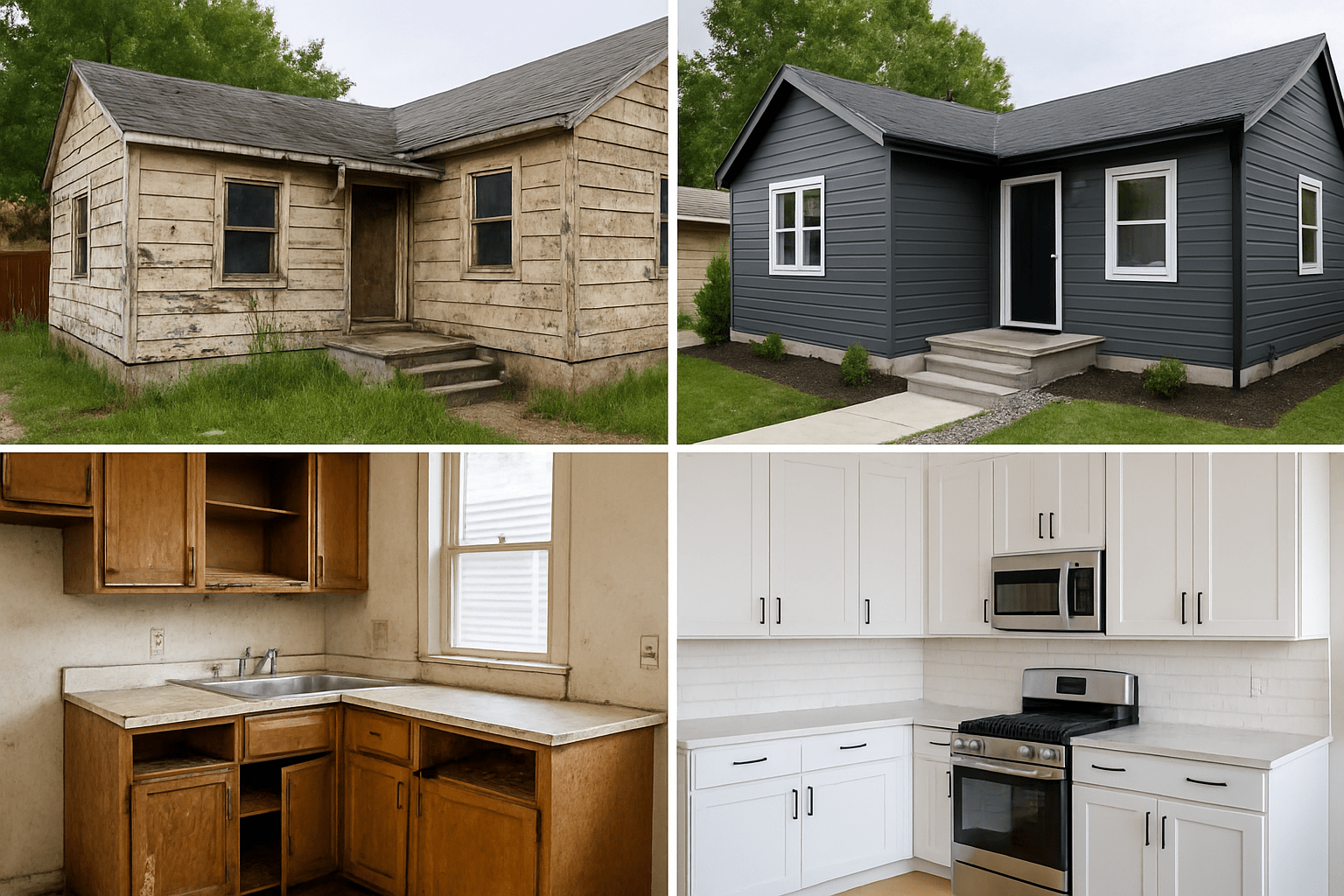

Successful BRRRR implementations begin with purchasing distressed properties at significant discounts from fair market values. Investors typically target properties selling for 20-30% below market value, creating immediate equity potential through strategic renovation work that transforms neglected properties into desirable rentals.

Finding these deeply discounted opportunities requires building relationships with wholesalers who specialize in locating distressed properties. Attending foreclosure auctions where banks sell repossessed homes provides another source of discounted BRRRR properties before they reach broader markets.

Networking with real estate agents specializing in investment properties generates off-market deal flow. Direct mail marketing to absentee owners, probate leads, and tired landlords creates additional deal sources for investors willing to implement consistent marketing systems generating steady opportunities.

Many successful BRRRR investors spend $500-$1,000 monthly on marketing activities. This consistent investment generates deal flow supporting systematic portfolio expansion of 3-6 properties annually depending on market conditions and investor capacity for managing multiple renovation projects simultaneously.

How Do BRRRR Investors Finance Initial Property Purchases?

Most BRRRR investors use hard money loans or bridge loans for initial acquisitions. These short-term loans provide quick closing capabilities often completing within 7-14 days compared to 30-45 days required for conventional financing through traditional banks.

Hard money lenders focus primarily on property values and investor experience rather than personal financial profiles. This makes financing accessible to investors with recent credit challenges or self-employed income that’s difficult to verify through traditional employment documentation methods.

Typical hard money terms include 85-90% loan-to-value ratios on purchase prices plus 100% of renovation costs funded through draw schedules. Interest rates typically range from 8-12% annually with origination points of 2-4% charged at closing, adding to total financing costs that must be recovered through successful sales or refinancing.

Calculate hard money loan costs for potential deals before submitting offers. Understanding total financing expenses including interest, points, and holding costs ensures adequate profit margins remain after accounting for all acquisition and carrying costs throughout project timelines.

Some experienced BRRRR investors transition from hard money to private money financing from individual investors. Private lenders typically offer lower rates of 6-10% with minimal points compared to institutional hard money lenders, significantly improving deal profitability through reduced financing costs on each transaction.

What Renovations Add Maximum Value in BRRRR Properties?

The rehabilitation phase transforms distressed properties into rent-ready assets attracting quality tenants while supporting premium rental rates. Smart BRRRR investors focus on repairs and upgrades that maximize after-repair values while controlling renovation costs carefully to preserve profitability margins.

Typical BRRRR renovations include complete kitchen updates with modern appliances and finishes. Bathroom renovations with updated fixtures and tile work significantly impact property appeal and rental rates in most markets.

New flooring throughout living areas creates move-in ready appearance that attracts quality tenants. Fresh neutral paint eliminates previous owner preferences while appealing to broader tenant demographics maximizing rental demand.

Necessary systems repairs ensure properties function reliably for tenants while minimizing maintenance calls. Fix and flip loan financing provides renovation capital through draw schedules tied to completion milestones, enabling contractors to receive payment as work progresses rather than requiring investors to fund entire renovations upfront.

Creating detailed scopes of work before closing prevents budget overruns and timeline delays. Walking properties methodically with experienced contractors before purchase identifies all required repairs and upgrades with associated cost estimates for materials and labor.

How Long Should BRRRR Renovations Take to Complete?

Properties should complete renovations within 60-90 days maximum to minimize carrying costs. Every additional month extending beyond planned timelines costs $2,000-$4,000 in interest payments, insurance premiums, utilities, property taxes, and opportunity costs from delayed tenant placement and rental income generation.

Creating detailed project schedules before renovations begin identifies task sequencing and duration estimates. Sharing schedules with contractors establishes clear timeline expectations with consequences for delays extending beyond reasonable tolerances.

Many successful BRRRR investors develop contractor teams capable of handling 3-5 renovation projects concurrently. This enables systematic portfolio scaling beyond what’s possible when personally managing each renovation project individually without delegation to experienced team members.

Calculate rental property returns factoring in realistic renovation timelines. Extended projects destroy profitability through increased carrying costs even when renovation budgets remain controlled within original estimates.

What Tenant Screening Protects BRRRR Investments?

Once renovations complete, BRRRR investors place quality tenants generating monthly rental income covering operating expenses. Proper tenant screening protects investments from problematic tenants who damage properties or fail to pay rent consistently causing costly eviction processes.

Verification of employment and income ensures tenants can afford rental rates. Checking rental history with previous landlords reveals payment patterns and property care standards before approving applications.

Reviewing credit reports identifies potential payment issues or excessive debt loads. Conducting criminal background checks protects properties and other tenants from individuals with violent histories or property crimes in their backgrounds.

Many BRRRR investors hire professional property management companies handling tenant placement, rent collection, and maintenance coordination. While management fees typically run 8-10% of gross rents, professional management enables portfolio scaling beyond personal management capacity while reducing investor time commitments.

Establishing rental income history for 6-12 months before refinancing strengthens applications. Some lenders require full 12-month rental history before approving BRRRR refinancing requests, making tenant placement timing critical for capital recycling speed.

How Does BRRRR Refinancing Pull Capital Out?

After establishing rental income for several months, BRRRR investors refinance into long-term financing based on properties’ new higher after-repair values. This refinancing pulls initial investment capital back out while establishing permanent financing with lower interest rates than initial acquisition loans charged.

DSCR loan programs enable refinancing based on rental income rather than personal income verification. This makes DSCR loans ideal for BRRRR investors with multiple properties or self-employed income that’s difficult to document through traditional verification methods requiring tax returns and pay stubs.

DSCR lenders underwrite properties based on debt service coverage ratios calculated by dividing net operating income by annual debt service. Most DSCR lenders require minimum ratios of 1.0-1.25, meaning rental income must exceed debt service by 0-25% for loan approvals.

Refinancing typically allows pulling out 70-75% of after-repair values as new loan proceeds. On properties purchased for $100,000 with $40,000 in renovations and $200,000 after-repair values, refinancing at 75% LTV yields $150,000 in proceeds.

This recovers the entire $140,000 initial investment while leaving $10,000 profit plus ongoing monthly cash flow. Calculate BRRRR refinancing scenarios to determine whether adequate value-add potential exists before purchasing properties.

What Makes BRRRR Method Repeatable for Portfolio Growth?

With capital recovered through refinancing, investors repeat the BRRRR process on additional properties systematically. This approach enables portfolio growth from 1-2 properties to 10-20+ properties within 3-5 years without continuously adding new capital beyond initial investment amounts.

Successful BRRRR investors build systematic processes for finding deals through consistent marketing efforts. Managing renovations with reliable contractor teams and placing tenants using professional property management creates operational efficiency enabling portfolio scaling.

Portfolio loan financing supports investors managing multiple BRRRR properties simultaneously. Blanket financing across entire portfolios simplifies management while potentially offering better terms than accumulating separate mortgages on each individual property acquisition.

Creating detailed systems, checklists, and processes for each BRRRR phase enables delegation as portfolios scale. Many successful investors eventually delegate property finding, renovation management, and tenant placement to team members while focusing personal attention on deal analysis and lender relationship management.

What Is Fix and Flip Real Estate Investing?

Fix and flip real estate strategies focus on purchasing distressed properties below market value, renovating them strategically and efficiently, and selling for substantial profits within 6-12 months. Unlike BRRRR investing creating long-term rental income streams, fix and flip strategies target immediate capital gains through property transformation and resale to end buyers.

The fix and flip business model attracts investors seeking active involvement in real estate investment strategies. Successful flippers can generate $20,000-$50,000+ profits per deal, making this approach attractive for investors willing to manage renovation projects actively while accepting lumpy income patterns versus steady monthly rental cash flow.

Fix and flip investing requires different skills than rental property investing approaches. Flippers must accurately estimate renovation costs, manage contractors and timelines effectively, and understand local real estate markets intimately for successful property transformations.

Strong sales and marketing abilities help sell renovated properties quickly at maximum prices. Calculate fix and flip potential profits before purchasing properties to ensure adequate margins exist after accounting for all costs including acquisition financing, renovation expenses, holding costs, and transaction fees at sale.

How Does Fix and Flip Differ From BRRRR Method Investing?

Understanding fundamental differences between fix and flip and BRRRR method approaches helps investors select strategies matching their goals and preferred involvement levels. Both strategies involve purchasing distressed properties and renovating them, but the similarities end there as exit strategies and profit realization timing differ dramatically.

Fix and flip investments target quick property turnaround times of 3-6 months total from initial purchase through complete renovation and final sale. Every additional month extending beyond planned timelines costs $2,000-$4,000 in carrying costs including interest payments, insurance, utilities, and property taxes.

BRRRR method strategies involve longer initial holding periods of 6-12 months to establish rental income history before refinancing. Properties then hold indefinitely as cash-flowing rentals generating ongoing monthly income while building equity through appreciation and mortgage principal paydown over many years.

The compressed fix and flip timeline creates intense pressure to complete renovations quickly and sell promptly. BRRRR timelines allow more flexibility since properties generate rental income during extended holding periods rather than incurring pure carrying costs during renovations and marketing periods before tenant placement.

How Are Fix and Flip Profits Taxed Differently Than Rentals?

Fix and flip profits realize entirely at sale closing when all proceeds distribute after paying off acquisition financing. This lumpy income pattern means flippers might complete 3-6 deals annually generating $60,000-$180,000 in total profits distributed across just a few large transactions throughout the year.

BRRRR investors realize profits gradually through monthly rental income cash flow and annual appreciation. This steady income stream provides more predictability and easier budgeting than fix and flip lumpy profits that arrive in large chunks at irregular intervals depending on project completion and sale timing.

Fix and flip profits typically get taxed as ordinary income at rates up to 37% federally plus state taxes. Properties held less than 12 months don’t qualify for long-term capital gains treatment, and flipping activity may be classified as active business income rather than investment income by tax authorities.

BRRRR rental income receives more favorable tax treatment through depreciation deductions reducing taxable income. Expense write-offs for operating costs and eventual long-term capital gains treatment when selling properties held beyond 12 months provide significant tax advantages compared to fix and flip ordinary income taxation.

What Financing Do Fix and Flip Investors Use?

Most fix and flip investors rely on hard money loan financing specifically designed for short-term property flipping. These specialized loans provide 85-90% of purchase prices plus 100% of renovation costs funded through progressive draw schedules tied to completion milestones throughout rehabilitation projects.

Hard money loans typically feature higher interest rates than conventional financing. Rates range from 8-12% annually depending on borrower experience, property type, local market conditions, and lender competition for quality deals in target markets.

Lenders also charge origination points of 2-4% of total loan amounts at closing. These points add to overall financing costs that must be recovered through profitable sales after accounting for all renovation expenses, holding costs, and transaction fees.

Despite higher rates, hard money offers substantial advantages for fix and flip investments including closing speed of 7-14 days. Flexible underwriting focuses on property values rather than borrower credit profiles, and willingness to fund properties in poor condition that conventional lenders would reject outright makes hard money essential for most flippers.

Calculate fix and flip financing costs from multiple lenders before committing to specific sources. Comparing total costs including rates, points, draw fees, extension fees, and prepayment penalties identifies the most cost-effective financing for specific deal parameters and expected holding periods.

How Do Experienced Flippers Find Private Money Lenders?

Experienced fix and flip investors often transition from hard money to private money financing from individual investors seeking higher returns. Private money typically offers lower rates of 6-10% with minimal points compared to hard money institutional lenders charging 10-12% plus 3-4 points.

Building private money lender networks requires demonstrating track records of successful flips through detailed case studies. Providing transparent reporting on project progress with regular updates and financial statements builds trust with private money sources considering lending on future deals.

Offering attractive risk-adjusted returns through first-position liens on real estate collateral worth substantially more than loan amounts protects private lenders. Most private money lenders require loan-to-value ratios of 65-75% maximum, meaning properties must appraise for $130,000-$155,000 to support $100,000 loans providing adequate equity cushions.

Fix and flip lenders evaluate funding speed, renovation draw schedules, and experience with property types. Lender familiarity with local markets enables better underwriting and more realistic loan structures than lenders unfamiliar with specific markets and property types where deals are located.

What Renovation Strategy Maximizes Fix and Flip Profits?

Renovation execution determines whether fix and flip deals generate substantial profits or devastating losses eating through projected margins. Every decision about renovation scope, materials selection, contractor management, and quality control impacts final profitability after accounting for all costs and holding period expenses.

Creating exhaustively detailed renovation scopes before closing prevents budget overruns and timeline delays. Walking properties methodically with experienced contractors documents all required work in writing with associated costs for materials and labor based on current market rates for quality craftsmanship.

Photographing every area during initial walkthroughs creates before documentation useful for marketing purposes. These photos also protect against contractor disputes about pre-existing damage versus damage occurring during renovation work when disagreements arise about responsibility for repairs.

Comprehensive budgets include structural repairs, roof replacement or repairs, mechanical systems upgrades, kitchen and bathroom renovations, flooring, painting, landscaping, permits and inspections, dumpster rentals, and contingency reserves. Calculate total renovation costs including 15-20% contingencies accounting for unexpected issues inevitably discovered once walls open and systems get thoroughly inspected during renovation work.

How Should Fix and Flip Investors Manage Contractors?

Managing contractors effectively represents perhaps the most critical skill fix and flip investors must develop for consistent profitability. Establishing clear expectations upfront through detailed contracts specifying every aspect of work to be performed prevents misunderstandings about scope, quality standards, and timeline expectations.

Payment schedules should tie compensation to milestone completion rather than time-based schedules rewarding speed over quality. Typical payment structures include 10% deposit at contract signing, 25% at rough work completion, 25% at drywall completion, 25% at substantial completion, and final 15% retention after punch list completion and final inspections.

Conducting regular site inspections at least twice weekly during active renovation periods documents progress through photographs. Verifying work quality meets standards before authorizing draw payments ensures accountability and addresses any deficiencies immediately before allowing contractors to proceed to subsequent phases where correcting earlier problems becomes more expensive.

Building backup contractor relationships for every trade prevents project stalls when primary contractors become unavailable. Having backup general contractors, electricians, plumbers, HVAC technicians, flooring installers, and painters enables quick replacement when performance issues require contractor termination mid-project.

Fix and flip loan draw schedules must align with contractor payment expectations. Coordinating lender inspections and draw releases with contractor milestone completion prevents payment delays that damage relationships or slow project momentum when contractors stop working while awaiting payment.

What Materials Selection Maximizes Fix and Flip Value?

Selecting materials providing the best balance of cost, durability, and market appeal determines profitability margins. Avoid the temptation to over-improve properties with luxury finishes that won’t generate proportional value increases in target price ranges where comparable sales establish value ceilings.

Similarly, avoid cheap materials that look low-quality or won’t withstand normal use without premature failure. Research competitor properties at similar price points to understand what finish levels buyers expect in target markets.

Matching or slightly exceeding these standards without going substantially beyond target market expectations prevents paying for improvements that won’t increase sale prices. Calculate fix and flip material costs factoring in both initial purchase prices and long-term durability expectations for properties being flipped versus rented long-term.

How Quickly Should Fix and Flip Renovations Complete?

Completing renovations in 60-90 days maximum minimizes carrying costs and enables quick sales while market conditions remain favorable. Every additional month extends holding costs by $2,000-$4,000 in interest payments, insurance premiums, utilities, property taxes, and opportunity costs from delayed sales and capital redeployment.

Creating detailed project schedules before renovations begin identifies task sequencing and duration estimates. Sharing schedules with contractors establishes clear timeline expectations with financial penalties for delays extending beyond reasonable tolerances.

Many successful flippers develop contractor teams capable of handling multiple projects concurrently through systematic processes. This enables scaling beyond what’s possible when personally managing each project individually without delegation to experienced team members.

Hard money loan terms typically run 6-12 months with extension options. Every month requiring extensions adds 1-2% in fees plus ongoing interest, destroying profitability even when renovation budgets remain controlled.

How Do Fix and Flip Investors Exit Properties Successfully?

Planning exit strategies before purchasing properties ensures selling renovated properties quickly at target prices. Analyzing comparable sales extensively before purchases reveals what prices similar properties achieve and how long they remain on market before selling.

Understanding buyer preferences in target neighborhoods guides renovation decisions creating maximum appeal. Some markets prefer traditional finishes while others expect modern contemporary aesthetics commanding premium prices.

After renovations complete, listing properties immediately without delays prevents market deterioration. Pricing competitively based on comprehensive comparable analysis, slightly below recent similar sales, generates immediate interest and potentially multiple offers creating competition among buyers.

Professional staging dramatically improves fix and flip outcomes according to National Association of Realtors data. Staged properties sell 73% faster and for 1-5% higher prices than vacant properties, making staging costs of $1,500-$3,000 generate returns of $3,000-$15,000 through faster sales at higher prices.

Professional photography is non-negotiable for marketing success. High-quality images showcase renovation quality, create emotional connections with buyers, and enable properties to stand out among competing listings in crowded markets where buyers scroll through dozens of options online.

What Backup Plans Protect Fix and Flip Investments?

Smart investors plan for scenarios where properties don’t sell quickly despite quality renovations and competitive pricing. Backup options include price reductions to accelerate sales when initial pricing proves optimistic based on actual buyer feedback and showing activity levels.

DSCR loan refinancing converts properties to rentals generating cash flow while waiting for better market conditions. This prevents forced sales at distressed prices during market downturns when buyer demand weakens unexpectedly.

Wholesaling properties to other investors at reduced prices enables quick exits recovering most invested capital. Having pre-existing relationships with investor buyers provides options when retail sales prove difficult due to market conditions or property-specific challenges.

Understanding which DSCR lenders refinance recently completed projects enables conversion to rentals without selling at losses. Not all lenders allow immediate refinancing of recently purchased properties, so researching lender policies before purchasing prevents being trapped without viable exit options.

What Is House Hacking and How Does It Work?

House hacking strategies involve purchasing multi-unit properties, living in one unit while renting others to cover housing costs. This approach allows new investors to enter real estate with owner-occupied financing while generating immediate rental income that dramatically reduces or eliminates personal housing expenses.

The strategy represents perhaps the most accessible entry point for new real estate investors. Using owner-occupied FHA loans with just 3.5% initial capital reduces capital requirements dramatically compared to traditional investment properties requiring 15-25% for initial investments.

House hacking enables investors to live essentially free while building equity through property ownership. Many house hackers achieve negative housing costs where rental income exceeds all property expenses including financing costs, taxes, insurance, and maintenance reserves.

Calculate house hacking potential savings before purchasing properties to understand how much rental income reduces personal housing costs. The calculator factors in all operating expenses, vacancy allowances, and maintenance reserves providing realistic projections of actual savings achieved through house hacking implementation.

What Are the Benefits of House Hacking for New Investors?

House hacking provides invaluable hands-on landlord education while living onsite and managing tenants directly. This experience teaches rental property operations, tenant management, maintenance coordination, and all aspects of property ownership before scaling to multiple properties where mistakes become more costly.

Lower initial capital requirements make house hacking accessible to investors without substantial savings. Using FHA financing for house hacking requires just 3.5% initial capital on properties up to four units, dramatically reducing entry barriers compared to traditional investment property purchases.

Veterans can use VA loans for house hacking with zero initial capital required on properties up to four units. VA loans also avoid mortgage insurance requirements, reducing monthly costs compared to FHA financing while providing identical house hacking benefits.

Reduced or eliminated housing costs accelerate wealth building through savings. Money not spent on rent or housing payments gets invested in additional properties, retirement accounts, or business ventures compounding returns over time through strategic capital deployment.

What Property Types Work Best for House Hacking?

Duplex properties represent the simplest house hacking approach for new investors. Living in one unit while renting the other typically covers 50-75% of total housing costs through rental income generation from the second unit.

Purchasing triplex or fourplex properties enables greater rental income generation while maintaining owner-occupied financing eligibility. Calculate house hacking returns on different property types before selecting property sizes that maximize income while fitting budgets and management capacity.

Some investors house hack single-family homes by renting individual bedrooms to roommates. Converting basements into rentable units or renting accessory dwelling units provides additional house hacking opportunities depending on local regulations and property characteristics.

Local zoning regulations determine feasibility of various house hacking approaches. Researching regulations before purchasing prevents discovering rental restrictions after closing on properties where intended house hacking strategies violate local ordinances or homeowner association rules.

How Do House Hackers Finance Property Purchases?

FHA loans for house hacking offer the lowest initial capital requirements and most flexible qualification standards. These loans work on properties with up to four units as long as owners occupy one unit as their primary residence for at least 12 months after closing.

FHA loans allow including 75% of projected rental income in qualification calculations. This helps buyers qualify for larger loan amounts than personal income alone supports, enabling purchase of properties generating sufficient rental income to cover or exceed all housing costs.

VA loans for house hacking veterans require zero initial capital on properties up to four units. VA financing also avoids mortgage insurance requirements that FHA loans mandate, reducing monthly costs while providing identical house hacking benefits for eligible service members.

Conventional loans for house hacking require higher initial capital but avoid mortgage insurance once reaching 20% equity. These loans offer competitive rates for house hackers with strong credit and ability to provide larger initial investments than FHA minimums require.

What Tenant Screening Protects House Hacking Investments?

Living near house hacking tenants makes proper screening critically important for quality of life. Verifying employment and income ensures tenants can afford rental rates without struggling financially throughout lease terms.

Checking rental history with previous landlords reveals payment patterns and property care standards. Reviewing credit reports identifies potential payment issues or excessive debt loads suggesting financial instability.

Conducting criminal background checks protects properties and personal safety from individuals with violent histories or property crimes. Many house hackers implement stricter screening standards than traditional landlords since they live onsite with tenants daily.

Professional property management companies can handle tenant screening even for house hackers. While management fees run 8-10% of rents, professional screening and placement reduces risk of problematic tenants destroying house hacking financial benefits through property damage or payment defaults.

How Do House Hackers Scale Beyond Their First Property?

After satisfying owner-occupancy requirements, house hackers can purchase additional properties while converting initial properties to pure rentals. This builds portfolios systematically using the same financing advantages repeatedly every 12 months when owners can relocate to new primary residences.

DSCR refinancing enables portfolio expansion without income verification requirements. Converting house hacked properties from owner-occupied FHA or VA loans to DSCR investment property financing frees up owner-occupied loan eligibility for new purchases.

Many successful investors begin with house hacking, then purchase 3-5 properties using owner-occupied financing over several years. This builds substantial portfolios with minimal initial capital compared to traditional investment approaches requiring 20-25% initial capital on every property purchased.

Calculate house hacking portfolio growth potential over multiple years. Understanding how systematic house hacking builds wealth through repeated application of the strategy motivates consistent execution despite challenges of living with tenants during accumulation phases.

>

What Is Real Estate Syndication for Passive Investors?

Real estate syndication pools capital from multiple investors to purchase properties too large for individual acquisition. This investment strategy provides access to commercial properties, large multifamily complexes, and other substantial assets generating institutional-quality returns without requiring active property management or operations involvement.

The syndication structure separates active operators from passive investors through defined roles. General partners identify investment opportunities, secure financing, manage properties, and coordinate all operational aspects while limited partners provide capital without active involvement in day-to-day operations.

Real estate syndication opportunities typically require minimum investments of $25,000-$100,000 per limited partner. Some syndications accept smaller amounts while institutional deals may require $250,000+ minimums depending on total capital raised and number of investors participating.

Understanding syndication structures, sponsor evaluation, and deal analysis enables informed investment decisions. Passive investors must evaluate opportunities carefully since they lack control over property operations once committing capital to syndication investments managed entirely by general partner teams.

How Do General Partners and Limited Partners Differ?

General partners in real estate syndication take active roles identifying investment opportunities and conducting due diligence. They secure financing, negotiate purchase contracts, manage properties, coordinate renovations, and handle all operational aspects throughout entire hold periods until properties sell or refinance.

GPs typically contribute 5-20% of required equity while managing all active responsibilities. Their compensation comes through acquisition fees, asset management fees, and promoted interest in profits after limited partners receive preferred returns and capital return priorities.

Limited partners provide capital for real estate syndication deals but maintain completely passive involvement throughout investment periods. LPs receive ownership percentages based on capital contributions and collect distributions according to operating agreements without participating in property operations or management decisions.

Calculate syndication return potential based on projected distributions and profit sharing structures. Understanding how preferred returns, profit splits, and waterfall distributions work helps evaluate whether syndication opportunities offer attractive risk-adjusted returns compared to alternative investments.

What Deal Structures Do Real Estate Syndications Use?

Most real estate syndications provide limited partners with preferred returns of 6-8% annually before general partners receive profit distributions. This structure aligns interests and prioritizes LP returns, ensuring passive investors receive targeted returns before operators take promoted interest in excess profits.

After paying preferred returns, excess profits split between GPs and LPs according to predetermined ratios. Common structures include 70-30 or 80-20 splits favoring limited partners, though some deals offer 60-40 or 50-50 splits depending on general partner contributions and market conditions.

Waterfall distribution structures tier profit splits based on return thresholds achieved. First-tier returns might split 80-20 favoring LPs, while second-tier returns exceeding 15% IRR might split 70-30, and third-tier returns exceeding 20% IRR might split 60-40 or 50-50.

Real estate syndication structures should align GP and LP interests through properly designed incentive compensation. Evaluating whether fee structures and profit splits create alignment helps determine if sponsor interests match investor objectives throughout entire investment periods.

How Should Investors Evaluate Syndication Sponsors?

Successful real estate syndication investing requires thorough sponsor vetting before committing capital. Reviewing past deal performance reveals whether sponsors consistently achieve projected returns or frequently miss targets requiring capital calls or delayed exits.

Analyzing communication practices shows whether sponsors provide transparent regular updates or go silent between capital raises. Checking investor satisfaction through references helps understand whether sponsors treat investors fairly and communicate honestly about challenges encountered.

Evaluating sponsor experience with specific property types and markets matters significantly for success probability. Sponsors with 10+ years managing multifamily properties in target markets possess expertise that first-time operators attempting new property types or markets lack.

Commercial real estate financing relationships indicate sponsor credibility with institutional lenders. Sponsors maintaining strong lender relationships access better financing terms, improving deal returns for passive investors through reduced interest costs and more favorable loan structures.

What Markets Work Best for Real Estate Syndication?

Evaluating markets where syndication properties are located reveals whether investments will likely achieve projected returns. Strong job growth exceeding national averages supports tenant demand and rent growth assumptions in syndication financial projections.

Population increases indicate market expansion providing tenant bases supporting occupancy. Favorable business climates attracting corporate relocations and expansions generate employment supporting residential demand where multifamily syndications invest capital.

Researching market-specific regulations helps understand landlord operating environment. Markets with rent control, strict eviction procedures, or hostile landlord regulations present operational challenges affecting returns compared to landlord-friendly markets with reasonable regulations.

Calculate syndication returns based on realistic market assumptions rather than sponsor projections alone. Conservative underwriting, realistic renovation budgets, and achievable rent growth assumptions indicate quality syndication opportunities worth serious consideration.

What Risks Do Real Estate Syndication Investors Face?

Real estate syndication investments carry illiquidity risk since capital locks up for 3-10 years typically. No secondary markets exist for selling syndication interests if investors need capital before properties sell or refinance distributions.

Operator risk represents the largest concern for passive investors. General partners control all decisions, and poor management, misappropriation of funds, or incompetence can destroy investor capital regardless of property quality or market conditions.

Market risk affects all real estate investments but syndications magnify exposure through leverage. Properties purchased near market peaks can experience value declines destroying equity when markets correct, potentially resulting in capital losses for investors despite initial underwriting suggesting profits.

Passive income investment diversification across multiple syndications, sponsors, property types, and markets reduces concentration risk. Investing $200,000 across four $50,000 syndications provides better risk management than concentrating entire amounts in single deals.

What Is Commercial Real Estate Investing?

Commercial real estate investing involves purchasing properties used for business purposes rather than residential occupancy. These properties include office buildings, retail centers, industrial warehouses, self-storage facilities, and multifamily properties with five or more units qualifying as commercial rather than residential financing.

Commercial properties typically feature longer lease terms than residential rentals. Office and retail leases often run 3-10 years compared to 6-12 month residential leases, providing more stable income but requiring longer tenant replacement periods when vacancies occur.

Commercial property investment valuation uses income approaches based on net operating income and capitalization rates. This differs from residential comparable sales methods, focusing on income generation capacity rather than recent sale prices of similar properties.

Understanding commercial property analysis requires evaluating tenant creditworthiness, lease terms, and market fundamentals. Successful commercial investors analyze supply and demand dynamics, economic indicators, and demographic trends affecting property types and locations where investments concentrate capital.

How Do Office Building Investments Generate Returns?

Office properties range from single-tenant buildings to large multi-tenant complexes. Success depends on location quality near employment centers, tenant creditworthiness providing stable rent payments, and lease term duration protecting against frequent turnover and vacancy periods.

Class A office buildings in prime locations command highest rents but require larger capital investments. Class B and C buildings in secondary locations offer higher yields but carry more risk from tenant turnover and market competition.

Office property net operating income gets impacted by occupancy rates and tenant improvement allowances. Strong markets with low vacancy and long average lease terms provide more predictable income than markets with high vacancy and frequent tenant turnover requiring constant leasing activity.

Commercial loan financing for office properties typically requires 25-30% initial capital. Lenders underwrite both property income and borrower financial strength when evaluating loan applications for office building acquisitions.

What Makes Retail Property Investing Successful?

Retail properties include everything from strip centers to regional malls. E-commerce growth challenges some retail formats while service-based tenants like restaurants, gyms, medical offices, and personal services remain strong despite online shopping competition.

Anchor tenant quality determines strip center success since anchors drive traffic benefiting smaller tenants. Strong anchors like grocery stores generate consistent traffic supporting smaller retail tenants relying on foot traffic from anchor visitors.

Percentage rent clauses in retail leases tie rent to tenant sales performance. This structure aligns landlord and tenant interests while providing upside potential when tenants succeed beyond base rent thresholds.

Retail property financing evaluates tenant sales performance and lease structure quality. Lenders prefer properties with creditworthy tenants on long-term leases providing stable income regardless of individual tenant sales fluctuations.

Why Do Investors Choose Industrial Warehouse Properties?

Industrial properties benefit from e-commerce growth requiring extensive warehouse and distribution space. Properties near major transportation corridors and population centers command premium rents from logistics companies and distributors.

These properties often feature triple-net leases where tenants pay operating expenses. This structure reduces landlord responsibilities while providing predictable net income since tenants handle property taxes, insurance, and maintenance directly.

Industrial property tenants typically occupy spaces longer than office or retail tenants. Specialized improvements and moving costs create switching costs preventing frequent tenant turnover and providing occupancy stability.

Commercial property investment in industrial assets offers recession resistance through essential logistics functions. Even during economic downturns, distribution and warehousing continue supporting consumer goods delivery and supply chain operations.

How Does Commercial Financing Differ From Residential?

Commercial loan requirements typically demand 25-30% initial capital compared to 15-25% for residential investment properties. Lenders underwrite both properties and borrowers carefully, evaluating personal financial strength alongside property income generation.

Commercial lenders require debt service coverage ratios of 1.25-1.35 meaning properties must generate 25-35% more income than debt service costs. This cushion protects lenders from income fluctuations or expense increases during loan terms.

Loan terms for commercial properties typically run 5-10 years with 20-25 year amortization schedules. Balloon payments at term maturity require refinancing into new loans exposing borrowers to rate risk and refinancing challenges if property performance deteriorates.

Calculate commercial property DSCR requirements before pursuing acquisitions. Understanding how rental income must exceed debt service helps evaluate whether properties can support financing while generating positive cash flow after all operating expenses.

What Are Turnkey Rental Properties?

Turnkey rentals are fully renovated, tenant-occupied properties sold to investors seeking completely passive real estate investments. These properties come with established property management in place, enabling immediate cash flow generation from day one without investor involvement in renovations, tenant placement, or operations setup.

The turnkey rental investment approach appeals to busy professionals, out-of-state investors, and anyone prioritizing passive income over active involvement. Properties arrive ready for ownership transfer with tenants paying rent, management handling operations, and systems established for maintenance coordination and rent collection.

Turnkey rental properties generate cash flow immediately since tenants occupy units and management handles operations. This eliminates the renovation timeline, tenant search process, and operational setup that traditional rental property investments require before producing income.

Out-of-state investing becomes practical through turnkey rentals since investors don’t need local presence. Properties in markets with strong fundamentals and favorable rent-to-price ratios generate better returns than expensive home markets where many investors live and work.

What Benefits Do Turnkey Rentals Provide Investors?

Immediate cash flow generation distinguishes turnkey rentals from properties requiring renovations before tenant placement. Rental income begins flowing immediately after closing, unlike BRRRR method properties requiring 60-90 days for renovations plus additional time for tenant screening and placement.

Out-of-state investing simplification enables investors to acquire properties in strong markets nationwide. Turnkey providers handle all local responsibilities including renovations, tenant placement, property management, and ongoing maintenance coordination that out-of-state investors can’t easily manage directly.

Reduced time commitment represents a major advantage for investors with demanding careers. Unlike fix and flip strategies requiring active renovation management, turnkey rentals need minimal investor time after purchase since property managers handle all operational aspects.

Calculate turnkey rental returns factoring in management fees, vacancy reserves, and maintenance costs. Understanding net returns after all expenses helps evaluate whether turnkey properties offer attractive returns compared to alternative investment opportunities.

How Should Investors Evaluate Turnkey Providers?

Success with turnkey rentals depends heavily on provider quality and market selection. Researching provider track records through customer testimonials and references reveals whether companies consistently deliver quality properties and responsive management as promised.

Visiting properties personally before purchasing, even when buying out-of-state, verifies renovation quality and neighborhood characteristics. Walking neighborhoods, meeting management teams, and inspecting properties firsthand prevents surprises after closing when correction becomes expensive or impossible.

Speaking with past clients provides insights into provider responsiveness and management quality. Asking about challenges encountered and how providers addressed problems reveals whether companies support clients beyond initial sale closings.

Turnkey rental financing through DSCR loans works perfectly since properties already have tenants and documented income. DSCR lenders qualify based on rental income rather than personal income verification, making financing straightforward for turnkey purchases.

What Markets Work Best for Turnkey Rental Investing?

Even with turnkey providers handling operations, investors must analyze markets carefully. Strong job growth exceeding national averages supports tenant demand and rent growth protecting against market downturns and economic challenges.

Population increases indicate expanding markets providing tenant bases supporting occupancy. Favorable rent-to-price ratios typically below 1% monthly enable positive cash flow after all expenses including management, maintenance, vacancy reserves, taxes, and insurance.

Evaluating landlord regulations helps understand operating environment. Markets with tenant-friendly laws, rent control, or difficult eviction procedures present challenges affecting returns compared to landlord-friendly markets with reasonable regulations balancing interests.

Rental property calculators help analyze turnkey rental returns in different markets. Comparing cash flow, appreciation potential, and total returns across markets identifies the strongest opportunities for capital deployment.

How Do Rental Properties Generate Passive Income?

Rental properties for passive income represent the most straightforward real estate investment strategy available. Investors purchase properties, place quality tenants, and hold long-term while building wealth through monthly cash flow, property appreciation, mortgage paydown, and substantial tax benefits that reduce taxable income.

Well-managed rental properties generate reliable monthly income requiring minimal ongoing investor involvement after initial acquisition. Calculate rental property returns to project cash flow before purchasing properties in different markets and price ranges.

Beyond monthly cash flow, rental properties build wealth through property appreciation over time. Historical averages show real estate appreciates 3-5% annually in most markets, though specific properties and markets vary significantly based on local economic conditions and supply-demand dynamics.

Tax advantages of rental income include depreciation deductions reducing taxable income, expense write-offs for operating costs, and preferential capital gains treatment. These benefits make rental properties attractive compared to stocks or bonds producing taxable ordinary income annually without comparable deductions.

What Financing Works Best for Rental Properties?

Conventional loans for rental properties typically require 15-25% initial capital and strong borrower credit scores above 680. These loans offer competitive interest rates for qualified investors with substantial savings and stable employment income.

Conventional financing limits investors to 10 financed properties maximum. This restriction forces portfolio investors to eventually transition to alternative financing options as portfolios scale beyond conventional lending limits.

DSCR loans for rental properties qualify based on property rental income rather than personal income verification. This makes DSCR financing ideal for investors with multiple properties, self-employed income, or retirement income that doesn’t qualify through traditional verification methods.

DSCR loans allow unlimited financed properties since lenders focus on individual property cash flow. No personal income verification requirements eliminate documentation burdens while enabling portfolio scaling beyond conventional lending restrictions.

Portfolio loans finance multiple properties under single loans with blanket liens across several assets. This simplifies management while potentially offering better terms than accumulating separate mortgages on each property purchased.

How Should Investors Select Rental Properties?

Successful rental property investors target properties generating positive cash flow after all expenses. Monthly income must exceed mortgage payments, property taxes, insurance, HOA fees, property management, maintenance reserves, and vacancy allowances to produce actual cash flow rather than just breaking even.

Rental property calculators help analyze cash flow accurately before purchasing. Factoring in realistic expense estimates and vacancy allowances provides accurate projections rather than overly optimistic assumptions that don’t account for real-world operating costs.

Cash flow requirements vary by investment goals. Some investors prioritize immediate cash flow accepting lower appreciation potential in affordable markets. Others accept break-even cash flow in expensive markets expecting substantial appreciation over time.

Appreciation potential analysis evaluates job growth, population trends, and infrastructure development. Markets with strong economic fundamentals typically deliver better long-term returns than markets with declining populations or contracting employment bases.

What Property Management Approach Works Best?

Many rental property investors hire professional property management companies handling tenant placement, rent collection, and maintenance coordination. While management fees run 8-10% of gross rents, professional management enables portfolio scaling beyond personal management capacity.

Self-management saves management fees but requires significant time commitments. Investors managing properties personally must handle tenant calls, coordinate repairs, collect rents, and manage all operational aspects that management companies handle systematically.

Property management software helps self-managing investors operate more efficiently. These platforms automate rent collection, maintenance requests, accounting, and communications reducing time requirements for investors managing smaller portfolios personally.

Calculate property management costs versus time savings before deciding. Understanding whether management fees justify time savings helps determine the best approach for specific investor situations and portfolio sizes.

How Do Short-Term Rentals Differ From Traditional Rentals?

Short-term rental strategies involve purchasing properties and renting them nightly through platforms like Airbnb and VRBO. This approach often generates 2-3x the income of traditional long-term rentals in tourist destinations and high-demand urban markets, justifying additional management intensity required.

Short-term rentals require active management including guest communication, cleaning coordination, and maintenance scheduling. Unlike passive turnkey rental properties with monthly tenants and professional management, short-term rentals need daily attention to guest inquiries, check-ins, and operations.

Income potential advantages make short-term rentals attractive despite management intensity. Properties in strong vacation markets frequently generate $60,000-$100,000+ annually compared to $24,000-$36,000 from traditional rentals, creating substantial income premiums justifying operational requirements.

Understanding local regulations is critical before investing. Many cities restrict or prohibit short-term rentals through zoning regulations, permit requirements, or outright bans making operations illegal in certain markets regardless of income potential.

What Financing Challenges Do Short-Term Rentals Face?

Many lenders restrict financing for properties primarily used as short-term rentals. Traditional loans often prohibit short-term rental operations, requiring owner occupancy or traditional long-term tenant arrangements for compliance with loan terms.

DSCR loan programs provide flexible short-term rental financing using projected rental income. These lenders understand short-term rental business models and structure loans appropriately using income projections from comparable properties.

Higher initial capital requirements typically apply to short-term rental financing. Lenders perceive increased risk from management intensity and regulatory uncertainty, resulting in initial capital requirements of 20-30% compared to 15-20% for traditional rentals.

Calculate short-term rental financing costs before purchasing properties in vacation markets. Understanding how financing impacts profitability helps evaluate whether projected income justifies higher financing costs and capital requirements.

How Should Investors Select Short-Term Rental Markets?

Successful short-term rental investing requires careful market selection analyzing seasonal demand patterns. Tourist destinations with year-round appeal provide more stable income than seasonal markets where occupancy fluctuates dramatically between peak and off-peak periods.

Analyzing local regulations ensures operations remain legal long-term. Cities frequently change short-term rental regulations, sometimes banning operations entirely after investors purchase properties specifically for short-term rental purposes.

Researching competition levels helps understand whether markets can support additional properties. Oversaturated markets with hundreds of listings competing for limited demand suffer from declining occupancy rates and pricing pressure destroying profitability.

Rental property calculators adjusted for short-term rentals help project realistic income and expenses. Factoring in higher management costs, cleaning expenses, utilities, and marketing costs provides accurate profitability projections.

What Are 1031 Exchanges in Real Estate?

1031 exchange strategies allow investors to defer capital gains taxes when selling investment properties by reinvesting proceeds into like-kind replacement properties. This powerful tax strategy preserves equity that would otherwise go to taxes, enabling larger purchases and accelerated wealth building.

Understanding 1031 exchange rules and requirements prevents costly mistakes that disqualify exchanges. Missing critical deadlines or taking possession of proceeds voids tax deferral benefits, triggering immediate tax obligations on gains.

1031 exchange strategies defer capital gains taxes, depreciation recapture taxes, and state taxes on investment property sales. This deferral preserves equity for reinvestment rather than paying 25-35% to federal and state tax authorities.

Beyond tax benefits, 1031 exchanges enable portfolio optimization through strategic property swaps. Exchanging multiple small properties for larger assets consolidates management while maintaining or improving income generation and appreciation potential.

What Timeline Requirements Do 1031 Exchanges Have?

Investors must identify replacement properties within 45 days of selling relinquished properties. This strict deadline requires advance planning since finding suitable replacement properties often takes substantial time and effort.

Closing on replacement properties must occur within 180 days of selling relinquished properties. Missing either deadline voids 1031 exchange tax benefits, triggering immediate tax obligations on previously deferred gains.

Working with experienced 1031 exchange qualified intermediaries helps navigate timeline requirements. These professionals coordinate sales and purchases while ensuring compliance with all IRS regulations governing exchange transactions.

Calculate 1031 exchange tax savings before selling properties to understand benefits. Comparing taxes paid versus deferred through exchanges motivates proper execution despite timeline pressures and complexity.

What Properties Qualify for 1031 Exchanges?

1031 exchanges require purchasing like-kind replacement properties held for investment purposes. This definition includes any real property held for investment, allowing exchanges of single-family rentals for commercial properties or land for apartment buildings.

Properties must be held for investment rather than personal use or immediate resale. Investment intent demonstrated through tenant leases, rental income history, and holding periods determines qualification rather than property type alone.

Primary residences and properties held primarily for sale don’t qualify. Flippers selling properties shortly after renovation typically can’t use 1031 exchanges since properties are held for sale rather than investment.

Portfolio loan financing helps investors consolidate multiple properties into single replacement properties. This simplifies management while maintaining 1031 exchange tax benefits through proper structuring.

How Do Qualified Intermediaries Facilitate Exchanges?

All 1031 exchanges require qualified intermediaries who hold sale proceeds and coordinate property exchanges. Never take direct possession of proceeds or exchanges fail, triggering immediate tax obligations on gains.

Qualified intermediaries establish exchange accounts holding proceeds from relinquished property sales. These funds remain with intermediaries until used to purchase replacement properties, maintaining exchange integrity throughout transactions.

Selecting experienced qualified intermediaries with proper bonding and insurance protects exchange funds. These professionals must maintain funds securely while coordinating complex transactions involving multiple parties and strict timelines.

DSCR loan programs work seamlessly with 1031 exchanges since income verification isn’t required. This enables quick closings on replacement properties without personal income documentation delays that might jeopardize exchange timeline compliance.

What Identification Rules Apply to 1031 Exchanges?

Investors can identify up to three replacement properties without value restrictions. This three-property rule provides flexibility while limiting options to manageable numbers within 45-day identification windows.

Alternatively, investors can identify unlimited properties totaling 200% of relinquished property values. This 200% rule enables identifying multiple properties while preventing excessive identification that indicates lack of serious purchase intent.

A third option allows identifying unlimited properties provided purchases equal 95% of identified property values. This 95% rule rarely gets used due to strict purchase requirements that most investors can’t satisfy within 180-day exchange periods.

Calculate replacement property requirements before identifying options. Understanding how much debt and equity must be replaced prevents identification of properties that don’t fully defer taxes due to inadequate purchase prices or debt levels.

What Other Real Estate Investment Strategies Exist?

Beyond major strategies covered extensively, numerous niche real estate investment strategies offer opportunities for specialized investors. These include real estate notes and private lending, wholesaling, mobile home parks, self-storage facilities, value-add multifamily, and land banking approaches.

Each niche strategy requires specialized knowledge and skills. Success demands understanding unique aspects of property types, markets, or business models that differ from traditional rental properties or fix and flip investments.

Fix and flip lenders often provide financing for multiple niche strategies beyond traditional flipping. Understanding which lenders support specific investment approaches helps access capital for specialized opportunities.

Diversifying across multiple strategies reduces concentration risk. Investors operating in several strategy areas weather market cycles better than those concentrating entirely in single approaches vulnerable to market-specific challenges.

How Does Real Estate Note Investing Work?

Real estate note investing involves becoming the lender rather than the property owner. Investors purchase existing notes or originate new loans secured by real estate collateral, generating completely passive income through monthly principal and interest payments.

Unlike rental properties requiring active management, note investing generates passive income without tenant calls, maintenance issues, or property management headaches. Borrowers make monthly payments directly to note holders throughout loan terms.

Note investors face default risk rather than property management challenges. Proper underwriting with conservative loan-to-value ratios and strong borrower qualification mitigates these risks effectively while maintaining passive income characteristics.

Calculate note investment returns based on note purchase prices, interest rates, and loan durations. Understanding total returns helps evaluate whether note investments offer attractive risk-adjusted returns compared to property ownership.

What Is Wholesaling Real Estate?

Wholesaling involves finding deeply discounted properties, securing them under purchase contracts, and assigning contracts to other investors for assignment fees. Wholesalers never take ownership, instead profiting from connecting motivated sellers with investor buyers.

Unlike BRRRR method investing or fix and flip strategies requiring substantial capital, wholesaling requires minimal money. Wholesalers secure properties with minimal earnest money deposits that get refunded if purchases don’t close.

Wholesalers generate income quickly by assigning contracts and collecting assignment fees. Typical fees range from $5,000-$20,000 per deal depending on property values and discounts negotiated below market values.

Building extensive buyer lists of active investors represents the most critical success factor. Wholesalers must know dozens of investors ready to close quickly on discounted properties at various price points and locations.

Why Do Investors Choose Mobile Home Parks?

Mobile home park investing involves purchasing communities with manufactured housing sites generating lot rental income. This niche strategy offers unique advantages through affordable housing demand and tenant-owned homes creating exit barriers.

Most mobile home park residents own their manufactured homes but rent land underneath. This reduces landlord maintenance responsibilities while creating significant exit barriers since moving manufactured homes costs $5,000-$15,000 preventing easy tenant relocation.

Affordable housing demand supports stable occupancy as housing costs rise. Mobile home parks serve lower-income demographics seeking affordable housing options when traditional apartments become financially out of reach.

Commercial loan financing for mobile home parks requires substantial initial capital and strong operating histories. Lenders carefully underwrite both properties and operators given specialized nature of mobile home park operations.

What Makes Self-Storage Investing Attractive?

Self-storage investing involves purchasing facilities where individuals and businesses rent storage units. This asset class offers recession-resistant characteristics since storage demand often increases during economic downturns when people downsize housing or businesses reduce office space.

Self-storage facilities require minimal staffing and maintenance compared to other commercial properties. No tenants live onsite creating disturbances, and units typically remain in good condition requiring minimal repair work between tenant turnovers.

Operating costs run 25-35% of revenue for well-managed self-storage facilities. This compares favorably to 50-60% operating expense ratios for multifamily properties, maximizing net operating income and property values for equivalent revenue levels.

Commercial property financing for self-storage requires 25-30% initial capital with strong cash flow coverage. Lenders evaluate market demographics carefully, preferring markets with storage supply below demand supporting healthy occupancy rates.

How Should Investors Select Investment Strategies?

Strategy selection requires honest self-assessment of available capital, time commitment capacity, risk tolerance, and desired involvement levels. Matching strategies to personal situations rather than chasing trendy approaches creates sustainable success.

Available capital determines which strategies are accessible initially. House hacking with FHA loans requires minimal funds while commercial property investments demand substantial capital.

Time commitment varies dramatically across strategies. Turnkey rental investments require minimal time while BRRRR method and fix and flip strategies demand substantial active involvement.

Risk tolerance should guide strategy selection. Conservative investors prefer stabilized rental properties while aggressive investors pursue fix and flip opportunities or value-add commercial deals with higher risk-return profiles.

What Investment Goals Determine Strategy Selection?

Investment goals significantly impact appropriate strategy selection. Investors prioritizing immediate cash flow gravitate toward rental properties for passive income generating monthly distributions.

Wealth building through appreciation suits investors accepting lower initial cash flow. Properties in expensive markets with strong appreciation potential but weak rent-to-price ratios require patience but deliver substantial long-term wealth.

Active involvement preferences determine strategy appropriateness. Real estate syndication offers complete passivity while BRRRR investing requires hands-on management throughout acquisition, renovation, tenant placement, and refinancing phases.

Tax situation influences strategy selection. High-income professionals benefit significantly from rental property depreciation deductions offsetting ordinary income while lower-income investors may prioritize cash flow over tax benefits.

Frequently Asked Questions About Real Estate Investment Strategies

What is the best real estate investment strategy for beginners?

House hacking represents the ideal beginner real estate investment strategy because it requires minimal initial capital using FHA financing with just 3.5% initial investment. This approach provides hands-on landlord education while living onsite and managing tenants directly without risking substantial capital on first investments.

The strategy dramatically reduces or eliminates personal housing costs through rental income from other units. Many house hackers achieve negative housing costs where rental income exceeds all property expenses including mortgage payments, property taxes, insurance, and maintenance reserves creating immediate savings.

Veterans can use VA loans for house hacking with zero initial capital required on properties up to four units. This makes house hacking even more accessible to service members seeking real estate investment entry points.

How much money do I need to start investing in real estate?

Required capital varies dramatically by strategy selected. House hacking with FHA loans requires as little as 3.5% initial capital on properties up to four units, meaning a $200,000 property needs just $7,000 plus closing costs for acquisition.

Traditional rental property investments typically need 15-25% initial capital plus reserves for maintenance and vacancies. A $150,000 rental property requires $22,500-$37,500 initial capital plus $5,000-$10,000 in cash reserves.

Fix and flip investments using hard money loans require 10-25% initial capital plus closing costs. Properties purchased for $100,000 need $10,000-$25,000 initial capital though hard money lenders fund 100% of renovation costs.

Calculate specific capital requirements for strategies and property types you’re considering before beginning property searches.

What is the BRRRR method and how does it work?

The BRRRR method stands for Buy, Rehab, Rent, Refinance, Repeat representing a systematic approach to building rental property portfolios with limited capital. Investors purchase distressed properties below market value using hard money financing for quick closings.

After renovations adding substantial value, properties rent to quality tenants generating cash flow. Once rental income stabilizes for 6-12 months, investors refinance into permanent DSCR loans pulling initial capital back out based on new higher property values.

Recovered capital gets redeployed into additional property acquisitions, repeating the process systematically. Calculate BRRRR potential to understand how this strategy builds portfolios from $100,000 into control of $1,000,000+ in real estate within 3-5 years.

The strategy works because forced appreciation through strategic renovations creates equity exceeding initial investment plus renovation costs. Refinancing at 70-75% loan-to-value on higher after-repair values recovers invested capital while maintaining ownership of cash-flowing properties.

How do I finance fix and flip investments?

Most fix and flip investors use hard money loans providing 85-90% of purchase prices plus 100% of renovation costs. These short-term loans feature higher interest rates of 8-12% annually but offer crucial advantages including fast closing within 7-14 days.

Hard money lenders focus on property values rather than borrower credit profiles. This makes financing accessible to investors with recent credit challenges or self-employed income that’s difficult to document through traditional verification methods.

Calculate hard money costs before committing to deals including interest, origination points of 2-4%, and potential extension fees if properties don’t sell within initial loan terms.

Experienced flippers often transition to private money from individual investors offering 6-10% rates with minimal points. Building private lender networks through demonstrated track records reduces financing costs significantly.

What are the best markets for rental property investing?

Strong rental markets combine job growth exceeding national averages with increasing population trends supporting tenant demand. Reasonable property prices relative to rental rates enable positive cash flow after all expenses.