Multifamily Market Analysis: Pick Winning Markets Before You Invest

Multifamily Market Analysis: Pick Winning Markets Before You Invest

You’re evaluating a syndication opportunity. The sponsor presents beautiful property photos, impressive renovation plans, and pro forma financials projecting eighteen percent returns. The deal looks fantastic on paper—until you research the market and discover population declining, major employers downsizing, new apartment construction flooding the submarket, and rental concessions becoming standard as landlords compete desperately for tenants.

The property might be perfect, the sponsor might be exceptional, but you’re investing in a declining market where even excellent operators struggle generating returns.

This scenario plays out constantly with passive investors who focus entirely on property-level metrics while ignoring market fundamentals. They vet sponsors thoroughly, analyze financial projections meticulously, and review operating agreements carefully—then invest in markets working against them from day one.

This is where understanding multifamily market analysis transforms you from someone who picks pretty deals into an investor who selects markets setting you up for success regardless of short-term operational fluctuations.

Key Summary

This guide explains how passive investors evaluate multifamily markets using population growth, employment diversity, supply-demand balance, and demographic trends to identify markets where strong fundamentals drive property performance and investment returns.

In this guide:

- Why market selection matters more than property selection for long-term passive investment success (macroeconomic factors in real estate)

- Population growth and migration trends indicating sustainable rental demand supporting occupancy and rent growth (demographic analysis for real estate)

- Employment and economic indicators showing job diversity, wage growth, and recession resilience protecting investments during downturns (economic metrics for market evaluation)

- Supply-demand dynamics including construction pipeline, absorption rates, and cap rate trends signaling market health and pricing (multifamily supply analysis)

Why Market Selection Matters More Than Property Selection

Understanding multifamily market analysis starts with accepting a fundamental truth most passive investors resist—your market choice impacts returns more significantly than your specific property selection. This “rising tide lifts all boats” principle means mediocre properties in excellent markets outperform excellent properties in declining markets.

Avoiding declining markets protects capital better than finding great deals. You can buy the best property in a shrinking market at an attractive price, renovate it beautifully, hire excellent management, and still struggle maintaining occupancy and rent growth when the broader market lacks demand. Population outmigration, job losses, and economic decline create headwinds even skilled operators cannot overcome. Conversely, buying average properties in growing markets often produces solid returns as market fundamentals drive performance despite operational mediocrity.

Macro trends trump property-level execution consistently over three to seven year hold periods typical of syndications. Short-term property improvements—unit renovations, management changes, expense reductions—create value, but long-term market trends ultimately determine exit valuations and investor returns. A property purchased at a six percent cap rate in a strengthening market might sell at a four and a half percent cap rate five years later due to investor demand for growing markets, creating substantial appreciation regardless of operational performance. The same property in a weakening market might require selling at a seven percent cap rate, potentially destroying equity despite strong operations.

The eighty-twenty rule applies perfectly to multifamily investing—eighty percent of your return depends on market selection, twenty percent on property-specific execution. This doesn’t diminish operator importance, but it contextualizes it appropriately. Excellent sponsors magnify good market returns and minimize bad market losses, but they cannot manufacture strong returns in fundamentally weak markets. Focus your due diligence effort proportionally—spend eighty percent of research time on market fundamentals, twenty percent on property specifics.

Using a rental property calculator helps model how market rent growth rates dramatically impact total returns over multi-year hold periods, showing why two percent annual rent growth versus five percent growth creates fifty-plus percent differences in exit valuations and investor returns.

The Hierarchy of Real Estate Investment Decisions

Passive investors making multifamily market analysis decisions should follow a logical hierarchy ensuring they evaluate opportunities correctly. This hierarchy prevents the common mistake of falling in love with specific properties before confirming market fundamentals support the investment thesis.

Market selection comes first—identify metros and submarkets showing strong fundamental trends supporting multifamily demand and pricing power. Only after confirming market strength should you evaluate specific opportunities within those markets. This sequence prevents wasting time analyzing beautiful deals in terrible markets that cannot produce target returns regardless of property quality or sponsor competence.

Strategy alignment follows market selection—different markets suit different strategies. High-growth markets with strong job creation support value-add strategies executing renovation programs and pushing rents aggressively. Stable, mature markets suit core strategies prioritizing current income over appreciation. Emerging markets support opportunistic strategies accepting higher risk for potentially higher returns. Match your investment strategy to appropriate market types rather than forcing strategies into mismatched markets.

Sponsor evaluation fits within market context—experienced sponsors operating in their expertise markets produce better results than generalists pursuing opportunities opportunistically. A sponsor with fifteen years of Sunbelt multifamily experience investing in their core markets deserves more confidence than equally experienced sponsors venturing into unfamiliar markets chasing deals. Market expertise matters as much as general operational competence.

Property-specific analysis comes last—only after confirming market strength, strategy alignment, and sponsor appropriateness should you deep-dive into individual property financials, condition, and specific business plans. This hierarchy ensures you’re comparing excellent properties in excellent markets rather than excellent properties in mediocre markets against mediocre properties in excellent markets.

Population Growth and Migration Trends Analysis

Conducting thorough multifamily market analysis requires starting with population dynamics—the fundamental driver of rental housing demand. Growing populations need more housing, stable populations maintain existing demand, declining populations create oversupply and pricing pressure.

Job relocation patterns drive much contemporary migration. Remote work trends accelerated during COVID enabled workers to relocate from expensive coastal cities to affordable Sunbelt markets without changing employers. Texas, Florida, Tennessee, North Carolina, South Carolina, Georgia, and Arizona gained hundreds of thousands of net migrants annually between 2020-2024 as workers fled high-cost, high-tax states for better quality of life and lower costs. These patterns continue though moderating as some employers mandate office returns.

Sunbelt growth continues dominating national population trends. The Sunbelt region—stretching from North Carolina through Texas to Arizona—captures the majority of national population growth. Favorable weather, business-friendly regulations, lower taxes, affordable housing costs, and strong job growth attract both companies and individuals. Markets like Austin, Dallas, Houston, Tampa, Charlotte, Nashville, Phoenix, and Raleigh consistently lead national population growth rankings. This sustained growth supports apartment demand and rent growth even as new supply delivers.

Metro area population data provides the foundation for multifamily market analysis. The Census Bureau publishes annual population estimates showing which metros gained or lost population. Look for metros with consistent one to two percent-plus annual population growth over multiple years rather than single-year spikes that might not sustain. Also examine components of population growth—natural increase (births minus deaths) versus migration. Migration-driven growth indicates the market attracts people actively choosing to relocate there, usually for economic opportunity. Natural increase without migration suggests stagnant markets where people stay only because they were born there.

Census projections help evaluate growth sustainability. The Census Bureau projects population growth rates over upcoming decades based on historical trends, birth rates, and migration patterns. Markets projected to maintain strong growth over ten to twenty years offer longer-term investment security than markets whose current growth might not sustain. However, recognize projections assume continuation of current trends—major economic disruptions, policy changes, or unforeseen events can alter trajectories.

Migration drivers determine growth quality and permanence. Understand why people move to markets you’re evaluating. Retirees seeking warm weather and low taxes? Young professionals pursuing career opportunities? Families seeking affordable homeownership? Military personnel due to base expansions? Each migration driver has different implications for rental demand. Young professional migration drives Class A apartment demand. Family migration often supports Class B and C apartments before families save for homeownership. Retiree migration has minimal rental demand impact but supports overall market vitality.

Employment and Economic Indicators Evaluation

Beyond population, multifamily market analysis requires examining employment and economic fundamentals driving rental housing demand and residents’ ability to afford rents. Strong job markets support high occupancy and rent growth, weak job markets create struggles even in otherwise attractive locations.

Job growth rates relative to national averages indicate market economic health. Markets consistently growing employment faster than the national average of one to two percent annually demonstrate economic vitality attracting businesses and workers. Check Bureau of Labor Statistics data showing employment growth by metro area over trailing one, three, and five year periods. Consistent above-average growth signals sustainable economic strength. Volatile growth—strong one year, weak the next—suggests economic dependence on cyclical industries creating risk.

Employment base diversity protects markets during recessions. Markets dominated by single industries—oil and gas in Houston historically, automotive in Detroit, government in Washington DC—experience severe downturns when those industries struggle. Diverse economies with substantial employment across multiple sectors—technology, healthcare, education, finance, manufacturing, logistics—weather recessions better as weakness in one sector gets offset by strength in others. Calculate employment concentration—if any single industry comprises over twenty percent of total employment, the market carries concentration risk.

Major employer stability matters significantly for rental demand. Markets depending heavily on a few large employers face risk if those companies downsize or relocate. Research major employers in markets you’re evaluating—are they financially healthy, growing, and committed to their locations? Or are they struggling, announcing layoffs, or threatening to relocate unless receiving tax incentives? The departure or major downsizing of a metro area’s largest employer devastates rental markets as thousands of workers leave simultaneously.

Wage growth trends indicate residents’ ability to afford rent increases. Job growth means nothing if wages stagnate. Markets with two to four percent annual wage growth support steady rent increases as residents’ incomes grow. Markets with flat or declining wages cannot support aggressive rent growth without pricing out existing residents and creating affordability crises. Examine wage growth data from Bureau of Labor Statistics—look for consistent wage growth slightly above inflation maintaining or improving affordability rather than wages lagging inflation and eroding purchasing power.

Using a passive income calculator helps model how different rent growth assumptions driven by wage growth trends impact your returns over typical five to seven year syndication hold periods.

New Supply and Construction Pipeline Assessment

Analyzing supply-demand balance represents the most critical element of multifamily market analysis for predicting near-term property performance and return outcomes. Markets can show strong population and job growth but still struggle if apartment construction exceeds demand growth, creating oversupply pressuring occupancy and rents.

Building permits serve as leading indicators of future supply. Municipalities issue building permits before construction begins, providing twelve to twenty-four month advance notice of supply increases. Track building permit data from Census Bureau and local planning departments showing how many multifamily units received permits over trailing twelve months. Compare this to historical averages—permit issuance significantly above historical norms signals potential oversupply concerns as those permitted units deliver over the next two years.

Units under construction currently represent near-term supply hitting markets. Commercial real estate data providers like CoStar track units under construction by market and submarket. Calculate units under construction as a percentage of existing stock—two to three percent is typical, four to five percent raises concerns, six percent-plus signals dangerous oversupply likely pressuring occupancy and forcing rent concessions. Also check estimated delivery dates showing when supply concentrates—ten thousand units delivering over twelve months is manageable, the same units delivering in three months creates supply shock.

Absorption rates historical show how quickly markets fill new units. Strong markets with robust demand absorb new supply quickly without occupancy pressure—units lease up within three to six months of completion. Weak markets see slow absorption extending twelve-plus months, forcing developers to offer multiple months free rent to attract tenants. Calculate absorption rate by tracking net new occupied units over trailing twelve months—if absorption runs below new deliveries, markets are oversupplied regardless of population growth statistics suggesting adequate demand.

Supply-demand balance synthesizes all supply data against demand drivers. Calculate annual demand from population growth and household formation rates, then compare against annual supply from construction completions. Demand exceeding supply by ten to twenty percent indicates healthy markets with room for rent growth. Supply exceeding demand signals oversupply requiring several years of population growth to absorb excess units before markets return to equilibrium. Be especially careful in markets where supply exceeds demand while construction pipeline remains robust—these markets face multi-year weakness.

Construction starts trends show whether supply pressures will worsen or moderate. Even oversupplied markets eventually recover as developers stop starting new projects and existing pipeline delivers. Track construction starts data showing whether developers broke ground on new projects recently. Declining starts suggest supply concerns will moderate over coming years as current pipeline delivers without replacement. Rising starts despite oversupply indicate developers ignoring market fundamentals, potentially extending oversupply periods.

Rent Trends and Affordability Analysis

Understanding rent dynamics through multifamily market analysis helps predict whether markets can support the rent growth projections used in syndication underwriting. Optimistic rent growth assumptions look compelling in pro formas but destroy returns when markets cannot deliver projected increases.

Historical rent growth patterns establish baseline expectations for markets. Markets averaging three to five percent annual rent growth over trailing five to ten years likely continue similar patterns absent major disruptions. Markets with volatile rent growth—alternating between strong increases and flat or declining rents—carry higher risk as future performance remains unpredictable. Download historical rent data from apartment data services showing effective rents (actual rents minus concessions) rather than asking rents that don’t reflect market realities.

Current rent trends and momentum indicate near-term trajectory. Rents growing four percent annually with trends accelerating suggest strengthening markets. Rents growing two percent with trends decelerating signal weakening conditions potentially leading to flat or declining rents. Particularly note concession trends—increasing concessions (free months, reduced deposits, waived fees) signal weak markets even if asking rents appear stable.

Affordability ratios determine whether rent growth is sustainable or approaching limits. Calculate average rent as a percentage of median household income—healthy markets see rents consuming twenty-eight to thirty-two percent of income. Markets where rents exceed thirty-five percent of income face affordability constraints limiting future rent growth. Residents paying excessive percentages of income for rent struggle affording increases, forcing them to move to cheaper units or markets. This creates natural caps on rent growth regardless of property quality or sponsor aggressiveness.

Price-to-rent relationships reveal whether markets favor renting versus homeownership. In markets where homeownership costs significantly exceed rental costs, people rent longer and demand remains strong. Markets where monthly homeownership costs (financing, taxes, insurance) approximate or fall below rental costs see renters transitioning to homeownership, reducing rental demand. Calculate price-to-rent ratios dividing median home prices by annual rents—ratios above fifteen favor renting, below twelve favor homeownership.

Rent burden percentages show what proportion of residents struggle with housing costs. Markets where high percentages of renters pay over thirty-five percent of income for rent face affordability crises potentially triggering political responses including rent control proposals. Research local rent burden statistics showing percentage of cost-burdened renters—markets over forty percent face political risk worth considering.

Cap Rate Trends and Investment Capital Flows

Analyzing cap rate trends and investment capital flows provides critical context for multifamily market analysis by revealing what investors collectively believe about market futures. Cap rates reflect investment return requirements—rising cap rates signal increasing risk perceptions, falling cap rates signal strengthening conviction.

Market cap rates currently establish baselines for comparing opportunities. Cap rates vary by property class, market, and condition, but generally range from three to seven percent for multifamily properties. Class A properties in primary markets (New York, San Francisco, Los Angeles) trade at three and a half to four and a half percent caps. Class B properties in secondary markets (Austin, Denver, Charlotte) trade at four and a half to five and a half percent caps. Class C properties in tertiary markets trade at five and a half to seven percent caps. Understanding where specific deals price relative to market norms helps evaluate whether sponsors are paying appropriate prices.

Historical cap rate trends reveal market sentiment evolution. Markets with compressing cap rates (declining over time) experience increasing investor demand as capital flows in seeking exposure. Compression signals strengthening conviction about market fundamentals and growth prospects. Markets with expanding cap rates (rising over time) see capital fleeing as investors reduce exposure. Expansion signals weakening confidence and deteriorating fundamentals. Plot metro area cap rates over five to ten years showing whether trends favor or oppose investments.

Investment capital flows indicate where institutional money moves. Major institutional investors—pension funds, sovereign wealth funds, insurance companies, REITs—deploy billions annually into multifamily markets showing strongest fundamentals. These sophisticated investors conduct extensive research before allocating capital. Track where institutions invest—Sunbelt markets capturing the majority of institutional capital demonstrate broad confidence in their prospects. Markets seeing institutional capital flight face headwinds.

Where money is moving reveals emerging opportunities and maturing markets. Capital consistently flows toward markets in early growth phases before retail investors recognize opportunities. By the time markets appear in mainstream media as hot investment markets, sophisticated capital already deployed and returns may have moderated. Conversely, markets seeing capital outflows despite attractive fundamentals might present contrarian opportunities if fundamentals remain solid despite sentiment souring.

Pricing pressure indicators show whether markets approach valuation tops. Markets trading at cap rates near historical lows face limited additional compression upside—if cap rates cannot fall further, appreciation requires NOI growth only. Markets at historical cap rate highs offer compression upside if fundamentals improve and sentiment shifts. Compare current cap rates to ten-year trading ranges showing where markets price within historical contexts and whether meaningful valuation upside remains available.

Submarket Selection Within Metro Areas

Even excellent metros contain weak submarkets—multifamily market analysis requires drilling beyond metro-level statistics into neighborhood-level dynamics determining property-specific performance. Two properties in the same metro can perform dramatically differently based on submarket selection.

Neighborhood-level analysis examines specific areas where properties locate. Growth markets contain submarkets ranging from declining neighborhoods seeing population loss to hot areas experiencing rapid gentrification. Research submarket-specific population trends, household income levels, employment concentrations, and development activity rather than assuming metro-level trends apply uniformly. Properties in weak submarkets within strong metros often underperform.

School quality ratings impact multifamily properties significantly. Families with children prioritize school quality when selecting housing. Properties in strong school districts command higher rents, maintain higher occupancy, and experience lower turnover than equivalent properties in weak school districts. Check GreatSchools.org ratings showing elementary, middle, and high school quality in areas surrounding properties. Submarkets with schools rating seven-plus out of ten offer family-friendly advantages supporting demand.

Crime statistics and safety perceptions drive renter decisions powerfully. Residents pay premiums for safe neighborhoods and flee areas where crime rises. Research FBI crime data and local police statistics showing violent crime and property crime rates for specific neighborhoods. Compare submarket crime rates to metro averages—submarkets with below-average crime rates attract quality residents, above-average crime areas struggle regardless of property quality.

Amenities and walkability determine quality of life and resident satisfaction. Modern renters, especially younger demographics, value walkable neighborhoods with restaurants, shopping, entertainment, parks, and services nearby. Check Walk Score ratings measuring neighborhood walkability and transit access. High Walk Scores (seventy-plus) indicate vibrant, desirable neighborhoods supporting premium rents. Low Walk Scores (below fifty) suggest car-dependent suburbs where renter demand might be softer.

Transit access and infrastructure affect submarkets differently by demographic. Urban submarkets with light rail stations or subway access command premiums from professional renters commuting downtown. Suburban submarkets might benefit more from highway access for car commuters. Understand submarket resident profiles and what infrastructure matters most to them. Properties near transit in transit-dependent submarkets outperform, while properties near transit in car-dependent suburbs gain little advantage.

Demographic Analysis for Apartment Demand

Conducting demographic analysis as part of multifamily market analysis helps predict which markets benefit most from national demographic trends and which face challenges from shifting population characteristics.

Renter household profiles vary significantly by market. Some markets attract young professionals in their twenties and thirties—prime apartment renters. Others attract families, empty nesters, or retirees. Understanding who rents in specific markets helps evaluate demand sustainability and appropriate property types. Markets dominated by student renters face demand tied to university enrollment. Markets with diverse renter profiles across age groups demonstrate broader appeal and stability.

Household formation rates drive net new apartment demand. Young adults forming their first independent households create rental demand. Research household formation rates—the rate at which young adults move out of parents’ homes to form their own households. Strong household formation in markets with growing populations of twentysomethings drives apartment absorption. Weak household formation despite population growth indicates young adults staying with parents longer due to affordability challenges, reducing effective rental demand below population numbers suggest.

Age cohort analysis reveals demographic tailwinds or headwinds. Millennials (born 1981-1996) represent the largest renter cohort, making markets attracting Millennials particularly attractive for multifamily investment. Gen Z (born 1997-2012) now enters peak renting years, adding to demand in markets where young people concentrate. Conversely, markets losing young adults to other metros face demand challenges as aging Baby Boomers don’t rent at high rates.

Education levels correlate with rental demand and affordability. Markets with high percentages of college-educated residents typically show stronger job markets, higher wages, and greater rental affordability supporting rent growth. Markets with lower education levels often have more limited job opportunities and wage growth, constraining rent growth potential. Research educational attainment data showing percentages of residents with bachelor’s degrees or higher—metros above thirty-five to forty percent generally offer more educated workforces supporting knowledge economy jobs.

Income distribution patterns determine which apartment classes find demand. Markets with growing upper-middle-class populations support Class A luxury apartment development. Markets with predominantly working-class populations support Class B and C workforce housing. Understand income distribution across markets—heavily bifurcated markets with high earners and low earners but limited middle class might struggle with mid-market Class B apartments finding tenants.

Using an investment growth calculator helps model how different demographic scenarios impact your multifamily investment returns over five to ten year timeframes.

Regulatory and Political Environment Assessment

Multifamily market analysis requires evaluating regulatory and political environments affecting property operations, returns, and exit strategies. Landlord-friendly markets with reasonable regulations offer better risk-adjusted returns than markets with tenant-friendly regulations constraining operations.

Rent control risks loom largest in expensive coastal markets where housing affordability crises drive political pressure for rent regulations. California, Oregon, and New York have statewide rent control provisions. Dozens of cities from Seattle to Minneapolis to Washington DC have local rent control ordinances. Markets actively discussing rent control proposals carry political risk worth discounting in underwriting. Even where rent control doesn’t currently exist, proposals gaining political momentum should concern investors as enactment could devastate returns by capping rent growth below projections.

Landlord-friendly versus tenant-friendly laws vary dramatically across markets. Texas, Florida, Georgia, and other Sunbelt states maintain landlord-friendly legal frameworks allowing relatively quick evictions, reasonable security deposit requirements, and minimal rent regulation. California, New York, New Jersey, and coastal states implement extensive tenant protections including lengthy eviction processes, strict security deposit limitations, mandatory relocation assistance, and rent increase restrictions. Research state and local landlord-tenant laws before investing—landlord-friendly markets reduce operational headaches and legal costs.

Development incentives and restrictions affect future supply competition. Markets with streamlined development approval processes see faster supply responses to demand, potentially creating oversupply cycles. Markets with restrictive development policies, extensive environmental reviews, affordable housing mandates, and NIMBYism face constrained supply growth potentially supporting rent growth but creating affordability challenges. Understand local development climate—markets making development difficult protect existing landlords from new competition but might face political backlash as housing costs rise.

Property tax environments directly impact property operating expenses and return. High property tax jurisdictions like Texas and New Jersey see property taxes consuming fifteen to twenty-five percent or more of gross income. Low property tax states like California (due to Proposition 13), Louisiana, and Alabama see taxes consuming only five to ten percent of income. Calculate property tax rates as percentage of property value and percentage of gross income—high tax markets require higher rents supporting tax burdens, potentially constraining affordability.

Future regulatory risk assessment requires evaluating political trends and housing policy discussions in markets you’re considering. Markets with progressive political leadership often implement new tenant protections, rent regulations, and landlord restrictions over time. Conservative-leaning markets typically maintain landlord-friendly frameworks. Monitor local political debates about housing policy, proposed legislation, and advocacy group activism signaling potential regulatory changes ahead.

Creating Market Ranking and Selection Framework

After conducting thorough multifamily market analysis across multiple metros, you need systematic frameworks for ranking markets objectively and selecting where to concentrate your passive real estate investments.

Weighting factors by importance reflects your investment priorities and risk tolerance. Assign weights to each market analysis component based on their importance to your returns. Growth-oriented investors might weight population growth and job growth most heavily at thirty to forty percent of total score. Income-focused investors might prioritize current cash flow sustainability by weighting rental affordability and supply-demand balance highest. Create your personalized weighting scheme reflecting your goals rather than treating all factors equally.

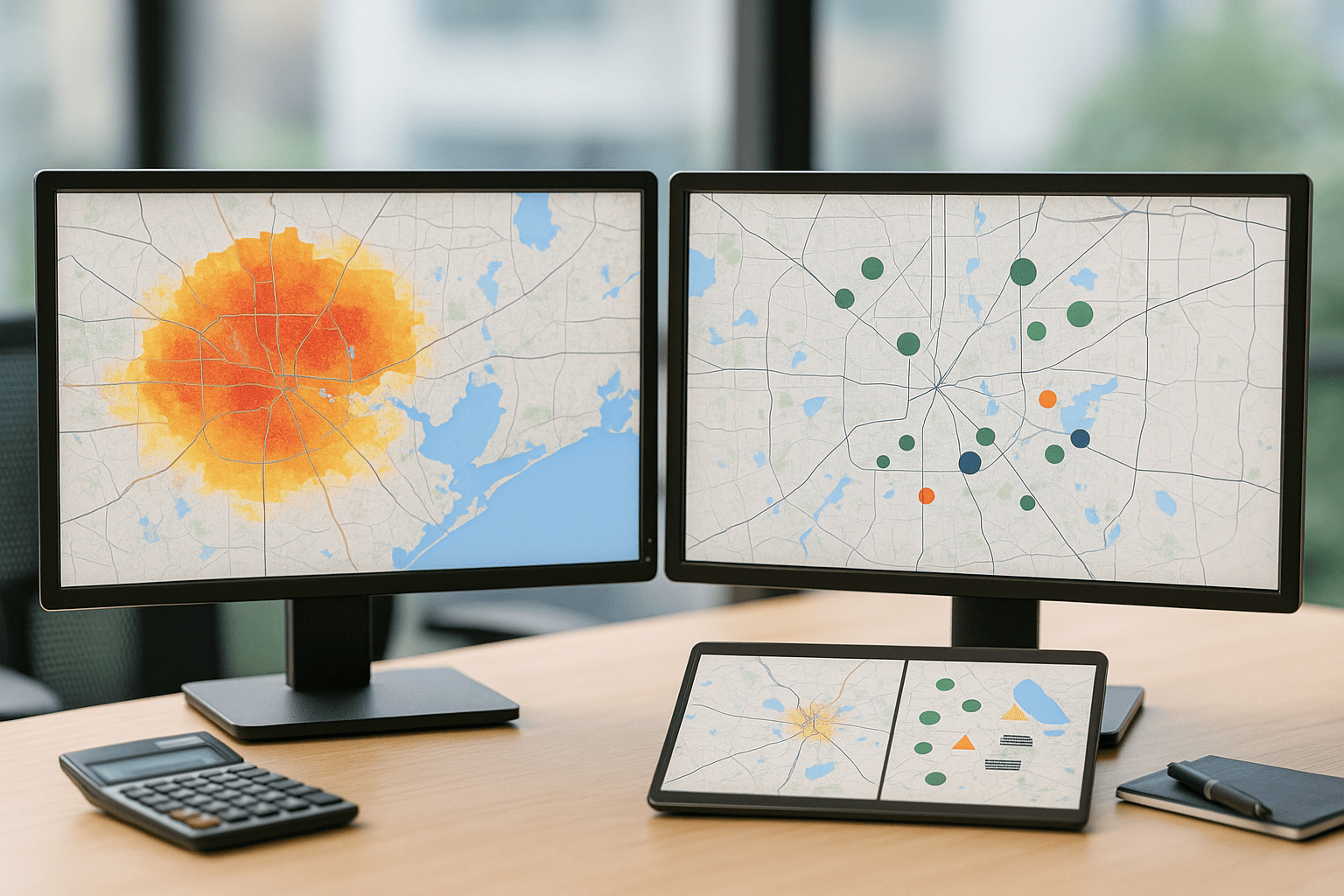

Scoring system development provides numerical comparison across markets. Rate each market on a one-to-ten scale for every factor—population growth, job diversity, supply-demand balance, regulatory environment, etc. Multiply each factor score by its weight percentage, sum the weighted scores, and calculate total market scores from one to ten. This quantitative approach eliminates emotion from market selection, forcing objective evaluation based on data rather than headlines or sponsorship relationships.

Comparing multiple markets objectively using consistent frameworks prevents the common mistake of falling in love with specific deals before confirming market quality. Build a spreadsheet scoring five to ten markets you’re considering for investment. List your factors down the left column, assign weights, input scores for each market, calculate weighted totals, and rank markets from highest to lowest scores. This matrix reveals which markets genuinely offer strongest fundamentals rather than which markets you subjectively prefer or which sponsors present most compellingly.

Decision matrix tools structured properly include not just quantitative scores but qualitative considerations that metrics don’t capture fully. Add columns for deal sponsor track records in each market, your personal familiarity with markets, regulatory risk factors difficult to quantify, and other considerations informing decisions beyond pure numbers. Your final decision balances quantitative market scores with qualitative factors, but the quantitative framework prevents ignoring red flags or overweighting peripheral considerations.

Top market identification focuses your deal flow efforts productively. Rather than evaluating every deal from every sponsor across the entire country, identify your top three to five markets based on your ranking framework. Then concentrate on finding quality deals from excellent sponsors in those specific markets. This focused approach produces better results than scattering capital randomly across markets based on whoever pitches you compelling-sounding deals.

Conclusion

Mastering multifamily market analysis transforms passive investors from deal chasers into strategic capital allocators who select markets offering fundamental advantages regardless of specific property or sponsor qualities. Strong markets amplify good operators’ results while weak markets undermine even excellent execution.

Key takeaways for passive investors:

- Market selection impacts eighty percent of returns with property and operator execution determining only twenty percent

- Population growth from in-migration signals economic opportunity attracting residents who choose markets deliberately

- Employment diversity across multiple industries protects markets during recessions when single-industry markets collapse

- Supply-demand balance predicts near-term performance more accurately than long-term growth fundamentals alone

- Rent affordability capping thirty-two percent of median income supports sustainable rent growth without political backlash

- Regulatory environments ranging from landlord-friendly to rent control determine operational ease and return predictability

- Systematic market ranking frameworks using weighted factors enable objective comparison eliminating emotional decision-making

Success in passive multifamily investing comes from identifying markets where population growth, job creation, controlled supply, and reasonable regulations create sustained rental demand supporting occupancy, rent growth, and appreciation. Invest in markets working with you rather than fighting against you.

Ready to evaluate multifamily syndication opportunities with professional-level market analysis? Schedule a call to discuss market trends and investment strategies.

Frequently Asked Questions

How do you research population and employment trends for multifamily markets?

Conducting professional-level multifamily market analysis for population and employment requires using authoritative government data sources. Start with the U.S. Census Bureau’s American Community Survey providing annual population estimates by metro area, county, and city showing population changes over one, three, and five year periods. The Bureau of Labor Statistics publishes monthly employment data by metro showing job growth rates, unemployment rates, and employment by industry sector. For migration data, check IRS migration statistics tracking where people move based on tax return filing address changes. Combine data from multiple sources painting complete pictures—Census for overall population, BLS for employment, IRS for migration patterns. Most multifamily data services like CoStar, RealPage, and Yardi Matrix publish market research reports synthesizing these government data sources with proprietary apartment performance data, providing comprehensive market overviews. Passive investors can access abbreviated versions of these reports through syndication sponsors who typically include market research in their investment presentations. Always verify sponsor market claims using independent sources rather than accepting their research unquestioningly.

What supply-demand ratios indicate healthy versus oversupplied multifamily markets?

Healthy supply-demand balance in multifamily market analysis shows annual demand from population growth and household formation slightly exceeding annual supply from new construction deliveries. Calculate annual demand by multiplying metro population growth by household formation rates (typically 1.5 to 2.0 persons per household for renters) to estimate new renter households formed annually. Compare this to annual supply from CoStar or RealPage data showing multifamily units delivering over the next twelve months. Demand exceeding supply by ten to twenty percent indicates healthy markets with room for rent growth. Balanced markets where demand approximately equals supply maintain stable occupancy and moderate rent growth. Oversupplied markets where annual deliveries exceed demand by ten percent-plus face pressure on occupancy and rental concessions becoming common. Also examine units under construction as percentage of existing stock—two to three percent is typical and manageable, four to five percent raises concerns, six percent-plus signals dangerous oversupply likely suppressing rents for several years until markets absorb excess units and construction slows. Markets can show strong population growth yet still struggle when construction outpaces demand growth.

How important are school ratings when analyzing multifamily markets?

School quality significantly impacts multifamily market analysis especially for Class B and C properties attracting families with children. Properties in excellent school districts (GreatSchools ratings of seven to ten out of ten) command rental premiums of ten to twenty percent, maintain higher occupancy rates, and experience lower turnover than equivalent properties in weak school districts. Families prioritize school quality when selecting housing, often paying extra rent to access better schools even if the property itself isn’t notably superior. However, school importance varies by property class and target demographic. Luxury Class A properties targeting young professionals without children see minimal school impact. Urban core properties targeting downtown workers similarly see limited school influence as residents prioritize work proximity over schools. Student housing near universities cares nothing about K-12 schools. Suburban family-oriented Class B properties experience maximum school impact as the target demographic actively considers education quality. When evaluating syndication deals, check whether the sponsor’s target demographic aligns with school quality—sponsors claiming to target families while investing in poor school districts likely misjudge market dynamics and might struggle maintaining projected occupancy and rents.

What cap rate trends indicate good versus risky entry points for passive investors?

Cap rate analysis in multifamily market analysis reveals whether markets offer attractive entry points or face valuation risk. Markets trading near ten-year cap rate lows face limited compression upside—if cap rates historically trade at four and a half to six percent and currently sit at four and three-quarters percent, minimal room exists for further compression. Returns depend entirely on NOI growth through rent increases and expense management. Conversely, markets trading near ten-year highs at six percent caps with historical ranges of four and a half to six percent offer potential compression upside if fundamentals improve and investor sentiment strengthens. However, also consider why cap rates expanded—if markets face legitimate fundamental challenges (population loss, job losses, oversupply), high cap rates might reflect appropriate risk pricing rather than opportunity. The best opportunities come from markets trading at mid-range cap rates (five to five and a half percent in markets historically ranging four and a half to six percent) with improving fundamentals suggesting potential for compression. Watch cap rate trends over trailing three to five years—consistent compression indicates strengthening markets attracting capital, while expanding cap rates signal deteriorating fundamentals or investor caution. For passive investors, avoid markets at extreme cap rate lows where minimal appreciation potential exists unless NOI growth is exceptional. Target markets at middle to higher ends of historical ranges showing early signs of fundamental improvement ahead of widespread investor recognition.

Should passive investors only invest in markets they personally know?

Market familiarity helps multifamily market analysis but shouldn’t become absolute requirement preventing diversification. Passive investors partner with local sponsors who provide market expertise you don’t need to replicate personally. The sponsor’s deep market knowledge—understanding submarkets, knowing contractor and management relationships, recognizing neighborhood trajectories—matters far more than your personal familiarity. However, some baseline market knowledge helps evaluate sponsor claims and perform independent due diligence. You don’t need to know every street name but should understand major employment drivers, general geography, development patterns, and regulatory environment. Research markets using online resources, read local news, review demographic data, and check development patterns through Google Maps before investing. Consider geographic diversification balancing markets you know personally (providing comfort and easier independent verification) with strong markets where excellent sponsors operate (providing returns and growth). Many successful passive investors concentrate eighty percent of capital in two to three markets they understand deeply while allocating twenty percent across another two to three strong markets with top-tier sponsors for diversification. This balanced approach provides familiarity benefits without sacrificing diversification or forcing you to ignore excellent opportunities in markets you don’t personally know.

Related Resources

Essential reading for passive investors:

- Best Way to Earn a Passive Income: Real Estate Returns Without Toilets or Tenants – Overview of passive real estate investing vehicles

- Invest in Apartment Complexes: Own a Piece of a $10M Property With $50K – Understanding multifamily syndication structures

- Commercial Real Estate Analysis: Evaluate Deals Like a Professional GP – Financial analysis frameworks for passive investors

Building your evaluation framework:

- Real Estate Due Diligence Checklist: Vet Sponsors Before You Wire Six Figures – Sponsor vetting processes

- Diversify Your Passive Real Estate Portfolio: Balance Risk Across Markets – Portfolio construction strategies

- Invest in Commercial Real Estate: Access Institutional Assets Through Syndications – Commercial property types beyond multifamily

Explore your analysis tools:

- Passive Income Calculator – Model passive income scenarios

- Investment Growth Calculator – Project market impact on returns

- Schedule a Call – Discuss market analysis and investment strategy

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a CallNot Sure About Your Next Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Related Posts

Subscribe to our newsletter

Get new posts and insights in your inbox.