DSCR Loan: 7 Smart Strategies for Real Estate Investors to Qualify

How a DSCR Loan Enables Investment Property Financing Without Personal Income Documentation

Real estate investors evaluating properties based on cash flow potential often find traditional income documentation irrelevant to their investment strategy. DSCR loans qualify you based solely on the property’s rental income potential rather than personal employment or tax returns. This investment-focused approach streamlines qualification for rental properties, vacation homes, and portfolio expansion when the property’s income-generating capacity matters more than your W-2.

Key Details: What You’ll Learn About DSCR Loans

- A DSCR loan qualifies borrowers based on the property’s rental income rather than personal income, using the debt service coverage ratio to determine approval (CFPB investment property mortgage information)

- Real estate investors can purchase or refinance rental properties without providing tax returns, W-2s, or employment verification (Fannie Mae investment property guidelines)

- Property types including single-family rentals, multi-unit buildings, condos, and townhomes qualify under a DSCR loan structure

- The debt service coverage ratio calculation divides monthly rental income by total monthly housing expense to determine if the property can support itself

- A DSCR loan accommodates experienced investors building portfolios and new investors acquiring their first rental properties

- Credit requirements focus on payment history and asset reserves rather than employment income or debt-to-income ratios

- Properties with strong rental potential in desirable locations qualify even when investors show minimal personal income on tax returns (IRS rental property income reporting guidelines)

Ready to explore your options? Schedule a call with a loan advisor.

What Is a DSCR Loan?

A DSCR loan represents an investment property financing approach that evaluates the property’s income-generating capacity rather than the borrower’s personal income. The acronym DSCR stands for Debt Service Coverage Ratio—a calculation comparing the property’s rental income to its total housing expenses.

How does the DSCR calculation work? Lenders divide the property’s monthly rental income by the total monthly housing expense (principal, interest, taxes, insurance, and HOA fees if applicable). A DSCR of 1.0 means the rental income exactly covers the expenses. A DSCR above 1.0 indicates positive cash flow, while below 1.0 shows the property requires subsidizing from other sources.

Most DSCR loan programs require minimum ratios ranging from 0.75 to 1.25 depending on the lender, property type, and borrower profile. A property generating sufficient rental income to achieve the minimum DSCR qualifies for financing without analyzing the investor’s personal income, employment, or tax returns.

This approach revolutionizes real estate investment financing by recognizing that rental property cash flow—not personal income—determines the investor’s ability to manage mortgage obligations. For investors with multiple properties or tax-efficient business structures showing minimal personal income, a DSCR loan provides qualification paths impossible through traditional financing.

Who Benefits Most from a DSCR Loan?

Several investor profiles find exceptional value in a DSCR loan structure. These programs serve real estate investors whose portfolio strategies don’t align with traditional income-based qualification methods.

Experienced real estate investors with multiple rental properties represent ideal candidates for a DSCR loan. Traditional mortgages struggle when investors own numerous properties because each mortgage obligation increases debt-to-income ratios, eventually preventing further acquisitions. A DSCR loan eliminates this constraint by ignoring personal debt-to-income calculations entirely.

Self-employed investors and business owners who strategically minimize taxable income through legitimate business deductions find a DSCR loan particularly valuable. Your tax returns might show minimal income despite strong cash flow and substantial assets. Since a DSCR loan doesn’t examine personal income, your tax strategies don’t sabotage your investment property financing.

Foreign national investors purchasing U.S. rental properties often lack the employment documentation, tax returns, and credit history that traditional programs require. A DSCR loan focuses on the property’s rental potential rather than extensive personal documentation, making it accessible for international investors.

Retirees building rental portfolios may have limited W-2 income but substantial assets and investment experience. A DSCR loan allows acquiring rental properties based on rental income potential rather than retirement income that might not meet traditional qualification thresholds.

New investors acquiring first rental properties can use a DSCR loan when the investment property generates sufficient rental income. While some DSCR programs prefer experienced investors, many accommodate first-time rental property owners when the property’s fundamentals support approval.

Explore all loan programs to understand your full range of options.

What Are the Requirements for a DSCR Loan?

Understanding the specific qualification criteria helps you assess whether a DSCR loan fits your investment strategy. While requirements vary by lender and program, certain standards commonly apply across most DSCR offerings.

DSCR ratio thresholds – Most programs require minimum debt service coverage ratios between 0.75 and 1.25. Properties with DSCR below 1.0 (where rental income doesn’t fully cover expenses) may still qualify but typically require larger equity contributions, stronger credit, or higher interest rates to compensate for the negative cash flow.

Credit score minimums – DSCR loan programs typically require credit scores of 620-680 minimum, with optimal programs available at 700+. Your credit history demonstrates financial responsibility even though lenders don’t analyze your income or employment.

Equity contribution expectations – Most DSCR loan programs require 20-25% equity contributions for single-family properties, with higher requirements (25-30%) for multi-unit buildings. The equity investment demonstrates commitment and provides lender security.

Reserve requirements – Lenders typically require substantial liquid reserves, often 6-12 months of the property’s total housing expenses. These reserves demonstrate your capacity to manage the property through vacancy periods, repairs, or market fluctuations. Multiple property owners may need reserves calculated across their entire portfolio.

Property rental income documentation – For properties with existing tenants, lenders use current lease agreements to establish rental income. For vacant properties or purchases, appraisers provide fair market rent estimates based on comparable rental properties in the area.

No income documentation required – The defining feature of a DSCR loan is the absence of personal income verification. No tax returns, no W-2s, no pay stubs, no employment verification letters. Your personal income remains irrelevant to qualification.

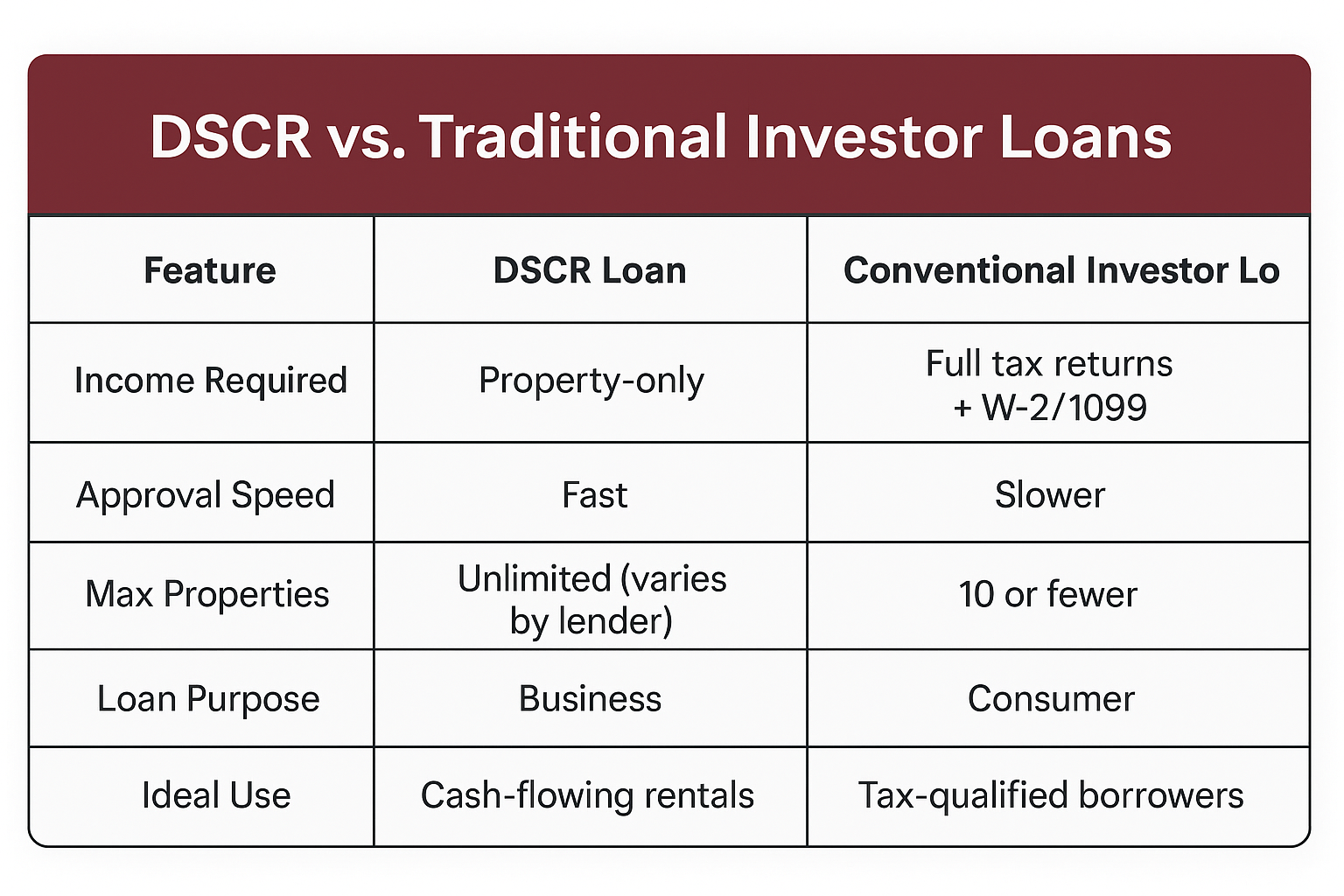

How Does a DSCR Loan Differ from Traditional Investment Property Financing?

The fundamental distinction lies in the qualification methodology and documentation requirements. Traditional investment property mortgages analyze your personal income and debt obligations while a DSCR loan focuses exclusively on the property’s rental income potential.

Traditional investment property financing:

- Requires personal tax returns showing income

- Analyzes all existing debt obligations including current mortgages

- Calculates debt-to-income ratios across all properties and debts

- Requires employment verification and income documentation

- Limits portfolio growth as debt-to-income ratios max out

- May require rental income seasoning or experience documentation

DSCR loan qualification approach:

- Ignores personal income and tax returns completely

- Evaluates each property independently based on rental income

- No debt-to-income ratio calculations

- No employment or income verification required

- Enables unlimited portfolio growth based on property performance

- Accommodates investors regardless of personal income appearance

Why does personal income not matter for a DSCR loan? The underwriting philosophy recognizes that rental properties should support themselves through tenant income. If the property generates sufficient rent to cover its obligations, the investor’s personal income becomes irrelevant. This approach aligns with how sophisticated real estate investors actually manage portfolios—evaluating each property as an independent business entity.

Ready to discuss your purchase scenario? Submit a purchase inquiry to explore your options.

What Property Types Qualify for a DSCR Loan?

A DSCR loan program accommodates various investment property categories. Understanding eligibility across different property types helps you plan your real estate investment strategy.

Eligible investment property types:

- Single-family detached rental homes

- Townhomes and row houses for rental

- Condominiums in approved developments

- Multi-unit properties including duplexes, triplexes, and fourplexes

- Planned unit developments (PUDs) for investment

- Mixed-use properties with residential rental components

Can you use a DSCR loan for fix-and-flip properties? Traditional DSCR loan programs focus on stabilized rental properties rather than short-term renovation projects. However, some specialized programs accommodate light renovation scenarios when the property will generate rental income after improvements. Extensive rehabs typically require alternative financing approaches.

What about vacation rentals or short-term rentals? Many DSCR loan programs now accommodate short-term rental properties including Airbnb, VRBO, or other vacation rental strategies. These programs use projected short-term rental income based on market analysis, comparable properties, and historical performance data rather than traditional long-term lease documentation.

Are there property location restrictions? DSCR loan programs generally work in all 50 states, though some lenders focus on specific markets or regions. Urban, suburban, and even some rural investment properties qualify when they demonstrate rental income potential. Properties in declining markets or economically challenged areas may face additional scrutiny.

What about property condition requirements? Most DSCR loan programs require properties in good condition suitable for immediate rental. Properties needing major repairs, significant safety issues, or system replacements may need renovation financing or alternative structures before qualifying for standard DSCR programs.

See how other real estate investors have successfully used DSCR financing:

How Is Rental Income Calculated for a DSCR Loan?

Understanding rental income verification and calculation helps you evaluate whether specific properties meet DSCR requirements. The income determination process varies based on whether the property currently has tenants or sits vacant.

For properties with existing tenants:

- Current lease agreements document actual rental income

- Lenders use the lease amount for DSCR calculations

- Remaining lease term should provide stability

- Month-to-month leases receive more conservative evaluation

- Below-market rents may prompt lenders to use market rent instead

For vacant properties or purchases:

- Appraisers provide fair market rent analysis

- Comparable rental properties establish income expectations

- Market rent reflects current rental rates for similar properties

- Seasonal adjustments may apply in vacation rental markets

- Conservative estimates protect against aggressive projections

What if you’re purchasing a property to convert to rental? Properties currently owner-occupied but destined for rental conversion use appraiser market rent estimates. The current owner’s occupancy doesn’t affect rental income potential. Lenders evaluate what tenants would pay in the current market regardless of current usage.

Do lenders account for vacancy rates? Most DSCR loan calculations use gross rental income without vacancy deductions. However, some conservative programs apply vacancy factors (typically 5-10%) when calculating the debt service coverage ratio. This approach provides additional safety margin for lenders.

Can you use Section 8 or subsidized rental income? Many DSCR loan programs accept government-subsidized rental income including Section 8 housing choice vouchers. These income sources often provide greater stability and consistency than market-rate rentals, potentially strengthening your application.

Calculate your DSCR loan scenarios:

What Documentation Does a DSCR Loan Require?

Understanding the specific documentation requirements helps you prepare for a smooth application process. While a DSCR loan eliminates income documentation, specific property and financial verification remains necessary.

Required documentation typically includes:

- Credit report authorization

- Proof of liquid reserves (bank or investment statements)

- Property appraisal including rent schedule

- Current lease agreements (for tenanted properties)

- Property insurance information

- Entity documentation if purchasing in LLC or corporation

- Property tax information

- HOA documents (if applicable)

- Purchase contract for acquisitions

Do you need to provide any personal financial information? While a DSCR loan doesn’t require income documentation, lenders need reserve verification. You’ll provide bank statements or investment account statements proving you have adequate liquid reserves to manage the property through challenges. The focus remains on assets rather than income.

What about entity ownership structures? Many real estate investors purchase properties through LLCs, corporations, or other legal entities for liability protection and tax purposes. DSCR loan programs accommodate entity ownership when you provide appropriate formation documents, operating agreements, and verification of your ownership stake or authority.

How do lenders verify property rental income? For existing tenants, lease agreements provide documentation. For vacant properties or purchases, the appraisal includes a rent schedule section where the appraiser analyzes comparable rental properties and establishes fair market rent estimates supporting the DSCR calculation.

Are tax returns ever required for a DSCR loan? Traditional DSCR loan programs specifically avoid tax return requirements—that’s the primary advantage. However, some hybrid programs might request tax returns for informational purposes without using them for income calculation. True DSCR programs require zero tax return documentation.

Common DSCR Loan Questions

Can you qualify for a DSCR loan with a DSCR below 1.0?

Yes, many DSCR loan programs accommodate properties with ratios below 1.0, meaning the rental income doesn’t fully cover the housing expenses. These scenarios require the investor to subsidize the property from other income sources, but qualification doesn’t require documenting those sources.

DSCR below 1.0 considerations:

- Larger equity contributions typically required (25-30%)

- Higher interest rates may apply

- Stronger credit scores preferred

- Substantial reserves become more critical

- Some programs allow ratios as low as 0.75

Properties with strong appreciation potential, tenant quality, or below-market rents that will increase might justify accepting lower initial DSCR if the property’s fundamentals support long-term value.

How many investment properties can you finance with DSCR loans?

Unlike traditional financing that caps portfolio growth through debt-to-income limitations, DSCR loan programs theoretically allow unlimited property acquisitions. Each property qualifies independently based on its own rental income rather than aggregating into personal debt ratios.

Practical portfolio growth limitations:

- Reserve requirements scale with portfolio size

- Credit profile must support multiple obligations

- Some lenders impose individual borrower limits

- Management capacity and experience considerations

- Geographic diversification may affect approval

Experienced investors use DSCR loan financing to build extensive portfolios that would be impossible through traditional income-based qualification.

Can you use projected rental income for new construction?

Standard DSCR loan programs focus on existing properties with established rental income or comparable properties proving market rent. New construction rentals face challenges because comparable rent analysis becomes difficult without similar completed properties.

Some specialized programs accommodate new construction investment properties when:

- Comparable rental properties exist in the development

- Builder provides rental income guarantees or projections

- Market analysis supports rental assumptions

- Construction completes before loan funding

Most investors use construction financing or alternative programs during building phases, then refinance into DSCR loan programs once properties stabilize with tenants.

What if the property has multiple units with different rent amounts?

Multi-unit properties with 2-4 units aggregate total rental income for DSCR calculations. If your triplex has three units renting for different amounts, lenders sum the total monthly income and divide by the total monthly housing expense to determine the DSCR.

Multi-unit DSCR considerations:

- All units must be rentable condition

- Market rent analysis covers each unit size

- Vacancy on one unit doesn’t necessarily disqualify the property

- Total income across all units determines qualification

- Larger multi-unit buildings may require higher DSCR minimums

How Do DSCR Loan Rates Compare to Traditional Investment Property Financing?

Understanding the pricing framework helps you evaluate whether a DSCR loan provides competitive overall costs for your investment strategy. Interest rates represent only one component of the total return calculation.

What factors influence DSCR loan pricing? Several elements affect your specific rate:

- Credit score and payment history

- DSCR ratio (higher ratios typically receive better pricing)

- Equity contribution percentage

- Property type and location

- Loan amount and total property value

- Reserve levels beyond minimums

- Number of properties in your portfolio

Are DSCR loan rates higher than traditional investment property mortgages? DSCR loan pricing typically reflects a modest premium compared to conventional investment property financing due to the reduced documentation and specialized underwriting. However, many investors find the premium worthwhile given the qualification flexibility and portfolio scalability advantages.

Does a higher DSCR improve your rate? Yes, properties demonstrating stronger cash flow through higher debt service coverage ratios typically access more favorable pricing. A property with a 1.5 DSCR showing substantial positive cash flow receives better rates than a property barely meeting minimum 1.0 requirements.

Can you improve pricing through relationship lending? Some DSCR loan lenders offer portfolio pricing programs where rates improve as you finance multiple properties through their institution. Building relationships with specialized investment property lenders may provide pricing advantages over time.

The total investment return calculation should consider both financing costs and the ability to scale your portfolio efficiently. Many investors accept slightly higher rates on DSCR loan financing in exchange for the ability to acquire properties that would be impossible to finance through traditional programs.

Considering a refinance? Submit a refinance inquiry to see if this makes sense for you.

What Are the Advantages of a DSCR Loan?

Understanding the specific benefits helps you evaluate whether this financing approach aligns with your real estate investment strategy. A DSCR loan offers distinct advantages for investors building rental property portfolios.

Key advantages include:

No income documentation required – Eliminate the extensive tax return analysis, W-2 collection, employment verification, and income calculation that complicates traditional investment property financing. Your personal income remains completely irrelevant to qualification regardless of how it appears on tax returns.

Unlimited portfolio growth potential – Traditional mortgages limit portfolio size through debt-to-income ratio constraints. Each additional property increases your debt obligations, eventually preventing further acquisitions. A DSCR loan evaluates each property independently, enabling continuous portfolio expansion limited only by your capital and management capacity.

Accommodates tax-efficient investment strategies – Real estate investors legally minimize taxable income through depreciation, cost segregation, expense deductions, and strategic tax planning. These approaches devastate traditional mortgage qualification but don’t affect DSCR loan approval since personal income isn’t analyzed.

Faster closing timelines – Without complex income documentation, employment verification, and debt-to-income analysis, DSCR loan approvals often proceed more quickly than traditional financing. Many investors experience streamlined underwriting enabling competitive closing timelines for investment acquisitions.

Entity ownership flexibility – Purchase properties through LLCs, corporations, or other legal entities without the complications that traditional mortgages impose on entity lending. DSCR loan structures naturally accommodate entity ownership common in sophisticated real estate investing.

Foreign national accessibility – International investors purchasing U.S. rental properties face significant barriers with traditional financing requiring domestic employment, credit history, and tax documentation. A DSCR loan focuses on the property rather than extensive personal documentation, making it accessible for foreign nationals.

Alternative Loan Programs for Investment Property Financing

If a DSCR loan isn’t the right fit, consider these alternatives for investment property financing:

- Conventional Loan – Traditional investment property financing when you can provide personal income documentation

- Bank Statement Loan – For self-employed investors using bank deposits instead of tax returns for income qualification

- Asset-Based Loan – Leverage investment portfolios for qualification when rental income or personal income is insufficient

- Fix and Flip Loan – Short-term financing for investors purchasing properties to renovate and resell quickly

- No-Doc Loan – Minimal income verification for investors with strong credit and substantial assets

Explore all 30+ loan programs to find your best option.

Not sure which program is right for you? Take our discovery quiz to find your path.

Advanced DSCR Loan Questions

Can you use projected rent increases in DSCR calculations?

Most DSCR loan programs use current market rent rather than projected future increases. Lenders focus on existing rental income or current market rents to ensure conservative, realistic calculations. Speculative rent growth doesn’t factor into approval decisions.

However, if you can demonstrate below-market rents that will increase upon lease renewal or tenant turnover, some lenders may consider using market rent rather than actual current rent. This requires clear documentation showing comparable properties commanding higher rents.

How do DSCR loans handle properties in transition or renovation?

Standard DSCR loan programs focus on stabilized rental properties ready for immediate tenant occupancy. Properties requiring significant renovations before renting typically need alternative financing approaches.

Transitional property considerations:

- Light cosmetic improvements may be acceptable

- Major systems (HVAC, roof, plumbing, electrical) must be functional

- Properties must pass rental property appraisal standards

- Some lenders offer rehab DSCR programs for renovation scenarios

- Consider renovation financing or hard money for extensive improvements

Can you assume existing DSCR loans or seller financing?

DSCR loan assumption possibilities vary by lender and loan structure. Some portfolio lenders offering DSCR loan programs allow qualified buyers to assume existing financing with lender approval, potentially providing favorable terms for property acquisitions.

Seller financing combined with DSCR loan refinancing offers creative acquisition strategies. Purchase properties with seller financing, stabilize operations with tenants, then refinance into DSCR loan programs to return capital to the seller or fund additional investments.

What if comparable rental properties are scarce in the area?

Properties in areas lacking rental comparables face appraisal challenges for DSCR loan qualification. Appraisers need similar rental properties to establish credible market rent estimates supporting the debt service coverage ratio.

Limited comparable solutions:

- Expand geographic radius for comparable search

- Use properties in similar markets or neighborhoods

- Consider traditional financing if DSCR becomes problematic

- Work with experienced appraisers familiar with the market

- Provide supporting rental data or market studies

How do seasonal rental markets affect DSCR calculations?

Seasonal vacation rental properties or markets with significant seasonal rental variations require specialized DSCR analysis. Lenders typically annualize rental income to calculate monthly averages for debt service coverage ratio purposes.

Seasonal rental considerations:

- Annual rental income divided by 12 for monthly equivalent

- Peak season rental income cannot be extrapolated year-round

- Historical performance data supports income projections

- Larger reserves may be required for seasonal cash flow gaps

- Experienced vacation rental management strengthens applications

Can you use a DSCR loan for owner-occupied multi-unit properties?

DSCR loan programs focus exclusively on investment properties without owner occupancy. If you plan to occupy one unit of a multi-unit property, traditional financing programs better accommodate owner-occupied scenarios with rental income from non-occupied units.

However, if you purchase as an investment property using a DSCR loan and later decide to occupy a unit, that transition typically doesn’t violate loan terms since the original purpose was investment—though specific loan documents should be reviewed.

How do rising interest rates affect DSCR loan qualification?

Rising interest rates increase the property’s monthly housing expense, reducing the debt service coverage ratio. Properties that previously qualified with comfortable DSCR margins may struggle to meet minimum requirements when rates increase significantly.

Rate environment strategies:

- Focus on properties with stronger rental income margins

- Consider larger equity contributions to reduce loan amounts

- Evaluate adjustable-rate options for initial qualification ease

- Target properties with rent growth potential

- Maintain flexibility to adjust acquisition criteria with market conditions

What if you’re purchasing from a family member or related party?

DSCR loan programs generally accommodate purchases from family members or related parties with appropriate documentation and legitimate transaction structures. Lenders want to ensure the transaction represents a true arm’s length sale rather than a disguised gift or inflated value.

Related party transaction requirements:

- Property must appraise at or above purchase price

- Transaction must reflect market terms and pricing

- Full equity contribution required (no gift equity)

- Clear documentation of relationship and transaction purpose

- Some lenders restrict or prohibit family transactions

Can you refinance from traditional financing into a DSCR loan?

Yes, many real estate investors refinance conventional investment property mortgages into DSCR loan programs. This strategy makes sense when:

- You’ve acquired multiple properties and hit debt-to-income limits

- You want to free up qualification capacity for additional acquisitions

- Your personal income documentation has become complicated

- You’re transitioning to entity ownership structures

- Cash-out refinancing for additional investments

Refinancing into DSCR loan structures positions your portfolio for continued growth without personal income qualification constraints.

How do DSCR loans handle properties with utilities included in rent?

Properties where landlords pay utilities or other operating expenses require careful DSCR analysis. The rental income appears higher because it includes utility reimbursement, but actual net income is lower after deducting utility costs.

Utilities-included considerations:

- Lenders may reduce rental income by estimated utility costs

- Market rent analysis should reflect comparable utility arrangements

- Properties with tenant-paid utilities present cleaner analysis

- Document average utility costs for realistic cash flow assessment

- Consider whether utility-included strategy benefits your investment model

Ready to get started? Apply now or schedule a call to discuss your situation.

Helpful DSCR Loan Resources

Official Government Guidance:

CFPB Investment Property Mortgage Information – Consumer Financial Protection Bureau resource explaining investment property financing options, qualification differences from primary residence mortgages, and borrower protections for rental property lending.

IRS Rental Property Income Reporting Guidelines – Internal Revenue Service official guidance on rental real estate income reporting, expense deductions, depreciation rules, and tax obligations for investment property owners.

HUD Fair Housing Requirements for Landlords – Department of Housing and Urban Development resource on fair housing laws, tenant rights, landlord obligations, and legal compliance for rental property owners.

Industry Organizations:

Fannie Mae Investment Property Guidelines – Official Fannie Mae underwriting standards for investment property mortgages explaining traditional qualification methods that DSCR loans provide alternatives to for real estate investors.

National Association of Residential Property Managers – Industry organization providing education, resources, and standards for residential property management, supporting real estate investors in professional rental property operations.

Educational Resources:

IRS Passive Activity Loss Rules – Internal Revenue Service guidance on passive activity loss limitations, rental real estate exceptions, and tax treatment of rental property income and expenses affecting investor tax planning.

Federal Reserve Real Estate Investment Information – Federal Reserve reports and data on real estate investment trends, market conditions, and economic factors affecting rental property investment strategies.

Need local expertise? Get introduced to trusted partners including loan officers, property managers, and real estate investors in your area.

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Ready to Take Your First Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Related Posts

Subscribe to our newsletter

Get program updates and rate insights in your inbox.