Closing On A House: Step-by-Step Process & Checklist

Closing On A House: Step-by-Step Process & Checklist

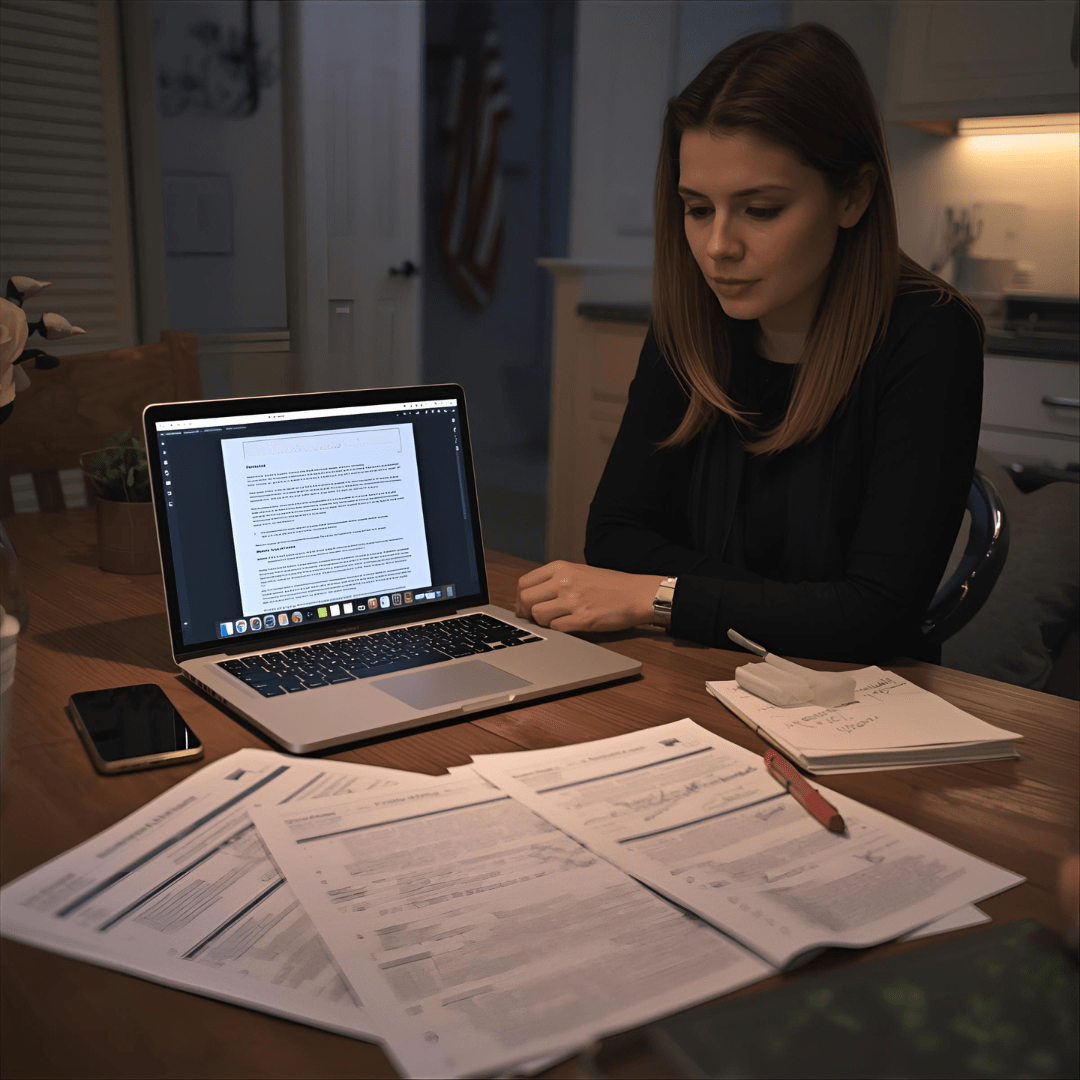

You’re 72 hours away from your closing date. The house you’ve dreamed about is almost yours. Yet between now and sitting at that closing table, you’ll encounter a process that trips up even experienced buyers.

The final walkthrough seems straightforward until you discover the sellers removed fixtures you expected. The closing disclosure arrives with numbers that don’t match your estimate. The title company calls about a lien nobody mentioned.

Your real estate closing demands your attention across dozens of details simultaneously. Understanding the real estate closing process transforms this potentially stressful period into a manageable sequence of tasks. When you know what closing a home actually involves, you protect yourself from last-minute surprises that delay or derail your purchase.

Every step from final walkthrough before closing through receiving your keys follows a predictable pattern once you understand the system. This guide walks you through every phase of closing on a house. You’ll learn exactly what happens at each stage, which documents protect your interests, and how to avoid the problems that catch first-time buyers off guard.

Whether you’re applying for your first mortgage or refinancing an existing property, these closing fundamentals apply to every real estate transaction. Understanding mortgage closing procedures helps you navigate the process confidently. The settlement statements, closing disclosure requirements, and title insurance considerations all work together to protect your interests during closing on a house.

Key Summary

Closing on a house involves coordinating inspection, appraisal, title work, and funding within a compressed timeline. Success requires understanding each stakeholder’s role during the real estate closing process. Reviewing critical closing disclosure documents accurately ensures you avoid costly surprises.

Preparing financially for costs beyond your initial estimate protects you during closing a home. The final walkthrough before closing gives you one last chance to verify property condition. Owner’s title insurance and lenders title insurance serve different but equally important purposes in protecting your investment.

In this comprehensive guide:

- Learn the complete timeline from accepted offer through receiving keys during your real estate closing (see the Consumer Financial Protection Bureau’s mortgage process timeline)

- Understand closing disclosure requirements under federal law when closing on a house (review TILA-RESPA Integrated Disclosure regulations)

- Master final walkthrough procedures that protect your investment during closing a home (reference National Association of Realtors closing guidelines)

- Identify owner’s title insurance and lenders title insurance coverage that shields you from hidden claims (examine American Land Title Association educational resources)

- Calculate actual closing escrow costs and settlement statements including often-overlooked fees (use Federal Housing Finance Agency settlement cost data)

Understanding Real Estate Closing: What Actually Happens When You Close on a Property

Real estate closing represents the final step in your home purchase process. This legal proceeding transfers property ownership from seller to buyer. The mortgage closing converts your approval into actual financing and officially makes you a homeowner.

The closing process typically occurs 30-45 days after your offer acceptance. Timelines vary based on financing type and local practices. Understanding how different loan programs affect closing timelines helps you plan accurately for closing on a house.

What Is a Real Estate Closing and Why Does It Matter?

During your real estate closing, multiple parties converge to complete complex paperwork. You’ll sign loan documents that obligate you to repayment terms. You’ll review settlement statements showing all transaction costs associated with closing a home.

You’ll receive title to your new property at the real estate closing. Your lender funds the purchase through the closing escrow process. The title company ensures clean ownership transfer when closing on a house.

You finally receive the keys to your new home after the mortgage closing completes. The importance of proper closing procedures cannot be overstated. Errors in documentation create legal problems that surface months or years later during or after closing a home.

Understanding how to apply for a mortgage properly helps you avoid issues before the real estate closing. The closing itself presents unique challenges requiring careful attention. Working with experienced mortgage professionals ensures smooth processing during closing on a house.

How Long Does the Closing Process Take?

Your closing timeline begins when the seller accepts your offer. The timeline ends when you receive keys after the real estate closing. Most closings complete within 30-45 days for conventional financing.

This varies significantly by loan type and local market conditions. FHA loan closings often take 32-45 days due to appraisal requirements. Government review processes extend the timeline for closing a home with FHA financing.

Veterans using VA loan benefits typically close in 35-45 days. This timeline starts after the VA appraisal is completed. Cash buyers purchasing with conventional loans may close in as little as 21-30 days when conditions align perfectly during the real estate closing.

Buyers using USDA rural housing loans should expect 40-50 days for closing on a house. Additional program requirements extend USDA closing timelines. Jumbo loan closings for high-value properties typically take 35-45 days.

Several factors accelerate or delay your real estate closing timeline. Quick mortgage preapproval from experienced lenders speeds the process. Establishing your financing early shortens the timeline for closing a home.

Appraisal scheduling in busy markets adds 7-14 days to your mortgage closing timeline. Title searches revealing unexpected liens or claims extend closings by weeks. Issues must resolve before you can complete the real estate closing process.

Calculate your specific timeline using tools designed for your situation when closing on a house. The FHA loan calculator estimates costs and timing for government-backed purchases. VA loan calculators help veterans plan their real estate closing timeline.

Conventional loan calculators show cost breakdowns and expected timeframes. These tools help you prepare for closing a home with traditional financing. USDA loan calculators project rural housing timelines for your mortgage closing.

What Is Closing Escrow and Who Manages It?

Closing escrow functions as a neutral holding account during the real estate closing. This protects both buyers and sellers during the transaction. When you make an earnest money deposit, those funds enter escrow rather than going directly to the seller.

An escrow officer or closing agent manages these funds throughout closing on a house. They manage documents and conditions during your transaction period. Your escrow officer coordinates with multiple parties to ensure all contingencies are satisfied during the real estate closing.

They communicate with your lender about funding requirements during closing a home. They coordinate with the title company on ownership verification. They ensure inspection, appraisal, and document conditions are met before releasing funds from closing escrow.

Understanding escrow management helps you navigate the closing process when you’re ready to make an offer. The escrow company holds responsibility for accurate accounting of all transaction costs. They collect your initial investment funds during the real estate closing.

They receive your lender’s financing through the mortgage closing process. They pay off the seller’s existing mortgage from closing escrow. They disburse funds to service providers involved in closing on a house.

They issue final settlement statements showing all transactions. Reviewing closing costs thoroughly before your closing date helps you verify escrow calculations. Accurate settlement statements protect both parties during the real estate closing.

Different regions use different closing systems when closing a home. Western states typically use escrow companies as neutral third parties. Eastern states often conduct closings at attorney offices during the mortgage closing.

Lawyers represent buyer and seller interests in attorney-managed closings. Some areas use title companies to manage the entire closing escrow process. Working with a knowledgeable mortgage broker helps you understand local practices when closing on a house.

Your earnest money deposit typically ranges from 1-3% of the purchase price. This demonstrates serious intent to complete the real estate closing. These funds remain in closing escrow throughout your contingency period.

The deposit applies toward your total investment at closing a home. Calculating your complete home purchase budget includes accounting for earnest money. Other escrow deposits required in your market affect your cash needed for the mortgage closing.

Closing a Home: The 72-Hour Final Preparation Period

The final three days before closing on a house represent your last opportunity to verify everything. Federal law mandates specific timing for the closing disclosure. This critical document shows your final loan terms for the real estate closing.

You receive monthly cost projections and total cash required to close. This arrives at least three business days before your scheduled mortgage closing. Reviewing this disclosure carefully protects you from unexpected surprises at the settlement table when closing a home.

What Happens 72 Hours Before Your Closing Date?

Your 72-hour window triggers several important tasks for the real estate closing. You’ll schedule your final walkthrough before closing to inspect the property. This inspection occurs one last time before closing on a house.

You’ll wire transfer your funds or obtain a cashier’s check. The amount must match exactly what’s shown on your closing disclosure. You’ll secure homeowners insurance proof and coordinate with your agent for policy activation.

Your insurance must be effective at the mortgage closing. During these final days before closing a home, your lender completes underwriting review. They prepare final approval for the real estate closing.

Understanding the mortgage approval process helps you appreciate why lenders conduct last-minute verifications. They verify your employment hasn’t changed before closing on a house. They confirm you haven’t opened new credit accounts that would affect the mortgage closing.

They ensure property value supports the loan amount for closing a home. Some buyers make critical mistakes during this window before the real estate closing. Opening new credit cards or financing major purchases changes your debt ratios.

These changes can derail your closing on a house completely. Taking on new employment raises red flags with underwriters before the mortgage closing. Making large deposits without explanation triggers fraud reviews that delay closing a home.

Avoid these pitfalls by maintaining your financial status quo. Keeping your finances stable until after the real estate closing completes protects your approval. Any changes before closing on a house risk your mortgage closing approval.

How to Read Your Closing Disclosure Document?

Your Closing Disclosure replaces the Good Faith Estimate received earlier in your transaction. This standardized five-page document breaks down every cost associated with your real estate closing. Page one shows your loan terms, projected costs, and cash needed for closing on a house.

Pages two and three itemize all costs in detail for the mortgage closing. Pages four and five provide additional loan information and disclosure requirements. The first section reveals your final interest rate for closing a home.

You’ll see monthly principal and interest cost on the closing disclosure. You’ll see whether your rate can change over time during your mortgage. Different loan programs affect these terms significantly when closing on a house.

FHA loans include mortgage insurance that appears as a separate line item on the closing disclosure. VA loans show funding fees but no monthly mortgage insurance during the real estate closing. These differences affect your monthly costs when closing a home.

Compare your Closing Disclosure against your Loan Estimate carefully before the mortgage closing. Federal law allows minor variances in certain fees. The law prohibits significant increases without valid reasons when closing on a house.

Recording fees and transfer taxes typically match original estimates for the real estate closing. Third-party service costs cannot increase by more than 10% in aggregate. Lender charges should match your Loan Estimate exactly unless you requested changes before closing a home.

Watch for these common disclosure issues before closing on a house. Loan amount differs from what you expected on the closing disclosure. Interest rate increased without explanation before the mortgage closing.

Seller concessions aren’t reflected properly on settlement statements for the real estate closing. Earnest money credit is missing from your closing disclosure when closing a home. Prepaid property taxes are calculated incorrectly on the settlement statements.

Catching these errors before signing documents saves you thousands. Corrected costs protect your interests during the mortgage closing. Your closing escrow section shows the accounting of all funds for the real estate closing.

Your initial deposit from contract appears as a credit when closing on a house. Your lender’s loan amount appears as a credit on the closing disclosure. The purchase price appears as a debit on settlement statements.

All closing costs appear as debits during the mortgage closing. The final line shows additional cash required from you to close. This number must match exactly what you’re wiring or bringing as a cashier’s check for the real estate closing.

Understanding Cash to Close Requirements

The cash to close figure represents your total out-of-pocket investment needed at the mortgage closing. This amount includes your initial investment beyond the loan amount. All closing costs not paid by seller must be covered when closing on a house.

Prepaid items like insurance and taxes are included in cash to close. Sometimes initial escrow account funding is required for the real estate closing. Calculating these costs accurately prevents last-minute scrambling for funds when closing a home.

Your initial investment varies significantly by loan program for the mortgage closing. FHA loans require 3.5% minimum investment from borrowers when closing on a house. VA loans offer zero initial investment options for eligible veterans during the real estate closing.

Conventional loans typically require 3-20% investment depending on property type. Your qualifications affect the investment required when closing a home. USDA loans offer zero initial investment in eligible rural areas for the mortgage closing.

Closing costs typically add 2-5% of your purchase price to your cash requirement. These include lender fees, title insurance, and recording charges. Various third-party services add to costs when closing on a house.

Some programs allow sellers to contribute toward buyer closing costs during the real estate closing. This reduces your cash requirement when closing a home. VA loans permit sellers to pay all buyer closing costs in many cases during the mortgage closing.

Prepaid items represent insurance and property taxes you pay in advance at the real estate closing. Lenders require one year of homeowners insurance paid when closing on a house. You’ll prepay 2-6 months of property taxes depending on your closing date timing.

These prepaid costs often surprise first-time buyers during closing a home. They focus only on initial investment and closing costs for the mortgage closing. Prepaid expenses significantly increase cash needed when closing on a house.

Initial escrow account funding varies by lender and loan type for the real estate closing. Your lender may collect 2-3 months of property tax reserves when closing a home. They collect 2-3 months of insurance reserves at the mortgage closing.

This creates a cushion ensuring sufficient funds exist when bills come due. Calculate complete costs using appropriate tools for your specific loan type. These calculators help you prepare accurate funding for closing on a house.

Gift money from family members can cover part or all of your cash to close requirements. Different loan programs have specific gift rules for the real estate closing. FHA loans allow gifts for the entire minimum investment when closing a home.

Conventional loans typically require at least 5% from your own funds when investment is under 20%. This requirement applies during the mortgage closing. VA loans accept gifts for any required funds when closing on a house for the real estate closing.

Final Walkthrough Before Closing: Protecting Your Investment

The final walkthrough before closing typically occurs 24-48 hours before your settlement appointment. This timing allows you to verify the property’s condition hasn’t changed since your original inspection. You have enough time to address any issues discovered during the real estate closing process.

Smart buyers coordinate this walkthrough carefully to ensure adequate time for problem resolution. Schedule your walkthrough during daylight hours when you can properly assess the property. Evening walkthroughs hide problems that become obvious in natural light when closing on a house.

When Should You Schedule Your Final Walkthrough?

Bring your home inspection report to compare current conditions against documented issues. Your earlier inspection identified concerns that should be resolved before the mortgage closing. Your original inspection report provides the baseline for comparison when closing a home.

Allow 30-60 minutes for thorough final walkthrough completion before the real estate closing. Rushing through this process causes you to miss significant problems. Bring a checklist covering all major systems, fixtures, and areas of concern for closing on a house.

Take photos or videos documenting the property’s condition at final walkthrough. These records protect you if disputes arise after the mortgage closing. Visual documentation provides evidence of condition when closing a home.

What Should You Look For During Final Walkthrough?

Your final walkthrough before closing verifies several critical conditions for the real estate closing. First, confirm all agreed-upon repairs from your home inspection were completed properly. Second, ensure the property is empty of seller’s belongings unless contract specifies otherwise when closing on a house.

Third, verify all fixtures and appliances included in the sale remain in the property. Fourth, check that utilities are functional and systems operate correctly before the mortgage closing. Each verification step protects your interests when closing a home.

Start your walkthrough outside by examining the property’s exterior condition for the real estate closing. Look for new damage from weather or moving activities before closing on a house. Verify the seller left all landscaping, outdoor structures, and equipment specified in the contract.

Check that exterior fixtures like mailboxes, house numbers, and light fixtures remain in place. Document any concerns immediately to address before the mortgage closing. Exterior condition verification prevents post-closing disputes when closing a home.

Test every major system during your final walkthrough before the real estate closing. Turn on all faucets to verify water pressure and drainage. Flush all toilets to confirm proper operation before closing on a house.

Test the heating and cooling systems in both heating and cooling modes. Operate the garage door opener and check for smooth function before the mortgage closing. Turn on all light switches and test electrical outlets throughout the property when closing a home.

Inspect appliances included in the sale carefully during your final walkthrough. Run the dishwasher through a cycle before the real estate closing. Turn on the oven and stovetop burners to verify they work when closing on a house.

Test the refrigerator’s cooling function and ice maker before the mortgage closing. Run the clothes washer and dryer if included in the sale. Document any appliances not working properly before you close on the property during the real estate closing.

Look for changes since your last visit during the final walkthrough before closing. New wall damage could indicate rough removal of seller’s belongings. Fresh paint might hide recent problems discovered before the mortgage closing.

Missing fixtures suggest sellers removed items that were supposed to stay. Landscape changes could indicate drainage issues or tree removal when closing on a house. Noting these changes protects your interests as you prepare to take ownership.

What Happens If You Find Problems During Final Walkthrough?

Discovering issues during your final walkthrough before closing creates complications for the real estate closing. However, you have options when problems arise before the mortgage closing. Minor problems like missing light bulbs or incomplete cleaning typically resolve with an escrow holdback.

The title company retains funds from seller proceeds until the issue is corrected. More significant problems may require delaying the real estate closing. Repairs must be completed before you can proceed with closing on a house.

Your contract dictates your rights when problems arise during the final walkthrough before closing. Most purchase agreements require sellers to leave properties in the same condition as when you made your offer. Normal wear and tear is expected and accepted during the mortgage closing.

Significant new damage or removal of included items constitutes breach of contract. Understanding your contractual protections helps you enforce your rights effectively. Contract terms guide resolution during the real estate closing when closing on a house.

Communicate discovered problems immediately to your agent and attorney if applicable. Document issues with photos and detailed descriptions before the mortgage closing. Request your agent contact the seller’s agent to negotiate solutions when closing a home.

Most sellers want to close on schedule and will cooperate on reasonable requests. Problems found during final walkthrough often resolve quickly. Working with experienced agents helps negotiate solutions for the real estate closing.

Consider your leverage carefully when problems arise before closing on a house. If you’re committed to the purchase, minor issues may not justify risking the transaction. Your earnest money is at risk if you refuse to close over issues the contract doesn’t support during the mortgage closing.

Major problems like non-functioning HVAC systems justify stronger positions. Undisclosed significant damage warrants potential contract cancellation before the real estate closing. Understanding when to take firm stances protects you when closing a home.

Escrow holdbacks work well for incomplete minor repairs during the final walkthrough. The title company holds back an amount sufficient to complete the work. They often retain 150% of estimated repair costs during the real estate closing.

The seller arranges completion of repairs after closing on a house. The holdback releases upon proof of proper completion after the mortgage closing. This approach allows closing on schedule while protecting your interests when closing a home.

Some issues require adjusting the purchase price instead of repair before the real estate closing. A malfunctioning appliance might warrant a $500 credit rather than delaying closing. Cosmetic damage from moving might justify a $200 credit for you to address when closing on a house.

Negotiating these adjustments quickly maintains your closing schedule. Fair compensation resolves issues without delaying the mortgage closing. Price adjustments often prove faster than repair completion for closing a home.

Rarely, discovered problems justify postponing closing during the final walkthrough. Major system failures require delaying settlement until sellers properly address the issues. Significant undisclosed damage warrants postponement of the real estate closing.

Unsafe conditions may require repair before you can proceed with closing on a house. Your agent and attorney guide you through this decision based on specific problems discovered. Contract terms determine whether postponement is justified during the mortgage closing.

Owner’s Title Insurance: Protecting Your Ownership Rights

Owner’s title insurance protects you from financial loss due to defects in your property’s title. Unlike other insurance policies that protect against future events, title insurance protects against past issues. These hidden problems surface after you purchase during the real estate closing.

Hidden problems include unpaid taxes, undisclosed heirs, forged documents, recording errors, and fraudulent sellers. Title defects create serious legal problems when closing on a house. Owner’s title insurance provides protection during and after the mortgage closing.

What Is Owner’s Title Insurance and Why Do You Need It?

Your lender requires lenders title insurance protecting their interest in the property. This policy doesn’t protect you as the owner during the real estate closing. Owner’s title insurance provides separate coverage for your ownership interest when closing on a house.

Your equity is protected by owner’s title insurance after the mortgage closing. Most title insurance policies remain in effect for as long as you or your heirs own the property. This permanent protection distinguishes title insurance from other coverage when closing a home.

The title insurance cost represents a one-time premium paid at the real estate closing. This cost typically ranges from $1,000-$4,000 depending on your property’s purchase price. Your location significantly affects the title insurance cost when closing on a house.

Some states regulate title insurance rates during the mortgage closing. Others allow title companies to set competitive pricing for the real estate closing. In some areas, sellers traditionally pay for owner’s title insurance when closing a home.

Buyers pay in other regions during the mortgage closing. Title insurance differs fundamentally from homeowners insurance when closing on a house. Your homeowners policy protects against future damage to your property from fire, theft, or weather.

Title insurance protects against ownership claims arising from events before you purchased. Both types of insurance serve different purposes during the real estate closing. You need both for complete protection when closing a home.

What Does Owner’s Title Insurance Cover?

Your owner’s title insurance policy covers legal defense costs during title disputes. Financial losses occur if someone challenges your ownership after the mortgage closing. Common covered issues include forged deeds or releases discovered after closing on a house.

Undisclosed or missing heirs claiming ownership threaten your title. Mistakes in public records affecting your title surface years after the real estate closing. Undiscovered wills that affect your ownership create problems when closing a home.

Fraudulent impersonation of the true owner can occur before your purchase. Title insurance protects against these hidden defects discovered after the mortgage closing. Coverage continues throughout your ownership period when closing on a house.

Title defects often hide for years before surfacing after the real estate closing. A previous owner’s divorce settlement might cloud your title if improperly recorded. An heir from three owners ago might emerge claiming improper transfer when closing a home.

Tax liens from a previous owner might attach to the property rather than the individual. These hidden problems create legal and financial nightmares without title insurance protection. Coverage protects you long after the mortgage closing completes.

Your policy pays for legal defense when title claims arise after closing on a house. Attorneys’ fees defending against ownership challenges often exceed $10,000-$50,000. Case complexity determines defense costs in title disputes following the real estate closing.

If a valid claim succeeds against your title, your policy covers financial loss. Coverage extends up to the policy amount, typically your purchase price. This protection continues even after you sell if claims relate to your ownership period from the mortgage closing.

Enhanced title insurance policies offer additional coverage beyond standard policies. These upgrades typically cover building permit violations discovered after closing on a house. Zoning violations found after purchase receive coverage under enhanced policies for the real estate closing.

Post-policy forgery or fraud protection extends coverage when closing a home. Encroachments by neighboring structures onto your property are covered. Forced removal of existing structures receives compensation under enhanced policies after the mortgage closing.

Enhanced coverage costs 10-20% more than standard policies. The broader protection provides significant value when closing on a house. Most professionals recommend enhanced coverage for the real estate closing.

Certain title issues aren’t covered by standard policies after the mortgage closing. Known defects disclosed before closing typically aren’t covered when closing a home. Environmental hazards and contamination fall outside title insurance scope.

Government regulations and zoning restrictions aren’t covered unless enhanced coverage is purchased. Understanding these limitations helps you assess enhanced title insurance value for closing on a house. Coverage gaps should be considered during the mortgage closing.

How Does Lenders Title Insurance Differ From Owner’s Coverage?

Lenders title insurance protects your mortgage lender’s interest in the property. Every mortgage transaction requires this coverage for the real estate closing. You pay for lenders title insurance but it protects only the lender when closing on a house.

As you pay down your mortgage after the mortgage closing, the lender’s title insurance coverage decreases proportionally. When you fully pay off the mortgage, lenders title insurance expires completely. The coverage only protects the lender’s interest during loan repayment when closing a home.

Your owner’s title insurance remains at full value regardless of mortgage debt. If you purchase a $400,000 home during the real estate closing, your owner’s policy provides $400,000 in coverage. This protection continues even after you pay the mortgage off completely following the mortgage closing.

This permanent protection covers your equity interest in the property. Your ownership interest is protected throughout ownership after closing on a house. Owner’s title insurance protects you beyond the mortgage period following the real estate closing.

The cost difference between lenders and owner’s title insurance reflects their functions. Lenders title insurance typically costs $500-$1,500 depending on loan amount. Location also affects the cost during the mortgage closing when closing a home.

Owner’s title insurance costs more because it protects the full purchase price. It protects more than just the loan amount during the real estate closing. Many title companies offer discounted owner’s coverage when you purchase both policies when closing on a house.

Both policies stem from the same title search and examination. The title company researches public records to verify clean ownership transfer. This examination reveals most title problems before the mortgage closing.

Resolution occurs before you purchase during the real estate closing. Hidden defects that escape the title search are what title insurance protects against. Undiscovered problems surface after closing on a house despite thorough examination.

Some buyers consider skipping owner’s title insurance to reduce costs. This decision exposes you to potentially catastrophic financial loss after the mortgage closing. Title defects emerging after closing a home can cost hundreds of thousands.

The modest one-time premium at the real estate closing protects your largest asset. Your investment likely represents your most significant holding. Most real estate professionals strongly recommend owner’s title insurance for all purchases when closing on a house.

Settlement Statements: Understanding Where Every Dollar Goes

Settlement statements provide a detailed accounting of all financial aspects of your real estate closing. Your closing disclosure serves as the primary settlement statement for most purchase transactions. This document itemizes every charge, credit, disbursement, and payment associated with closing on a house.

Understanding each line item helps you verify accuracy before signing documents. Settlement statements protect both buyers and sellers during the mortgage closing. Accurate accounting ensures fair treatment for all parties when closing a home.

What Information Do Settlement Statements Show?

Your settlement statement breaks into buyer and seller sections for the real estate closing. The buyer side shows your mortgage loan amount and your cash contribution. All costs you’re paying appear on the buyer section when closing on a house.

The net amount required from you appears on settlement statements. The seller side shows the purchase price and payoff of their existing mortgage. Costs they’re paying and net proceeds they’ll receive are detailed during the mortgage closing.

These two sides must balance to the penny for the real estate closing to proceed. Every charge on your settlement statement fits into categories. Loan origination fees compensate your lender for processing your financing when closing on a house.

Title charges cover the examination, insurance, and recording of ownership transfer. Escrow and settlement charges pay for managing the closing process during the mortgage closing. Prepaid items cover insurance and taxes you pay in advance for the real estate closing.

Initial escrow deposits fund your reserve account for future tax and insurance bills. These reserves protect the lender’s interest after closing on a house. Property tax and insurance reserves ensure bills get paid during ownership following the mortgage closing.

Government recording and transfer charges vary significantly by location. Some jurisdictions charge minimal recording fees during the real estate closing. Others impose significant transfer taxes when closing on a house.

Your closing disclosure shows these costs several days before the mortgage closing. This allows you to verify amounts against local norms. These charges are non-negotiable as they go directly to government entities when closing a home.

Additional settlement statement entries handle specific transaction aspects. Earnest money you deposited earlier appears as a credit during the real estate closing. This reduces cash required at closing on a house.

Seller concessions toward your closing costs appear as credits on settlement statements. Property tax and homeowners association prorations show who pays for portions of the year. Understanding these adjustments ensures accurate final accounting during the mortgage closing.

How to Verify Settlement Statement Accuracy?

Verifying your settlement statement requires systematic comparison against earlier estimates. Start by comparing your closing disclosure against the loan estimate for the real estate closing. Federal law limits how much certain fees can increase between estimate and final settlement statement.

Check loan terms carefully on your settlement statement before closing on a house. Your interest rate should match your rate lock unless you chose to let it float. Your loan amount should equal the purchase price minus your initial investment during the mortgage closing.

Your loan program should reflect what you applied for when closing a home. Whether FHA, VA, conventional, or other financing affects your real estate closing. Loan program determines specific fees and requirements.

Verify all credits appear on your settlement statement before the mortgage closing. Your earnest money deposit should show as a credit reducing cash needed. Seller concessions toward closing costs should appear as specified in your contract when closing on a house.

Lender credits for rate or program selection should match what you negotiated. Missing credits create costly errors requiring closing delay or additional payment. Verification prevents problems during the real estate closing process.

Property tax prorations require careful verification on settlement statements. Errors occur frequently in tax proration calculations before the mortgage closing. Your settlement statement should show who pays taxes for which time periods when closing on a house.

If taxes for the current year aren’t yet paid, you’ll credit the seller for their portion. If sellers already paid annual taxes, they’ll receive a credit for your ownership portion. These prorations significantly affect your cash required during the real estate closing.

Homeowners association transfers and fees appear on settlement statements for HOA properties. Common charges include HOA transfer fees and resale certificate fees. First month’s HOA dues and reserve contributions may apply when closing on a house.

Verify these charges match amounts disclosed in your HOA documents. Ensure you’re not being charged for seller’s unpaid dues during the mortgage closing. HOA charges should be clearly documented before the real estate closing.

Common Settlement Statement Errors to Watch For

Duplicate charges represent the most common settlement statement error. Review every line item to ensure you’re not being charged twice. Appraisal fees sometimes appear on both loan origination and third-party sections when closing on a house.

Title work might show in multiple places on settlement statements. Catching duplicate charges prevents overpayment during the mortgage closing. Careful review protects you when closing a home.

Incorrect loan amounts or interest rates on settlement statements require immediate correction. A difference of even 0.125% in interest rate affects your monthly cost significantly. Loan amounts differing from your agreement change your financing structure fundamentally during the real estate closing.

Don’t sign settlement documents containing loan term errors without proper corrections. Insist on accuracy before the mortgage closing proceeds. Errors in basic loan terms must be fixed before closing on a house.

Missing seller concessions toward buyer closing costs create significant problems. If your contract specifies the seller paying $5,000 toward your costs, this credit must appear. When this credit doesn’t show on your settlement statement, you’ll pay $5,000 extra during the mortgage closing.

Verify all negotiated concessions appear before signing any closing documents. Missing seller concessions must be added to settlement statements. This protects you when closing a home during the real estate closing.

Incorrect property tax calculations cause frequent settlement statement disputes. Tax amounts should match actual local government assessments. Proration calculations should use correct ownership transfer dates when closing on a house.

Some jurisdictions use calendar year tax billing while others use fiscal years. Ensuring correct tax treatment prevents costly errors. Property tax accuracy matters significantly during the mortgage closing.

Fee amounts exceeding your loan estimate without justification violate federal lending regulations. While some variance is permitted, significant increases trigger disclosure requirements. Lender charges, title fees, or certain other costs shouldn’t increase dramatically during the real estate closing.

If fees increased substantially from your estimate when closing on a house, ask your lender to explain. Get written justification for significant cost increases before the mortgage closing. Federal regulations protect you from unjustified fee increases when closing a home.

Closing Disclosure Requirements: Federal Protection for Homebuyers

The Truth in Lending Act (TILA) and Real Estate Settlement Procedures Act (RESPA) govern your closing disclosure requirements. Congress integrated these laws through the TILA-RESPA Integrated Disclosure (TRID) rule in 2015. These federal protections ensure you receive clear, accurate information about your mortgage closing.

You receive information about your mortgage terms and closing costs before committing. Federal regulations protect consumers during the real estate closing process. TRID rules ensure transparency when closing on a house.

What Federal Laws Govern the Closing Disclosure?

TRID rules require lenders to provide your loan estimate within three business days of application. This initial disclosure shows estimated loan terms for the mortgage closing. Projected costs and expected cash required appear on the loan estimate when closing a home.

Your closing disclosure must arrive at least three business days before the real estate closing. This allows you to compare final terms against initial estimates. You prepare accurate funds for settlement during this review period when closing on a house.

The three-business-day rule protects consumers from pressure tactics. Surprise costs at closing are prevented by this federal requirement. Business days exclude Sundays and federal holidays during the mortgage closing timeline.

If you receive your closing disclosure on Monday, the earliest you can close is Thursday. If you receive it on Friday, the earliest real estate closing is Wednesday of the following week. Weekend days don’t count toward the three-day requirement when closing on a house.

Changes to your closing disclosure can extend your timeline significantly. If your loan amount, interest rate, or loan product changes after disclosure delivery, lenders must act. They must provide a revised closing disclosure when closing a home.

They must wait three more business days before the mortgage closing can occur. Minor fee changes typically don’t trigger this requirement. Understanding these rules helps you plan your closing timeline accurately during the real estate closing.

What Must Be Disclosed on Your Closing Disclosure?

Your closing disclosure must show specific information in standardized format. Page one displays loan terms, projected costs, cash to close, and loan information. Property information also appears on page one of the closing disclosure when closing on a house.

This page gives you a quick overview of your final mortgage closing terms. The total investment required appears clearly on page one. The standardized format helps you compare offers from different lenders easily during the real estate closing.

Loan terms section shows your interest rate and monthly principal and interest cost. Prepayment penalty information appears if applicable to your loan. Balloon payment details show if your mortgage includes this feature when closing on a house.

You’ll see whether your rate can change over time during the mortgage. Whether your monthly cost includes other charges like mortgage insurance is disclosed. Different loan types show different features in this section of the closing disclosure.

Projected costs section breaks down your monthly expenses beyond principal and interest. Mortgage insurance appears here for FHA loans during the real estate closing. Conventional loans with less than 20% investment show mortgage insurance when closing on a house.

Estimated escrow costs for property taxes and homeowners insurance appear. Monthly reserves your lender collects are detailed on the closing disclosure. Other costs like HOA dues appear if applicable to your mortgage closing.

Pages two and three itemize all closing costs in detailed categories. Origination charges show what you’re paying your lender for processing. Services you cannot shop for include appraisal, credit reports, and flood certification when closing on a house.

Services you can shop for include title services, survey, and pest inspection. Prepaids cover insurance, property taxes, and interest due at the real estate closing. Reviewing these details helps you verify fair pricing when closing a home.

Page four provides additional loan information for the mortgage closing. Rate adjustment details appear if you have an adjustable loan. Prepayment penalty information and refinance assumptions are disclosed when closing on a house.

Liability after foreclosure information appears on page four. This page discloses whether your loan includes features that could increase costs. Understanding these terms protects you from unexpected financial surprises during ownership following the real estate closing.

Page five contains contact information for all transaction participants. Confirmation of information receipt appears on the final page. Loan calculator information showing how interest affects total costs over time is provided when closing on a house.

The disclosures section confirms you received important consumer information. Your signature acknowledges receipt of the closing disclosure during the mortgage closing. This signature doesn’t obligate you to proceed with the real estate closing transaction.

How to Exercise Your Right to Review Before Closing?

Federal law gives you three business days to review your closing disclosure before settlement. Use this time wisely to verify accuracy and compare against your loan estimate. Calculate your final investment and consult with advisors about any concerns before the mortgage closing.

Rushing through closing disclosure review causes costly mistakes during the real estate closing. These mistakes affect you for years after closing on a house. Thorough review protects your financial interests during the mortgage closing.

Create a systematic review process for your closing disclosure. First, verify all personal information including names, addresses, and property description. Second, confirm loan terms match your agreement including rate, amount, and program type before the real estate closing.

Third, check that all costs fall within expected ranges based on your loan estimate. Fourth, ensure all credits appear including earnest money and seller concessions when closing on a house. Each verification step protects you during the mortgage closing.

Compare every section of your closing disclosure against your loan estimate carefully. Loan costs should match within narrow tolerances for the real estate closing. Third-party fees you could shop for can increase by any amount when closing on a house.

Services you couldn’t shop for cannot increase by more than 10% in total. Recording fees and transfer taxes can vary based on actual government charges. Federal limits protect you from excessive fee increases during the mortgage closing.

Questions about your closing disclosure deserve immediate attention before the real estate closing. Contact your loan officer about discrepancies between your estimate and final disclosure. Ask your attorney to review unclear terms or unusual charges when closing on a house.

Consult with your real estate agent about seller credit accuracy and proration calculations. Don’t hesitate to request clarification about anything you don’t understand. Your questions should be answered before the mortgage closing proceeds.

If you discover errors or concerning issues, you can delay the real estate closing. Federal regulations prohibit lenders from pressuring you to close before satisfaction. Requesting corrections extends your closing date but protects your interests when closing on a house.

Most sellers accept reasonable delays when legitimate problems need resolution during the mortgage closing. Your rights under federal law protect you. Accuracy matters more than meeting the original real estate closing date.

Title Insurance Cost: Understanding What You’re Paying For

Title insurance cost varies based on your property’s purchase price and your location. Whether you purchase owner’s or lender’s coverage affects the total cost. Most states use one of two rating methods for the real estate closing.

Filed rate states have government-regulated title insurance premiums. Free market states allow title companies to compete on pricing when closing on a house. Understanding your state’s system helps you evaluate fair pricing during the mortgage closing.

How Is Title Insurance Cost Calculated?

Filed rate states include Florida, Texas, New Mexico, and others. The state insurance department approves title insurance rates in these jurisdictions. All title companies in these states charge identical premiums for the same coverage during the real estate closing.

Shopping between title companies won’t save money on the premium itself. You might find variations in related service fees when closing on a house. The base premium remains consistent across providers in filed rate states during the mortgage closing.

Free market states allow title insurers to set competitive rates for the real estate closing. These states include California, Illinois, Pennsylvania, and many others. Premiums vary significantly between companies in free market states when closing on a house.

Shopping for title insurance in free market states can save hundreds or thousands. Comparing quotes from multiple title companies ensures competitive pricing during the mortgage closing. Free market states reward comparison shopping when closing a home.

Base title insurance premiums typically range from 0.5% to 1.0% of your purchase price. A $300,000 home might carry $1,500-$3,000 in owner’s title insurance costs. Your state determines where you fall in this range during the real estate closing.

Lenders title insurance usually costs 30-50% of owner’s coverage when purchased simultaneously. Enhanced title insurance policies cost 10-20% more than standard coverage. Broader protection justifies the additional cost when closing on a house.

Additional fees accompany your title insurance premium during the mortgage closing. Title search fees cover the examination of public records. These verify ownership history when closing a home during the real estate closing.

Title examination fees compensate attorneys or abstractors who review search results. Settlement or closing fees pay for the title company’s administrative work. These additional costs add $500-$1,500 to your title insurance expenses when closing on a house.

Who Pays Title Insurance Costs in Real Estate Transactions?

Title insurance payment responsibility varies by local custom during the mortgage closing. Loan program requirements affect who pays these costs. Negotiated contract terms ultimately determine payment responsibility for the real estate closing.

In many areas, sellers traditionally pay for owner’s title insurance when closing on a house. Buyers pay for lenders title insurance in these markets. Other regions follow opposite customs with buyers paying all title costs during the mortgage closing.

Some markets split title insurance expenses between buyer and seller. Your purchase contract specifies who pays for title insurance in your transaction. Standard real estate contracts typically include payment terms reflecting local customs when closing a home.

You can negotiate different arrangements when making your offer. First-time buyers often request sellers contribute toward title costs during the real estate closing. This reduces cash needed when closing on a house.

Different loan programs treat title insurance differently during the mortgage closing. FHA loans require borrowers to pay for lenders title insurance but don’t mandate owner’s coverage. VA loans prohibit charging veterans for owner’s title insurance in most cases when closing on a house.

This makes it a seller expense in VA transactions during the real estate closing. Conventional loans allow flexibility in title insurance payment allocation based on negotiation. Local customs influence payment responsibility when closing a home.

Refinancing transactions shift title insurance responsibility entirely to borrowers. When you refinance your existing mortgage, you pay for new lenders title insurance. Your new lender requires protection during the mortgage closing.

Many title companies offer refinance discounts on lenders coverage. This applies if you refinance within several years of your original purchase. Using the same title insurer often qualifies you for reduced rates when closing on a house.

Investment property purchases typically allocate title costs differently than owner-occupied transactions. Buyers purchasing rental properties often pay all title insurance expenses. Sellers have less incentive to contribute toward investor closing costs during the real estate closing.

Negotiating these costs as part of your overall offer strategy affects your final investment. Title insurance payment terms should be clear in your purchase contract when closing on a house. Clarifying responsibility prevents disputes during the mortgage closing.

Mortgage Closing Process: From Approval to Funding

Final loan underwriting represents your lender’s last verification before the real estate closing. You must still qualify for financing when closing on a house. The property must meet lending standards during the mortgage closing.

This process typically occurs 3-5 days before closing on a house. It involves reviewing updated financial documents and re-verifying employment. Income verification continues through the mortgage closing process.

What Happens During Final Loan Underwriting?

Your underwriter examines every aspect of your mortgage application during final review. They verify you haven’t opened new credit accounts since initial approval. They confirm your employment status hasn’t changed before the real estate closing.

They ensure you still meet minimum credit score requirements when closing on a house. They review gift letters if using gift money for closing costs or initial investment. Every financial detail receives scrutiny during the mortgage closing.

Property verification occurs simultaneously with borrower verification during final underwriting. The appraiser’s value must meet or exceed your purchase price. This supports your loan amount for the real estate closing.

Title examination must reveal clear ownership transfer with no unexpected liens. Hazard insurance coverage must meet lender requirements for protection when closing on a house. All these elements must align for your closing to proceed during the mortgage closing.

Changes in your financial situation during final underwriting create delays or denials. Opening a new credit card lowers your available debt capacity. This might disqualify you from the real estate closing entirely.

Changing jobs raises red flags about income stability when closing on a house. Making large unexplained deposits triggers fraud investigations. Paying down debt with undisclosed loans changes your qualification for the mortgage closing.

Maintaining financial stability until after closing protects your approval. Your lender issues a “clear to close” status once final underwriting completes successfully. This milestone confirms you’ve satisfied all conditions when closing on a house.

Your loan is approved for the real estate closing at this point. Your lender then prepares final closing documents for the mortgage closing. They coordinate with the title company to schedule settlement when closing a home.

Clear to close typically occurs 24-48 hours before your scheduled closing date. Receiving this confirmation allows final preparations for the real estate closing. You can proceed confidently with moving plans when closing on a house.

How Does the Lender Fund Your Mortgage?

Mortgage funding occurs through wire transfer on your closing date. Your lender sends funds electronically to the title company during the real estate closing. The closing attorney manages your settlement if your state uses attorney closings.

This wire transfer typically arrives within hours of document signing. Same-day recordation of your deed and mortgage documents occurs in most cases when closing on a house. Funding speed varies by lender and closing method during the mortgage closing.

The funding process follows specific timing requirements for the real estate closing. Most lenders fund loans only after confirming document execution meets standards. Wet-signed documents require physical delivery before funding occurs when closing on a house.

Remote online notarization allows faster funding in states permitting electronic closing. Your closing location and method affect same-day funding availability during the mortgage closing. Traditional in-person closings typically fund same day when closing a home.

Your lender’s wire transfer includes your entire loan amount for the real estate closing. The title company uses these funds plus your cash contribution for multiple purposes. They pay the seller their net proceeds from the transaction when closing on a house.

They satisfy the seller’s mortgage payoff if one exists. They pay all closing costs as allocated in your settlement statements during the mortgage closing. They handle final transaction details to complete the real estate closing.

Proper fund accounting ensures every party receives correct payment amounts. Accurate disbursement protects all parties when closing on a house. The title company manages this complex accounting during the mortgage closing.

Some loan programs require post-closing conditions before full funding. FHA loans sometimes have trailing documents that need collection after the real estate closing. VA loans may require certain certifications from borrowers post-settlement when closing on a house.

Most conventional loans fund completely at closing without trailing requirements. Understanding your loan program’s funding pattern helps you anticipate timing during the mortgage closing. Different programs have different final requirements for the real estate closing.

Funding delays occasionally occur despite proper planning when closing on a house. Wire transfer problems might prevent same-day funding. Document issues discovered after signing might halt funding until corrected during the mortgage closing.

Last-minute title problems might require resolution before lenders release funds. These delays postpone when you receive keys after the real estate closing. Taking possession depends on complete funding when closing on a house.

Special Considerations for Different Loan Types

Different loan programs create unique requirements during the real estate closing. Understanding program-specific rules helps you prepare properly. Each loan type affects your closing experience when closing on a house.

Federal programs like FHA and VA have specific closing requirements. Investment property financing differs from owner-occupied purchases. Construction loans involve unique closing procedures during the mortgage closing.

How Do FHA Loan Closings Differ?

FHA loan closings include unique requirements not present in conventional transactions. Upfront mortgage insurance premiums (UFMIP) of 1.75% of your loan amount add to closing costs. This fee can be financed into your loan amount rather than paid in cash during the real estate closing.

Understanding FHA-specific costs helps you budget accurately for your transaction. FHA appraisals include health and safety inspections beyond standard value assessments. Appraisers must document property condition meets FHA’s minimum property standards when closing on a house.

Required repairs must be completed before the mortgage closing can occur. Peeling paint in homes built before 1978 requires remediation due to lead paint concerns. These FHA requirements sometimes delay closings when repairs take longer than anticipated during the real estate closing.

FHA closing cost limits restrict what sellers can charge buyers for certain fees. Sellers cannot charge buyers for FHA mortgage insurance premiums. Tax service fees must come from sellers when they’re charged during the mortgage closing.

These protections prevent borrowers from being overcharged when closing on a house. VA loans provide similar protections for eligible veterans during the real estate closing. Understanding program protections helps you verify proper cost allocation when closing a home.

FHA streamline refinance closings simplify the process for existing FHA borrowers. These transactions typically don’t require appraisals or income verification. Reduced documentation speeds closings to 21-30 days in many cases during the mortgage closing.

Streamline refinances provide cost-effective ways to lower rates or adjust terms. FHA borrowers benefit from simplified requirements during the real estate closing. Less documentation means faster processing when closing on a house.

What Makes VA Loan Closings Unique?

VA loan closings provide significant benefits for eligible military service members. Veterans receive advantages during the real estate closing process. No initial investment requirement eliminates the largest cash need for most buyers when closing on a house.

Veterans can finance 100% of the purchase price during the mortgage closing. This requires only closing costs and prepaids at settlement. This zero-down feature helps military families achieve homeownership sooner than traditional financing during the real estate closing.

VA funding fees replace traditional mortgage insurance when closing on a house. These one-time fees range from 1.25% to 3.3% of the loan amount. Service type, initial investment amount, and previous VA benefit use affect the fee during the mortgage closing.

The funding fee can be financed into your loan amount. Disabled veterans often qualify for fee waivers reducing closing costs significantly during the real estate closing. Complete fee waiver saves thousands when closing on a house.

VA appraisals include specific property requirements protecting veteran buyers. The Notice of Value (NOV) establishes maximum reasonable value for the property. Minimum property requirements ensure homes meet safety and habitability standards during the mortgage closing.

Required repairs must be completed before the real estate closing proceeds. These protections help veterans avoid purchasing problematic properties when closing on a house. Quality standards protect service members during the mortgage closing.

VA loan regulations prohibit charging veterans for certain closing costs. Sellers must pay for owner’s title insurance in most VA transactions. Lenders cannot charge application fees, processing fees, or certain other costs to veteran borrowers during the real estate closing.

These protections reduce cash required when closing on a house. Understanding VA closing cost rules helps you negotiate effectively during the mortgage closing. Veterans receive maximum protection during the real estate closing.

VA IRRRL refinances simplify refinancing for existing VA borrowers. These streamlined transactions require no appraisal and minimal documentation. Closings complete quickly with reduced costs when closing on a house.

Calculate potential savings using VA refinance tools before deciding. IRRRL provides cost-effective rate reduction during the mortgage closing. Veterans benefit from simplified requirements for the real estate closing.

How Do Investment Property Closings Differ?

Investment property closings involving rental properties include different requirements. Fix and flip projects have unique closing procedures during the mortgage closing. These differ from owner-occupied purchases when closing on a house.

Lenders typically require 15-25% initial investment for investment properties. This compares to 3-5% for primary residences during the real estate closing. This increased requirement significantly affects cash needed when closing on a house.

DSCR loans for investment properties qualify based on property income. Traditional personal income isn’t used for qualification during the mortgage closing. The debt service coverage ratio compares property rental income to mortgage expenses when closing a home.

Closings proceed based on property cash flow rather than traditional employment verification. Understanding DSCR requirements helps real estate investors structure deals effectively during the real estate closing. Property performance matters more than personal income when closing on a house.

Interest rates on investment properties typically run 0.375% to 0.750% higher. Owner-occupied rates are lower due to reduced lender risk during the mortgage closing. This rate premium affects your monthly costs and long-term profitability when closing a home.

Calculate investment returns accounting for these rate differences before purchasing. Higher rates reduce net cash flow during the real estate closing period. Investment analysis must account for rate premiums when closing on a house.

Investment property closings require rental agreements if tenants occupy the property. Leases must be reviewed and assigned to new owners during the mortgage closing. Security deposits transfer to buyers at the real estate closing.

Rent proration calculations ensure sellers receive rent for their ownership period. Buyers receive rent beginning at closing when closing on a house. These rental-specific issues add complexity to investment closings during the mortgage closing.

Hard money loans for investment properties close faster than traditional financing. Asset-based loans focus on property value rather than borrower qualifications. Closings complete in 7-15 days compared to 30-45 days for conventional financing during the real estate closing.

Fast closings help investors capture opportunities in competitive markets. Speed matters when closing on investment houses. Quick access to capital provides competitive advantages during the mortgage closing.

Common Closing Complications and How to Avoid Them

Title issues cause frequent closing delays when unexpected problems emerge. Undisclosed liens from previous owners’ debts must be satisfied before the real estate closing. Gaps in the chain of title require additional research and documentation when closing on a house.

Easements or encroachments discovered during survey delay closings until resolved. Ordering title work early in your transaction timeline allows more time for problem resolution. Early discovery prevents last-minute delays during the mortgage closing.

What Are the Most Common Reasons Closings Get Delayed?

Appraisal problems create significant closing delays when property value comes in below purchase price. Low appraisals require either renegotiating the purchase price when closing on a house. You might need to increase your initial investment to cover the gap during the mortgage closing.

You might need to cancel the transaction entirely if resolution isn’t possible. Some buyers appeal low appraisals by providing comparable sales data. Understanding the appraisal process helps you anticipate potential value issues during the real estate closing.

Employment verification failures occur when underwriters cannot confirm continued employment. Job changes during your transaction period raise major red flags. Gaps in employment must be explained and may disqualify you from the mortgage closing.

Reduced income due to salary cuts or hour reductions changes your qualification. Maintaining employment stability until after closing protects your approval when closing on a house. Don’t change jobs before the real estate closing completes.

Final walkthrough discoveries sometimes reveal problems requiring resolution. Missing appliances or fixtures that were included must be replaced. Price adjustment must be negotiated if items can’t be replaced during the mortgage closing.

New damage to the property might warrant repair or compensation. Incomplete repairs from your home inspection could delay closing until properly addressed. Conducting your walkthrough 24-48 hours before closing allows time to resolve issues when closing on a house.

Funding delays occasionally occur even when all documentation is complete. Wire transfer problems might prevent same-day funding during the real estate closing. Lender processing bottlenecks during busy periods can delay loan funding when closing on a house.

Document discrepancies discovered during final review might halt funding. Working with experienced lenders minimizes funding delay risks during the mortgage closing. Choose reliable partners for the real estate closing process.

How to Prevent Last-Minute Closing Problems

Maintain financial stability throughout your mortgage process to avoid last-minute issues. Don’t open new credit accounts that change your debt ratios. Avoid large purchases that deplete your cash reserves before the real estate closing.

Keep your employment stable without job changes when closing on a house. Preserve your financial status quo from application through closing to protect approval. Any changes risk your mortgage closing approval.

Respond promptly to all lender requests for information or documentation. Delays in providing requested items extend your closing timeline during the real estate closing. Some conditions have expiration dates requiring resubmission if not satisfied quickly when closing on a house.

Missing deadlines might cause you to lose rate locks. This increases your costs significantly during the mortgage closing. Treating your lender’s requests as urgent priorities speeds your transaction when closing a home.

Review your closing disclosure immediately upon receipt during the real estate closing preparation. Contact your lender about any questions or discrepancies right away. The three-business-day waiting period exists specifically for you to verify accuracy when closing on a house.

Waiting until the day before closing to review leaves insufficient time for corrections. Taking disclosure review seriously prevents closing day surprises during the mortgage closing. Thorough review protects your interests when closing a home.

Arrange your closing funds transfer several days before settlement. Verify wire transfer instructions directly with the title company via phone. Call their published number, never trust email instructions alone during the real estate closing.

Wire fraud schemes target real estate closings with fake wire instructions. Confirming instructions prevents theft of your closing funds when closing on a house. Protecting your funds transfer requires vigilance during the mortgage closing.

Complete your final walkthrough 24-48 hours before closing when time exists. Earlier walkthroughs risk missing issues that develop between walkthrough and closing. Last-minute walkthroughs leave no time for problem resolution during the real estate closing.

The 24-48 hour window balances timeliness with time for solutions. Proper walkthrough timing protects your interests when closing on a house. Strategic scheduling prevents problems during the mortgage closing.

[PART 4 COMPLETE – ~3,500 words – Continue to Part 5 with Closing Day, After Closing, and 20+ Question FAQ]

Closing On A House: Step-by-Step Process & Checklist

[PART 5 OF 5 – FINAL]

Closing Day: What to Expect When You Close

Government-issued photo identification is mandatory for all parties signing closing documents. Your driver’s license or passport must be current and match names on paperwork. Some states require additional identification for notarization during the real estate closing.

Bring identification even if you’ve worked with your lender for months. Proper identification prevents closing delays when closing on a house. ID requirements apply to everyone at the mortgage closing.

What Should You Bring to Your Closing?

Cashier’s check or wire confirmation for your cash to close must arrive before document signing. Personal checks aren’t accepted for amounts over $500-$1,000 in most cases. Wire transfers require confirmation from your bank showing successful transmission during the real estate closing.

The amount must match your closing disclosure exactly when closing on a house. Having correct funds available completes your closing smoothly during the mortgage closing. Bring proof of wire transfer or certified funds to the real estate closing.

Proof of homeowners insurance showing coverage effective at closing must be provided. Your insurance agent typically sends this directly to your lender. Bringing a copy provides backup during the mortgage closing when closing on a house.

Coverage must meet lender minimum requirements for the real estate closing. Additional flood insurance proof is necessary if your property lies in designated zones. Proper insurance documentation is mandatory for closing on a house.

Your closing disclosure reviewed and annotated with questions helps you verify final numbers. Bringing your signed loan estimate allows comparison against closing figures. Having your purchase contract available helps resolve any questions about terms during the mortgage closing.

These documents support informed signing of final paperwork when closing a home. Being well-prepared makes closing more efficient during the real estate closing. Organized documentation speeds the process when closing on a house.

Questions about charges, terms, or procedures should be written down before closing. The settlement table isn’t the time to discover you don’t understand mortgage terms. Addressing questions before signing protects your interests during the mortgage closing.

Preparing questions in advance makes closing more efficient when closing on a house. Clear understanding prevents problems after the real estate closing. Get answers before signing documents during the mortgage closing.

How Long Does the Closing Meeting Last?

Typical closings require 60-90 minutes for document review, explanation, and signing. This timeline assumes no complications or questions requiring extensive discussion. More complex transactions like new construction closings may take longer when closing on a house.

Investment properties often require additional time during the mortgage closing. Simple refinance closings often complete in 30-45 minutes for the real estate closing. Transaction complexity determines duration when closing a home.

The closing agent or attorney explains each document before you sign. They verify your understanding of key terms and obligations. You’ll sign each document after explanation and any questions during the mortgage closing.

Count on signing 50-100+ pages of documents depending on your transaction type. Understanding documents in advance speeds the signing process when closing on a house. Familiarity with paperwork makes the real estate closing faster.

Your spouse or co-borrower must attend closing to sign documents. Powers of attorney can be arranged if someone cannot attend the mortgage closing. Both parties must sign the promissory note, mortgage, and various other closing documents when closing on a house.

One party signing alone typically doesn’t satisfy lender requirements. Plan for both parties to attend unless special arrangements are made. Joint attendance ensures proper execution during the real estate closing.

Remote online notarization allows closing from home in states permitting this technology. You’ll video conference with a notary while reviewing documents electronically. This option saves travel time but requires reliable internet connection when closing on a house.

Compatible devices are necessary for remote closings during the mortgage closing. Not all lenders offer remote options for the real estate closing. Remote technology provides flexibility for busy schedules when closing a home.

Mobile notary services bring closing documents to your preferred location. For additional fees, notaries meet you at home, work, or other convenient spots. This service accommodates buyers with scheduling conflicts or transportation limitations during the mortgage closing.

Mobile notaries make closing more convenient for many buyers when closing on a house. Location flexibility helps complete the real estate closing efficiently. Choose options that work for your schedule during the mortgage closing.

When Do You Actually Get the Keys?

Key transfer timing varies by location and loan type after the mortgage closing. In many states, you receive keys immediately after signing closing documents. Other jurisdictions require recordation of deed and mortgage before key release when closing on a house.

This difference might mean same-day keys or waiting until the following day. Local practices determine your key transfer timing during the real estate closing. Regional customs affect when you take possession after closing on a house.

Funding confirmation precedes key release in most transactions during the mortgage closing. The title company must confirm your lender’s wire transfer arrived. This confirmation typically occurs within hours of document signing when closing a home.

Funding delays postpone key receipt even if documents are signed. Understanding funding timing helps manage expectations during the real estate closing. Complete funding triggers key release when closing on a house.