States Without Estate Taxes: Where to Retire and Preserve More Wealth

States Without Estate Taxes: Where to Retire and Preserve More Wealth

State estate taxes can consume 10-20% of your wealth before your heirs receive a single dollar. For a $5 million estate in Washington or Oregon, that’s $500,000 to $1 million disappearing to state tax collectors—money that could fund your children’s retirements, establish charitable foundations, or support grandchildren’s educations. Meanwhile, retirees living just across the border in states without estate taxes preserve that entire amount for their families.

Relocating to one of the 38 states without estate taxes represents one of the most powerful wealth preservation strategies available. By establishing legal residency before death, you can eliminate state death tax entirely while potentially reducing income taxes, property taxes, and overall cost of living. The decision of where to spend your final decades directly impacts how much wealth transfers to the next generation.

Understanding which states impose estate taxes, how to establish residency properly, and when relocation makes financial sense helps you make informed decisions protecting your legacy. Ready to schedule a call about financing property in tax-advantaged retirement locations?

Key Summary

This comprehensive guide identifies all states without estate taxes, explains state death tax structures, details residency requirements for establishing domicile, and provides strategies for relocating to preserve maximum wealth for your heirs and charitable intentions.

In this guide:

- Complete list of states without estate taxes and those imposing death taxes (state tax structures)

- Understanding estate tax vs inheritance tax differences and who pays (death tax explanations)

- Residency requirements for establishing legal domicile in new states (state residency rules)

- Wealth preservation strategies maximizing inheritance for future generations (legacy planning guidance)

States Without Estate Taxes: Complete List of Tax-Friendly Retirement Destinations

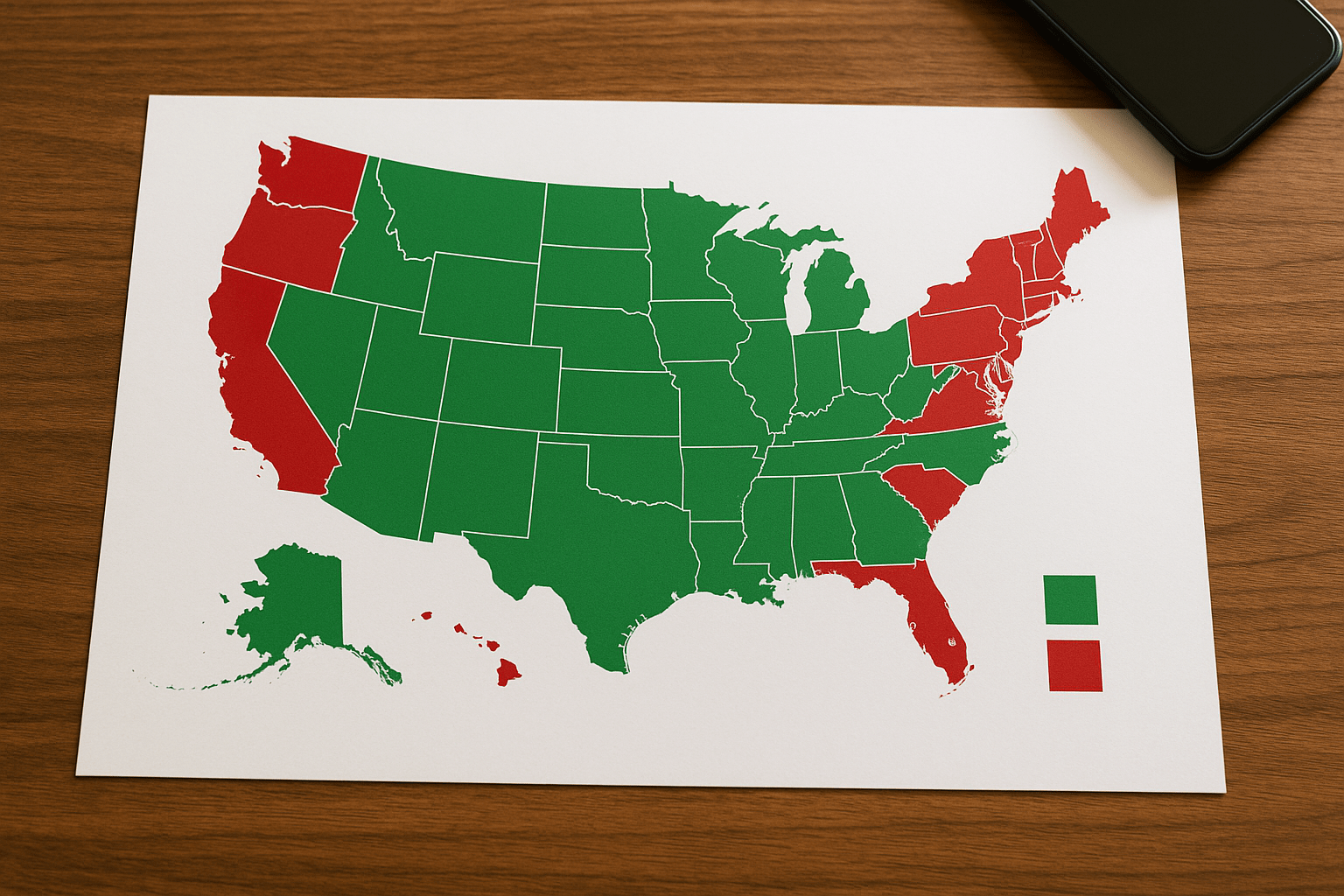

Thirty-eight states currently impose no estate taxes, allowing residents to transfer wealth to heirs without state-level death taxes. These states without estate taxes include traditional retirement destinations like Florida and Arizona, low-cost-of-living states like Tennessee and Nevada, and surprising options like Alaska and Wyoming offering unique lifestyle benefits.

The complete list of states without estate taxes includes: Alabama, Alaska, Arizona, Arkansas, California, Colorado, Delaware, Florida, Georgia, Idaho, Indiana, Kansas, Kentucky, Louisiana, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Mexico, North Carolina, North Dakota, Ohio, Oklahoma, South Carolina, South Dakota, Tennessee, Texas, Utah, Virginia, West Virginia, Wisconsin, and Wyoming.

Understanding this list matters because simply living in a state without estate taxes at death eliminates state-level taxation entirely—regardless of estate size. A $10 million estate faces zero state estate tax in Florida or Texas, while the same estate in Washington state incurs roughly $1 million in state death taxes. The geographic choice directly determines how much wealth passes to your heirs.

Florida stands out as America’s most popular retirement destination among high-net-worth individuals seeking states without estate taxes. No state income tax, no estate tax, generous homestead protections, and favorable creditor exemptions make Florida exceptionally attractive for wealth preservation. Major metropolitan areas like Miami, Tampa, and Naples offer urban amenities while smaller Gulf Coast communities provide relaxed coastal living—all tax-advantaged.

Texas provides another compelling option among states without estate taxes, particularly for those wanting lower costs than Florida. No state income tax combines with no estate tax for maximum wealth preservation. Texas offers diverse geography from Hill Country to Gulf Coast to metropolitan Dallas and Houston. Property taxes run higher than many states, but overall tax burden remains low compared to high-tax states. Many investors use DSCR loans to purchase rental properties in Texas for passive income generation.

Nevada attracts retirees seeking both states without estate taxes and no income taxation. Las Vegas and Reno provide entertainment and services while northern Nevada offers rural mountain living. Nevada’s lack of income tax benefits retirees drawing from retirement accounts or collecting rental income. The state’s modest property taxes and low sales taxes create favorable overall tax environments for wealth accumulators. Calculate your potential tax savings using our legacy planning calculator when considering Nevada residency.

Tennessee provides surprisingly attractive tax benefits among states without estate taxes. Repealing its Hall income tax in 2021 eliminated taxation on investment income and interest, joining the no-income-tax category. Tennessee offers significantly lower cost of living than coastal states, favorable property taxes, and no estate tax. Cities like Nashville and Chattanooga provide culture and healthcare access while rural areas offer mountain or lake living at modest costs.

Wyoming combines states without estate taxes with no income tax and America’s lowest property taxes. While harsh winters deter many retirees, those seeking privacy, outdoor recreation, and minimal government interference find Wyoming ideal. The state’s tiny population and vast spaces appeal to those wanting isolation. Jackson Hole offers upscale mountain living while smaller communities throughout the state provide frontier lifestyles with modern amenities.

Arizona ranks among the most popular states without estate taxes for retirees, though it does impose modest state income tax. Phoenix, Scottsdale, and Tucson offer desert living with excellent healthcare, vibrant cultural scenes, and substantial retiree communities. Arizona’s warm winters attract snowbirds from high-tax northern states. Property costs remain reasonable compared to California, and the state’s business-friendly environment benefits entrepreneurs continuing to generate income in retirement.

North Carolina appears on the states without estate taxes list and offers exceptional value for retirees seeking mountains, beaches, or urban areas. The state repealed its estate tax in 2013. Modest income tax rates, reasonable property taxes, and low cost of living make North Carolina attractive for middle-class retirees. The Research Triangle provides urban sophistication while Asheville offers mountain charm and coastal areas provide beach access—all without death tax concerns.

Alaska technically belongs among states without estate taxes, though extreme climate and isolation make it impractical for most retirees. For those seeking adventure, Alaska offers the Permanent Fund Dividend paying residents annual oil revenue distributions, no state income tax, no estate tax, and unmatched natural beauty. Healthcare access challenges and harsh winters offset financial benefits for many families. However, adventurous retirees find Alaska’s unique lifestyle worth these trade-offs.

The 12 States That Still Impose Death Taxes: Estate Tax vs Inheritance Tax

Twelve states and the District of Columbia currently impose either estate taxes or inheritance taxes—collectively called death taxes. Understanding which states have these taxes and how they work helps you avoid unwanted tax burdens or plan strategically if you’re committed to remaining in these locations despite the tax implications.

Estate tax states include Connecticut, Hawaii, Illinois, Maine, Massachusetts, Minnesota, New York, Oregon, Rhode Island, Vermont, Washington, and the District of Columbia. These jurisdictions tax the estate itself before distributing assets to heirs. The estate pays the tax, not the beneficiaries. Tax rates range from 10-20% depending on the state, with most using graduated rate structures charging higher percentages on larger estates.

Exemption amounts vary dramatically among estate tax states. The federal estate tax exemption currently sits at $13.61 million per individual ($27.22 million for married couples), but state exemptions are much lower. Oregon imposes estate tax on estates exceeding just $1 million. Massachusetts and Oregon offer the nation’s lowest exemptions, while Connecticut provides a $13.6 million exemption matching federal levels. These differing thresholds mean a $2 million estate faces no federal tax but potentially significant state death tax depending on location.

Connecticut stands out among estate tax states with its $13.6 million exemption, effectively eliminating estate tax for all but the wealthiest residents. However, high income taxes, property taxes, and cost of living make Connecticut expensive overall despite recent estate tax reforms. Wealthy individuals committed to New England should consider Connecticut over Massachusetts which taxes estates exceeding $2 million.

Washington imposes among the nation’s highest estate tax rates reaching 20% on estates exceeding $9 million. Combined with no income tax, Washington attracts high earners during working years but punishes them at death with substantial estate taxes. Many wealthy Washington residents relocate to states without estate taxes in retirement to preserve wealth for heirs. A $10 million estate in Washington faces roughly $1 million in state death tax.

Oregon presents challenging circumstances with both estate tax and high income tax. The $1 million exemption means even modest estates face taxation. Oregon’s desirable climate, outdoor recreation, and urban amenities in Portland keep many residents despite tax burdens. However, retirees with substantial estates should seriously consider relocating across the river to Washington (if avoiding income tax matters more) or to states without estate taxes entirely like Nevada or Idaho.

Illinois imposes estate tax with a $4 million exemption but faces ongoing fiscal challenges leading some to predict future tax increases. High property taxes and income taxes combine with estate tax to create substantial overall tax burden. Many Illinois residents retire to Florida or other states without estate taxes, establishing residency well before death to eliminate Illinois estate tax exposure.

Inheritance tax states include Iowa, Kentucky, Maryland, Nebraska, New Jersey, and Pennsylvania. These states tax beneficiaries on what they receive rather than taxing the estate itself. Inheritance tax rates and exemptions typically vary based on beneficiary relationship to the deceased. Spouses usually pay nothing while distant relatives or unrelated beneficiaries face higher rates.

Maryland uniquely imposes both estate tax and inheritance tax, though the estate tax exemption matches the federal level at $5 million. Nebraska both estate and inheritance taxes as well. Pennsylvania’s inheritance tax exempts spouses and minor children but taxes adult children at 4.5% and siblings at 12%. Understanding your state’s specific rules determines whether inheritance or estate tax applies to your situation.

New Jersey historically imposed among America’s most burdensome death taxes but reformed its laws significantly in recent years. The state eliminated its estate tax in 2018, retaining only inheritance tax with spousal and direct descendant exemptions. While improvement over previous law, New Jersey’s high property taxes and income taxes still motivate many wealthy residents to relocate to states without estate taxes.

Death tax states often lose high-net-worth residents to tax-friendly jurisdictions as people approach retirement. This migration drains tax revenue, prompting occasional reforms reducing or eliminating death taxes. Several states including Tennessee, Delaware, and New Jersey repealed death taxes in recent years recognizing their economic disadvantages. However, states facing fiscal pressures sometimes increase death taxes or reduce exemptions, making ongoing monitoring essential for estate planning.

Understanding Intestate Succession and Dying Without a Will in Tax States

Dying without a will creates complications regardless of your state’s tax structure, but intestate succession in estate tax states adds extra complexity. Intestate succession laws determine who inherits when someone dies without valid estate planning documents. These state laws vary significantly and may distribute assets in ways you’d never intend while also maximizing unnecessary tax burdens.

Intestate succession typically prioritizes spouses and children first, then parents, siblings, and more distant relatives following state-specific formulas. If you die without a will in most states, your spouse receives a portion of your estate with the remainder split among children. If you have no spouse or children, assets pass to parents, then siblings, then nieces and nephews, continuing down your family tree until the state finds living relatives.

The tax implications of dying without a will become particularly problematic in estate tax states. Without proper planning, your estate may face maximum tax exposure rather than utilizing available exemptions and deductions efficiently. For example, married couples can typically double their estate tax exemptions through proper planning. Dying without estate plans may result in paying taxes that proper planning would have eliminated.

Intestate succession also prevents you from directing specific assets to particular beneficiaries. If you own rental properties in states without estate taxes but die as a resident of a death tax state, your real estate could end up distributed to unintended heirs who’ll immediately sell properties you wanted kept in the family. Proper estate planning with wills, trusts, and beneficiary designations ensures your wishes control distribution while minimizing taxes.

Inheritance lawyers become necessary when someone dies intestate with significant assets or complicated family structures. These attorneys help families navigate probate courts, establish heir identities, resolve disputes, and address tax obligations. Legal fees for intestate estates typically exceed costs for estates with proper planning. The combination of attorney fees, court costs, appraisal expenses, and estate taxes can consume substantial portions of intestate estates.

Children from multiple marriages create especially complex intestate situations. State laws may not distribute assets the way blended families expect or desire. Second spouses might receive everything, cutting out children from prior marriages. Alternatively, children might receive substantial portions, leaving current spouses without adequate support. These unintended consequences make estate planning essential for anyone in blended families regardless of estate size or state tax implications.

Minor children face particular problems with intestate succession. Courts must appoint guardians to manage inheritances until children reach adulthood—typically age 18 or 21. At that age, children receive full inheritance outright with no restrictions. Most parents prefer trusts holding and distributing assets gradually as children mature, but intestate succession provides no such protections. An 18-year-old might inherit hundreds of thousands of dollars without guidance, often with poor results.

Business owners dying intestate create chaos for their companies. Without succession plans, business ownership passes through intestate rules potentially splitting control among multiple heirs with conflicting interests. Businesses often fail during these transitions. Proper planning with buy-sell agreements, trusts, and clear succession documentation prevents business destruction while minimizing estate taxes in death tax states.

Real estate investors particularly need estate planning preventing intestate succession. Properties titled individually face full probate exposure. If you own rental properties in multiple states, probate proceedings must occur in each state—exponentially increasing costs and delays. Structuring property ownership in LLCs or trusts avoids this multi-state probate nightmare while providing asset protection and potential tax benefits.

Capital Gains Tax on Inherited Property: Federal Rules Apply Everywhere

While states without estate taxes eliminate state-level death taxes, federal capital gains rules apply uniformly regardless of where you inherit property. Understanding capital gains on inherited property helps you make informed decisions about keeping or selling real estate after inheritance, particularly when inheriting investment properties or appreciated family homes.

Inherited property receives a stepped-up basis to fair market value as of the date of death. This step-up in basis eliminates unrealized capital gains accrued during the deceased’s ownership. If your parent purchased a home in 1980 for $100,000 and it’s worth $600,000 at death, you inherit with a $600,000 basis—not the original $100,000 purchase price. This stepped-up basis dramatically reduces or eliminates capital gains tax if you sell shortly after inheritance.

The step-up in basis rules provide enormous tax benefits for heirs, particularly with highly appreciated assets. Real estate held for decades often carries substantial embedded capital gains. Without basis step-up, selling inherited property would trigger massive capital gains taxes. The step-up effectively forgives all appreciation that occurred during the deceased’s life, providing a fresh start for beneficiaries.

Capital gains on inheritance only apply when you eventually sell for more than the stepped-up basis. If you inherit property worth $600,000 and sell immediately for $600,000, you owe no capital gains tax. If you hold the property several years and sell for $700,000, you owe tax on the $100,000 of appreciation occurring after inheritance. Long-term capital gains rates typically range from 0-20% depending on your income, plus potential 3.8% net investment income tax.

Selling an inherited home triggers capital gains calculations unless you moved into the property and established it as your primary residence. The $250,000/$500,000 home sale exclusion available to homeowners doesn’t automatically apply to inherited property. However, if you move into inherited property, live there at least two of the five years before selling, and meet other requirements, you may qualify for partial or full exclusion of gains.

Inherited rental properties present particular considerations regarding capital gains on inherited property. Many heirs inherit income-producing real estate generating monthly cash flow. Keeping these properties often makes excellent financial sense given the stepped-up basis eliminates prior depreciation recapture obligations. If you sell immediately, any new depreciation you take reduces your basis, increasing future capital gains when you eventually sell.

1031 exchanges don’t apply to inherited property sales because you haven’t held the property long enough to establish investment intent. However, after inheriting investment property, you can subsequently exchange it for other investment property using 1031 rules. This allows building wealth through real estate exchanges while deferring capital gains taxes indefinitely. Many investors inherit property, hold it briefly, then exchange into different properties better suited to their management preferences or geographic location.

Multiple heirs inheriting property together often disagree about keeping versus selling. Some siblings want immediate liquidity while others prefer holding income-producing assets. These disputes frequently force property sales. When multiple people inherit property in states without estate taxes, they avoid state death taxes but must still navigate capital gains implications and family disagreements about disposition strategies.

Capital gains on inheritance can be minimized through strategic timing of sales. Selling in years with lower overall income reduces capital gains rates. Spreading sales across multiple tax years prevents pushing income into higher brackets. Donating appreciated inherited property to charity eliminates capital gains entirely while providing income tax deductions. Thoughtful planning around inherited property sales preserves more wealth for your benefit and future generations.

Calculating inheritance tax becomes unnecessary for capital gains purposes since capital gains tax is separate from inheritance or estate taxes. States like Pennsylvania may impose inheritance tax on the value you receive, but you’ll separately owe federal capital gains tax if you later sell inherited property for more than stepped-up basis. These represent different tax obligations with different rules and rates. Use our passive income calculator to project returns if you’re considering keeping inherited rental property.

Establishing Residency in States Without Estate Taxes: What Actually Counts

Simply purchasing property in states without estate taxes provides no protection from death taxes if your legal domicile remains in an estate tax state. Establishing bona fide residency requires demonstrating clear intent to make the new state your permanent home through multiple objective factors state tax authorities scrutinize carefully after death.

Legal domicile means your true, permanent home where you intend to return whenever absent. You can own homes in multiple states, but you maintain only one legal domicile. This domicile determination controls which state can impose estate tax on your worldwide assets at death. Getting domicile wrong means your estate faces unnecessary tax obligations your relocation intended to avoid.

Physical presence represents the most important factor in establishing residency in states without estate taxes. You should spend more than half the year physically present in your new state—minimum 183 days annually. Count carefully and maintain detailed calendars documenting your whereabouts. Estate tax states aggressively challenge claimed residency changes, demanding proof of actual presence. Credit card statements, EZ-Pass records, cell phone location data, and airline tickets can all verify or disprove residency claims.

Driver’s license and vehicle registration should change to your new state immediately upon relocating. Register all vehicles in your new domicile state and obtain a new driver’s license. While alone insufficient to establish domicile, failing to change these documents severely undermines residency claims. Tax authorities view maintaining prior-state driver’s licenses as evidence you never truly changed domicile despite owning property elsewhere.

Voter registration in your new state and voting in local elections demonstrates civic engagement establishing residency. Register to vote immediately after relocating and actually vote in elections. Continuing to vote in your former state directly contradicts claims of establishing new domicile. Estate tax states monitor voter records when challenging residency changes by high-net-worth individuals.

Filing tax returns as a resident of your new state confirms your intended domicile. File part-year resident returns for your year of relocation showing departure from the old state and arrival in the new state. In subsequent years, file as a full resident of your new domicile state. Continuing to file as a resident of a high-tax state makes claiming different domicile for estate tax purposes nearly impossible to defend.

Property ownership patterns matter significantly for residency claims. Your primary residence should be in your new domicile state—your largest, most valuable home where you keep the majority of personal belongings. If you maintain homes in multiple states, the new-state home should be clearly more significant. Spending equal time in multiple homes or keeping your largest residence in your old state undermines residency claims even with other factors supporting change.

Banking relationships, professional advisors, and personal connections should shift to your new state. Open accounts at local banks, establish relationships with attorneys and accountants in your new state, join local organizations, and develop friend networks. These connections demonstrate genuine intent to permanently reside in your new location rather than merely maintaining a vacation home while remaining domiciled elsewhere.

Homestead exemptions and property tax benefits available to state residents should be claimed in your new domicile. States like Florida offer valuable homestead protections to residents. Claiming these benefits formally declares your home as your primary residence for legal purposes. However, claiming homestead protection in multiple states simultaneously will destroy your residency claims and potentially trigger fraud penalties.

Professional licenses and business registrations should transfer to your new state if you continue working. Operating businesses from your old state while claiming residency elsewhere invites scrutiny. If substantial business activities remain in your former state, expect tax authorities to claim you never truly changed domicile. Retirees no longer running businesses find establishing residency simpler than working professionals maintaining prior-state business interests.

Estate planning documents should be updated reflecting your new domicile and potentially incorporate state-specific planning opportunities. Many individuals relocating to states without estate taxes use this opportunity to comprehensively update wills, trusts, and other documents. Working with attorneys in your new state demonstrates commitment to permanent relocation while ensuring documents comply with local law.

Documentation proving residency should be maintained systematically. Keep utility bills, bank statements, medical records, religious organization membership, club memberships, and any other documents demonstrating genuine ties to your new state. After death, your executor will need this evidence if your former state challenges your residency change. The burden of proof falls on your estate to demonstrate successful domicile change, so thorough documentation is essential.

Time requirements for establishing residency vary, but moving at least two to three years before death provides stronger protection than last-minute changes. While no bright-line rule exists, tax authorities view deathbed relocations skeptically. Moving to states without estate taxes while healthy and maintaining genuine residency for years establishes clear intent. Moving while terminally ill invites challenges arguing the relocation was tax-motivated without genuine intent to permanently reside in the new state.

When Relocating to States Without Estate Taxes Makes Financial Sense

Moving to states without estate taxes provides clear benefits, but relocation also carries costs and disruptions worth evaluating carefully. Running the numbers on your specific situation determines whether relocation saves enough tax to justify leaving your current community, moving away from family and friends, and adapting to a new location.

Estate size represents the primary factor determining whether relocation makes financial sense. If your estate falls well below your state’s exemption threshold, you face no death tax regardless. A $2 million estate in Washington faces no estate tax since Washington’s exemption is $2.193 million. Relocating saves nothing in this scenario unless estate growth will exceed future exemptions. However, a $5 million estate in Washington would face roughly $360,000 in state death tax, making relocation potentially worthwhile.

Age and health influence relocation timing and benefits. Moving in your 60s or early 70s while healthy allows decades of enjoyment in your new location while establishing unquestionable residency. The estate tax savings at death in 20-30 years justifies earlier relocation even for moderate estates. However, moving in your 80s or 90s provides fewer years to enjoy the new location and invites residency challenges. Terminally ill individuals should generally avoid deathbed relocations unlikely to withstand tax authority scrutiny.

Income tax considerations often matter as much as estate tax for relocation decisions. States without estate taxes frequently also lack income taxes—Florida, Texas, Nevada, Tennessee, Washington, Wyoming, South Dakota, and Alaska impose no state income tax. For retirees with substantial ongoing income from investments, rental properties, or retirement account distributions, state income tax savings can exceed eventual estate tax savings. Calculate both income and estate tax implications across your remaining lifespan.

Property taxes, sales taxes, and cost of living vary dramatically among states without estate taxes. Florida and Nevada offer no income tax but impose relatively high property taxes. Texas has high property taxes compensating for lack of income tax. Tennessee provides low overall taxes and modest living costs. Wyoming offers rock-bottom property taxes but harsh winters and isolation. Total tax burden analysis considering all tax types, not just estate tax, determines actual savings.

Lifestyle preferences should drive relocation decisions as much as tax considerations. The best financial outcome means nothing if you’re miserable in your new location. If you crave ocean views and warm weather, Florida or coastal South Carolina among states without estate taxes might suit you. If you prefer mountains and four seasons, Tennessee, North Carolina, or Wyoming offer tax advantages with different climates. Match tax benefits with lifestyle requirements ensuring you’ll genuinely enjoy your retirement years.

Family considerations complicate relocation decisions for many retirees. Moving to states without estate taxes while children and grandchildren remain elsewhere means less frequent contact. Video calls and annual visits differ from weekly family dinners and being present for grandchildren’s activities. Some families coordinate moves with adult children relocating together to tax-friendly states. Others prioritize family proximity over tax savings, accepting death tax costs to remain near loved ones.

Real estate investments in your current state may anchor you despite tax motivations to leave. If you own substantial rental properties generating strong cash flow, selling to relocate triggers capital gains taxes and eliminates reliable income. Continuing to own property in your former state after relocating doesn’t prevent domicile change but does create ongoing connections potentially complicating residency claims. Many investors keep prior-state properties but ensure their new-state presence clearly establishes domicile. When purchasing investment properties in states without estate taxes, many investors use jumbo loans for high-value acquisitions.

Healthcare access becomes increasingly important as you age. States without estate taxes range from those with excellent medical facilities to those with limited healthcare infrastructure. Florida offers world-class medical centers throughout the state. Rural Wyoming provides limited options. Before relocating, research available healthcare considering your current and anticipated future needs. Relocating to save taxes but lacking access to necessary medical care proves penny-wise and pound-foolish.

Spousal agreement on relocation is obviously essential for married couples. If one spouse strongly opposes leaving current community while the other focuses solely on tax savings, the resulting conflict outweighs financial benefits. Both partners must feel comfortable with and excited about relocation for it to work long-term. Consider test-driving your intended location through extended stays before making permanent moves.

Break-even analysis helps quantify relocation benefits. Calculate expected estate tax under current state law. Compare against all costs of relocating—real estate transaction costs, moving expenses, potential income tax differences, cost of living changes, and non-financial costs like distance from family. If estate tax savings clearly exceed all relocation costs with comfortable margin, relocation makes financial sense. If savings barely exceed costs or take decades to break even, staying put may be wiser.

Financing Property in States Without Estate Taxes for Retirement Relocation

Purchasing property in states without estate taxes to establish residency requires navigating real estate markets, understanding local property values, and securing appropriate financing. Whether buying a primary residence for retirement relocation or investment properties generating income in tax-advantaged locations, proper financing maximizes your wealth preservation strategy.

Primary residence purchases in retirement typically use conventional financing if you’re not yet Medicare age and plan to work part-time or have sufficient retirement income. Conventional loans offer the best terms for qualified borrowers with strong credit, stable income, and adequate reserves. Rates typically run lowest on conventional mortgages, and loan limits extend to $766,550 in most areas ($1,149,825 in high-cost counties) for single-family homes.

Higher-value properties in premium retirement locations often exceed conventional loan limits, requiring jumbo financing. Florida coastal properties, Arizona Scottsdale homes, and Nevada Las Vegas luxury residences frequently cost $1-3 million or more. Jumbo loans finance these high-value properties with competitive terms for well-qualified borrowers. Many retirees relocating to states without estate taxes downsize from expensive primary residences in high-tax states, using substantial equity from prior home sales to purchase with smaller financing needs.

Reverse mortgages provide alternative financing allowing seniors to access home equity without required payments during their lifetime. If you’re 62 or older, reverse mortgages convert home equity into available funds through various distribution options. Many retirees relocate to states without estate taxes using reverse mortgages to fund lifestyle expenses, supplement retirement income, or provide financial flexibility. The loan balance grows over time but doesn’t need repayment until you permanently leave the home or die.

Investment property financing in states without estate taxes allows building passive income streams while benefiting from no death tax at the state level. Purchasing rental properties in Florida, Texas, Nevada, or other no-estate-tax states generates monthly cash flow while your rental income won’t face state estate tax when you die. DSCR loans work well for real estate investors since qualification bases on rental income rather than personal income, particularly beneficial for retirees with limited W-2 income.

Multiple property acquisitions across different states without estate taxes diversify geographic risk while maintaining tax benefits. Some investors purchase properties in multiple no-estate-tax states—perhaps rental properties in Texas and Florida, and a personal residence in Nevada. This strategy provides location flexibility, spreads investment risk, and maintains tax advantages. Each property should be financed and managed independently with proper legal structuring.

Bridge financing helps retirees relocate who need to purchase property in states without estate taxes before selling primary residences in their current states. Bridge loans provide short-term financing secured by equity in your existing home, allowing you to buy your new residence without contingent offers. Once your old property sells, you repay the bridge loan and refinance your new home into permanent financing.

Timing considerations affect financing availability and terms. Many retirees relocate to states without estate taxes in their early 60s while still potentially working part-time or shortly after retirement. Qualifying for financing becomes simpler while you have ongoing income, even if modest. Waiting until late 70s or 80s makes traditional mortgage approval more challenging as lenders scrutinize income sources, credit profiles, and repayment likelihood more carefully.

Cash purchases eliminate financing requirements entirely but tie up capital that might generate better returns invested elsewhere. Retirees with substantial liquid assets often debate paying cash versus financing property purchases. Carrying a mortgage on your new home in states without estate taxes provides liquidity, allows investment of remaining assets for potentially higher returns, and maintains flexibility. However, debt-free living offers psychological benefits and eliminates payment obligations from fixed retirement income.

Pre-approval before shopping for property in your target state streamlines the buying process and strengthens your negotiating position. Whether you’re relocating to Florida, Texas, Nevada, or any state without estate taxes, get pre-approved before starting your property search to understand budget, identify potential issues, and move quickly when finding the right property.

Next Steps: Creating Your Strategic Relocation and Tax Minimization Plan

Relocating to states without estate taxes requires careful planning, proper timing, and systematic execution ensuring you successfully establish residency while preserving maximum wealth for your heirs. Taking strategic action now—even if you don’t plan to move for several years—positions you for smooth transition when the time comes.

Assess your current estate tax exposure by calculating your total estate value including all assets worldwide. Real estate, investment accounts, retirement funds, business interests, life insurance, and personal property all count toward estate tax calculations. Compare your estate to your state’s exemption level determining potential tax liability. Remember exemption amounts and tax laws change, so build in safety margins accounting for estate growth and potential law changes.

Identify target states among those without estate taxes that match your lifestyle preferences, family situation, healthcare needs, and financial priorities. Research multiple states reading about cost of living, property taxes, income taxes, climate, healthcare facilities, cultural amenities, and quality of life factors. Visit potential locations during different seasons experiencing what daily life would feel like. Many retirees test-drive target states through extended stays before committing to relocation.

Consult with estate planning attorneys in both your current state and potential new states understanding implications of relocation on your overall plan. Attorneys advise whether relocation makes sense for your situation, help structure the move to establish clear residency, and update estate planning documents appropriately. Tax advisors should review income tax implications, estate tax projections, and overall financial impact of relocation across your remaining expected lifetime.

Plan your relocation timeline allowing adequate time to establish residency before death. Moving 5-10+ years before anticipated death provides ample time demonstrating genuine domicile change. Even if you’re healthy, relocating earlier rather than later builds stronger residency claims. Avoid waiting until health crisis or terminal diagnosis makes last-minute moves appear tax-motivated rather than genuine lifestyle choices.

Document your residency systematically from day one tracking physical presence, changing official documents, establishing local connections, and creating paper trails proving genuine relocation. Maintain calendars showing where you stay each night. Keep receipts, credit card statements, and other records demonstrating consistent presence in your new state. This documentation protects your estate from residency challenges by former states seeking tax revenue.

Update all legal documents, beneficiary designations, and financial accounts reflecting your new residency. Change your driver’s license, register to vote, register vehicles, update estate planning documents, change address with IRS and Social Security, update bank accounts, and revise investment account registrations. Each change reinforces your intent to permanently reside in your new state rather than merely maintaining a vacation home.

Review your decision periodically ensuring your relocation continues serving your needs and goals. Life circumstances change, and what made sense initially may not remain optimal. Perhaps family considerations shift priorities, health needs change, or tax laws evolve. Periodically reassessing your situation ensures you remain in the right location or identifies when additional moves might benefit your family.

Use our legacy planning calculator to project how relocating to states without estate taxes affects wealth transfer to your heirs across various scenarios. The calculator helps quantify tax savings over your remaining life expectancy, accounting for estate growth, and demonstrating the long-term impact of strategic relocation decisions on your family’s financial security.

Ready to explore financing options for purchasing property in tax-advantaged retirement states? Schedule a call to discuss how to structure property acquisitions supporting your wealth preservation and legacy planning goals.

Conclusion

Relocating to states without estate taxes represents one of the most powerful wealth preservation strategies available to high-net-worth individuals and families committed to passing maximum inheritance to future generations. By eliminating state death taxes entirely, strategic relocation can save hundreds of thousands or millions of dollars that otherwise would fund state governments rather than your heirs, charities, or other intended beneficiaries.

Key takeaways for estate tax minimization:

- Thirty-eight states impose no estate taxes, offering complete state death tax elimination

- Twelve states and DC still impose estate or inheritance taxes with varying exemptions

- Establishing legal residency requires physical presence, changed documents, and clear intent

- Estate size, income taxes, lifestyle preferences, and family all affect relocation decisions

- Starting the relocation process years before anticipated death strengthens residency claims

The decision to relocate to states without estate taxes should balance tax benefits against lifestyle priorities, family considerations, healthcare needs, and personal preferences. For many wealthy families, the substantial tax savings justify relocating to locations offering desirable amenities, excellent healthcare, and favorable climates. For others, remaining near family and established communities outweighs tax considerations despite the cost.

If relocation makes sense for your situation, begin planning now rather than waiting until tax changes or health crises force rushed decisions. Methodical preparation, proper residency establishment, comprehensive documentation, and patient execution ensure your strategic move successfully preserves wealth while enhancing your quality of life during retirement years.

Take the first step toward strategic tax planning by assessing your estate, researching potential states, and consulting with qualified advisors about whether relocation aligns with your wealth preservation goals. Your family’s financial security for generations may depend on decisions you make today about where you spend your final decades.

Ready to begin your journey to tax-advantaged retirement? Get pre-approved for property financing in states without estate taxes and start building the retirement lifestyle that preserves your legacy.

Frequently Asked Questions

What states have no estate tax or inheritance tax in 2025?

Thirty-eight states currently impose no estate taxes: Alabama, Alaska, Arizona, Arkansas, California, Colorado, Delaware, Florida, Georgia, Idaho, Indiana, Kansas, Kentucky, Louisiana, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Mexico, North Carolina, North Dakota, Ohio, Oklahoma, South Carolina, South Dakota, Tennessee, Texas, Utah, Virginia, West Virginia, Wisconsin, and Wyoming. Among these, nine also have no state income tax: Alaska, Florida, Nevada, New Hampshire (limited income tax on dividends and interest ending 2024), South Dakota, Tennessee, Texas, Washington, and Wyoming. States with either estate or inheritance taxes include Connecticut, Hawaii, Illinois, Iowa, Kentucky, Maine, Maryland, Massachusetts, Minnesota, Nebraska, New Jersey, New York, Oregon, Pennsylvania, Rhode Island, Vermont, Washington, and the District of Columbia. State tax laws change frequently, so verify current status when making relocation decisions.

How long do I need to live in a state to establish residency for estate tax purposes?

No specific time requirement guarantees residency establishment, but most estate planning attorneys recommend living in your new state at least two to three years before death to successfully defend residency claims. You should spend more than half of each year physically present in your new state—minimum 183 days annually. Beyond time, you must demonstrate clear intent to make the new state your permanent home through actions like obtaining driver’s licenses, registering to vote, changing bank accounts, filing tax returns as a resident, and maintaining your primary residence there. The totality of circumstances determines residency, not any single factor. Moving while healthy and living in the new state for many years provides strongest protection. Deathbed relocations face scrutiny and often fail to establish residency successfully.

Can I avoid estate tax by buying property in Florida but keeping my primary residence elsewhere?

No, simply owning property in states without estate taxes provides no protection if your legal domicile remains in an estate tax state. Domicile means your true permanent home, and you can only have one domicile at a time regardless of how many properties you own in multiple states. Your state of domicile at death determines which state can impose estate tax on your worldwide assets. To benefit from Florida’s lack of estate tax, you must establish Florida as your legal domicile by making it your primary residence, spending more than half your time there, obtaining Florida driver’s license, registering to vote in Florida, filing Florida tax returns, and demonstrating clear intent to permanently reside there. Owning a vacation home in Florida while maintaining domicile in New York or Massachusetts provides no estate tax benefits.

What’s the difference between estate tax and inheritance tax?

Estate tax is imposed on the estate itself before distributing assets to beneficiaries. The estate pays the tax, reducing the amount available to heirs. Estate tax states include Connecticut, Hawaii, Illinois, Maine, Massachusetts, Minnesota, New York, Oregon, Rhode Island, Vermont, Washington, and DC. Inheritance tax is imposed on beneficiaries based on what they receive. Tax rates and exemptions typically vary based on the beneficiary’s relationship to the deceased—spouses usually pay nothing while distant relatives face higher rates. Inheritance tax states include Iowa, Kentucky, Maryland, Nebraska, New Jersey, and Pennsylvania. Maryland and Nebraska uniquely impose both types of death taxes. Some states exempt certain beneficiaries entirely while taxing others, so specific state rules matter tremendously for calculating inheritance tax liability.

Do I have to pay capital gains tax when I sell inherited property?

Yes, you owe federal capital gains tax if you sell inherited property for more than its stepped-up basis, regardless of which state you live in. Inherited property receives a basis step-up to fair market value as of the date of death, eliminating capital gains accrued during the deceased’s lifetime. If you sell inherited property for approximately the stepped-up basis value, you owe little or no capital gains tax. However, if the property appreciates after you inherit it and you later sell for more than basis, you owe capital gains tax on the appreciation occurring during your ownership. Capital gains on inheritance is separate from estate or inheritance taxes—you might owe both depending on circumstances. Long-term capital gains rates range from 0-20% depending on your income level, plus potential 3.8% net investment income tax. States without estate taxes still impose state-level capital gains taxes if they have income taxes.

Can I change my legal residence to a no-tax state while keeping significant business interests in my current state?

Technically yes, but maintaining substantial business activities in your former state makes establishing new domicile more challenging and invites residency disputes. If you continue operating businesses, maintaining professional licenses, earning the majority of income, and spending significant time in your old state for business reasons, tax authorities may argue you never truly changed domicile despite claiming otherwise. Retirees no longer actively working find residency changes simpler to establish and defend. If you must maintain business activities in your former state, strengthen your residency claim in your new state through overwhelming evidence of domicile change—spend as much time as possible in the new state, establish prominent residence there, create strong local connections, and maintain meticulous documentation of physical presence. Consult estate planning attorneys about your specific circumstances before relocating while maintaining significant prior-state business ties.

What happens if I die shortly after moving to a state without estate taxes?

If you die shortly after relocating, your former state will likely challenge your residency change, arguing you never established genuine domicile in the new state and your estate remains subject to their death tax. The burden falls on your estate to prove you successfully changed domicile through preponderance of evidence. Courts examine all factors—physical presence, intent, connections to each state, and whether actions support claimed domicile change. Moving while terminally ill or in failing health particularly invites challenges since tax authorities argue the move was solely tax-motivated without genuine intent to permanently reside in the new location. If you anticipate moving to states without estate taxes, relocate while healthy and live there for several years before death. Maintain thorough documentation of all residency factors so your executor can defend the domicile change if challenged. Working with experienced estate planning attorneys in both states helps navigate these situations and structure moves more likely to withstand scrutiny.

Related Resources

Also helpful for Legacy Angels:

- Understanding legacy planning fundamentals helps project wealth transfer under various scenarios

- Passive income strategies for retirement shows returns from rental properties in tax-advantaged states

- Conventional financing for retirement homes explains purchasing primary residences in no-estate-tax states

What’s next in your journey:

- Jumbo loans for luxury retirement properties finance high-value homes in premium locations

- Reverse mortgage options for seniors provide income without required payments

- Schedule a consultation to discuss financing property acquisitions supporting tax planning

Explore your financing options:

- DSCR loans for investment properties help build rental portfolios in tax-friendly states

- Get pre-approved for property financing before shopping in target retirement locations

- Legacy planning tools and calculators quantify tax savings from strategic relocation

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a CallNot Sure About Your Next Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Related Posts

Subscribe to our newsletter

Get new posts and insights in your inbox.