Selling A House: Complete Decision Framework & Process Guide

When you’re selling a house, every decision impacts your final proceeds and timeline. Whether you’re upgrading, downsizing, relocating, or wondering should i rent out my house instead of selling, understanding selling a house costs and strategic timing determines your success. This comprehensive guide delivers the complete decision framework for the home selling process, from calculating home sale proceeds to implementing strategies that sell house fast while maximizing value.

Key Summary

This definitive resource covers every dimension of selling a house successfully. Learn how to determine the best time to sell house in any market using National Association of Realtors timing research, understand all selling a house costs including IRS capital gains rules, establish accurate market value of home through Consumer Financial Protection Bureau valuation guidance, master the complete home selling process from Federal Trade Commission consumer protection resources, and leverage home sale capital gains exclusion strategies sheltering $250,000-$500,000 from taxation. Whether you’re evaluating sell house by owner approaches, implementing tactics to sell house fast, determining the best way to sell home, comparing low commission real estate agents, or calculating optimal cost for home staging investment, this guide provides actionable frameworks backed by market data and professional experience.

Understanding the Fundamental Decision: Selling a House vs Alternatives

What Core Factors Drive the Decision When Selling a House?

Before committing to selling a house, examine whether this path truly serves your objectives better than alternatives. The decision typically stems from life transitions, financial opportunities, or investment strategy evolution requiring careful evaluation.

Life changes create the most common motivations for selling a house. Growing families need additional bedrooms and yard space. Empty nesters find themselves maintaining properties far larger than necessary for two people. Career relocations require geographic moves to new cities or states. Divorce proceedings necessitate asset division and separate living arrangements. Retirement opens possibilities for downsizing or relocating to preferred climates with lower living costs.

Financial opportunities often trigger strategic home sales. Rising property values create substantial equity available for extraction through sales. Market conditions shift dramatically, making certain periods far more advantageous for sellers than others. Calculate your potential home sale proceeds after all costs to understand your financial position. Maintenance obligations on aging properties consume resources better allocated to newer, more efficient homes or alternative investments.

Investment strategy evolution changes homeowner thinking about property holdings. Some owners convert primary residences to rentals building long-term wealth through DSCR loan programs that qualify properties based on rental income rather than personal employment income. Portfolio rebalancing requires selling underperforming assets to fund better opportunities. Understanding whether should i rent out my house or sell requires analyzing rental income potential compared to sale proceeds and alternative investment returns.

How Do You Evaluate Selling a House vs Should I Rent Out My House?

The should i rent out my house versus sell decision represents one of the most consequential choices homeowners face. Each path offers distinct advantages and challenges requiring thorough financial analysis and honest assessment of your capabilities and objectives.

Selling a house provides immediate liquidity and eliminates ongoing responsibilities. You receive lump-sum home sale proceeds enabling next purchase or investment without delay. All property management burdens disappear entirely. You avoid tenant problems, maintenance emergencies, and vacancy periods entirely. The home sale capital gains exclusion shelters $250,000 for single filers or $500,000 for married couples filing jointly when meeting primary residence requirements.

Renting your current property while moving preserves long-term appreciation potential. This strategy works particularly well for properties in appreciating markets where current values seem temporarily depressed. Strong rental markets generate positive cash flow covering mortgage obligations plus maintenance reserves while building equity over time. Access equity for your next purchase through bridge loan financing without forcing immediate sale when you’re not ready.

The should i rent out my house analysis requires honest evaluation of several key factors. Do local rental rates cover your full carrying costs including mortgage principal and interest, property taxes, insurance, HOA fees, and maintenance reserves? Can you handle being a landlord with tenant issues, maintenance calls, and vacancy periods? Do you have sufficient reserves to cover periods without rental income? Will converting to rental affect your ability to use the home sale capital gains exclusion in the future?

Market conditions heavily influence whether should i rent out my house makes financial sense. Properties in strong rental markets with high demand and low vacancy rates favor rental conversion. Areas with weak rental demand or declining property values typically favor immediate sale. Calculate your break-even rental rate including all carrying costs, vacancy factors, management fees, and maintenance to determine viability.

What Alternative Strategies Exist Beyond Simply Selling a House?

The best way to sell home isn’t always an outright sale. Several alternatives provide liquidity or solve problems without triggering full property disposition and associated selling a house costs.

Refinancing extracts value while maintaining ownership and avoiding selling a house costs entirely. Home equity loans provide lump-sum funding for major expenses without triggering taxable events or forcing relocations. HELOCs offer flexible credit lines you can access as needed rather than all at once. Rate reductions through conventional loan refinancing lower your ongoing costs substantially, freeing monthly cash flow for other purposes.

Renovating refreshes properties without moving hassles or selling a house costs. Strategic improvements through FHA 203k rehabilitation financing modernize aging homes while building equity simultaneously. Construction loans fund major additions and remodels that accommodate changing family needs without disrupting your life through moves. Plan your renovation costs and financing to evaluate value creation potential.

Reverse mortgages allow seniors to access equity without selling a house or making payments. Reverse mortgage programs enable homeowners 62 and older to convert home equity into cash while continuing to live in properties. No required monthly mortgage obligations exist during occupancy. However, interest accrues reducing home sale proceeds or inheritance amounts for heirs. Calculate reverse mortgage proceeds and long-term costs to evaluate this alternative.

Calculating All Selling a House Costs: Complete Expense Breakdown

What Are the Major Components of Selling a House Costs?

Understanding selling a house costs before listing prevents unpleasant surprises reducing your home sale proceeds at closing. Successful sellers budget comprehensively, accounting for both obvious expenses and easily overlooked obligations that can total eight to ten percent of your property value.

Real estate commissions represent the single largest selling a house costs for most sellers. Traditional full-service agents typically charge five to six percent of sale price, split between listing and buyer agents. On a property selling for $400,000, that’s $20,000 to $24,000 in commissions immediately reducing your home sale proceeds. Low commission real estate agents offer reduced rates, typically two to four percent total, saving thousands while still providing professional representation.

Title-related closing costs add another one to two percent to selling a house costs. Title insurance protects buyers against ownership defects and lien surprises. Title searches reveal any problems requiring resolution before closing. Escrow fees for neutral third-party transaction management vary by location. Recording fees for deed transfers with county registrars represent minor but required costs. Calculate your estimated closing costs to budget accurately.

Transfer taxes vary dramatically by jurisdiction, adding significant selling a house costs in some areas. Some states charge percentage-based taxes on sale prices. Others impose flat fees regardless of property value. High-tax areas like New York City and Washington, D.C. assess substantial transfer obligations consuming home sale proceeds. Florida imposes documentary stamp taxes that vary by county and can reach thousands on valuable properties.

Attorney fees in attorney-required states add legal representation to selling a house costs. Northeastern states typically mandate attorney involvement in real estate transactions. Fees range from $500 to $2,000 depending on transaction complexity and attorney experience. Legal reviews protect against contract issues and ensure proper documentation. Complex situations involving trusts, estates, or foreign national buyers justify legal guidance regardless of location.

How Do Property Preparation Costs Impact Your Home Sale Proceeds?

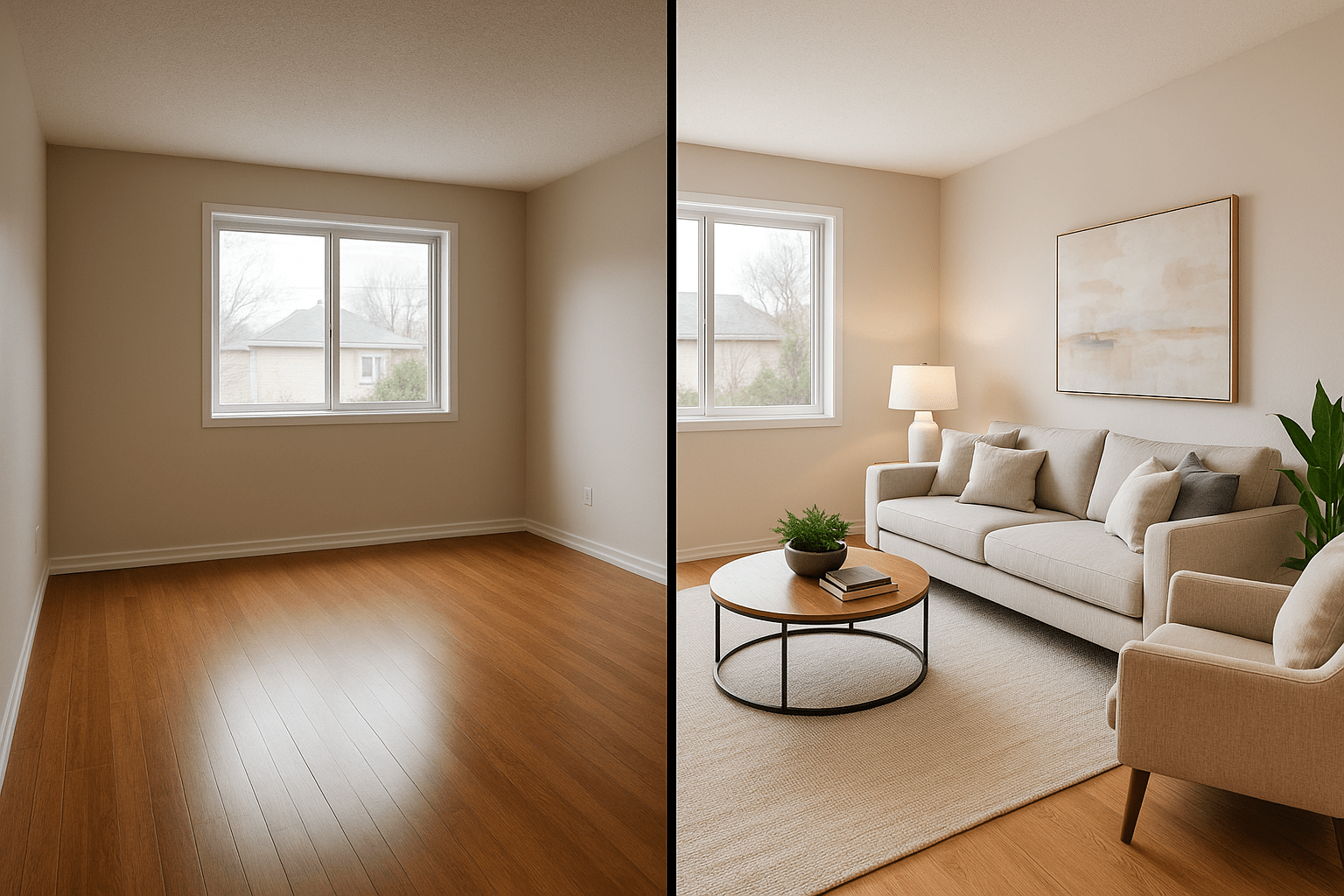

The cost for home staging and strategic improvements dramatically influence final sale prices and time on market. Smart sellers focus on high-impact, cost-effective improvements rather than over-investing in low-return renovations that inflate selling a house costs without proportional proceeds increases.

Professional staging generates measurable advantages justifying cost for home staging investment. Staged homes sell 73 percent faster than unstaged properties according to industry research. Vacant homes particularly benefit from furniture placement helping buyers envision space utilization. The cost for home staging ranges from $2,000 to $5,000 for typical three-month listing periods. Professional stagers understand buyer psychology, creating emotional connections through intentional design that increases home sale proceeds.

Curb appeal improvements create critical first impressions without excessive cost. Fresh exterior paint addresses deferred maintenance concerns signaling property pride. Landscaping enhancements through mulch, plants, and lawn care transform presentations. Power washing decks, siding, and driveways removes years of accumulated grime for hundreds rather than thousands. Updated mailboxes, house numbers, and lighting modernize entries inexpensively. Buyers decide whether to pursue properties within seconds of arrival.

Minor repairs addressing obvious defects prevent negotiation reductions to home sale proceeds. Leaky faucets, cracked caulk, and squeaky doors signal deferred maintenance to buyers. Burned-out light bulbs, torn screens, and broken doorknobs distract from property strengths. Addressing minor issues through home improvement planning costs little while dramatically improving buyer perceptions and protecting home sale proceeds.

Major renovations before selling a house rarely return full investment in proceeds. Kitchen and bathroom remodels typically return 60-80 percent of costs at sale. New roofs, HVAC systems, and windows provide value but don’t generate premium pricing. Properties requiring significant work may benefit from FHA 203k buyer financing enabling buyers to purchase and renovate rather than sellers investing before sale.

What Carrying Costs Accumulate During the Home Selling Process?

Extended listing periods increase selling a house costs through ongoing obligations reducing your ultimate home sale proceeds. Understanding these accumulating expenses motivates strategic timing and aggressive pricing when circumstances demand faster sales.

Mortgage obligations continue throughout the home selling process until closing day. Monthly principal and interest payments never pause regardless of listing status. Property taxes, homeowners insurance, and HOA fees remain your responsibility. On properties with $2,000 monthly payments, every additional month on market costs $2,000 in carrying obligations reducing home sale proceeds. Calculate your monthly carrying costs to understand extended timeline impacts.

Utilities, maintenance, and other operational costs persist as selling a house costs. You must maintain electricity, water, gas, internet for showings. Lawn care and snow removal continue for curb appeal. HVAC operation keeps properties comfortable for buyers. Pool and spa maintenance can’t be deferred. Emergency repairs sometimes arise during listing periods. These ongoing operational costs reduce your net home sale proceeds.

Seasonal factors influence carrying cost duration and total selling a house costs. Properties listed during optimal spring markets often sell within 30-45 days. Those listed during slower winter periods may sit 60-90 days or longer. Every additional month adds $2,000-$4,000 in typical carrying costs reducing home sale proceeds. Understanding the best time to sell house minimizes accumulated carrying costs.

Strategic pricing to sell house fast minimizes carrying cost accumulation. Properties priced aggressively at or below market value generate immediate interest. Faster sales mean fewer months of carrying costs and higher net home sale proceeds despite potentially slightly lower gross prices. The math often favors quick sales over waiting for maximum price while accumulating selling a house costs.

Determining the Best Time to Sell House in Your Market

How Do Seasonal Patterns Influence the Best Time to Sell House?

The best time to sell house varies by market, but recognizable patterns emerge across most regions influencing the home selling process timeline and final home sale proceeds. Successful sellers align listing dates with buyer activity peaks, maximizing competition and avoiding slow periods that extend selling a house costs through prolonged carrying obligations.

Spring represents the best time to sell house in most markets nationwide. March through June generates peak buyer activity as families with school-age children time moves with summer breaks. Warmer weather showcases properties attractively through enhanced curb appeal. Gardens bloom and lawns green up, creating appealing first impressions. Tax refund arrivals in March and April provide initial capital for many first-time buyers. Calculate buyer qualification impacts at different price points during peak seasons.

Summer extends strong market conditions through August in most regions. Long daylight hours facilitate evening showings for working buyers. Vacation schedules create flexibility for property tours and moving logistics. Pleasant weather conditions reveal property conditions accurately. However, intense competition from other sellers during this best time to sell house can dilute individual listing attention. Multiple similar properties compete for the same buyer pools.

Fall experiences declining but still viable activity making it a moderate time for the home selling process. Serious buyers motivated by year-end deadlines actively search September through November. Some holiday interruptions reduce momentum in late November and December. Shorter daylight limits evening showing opportunities. Cold weather in northern climates makes properties less appealing during tours. Bridge loan financing helps sellers purchasing before sale closes without contingencies.

Winter typically represents the slowest season, though the best time to sell house for serious buyers. Reduced buyer pools create longer market times and extended selling a house costs. Holiday focus diverts attention from home searches. Weather conditions in many regions complicate showings and moving logistics. However, serious winter buyers face less competition, sometimes yielding surprisingly strong home sale proceeds. Motivated sellers willing to list during this period often find highly qualified, serious buyers.

What Market Indicators Signal the Best Time to Sell House Locally?

Beyond seasonal patterns, specific local market conditions dramatically impact the home selling process timeline and ultimate home sale proceeds. Successful sellers monitor key indicators, timing listings to capture market advantages and determining the optimal best way to sell home in current conditions.

Inventory levels determine whether it’s the best time to sell house in your specific market. Seller’s markets feature few available properties relative to buyer demand, driving prices upward and accelerating sales. Months of inventory below three signals strong seller conditions favoring aggressive pricing. Buyer’s markets with six-plus months inventory favor purchasers through selection and negotiation leverage, extending the home selling process. Balanced markets with four to five months inventory create reasonable conditions for both parties.

Interest rate environments shape buyer purchasing power and the best time to sell house. Rising rates reduce qualification amounts, constraining buyer budgets and potentially depressing home sale proceeds. Calculate buyer DTI impact at different rate levels to understand market sensitivity. Falling rates expand buyer pools and increase qualification amounts, often making it the best time to sell house. Rate expectations influence urgency, with anticipated increases motivating faster purchases benefiting sellers.

Local employment trends drive housing demand fundamentals determining the best time to sell house. Growing employers attract workers requiring housing. Corporate relocations create sudden demand spikes in receiving markets. Plant closures or major layoffs reduce buyer pools dramatically, making immediate sale crucial. Remote work trends shift demand from urban cores to suburban and rural properties. Properties in appreciating employment markets benefit from rental conversion strategies when should i rent out my house makes sense.

Days on market statistics reveal whether it’s the best time to sell house currently. Average days on market below 30 indicates strong demand and potential bidding wars. Listings sitting 60-plus days suggest either overpricing or weak markets. Comparing your property type and price range to overall market statistics provides specific timing guidance. Properties needing to sell house fast benefit from understanding current market absorption rates.

Should You Wait for Market Appreciation or Sell Now?

Determining the best time to sell house often involves evaluating current conditions versus anticipated future appreciation. Market timing attempts frequently backfire, leaving sellers in worse positions than immediate execution while accumulating unnecessary selling a house costs.

Appreciation occurs unevenly across property types, locations, and timeframes. Desirable school districts typically outperform market averages. Transit access and walkability command premiums in urban markets. Properties requiring deferred maintenance lag market appreciation significantly regardless of location trends. Evaluate investment property appreciation trends when comparing selling versus holding decisions affecting should i rent out my house analysis.

Carrying costs during waiting periods offset theoretical appreciation gains rapidly. Ongoing mortgage obligations, property taxes, insurance, maintenance, and utilities accumulate substantial selling a house costs monthly. One year of carrying costs on a $400,000 property easily exceeds $30,000 when including all obligations. Modest appreciation of three to five percent barely covers these expenses before even accounting for additional selling a house costs at eventual sale. Calculate true holding costs for realistic projections.

Opportunity costs matter as much as appreciation when determining the best time to sell house. Capital tied in current properties prevents deployment in potentially superior investments. Access equity through cash-out refinancing for investment opportunities without forcing sales. Time spent maintaining properties diverts attention from income-producing activities. Life quality improvements from desired moves provide intangible but real value not captured in appreciation calculations.

Market peaks prove impossible to predict accurately, making any reasonable time potentially the best time to sell house. Waiting for perfect timing often means missing good opportunities entirely. Transaction costs remain constant regardless of minor price fluctuations. Personal circumstances should drive decisions more than market speculation. Evaluate strategic timing through comprehensive analysis weighing multiple factors beyond simple appreciation projections.

Establishing Accurate Market Value of Home for Optimal Pricing

How Do You Determine the True Market Value of Home?

Proper pricing strategy represents the single most critical decision in the home selling process. Overpricing extends market time while accumulating unnecessary selling a house costs and ultimately reduces final home sale proceeds. Underpricing leaves substantial value on the table. Accurate market value of home assessment generates competitive interest driving optimal results.

Comparative market analysis forms the foundation for determining market value of home. Recent sales of similar properties within your neighborhood provide baseline valuation. Closed transactions within the past three to six months offer most relevant comparables for market value of home determination. Pending sales indicate current market direction. Active listings represent direct competition for buyer attention. Professional real estate agents provide detailed CMA reports supporting confident pricing.

Property characteristics influence pricing adjustments from comparable sales when establishing market value of home. Square footage differences justify per-square-foot price variations. Bedroom and bathroom counts affect value substantially. Lot sizes matter more in some markets than others. Condition variations through updates, finishes, and maintenance levels support premium or discount pricing relative to market value of home baselines. Property tax assessments provide one data point but often lag actual market value of home by years.

Online valuation tools provide starting points for market value of home requiring professional verification. Automated valuation models process massive datasets identifying patterns. Algorithms struggle with unique properties lacking close comparables for accurate market value of home determination. Local market nuances escape broad statistical models. Professional appraisers and experienced agents refine automated estimates through on-site evaluation, providing more accurate market value of home assessments.

Market conditions demand pricing strategy adjustments relative to market value of home. Seller’s markets with low inventory support aggressive pricing at or above market value of home and often generate multiple offers above asking. Balanced markets require competitive pricing at or slightly below likely market value of home to generate showing activity. Buyer’s markets necessitate conservative pricing, often 5-10 percent below optimistic market value of home estimates, to generate interest.

What Role Do Professional Appraisals Play in Establishing Market Value of Home?

Pre-listing appraisals provide objective market value of home perspectives supporting confident pricing decisions during the home selling process. Understanding appraisal processes and limitations guides effective use of these tools for determining accurate market value of home.

Professional appraisers employ standardized methodologies ensuring consistent market value of home determination. Sales comparison approach analyzes recent comparable sales adjusting for property differences. Cost approach calculates land value plus depreciated improvement replacement costs. Income approach evaluates investment properties based on rental income generation when determining market value of home for rental conversions. Appraisers synthesize multiple approaches reaching supported conclusions about market value of home.

Appraiser independence requirements eliminate conflicts of interest in market value of home determination. Appraisal Management Companies coordinate assignments preventing lender influence on market value of home assessments. Direct appraiser contact by parties with transaction interests violates regulations. USPAP standards govern ethical conduct and professional practices. Fannie Mae and Freddie Mac require appraisal independence for all loan-backed transactions affecting market value of home valuations.

Market conditions impact appraisal outcomes and market value of home significantly. Rapidly appreciating markets create challenges finding recent comparable sales reflecting current market value of home accurately. Declining markets produce appraised market value of home below seller expectations and listing prices. Unique properties in areas lacking similar sales limit comparable selection for market value of home determination. Rural properties face particular appraisal challenges given fewer transactions.

Pre-listing appraisal costs of $300 to $600 provide objective market value of home verification. Larger homes and complex properties command higher fees. Rural locations with limited appraiser availability cost more. Investment properties requiring income analysis when evaluating should i rent out my house decisions add expenses. Appraisal validity lasts six months for most purposes, potentially serving dual roles for selling and purchasing.

How Do Low Appraisals Affect the Home Selling Process and Home Sale Proceeds?

Appraisal shortfalls below anticipated market value of home create negotiation flashpoints threatening transaction closures. Understanding options and leverage guides successful resolution protecting your home sale proceeds while maintaining deal viability during the home selling process.

Appraisal contingencies allow buyers to cancel without penalties when market value of home comes in low. Most purchase contracts include appraisal contingencies protecting buyers from overpaying relative to market value of home. Low appraisals force renegotiations or transaction terminations. Buyers obtain refunded earnest money when exercising appraisal contingencies. Multiple offers sometimes include appraisal gap coverage where buyers commit to covering shortfalls below market value of home expectations.

Challenging appraisals through reconsideration processes sometimes yields market value of home adjustments. Providing additional comparable sales the appraiser missed justifies market value of home reconsideration. Documenting property improvements not apparent during inspection supports higher market value of home assessments. Correcting factual errors in appraisal reports creates grounds for market value of home revision. Success rates vary but attempts cost nothing beyond time invested.

Price reductions matching appraised market value of home preserve transaction integrity. Buyers securing financing cannot close loans exceeding appraised market value of home without additional capital. Sellers unwilling to reduce prices force buyers to find substantial additional funds. Market conditions influence negotiation dynamics, with seller’s markets reducing seller willingness to adjust despite market value of home shortfalls. Calculate impact of price reductions on home sale proceeds before negotiating.

Split-the-difference compromises resolve market value of home disputes maintaining transaction momentum. Sellers reduce prices modestly while buyers increase initial capital to bridge gaps between contract price and market value of home. Creative solutions include seller-paid closing cost assistance or personal property inclusions. Bridge financing allows sellers to proceed with purchases despite delayed closings from market value of home renegotiations.

Mastering the Complete Home Selling Process from Start to Finish

What Pre-Listing Activities Optimize the Home Selling Process?

The home selling process begins well before listing properties on MLS databases. Thorough preparation creates competitive advantages generating higher home sale proceeds and minimizing selling a house costs through faster sales and stronger negotiating positions.

Pre-listing inspections identify issues for proactive resolution during the home selling process. Professional inspectors evaluate properties using standardized checklists covering major systems and structural components. Inspection reports detail deficiencies with severity assessments guiding repair priorities. Addressing problems before listing prevents surprises during buyer due diligence that reduce home sale proceeds. Documented repairs through licensed contractors provide buyer confidence and inspection report rebuttals.

Title work confirms clear ownership and reveals potential problems early in the home selling process. Title searches through public records identify liens, judgments, easements, and ownership clouds. Most issues resolve straightforwardly through payoffs and documentation. Complex title problems require attorney involvement and sometimes quiet title actions. Clean title insurance commitments support smooth closings and full home sale proceeds transfers. Properties with title issues may require specialized portfolio financing for buyers.

Strategic improvements maximize showing appeal within budget constraints before the home selling process begins. Focus on inexpensive, high-impact improvements rather than major renovations that inflate selling a house costs. Clean, neutral, and well-maintained properties show better than recently renovated but cluttered ones. Price reductions often yield better returns than expensive improvements when evaluating the best way to sell home. Evaluate improvement financing through home equity access for major property preparations.

Gathering documentation streamlines the entire home selling process. Property surveys show boundary lines, easements, and improvements. HOA documents for condominiums and townhomes detail rules, fees, and restrictions. Warranties for major systems and appliances transfer value to buyers. Permit records for improvements verify compliance with building codes. FHA financing requires specific property standards affecting eligible properties during the home selling process.

How Do You Choose Between Traditional Agents and Sell House by Owner?

The sell house by owner versus professional representation decision significantly impacts the home selling process, your time commitment, stress levels, and ultimate home sale proceeds. Understanding trade-offs guides choices matching your situation and determining the best way to sell home.

Traditional full-service agents provide comprehensive management throughout the home selling process. Professional marketing leverages MLS exposure, social media reach, and agent networks. Experienced negotiators protect interests during offer evaluations and counteroffers maximizing home sale proceeds. Transaction coordination prevents costly procedural mistakes during the complex home selling process. Market knowledge supports accurate pricing and positioning. Research agent selection best practices for optimal representation.

Sell house by owner approaches save commission costs improving home sale proceeds but increase time commitments. FSBO sellers retain full control over pricing, showings, and negotiations throughout the home selling process. Saved commissions improve home sale proceeds, particularly on high-value properties. However, limited MLS access reduces buyer exposure significantly during the critical home selling process. Complex legal and procedural requirements create liability risks without professional guidance when you sell house by owner.

Low commission real estate agents balance selling a house costs savings with professional services. These agents charge two to four percent rather than traditional five to six percent commissions. Limited service models reduce personal agent interaction during the home selling process, requiring seller self-sufficiency. Technology platforms provide showing scheduling, offer management, and document handling. Marketing budgets typically run leaner than traditional brokerage operations affecting the best way to sell home exposure.

Agent selection criteria beyond commission rates drive successful outcomes when not choosing to sell house by owner. Local market expertise ensures accurate market value of home determination and positioning. Proven marketing systems maximize property exposure during the home selling process. Strong negotiation skills protect home sale proceeds during offers and inspections. Professional networks accelerate buyer identification. Transaction management experience prevents closing delays and complications.

What Marketing Strategies Maximize Property Exposure in the Home Selling Process?

Modern real estate marketing extends far beyond yard signs, representing the best way to sell home through comprehensive exposure across multiple channels during the home selling process.

MLS listing provides foundational market exposure during the home selling process. All cooperating brokers access listings, exposing properties to entire agent community. Syndication pushes listings to consumer portals like Zillow, Realtor.com, and Redfin automatically. Detailed descriptions with 25-30 photos showcase properties comprehensively. Virtual tours and 3D walkthroughs enable remote property evaluation during the initial home selling process phases.

Professional photography dramatically improves online engagement throughout the home selling process. Properties with professional photos receive 61 percent more views than amateur photography listings. HDR photography captures both interior and exterior details accurately. Drone photography showcases properties and neighborhoods from compelling perspectives. Twilight photography creates emotional appeal through dramatic lighting. Typical photography costs of $200 to $500 represent minimal selling a house costs delivering substantial returns through increased home sale proceeds.

Strategic pricing generates immediate showing activity in the home selling process. Properties priced within five percent of market value of home receive multiple showing requests within days. Overpriced listings languish, eventually requiring price reductions that stigmatize properties and extend the home selling process unnecessarily. Underpriced properties generate bidding wars driving final home sale proceeds above asking prices. Use buyer affordability analysis to understand target market constraints.

Open houses create urgency through time-limited viewing opportunities during the home selling process. Multiple buyers viewing simultaneously stimulates competitive psychology beneficial to home sale proceeds. Agent networking open houses expose properties to buyer’s agents who haven’t yet shown properties. Virtual open houses accommodate remote buyers and international investors. Well-staged open houses with refreshments create memorable impressions supporting the best way to sell home quickly.

How Do You Navigate Offer Negotiations to Maximize Home Sale Proceeds?

The home selling process reaches critical junctures when offers arrive. Strategic negotiation protects your home sale proceeds while maintaining transaction viability and buyer goodwill.

Offer evaluation extends beyond simple price comparisons when considering home sale proceeds. Initial capital amounts signal buyer financial strength and commitment. Financing contingency types reveal transaction risk levels during the home selling process. Conventional financing carries less risk than contingent-on-sale offers. Closing timelines align with your moving plans and purchase contingencies. Earnest money deposits demonstrate buyer seriousness, with typical amounts ranging one to three percent of purchase price.

Seller concessions address buyer requests while preserving net home sale proceeds. Closing cost assistance reduces buyer initial capital requirements without reducing gross sale price. Home warranties costing $400 to $600 provide buyer protection against major system failures. Repair credits allow buyers to address issues rather than requiring seller completion. Personal property inclusions like appliances or furniture sometimes bridge negotiation gaps protecting home sale proceeds.

Multiple offer situations create opportunities for maximizing home sale proceeds through highest and best procedures. Requesting revised offers from all parties by specific deadlines stimulates competitive dynamics. Establishing clear evaluation criteria beyond price helps sort similar offers. Escalation clauses automatically raise buyer offers above competing bids up to specified maximums. Review negotiation best practices for protecting home sale proceeds.

Counteroffer strategies balance multiple objectives during the home selling process. Price increases capture additional value while maintaining buyer interest and maximizing home sale proceeds. Shortened inspection periods reduce transaction risk and accumulated selling a house costs. Requesting stronger earnest money demonstrates buyer commitment. Modified closing dates accommodate your plans. Bridge loans facilitate purchasing before selling completes when timing creates complications in the home selling process.

Understanding Home Sale Capital Gains Exclusion and Tax Planning

How Does the Home Sale Capital Gains Exclusion Protect Home Sale Proceeds?

The home sale capital gains exclusion represents one of the most valuable tax benefits in the Internal Revenue Code, protecting substantial home sale proceeds from federal taxation. Understanding qualification requirements and strategic planning maximizes protection when selling a house.

The home sale capital gains exclusion shelters substantial gains protecting home sale proceeds from taxation. Single filers exclude up to $250,000 of capital gain from their home sale proceeds. Married couples filing jointly exclude up to $500,000. These amounts represent actual profit after subtracting cost basis from gross home sale proceeds. Calculate potential capital gains exposure on your home sale proceeds before listing when selling a house.

Primary residence qualification requires meeting ownership and use tests for the home sale capital gains exclusion. You must have owned the property for at least two of the five years before selling a house. The property must have served as your main home for at least two of the five years before sale. The two-year periods need not be continuous or coincident when determining home sale capital gains exclusion eligibility. Vacation homes and investment properties don’t qualify absent specific circumstances affecting when should i rent out my house decisions.

Each qualifying seller can use the home sale capital gains exclusion protecting home sale proceeds once every two years. The two-year window begins from prior exclusion use, not from prior sale. Multiple property ownership doesn’t accelerate eligibility for subsequent home sale capital gains exclusion benefits. Spouses filing jointly must meet ownership and use requirements individually for maximum home sale proceeds protection. IRS Publication 523 details specific qualification scenarios for home sale capital gains exclusion.

Partial exclusions address unforeseen circumstances when selling a house before meeting full requirements. Job relocations beyond 50 miles from current employment location qualify for partial home sale capital gains exclusion. Health-related moves to care facilities or closer to medical providers create exceptions protecting home sale proceeds. Unforeseen circumstances including divorce, death, multiple births, and certain disasters allow prorated home sale capital gains exclusion. Qualification percentage applies to maximum exclusion amount, not actual gain on home sale proceeds.

What Expenses Increase Cost Basis Reducing Taxable Gains on Home Sale Proceeds?

Understanding cost basis calculations prevents overpaying capital gains taxes on legitimate home sale proceeds exclusions when selling a house. Maintaining documentation throughout ownership supports accurate basis calculations protecting maximum home sale proceeds.

Original purchase price forms baseline cost basis for eventual home sale proceeds calculations. Settlement statements from purchase detail acquisition costs including property price, title insurance, recording fees, and transfer taxes. Legal fees for purchase transaction add to basis protecting future home sale proceeds. Survey costs at purchase qualify as basis additions. Review purchase closing documents to identify all includable costs increasing basis.

Capital improvements increase basis dollar for dollar protecting more home sale proceeds. Additions including rooms, decks, patios, and garages add full costs to basis. Major system replacements of roofing, HVAC, electrical, and plumbing qualify as improvements. Permanent landscaping like retaining walls and sprinkler systems add to basis. Substantial renovations of kitchens and bathrooms count as capital improvements protecting home sale proceeds.

Selling a house costs reduce taxable gains similar to basis increases protecting home sale proceeds. Real estate commissions directly reduce proceeds subject to taxation. Title insurance, attorney fees, and recording costs incurred at sale lower gain calculations. Advertising costs for sale and the cost for home staging expenses qualify as selling costs. Calculate net home sale proceeds after basis and selling cost adjustments for tax planning.

Routine maintenance and repairs don’t increase basis despite costs incurred when selling a house. Painting, minor repairs, and ongoing maintenance preserve property rather than improving it. HVAC repairs short of full system replacement don’t qualify for basis increases. Roof repairs versus complete replacement determine basis treatment affecting home sale proceeds calculations. Documentation distinguishes capital improvements from maintenance for audit defense.

How Does Converting to Rental Affect Should I Rent Out My House and Future Home Sale Capital Gains Exclusion?

Converting primary residences to rental properties complicates home sale capital gains exclusion calculations and requires strategic planning when deciding should i rent out my house versus selling immediately.

Depreciation deductions during rental periods reduce cost basis affecting future home sale proceeds. Residential rental property depreciates over 27.5 years using straight-line methods when you decide should i rent out my house. Calculate depreciation schedules to understand basis reductions before deciding should i rent out my house. Accumulated depreciation reduces basis regardless of whether deductions were claimed. The IRS requires basis reduction even if taxpayers failed to claim legitimate depreciation.

Depreciation recapture taxes previously claimed deductions at 25 percent rates reducing home sale proceeds. Total depreciation claimed multiplies by 25 percent determining recapture tax when eventually selling a house after rental periods. Recapture applies even when home sale capital gains exclusion covers remaining gain. Recapture cannot be offset by the home sale capital gains exclusion, creating surprise tax obligations reducing home sale proceeds when you previously decided should i rent out my house.

Strategic timing of conversions affects qualification for home sale capital gains exclusion protecting home sale proceeds. Converting from primary residence to rental doesn’t immediately disqualify properties from exclusions. The five-year lookback period permits two years of rental use while maintaining qualification. Converting back to primary residence before selling a house can restore full home sale capital gains exclusion eligibility. Evaluate rental conversion strategies through DSCR loan programs when deciding should i rent out my house.

1031 exchange strategies defer gains on investment properties protecting proceeds from immediate taxation. Like-kind exchanges under Section 1031 defer capital gains through property exchanges when you decided should i rent out my house. Qualified intermediaries facilitate compliant transactions within strict timelines. Properties held for rental or investment purposes qualify for exchanges. Primary residences don’t qualify unless converted to investment properties meeting holding requirements.

Implementing Cost for Home Staging Strategies That Maximize Returns

What Cost for Home Staging Investment Delivers Best Returns on Home Sale Proceeds?

The cost for home staging varies dramatically based on property condition, vacant versus occupied status, and service scope. Strategic cost for home staging investments generate measurable returns through higher home sale proceeds and faster sales reducing accumulated selling a house costs.

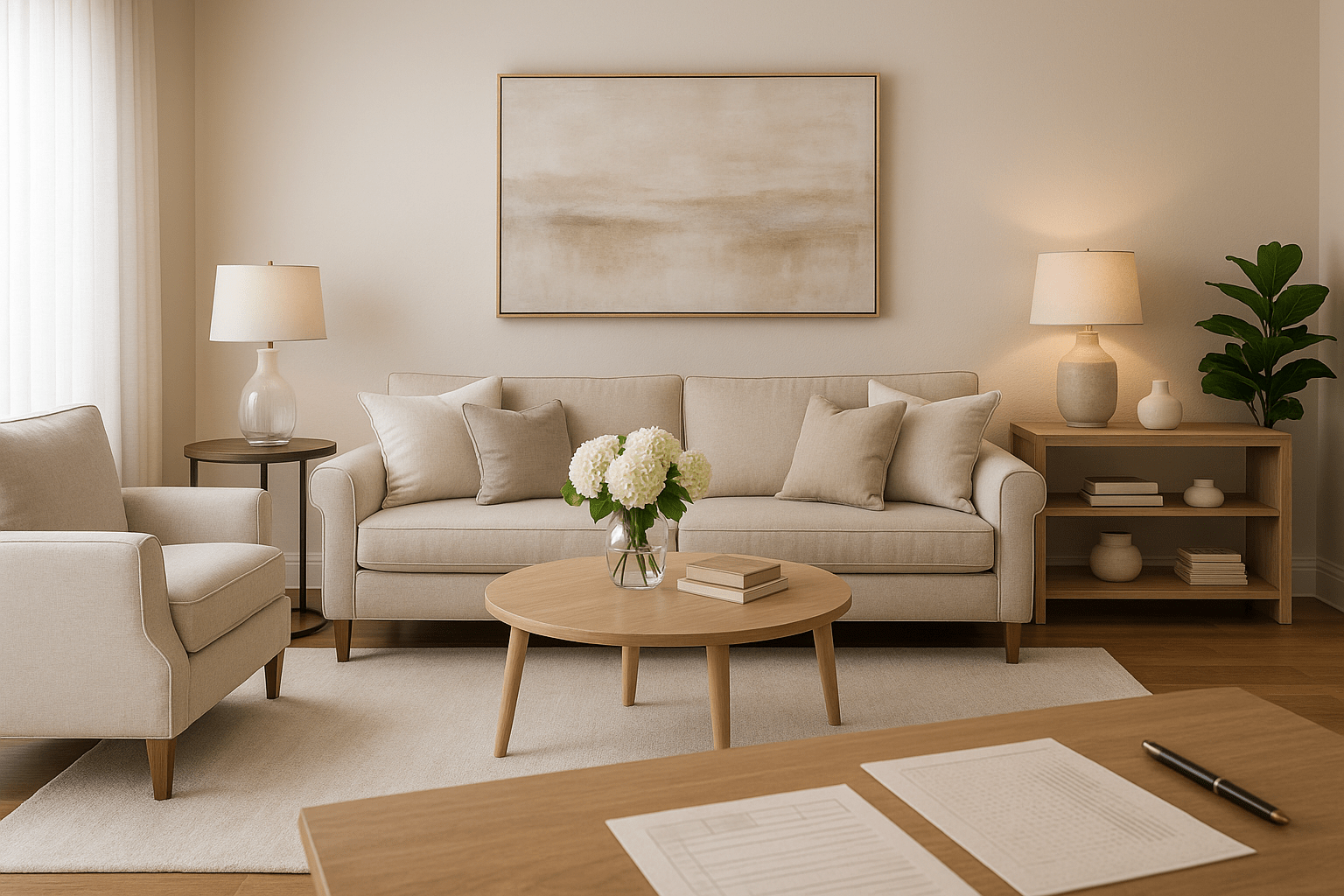

Vacant property staging transforms empty spaces into enviable homes justifying cost for home staging investment. Furnished rooms help buyers understand scale and functionality protecting home sale proceeds through reduced negotiation. Strategic furniture placement highlights architectural features and traffic flow. Complete cost for home staging including living rooms, dining rooms, bedrooms, and bathrooms runs $2,000 to $5,000 for typical three-month listing periods. Partial staging of main living areas reduces cost for home staging while maintaining impact.

Occupied home staging through redesign uses existing furniture minimizing cost for home staging. Professional stagers rearrange furniture optimizing room flow and function. Decluttering and depersonalization allow buyers to envision their belongings. Accessorizing with artwork, plants, and décor creates warmth and appeal. Consultation-only cost for home staging runs $300 to $600 for professional guidance on seller-executed improvements protecting home sale proceeds through better presentation.

Virtual staging digitally furnishes vacant properties in photographs reducing cost for home staging. Photographers shoot empty rooms then digitally add furniture and accessories. Virtual cost for home staging runs $50 to $150 per room versus thousands for physical furniture. Limitations include buyers seeing empty spaces during showings creating disappointment. Ethical considerations require disclosure of virtual enhancements in the home selling process.

Luxury properties justify premium cost for home staging protecting maximum home sale proceeds. Designer furniture, artwork, and accessories create aspirational lifestyle impressions. Complete property staging including outdoor spaces can cost $10,000 to $20,000 monthly. However, million-dollar-plus properties justify cost for home staging through price premiums and accelerated sales. Calculate staging ROI on high-value properties to evaluate whether cost for home staging investment makes sense.

How Does Professional Staging Increase Home Sale Proceeds Beyond Cost for Home Staging?

Understanding staging principles helps sellers evaluate whether cost for home staging delivers value protecting and enhancing home sale proceeds through the home selling process.

Furniture scale and placement guide buyer traffic flow and room understanding increasing home sale proceeds. Oversized furniture makes rooms appear smaller than actual dimensions reducing home sale proceeds potential. Properly scaled pieces demonstrate functional layouts and space capacity. Angled furniture placements create visual interest versus predictable wall-hugging arrangements. Empty corners get filled with plants or small accent furniture preventing dead space that reduces perceived home sale proceeds value.

Color psychology influences buyer emotional responses affecting home sale proceeds beyond cost for home staging. Neutral palettes including grays, beiges, and whites appeal to broadest buyer demographics maximizing home sale proceeds potential. Accent colors through pillows, artwork, and accessories add visual interest without polarizing taste. Bright, light spaces feel larger and more inviting than dark environments supporting higher home sale proceeds. Fresh paint in neutral colors represents highest-ROI improvement beyond cost for home staging.

Decluttering and depersonalization allow buyers to envision their lives in spaces improving home sale proceeds. Removing family photos, personal collections, and excess possessions creates neutral canvases. Clearing countertops, tables, and surfaces makes spaces appear larger and more organized. Organizing closets demonstrates storage capacity rather than owner possessions. Minimalist aesthetic appeals to modern buyers expecting move-in-ready properties worth premium home sale proceeds.

Curb appeal improvements create critical first impressions supporting cost for home staging investment returns. Professional landscaping with fresh mulch, trimmed shrubs, and colorful plantings welcomes buyers. Power-washed exteriors, driveways, and walkways remove years of accumulated grime. Painted front doors and updated hardware provide inexpensive modernization. Strong curb appeal generates online listing clicks and showing requests protecting home sale proceeds through buyer interest.

What Alternatives to Traditional Cost for Home Staging Exist for Maximizing Home Sale Proceeds?

Sellers with limited budgets or occupied properties explore alternatives delivering similar benefits protecting home sale proceeds without full cost for home staging investment.

DIY staging using existing furniture eliminates cost for home staging expenses. Rearranging furniture based on staging principles costs only time and effort. Borrowing neutral throw pillows, artwork, and accessories from friends provides enhancement without cost for home staging fees. Professional staging consultations costing $300 to $600 guide effective DIY execution. However, lack of proper furniture limits achievable impact on home sale proceeds.

Rental furniture services provide temporary staging inventory at moderate cost for home staging levels. Monthly rental fees of $150 to $300 per room deliver furnished-home benefits. Flexible rental terms allow staging only during active listing periods reducing total cost for home staging. Selection includes current furniture styles appealing to target buyer demographics. Calculate cost for home staging rental versus home sale proceeds benefits for financial analysis.

Professional photography enhancement maximizes presentation without full cost for home staging investment. Skilled photographers maximize property strengths through strategic angles and lighting supporting home sale proceeds. HDR photography captures interior and exterior details in single exposures. Editing removes minor distractions and optimizes color balance. Wide-angle lenses make rooms appear larger. Professional photography represents best single investment beyond cost for home staging.

Aggressive pricing compensates for presentation limitations when avoiding cost for home staging. Properties lacking time or budget for cost for home staging improvements price below competition. Reduced prices attract buyers willing to envision post-purchase improvements. Investors purchasing through fix and flip financing target un-staged properties. However, price reductions often exceed cost for home staging making staging more profitable for home sale proceeds.

Evaluating Low Commission Real Estate Agents vs Traditional Representation

What Service Levels Do Low Commission Real Estate Agents Provide in the Home Selling Process?

Low commission real estate agents offer varying service levels at reduced rates compared to traditional representation. Understanding specific service inclusions determines whether this best way to sell home protects your home sale proceeds adequately.

MLS listing and syndication form the foundation of low commission real estate agents services. Properties appear on local MLS databases exposing them to cooperating brokers during the home selling process. Automatic syndication to consumer portals like Zillow and Realtor.com provides public visibility. However, enhanced featured listings typically cost extra with low commission real estate agents. Traditional full-service representation includes comprehensive MLS marketing automatically throughout the home selling process.

Basic photography and signage represent standard inclusions with low commission real estate agents. Amateur-quality photography using smartphones provides minimum coverage. Standard yard signs mark properties during the home selling process. Lockbox installation enables showing access. However, professional HDR photography, drone shots, and twilight images require upgrades with most low commission real estate agents affecting the best way to sell home presentation.

Document preparation and transaction coordination vary significantly among low commission real estate agents. Some models provide experienced coordinators managing paperwork protecting home sale proceeds. Others offer document templates for seller completion. Contract review depth ranges from comprehensive analysis to basic compliance checks. Closing coordination assistance differs dramatically across low commission real estate agents affecting the home selling process smoothness.

Negotiation support from low commission real estate agents ranges from hands-on guidance to self-service resources. Full-service discount brokerages assign experienced agents for offer negotiations protecting home sale proceeds. Limited-service low commission real estate agents provide educational materials for seller-directed negotiations. Counteroffer preparation assistance varies from templates to custom strategy development. Most low commission real estate agents charge additional fees for extensive negotiation involvement.

How Do Commission Structures Compare When Evaluating Selling a House Costs?

Understanding commission economics helps sellers evaluate true selling a house costs versus value received across representation options affecting ultimate home sale proceeds.

Traditional full-service commissions typically total five to six percent as selling a house costs. Commission splits evenly between listing and buyer’s agents at closing. On a $450,000 sale, six percent commission equals $27,000 total reducing home sale proceeds, with $13,500 to each side. Listing agent commissions often get split again with managing brokers. Calculate commission impact on home sale proceeds across different rate scenarios.

Low commission real estate agents charge one to four percent listing-side reducing selling a house costs. One percent listing side remains rare, typically offering only MLS access. Two percent listing-side commissions from low commission real estate agents provide modest service levels. Three percent approaches traditional service with selective economies. Four percent rates question value proposition versus traditional five to six percent affecting best way to sell home decisions.

Buyer’s agent commissions remain separate consideration affecting total selling a house costs. Most sellers using low commission real estate agents still offer three percent buyer’s agent commissions ensuring agent cooperation. Reduced buyer’s agent commissions sometimes reduce showing activity as agents prioritize higher-commission listings. Local market customs dictate competitive buyer’s agent commission rates. Properties offering below-market buyer’s agent commissions risk reduced exposure affecting home sale proceeds.

Flat-fee alternatives separate commission from sale price percentages as selling a house costs. Some services charge fixed fees regardless of sale price providing predictable selling a house costs. Flat fees work better for high-value properties where percentage savings magnify. Lower-priced properties sometimes pay higher effective rates through flat-fee structures. Buyer’s agent commissions still apply at traditional percentage rates as part of total selling a house costs.

When Do Low Commission Real Estate Agents Make Strategic Sense for the Best Way to Sell Home?

Specific seller situations and property characteristics favor low commission real estate agents over traditional full-service models as the best way to sell home protecting home sale proceeds.

Experienced sellers comfortable with self-service components benefit from low commission real estate agents. Previous selling experience reduces guidance needs during the home selling process. Knowledge of contracts and procedures minimizes coordination requirements. Confident negotiators manage discussions effectively with limited support from low commission real estate agents. However, even experienced sellers sometimes miss subtle leverage points professionals identify affecting home sale proceeds.

Properties in extremely hot markets often succeed with low commission real estate agents as best way to sell home. Low inventory and high demand reduce marketing necessity during the home selling process. Multiple immediate offers diminish negotiation complexity. Simple transactions with cash buyers minimize coordination needs. However, market conditions shift quickly making assumptions risky when using low commission real estate agents.

High-value properties magnify savings from low commission real estate agents affecting home sale proceeds. Five percent commission on a $1,000,000 property equals $50,000 versus $20,000 at two percent from low commission real estate agents. Absolute dollar savings justify some service trade-offs. Luxury marketing still demands professional photography. Calculate commission savings across price points evaluating low commission real estate agents value.

Sellers with flexible timelines accepting extended market exposure may benefit from low commission real estate agents. Reduced marketing may extend average days on market slightly. Sellers without urgent deadlines tolerate longer selling periods accumulating higher selling a house costs. Cost savings justify patience for non-urgent transactions. However, carrying costs during extended exposure offset commission savings partially reducing net home sale proceeds benefits.

Determining Should I Rent Out My House vs Selling for Best Returns

What Financial Analysis Determines Should I Rent Out My House vs Sell?

The should i rent out my house versus selling decision requires comprehensive financial analysis comparing immediate home sale proceeds against long-term rental income potential and appreciation.

Home sale proceeds provide immediate liquidity for next purchase or other investments when not asking should i rent out my house. You receive lump-sum home sale proceeds enabling next purchase without delay or rental management burdens. All property management responsibilities disappear when selling versus when you decide should i rent out my house. The home sale capital gains exclusion shelters substantial proceeds from taxation when selling rather than deciding should i rent out my house.

Rental income builds long-term wealth when you decide should i rent out my house instead of selling immediately. Monthly rental income covers mortgage obligations plus generates positive cash flow. Calculate potential rental cash flow before deciding should i rent out my house. Appreciation over decades builds substantial wealth. Depreciation deductions reduce taxable rental income. Mortgage paydown through tenant rent builds equity when you decide should i rent out my house.

The should i rent out my house analysis requires honest evaluation of rental market strength. Do local rental rates cover your full carrying costs including mortgage, taxes, insurance, HOA fees, and maintenance reserves? Strong rental markets with low vacancy rates favor deciding should i rent out my house. Areas with weak rental demand typically favor immediate sale over should i rent out my house conversions. DSCR loan programs qualify rental conversions based on property income when you decide should i rent out my house.

Personal capability assessment determines whether should i rent out my house makes practical sense. Can you handle being a landlord with tenant issues and maintenance calls? Do you have sufficient reserves to cover vacancy periods if you decide should i rent out my house? Will rental conversion affect your ability to use the home sale capital gains exclusion later? Time commitments managing rental properties vary significantly affecting whether you should i rent out my house.

How Does Converting to Rental Affect Future Home Sale Capital Gains Exclusion When You Decide Should I Rent Out My House?

Tax implications play crucial roles when deciding should i rent out my house versus selling immediately to capture home sale capital gains exclusion benefits.

The home sale capital gains exclusion requires primary residence use for two of five years before sale. Converting to rental doesn’t immediately disqualify home sale capital gains exclusion benefits if you later decide against should i rent out my house long-term. The five-year lookback permits two years rental use while maintaining qualification. Converting back to primary residence before sale restores full home sale capital gains exclusion eligibility after deciding should i rent out my house temporarily.

Depreciation claimed during rental periods must be recaptured at 25 percent when eventually selling. Even if home sale capital gains exclusion covers gain, depreciation recapture applies separately. This creates surprise tax obligations reducing ultimate home sale proceeds when you previously decided should i rent out my house. Calculate depreciation recapture tax impact before deciding should i rent out my house.

Strategic timing maximizes both rental benefits and home sale capital gains exclusion protection. Rent for up to three years then reconvert to primary residence before sale. This preserves full home sale capital gains exclusion eligibility while generating rental income. Professional tax advisors guide conversion timing optimizing lifetime outcomes when you decide should i rent out my house. Understanding when should i rent out my house versus sell requires comprehensive tax planning.

1031 exchange strategies defer gains indefinitely when committed to rental property investing beyond temporary should i rent out my house decisions. Like-kind exchanges defer capital gains through property exchanges. Properties held for rental qualify for exchanges. This strategy works when should i rent out my house represents long-term investment plan rather than temporary solution.

Implementing Strategies to Sell House Fast in Any Market Condition

What Pricing Tactics Help You Sell House Fast While Protecting Home Sale Proceeds?

When circumstances require accelerated sales, strategic pricing creates urgency and competitive interest. Understanding psychological pricing triggers represents the best way to sell home quickly while still maximizing home sale proceeds.

Pricing below comparable properties to sell house fast stimulates immediate showing activity. Listings priced five to ten percent below recent sales generate multiple showing requests within 48 hours. Perceived value relative to competition drives buyer urgency when trying to sell house fast. Strategic underpricing often generates bidding wars driving final home sale proceeds to or above market value of home despite initial discount. Calculate optimal pricing thresholds balancing efforts to sell house fast with protecting home sale proceeds.

Psychological price points influence buyer search parameters when you need to sell house fast. Properties priced at $299,000 appear in sub-$300,000 searches maximizing exposure to sell house fast while $301,000 properties don’t. Round numbers like $250,000 or $500,000 create clean search boundaries. Avoiding psychological barriers expands buyer visibility helping sell house fast. Minor price adjustments crossing these thresholds dramatically affect exposure.

Aggressive initial pricing beats multiple reductions for market perception when trying to sell house fast. Properties requiring repeated price cuts develop stigma suggesting problems or unreasonable sellers. Initial aggressive pricing preserves property reputation while generating urgency to sell house fast. Market time accumulation reduces buyer interest as listings age. Properties sitting over 60 days face growing perception challenges regardless of objective quality making it harder to sell house fast.

Flexibility on contingencies and terms complements aggressive pricing to sell house fast. Accepting offers with reasonable inspection and financing contingencies accelerates deals. Flexible closing timelines accommodate buyer needs when trying to sell house fast. Seller-paid closing costs reduce buyer initial capital requirements. Bridge loan financing enables sellers accepting extended closings to sell house fast without jeopardizing their purchase plans.

How Does Property Condition Affect Your Ability to Sell House Fast?

Move-in ready properties with strong presentation sell house fast compared to those requiring buyer imagination or work. Strategic improvements accelerate timelines dramatically representing the best way to sell home quickly.

Neutralized, decluttered, and spotlessly clean properties help sell house fast through optimal showing. Professional cleaning creates favorable impressions. Removing personal items allows buyers to envision their belongings. Neutral paint colors appeal to broader buyer pools helping sell house fast. Fresh, light interiors photograph better supporting efforts to sell house fast.

Minor repairs addressing obvious defects prevent buyer concerns that delay ability to sell house fast. Leaky faucets, cracked caulk, and squeaky doors signal deferred maintenance. Burned-out light bulbs and broken doorknobs distract from property strengths. Addressing minor issues costs little while dramatically improving impressions helping sell house fast. Properties requiring major repairs may benefit from FHA 203k buyer financing when trying to sell house fast to investors.

Professional staging investment helps sell house fast through emotional buyer connections. The cost for home staging ranging $2,000 to $5,000 creates move-in ready appeal. Furnished vacant properties help buyers envision space utilization. Strategic furniture placement highlights room functions. Investment in cost for home staging generates measurable returns helping sell house fast at higher home sale proceeds.

Enhanced curb appeal creates critical positive first impressions helping sell house fast. Fresh mulch, trimmed shrubs, and manicured lawns signal pride of ownership. Power washing siding and driveways removes accumulated grime. Painted front doors provide inexpensive modernization. Buyers decide whether to pursue properties within seconds of arrival affecting ability to sell house fast.

What Marketing Tactics Accelerate Your Ability to Sell House Fast?

Modern real estate marketing represents the best way to sell home quickly through comprehensive exposure accelerating the timeline to sell house fast.

Professional photography investment helps sell house fast through superior online engagement. Properties with professional photos receive significantly more views than amateur photography. HDR techniques capture details accurately. Twilight photography creates dramatic appeal. Drone photography showcases properties from compelling perspectives. Typical $200 to $500 investment pays for itself helping sell house fast through increased buyer interest and higher home sale proceeds.

Aggressive social media advertising helps sell house fast by targeting specific buyer demographics. Facebook and Instagram advertising allows precise targeting by age, income, and location. Video tours reach broader audiences. Sponsored posts to local groups identify nearby buyers. Retargeting campaigns keep properties visible helping sell house fast. Low commission real estate agents often reduce marketing budgets affecting ability to sell house fast.

Strategic open house timing creates urgency helping sell house fast. Multiple simultaneous buyers create competitive psychology. Weekend open houses accommodate working buyers’ schedules. Broker open houses for real estate agents generate awareness. Virtual open houses reach remote buyers. Compelling staging during open houses creates memorable impressions helping sell house fast.

Optimal listing launch timing maximizes initial exposure to sell house fast. Thursday afternoon listings capture weekend showing opportunities. Avoiding holiday weeks when buyer activity slows prevents wasted early days. Spring listing launches capitalize on peak market activity during the best time to sell house. However, urgent timelines sometimes override optimal timing considerations when you need to sell house fast.

When Do Cash Buyers Help You Sell House Fast?

Properties requiring rapid sales sometimes benefit from cash buyer approaches despite pricing concessions. Understanding trade-offs guides decisions about whether this represents the best way to sell home quickly.

All-cash purchases eliminate financing contingencies helping sell house fast with closings in one to two weeks. Cash buyers close transactions quickly versus 30-45 days for financed purchases. Appraisal contingencies disappear with cash transactions. Reduced complexity minimizes deal-falling risk when trying to sell house fast. However, cash buyers demand price concessions for speed and certainty reducing home sale proceeds. Investors utilizing hard money financing move nearly as quickly helping sell house fast.

iBuyer programs provide instant offers with minimal seller effort to sell house fast. Major iBuyer platforms evaluate properties through automated systems generating instant offers. Closing date flexibility accommodates seller timelines. Sellers avoid showing inconvenience when trying to sell house fast. However, offers typically run five to ten percent below market value of home. Service fees approximate traditional selling a house costs.

Real estate investor purchases suit properties with condition issues when trying to sell house fast. Distressed properties face financing obstacles limiting buyer pools. Fix and flip investors purchasing through specialized financing buy properties requiring renovation helping sell house fast. As-is sales eliminate seller repair obligations. However, investor offers reflect renovation costs and profit margins, reducing home sale proceeds significantly. Calculate investment potential understanding buyer perspectives.

1031 exchange buyers face deadline pressures creating opportunities to sell house fast. Investors completing like-kind exchanges operate under 45-day identification and 180-day closing deadlines. Approaching deadlines create urgency motivating premium offers helping sell house fast. Properties matching specific exchange requirements command attention. Understanding exchange dynamics helps sell house fast to time-constrained buyers.

Understanding Sell House by Owner Strategies and Trade-offs

What Are the True Advantages When You Sell House by Owner?

The decision to sell house by owner appeals to sellers seeking maximum control and commission savings. Understanding genuine benefits versus perceived advantages guides informed decisions about the best way to sell home.

Commission savings represent the most compelling reason to sell house by owner. Traditional full-service agent commissions of five to six percent equal $25,000 to $30,000 on a $500,000 property as part of selling a house costs. Even low commission real estate agents cost thousands. Retaining full commission amounts when you sell house by owner increases net home sale proceeds substantially. Calculate commission impact on home sale proceeds to quantify savings when you sell house by owner.

Complete control over property access suits particular sellers who sell house by owner. FSBO sellers determine showing windows matching their schedules during the home selling process. Privacy concerns in owner-occupied homes get addressed through restricted access when you sell house by owner. Limiting showings to serious buyers reduces inconvenience. However, restricted access typically extends market time and reduces buyer pools making it harder to sell house fast.

Direct buyer communication sometimes accelerates negotiations when you sell house by owner. Eliminating agent intermediaries can speed offer discussions and clarifications. Sellers with strong negotiation skills navigate deals effectively when they sell house by owner. However, most sellers lack expertise making direct negotiations risky for protecting home sale proceeds when they sell house by owner.

Niche properties with built-in buyer pools minimize marketing needs to sell house by owner. Properties in communities where residents commonly buy from neighbors suit sell house by owner approaches. Unique properties appealing to specific buyer types facilitate targeted marketing when you sell house by owner. Properties in extremely hot markets sell regardless of marketing approach. However, most properties require comprehensive marketing for optimal home sale proceeds beyond what sellers can achieve when they sell house by owner.

What Challenges Risk Home Sale Proceeds When You Sell House by Owner?

The home selling process involves complex legal, financial, and procedural requirements that challenge sellers who sell house by owner. Understanding obstacles helps evaluate whether to sell house by owner or use professional representation.

Limited MLS exposure dramatically reduces buyer visibility when you sell house by owner. The Multiple Listing Service reaches all cooperating brokers and buyer’s agents actively seeking properties for clients. MLS syndication to consumer portals provides automatic exposure. When you sell house by owner, listings lack this distribution channel, limiting exposure to DIY marketing efforts. Reduced buyer pools typically mean longer market time and lower home sale proceeds when you sell house by owner offsetting commission savings.

Legal and procedural requirements create significant liability exposure to sell house by owner. Purchase agreements contain complex contingencies, disclosures, and legal language. State-specific disclosure obligations vary dramatically requiring local expertise when you sell house by owner. Fair housing laws prohibit certain conduct during showings. Contract mistakes create litigation risk when you sell house by owner. Review legal requirements through consumer protection resources before pursuing sell house by owner strategies.

Negotiation dynamics favor experienced professionals over novices who sell house by owner. Buyer’s agents negotiate full-time, understanding leverage points and common seller mistakes. Sellers who sell house by owner often concede negotiating points unknowingly or accept suboptimal terms reducing home sale proceeds. Emotional attachment to properties impairs objective decision-making when you sell house by owner. Inexperienced negotiators leave significant value on the table.

Transaction management demands substantial time commitments to sell house by owner successfully. Coordinating showings, fielding buyer questions, and managing paperwork consumes hours daily when you sell house by owner. Title company coordination, inspection scheduling, and appraisal arrangements require active management. Working sellers struggle balancing employment obligations with transaction demands when they sell house by owner.

When Does Sell House by Owner Make Strategic Sense as Best Way to Sell Home?

Specific situations favor sell house by owner approaches over traditional representation. Matching your circumstances to successful FSBO profiles increases likelihood of satisfactory home sale proceeds.

Real estate professionals with industry expertise navigate transactions confidently to sell house by owner. Licensed agents, brokers, appraisers, and title professionals understand legal requirements and procedures when they sell house by owner. Transaction familiarity reduces rookie mistake risks. Professional networks facilitate buyer identification. However, representing yourself sacrifices objective third-party perspective even when you sell house by owner.

Properties with waiting buyers minimize marketing needs to sell house by owner. Tenants in rental properties sometimes purchase from landlords they know. Family members or friends expressing interest create natural buyer pools when you sell house by owner. Neighbors seeking to expand holdings approach owners directly. These scenarios reduce marketing needs justifying sell house by owner approaches. Evaluate rental conversion when tenants express purchase interest before deciding should i rent out my house long-term.

Extreme seller’s markets reduce marketing necessity making it easier to sell house by owner. Multiple competing buyers willing to pay asking prices without contingencies favor sellers dramatically. Commission savings in hot markets don’t sacrifice competitive positioning when you sell house by owner. However, markets shift quickly making timing-dependent strategies risky. Professional marketing still maximizes home sale proceeds.

High-value properties magnify commission savings justifying efforts to sell house by owner. Five percent commission on a $1,000,000 property equals $50,000 saved when you sell house by owner successfully. Absolute dollar savings justify some service trade-offs on luxury properties. However, luxury marketing still demands professional photography and sophisticated materials for optimal home sale proceeds even when you sell house by owner.

Comprehensive FAQ Section: Selling a House Successfully

What is the typical timeline for the complete home selling process from listing to closing?