ITIN Loan: 7 Smart Ways Non-Citizens Can Qualify for a Mortgage Without a Social Security Number

Achieve Homeownership in America Without Traditional Documentation Requirements

Buying a home in the United States doesn’t require citizenship or a Social Security number. ITIN loans open the door to homeownership for foreign nationals, non-permanent residents, and others who file taxes using an Individual Taxpayer Identification Number—proving that the American Dream is accessible to everyone who works hard and builds financial stability.

Key Details: What You’ll Learn About ITIN Mortgage Financing

- How ITIN loans work for borrowers without Social Security numbers, including eligible visa types and residency statuses (IRS Individual Taxpayer Identification Number information)

- Documentation requirements replacing traditional employment verification and credit reporting (Consumer Financial Protection Bureau mortgage guide for non-citizens)

- Property types and loan purposes eligible under ITIN financing programs

- Alternative credit building strategies when you lack traditional credit history (Federal Trade Commission credit building guidance)

- Income documentation methods for self-employed and employed ITIN borrowers

- Tax return requirements and how filing history impacts loan approval (IRS tax filing requirements for non-residents)

- State-by-state considerations and lender availability for ITIN mortgage programs

Ready to explore your options? Schedule a call with a loan advisor.

What Is an ITIN Loan?

An ITIN loan is a specialized mortgage product designed for borrowers who have an Individual Taxpayer Identification Number instead of a Social Security number. ITINs are issued by the IRS to individuals who need to file U.S. taxes but aren’t eligible for Social Security numbers—including foreign nationals, non-permanent residents, visa holders, and others living and working in America.

Can you really buy a home without a Social Security number? Absolutely. ITIN loans recognize that many people contribute to the U.S. economy, pay taxes faithfully, and deserve the opportunity to build wealth through homeownership even without citizenship or permanent residency.

These loans function similarly to conventional mortgages in many ways—you make monthly payments covering principal and interest, build equity over time, and can eventually refinance or sell. The key difference lies in how lenders verify your identity, income, and creditworthiness without access to traditional Social Security-based systems.

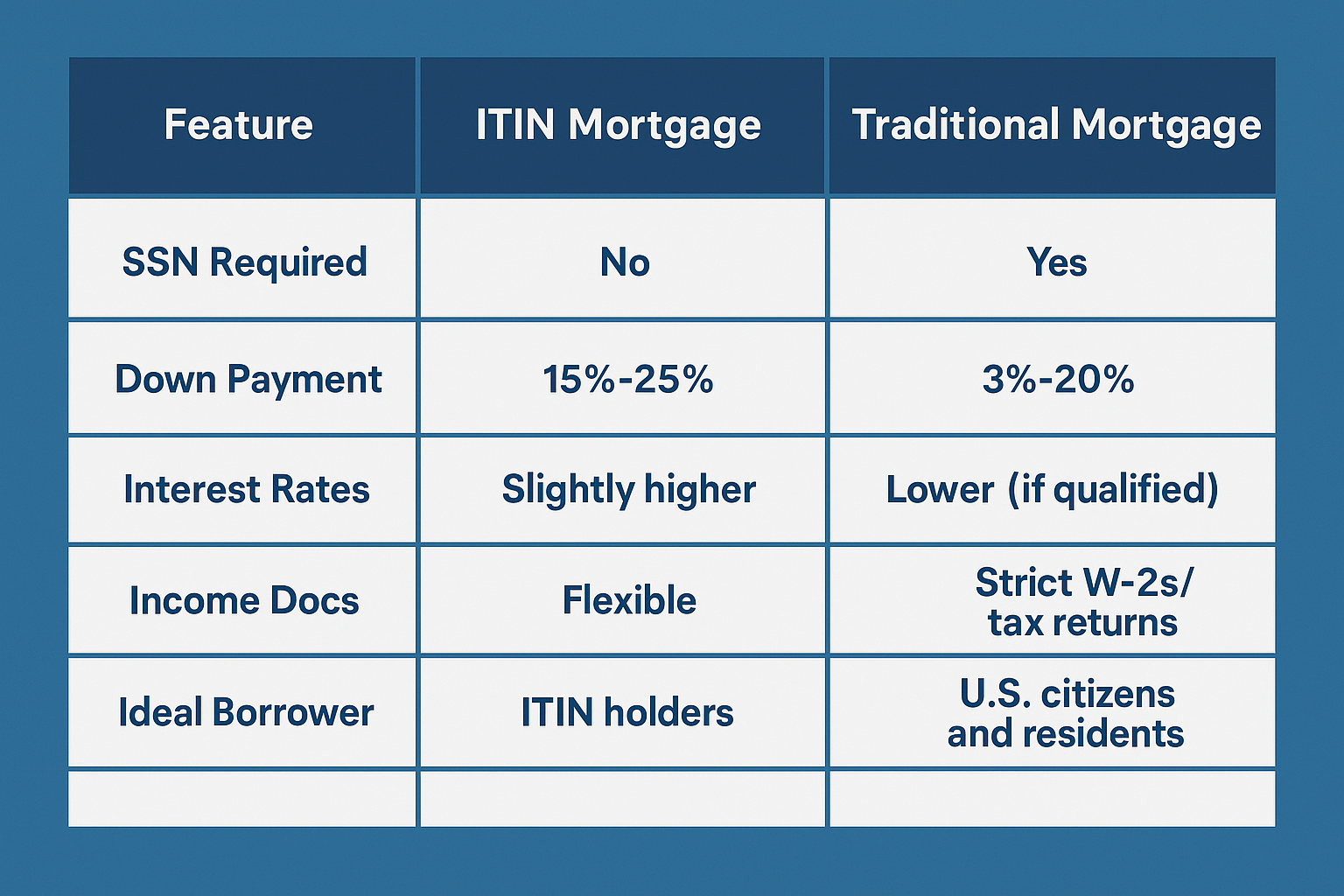

How Does an ITIN Loan Differ from Traditional Mortgages?

Traditional mortgages rely heavily on Social Security numbers to:

- Pull credit reports from major bureaus

- Verify employment through E-Verify systems

- Cross-reference tax returns with IRS databases

- Confirm identity through government systems

- Process automated underwriting decisions

ITIN loans use alternative verification methods that accomplish the same goals through different channels:

- Manual underwriting instead of automated systems

- Alternative credit documentation like payment history letters

- Bank statements and tax returns for income verification

- Direct employer verification or business documentation

- Passport and ITIN documentation for identity confirmation

- Larger reserve requirements demonstrating financial stability

This manual approach requires more documentation and typically takes longer to process, but it ensures qualified borrowers can access financing despite lacking traditional identification numbers.

7 Smart Ways to Use an ITIN Loan for Homeownership

1. Purchase Your Primary Residence and Build Equity

Why rent when you can own? For many ITIN borrowers, years of rent payments represent missed opportunities to build wealth through real estate equity.

Homeownership through ITIN financing allows you to:

- Stop paying rent that builds someone else’s equity

- Lock in stable housing costs immune to annual rent increases

- Build forced savings through principal paydown each month

- Benefit from property appreciation in your local market

- Create generational wealth transferable to your family

- Establish deeper community roots and stability

Your primary residence becomes both your home and your most powerful wealth-building tool. Each monthly payment increases your ownership stake, and over time, your equity can fund education, business ventures, or future real estate investments.

The key is selecting properties in stable or appreciating neighborhoods where your investment will grow alongside your community ties.

2. Invest in Rental Properties for Passive Income

ITIN loans aren’t limited to primary residences—many lenders offer investment property financing that lets you build a real estate portfolio:

Investment property advantages:

- Generate monthly cash flow covering mortgage payments and expenses

- Diversify income sources beyond employment

- Build long-term wealth through multiple properties

- Create tax advantages through depreciation and expense deductions

- Develop expertise in real estate that compounds over time

- Establish business relationships with property managers and contractors

Investment properties require larger initial investments and more substantial reserve requirements, but they offer powerful wealth-building potential. Rental income from responsible tenants pays your mortgage while you benefit from appreciation and principal paydown.

Many successful ITIN borrowers start with their primary residence, then transition to investment properties once they’ve built equity and understand the local market.

3. Refinance Existing Mortgages to Better Terms

Already own a home but stuck with unfavorable loan terms? ITIN refinancing can help you optimize your existing mortgage.

Refinancing scenarios that make sense:

- Reducing your interest costs with better current market conditions

- Shortening your repayment period to build equity faster

- Switching from adjustable to fixed payments for stability

- Removing mortgage insurance when you’ve built sufficient equity

- Consolidating higher-interest debt into your mortgage

- Accessing equity for business investments or education

Refinancing through ITIN programs sometimes offers better terms than your original loan, especially if you’ve built strong payment history, increased your income, or improved your financial profile since your initial purchase.

The key is calculating whether closing costs justify the long-term savings or benefits you’ll receive from the new loan terms.

4. Access Home Equity Without Selling

Cash-out refinancing allows ITIN borrowers to tap into accumulated equity while maintaining homeownership:

Strategic uses for cash-out refinancing:

- Starting or expanding a business venture

- Funding education for yourself or family members

- Making substantial home improvements that increase value

- Consolidating expensive credit card or personal loan debt

- Building emergency reserves for financial security

- Purchasing additional investment properties

This strategy works best when you’ve built significant equity through appreciation, principal paydown, or both. By accessing a portion of your equity at mortgage interest rates rather than higher-cost alternatives, you can leverage your real estate investment to achieve other financial goals.

Remember that cash-out refinancing increases your loan balance, so ensure the purpose justifies the additional debt and that you can comfortably afford the new payment structure.

Considering a refinance? Submit a refinance inquiry to explore if this makes sense for your situation.

5. Purchase Multi-Family Properties and House-Hack

Want to minimize your housing costs while building wealth? Multi-family ITIN loans let you live in one unit while renting others to offset your mortgage payment.

House-hacking advantages for ITIN borrowers:

- Rental income from other units reduces your net housing costs

- Owner-occupancy allows access to more favorable loan terms

- Learn property management skills while living on-site

- Build equity faster by applying rental income to principal

- Create multiple income streams from one property

- Transition to full investment property when you move

Two- to four-unit properties qualify for owner-occupied financing if you live in one unit, combining the benefits of homeownership with income generation. This strategy is particularly powerful for borrowers in expensive markets where purchasing a single-family home stretches affordability limits.

The rental income doesn’t just help with qualification—it fundamentally changes your housing economics, potentially reducing your net costs below what you’d pay renting a single-family home.

6. Establish U.S. Credit History Through Mortgage Payments

For many ITIN borrowers, traditional credit history is limited or non-existent. Your mortgage becomes your most powerful credit-building tool:

How mortgage payments build your financial profile:

- Demonstrates long-term financial responsibility

- Creates verifiable payment history for future lenders

- Establishes patterns of reliability and stability

- Opens doors to other credit products over time

- Improves your financial standing for future purchases

- Provides references for business relationships

While ITIN borrowers may not immediately benefit from traditional credit bureau reporting, maintaining perfect payment history creates documented evidence of creditworthiness. This becomes invaluable when you eventually refinance, purchase additional properties, or seek other financing.

Your mortgage payment history can also support alternative credit profiles used by specialized lenders, gradually expanding your access to the broader financial system.

7. Create Stability for Your Family and Community

What’s the real value of homeownership beyond financial returns? For many ITIN borrowers, stability and community integration matter as much as wealth building.

Homeownership provides:

- Consistent housing without risk of landlord decisions or rent increases

- Ability to customize your living space to your family’s needs

- Stronger community connections through long-term residence

- Better educational outcomes for children in stable housing

- Sense of belonging and investment in your neighborhood

- Foundation for building local business and social relationships

These intangible benefits compound over years and decades, creating quality of life improvements that transcend balance sheets. Your home becomes the center of your American experience, regardless of your citizenship status.

Explore all loan programs to compare financing options for non-citizens.

What Are the ITIN Loan Requirements?

Who qualifies for ITIN mortgage financing? While requirements vary by lender, certain standards apply across most programs.

ITIN and Identity Documentation

Your Individual Taxpayer Identification Number forms the foundation of your application:

ITIN requirements:

- Valid, unexpired ITIN issued by the IRS

- ITIN must be in your legal name matching other documentation

- Renewal completed if your ITIN expired (ITINs issued before 2013 require renewal)

- No evidence of ITIN misuse or tax filing issues

Supporting identity documents:

- Valid passport from your country of origin

- Visa documentation (if applicable to your situation)

- Secondary identification matching your ITIN

- Proof of U.S. address and residence

- Documentation explaining your residency status

Lenders verify these documents carefully since they cannot use traditional Social Security-based verification systems. Ensuring all documentation is current, consistent, and properly translated (when necessary) streamlines the approval process.

Income Verification and Tax Returns

How do lenders verify income without W-2s linked to Social Security numbers? ITIN loans use alternative documentation methods:

For employed borrowers:

- Recent pay stubs showing year-to-date earnings

- Employer verification letters confirming position and salary

- Bank statements demonstrating consistent deposits

- Tax returns filed with your ITIN for recent years

- Employment contracts or offer letters

For self-employed borrowers:

- Business and personal tax returns filed with your ITIN

- Profit and loss statements for your business

- Bank statements showing business income deposits

- Business licenses and registration documentation

- Client contracts or invoices demonstrating income

- CPA-prepared financial statements

Most lenders require a filing history showing consistent tax compliance. Typically, you’ll need to provide documentation for the most recent tax years, demonstrating stable or increasing income patterns.

Missing tax returns or inconsistent filing creates significant obstacles, as tax compliance serves as the primary income verification method for ITIN borrowers.

Credit and Payment History Documentation

Traditional credit scores may be unavailable or limited for ITIN borrowers. Lenders evaluate creditworthiness through alternative means:

Alternative credit documentation:

- Rent payment history letters from landlords

- Utility bill payment records (electricity, water, gas)

- Phone and internet service payment history

- Insurance premium payment records

- Remittance payment patterns

- Bank account management history

These alternative credit sources demonstrate your financial responsibility when traditional credit reports offer insufficient information. Providing comprehensive documentation showing 12-24 months of consistent, on-time payments strengthens your application significantly.

If you have traditional credit:

- Credit card accounts and payment history

- Auto loans or personal loans in good standing

- Previous mortgage history (if applicable)

- Authorized user accounts showing positive history

Any traditional credit you’ve established supplements alternative documentation, potentially improving your loan terms and approval odds.

Financial Reserves and Assets

Why do ITIN loans require substantial reserve funds? Reserves demonstrate financial stability and ability to weather unexpected challenges.

Typical reserve requirements:

- Reserves covering multiple months of housing payments

- Verification through bank statements showing seasoned funds

- Retirement accounts and investment accounts (if accessible)

- Gift funds from acceptable sources with documentation

- Business reserves for self-employed borrowers

The exact reserve requirements vary based on:

- Whether the property is your primary residence or investment

- Your overall financial profile and income stability

- The initial investment amount and loan structure

- Your documented credit and payment history

- The lender’s specific program guidelines

Higher reserves compensate for the lack of traditional credit data and demonstrate your ability to maintain payments during income disruptions. These funds must typically be seasoned (in your accounts for a documented period) rather than recently deposited.

How Does the ITIN Loan Application Process Work?

Gathering Required Documentation

What documents should you prepare before applying? Thorough preparation significantly speeds the approval process.

Essential documentation checklist:

Identity and ITIN verification:

- Current, valid ITIN card or letter from IRS

- Valid passport with current visa (if applicable)

- Secondary identification documents

- Proof of current U.S. address

Income documentation:

- Tax returns for recent years filed with ITIN

- Recent pay stubs (if employed)

- Employer verification letter

- Business documentation (if self-employed)

- Bank statements showing income deposits

Asset verification:

- Bank statements for all accounts

- Investment account statements

- Retirement account statements

- Documentation of gift funds (if applicable)

- Business account statements

Credit and payment history:

- Rent payment history letters

- Utility payment records

- Alternative credit documentation

- Traditional credit accounts (if available)

Property documentation (for purchases):

- Purchase agreement

- Property inspection reports

- HOA documents (if applicable)

- Property insurance quotes

Organizing these documents before starting your application prevents delays and demonstrates your preparedness to lenders.

Working with ITIN-Friendly Lenders

Not all mortgage lenders offer ITIN loan programs. Finding the right lending partner is crucial:

What to look for in ITIN lenders:

- Specific experience with ITIN mortgage programs

- Understanding of alternative credit documentation

- Manual underwriting capabilities and expertise

- Clear communication in your preferred language

- Transparent pricing and fee structures

- Positive reviews from other ITIN borrowers

ITIN lending requires specialized knowledge of documentation requirements, alternative verification methods, and the unique challenges non-citizen borrowers face. Lenders experienced in this niche navigate the process more efficiently and advocate effectively on your behalf.

Don’t hesitate to interview multiple lenders about their ITIN program experience, approval rates, and typical timelines before committing to work with one.

Understanding Underwriting and Approval

How do underwriters evaluate ITIN loan applications? The manual underwriting process examines your entire financial picture:

Underwriting evaluation factors:

- Income stability: Consistency and growth in earnings over time

- Payment history: Demonstrated reliability paying obligations on time

- Reserves: Adequate savings to weather financial challenges

- Property value: Appraisal supporting the purchase price or refinance amount

- Debt obligations: Total monthly debts relative to your income

- Down payment source: Verification that funds come from acceptable sources

Manual underwriting takes longer than automated systems but allows for nuanced evaluation of your circumstances. Underwriters can consider positive factors that automated systems might overlook, such as increasing income trends, strong alternative credit, or substantial reserves.

Be prepared to provide additional documentation or clarification during underwriting. Prompt responses to requests keep your application moving forward efficiently.

Timeline Expectations for ITIN Loans

ITIN loan processing typically takes longer than traditional mortgages due to manual underwriting and documentation verification:

Typical timeline breakdown:

- Initial application and document collection: 1-2 weeks

- Income and identity verification: 1-2 weeks

- Underwriting review: 2-3 weeks

- Additional documentation requests: Ongoing throughout process

- Final approval and closing preparation: 1-2 weeks

Total timeline from application to closing often spans 45-75 days, though complex situations may require additional time. Starting early and maintaining organized documentation helps minimize delays.

During purchase transactions, working with experienced real estate agents familiar with ITIN financing ensures purchase contracts include appropriate timelines that accommodate your financing needs.

Want to discuss your specific purchase scenario? Submit a purchase inquiry to explore your options.

Frequently Asked Questions About ITIN Loans

Do I need to be employed to qualify for an ITIN loan?

Employment isn’t strictly required—what matters is demonstrable income sufficient to support mortgage payments. Many ITIN borrowers qualify through:

- Traditional W-2 employment with verifiable paystubs

- Self-employment income documented through tax returns

- Business ownership with consistent profitability

- Rental income from other properties

- Investment income from liquid assets

The key is providing documentation that proves stable, reliable income likely to continue. Self-employment often requires more extensive documentation but is absolutely acceptable when properly verified through tax returns and financial statements.

Some borrowers combine multiple income sources to meet qualification thresholds, which is perfectly acceptable if all income is properly documented and verified.

Can I use gift funds for my initial investment?

Yes, gift funds from acceptable sources can supplement or fully cover your required investment:

Gift fund requirements:

- Donor relationship must be documented (typically family members)

- Gift letter stating funds are gifts, not loans requiring repayment

- Paper trail showing funds transferred from donor to you

- Donor’s ability to make gift verified through bank statements

- Gift funds must be in your account before closing

Gift funds help borrowers who have sufficient income and creditworthiness but limited savings for the initial investment. Some lenders limit how much of your investment can come from gifts, particularly for investment properties.

Documenting gifts properly from the beginning prevents underwriting delays or complications near closing.

What property types are eligible for ITIN financing?

Can you finance any property type with an ITIN loan? Most residential property types qualify, though requirements vary:

Eligible property types:

- Single-family homes (detached and attached)

- Condominiums in approved projects

- Townhomes and row houses

- Two- to four-unit multi-family properties

- Planned unit developments (PUDs)

- Some manufactured homes (with restrictions)

Occupancy types:

- Primary residences (properties you’ll live in)

- Second homes and vacation properties

- Investment properties (rental properties)

Each property type and occupancy category has different qualification requirements. Primary residences typically offer the most favorable terms, while investment properties require larger investments and more substantial reserves.

Property condition matters significantly—most ITIN lenders require properties to meet standard livability and safety requirements without major defects or necessary repairs.

How long does my ITIN need to be active?

Your ITIN must be current and valid throughout the application process. ITINs issued before 2013 may have expired and require renewal through the IRS.

ITIN renewal considerations:

- Check your ITIN expiration date well before applying

- Allow sufficient time for IRS processing if renewal is needed

- Ensure renewed ITIN appears on recent tax returns

- Maintain consistent name and information across all documentation

If your ITIN expired and you haven’t filed taxes recently, renewing your ITIN and filing current returns before applying for a mortgage saves significant time and prevents approval obstacles.

Working with a tax professional experienced in ITIN matters ensures your tax situation supports mortgage approval rather than creating complications.

Are ITIN loan costs higher than traditional mortgages?

ITIN loans often involve higher costs due to additional risk factors and manual processing:

Potential cost differences:

- Interest rates may be higher than conventional loans

- Origination and processing fees may be elevated

- Appraisal and documentation requirements can be more extensive

- Larger initial investments reduce lender risk

- Private mortgage insurance may be required or have higher costs

However, these increased costs must be weighed against the alternative—no homeownership at all. For many ITIN borrowers, slightly higher costs represent worthwhile investments in building equity and achieving housing stability.

Shopping among multiple ITIN lenders helps you find competitive pricing, as costs vary significantly between programs. The least expensive option isn’t always best—consider the lender’s expertise, service quality, and likelihood of successfully closing your loan.

Can I refinance from an ITIN loan to a traditional mortgage later?

What happens if you eventually obtain a Social Security number? Transitioning to traditional financing becomes possible and often advantageous.

When you might refinance to traditional mortgages:

- After obtaining permanent residency or citizenship

- When you receive a Social Security number

- After building traditional credit history

- To access better terms or reduced costs

- When you’ve built substantial equity

Having established mortgage payment history makes refinancing easier, as you’ve demonstrated creditworthiness through actual performance. Your home becomes a bridge asset, allowing you to build credit and financial history that eventually qualifies you for mainstream financing products.

Even without status changes, refinancing your ITIN loan to better ITIN loan terms becomes possible as markets change, your financial profile strengthens, or you build additional equity.

See how other ITIN holders have successfully used this financing:

Calculate your ITIN loan scenarios:

Alternative Loan Programs for Non-Citizen Borrowers

If an ITIN loan isn’t the right fit, consider these alternatives:

- Foreign National Loan – For non-citizens without ITINs or U.S. credit history

- Bank Statement Loan – For self-employed ITIN holders using bank deposits instead of tax returns

- Asset-Based Loan – Leverage investment portfolios and liquid assets for qualification

- No-Doc Loan – Minimal documentation financing for borrowers with strong credit and substantial assets

- DSCR Loan – For investment properties qualifying based on rental cash flow without personal income documentation

Explore all 30+ loan programs to find your best option.

Not sure which program is right for you? Take our discovery quiz to find your path.

Advanced ITIN Loan Questions

What tax filing requirements must ITIN borrowers meet?

How many years of tax returns do you need? Most ITIN lenders require documentation spanning recent tax years showing:

Tax return essentials:

- Returns filed with IRS using your ITIN

- All schedules and supporting documentation included

- Consistent income reporting across all years

- No significant unexplained income gaps or declines

- Tax compliance with no outstanding liabilities

- Signed tax returns with proof of filing

Self-employed borrowers need complete business returns showing profitable operations and sustainable income. Employed borrowers need returns demonstrating W-2 income matching employment verification.

Gaps in tax filing history create significant obstacles. If you haven’t filed recently, working with a tax professional to catch up on filing before applying for mortgages improves approval odds substantially.

How do state laws impact ITIN loan availability?

ITIN loan availability varies significantly by state due to different regulatory environments and lender appetites:

State-by-state considerations:

- Some states have more ITIN-friendly lenders than others

- Property laws and foreclosure processes affect lender risk assessment

- State-specific lending regulations impact product availability

- Local market conditions influence program terms

- Community banking presence varies by region

High-population states with substantial immigrant communities typically have more developed ITIN lending markets. Rural areas or states with smaller immigrant populations may have limited lender options.

Working with lenders who operate nationally or specialize in ITIN financing helps overcome geographic limitations. Many experienced ITIN lenders can work with borrowers across multiple states through licensed loan officers.

Can you finance investment properties with ITIN loans?

Yes, ITIN investment property loans are available, though qualification requirements are stricter than primary residence financing:

Investment property considerations:

- Larger initial investments required

- More substantial reserve requirements

- Higher interest costs reflecting increased risk

- Rental income may help qualification but requires documentation

- Property management experience may strengthen applications

Investment property ITIN loans work best for borrowers with:

- Strong income documentation showing capacity to carry mortgage without rental income

- Substantial reserves covering extended vacancy periods

- Previous real estate or property management experience

- Clear investment strategy and market knowledge

Starting with a primary residence purchase often makes more sense, allowing you to build equity and establish mortgage payment history before transitioning to investment properties.

What happens if you lose your job during the application process?

How does employment loss affect pending ITIN loan applications? This creates significant complications that require immediate communication with your lender:

Options when employment changes occur:

- Alternative income sources: Documenting other income streams that support qualification

- Spouse or co-borrower income: Relying more heavily on co-borrower earnings

- Application postponement: Pausing the application until reemployment and income stabilization

- Self-employment transition: Documenting new business income (typically requires history)

Lenders verify employment shortly before closing, so employment changes discovered late in the process can derail approvals. Immediate notification gives lenders time to explore alternatives rather than discovering issues at the worst possible moment.

Maintaining emergency reserves and stable employment during the application period protects your approval and closing timeline.

How do ITIN loans handle self-employment income fluctuations?

Self-employed ITIN borrowers often experience variable income that requires careful documentation:

Underwriter evaluation of variable income:

- Average income calculated across multiple years

- Declining income trends scrutinized carefully

- Income stability and predictability assessed

- Business continuity and viability evaluated

- Industry conditions and seasonal patterns considered

Providing context for income variations helps underwriters understand your situation:

- Business growth requiring reinvestment that temporarily reduces personal income

- Seasonal business patterns affecting year-to-year comparisons

- Industry-wide conditions impacting specific periods

- Documented pipeline or contracts showing future income

CPA-prepared financial statements, business bank statements showing consistent deposits, and detailed explanations help underwriters see beyond raw tax return numbers to understand your actual earning capacity.

Can family members co-sign or be co-borrowers on ITIN loans?

Who can help you qualify by joining your application? Co-borrowers strengthen applications by combining income and assets:

Co-borrower requirements:

- Must be legally married or have ownership interest in the property

- Must meet all ITIN loan requirements independently

- Income and assets combined for qualification purposes

- Credit and payment history of both borrowers evaluated

- Both borrowers equally obligated on the mortgage

Co-signers (non-occupying co-borrowers) face restrictions:

- May not be allowed on some ITIN loan programs

- Generally require family relationship if permitted

- Must meet credit and reserve requirements

- Typically cannot use co-signer’s income for qualification

Most ITIN lenders prefer occupying co-borrowers who will live in and have ownership stakes in the property. This aligns interests and reduces default risk compared to non-occupying guarantors.

What renovation or property condition issues prevent ITIN loan approval?

ITIN lenders typically require properties to meet minimum condition standards:

Property condition requirements:

- Safe, habitable condition at closing

- No major systems in failure (roof, HVAC, plumbing, electrical)

- Adequate heating and cooling for climate

- Potable water and functional sewage systems

- No health or safety hazards

- Structurally sound foundation and framing

Commonly problematic conditions:

- Significant deferred maintenance requiring immediate attention

- Code violations or unpermitted additions

- Electrical or plumbing systems not meeting current codes

- Roof damage or remaining life under acceptable thresholds

- Foundation movement or structural concerns

- Environmental hazards like mold or lead paint

Properties requiring extensive repairs before occupancy often don’t qualify for standard ITIN financing. In these cases, renovation loan programs that combine purchase and improvement costs may offer better solutions.

How do you build traditional credit as an ITIN borrower?

What strategies help ITIN borrowers establish conventional credit profiles? Building credit opens doors to better financing terms and broader opportunities:

Credit-building strategies for ITIN borrowers:

- Secured credit cards: Deposit-backed cards that report to credit bureaus

- Credit builder loans: Small loans specifically designed to establish payment history

- Authorized user status: Being added to established credit accounts

- Retail store cards: Often easier to obtain and build payment history

- Utility and phone accounts: Ensuring these report to alternative credit bureaus

- Rent reporting services: Services that report your rent payments to credit bureaus

As you build credit history, periodically checking whether traditional mortgages become available to you makes sense. Even modest credit scores can qualify you for conventional financing with better terms than ITIN-specific products.

Your mortgage payment history becomes your most powerful credit reference, even if it doesn’t immediately appear on traditional credit reports.

What recourse do ITIN borrowers have if denied?

What should you do if your ITIN loan application is declined? Understanding denial reasons helps you develop an action plan:

Common denial reasons and solutions:

- Insufficient income: Build employment history, increase earnings, add co-borrower, or reduce target purchase price

- Inadequate reserves: Save additional funds before reapplying to meet reserve requirements

- Limited credit history: Develop more extensive alternative credit documentation over 12-24 months

- Tax filing gaps: Complete missing returns and establish consistent filing pattern

- Property issues: Select different property meeting lender condition requirements

- Documentation problems: Organize complete, consistent documentation before reapplying

Request specific denial reasons in writing and discuss with your loan officer what changes would result in approval. Some issues can be resolved quickly, while others require months of preparation.

Working with different lenders also makes sense, as program requirements vary. One lender’s denial doesn’t mean all lenders will decline—specialized ITIN lenders may accommodate situations that mainstream lenders cannot.

How do ITIN mortgage payments impact your tax situation?

Can ITIN borrowers deduct mortgage interest on tax returns? Yes—ITIN holders have the same tax benefits as citizens:

Mortgage-related tax considerations:

- Mortgage interest typically deductible on your tax returns

- Property taxes generally deductible

- Investment property expenses deductible against rental income

- Capital gains treatment when selling appreciated property

- Depreciation benefits for rental properties

Working with tax professionals experienced in ITIN filer situations ensures you maximize available deductions and properly report real estate transactions. Your mortgage interest statements provided annually by your lender document deductible interest paid.

These tax benefits improve the after-tax cost of homeownership compared to renting, where no deductions offset your housing expenses.

Ready to get started? Apply now or schedule a call to discuss your situation.

Helpful ITIN Loan Resources

Official Government Guidance

IRS Individual Taxpayer Identification Number Information – Official IRS resource covering ITIN application procedures, renewal requirements, and proper usage for tax filing purposes.

IRS Non-Resident Alien Tax Filing Requirements – Federal guidance on tax obligations for non-residents, including filing requirements, deductions, and treaty benefits.

Consumer Financial Protection Bureau Mortgage Guide for Non-Citizens – Federal consumer protection resource explaining mortgage rights and options for non-citizens pursuing homeownership.

Credit and Financial Resources

Federal Trade Commission Credit Building Guidance – Government advice on establishing credit history, understanding credit reports, and improving creditworthiness.

Consumer Financial Protection Bureau Guide to Alternative Credit Data – Information about alternative credit evaluation methods including rent payment history and utility accounts.

Housing and Fair Lending

HUD Fair Housing Information – Federal resources on housing discrimination protections, fair lending laws, and filing complaints if you experience discrimination.

Fannie Mae HomeReady Mortgage Overview – Information about flexible conventional mortgage options that may become available as you build credit and residency history.

Educational Resources

Federal Reserve Consumer Credit Resources – Federal Reserve educational materials on credit, mortgages, and personal financial management.

Need local expertise? Get introduced to trusted partners including loan officers, realtors, and tax professionals experienced in working with ITIN borrowers in your area.

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Not Sure About Your Next Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Related Posts

Subscribe to our newsletter

Get program updates and rate insights in your inbox.