Section 184 Loan: 7 Strategies for Native American Homeownership on Trust Land

Access Federally-Guaranteed Financing for Homes on Tribal Trust Property Nationwide

Purchasing or refinancing homes on tribal trust land creates unique challenges that conventional mortgages can’t address—Section 184 loans provide the solution. This federally-guaranteed program through the Office of Native American Programs enables eligible Native Americans, Alaska Natives, and qualifying tribes to obtain affordable financing for properties on restricted trust land, fee-simple land, or in approved areas where standard lending programs don’t work. Understanding Section 184 eligibility, how tribal trust land affects conventional lending, and strategic approaches to maximize program benefits helps you achieve homeownership in tribal communities while building equity and establishing housing stability.

Key Details You’ll Learn About Section 184 Loans:

- How Section 184 loans differ from conventional mortgages and FHA loans in terms of eligibility, property types, and lending structure

- Tribal membership and enrollment requirements that determine who qualifies for Section 184 financing across federally-recognized tribes (HUD Section 184 program information)

- Property eligibility including tribal trust land, restricted fee land, fee-simple property, and Alaska Native village areas approved for financing

- The loan guarantee structure and how federal backing enables lenders to finance properties they otherwise couldn’t due to jurisdictional complexities

- Credit, income, and equity requirements that differ from conventional lending with flexible underwriting accommodating tribal situations

- Interest rates and costs comparing favorably to FHA loans while providing access to trust land properties (Bureau of Indian Affairs land management resources)

- Tribal housing authority coordination and how tribes facilitate Section 184 lending through approved processes and documentation

- Refinancing options including rate-and-term and cash-out structures for existing Section 184 and conventional mortgages on eligible properties

- Strategic timing and planning to maximize Section 184 benefits while building long-term housing equity in tribal communities

Ready to explore your options? Schedule a call with a loan advisor.

What Is a Section 184 Loan and Why Does It Exist?

A Section 184 loan is a federally-guaranteed mortgage program administered by the Department of Housing and Urban Development’s Office of Native American Programs (ONAP), specifically designed to increase homeownership opportunities for Native Americans and Alaska Natives on tribal trust land, restricted Indian land, and in other approved areas where conventional financing faces legal and jurisdictional barriers.

Why can’t conventional mortgages finance homes on tribal trust land? Trust land remains under federal protection with restrictions on ownership transfer, taxation, and foreclosure—these restrictions create legal complications preventing conventional lenders from securing typical mortgage protections, effectively blocking standard lending programs from financing homes on trust property despite demand from tribal members seeking homeownership.

The jurisdictional complexity creates a fundamental lending problem. Conventional mortgages rely on state foreclosure laws and clear title systems that don’t apply on trust land. Without ability to foreclose and sell property through standard legal channels if borrowers default, lenders can’t take the risks associated with large mortgage loans, leaving tribal members without access to homeownership financing.

How the Federal Guarantee Solves the Problem

Section 184’s structure addresses trust land lending barriers:

- Federal guarantee – HUD guarantees up to 100% of loan losses, protecting lenders against default risk

- Tribal coordination – Program works with tribal housing authorities and governments to facilitate lending

- Legal framework – Federal backing provides protections replacing state-level foreclosure mechanisms

- Lender participation – Guarantee enables conventional lenders to offer mortgages they otherwise couldn’t

- Standardized process – Creates consistent lending approach across diverse tribal jurisdictions

- Nationwide availability – Covers all federally-recognized tribes and Alaska Native villages

How does the guarantee protect lenders? If a borrower defaults and the lender cannot recover the full loan amount through property disposition, HUD’s guarantee covers the loss up to the guaranteed percentage—this protection enables lenders to offer mortgages on trust land with confidence similar to conventional lending, though the process involves additional coordination with tribal entities.

Section 184 vs. Other Loan Programs

Understanding how Section 184 compares to alternatives:

Section 184 vs. Conventional Loans:

- ✅ Works on tribal trust land (conventional doesn’t)

- ✅ Flexible equity requirements

- ✅ Competitive interest rates

- ✅ Available to all federally-recognized tribal members nationwide

- ❌ Limited to eligible borrowers and approved property types

- ❌ Requires tribal coordination and documentation

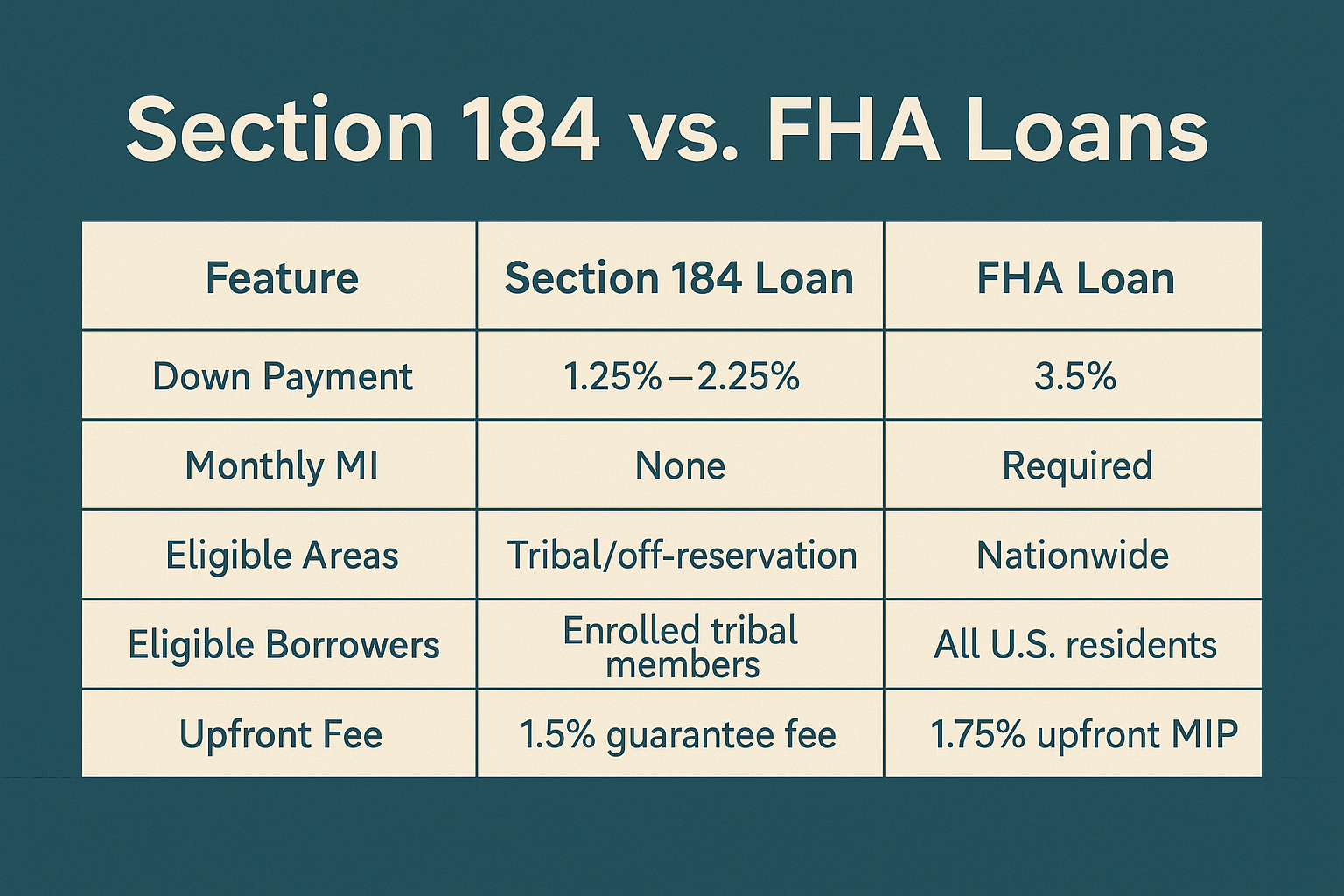

Section 184 vs. FHA Loans:

- ✅ Lower guarantee fee (1.5% vs. 1.75% upfront MIP)

- ✅ Works on trust land (FHA generally doesn’t)

- ✅ Tribal-specific program understanding

- ✅ Similar flexible underwriting standards

- ❌ More limited lender participation

- ❌ Requires tribal member eligibility

Section 184 vs. VA Loans:

- ✅ Available to all qualifying tribal members (VA requires military service)

- ✅ Works on trust land specifically

- ❌ Requires down payment (VA offers zero down to eligible veterans)

- ❌ Has guarantee fee (VA funding fee is comparable but waived for disabled veterans)

Can Native American veterans use VA loans on trust land? Some trust land situations may work with VA loans depending on tribal jurisdiction and property status, though Section 184 specifically addresses trust land challenges—eligible Native American veterans should compare both programs to determine which offers better terms for their specific property and situation.

Section 184 Loan Strategy #1: Understand Tribal Membership and Eligibility Requirements

Who qualifies for Section 184 loans? Enrolled members of federally-recognized Indian tribes, Alaska Natives enrolled in regional or village corporations, and in some cases federally-recognized tribes themselves can access Section 184 financing—eligibility requires documented tribal membership through tribal enrollment offices and extends to tribal members nationwide regardless of where they’re purchasing property.

Understanding complete eligibility criteria helps you determine whether Section 184 loans fit your situation and what documentation you’ll need for approval.

Tribal Membership Requirements

Enrollment in federally-recognized tribes forms the foundation:

- Federally-recognized tribes – Must be on the U.S. Department of Interior’s list of federally-recognized tribes

- Tribal enrollment – Must be enrolled member with documentation from tribal enrollment office

- Alaska Native corporations – Alaska Natives enrolled in regional or village corporations qualify

- Blood quantum – Tribes set their own enrollment criteria; Section 184 follows tribal determinations

- Nationwide eligibility – Can be member of any federally-recognized tribe purchasing anywhere in the U.S.

- Certificate of Indian Blood – May be required along with tribal enrollment documentation

Do you have to live on a reservation to use Section 184? No, Section 184 loans work nationwide for eligible tribal members—you can be enrolled in a tribe in Oklahoma and purchase property in Arizona using Section 184, or be an Alaska Native purchasing in Washington state, as long as the property type qualifies and you meet program requirements.

Alaska Native Eligibility

Alaska Natives have unique provisions:

Alaska Native corporations:

- Regional corporations established under Alaska Native Claims Settlement Act

- Village corporations serving specific communities

- Shareholders in these corporations qualify for Section 184

- Properties in Alaska Native village areas eligible

Documentation requirements:

- Stock certificate or shareholder documentation from regional or village corporation

- Proof of Alaska Native enrollment or lineage

- Tribal enrollment if also enrolled in federally-recognized Alaska Native tribe

Tribal Entity Eligibility

Tribes themselves can be borrowers:

Qualifying tribal entities:

- Federally-recognized tribes as governmental entities

- Tribally Designated Housing Entities (TDHEs)

- Tribal housing authorities

- Alaska Native village or regional corporations

Typical tribal uses:

- Constructing or purchasing rental housing for tribal members

- Developing subdivisions on trust land

- Refinancing existing tribal housing projects

- Infrastructure development supporting homeownership

How do tribal entities use Section 184 differently than individual members? Tribal borrowers typically use Section 184 for larger-scale housing projects serving their communities—rental developments, lease-to-own programs, or housing authority projects, while individual tribal members use it for single-family home purchases or refinances.

Non-Member Eligibility

Some non-members may access Section 184 in specific situations:

Eligible non-members:

- Non-Native spouses married to enrolled tribal members (as co-borrowers with enrolled spouse)

- Other family members in some circumstances with tribal member co-borrower

- Must be purchasing or refinancing with eligible tribal member as primary borrower

Restrictions for non-members:

- Cannot be sole borrower without enrolled tribal member

- Property must still meet Section 184 location and type requirements

- Tribal member must meet all eligibility requirements

- Some lenders may have additional overlays

Can a non-Native spouse get a Section 184 loan if the Native spouse has passed away? Generally no, as eligibility flows from the enrolled tribal member—however, specific circumstances involving inherited property or surviving spouse protections may create exceptions requiring consultation with Section 184 lenders and tribal housing authorities.

What Property Types Qualify for Section 184 Financing?

What kinds of properties can you finance with Section 184 loans? Trust land, restricted fee land, and fee-simple property in tribal jurisdictions, Alaska Native villages, or on reservations—additionally, fee-simple property anywhere in the United States when purchased by eligible tribal members, though financing trust land represents the program’s primary unique value where conventional lending cannot operate.

Understanding property eligibility prevents pursuing properties that won’t qualify and helps you identify optimal opportunities within program parameters.

Trust Land and Restricted Land

The program’s core purpose addresses these property types:

Tribal trust land:

- Land held in trust by the federal government for the benefit of tribes or individual Indians

- Title held by United States in trust for tribal or individual Indian beneficiaries

- Cannot be sold or transferred without federal approval through Bureau of Indian Affairs

- Not subject to state property taxation

- Foreclosure requires federal coordination rather than state court processes

Restricted fee land:

- Individual Indian ownership with restrictions on alienation (transfer)

- Owner holds title but cannot sell without federal approval

- Similar protections to trust land with slightly different legal structure

- Common in certain tribal areas and allotment situations

What’s the difference between trust land and restricted land? Trust land title is held by the United States on behalf of tribes or individuals, while restricted land has individual Indian ownership with federal restrictions on transfer—both create similar lending challenges requiring Section 184’s federal guarantee to enable mortgage financing.

Alaska Native Village Land

Unique Alaska provisions address specific circumstances:

Alaska Native village areas:

- Properties in Alaska Native villages

- Land conveyed to village or regional corporations under Alaska Native Claims Settlement Act

- Properties within approved Alaska Native village boundaries

- Fee-simple land owned by corporations or shareholders

Alaska-specific considerations:

- Village corporation approval may be required

- Land status varies significantly across Alaska Native areas

- Some areas require coordination with regional corporations

- Property surveys and title work may be more complex

Fee-Simple Property

Section 184 also finances standard property ownership:

Fee-simple land eligibility:

- Property anywhere in the United States purchased by eligible tribal members

- Standard property ownership without restrictions on transfer

- In tribal jurisdictions, on reservations, or completely off-reservation

- Conventional title and taxation apply

Why use Section 184 for fee-simple property? Even on fee-simple land, Section 184 offers competitive terms with lower guarantee fees than FHA, flexible underwriting, and tribal-specific program understanding—additionally, building relationship with Section 184 lenders helps if you later purchase trust land property requiring their specialized expertise.

Property Condition and Standards

All properties must meet basic requirements:

- HUD minimum property standards – Similar to FHA, properties must be safe, sound, and sanitary

- Adequate utilities – Water, sewer or septic, electricity, and heating systems

- Structural integrity – Foundation, roof, and major systems in acceptable condition

- Access – Legal access to the property via roads

- Habitability – Property must be livable and meet local codes

- Appraisal requirements – Licensed appraiser must determine value

What happens if a trust land property doesn’t meet HUD standards? Section 184 includes a Rehabilitation/Improvement loan option allowing you to finance both purchase and necessary repairs in a single loan—funds for improvements are held in escrow and released as work completes, similar to FHA 203(k) renovation loans.

Ready to discuss your purchase scenario? Submit a purchase inquiry to explore your options.

See how other Native American borrowers have successfully used Section 184 financing:

- View Section 184 loan purchase case studies

- View Section 184 loan refinance case studies

- View Section 184 loan cash-out refinance case studies

Section 184 Loan Strategy #2: Navigate Tribal Coordination Requirements

Why does Section 184 require tribal involvement? Trust land transactions need tribal housing authority or tribal government coordination for documentation, lease approvals, construction inspections, and understanding tribal-specific requirements—this coordination ensures proper handling of trust land complexities, tribal sovereignty considerations, and alignment with tribal housing policies and development plans.

Understanding the tribal coordination process helps you prepare appropriately and work effectively with all parties involved in your transaction.

Tribal Housing Authority Role

Most Section 184 transactions involve tribal housing entities:

Common responsibilities:

- Verifying tribal enrollment and eligibility

- Reviewing and approving proposed transactions

- Providing required tribal documentation

- Coordinating with Bureau of Indian Affairs when necessary

- Facilitating inspections and appraisals on trust land

- Ensuring compliance with tribal housing policies

- Supporting the lending process with tribal expertise

What documentation do tribal housing authorities provide? Tribal enrollment verification, trust land lease documentation if applicable, letters supporting the transaction, verification that properties comply with tribal codes, confirmation of utility availability and access, and other tribal-specific documentation lenders need for underwriting trust land transactions.

Leasehold Interests on Trust Land

Trust land “purchases” often involve long-term leases:

How trust land homeownership works:

- Individual tribal members cannot own trust land in fee simple

- Instead, you obtain long-term leasehold interest (commonly 50+ years)

- Lease provides exclusive use and occupancy rights

- Section 184 mortgages finance the leasehold interest and improvements

- You “own” the home structure but lease the land from the tribe

Lease requirements:

- Lease term must extend beyond mortgage term

- Renewable or assignable provisions often required

- Lender named as interested party on lease

- Lease must allow mortgage financing

- Terms acceptable to lender and HUD

What happens when the lease expires? Most leases for residential purposes on trust land are renewable, extending 25-50 years at a time—as mortgage borrower, you’ll want lease term extending well beyond mortgage payoff date, and lenders require leases with terms substantially longer than the loan to protect their security interest.

Bureau of Indian Affairs Coordination

Federal agency involvement varies by situation:

When BIA coordination occurs:

- Trust land transactions requiring federal approvals

- Leasehold interest establishment or modification

- Right-of-way approvals for utilities or access

- Verification of trust land status

- Approval of certain lease terms or transfers

BIA processing considerations:

- Federal approval processes can extend timelines

- Documentation requirements vary by BIA regional office

- Coordination between lender, tribe, and BIA necessary

- Planning for longer closing timelines prevents surprises

How long does BIA approval take? Processing times vary significantly by regional office, transaction complexity, and current workload—some approvals complete in weeks while others take months, making early initiation and realistic timeline expectations important for successful Section 184 transactions.

Tribal Codes and Development Standards

Properties must comply with tribal regulations:

- Building codes – Tribal building codes or adopted national standards

- Site development – Subdivision regulations and development requirements

- Environmental compliance – Tribal environmental review processes

- Cultural resource protection – Archaeological or cultural site considerations

- Zoning and land use – Tribal zoning designations and permitted uses

Do tribal building codes differ significantly from state codes? Some tribes adopt national model codes (International Building Code), others develop custom codes, and some areas have minimal codification—Section 184 lenders work with tribal housing authorities to understand applicable standards and ensure properties meet necessary requirements.

What Are Section 184 Credit and Financial Requirements?

What credit score do you need for Section 184 loans? While no absolute minimum exists in Section 184 guidelines, most lenders establish credit score thresholds, typically looking for reasonable credit histories showing ability to meet financial obligations—the program offers flexibility for tribal members with limited credit history or non-traditional credit, recognizing that access to traditional credit may be limited in some tribal communities.

Understanding financial requirements helps you prepare your application and identify any areas needing attention before applying.

Credit Requirements and Flexibility

Section 184 accommodates diverse credit situations:

Credit history standards:

- Reasonable credit scores preferred though flexible minimums

- Limited credit history acceptable with alternative credit documentation

- Recent payment history weighted heavily in decisions

- Explanation letters can address past credit issues

- Non-traditional credit sources considered (rent, utilities, tribal payments)

What’s alternative or non-traditional credit? Documentation of payment obligations not reported to credit bureaus—consistent rent payments, utility bills, insurance premiums, tribal housing payments, or other recurring financial obligations demonstrating responsibility even without conventional credit accounts.

Credit challenges that may require explanation:

- Recent late payments on housing or installment debt

- Collections or charge-offs (may need to be resolved)

- Judgments or tax liens (typically must be satisfied)

- Previous foreclosure or bankruptcy (waiting periods apply)

- High debt-to-income ratios affecting qualification

Can you get a Section 184 loan after bankruptcy or foreclosure? Yes, with appropriate waiting periods after discharge or completion—requirements are generally similar to FHA loans, allowing more flexibility than conventional financing, with waiting periods depending on bankruptcy type and circumstances leading to previous housing loss.

Income Documentation

Stable income supports loan qualification:

Acceptable income sources:

- W-2 employment income with verification

- Self-employment income from tribal businesses or other enterprises

- Per capita payments from tribal gaming or other revenues

- Trust income from individual Indian money accounts

- Retirement income and Social Security benefits

- Disability income and government assistance

- Rental income from other properties

- Income from multiple part-time jobs common in tribal economies

Self-employment considerations:

- Two years of self-employment history preferred

- Tax returns and business documentation required

- Per capita payments typically treated as stable income

- Tribal business income documented through tribal records

How do per capita payments affect qualification? Most lenders treat per capita distributions from tribal gaming or other sources as stable income if documented and shown to be consistent—these payments count toward qualifying income similar to employment earnings, though documentation requirements vary by lender and tribe.

Debt-to-Income Ratios

Section 184 allows reasonable debt levels:

Standard DTI guidelines:

- Housing expense ratio (front-end): typically up to 31% of gross income

- Total debt ratio (back-end): typically up to 43% of gross income

- Flexibility exists with compensating factors

- Strong credit, reserves, or stable income allow higher ratios

Compensating factors enabling higher DTI:

- Excellent credit history

- Substantial cash reserves

- Minimal increase from current housing payment

- Demonstrated ability to manage higher debt levels

- Strong employment stability

- Additional income streams not counted in qualification

What’s included in debt-to-income calculations? Monthly housing payment (principal, interest, taxes, insurance, HOA fees if applicable), installment loans with more than 10 months remaining, revolving debt minimum payments, child support or alimony obligations, and other monthly debt obligations—short-term debt with fewer than 10 months remaining may be excluded.

Reserve Requirements

Cash reserves vary by situation:

Typical reserve requirements:

- Purchase transactions: usually minimal reserves required

- Investment properties: several months reserves typically needed

- Cash-out refinances: additional reserves may be required

- Higher loan amounts: increased reserve expectations

What counts as reserves?

- Checking and savings accounts

- Money market and CD accounts

- Stocks, bonds, mutual funds

- Retirement accounts (sometimes with adjustments)

- Per capita payment future distributions (some lenders)

How many months of reserves do you need? Requirements are generally less stringent than conventional loans—many purchase transactions proceed with minimal reserves if other qualification factors are strong, though lenders appreciate reserves demonstrating financial stability and capacity to handle unexpected expenses.

Calculate your Section 184 loan scenarios:

- Section 184 loan purchase calculator

- Section 184 loan refinance calculator

- Section 184 loan cash-out refinance calculator

Section 184 Loan Strategy #3: Understand Down Payment and Equity Requirements

What down payment do Section 184 loans require? Minimum equity contributions vary by loan amount—loans under $50,000 require only 2.25% equity contribution, while loans between $50,000-$144,000 need 4.25%, and loans exceeding certain thresholds require 5% or more, making Section 184 one of the lowest down payment options for tribal members purchasing homes including on trust land.

Understanding equity requirements helps you plan financially and compare Section 184 to alternatives.

Tiered Equity Structure

Down payments adjust based on loan amount:

Section 184 equity tiers:

- Loans under $50,000: 2.25% minimum equity contribution

- Loans $50,000 to $144,000: 4.25% minimum equity contribution

- Loans over $144,000: Generally 5% minimum equity contribution

- Investment properties: Higher requirements apply

Why does down payment increase with loan amount? The tiered structure balances access to homeownership with appropriate risk management—very low down payments help tribal members with limited savings access homeownership, while larger loans require more substantial equity contributions demonstrating financial capacity.

Equity Source Requirements

Where your down payment comes from matters:

Acceptable equity sources:

- Personal savings and checking accounts

- Gift funds from family members

- Grants from tribal housing programs or nonprofits

- Down payment assistance from tribal entities

- Proceeds from sale of other property

- Retirement account funds (with proper handling)

Gift fund considerations:

- Must come from family members or qualifying donors

- Gift letters required stating funds don’t require repayment

- Documentation of donor’s ability to provide funds

- Paper trail showing fund transfer

Can you use tribal down payment assistance with Section 184? Yes, many tribes offer down payment assistance programs that combine with Section 184 loans—these tribal programs may provide grants, zero-interest second mortgages, or forgivable loans helping members achieve homeownership, and coordination between tribal housing authorities and Section 184 lenders facilitates these combinations.

Seller Contributions

Sellers can help with closing costs:

Seller concessions allowed:

- Up to 6% of home price for owner-occupants

- Can cover closing costs, prepaid items, or discount points

- Cannot be applied directly to down payment

- Reduces out-of-pocket cash needed at closing

How do seller concessions work practically? Negotiate seller contribution in your purchase agreement—the seller credits specified amount at closing toward your fees, reducing your cash requirement, though you still must provide the required down payment from your own funds or gifts.

Comparing to Other Programs

Section 184 equity requirements compete favorably:

Section 184 vs. other programs:

- VA loans: 0% down (but require military service)

- USDA loans: 0% down (but have income limits and rural requirements)

- FHA loans: 3.5% down (similar to Section 184 but doesn’t work on trust land)

- Conventional loans: typically 5-20% down (and don’t work on trust land)

What makes Section 184 unique? The combination of low down payment requirements AND ability to finance trust land creates homeownership access unavailable through any other program—no other financing option offers both features, making Section 184 irreplaceable for tribal members seeking homeownership on trust property.

How Do Section 184 Interest Rates and Fees Compare?

Are Section 184 interest rates competitive? Yes, Section 184 rates typically align with or beat FHA rates while remaining close to conventional mortgage pricing—the federal guarantee enables lenders to offer competitive terms, and Section 184’s lower upfront guarantee fee (1.5% vs. 1.75% FHA) makes the program cost-effective, particularly for tribal members purchasing trust land where alternatives don’t exist.

Understanding complete cost structure helps you evaluate Section 184’s value and plan financially.

Interest Rate Competitiveness

Section 184 rates compare favorably to alternatives:

Rate positioning:

- Generally similar to FHA interest rates

- Slightly above conventional rates for comparable situations

- Significantly better than high-cost alternatives

- Fixed-rate mortgages available in standard terms

- Adjustable-rate options sometimes available

Factors affecting your rate:

- Credit score and history

- Loan-to-value ratio (down payment size)

- Loan amount and property location

- Lender-specific pricing

- Overall financial profile

- Current market conditions

Why do rates vary between lenders? Each lender establishes their own pricing within program parameters based on business model, volume, overhead costs, and desired return—shopping multiple Section 184-approved lenders helps you find optimal pricing rather than assuming all lenders offer identical rates.

Guarantee Fee Structure

Section 184’s guarantee fee beats FHA costs:

Upfront guarantee fee:

- 1.5% of loan amount charged at closing

- Can be financed into loan balance

- Covers administrative costs and supports guarantee fund

- Compares favorably to 1.75% FHA upfront MIP

Annual guarantee fee:

- 0.50% of outstanding loan balance annually

- Divided into monthly payments added to your mortgage payment

- Continues for life of loan (unlike FHA which can drop after certain periods)

- Protects the guarantee fund enabling program sustainability

Example guarantee fee calculation:

- $200,000 loan amount

- Upfront: $3,000 (1.5%)

- Annual: $1,000 ($200,000 × 0.50% = $1,000 ÷ 12 = $83.33/month)

- As principal balance decreases, monthly guarantee fee reduces accordingly

Can guarantee fees be avoided or reduced? No, guarantee fees are mandatory program components enabling the federal guarantee that makes trust land lending possible—these fees support the guarantee fund protecting lenders against losses, making the entire program viable and sustainable.

Other Closing Costs

Standard mortgage costs apply:

Typical closing costs:

- Appraisal fee for professional property valuation

- Credit report charges

- Title examination and title insurance (where applicable to property type)

- Recording fees and documentary stamps

- Lender processing and underwriting fees

- Survey costs if required

- Inspection fees for property condition

- Attorney fees in states requiring legal representation

Trust land specific costs:

- Tribal administrative fees if charged

- Leasehold documentation and recording

- BIA approval processing fees if applicable

- Additional title work for trust land status verification

How much should you budget for closing costs? Typically 2-5% of loan amount for total closing costs including the guarantee fee—exact amounts vary based on property location, loan amount, title insurance requirements (different for trust vs. fee-simple land), tribal fees if any, and lender-specific charges.

Section 184 Loan Strategy #4: Explore Refinancing Opportunities

Can you refinance with a Section 184 loan? Yes, Section 184 offers both rate-and-term refinancing to improve loan terms and cash-out refinancing to access home equity—you can refinance existing Section 184 loans or, in some cases, refinance conventional loans on eligible properties, providing flexibility to optimize your financing as circumstances change or equity builds over time.

Understanding refinancing options helps you plan strategically for long-term financial management.

Rate-and-Term Refinancing

Improve your existing loan terms:

Rate-and-term purposes:

- Lower your interest rate when market conditions improve

- Shorten loan term to build equity faster

- Convert adjustable-rate to fixed-rate mortgage

- Remove mortgage insurance (not applicable to Section 184 which has lifetime guarantee fee)

- Consolidate first and second mortgages

Eligibility requirements:

- Must meet current Section 184 qualifying standards

- Property must still be eligible under program rules

- Credit and income verification required

- Appraisal typically needed to verify property value

- Cannot extract significant cash (limited to closing costs)

Benefits of refinancing your Section 184 loan:

- Potentially lower monthly payments from reduced rates

- Faster equity building with shorter terms

- Fixed payment certainty if moving from ARM

- May reduce overall interest paid over loan life

When does Section 184 refinancing make sense? If market rates have dropped substantially since your original loan (typically 0.75-1% or more improvement), if you want to shorten your term while maintaining affordable payments, or if you need to convert an ARM to fixed rate for payment stability and planning certainty.

Cash-Out Refinancing

Access accumulated home equity:

Cash-out purposes:

- Home improvements and renovations

- Debt consolidation at lower interest rates

- Educational expenses

- Business investments

- Emergency expenses or medical bills

- Any legal purpose

Cash-out requirements:

- Property must have adequate equity for desired cash-out

- Must meet current credit and income standards

- Property appraisal determines available equity

- Loan-to-value limits restrict maximum cash-out

- Purpose restrictions may apply in some situations

Maximum cash-out amounts:

- Generally up to 80-85% loan-to-value ratio depending on property type

- Primary residence typically allows highest LTV

- Investment properties more restrictive

- Must maintain adequate equity per program guidelines

Can you cash-out refinance trust land properties? Yes, Section 184 cash-out refinancing works on trust land as well as fee-simple property—this provides equity access unavailable through conventional cash-out programs that can’t finance trust land, giving tribal members on trust property options to leverage accumulated equity.

Streamline Refinancing

Simplified refinance process for existing Section 184 loans:

Streamline benefits:

- Reduced documentation requirements

- May not require new appraisal in some cases

- Faster processing timeline

- Lower closing costs in some situations

- Must result in net tangible benefit to borrower

Streamline requirements:

- Must have existing Section 184 mortgage

- Current on payments with acceptable payment history

- Refinancing to lower rate or better terms

- Cannot include cash-out beyond closing costs

- Property eligibility previously established

What’s a “net tangible benefit”? Refinancing must provide clear financial advantage—either lower interest rate by specific minimum threshold, reduced loan term building equity faster, or conversion from ARM to fixed rate eliminating rate risk, not just generating fees for lenders without borrower benefit.

Considering a refinance? Submit a refinance inquiry to see if this makes sense for you.

What Lenders Offer Section 184 Loans?

Can any lender provide Section 184 financing? No, only HUD-approved Section 184 lenders can originate these loans—the program requires specific approval, training, understanding of trust land complexities, and experience working with tribal housing authorities, making the lender pool smaller than conventional mortgage lenders but including major national lenders, regional banks, and specialized Native American lending institutions.

Finding approved lenders with appropriate expertise ensures smooth transactions and proper handling of tribal land complexities.

Types of Section 184 Lenders

Different institutions offer the program:

National mortgage lenders:

- Large lenders with Native American lending divisions

- Nationwide reach serving tribal members everywhere

- Established Section 184 expertise and volume

- May have dedicated tribal lending specialists

- Examples include major mortgage companies with government lending focus

Regional and community banks:

- Banks serving specific tribal areas or regions

- Local market knowledge and tribal relationships

- May offer relationship banking advantages

- Often have long-standing tribal community connections

Tribal lending institutions:

- Native Community Development Financial Institutions (CDFIs)

- Tribally-chartered lending institutions

- Native American-owned banks and credit unions

- Deep cultural understanding and tribal focus

Credit unions:

- Some credit unions offer Section 184 loans

- May serve specific tribal membership

- Community-focused lending approach

- Competitive rates through member ownership model

Which lender type works best? Depends on your location, property type, and preferences—national lenders offer broad availability and high volume expertise, regional banks provide local market knowledge, while Native CDFIs and tribal institutions bring cultural understanding and mission-driven focus on Native homeownership.

Finding Approved Lenders

Multiple resources help identify Section 184 lenders:

- HUD’s online lender list – Official list of approved Section 184 lenders by state

- Tribal housing authorities – Can provide referrals to lenders active in their area

- Native CDFI network – Specialized Native American lending institutions

- Mortgage broker networks – Brokers with Section 184 lender relationships

- Local bank research – Contact banks serving your tribal area

How do you verify a lender is Section 184-approved? Check HUD’s official lender list online, ask lenders for their Section 184 approval status and experience level, request references from recent tribal borrowers, and confirm with your tribal housing authority whether the lender has successfully closed loans in your community.

Lender Selection Criteria

Evaluate lenders beyond just interest rates:

Important factors:

- Section 184 experience and closed loan volume

- Trust land transaction expertise

- Relationships with your tribal housing authority

- Understanding of your tribe’s specific processes

- Communication and responsiveness

- Rates, fees, and overall costs

- Timeline capabilities and processing speed

- References from recent tribal borrowers

Questions to ask potential lenders:

- How many Section 184 loans do you close annually?

- Have you worked with my tribe or tribal housing authority?

- What’s your typical closing timeline for trust land transactions?

- What support do you provide coordinating with tribal entities?

- Can you provide references from recent tribal member borrowers?

- What are your complete costs including all fees?

Why does tribal experience matter? Trust land transactions involve unique coordination with tribal housing authorities, understanding of tribal processes, relationship with BIA regional offices, and familiarity with tribe-specific documentation—lenders experienced with your tribe or similar tribal situations navigate these complexities more smoothly than those learning as they go.

Frequently Asked Questions About Section 184 Loans

Can Non-Native Spouses Co-Borrow on Section 184 Loans?

Yes, non-Native spouses can co-borrow on Section 184 loans alongside their enrolled tribal member spouse—the enrolled spouse must be a primary borrower, but adding the non-Native spouse’s income and credit can strengthen qualification, improve debt-to-income ratios, or increase available loan amounts, making co-borrowing common and beneficial in many situations.

How does non-Native co-borrowing work? The enrolled tribal member qualifies the loan for Section 184 eligibility through their membership, while both spouses’ financial profiles combine for underwriting—both incomes count toward qualifying, both credit histories are reviewed, and both parties sign the mortgage, creating joint obligation and ownership.

Co-borrower considerations:

- Both spouses’ incomes count toward debt-to-income ratios

- Both credit reports reviewed in underwriting

- Stronger combined profile can improve approval odds

- Both parties responsible for mortgage payment

- Both hold ownership interest in the property

- Protections exist for non-borrowing spouses in some situations

What Happens to Section 184 Loans in Divorce?

Divorce creates complications requiring careful handling of Section 184 loans—one party keeping the home must typically refinance into their name alone or formally assume the existing loan with lender approval, property division must account for equity in the home, and trust land status may affect options since tribal membership might be required for continued occupancy rights.

Can a non-Native ex-spouse keep a home on trust land? Generally no for trust land properties where occupancy rights flow from tribal membership—if the tribal member spouse leaves, the non-Native ex-spouse typically cannot maintain leasehold rights or occupancy, requiring property transfer to the tribal member spouse or sale, though specific situations vary by tribal law and lease terms.

Divorce planning considerations:

- Consult divorce attorney experienced with tribal land issues

- Understand how tribal law affects property division

- Evaluate refinancing feasibility for spouse keeping property

- Consider whether non-tribal spouse can maintain occupancy on trust land

- Review lease terms for divorce provisions or restrictions

- Coordinate with tribal housing authority about required processes

Can You Build a New Home With a Section 184 Loan?

Yes, Section 184 includes construction-to-permanent financing for building new homes on trust land or eligible property—funds disburse in draws as construction progresses, then convert to permanent mortgage upon completion, providing single-close convenience and eliminating need for separate construction loan and permanent financing.

Construction loan requirements:

- Complete architectural plans and specifications

- Licensed contractor with appropriate credentials and insurance

- Detailed construction budget and timeline

- Building permits or tribal approvals

- Land ready for construction (if trust land, lease in place)

- Draw schedule aligned with construction milestones

- Inspections at each draw stage

How do construction draws work on trust land? Similar to standard construction loans—lender releases funds at completion milestones (foundation, framing, rough mechanicals, etc.) after inspection verification, though coordination with tribal housing authority or building department ensures compliance with tribal codes and proper oversight.

Construction timeline considerations:

- Longer processing for initial approval due to plan review

- Draw requests require coordination with tribal inspectors

- BIA approvals if needed can extend timeline

- Weather and contractor schedules affect completion

- Plan for 12-18+ months from application to move-in

Are Section 184 Loans Available for Investment Properties?

Yes, Section 184 finances investment properties for eligible tribal members—requirements are stricter than owner-occupied financing with larger down payments, lower maximum loan-to-value ratios, higher reserve requirements, and more conservative underwriting, but the program does enable tribal members to build rental property portfolios including on trust land.

Investment property requirements:

- Typically 10-15% minimum down payment (higher than owner-occupied)

- Lower maximum LTV ratios

- 6+ months reserves usually required

- Property must generate rental income

- May require rental market analysis

- Investment property rental history helpful if you own other rentals

Can tribes use Section 184 for rental housing projects? Yes, tribal entities can use Section 184 for developing rental housing serving tribal members—tribal housing authorities, TDHEs, or tribes themselves can finance multi-family projects, scattered-site rental homes, or lease-to-own programs using Section 184 guarantees for projects conventional financing cannot address.

How Long Does Section 184 Loan Approval Take?

Section 184 timelines vary based on property type and tribal coordination—fee-simple property transactions often close within standard 30-45 day periods similar to conventional loans, while trust land transactions typically require longer due to tribal coordination, lease documentation, BIA approvals if needed, and additional complexity, with 60-90+ days more realistic for trust land purchases.

Factors affecting Section 184 timelines:

- Property type (fee-simple faster than trust land)

- Tribal housing authority responsiveness

- BIA approval requirements and processing speed

- Completeness of initial application and documentation

- Appraisal scheduling in remote areas

- Title work complexity

- Lender experience and workload

How can you expedite Section 184 closing? Submit complete application packages upfront, coordinate early with tribal housing authority, initiate any needed BIA processes immediately, maintain communication with all parties, respond quickly to lender requests, schedule appraisal promptly, and set realistic expectations allowing adequate time rather than creating unnecessary pressure.

Expediting strategies:

- Pre-qualification before house hunting

- Early tribal housing authority engagement

- Complete documentation at application

- Prompt response to lender requests

- Realistic timeline expectations in purchase contracts

- Regular communication with all parties

Can Section 184 Loans Finance Manufactured Homes?

Yes, Section 184 finances manufactured homes on permanent foundations meeting HUD standards—the manufactured home must be permanently affixed to the land, meet HUD manufactured home construction and safety standards, be titled as real property rather than personal property, and be on approved foundation systems, enabling affordable housing options in tribal communities.

Manufactured home requirements:

- Built to HUD manufactured home standards (not mobile home standards)

- Permanently attached to foundation meeting HUD requirements

- Titled as real property and land ownership or lease

- Wheels, axles, and towing hitch removed

- Connection to permanent utilities

- Meets local/tribal building codes and zoning

- Appraisal as real property

What’s the difference between mobile homes and manufactured homes? Manufactured homes are built after June 15, 1976 to HUD Code (federal standards), have permanent foundations, and can qualify for mortgage financing, while mobile homes were built before HUD Code implementation, often lack permanent foundations, and typically cannot qualify for standard mortgage programs including Section 184.

Section 184 Loan Strategy #5: Coordinate Estate Planning and Succession

How do Section 184 loans affect inheritance on trust land? Estate planning becomes complex with trust land due to federal restrictions and fractionation concerns—Section 184 borrowers should plan carefully for succession, understand how trust land passes to heirs, consider life insurance covering mortgage balances, and work with attorneys experienced in Indian law to ensure property can transfer efficiently within families while satisfying loan obligations.

Proper planning protects your investment and family’s interests.

Trust Land Inheritance Complexity

Federal restrictions create unique challenges:

Fractionation concerns:

- Trust land historically divided among multiple heirs over generations

- Undivided interests in small percentages create management problems

- Federal policies attempt to prevent further fractionation

- Section 184 mortgaged property passes with debt obligations intact

How does fractionated ownership affect Section 184 loans? When trust land passes to multiple heirs, the mortgage obligation remains against the property—heirs must coordinate loan repayment, decide who keeps the home, potentially buy out other heirs’ interests, or sell to pay off the mortgage, creating complexity when multiple parties have interests in one property with debt attached.

Estate Planning Strategies

Several approaches protect family interests:

Life insurance coverage:

- Purchase life insurance with death benefit covering mortgage balance

- Allows heirs to pay off Section 184 loan and retain property

- Ensures home passes to family without debt burden

- Relatively affordable compared to mortgage balance

Wills and succession planning:

- Clear will designating who receives property

- Understanding of how trust land transfers under federal and tribal law

- Consideration of who can realistically maintain property and payments

- Communication with intended heirs about expectations

Buy-sell agreements:

- Family agreements about property disposition

- Pre-arranged terms for buyouts if multiple heirs

- Funding mechanisms for purchasing other heirs’ interests

- Clarity about who maintains home and mortgage

Tribal probate considerations:

- Trust land passes through federal probate system under American Indian Probate Reform Act

- Tribal law may also apply to succession

- Process differs from state probate for fee-simple property

- Specialized attorneys needed for trust land estate planning

Should you pay off your Section 184 loan before death? If possible and financially optimal, eliminating the mortgage before passing provides cleanest transfer to heirs—however, maintaining mortgage while investing elsewhere, carrying affordable debt in retirement, or using life insurance to cover the balance can be equally valid strategies depending on your overall financial situation.

Protecting Heirs From Mortgage Default

Several protections help heirs:

- Loan assumption – Heirs may assume existing Section 184 mortgage if they qualify

- Refinancing – Heirs can refinance into their own names if eligible

- Sale option – Property can be sold to pay mortgage if keeping isn’t feasible

- Non-recourse protection – Heirs never owe more than property value

- Reasonable timeline – Lenders work with heirs through probate and transition

What happens if heirs cannot maintain Section 184 payments? Lenders work with heirs through reasonable transition periods while probate resolves, allowing time to decide whether to keep property through assumption or refinancing, sell to pay off the loan, or in worst case allow foreclosure proceedings, though families typically find solutions preserving property.

Alternative Loan Programs for Native American Homeowners

If a Section 184 loan isn’t the right fit, consider these alternatives:

- FHA Loan – Government-backed financing with flexible qualification standards for properties off tribal lands

- VA Loan – Competitive financing for Native American veterans with military service eligibility

- USDA Loan – Rural property financing for eligible areas including some tribal lands

- Conventional Loan – Traditional financing for properties with standard fee-simple ownership

- Down Payment Assistance – Programs providing grants or low-interest loans to help with upfront costs

Explore all 30+ loan programs to find your best option.

Not sure which program is right for you? Take our discovery quiz to find your path.

Helpful Section 184 Loan Resources

Official Government Guidance

HUD Section 184 Indian Home Loan Guarantee Program – Department of Housing and Urban Development’s official Section 184 program resource providing eligibility requirements, lender lists, application processes, and borrower information for Native American homeownership financing.

Bureau of Indian Affairs Land Management – Federal agency resource covering trust land administration, leasing processes, probate procedures, and land status verification for understanding trust property regulations affecting Section 184 financing.

Consumer Financial Protection Bureau Native American Mortgage Resources – Federal consumer protection agency offering educational materials on mortgages, borrower rights, and protections applicable to all loan programs including Section 184.

Industry Organizations

Native American Housing Assistance and Self-Determination Act Information – HUD resources on NAHASDA programs supporting tribal housing development, down payment assistance, and complementary programs working alongside Section 184 loans.

National American Indian Housing Council – Tribal housing authority association providing resources, training, best practices, and advocacy supporting Native American housing development and homeownership programs.

Educational Resources

HUD Office of Native American Programs – Federal office administering Section 184 and other Native American housing programs with resources on program requirements, tribal coordination, and homeownership opportunities in Indian Country.

First Nations Development Institute Financial Education – Native American-led nonprofit providing financial literacy resources, homeownership education, asset building programs, and tools specifically designed for tribal communities and members.

National Congress of American Indians Policy Resources – Tribal government organization offering policy analysis, advocacy resources, and information on federal programs affecting tribal communities including housing and homeownership initiatives.

Need local expertise? Get introduced to trusted partners including loan officers, realtors, and contractors in your area.

Ready to get started? Apply now or schedule a call to discuss your situation.

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Not Sure About Your Next Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Related Posts

Subscribe to our newsletter

Get program updates and rate insights in your inbox.