Asset Based Loan: 7 Powerful Advantages for High-Net-Worth Borrowers

How an Asset Based Loan Provides Financing Without Traditional Income Documentation

Traditional mortgage qualification focuses on monthly income, leaving many financially secure borrowers unable to access financing despite substantial wealth. Asset-based loans evaluate your qualification through liquid assets like investment accounts, retirement funds, and savings rather than employment income. This approach opens homeownership opportunities for retirees, trust fund beneficiaries, and high-net-worth individuals whose financial strength lies in accumulated wealth rather than regular paychecks.

Key Details: What You’ll Learn About Asset Based Loans

- An asset based loan uses your liquid assets—rather than employment income—to qualify for mortgage financing (FDIC asset-based lending examination guidance)

- Borrowers with substantial investment portfolios, retirement accounts, or liquid assets can secure financing without W-2s or tax returns (CFPB alternative mortgage qualification information)

- Properties up to luxury price points qualify through asset depletion calculations that demonstrate repayment capacity

- Retirees, investors, and entrepreneurs benefit from streamlined documentation focusing on asset verification rather than income complexity (IRS retirement account distribution guidelines)

- An asset based loan accommodates primary residences, second homes, and investment properties with flexible qualification structures

- Credit profiles with past challenges can qualify when substantial liquid assets demonstrate financial strength

- Multiple asset types contribute to qualification including brokerage accounts, mutual funds, stocks, bonds, and retirement portfolios (SEC investment account protection information)

Ready to explore your options? Schedule a call with a loan advisor.

What Is an Asset Based Loan?

An asset based loan represents a mortgage qualification strategy that evaluates your borrowing capacity based on liquid assets rather than traditional employment income. Instead of analyzing pay stubs, W-2 forms, or tax returns, lenders calculate your qualifying capacity by applying a depletion method to your investment and retirement accounts.

How does the asset depletion calculation work? Lenders divide your total qualifying liquid assets by a specific factor—typically ranging from 60 to 240 months depending on the program—to determine your monthly qualifying income. This approach recognizes that substantial asset portfolios demonstrate repayment capacity even without traditional employment documentation.

The process focuses on verifying and valuing your liquid holdings rather than reconstructing complex business tax returns or explaining income fluctuations. For borrowers with significant wealth but non-traditional income patterns, this creates a streamlined path to mortgage financing that conventional programs cannot accommodate.

Who Benefits Most from an Asset Based Loan?

Several borrower profiles find exceptional value in an asset based loan structure. These programs serve individuals whose financial strength lies in accumulated wealth rather than current employment income.

Retirees and early retirees represent ideal candidates for an asset based loan. After decades of saving and investing, many retirees hold substantial portfolios but show minimal taxable income on their returns. Traditional mortgage programs struggle to qualify these borrowers despite obvious financial capacity. An asset based loan solves this disconnect by recognizing portfolio value as the true indicator of repayment ability.

Entrepreneurs and business owners frequently face qualification challenges with conventional programs. Business tax returns often show strategic losses, depreciation, or reinvestment that reduces reported income despite strong cash flow and asset accumulation. When your business strategy prioritizes growth over reported income, an asset based loan provides an alternative qualification path.

Investment-focused individuals who generate wealth through capital gains, dividend income, or portfolio management may find traditional income documentation cumbersome. An asset based loan eliminates the need to reconstruct complex investment income patterns when substantial liquid assets speak for themselves.

Recently relocated or career-transitioning professionals sometimes encounter gaps in traditional employment documentation. If you’ve accumulated significant assets but recently changed career paths, retired early, or relocated internationally, an asset based loan offers qualification flexibility during transitional periods.

Explore all loan programs to understand your full range of options.

What Types of Assets Qualify for an Asset Based Loan?

Understanding which assets contribute to your qualification helps you assess whether this program fits your financial profile. Lenders typically accept a range of liquid and semi-liquid holdings.

Qualifying liquid assets include:

- Checking and savings account balances

- Money market accounts and certificates of deposit

- Brokerage account holdings including stocks, bonds, and mutual funds

- Retirement accounts including 401(k), IRA, and Roth IRA balances

- Trust account balances with verified access

- Investment portfolios with established market values

What about retirement accounts? Most asset based loan programs allow retirement account balances to contribute to qualification calculations. However, lenders typically apply a discount factor—often 60-70% of the account value—to account for potential tax implications and early withdrawal penalties. This conservative approach ensures the calculation reflects realistic accessible funds.

Do all investment types qualify equally? Lenders prioritize liquid holdings that can be quickly converted to cash with minimal market risk. Stocks, bonds, and mutual funds in established brokerage accounts receive full consideration. More volatile holdings or illiquid investments may receive reduced weighting or exclusion from calculations.

Properties, business assets, and non-liquid holdings typically do not contribute to asset based loan qualification. The focus remains on holdings that demonstrate clear, accessible financial capacity for mortgage obligations.

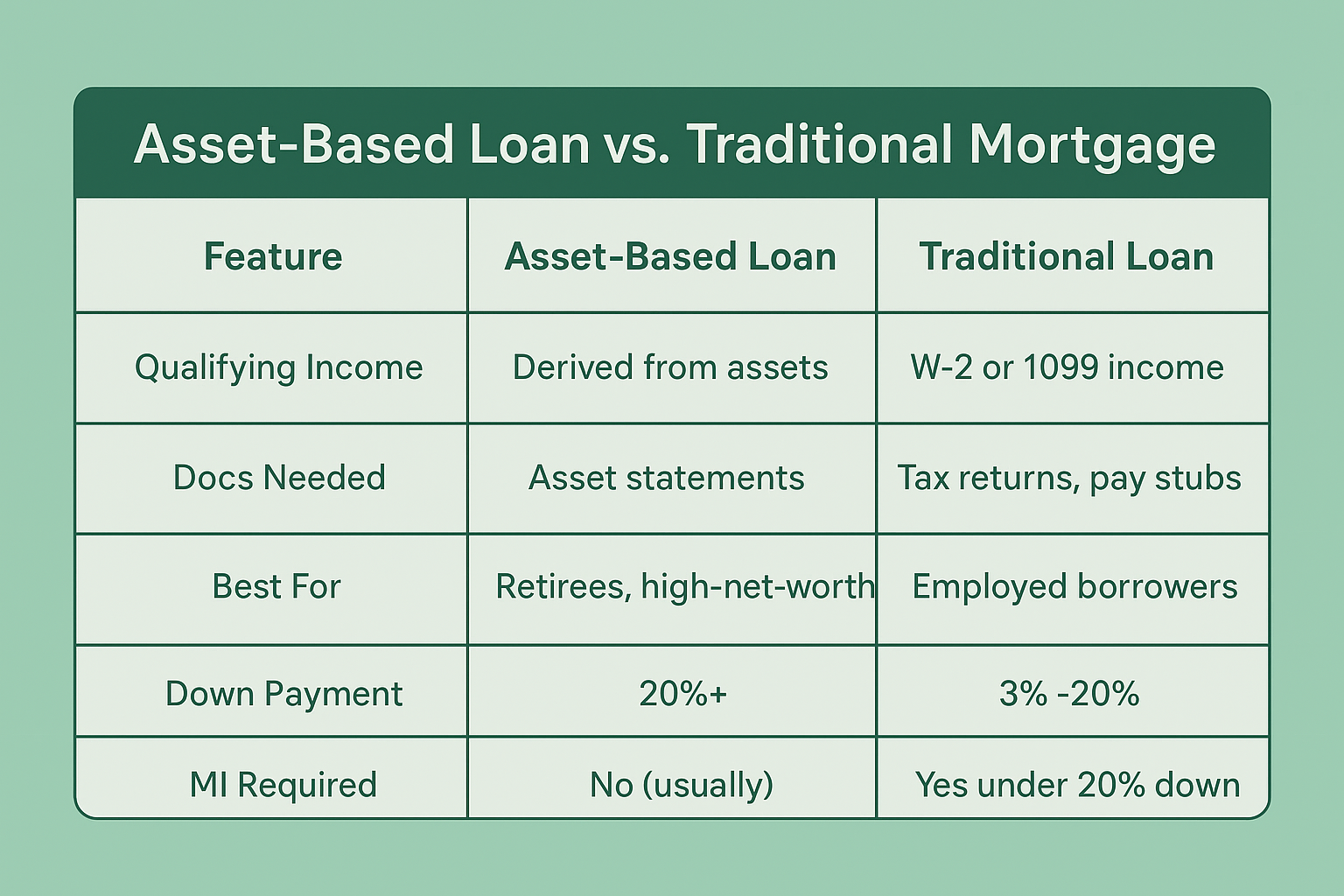

How Does an Asset Based Loan Differ from a Conventional Mortgage?

The fundamental distinction lies in the qualification methodology and documentation requirements. Conventional mortgages follow standardized underwriting guidelines established by Fannie Mae and Freddie Mac, requiring detailed employment verification, income documentation, and debt-to-income calculations. An asset based loan bypasses these traditional requirements entirely.

Documentation differences:

- No W-2 forms or pay stubs required

- No tax return analysis or income reconstruction

- No employment verification letters or VOEs

- No complex self-employment calculations

- Asset statements replace income documentation

- Simplified verification process focused on account balances

Can you qualify with lower credit scores using an asset based loan? While an asset based loan offers flexibility in income documentation, credit requirements remain important. However, borrowers with past credit challenges may find more accommodating review when substantial assets demonstrate clear financial capacity. The focus shifts from credit perfection to overall financial strength.

The underwriting timeline often compresses significantly compared to conventional programs. Without the need to analyze multiple years of tax returns, reconcile business expenses, or reconstruct complex income patterns, approvals can proceed more efficiently once asset verification completes.

Ready to discuss your purchase scenario? Submit a purchase inquiry to explore your options.

What Property Types Qualify for an Asset Based Loan?

An asset based loan program accommodates diverse property categories, providing flexibility for various real estate strategies. Understanding which property types qualify helps you plan your financing approach.

Eligible property categories:

- Primary residences in urban, suburban, and rural locations

- Second homes and vacation properties

- Single-family investment properties

- Multi-unit properties including 2-4 unit configurations

- Condominiums in approved developments

- Luxury properties above conventional limits

Are there property value restrictions for an asset based loan? Many asset based loan programs extend to higher property values than conventional mortgages, making them particularly valuable for luxury home purchases. When your target property exceeds conforming limits, an asset based loan provides qualification flexibility without the income documentation requirements of jumbo conventional programs.

What about unique property characteristics? An asset based loan often accommodates properties that conventional programs flag as non-conforming. Rural locations, large acreage, unique architectural features, or properties requiring minor repairs may find more flexible evaluation under asset based underwriting.

Investment properties receive particular attention in asset based loan programs. Whether acquiring rental properties for portfolio growth or purchasing fix-and-flip opportunities, asset based qualification focuses on your overall financial capacity rather than rental income projections or employment documentation.

See how other asset-rich borrowers have successfully used this financing:

How Much in Assets Do You Need to Qualify?

The asset threshold for qualification depends on multiple factors including property value, desired funding structure, and program guidelines. Understanding the general parameters helps you assess your eligibility.

What’s the typical asset requirement calculation? Lenders evaluate whether your liquid assets, when divided by the depletion factor, generate sufficient monthly qualifying income to support the anticipated obligations. The specific calculation varies by lender and program, but most programs require demonstrating 60-360 months of reserves depending on the structure.

Does property value affect asset requirements? Higher property values naturally require larger asset portfolios to demonstrate adequate repayment capacity. A luxury property acquisition demands proportionally greater assets than a modest home purchase. The relationship between asset holdings and property value forms the foundation of the qualification assessment.

Can you combine multiple asset accounts? Most programs allow aggregating assets across multiple account types to reach qualification thresholds. Your IRA, brokerage account, savings accounts, and other qualifying holdings typically combine to establish your total asset position. This flexibility allows you to leverage your complete financial picture rather than relying on a single account.

Borrowers typically need substantial six-figure or seven-figure liquid asset portfolios to qualify for meaningful property acquisitions through asset based programs. However, the specific threshold varies significantly based on individual circumstances and program parameters.

Calculate your asset-based loan scenarios:

What Documentation Does an Asset Based Loan Require?

While an asset based loan eliminates traditional income documentation, specific verification requirements ensure your financial capacity. Understanding the required documentation helps you prepare for a smooth application process.

Required documentation typically includes:

- Recent statements from all asset accounts (usually 2-3 months)

- Account verification letters from financial institutions

- Credit report authorization

- Property appraisal for the subject property

- Homeowner’s insurance information

- Title and escrow documentation

How recent must asset statements be? Most lenders require statements dated within 60-90 days of application. The recency requirement ensures calculations reflect current asset positions rather than outdated balances. Market fluctuations can significantly impact account values, making current documentation essential for accurate qualification assessment.

Do you need to explain asset sources? Unlike conventional mortgages that scrutinize large deposits and require extensive sourcing documentation, an asset based loan focuses primarily on current holdings. While lenders verify account ownership and confirm balances, the seasoning requirements and deposit explanations that complicate conventional applications rarely apply to asset based programs.

What about property documentation? Standard property requirements remain consistent with other mortgage programs. You’ll need a professional appraisal, title search, homeowner’s insurance, and standard closing documentation. The simplified requirements apply specifically to income and employment verification—not to property due diligence.

The streamlined documentation process represents one of the most significant advantages for borrowers with complex financial profiles. Instead of reconstructing years of tax returns and explaining business structures, you focus on demonstrating current asset positions.

Common Asset Based Loan Questions

Can you use retirement accounts for asset based loan qualification?

Retirement account balances typically contribute to asset based loan qualification with certain considerations. Most lenders accept 401(k), traditional IRA, Roth IRA, and other qualified retirement accounts as part of your total asset calculation. However, expect the lender to apply a discount factor—often 30-40%—to account for potential taxes and early withdrawal penalties that would apply if you actually liquidated the accounts.

This conservative approach protects both you and the lender by ensuring the qualification calculation reflects realistic accessible value rather than face value. Even with the discount, substantial retirement portfolios provide significant qualifying power for an asset based loan.

How do market fluctuations affect your qualification?

Asset based loan qualification uses account values at the time of documentation and underwriting. Market volatility can impact your qualification if account values drop significantly between application and closing. Most lenders lock in your qualification based on verified asset statements, but substantial market corrections might trigger reverification requirements.

Working with experienced loan advisors helps you time your application strategically and structure your asset verification to minimize market timing risks. Some borrowers choose to increase liquid account balances or add additional asset documentation to create cushion against market fluctuations.

Can you qualify with assets in different ownership structures?

Individual accounts, joint accounts, trust accounts, and certain business accounts may all contribute to qualification depending on verified ownership and access. Lenders evaluate both the account holder designations and the legal authority to access funds when determining which assets qualify.

Trust accounts require specific documentation:

- Copy of the complete trust document

- Verification of trustee authority

- Confirmation of asset access rights

- Account statements in the trust name

Joint account contributions typically require both parties to qualify as borrowers or appropriate documentation establishing individual access rights.

Does an asset based loan work for investment property purchases?

An asset based loan accommodates investment property acquisitions with particular effectiveness. When purchasing rental properties, conventional programs require analyzing existing rental income, projecting new property income, and navigating complex debt-to-income calculations. Asset based qualification bypasses these complications entirely.

Your substantial liquid assets demonstrate capacity to manage investment property obligations regardless of rental income projections. This approach particularly benefits investors building portfolios without traditional employment income or those acquiring properties in need of repositioning before generating rental income.

How Do Interest Rates Compare on an Asset Based Loan?

Competitive program structures reflect the reduced documentation requirements and specialized underwriting approach. While specific pricing varies based on individual scenarios, understanding the general pricing framework helps you evaluate whether an asset based loan fits your financial strategy.

What factors influence pricing on an asset based loan? Several elements affect your specific rate structure:

- Total asset position relative to funding needs

- Credit profile and history

- Property type and location

- Overall financial strength beyond minimum requirements

- Equity contribution and funding structure

Are rates higher than conventional mortgages? Asset based loan pricing typically reflects a premium compared to conventional conforming mortgages due to the specialized underwriting and portfolio lending nature. However, many borrowers find the pricing differential worthwhile given the qualification flexibility and documentation simplification.

Can you reduce costs with larger equity contributions? Demonstrating substantial assets beyond minimum qualification requirements often provides access to more competitive pricing. When your liquid holdings significantly exceed the required threshold, lenders may offer preferential structures reflecting the reduced risk profile.

The total cost evaluation should consider both pricing and the value of simplified qualification. For borrowers who cannot qualify through conventional programs—or who would face extensive documentation requirements—the convenience and accessibility often justify the program costs.

Considering a refinance? Submit a refinance inquiry to see if this makes sense for you.

What Are the Advantages of an Asset Based Loan?

Understanding the specific benefits helps you evaluate whether this program aligns with your financial situation and real estate goals. An asset based loan offers distinct advantages for borrowers whose wealth accumulation doesn’t follow traditional employment patterns.

Key advantages include:

Simplified documentation process – Skip the extensive income verification that complicates conventional applications. No tax returns, no W-2s, no employment verification letters, no complicated self-employment calculations. Your asset statements tell the complete qualification story.

Faster approval timelines – Without complex income analysis, underwriting proceeds more efficiently. Many borrowers experience compressed timelines from application to approval, allowing quicker transaction closings when time sensitivity matters.

Flexibility for complex income situations – Business owners, entrepreneurs, and investors with strategic tax planning often show minimal taxable income despite substantial wealth. An asset based loan recognizes your true financial capacity rather than penalizing tax-efficient strategies.

Accommodation of recent career changes – Transitioning from employment to retirement, changing business structures, or relocating internationally creates income documentation gaps that complicate conventional qualification. An asset based loan focuses on current financial strength rather than historical income patterns.

Higher loan amounts – Substantial asset portfolios can support larger financing amounts than income-based calculations would allow. For luxury property acquisitions or portfolio expansion, asset based qualification may enable strategies conventional programs cannot accommodate.

Privacy and discretion – Borrowers who prefer not to share detailed business information, complex financial structures, or intricate tax strategies appreciate the limited disclosure requirements. Asset verification provides the necessary qualification data without exposing extensive financial details.

Alternative Loan Programs for Asset-Rich Borrowers

If an asset-based loan isn’t the right fit, consider these alternatives:

- Bank Statement Loan – Uses 12-24 months of bank deposits for self-employed borrowers with strong cash flow

- Profit and Loss Loan – Qualifies using CPA-prepared profit and loss statements for business owners

- 1099 Loan – For independent contractors using 1099 income documentation

- No-Doc Loan – Minimal income verification for borrowers with strong credit and substantial assets

- Jumbo Loan – For high-value properties when traditional income documentation is available

Explore all 30+ loan programs to find your best option.

Not sure which program is right for you? Take our discovery quiz to uncover your goals.

Advanced Asset Based Loan Questions

Can foreign nationals qualify for an asset based loan?

Foreign national borrowers with substantial U.S.-based asset holdings may qualify for an asset based loan depending on program guidelines and documentation requirements. The key factors include verifying asset ownership, confirming account access, and establishing identity through appropriate documentation.

Foreign national requirements typically include:

- Valid passport and visa documentation

- U.S.-based asset accounts or verifiable foreign accounts

- Credit profile through international reporting or alternative verification

- Larger equity contributions than U.S. citizens

- Additional documentation establishing residency plans

Some lenders specialize in foreign national asset based loan programs, providing specific program structures for international buyers investing in U.S. real estate.

How does an asset based loan handle multiple properties?

Borrowers acquiring multiple properties or maintaining existing real estate portfolios can leverage an asset based loan for additional acquisitions. The qualification calculation considers your total obligations including existing properties, but focuses primarily on whether your asset position supports the combined housing expenses.

Are existing mortgages counted against your qualification? Yes, lenders evaluate all debt obligations when determining whether your assets provide adequate capacity. However, the flexibility of asset based qualification often accommodates multiple property strategies more effectively than conventional income-based calculations.

Can you combine an asset based loan with other income documentation?

Some programs allow hybrid qualification approaches that consider both assets and income. If you have some employment income but insufficient documentation for conventional qualification, combining asset consideration with partial income verification might strengthen your application.

This approach particularly benefits borrowers in transition—perhaps recently retired but maintaining part-time consulting income, or business owners with modest W-2 income supplemented by substantial accumulated wealth.

What happens to your assets during the loan term?

Asset based loan qualification verifies your holdings at origination but does not restrict how you manage those assets after closing. You maintain complete control over your investment accounts, retirement portfolios, and liquid holdings throughout the loan term.

Do you need to maintain specific asset levels? Unlike some specialized programs, an asset based loan does not impose ongoing asset maintenance requirements. Once your loan closes, you can invest, spend, or reallocate your assets based on your financial goals without loan compliance concerns.

Can you use pledged assets instead of liquidating investments?

Some sophisticated asset based structures allow pledging securities or investment accounts as collateral rather than calculating depletion income. These pledged asset mortgages let you borrow against your portfolio without liquidating positions or triggering tax consequences.

How do pledged asset mortgages differ from standard asset based loan programs? Pledged structures typically require larger asset portfolios, impose restrictions on pledged account management, and may offer more favorable pricing due to the additional collateral security. These programs suit borrowers with substantial non-retirement investment portfolios who want to maintain market positions.

Are there prepayment penalties on an asset based loan?

Prepayment penalty structures vary by lender and program. Some asset based loan options include prepayment restrictions during initial years, while others offer full prepayment flexibility from inception. Understanding the specific terms helps you align the financing structure with your expected holding period and exit strategy.

Why would lenders impose prepayment penalties? These provisions help lenders recoup the specialized underwriting investment and compensate for abbreviated interest collection when borrowers refinance quickly. However, many programs offer penalty-free structures, particularly for borrowers with substantial asset positions beyond minimum requirements.

Can you use an asset based loan for construction or renovation projects?

While most asset based loan programs focus on purchase or refinance transactions involving completed properties, some lenders offer construction or renovation financing backed by substantial asset portfolios. These specialized structures provide draws against your asset-backed qualification for property improvements or ground-up construction.

What documentation do construction asset based loan programs require? Beyond standard asset verification, construction programs need detailed project plans, contractor bids, architectural drawings, and milestone schedules. The dual complexity of construction lending and asset-based qualification makes these programs less common but valuable for high-net-worth borrowers undertaking significant property projects.

How do divorce or inheritance situations affect asset based loan qualification?

Borrowers acquiring assets through divorce settlements or inheritance can leverage these holdings for asset based loan qualification once account transfers complete and ownership establishes clearly. Documentation requirements include settlement agreements, transfer records, and updated account statements reflecting your ownership.

Can you qualify during settlement transitions? Some lenders accommodate qualification during active divorce proceedings or estate settlements when documentation clearly establishes your entitlement to assets. These situations require specialized underwriting review but can proceed when your asset position is well-documented despite incomplete legal transitions.

Are gift assets eligible for asset based loan qualification?

Asset gifts from family members may contribute to qualification depending on documentation, seasoning requirements, and gift letter provisions. Lenders evaluate whether gifted assets demonstrate stable financial capacity or represent one-time transfers that don’t reflect your ongoing financial strength.

Gifted asset considerations:

- Gift letters documenting the transfer

- Seasoning periods establishing account stability

- Donor capacity to verify gift legitimacy

- Integration with your overall asset profile

Large recent deposits in asset accounts trigger scrutiny similar to conventional mortgage down payment sourcing, though asset based programs often apply more flexible evaluation.

Can businesses use an asset based loan for owner-occupied properties?

Business entities with substantial liquid assets can sometimes qualify for an asset based loan on owner-occupied properties, though most programs require individual ownership. The relationship between business asset ownership and personal property acquisition requires careful structure review with experienced advisors.

Alternative approaches might include business owners qualifying individually based on personal assets, or exploring commercial financing options when business entity ownership is required.

Ready to get started? Apply now or schedule a call to discuss your situation.

Helpful Asset Based Loan Resources

Official Government Guidance:

FDIC Asset-Based Lending Examination Guidelines – Federal banking regulator’s official guidance on asset-based lending practices, qualification standards, and examination procedures for financial institutions offering asset-backed financing programs.

CFPB Ability-to-Repay Rule Information – Consumer Financial Protection Bureau resource explaining ability-to-repay requirements, qualified mortgage standards, and alternative documentation mortgage programs under federal regulations.

IRS Retirement Account Distribution Guidelines – Internal Revenue Service official guidance on retirement account withdrawals, early distribution penalties, tax implications, and qualified retirement plan rules affecting asset-based qualification calculations.

Industry Organizations:

SEC Investment Account Protection Information – Securities and Exchange Commission investor education resource covering brokerage account protections, SIPC coverage, investment account security, and investor rights for accounts used in asset-based loan qualification.

FINRA Investor Education Resources – Financial Industry Regulatory Authority’s comprehensive investor education center providing guidance on investment accounts, securities, portfolio management, and financial planning relevant to asset-based mortgage qualification.

Educational Resources:

Federal Reserve Consumer Credit Information – Federal Reserve statistical releases and consumer credit data providing context for alternative mortgage qualification methods and lending trends in asset-based programs.

HUD Alternative Mortgage Programs Overview – Department of Housing and Urban Development resource explaining various mortgage program types including alternative documentation options for borrowers with non-traditional income or asset-based qualification needs.

Need local expertise? Get introduced to trusted partners including loan officers, realtors, and financial advisors in your area.

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Not Sure About Your Next Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Related Posts

Subscribe to our newsletter

Get program updates and rate insights in your inbox.