Passive Portfolio Management: Build a $2M Portfolio Without Active Management

Passive Portfolio Management: Build a $2M Portfolio Without Active Management

Active real estate investing demands tremendous time commitments—screening tenants, coordinating repairs, managing contractors, handling emergencies, tracking finances, and making countless operational decisions that transform property ownership into second jobs consuming 10-20+ hours weekly. Many high-income professionals, busy executives, and individuals prioritizing family time or other pursuits want real estate’s wealth-building benefits without sacrificing limited discretionary time to management demands that traditional property ownership requires.

Passive portfolio management strategies allow building substantial real estate portfolios—often reaching $1-3 million in value—through completely hands-off investment approaches where professional operators handle all management responsibilities while you provide capital receiving proportional returns. These strategies range from syndication investments in commercial properties to real estate investment trusts, turnkey rental properties with professional management, and debt investments providing fixed returns without any property ownership responsibilities whatsoever.

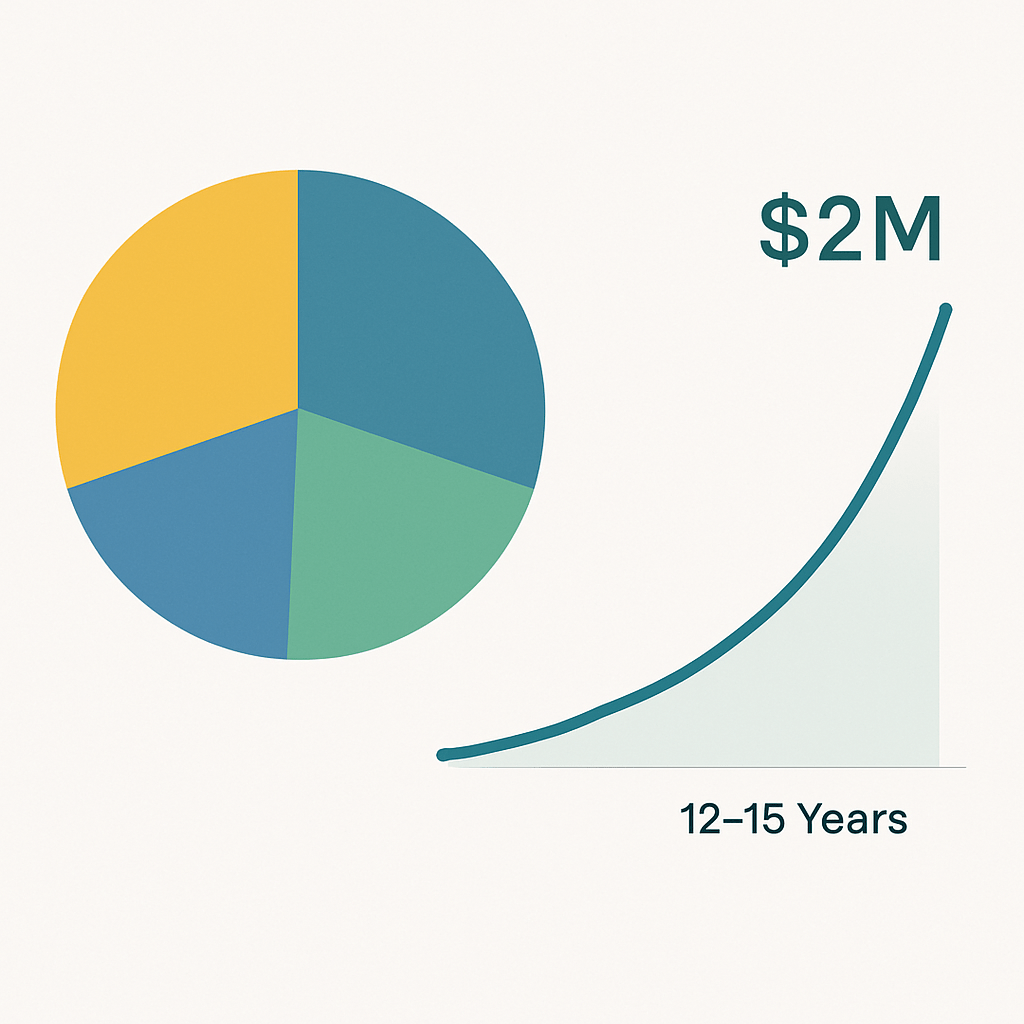

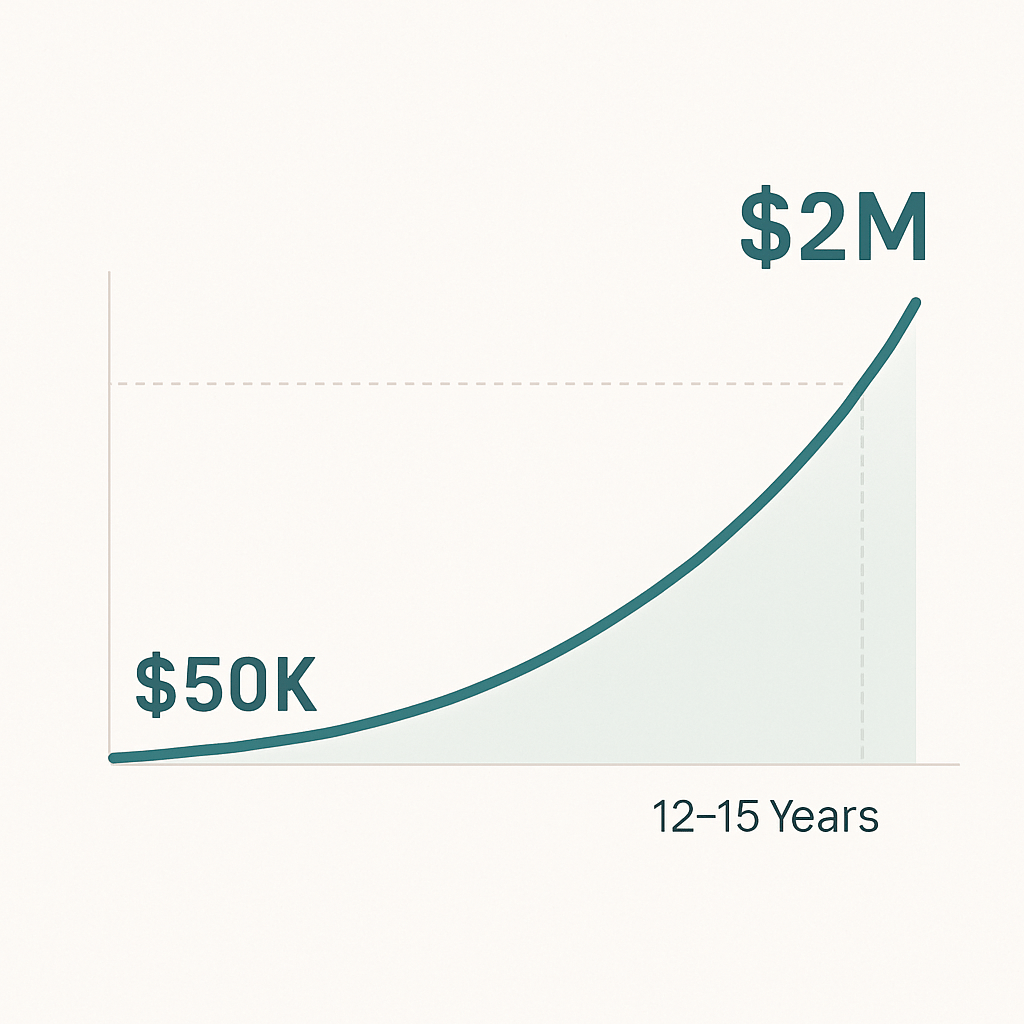

The path to $2 million in passive real estate holdings doesn’t require decades of accumulation or massive initial capital. A disciplined investor deploying $50,000 annually into diversified passive investments targeting 14-18% average returns could reach $2 million in portfolio value within 12-15 years through systematic accumulation and compound growth—without ever managing a property, screening a tenant, or coordinating a repair. Understanding which passive portfolio management strategies align with your capital availability, risk tolerance, time horizon, and return expectations determines whether you successfully build substantial passive wealth or struggle with investments mismatched to your circumstances.

Key Summary

This comprehensive guide explores passive portfolio management strategies for building $2 million real estate portfolios through completely hands-off investment approaches requiring zero active management.

In this guide:

- How passive portfolio management differs from active investing and which investors benefit most from completely passive approaches (passive real estate investment strategies)

- Specific passive investment vehicles including syndications, REITs, turnkey properties, and debt investments with their risk-return profiles (real estate passive investment options)

- Portfolio construction strategies balancing different passive investments for optimal returns with appropriate diversification (investment portfolio diversification)

- Realistic timelines and capital deployment schedules for building $2M portfolios through systematic passive investing (wealth building timelines)

Understanding Passive Portfolio Management: What Makes Investments Truly Passive

Passive portfolio management in real estate means owning fractional interests in properties or funds where professional third-party operators handle all management decisions, operational execution, tenant relations, maintenance coordination, and property-level activities while you receive distributions based on investment performance without any required involvement beyond initial capital deployment and periodic performance monitoring. This definition distinguishes truly passive investments from semi-passive arrangements requiring occasional involvement or active oversight.

The passivity spectrum ranges from completely hands-off (REITs, syndications, funds) to mostly passive (professionally managed turnkey properties, triple-net lease properties) to semi-passive (properties with management but requiring owner oversight and major decision participation). True passive portfolio management focuses on the completely hands-off category—investments where you literally do nothing after capital deployment except receive distributions, review quarterly reports, and make occasional decisions about re-investing proceeds or taking distributions. Your time commitment approximates zero hours weekly compared to 10-20+ hours for active property management.

Returns on passive investments typically range 8-20% annually combining cash distributions and appreciation, with specific returns depending on investment type, leverage levels, operator quality, and market conditions. Conservative passive approaches targeting 8-12% returns emphasize stable current income through REITs or debt investments, while aggressive approaches targeting 15-20% returns pursue syndications, funds, or other equity positions with higher risk profiles and operational complexity. Most balanced passive portfolio management strategies target 12-16% blended returns across diversified holdings—generating wealth accumulation comparable to or exceeding active investing without any time requirements.

Passive portfolio management benefits specific investor profiles more than others. High-income professionals earning $200,000+ annually whose time values at $150-$300+ hourly find passive approaches economically superior—spending 15 hours monthly on active management costs $2,250-$4,500 in opportunity cost, potentially exceeding returns that active involvement generates over passive alternatives. Busy executives and business owners lacking discretionary time for property management regardless of hourly value similarly benefit. Geographic flexibility seekers wanting to relocate, travel extensively, or maintain multiple residences benefit from portfolios not tied to specific cities requiring local presence. Individuals approaching retirement wanting to transition from active management to passive income benefit from building passive positions before work cessation eliminates time for active involvement.

Tax considerations in passive portfolio management create both advantages and limitations compared to active property ownership. Passive investments generate passive income subject to passive activity loss rules—losses from passive investments typically can only offset passive income, not wages or business income, unless you qualify as real estate professional. However, depreciation from direct property ownership (even through syndications) creates paper losses potentially offsetting other passive income. Additionally, long-term capital gains treatment on eventual sales preserves more wealth than ordinary income taxation. Understanding these tax implications helps structure passive investments optimizing after-tax returns within your specific tax situation.

Liquidity considerations distinguish different passive investment types significantly. Publicly traded REITs provide daily liquidity through stock exchanges—you can sell positions any time at market prices with settlement in days. Private syndications and funds remain illiquid for 3-7 years until properties sell or funds liquidate—no secondary markets exist for early exits except at substantial discounts. Debt investments might offer semi-liquidity through loan sales or early payoffs depending on structures. Turnkey properties with management provide moderate liquidity—you can sell properties in months through normal real estate marketing, but not instantly. Balancing liquidity needs against return targets guides passive investment selection ensuring you don’t commit capital to illiquid positions when near-term access might prove necessary.

Control versus returns trade-offs define passive investing fundamentally—you’re sacrificing operational control and decision-making authority to operators in exchange for professional management expertise and time freedom. This trade works when operators possess superior expertise, economies of scale, or market access you couldn’t replicate independently. However, surrendering control creates vulnerability to operator competence and integrity—poor operators destroy returns despite your having no ability to intervene. Thorough operator due diligence before investing matters enormously when passive portfolio management means delegating all control to third parties managing your capital.

Passive Investment Vehicle #1: Real Estate Syndications and Private Funds

Real estate syndications allow passive portfolio management through fractional ownership in commercial properties—apartment complexes, office buildings, retail centers, industrial warehouses—where general partners acquire and manage properties while limited partners provide capital receiving proportional returns. Investment minimums typically range $25,000-$100,000 per deal, with hold periods of 3-7 years until properties sell or funds liquidate.

Syndication structures organize as limited liability companies or limited partnerships where you become limited partner contributing capital but maintaining zero operational responsibilities or management authority. General partners source deals, coordinate acquisitions, oversee property management, implement business plans (renovations, operational improvements, leasing strategies), and eventually orchestrate exits through sales. You receive quarterly distributions from net operating income after debt service, plus profit participation when properties sell based on negotiated waterfall structures prioritizing limited partner returns before general partners earn promoted interests.

Return profiles on syndications typically target 14-20% internal rates of return combining quarterly distributions (6-10% annual cash-on-cash returns) plus appreciation realized at sale. Conservative stabilized property syndications might target 12-15% IRRs focusing on cash flow stability over appreciation, while value-add strategies involving renovations and operational turnarounds target 16-20%+ IRRs through forced appreciation beyond market trends. Evaluate whether projected returns adequately compensate for specific risks—execution challenges, market cycles, operator competence, leverage levels—ensuring return targets reflect realistic scenarios rather than best-case optimism.

Sponsor selection determines syndication success more than property selection—competent sponsors generate returns even with challenging properties while incompetent sponsors destroy value despite acquiring excellent assets. Evaluate sponsor track records across complete investment cycles showing properties purchased and sold with actual versus projected returns documented through third-party verification. Assess sponsor team depth, financial strength, alignment of interests through personal capital contributions, and communication quality through regular reporting. Request references from prior limited partners verifying sponsor performance, integrity, and appropriate handling of challenges when they inevitably arise.

Diversification within syndication investing requires multiple positions across different sponsors, markets, property types, and strategies. Rather than concentrating $500,000 with single sponsor, deploy capital across six $80,000 syndication positions with different operators in various markets pursuing diverse strategies. This diversification protects against single sponsor failure, market downturns affecting specific regions, or strategy-specific challenges (value-add execution risks, market timing issues) destroying concentrated positions. Build diversified syndication portfolios over 2-4 years as appropriate opportunities arise rather than rushing into limited options forcing concentration.

Private real estate funds pool capital from multiple investors deploying across several properties simultaneously or sequentially, providing instant diversification compared to single-property syndications. Funds might invest in 5-15 properties across multiple markets and property types, reducing single-asset concentration risk while maintaining passive investment structure. Fund minimums often exceed single syndication minimums—perhaps $100,000-$250,000—reflecting institutional structures and operational complexity. Funds benefit sophisticated investors with sufficient capital for comfortable minimums and desire for instant diversification, though they sacrifice property-level transparency that single-asset syndications provide.

Opportunity zones provide additional tax benefits when syndications or funds invest in designated economically distressed areas. Capital gains from other investments can be rolled into opportunity zone funds within 180 days, deferring gain recognition until 2026 or fund disposition. Hold opportunity zone investments 10+ years and all appreciation becomes completely tax-free—powerful incentive for appropriate investors with suitable time horizons and risk tolerance for challenged locations offering uncertain returns compensated only through tax benefits. Use our investment growth calculator modeling how opportunity zone tax benefits affect ultimate after-tax returns across different holding periods and return scenarios.

Passive Investment Vehicle #2: Real Estate Investment Trusts (REITs)

Publicly traded real estate investment trusts provide the most liquid passive portfolio management option—owning shares in professionally managed portfolios of commercial properties across various sectors (residential, office, retail, industrial, healthcare, data centers) with daily trading on stock exchanges allowing purchases and sales within seconds at market prices.

REIT structures require distributing 90%+ of taxable income to shareholders, creating high dividend yields typically ranging 3-6% annually plus potential share price appreciation from portfolio value growth. Total returns on publicly traded REITs average 8-12% annually historically, combining dividends with capital appreciation, though specific performance varies dramatically by sector, management quality, and market cycles. REITs underperform direct real estate ownership’s return potential but compensate through perfect liquidity, instant diversification, professional management, and zero time requirements.

REIT categories span residential (apartment buildings, manufactured housing, single-family rentals), office (urban towers, suburban campuses), retail (shopping malls, strip centers, freestanding stores), industrial (warehouses, distribution centers, fulfillment facilities), specialized (healthcare facilities, self-storage, data centers, cell towers), and mortgage REITs (lending rather than property ownership). Diversify across multiple REIT sectors preventing concentration in single property types facing sector-specific challenges—perhaps 30% residential, 25% industrial, 20% specialized, 15% office, 10% retail balancing stable income generators with growth opportunities.

Public versus private REITs present trade-offs between liquidity and returns. Public REITs trade on exchanges providing instant liquidity but face market volatility where share prices fluctuate based on investor sentiment often disconnected from underlying property values. Private REITs (non-traded) typically target higher returns (10-14% versus 8-12% for public REITs) and avoid daily price volatility, but sacrifice liquidity requiring multi-year commitments before redemptions. Most passive portfolio management strategies emphasize public REITs for their liquidity advantages despite accepting slightly lower returns and price volatility, using private REITs selectively when comfortable with illiquidity in exchange for enhanced yield.

REIT taxation creates complexity compared to direct property ownership—dividends face ordinary income taxation rather than preferential qualified dividend rates, though portions classified as return of capital receive favorable treatment deferring taxation until share sales. No depreciation deductions pass through to REIT shareholders unlike direct property ownership or syndications providing paper losses. However, REITs’ simplicity (1099-DIV forms instead of K-1s), liquidity, and diversification often outweigh tax disadvantages for appropriate investors. Calculate after-tax returns comparing REIT taxation to direct ownership ensuring liquidity and simplicity benefits justify any tax efficiency sacrifices.

Portfolio allocation to REITs within overall passive real estate holdings balances liquidity needs against return optimization. Conservative approaches might allocate 40-60% of passive portfolios to public REITs providing liquidity and stability, with remaining 40-60% in higher-returning illiquid syndications or private investments. Aggressive approaches focused purely on return maximization might allocate only 10-20% to REITs for emergency liquidity while concentrating 80-90% in syndications and private funds targeting superior returns. Your specific allocation depends on liquidity requirements, risk tolerance, and whether you maintain other liquid assets (stocks, bonds, cash) outside real estate providing access to capital when unexpected needs arise.

REIT selection within publicly traded options requires evaluating specific fund management quality, property portfolio composition, balance sheet strength, dividend sustainability, and historical performance across market cycles. Some REITs specialize in single sectors (pure-play apartment REITs) while others diversify across multiple property types. Some operate conservatively with low leverage and stable properties while others pursue aggressive growth through acquisitions and development. Research individual REITs through financial statements, analyst reports, and management track records rather than treating all REITs as interchangeable commodities—quality REITs significantly outperform inferior competitors over multi-year periods justifying selectivity despite broader sector exposure benefits.

Passive Investment Vehicle #3: Turnkey Rental Properties with Professional Management

Turnkey rental properties combine direct property ownership benefits (depreciation, appreciation, direct control if desired) with passive management through professional property management companies handling tenant relations, maintenance, leasing, and operations. You own properties directly—taking title, securing financing, claiming tax benefits—but delegate all operational responsibilities to managers charging 8-12% of collected rents.

Turnkey providers specialize in acquiring, renovating, tenant-placing, and selling ready-to-operate rental properties to investors seeking passive income without acquisition headaches or renovation project management. These companies purchase distressed properties, complete renovations bringing them to rent-ready condition, place qualified tenants, establish property management, then sell turnkey packages to investors buying properties already generating income from day one. Purchase prices typically range $100,000-$300,000 for single-family or small multifamily properties depending on markets, with cash flow often supporting most or all debt service when financed conservatively.

Management company selection critically determines turnkey passive portfolio management success—excellent managers maintain properties properly, screen tenants effectively, handle issues promptly, and communicate proactively, while poor managers allow properties deteriorating, place problematic tenants, ignore maintenance, and provide minimal updates. Evaluate management companies through existing client references (not company-provided testimonials), online review research, transparency about processes and fees, technological capabilities (online portals providing real-time financial access), and size/stability suggesting ongoing viability. Established companies managing 1,000+ properties demonstrate scale and staying power compared to startups managing 50-100 properties potentially folding if a few clients leave.

Geographic considerations affect turnkey investment success significantly. Invest in markets where turnkey providers and management companies demonstrate track records, where landlord-friendly laws protect owner interests, where employment diversity prevents single-industry dependence, and where population growth supports housing demand. Markets like Memphis, Indianapolis, Birmingham, Kansas City, and other Midwest/Southeast cities often provide strong cash flow with affordable entry prices, though appreciation potential might lag coastal markets. Balance current income (favoring cash-flow markets) against appreciation potential (favoring growth markets) based on whether you prioritize immediate distributions or long-term wealth accumulation.

Financing turnkey properties through DSCR loans allows qualification based on rental income rather than personal finances, enabling portfolio scaling beyond conventional financing limits of 10 properties. DSCR loans assess whether property rental income sufficiently covers debt service (typically requiring 1.25x coverage or better), ignoring personal income, employment, or other qualification factors constraining conventional financing. This income-based approach particularly benefits high-earning professionals whose strong incomes might not translate to conventional mortgage qualification due to high existing debt levels or self-employment income documentation complexity. Calculate DSCR qualification using our DSCR loan calculator understanding which properties qualify under income-based underwriting.

True passivity in turnkey investments depends on appropriate reserve maintenance and realistic expectations about owner decision-making. Even with professional management, you make final decisions on major repairs, capital improvements, tenant removal, property sales, refinancing, and other strategic choices. Management companies execute decisions but typically require owner approval for expenditures exceeding certain thresholds (perhaps $500-$1,000). Maintain 6-12 months of operating expense reserves ensuring you can fund unexpected repairs, extended vacancies, or tenant-caused damages without financial stress forcing poor decisions. Budget monthly into reserves from positive cash flow building capital cushions preventing surprise expenses from destroying otherwise passive ownership.

Turnkey portfolios require more active monitoring than syndications or REITs despite professional management—you should review monthly financial statements, monitor occupancy and rent collection, approve maintenance beyond routine items, and periodically inspect properties (annually or bi-annually) ensuring they’re being maintained appropriately. This monitoring requires perhaps 2-4 hours monthly per property—substantially less than self-management’s 5-10 hours weekly but more than syndications’ quarterly report review. Turnkey strategies work best for investors wanting more control and direct ownership benefits than syndications provide, accepting slightly increased time commitments in exchange for enhanced returns and preferential tax treatment through direct property ownership.

Passive Investment Vehicle #4: Real Estate Debt Investments

Debt investing in real estate provides completely passive fixed-return investments where you lend capital to property owners or operators receiving interest payments without property ownership, appreciation participation, or management responsibilities. Returns typically range 7-12% annually depending on security level, borrower quality, and loan terms, providing stable income streams less volatile than equity investments but with limited upside beyond contractual interest rates.

Private lending to individual real estate investors creates opportunities earning 8-11% interest on loans secured by properties as collateral. These loans fund acquisitions, renovations, or bridge financing for investors unable or unwilling to use traditional mortgages. As lender, you receive monthly interest payments typically on interest-only terms over 12-24 months, with principal returning when borrowers sell properties, refinance into permanent financing, or pay loans off through other capital sources. Security comes through first-position liens on properties plus personal guarantees from borrowers creating multiple recovery paths if defaults occur.

Debt funds pool capital from multiple investors deploying across diversified loan portfolios, spreading default risk across 20-50+ loans rather than concentrating in single-borrower exposure. These funds might target 9-12% returns through higher-risk lending to borrowers conventional lenders decline—fix-and-flip investors, value-add operators, or borrowers with recent credit challenges but strong current financial positions. Fund diversification reduces single-loan default impact while professional fund managers source loans, conduct due diligence, monitor borrower performance, and handle collection activities when problems arise. Minimum investments typically range $25,000-$100,000 for passive participation in professionally managed debt portfolios.

Mortgage notes represent existing loans you purchase from original lenders or note brokers at discounts to remaining balances, earning returns through interest collection plus profit at payoff when remaining balances exceed purchase prices. Example: purchasing $200,000 remaining balance loan for $175,000 creates immediate equity plus ongoing interest income. Note investing requires expertise evaluating borrower quality, property values securing loans, and note pricing determining whether purchase prices justify risks, making this strategy more suitable for sophisticated investors or those working with experienced advisors rather than beginners pursuing passive strategies without relevant expertise.

Real estate crowdfunding platforms democratize debt investing by accepting smaller minimums (often $5,000-$25,000) and providing online marketplaces connecting investors with borrowers seeking financing for specific projects. These platforms conduct borrower vetting, property evaluations, and loan structuring, presenting finished opportunities to investors who select loans based on risk profiles and return targets. Platforms charge fees (1-3% of loan amounts typically) reducing net returns but provide access to diversified debt investing without requiring borrower networks or lending expertise individual investors lack. Research platform track records, default rates, recovery percentages, and investor protections before committing capital—platform quality varies dramatically affecting actual returns despite similar projected yields.

Security levels in debt investments determine risk-return profiles significantly. First-position liens provide superior protection—if borrowers default and properties foreclose, first lienholders get paid first from sale proceeds before any junior lienholders or equity owners receive anything. Second-position liens behind existing first mortgages carry higher default risk—property values must exceed first-position debt plus your loan amount to recover capital fully in foreclosures. Conservative debt investors focus exclusively on first-position lending at 65-75% loan-to-value ratios providing equity cushions protecting against value declines, while aggressive approaches pursue second-position loans or higher LTV first liens earning premium yields compensating for elevated risks. Balance your debt portfolio across security levels diversifying risk exposures appropriately.

Debt investments provide stable cash flow immune to property operational performance—you earn contractual interest regardless of whether properties achieve profitability, maintain occupancy, or appreciate. This stability appeals to conservative investors prioritizing income consistency over return maximization. However, debt investments sacrifice appreciation upside—you earn only interest and principal return regardless of property value increases equity investors capture. Additionally, debt investments lack depreciation tax benefits direct property ownership provides. Weigh these trade-offs when allocating passive portfolio capital between debt (stability, simplicity, fixed returns) and equity positions (volatility, complexity, unlimited upside potential).

Building Your $2M Passive Portfolio: Capital Deployment Strategies

Reaching $2 million in passive real estate holdings requires systematic capital deployment over 10-20 years depending on initial capital, contribution rates, and achieved returns. Understanding realistic timelines and disciplined accumulation strategies prevents either underestimating required commitment or pursuing unsustainable aggressive approaches likely failing under pressure.

Initial capital availability determines feasible timelines significantly. Starting with $200,000 investable capital reaches $2 million in approximately 8-10 years targeting 15% average returns with no additional contributions. Starting with $50,000 requires adding $40,000-$50,000 annually to reach $2 million in 12-15 years at similar returns. Starting from zero requires aggressive annual contributions of $75,000-$100,000 sustaining over 10-15 years depending on achieved returns. Calculate your specific timeline using our passive income calculator understanding how initial capital, annual contributions, and target returns interact determining accumulation speed.

Annual contribution discipline matters more than initial capital for most investors—consistently deploying $40,000-$60,000 annually into passive investments over 15 years builds $2 million portfolios assuming moderate 14-16% returns. Structure automatic contributions from employment income, business profits, or investment account transfers ensuring capital deployment occurs systematically regardless of market timing concerns or hesitation. Many successful passive investors allocate 15-25% of annual income to real estate systematically, treating contributions as non-negotiable obligations rather than discretionary amounts deployed only when “extra” money appears.

Diversification strategies balance return optimization against risk management through allocating capital across multiple passive investment types, sponsors, markets, and strategies. A balanced $2 million passive portfolio might allocate: 30% to syndications (6-8 positions across different sponsors and markets), 25% to public REITs (diversified across sectors), 25% to turnkey rental properties with management (4-6 properties in different markets), and 20% to debt investments (private lending or debt funds). This allocation provides income stability through REITs and debt, growth potential through syndications and appreciation, diversification across strategies and operators, and balanced liquidity combining instantly liquid REITs with illiquid longer-term positions.

Sequential versus parallel deployment approaches differ in building speed and diversification timing. Sequential deployment invests fully in one opportunity before considering additional positions—perhaps deploying $100,000 completing a syndication position, then waiting to accumulate additional $100,000 for next investment. This approach ensures full position sizes but creates concentration during building phase. Parallel deployment spreads capital across multiple opportunities simultaneously—perhaps investing $25,000 each into four different syndications rather than $100,000 into one, accepting smaller position sizes but achieving faster diversification. Most sophisticated passive portfolio management uses parallel approaches prioritizing diversification over maximizing individual position sizes.

Reinvestment strategies compound growth acceleration through deploying distributions and sale proceeds into additional passive investments rather than consuming cash flow for lifestyle expenses. If syndications distribute $15,000 annually and you reinvest rather than spend, compounding dramatically accelerates wealth accumulation. Example: $500,000 passive portfolio generating 8% annual distributions ($40,000) and 6% annual appreciation ($30,000) creates $70,000 total annual returns. Reinvesting all returns grows portfolio 14% annually, reaching $2 million in approximately 10 years. Consuming distributions grows portfolio only 6% annually from appreciation alone, requiring 24 years reaching $2 million. Lifestyle balance matters—consuming some distributions while reinvesting portions creates sustainable approaches supporting current needs while building long-term wealth.

Market cycle considerations affect passive portfolio management deployment timing—investing during economic downturns, market corrections, or distressed conditions provides enhanced returns through acquiring assets at depressed valuations with superior risk-reward profiles. However, timing markets perfectly proves impossible, and waiting for perfect entry timing often means never deploying capital. Disciplined systematic deployment regardless of market conditions using dollar-cost averaging approaches generally outperforms attempting to time bottoms and peaks. During strong markets, emphasize debt investments and conservative equity positions reducing valuation risk. During corrections, emphasize equity investments and value-add strategies capturing cyclical opportunities.

Tax Optimization in Passive Portfolio Management

Tax efficiency in passive portfolio management significantly affects after-tax returns—investors in high tax brackets potentially improving effective returns by 200-400 basis points through strategic tax planning compared to ignoring tax implications entirely.

Depreciation benefits from syndications and direct property ownership (turnkey rentals) create paper losses offsetting passive income despite receiving positive cash distributions. A syndication generating $8,000 annual distributions might allocate $12,000 depreciation to your position—you receive $8,000 cash but report $4,000 loss on tax returns. These losses offset passive income from other syndications, rental properties, or passive business activities, reducing current tax obligations. However, passive activity loss rules restrict using passive losses to offset active income (wages, active business income) unless you qualify as real estate professional meeting IRS material participation standards.

Real estate professional status requires spending 750+ hours annually in real estate activities and more time in real estate than any other occupation, allowing passive real estate losses to offset ordinary income from any source. This powerful designation transforms passive losses into usable deductions against six-figure W-2 income, potentially saving $20,000-$50,000+ annually in taxes for high earners with substantial passive real estate holdings. However, achieving and maintaining real estate professional status requires significant time commitment (15+ hours weekly minimum) potentially conflicting with truly passive investment approaches. Some investors achieve status through spouses dedicating full-time to real estate activities while primary earners maintain high-income careers, creating family-level tax benefits from real estate professional designation.

Capital gains treatment on eventual property sales or syndication exits preserves more wealth through preferential long-term capital gains rates (15-20% federal plus state taxes) compared to ordinary income taxation at 37%+ marginal rates. Hold passive investments 12+ months ensuring long-term capital gains treatment rather than short-term ordinary income taxation destroying wealth through excessive taxation. For investors in highest tax brackets, this difference represents 17-20+ percentage point savings—substantial enough to materially affect which passive investment strategies prove most attractive after considering tax implications.

REIT dividend taxation as ordinary income creates tax disadvantages compared to qualified dividends from stock investments receiving preferential rates. However, portions of REIT dividends classified as return of capital receive favorable treatment—deferring taxation until REIT share sales, then facing capital gains rates rather than ordinary income rates. Additionally, REIT dividends’ simplicity (1099-DIV forms requiring no special handling) and liquidity advantages often outweigh tax efficiency differences. Calculate after-tax returns comparing REIT ordinary dividend taxation to syndication distributions partially offset by depreciation deductions, understanding which vehicles prove superior after considering your specific marginal tax rates.

Tax-loss harvesting in public REIT positions provides opportunities using market volatility strategically. When REIT share prices decline below purchase prices, selling positions realizes capital losses offsetting capital gains from other investments (including eventual real estate syndication sales). Immediately repurchase different REITs avoiding wash sale rules while maintaining real estate exposure—selling one apartment REIT at loss then immediately buying different apartment REIT preserves sector allocation while capturing tax benefits. This strategy works only with publicly traded REITs providing daily pricing and instant liquidity, not illiquid syndications or turnkey properties where market values prove harder to determine and selling involves lengthy processes.

Opportunity zone investments provide temporary capital gains deferral plus permanent elimination of appreciation if held 10+ years—one of the most powerful tax strategies available to passive real estate investors with suitable time horizons and risk tolerance for opportunity zone locations. However, opportunity zone benefits only apply when rolling capital gains from other sources into these investments—you can’t use ordinary income or previously tax-deferred retirement accounts. Plan opportunity zone deployment strategically around major taxable events (business sales, large investment position liquidations, property sales outside 1031 exchanges) creating capital gains eligible for opportunity zone tax treatment.

State tax planning through allocating investments across different states affects overall tax obligations substantially—real estate income gets taxed where properties locate, not where you reside. High-tax-state residents (California, New York, New Jersey) benefit from passive investments in zero-income-tax states (Texas, Florida, Tennessee, Nevada, Washington) reducing state tax burdens. A California resident earning $40,000 annually from Texas syndications pays zero state tax on that income versus $4,400+ in California state taxes on equivalent California investments—potentially improving returns by 11% purely through geographic tax planning. Actively consider state tax implications when evaluating passive investments across different markets.

Common Mistakes in Passive Portfolio Management

Even sophisticated investors make preventable errors pursuing passive real estate wealth, understanding these mistakes helps you avoid costly learning experiences that destroy capital or derail portfolio building momentum.

Over-concentration with single sponsors creates catastrophic risk when operators fail—even with excellent track records, any sponsor might encounter unforeseen challenges destroying returns across all their investments. Diversify across minimum 4-6 different sponsors ensuring single sponsor failure doesn’t devastate your entire passive portfolio. Some investors develop comfort with particular sponsors after initial success, then concentrate 70-80% of capital with those operators—disastrous approach if those sponsors subsequently stumble. Maintain discipline limiting any single sponsor relationship to 20-30% maximum of total passive holdings regardless of past performance or personal relationships.

Chasing yields without understanding risks leads to investments in high-risk deals projecting 25-30% returns that frequently result in capital losses rather than outsized gains. Yields exceeding 20% typically indicate either exceptional opportunity (rare) or elevated risk (common)—most passive investments generating sustainable 20%+ returns involve substantial execution risk, market timing dependencies, or leverage levels creating significant downside exposure. Realistic passive portfolio management targeting 12-16% blended returns proves more sustainable than aggressive approaches chasing 20%+ yields likely leading to boom-bust cycles with ultimate returns proving inferior to consistent moderate performance.

Ignoring liquidity needs by allocating 100% of passive capital to illiquid syndications and funds creates problems when unexpected expenses, opportunities, or personal circumstances require capital access. Maintain 20-40% of passive portfolios in liquid investments (public REITs, debt positions allowing early exits) ensuring you can access capital within days or weeks rather than being completely locked into multi-year hold periods. Liquidity becomes particularly important as portfolios grow—$100,000 illiquid portfolio might seem manageable, but $1.5 million completely illiquid creates substantial vulnerability to life changes requiring capital flexibility.

Inadequate due diligence rushing into investments under time pressure leads to capital commitments with problematic sponsors, poor operating agreement terms, or unrealistic financial projections. Many sponsors create artificial urgency—”closing in 48 hours,” “only 2 spots remaining,” “won’t see opportunities like this again”—pressuring quick decisions without thorough evaluation. Resist this pressure: legitimate opportunities allow adequate due diligence time (minimum 7-14 days), strong sponsors welcome analytical questioning, and abundant passive investments always exist. Missing one opportunity to maintain diligence standards proves far less costly than committing capital hastily to unsuitable investments.

Treating passive investments as completely set-and-forget without ongoing monitoring creates vulnerabilities to sponsor underperformance or problems going undetected until irreversible. Even with professional operators handling management, you should review quarterly financial reports, monitor whether distributions and performance match projections, maintain awareness of market conditions in investment locations, and stay current on sponsor communications. This monitoring requires perhaps 1-2 hours quarterly per position—minimal time commitment protecting capital through early problem identification allowing corrective action before minor issues become catastrophic failures.

Failing to rebalance portfolios as they mature leaves holdings drifting from intended allocations toward whatever performs best, creating inadvertent concentration in recent top performers—exactly when those strategies might face mean reversion or market corrections. If initial 30/25/25/20 allocation across syndications/REITs/turnkey/debt drifts to 45/30/15/10 through syndication outperformance, you’ve concentrated toward equity exposure beyond intended risk levels. Periodically rebalance toward target allocations through directing new capital to underweighted categories or occasionally trimming overweight positions when possible (selling liquid REITs or exiting maturing syndications without immediate redeployment into similar positions).

Lifestyle inflation consuming all distributions prevents compounding acceleration that builds wealth most efficiently. Early passive portfolio development requires reinvesting most or all distributions enabling compound growth, yet many investors immediately increase spending matching new cash flow rather than maintaining prior living standards while reinvesting income. This consumption mindset extends timelines reaching wealth targets by years or decades. Establish discipline: reinvest 80-100% of distributions during accumulation phase (perhaps first 10-15 years), then gradually increase consumption as portfolios reach sufficient scale supporting lifestyle needs while continuing growth.

Your Next Steps: Launching Your Passive Portfolio Management Strategy

Converting passive portfolio management knowledge into actual wealth accumulation requires systematic steps establishing foundation, initial investments, and ongoing discipline over multi-year periods building substantial portfolios.

Clarify your specific goals, timeline, and capital availability before evaluating investment opportunities. How much do you want to accumulate? Over what timeline? How much initial capital do you have? What annual contributions can you sustain? What returns do you need to reach goals within desired timelines? What risk tolerance do you possess—comfortable with aggressive equity positions or preferring conservative debt and stable income? Answering these questions guides you toward appropriate passive investment strategies matching your circumstances rather than pursuing unsuitable approaches likely frustrating you through misalignment.

Schedule a call discussing passive portfolio management strategies and how some investors blend passive positions with select direct property ownership through DSCR financing creating hybrid approaches balancing complete passivity with some active involvement where beneficial. Many sophisticated investors maintain 70-80% passive holdings providing time freedom while keeping 20-30% in direct ownership of carefully selected properties providing higher returns and fuller control on limited positions they’re willing to monitor actively.

Research multiple passive investment sponsors and platforms before committing capital anywhere. Attend real estate investor association meetings, conference sessions, webinars where sponsors present opportunities and investment approaches. Join online communities like BiggerPockets forums where passive investors discuss experiences with various sponsors, platforms, and strategies. Read educational content from multiple sources building comprehensive understanding of passive investing landscape. This educational phase might require 2-3 months before making first investment—time well spent preventing costly beginner mistakes that rushed approaches create.

Make your first passive investment within 6-9 months of deciding to pursue passive portfolio management—education without action produces no wealth. Start conservatively: perhaps $25,000-$50,000 in single syndication with well-credentialed sponsor, or diversified allocation across REITs requiring no minimum beyond brokerage account capabilities. This initial investment provides real experience—how does communication work? When do distributions arrive? How does reporting function? What does it actually feel like owning passive positions?—teaching more than additional research ever could.

Establish systematic capital deployment schedules contributing regularly to passive investments rather than sporadic large investments when capital accidentally accumulates. Automate transfers from checking accounts to investment accounts, treating passive portfolio contributions as non-negotiable obligations rather than discretionary choices made only when convenient. Many successful passive investors deploy quarterly—perhaps $12,000-$15,000 every 3 months into whatever opportunities currently offer best risk-adjusted returns given portfolio needs, maintaining consistent accumulation regardless of market conditions or personal hesitation.

Track performance meticulously across all passive positions using spreadsheets or portfolio management software monitoring actual versus projected returns, distribution timing and amounts, sponsor communication quality, and overall portfolio construction. This tracking identifies underperforming positions warranting concern, successful sponsors deserving additional capital allocation, and whether overall portfolio progress remains on track reaching accumulation goals within desired timelines. Quarterly portfolio reviews—perhaps 2-3 hours every 3 months—ensure you remain informed about performance and positioning without excessive time commitments contradicting passive investment objectives.

Build your passive portfolio systematically over 10-15 years understanding wealth accumulation requires patience and discipline rather than shortcuts or aggressive timing speculation. Some investors attempt accelerating timelines through excessive leverage, concentrated bets with unproven sponsors, or high-risk strategies pursuing unsustainable returns. These approaches occasionally succeed spectacularly but more often fail catastrophically, leaving investors worse off than systematic moderate approaches building wealth steadily. Embrace long-term perspective: $2 million portfolios built over 12-15 years through disciplined accumulation provide sustainable wealth foundation lasting decades supporting retirement, legacy goals, and financial security unreplicable through aggressive shortcut attempts.

Passive portfolio management doesn’t mean passive monitoring or lazy capital allocation—it means delegating operational management to professionals while maintaining strategic oversight of portfolio construction, sponsor selection, diversification maintenance, and progress toward wealth accumulation goals. The “passive” describes time commitment to operations (essentially zero), not attitude toward wealth building (disciplined, informed, strategic). Combine zero operational involvement with thoughtful strategic portfolio development, and you’ll build substantial real estate wealth without sacrificing time to management demands that traditional property ownership requires.

Frequently Asked Questions

How much money do I need to start building a passive real estate portfolio?

Minimum entry varies by investment type: publicly traded REITs require only $500-$1,000 for single shares or fractional shares through modern brokerages, while syndications typically require $25,000-$100,000 minimums per deal. Realistically, effective passive portfolio management with meaningful diversification requires $75,000-$150,000 to deploy across 3-4 initial positions establishing diversified foundation. However, you can start building with $25,000-$50,000 making first investment, then systematically adding positions over 2-3 years as additional capital accumulates reaching appropriate diversification. Don’t wait until accumulating “enough” to fully diversify before starting—make first investment when you have capital for single appropriate position, then expand portfolio systematically. The biggest mistake is perpetual research without action, waiting for perfect circumstances that never materialize. Start where you are with capital available, build systematically from that foundation toward comprehensive diversification over time.

What returns should I expect from passive real estate investments compared to active property ownership?

Passive investment returns typically range 8-18% annually compared to 15-25% potential returns from active property ownership requiring significant personal involvement. Conservative passive approaches emphasizing REITs and debt investments target 8-12% returns providing stability and liquidity but limited upside. Moderate passive strategies mixing syndications with REITs target 12-15% returns balancing growth with diversification. Aggressive passive approaches concentrating in syndications and private funds target 15-18% returns accepting illiquidity and execution risk. Active ownership potentially generates higher returns through direct control, operational optimization, and tax benefits like cost segregation and real estate professional status, but requires 10-20+ hours weekly managing properties. Most high-income professionals value their time at rates where passive strategies’ lower returns still provide superior risk-adjusted value after accounting for opportunity costs of time commitment. Calculate whether active involvement’s potential return premium (perhaps 5-7 percentage points) justifies time investment given your hourly value and alternative uses of that time.

Can I really build $2 million in passive real estate without ever managing properties?

Yes—completely hands-off passive portfolio management can absolutely build $2 million portfolios over 12-15 years through disciplined systematic investment in syndications, REITs, debt positions, or professionally managed turnkey properties. Time requirements approximate 2-4 hours quarterly reviewing performance across all positions—perhaps 10-15 hours annually total compared to 500-1,000 hours annually active property ownership might require. The keys to success: adequate initial capital or substantial annual contributions ($40,000-$60,000+ yearly), realistic return expectations (14-16% blended averages), systematic deployment discipline deploying capital consistently regardless of market conditions or hesitation, appropriate diversification across 8-12 positions preventing single failure from devastating portfolio, and patience sustaining strategy over full 10-15 year accumulation period rather than expecting instant wealth. Use our investment growth calculator modeling your specific capital deployment schedule, contribution rates, and target returns showing exact timeline reaching $2 million given your circumstances.

Should I invest in syndications, REITs, or turnkey rental properties with management?

Most sophisticated passive portfolio management strategies include all three types in diversified allocations balancing each strategy’s strengths and weaknesses. REITs provide liquidity and simplicity but lower returns (8-12%); syndications provide higher returns (14-20%) but complete illiquidity for 3-7 years; turnkey rentals provide direct ownership benefits like depreciation and control but require more monitoring than purely passive alternatives. A balanced allocation might include 30% REITs (liquidity, stability), 40% syndications (growth, highest returns), and 30% turnkey rentals with management (direct ownership, control, tax benefits). Adjust allocations based on your specific priorities: emphasize REITs if liquidity is paramount, concentrate in syndications if return maximization trumps all other concerns, or focus on turnkey properties if direct ownership control and preferential tax treatment through cost segregation and potential real estate professional status matter most. Don’t force yourself choosing single approach when diversified allocation across multiple strategies provides better risk-adjusted returns than concentrating entirely in any single investment type.

How do I find legitimate sponsors for syndications versus avoiding fraudulent operators?

Thorough due diligence protects you from fraudulent or incompetent sponsors through systematic verification before committing capital. Essential steps include: requesting complete track records showing actual performance across full investment cycles with third-party verification (audited financials, actual investor references), conducting background research through court records, SEC enforcement databases, bankruptcy filings, and general web searches for negative information, speaking with 5-10 references from prior investments (random selection not cherry-picked testimonials) asking about return delivery, communication, integrity, and reinvestment intentions, reviewing operating agreements with experienced real estate attorneys identifying problematic provisions or concerning terms, verifying sponsor financial strength ensuring they can support deals during difficulties, and starting with smaller initial investments ($25,000-$50,000) with new sponsors before committing larger amounts after observing actual performance. Red flags warranting immediate disqualification: sponsors eliminating fiduciary duties in operating agreements, refusing to provide complete track records or references, contributing zero personal capital while earning substantial fees, resisting due diligence or rushing decisions, or displaying previous fraud, bankruptcy, or investor dispute history. If something feels wrong despite inability to identify specific issues, trust instincts and walk away—plenty of legitimate opportunities exist without accepting questionable situations.

Related Resources

Also helpful for passive investors:

- Invest in Apartment Complexes — Syndication structures and evaluation strategies

- Capital Partners Rights — Understanding LP protections and operating agreements

- Passive Income Real Estate Strategies — Multiple passive approaches

What’s next in your journey:

- Building Generational Wealth Through Real Estate — Long-term wealth building

- Tax Strategies for Real Estate Investors — Optimizing after-tax returns

- Advanced Portfolio Diversification — Sophisticated allocation strategies

Explore your financing options:

- DSCR Loan Program — Income-based financing for selective direct ownership

- Portfolio Loan Program — Multi-property financing

- Asset-Based Loan Program — Qualification through financial strength

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a CallNot Sure About Your Next Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Related Posts

Subscribe to our newsletter

Get new posts and insights in your inbox.