Mortgage Protection Insurance: Complete Guide to Qualification, Rates & Process

Mortgage Protection Insurance: Complete Guide to Qualification, Rates & Process

When tragedy strikes, your family shouldn’t face both grief and financial catastrophe. Yet thousands of families lose their homes every year because the primary earner passed away without protection.

Mortgage protection insurance creates a financial safety net that ensures your loved ones can stay in their home even when you’re no longer there to make required installments. This comprehensive guide reveals everything you need to know about qualifying for mortgage protection, comparing program options, understanding true coverage costs, and implementing a protection strategy that actually works for your family.

Key Summary

Protecting your family’s home represents one of the most important financial decisions you’ll make. This comprehensive guide covers mortgage protection insurance across 11 critical areas:

In this comprehensive guide:

- Mortgage protection essentials (Truth in Lending Act consumer protections from the Federal Reserve)

- Term life insurance vs mortgage protection comparison (Life insurance guidance from the National Association of Insurance Commissioners)

- Disability insurance integration strategies (Disability insurance education from the U.S. Department of Labor)

- Mortgage protection insurance cost factors (Consumer Financial Protection Bureau mortgage insurance information)

- Best mortgage protection programs by family situation (Federal Trade Commission consumer protection guidance)

Understanding Mortgage Protection Insurance: What It Really Covers

Mortgage protection insurance serves as specialized coverage designed specifically to satisfy your outstanding balance if you die before your home financing is complete. Unlike traditional life insurance that provides flexible benefit allocation, mortgage protection insurance directs benefits exclusively toward satisfying your home financing obligation.

The core mechanics involve purchasing coverage that matches your current outstanding balance. When the insured person passes away, the insurance company sends funds directly to your lender rather than to your beneficiaries. This direct structure ensures your family retains homeownership even when the primary earner can no longer contribute financially.

What is mortgage protection insurance and how does it differ from mortgage insurance?

Mortgage protection insurance protects your family from losing their home if you pass away. Traditional mortgage insurance like PMI or MIP protects the lender if you default. These serve completely different purposes despite similar names.

Your FHA loan qualification requirements include mortgage insurance premium that protects the lender’s investment. Mortgage protection insurance works differently by protecting your family instead.

When you apply for a mortgage through conventional financing, lenders require PMI when initial investment falls below 20%. This coverage protects the lender if you stop making required installments. Calculate your conventional loan monthly costs including PMI to understand lender protection expenses.

Mortgage protection insurance functions differently by providing death benefit coverage that satisfies your outstanding balance. Your beneficiaries receive funds specifically designated to maintain homeownership rather than covering multiple financial obligations.

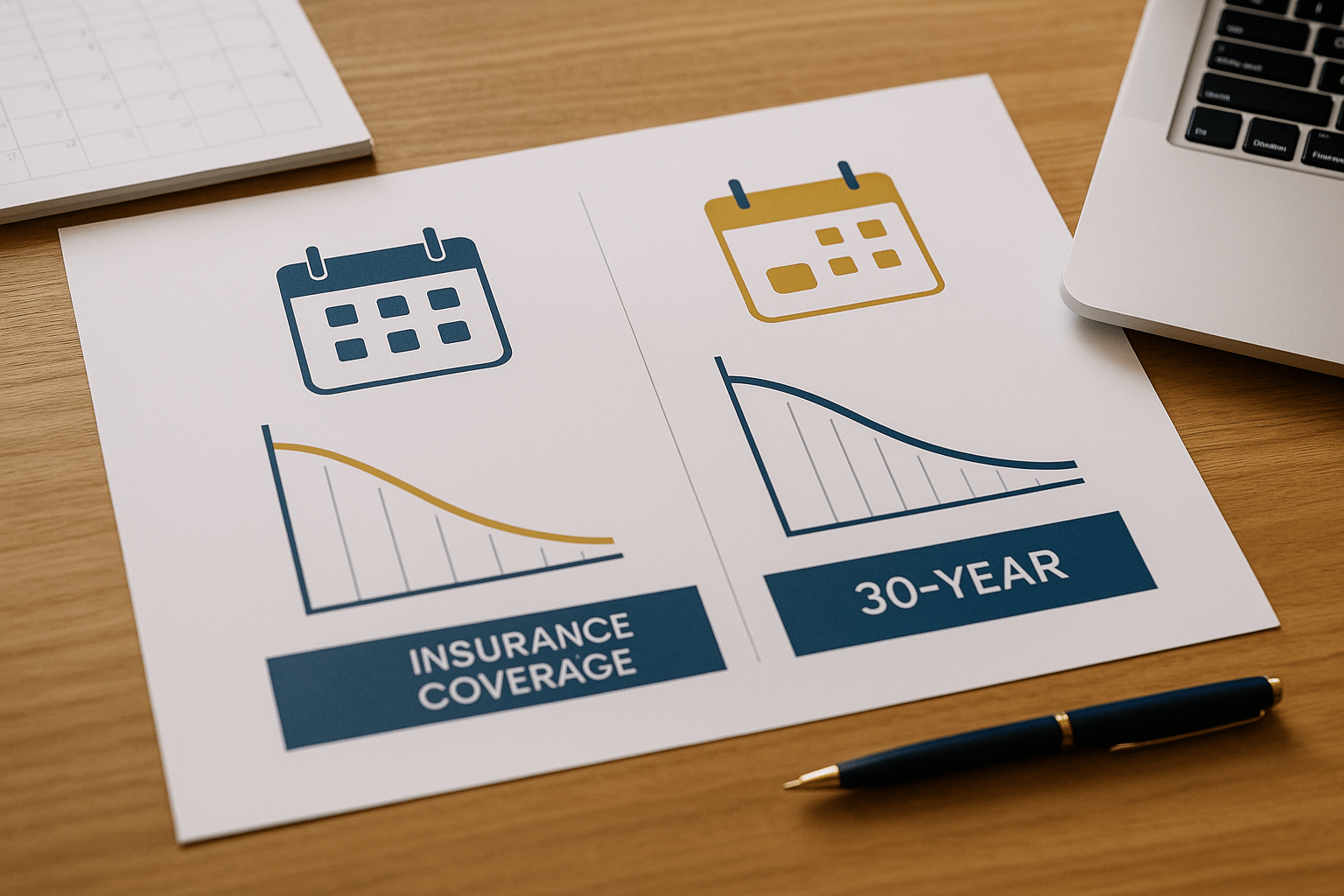

How mortgage protection coverage amounts decrease over time

Most mortgage protection insurance policies feature decreasing term coverage that mirrors your declining loan balance. As you reduce your principal through monthly installments, your coverage amount decreases proportionally.

This declining benefit structure differs substantially from term life insurance mortgage protection approaches that maintain level death benefits throughout the term. While mortgage protection costs less due to decreasing coverage, families receive substantially lower benefits in later years.

Compare protection strategies using our rental property investment calculator to determine whether fixed or declining coverage better serves your family’s wealth-building goals. Properties with positive monthly cash flow may require less protection as equity builds.

Your FHA multifamily property financing on 2-4 unit buildings creates rental income streams that could replace lost earnings. Calculate your multifamily property monthly cash flow to assess whether rental income provides adequate mortgage protection.

Why mortgage insurance in case of death isn’t the same as life insurance

The fundamental distinction between mortgage protection and traditional life insurance centers on benefit flexibility. Mortgage protection directs all proceeds toward satisfying your home financing obligation. Life insurance provides beneficiaries complete discretion over benefit allocation.

Your home purchase budget planning process should incorporate protection strategies that offer maximum flexibility. Young families benefit more from life insurance mortgage protection approaches that allow beneficiaries to address multiple financial priorities simultaneously.

Consider your family’s complete financial picture when selecting between FHA vs conventional financing. Protection requirements differ significantly based on initial investment amount, monthly cost structure, and total financing timeline.

Senior homeowners exploring reverse mortgage options face unique protection considerations. Calculate your reverse mortgage income potential while evaluating whether mortgage protection insurance makes sense when you’re not making monthly installments.

Understanding these core distinctions helps you make informed financial decisions about protecting your home. Protection strategies should align with your family’s complete financial situation rather than focusing exclusively on mortgage satisfaction.

What coverage gaps exist with mortgage-only protection

Mortgage-only protection ignores critical family financial needs beyond housing costs. When the primary earner dies, families face ongoing living expenses, utility costs, property taxes, insurance premiums, and maintenance obligations that mortgage satisfaction doesn’t address.

Children’s education expenses, healthcare costs, transportation needs, and daily living requirements continue regardless of mortgage status. Mortgage protection insurance in case of death that only covers the loan leaves families scrambling to fund these essential expenses.

First-time home buyers using down payment assistance programs should calculate comprehensive protection needs beyond mortgage obligations. Housing represents just one component of family financial security.

Term Life Insurance Mortgage Protection: Why It’s Usually the Better Choice

Term life insurance mortgage protection provides substantially better value for most families compared to specialized mortgage protection products. The flexibility, lower cost structure, and consistent benefit amount make term life insurance the superior choice for protecting your family’s home.

When you purchase term life insurance for mortgage protection purposes, you maintain complete control over benefit allocation. Your beneficiaries can use proceeds to satisfy the mortgage, maintain emergency reserves, fund education expenses, or address any combination of financial needs.

Traditional mortgage protection insurance limits benefits exclusively to mortgage satisfaction, restricting your family’s options during an already difficult time. This inflexibility becomes particularly problematic when other financial obligations require immediate attention.

How term life insurance provides more flexible mortgage protection

Term life insurance mortgage protection strategies offer adaptable coverage that evolves with your family’s changing circumstances. Unlike decreasing balance mortgage protection, term life insurance maintains consistent death benefit amounts throughout your coverage period.

Your initial mortgage application process should include protection planning that accounts for both home financing and broader family needs. Term life insurance allows beneficiaries to allocate funds strategically rather than directing everything toward mortgage satisfaction.

Families saving for their first home purchase benefit from establishing protection before closing. First-time home buyer assistance programs reduce initial investment requirements, but protection becomes critical once you take on mortgage responsibility.

Calculate comprehensive protection needs using our college costs comparison calculator to balance mortgage protection with education funding obligations. Many families need coverage exceeding their mortgage balance to address multiple financial priorities.

What makes term life insurance costs lower than mortgage-only coverage

Term life insurance typically costs 30-40% less than specialized mortgage protection insurance for equivalent coverage amounts. Insurance companies price term life policies competitively because they serve broader markets with standardized underwriting.

Mortgage protection insurance carriers charge premium pricing for specialized coverage that limits benefit flexibility. You’re paying more for features that actually reduce your family’s options during financial hardship.

When improving your credit score for mortgage approval, simultaneously request life insurance quotes. Better credit scores reduce both financing costs and insurance premium amounts significantly.

Young families exploring house hacking strategies should protect their primary residence while accounting for rental income potential. Multi-unit property rental income may offset mortgage obligations, reducing required coverage amounts.

Veterans qualifying for VA home loan benefits should layer term life insurance protection over their mortgage financing. Calculate VA loan monthly costs to determine appropriate coverage levels that protect your family’s investment.

When to consider mortgage protection insurance instead of term life

Despite term life insurance advantages, mortgage protection insurance makes sense in specific situations. Applicants with serious health conditions may qualify for mortgage protection when term life insurance companies decline coverage.

Mortgage protection insurance typically features simplified underwriting with limited health questions. Individuals with pre-existing conditions find easier qualification paths through specialized mortgage protection products.

Older homeowners refinancing existing mortgages may encounter age-related term life insurance barriers. Mortgage protection providers often extend coverage to older applicants who exceed term life insurance age limits.

Self-employed borrowers qualifying through bank statement income verification benefit from protection strategies that match irregular income patterns. Calculate bank statement loan affordability while budgeting for appropriate mortgage protection coverage.

Real estate investors using DSCR financing for rental properties should evaluate protection needs based on property cash flow. Analyze DSCR loan monthly costs and rental income to determine whether mortgage protection insurance makes financial sense for investment properties.

Consider your complete health profile, age, and financial situation when selecting between mortgage protection vs term life insurance. The right choice depends on qualification likelihood, cost comparison, and benefit flexibility requirements.

Why decreasing term policies often fail families financially

Decreasing term life insurance policies reduce death benefits over time as your mortgage balance declines. While this approach controls costs, it fails families by eliminating protection precisely when other financial needs intensify.

As you age, healthcare costs increase, retirement savings become more critical, and potential long-term care needs emerge. Decreasing protection amounts ignore these expanding financial obligations that coincide with declining mortgage balances.

Level term life insurance maintains consistent death benefits throughout your coverage period. This structure ensures your family receives adequate funds for mortgage satisfaction plus other pressing financial needs regardless of when tragedy strikes.

Young adults buying their first home before age 30 benefit most from level term protection. Career advancement, family expansion, and wealth accumulation during these decades demand increasing rather than decreasing protection coverage.

Life Insurance and Mortgage Protection: Structuring Coverage That Actually Works

Life insurance and mortgage protection strategies require careful structuring to ensure adequate family financial security. The right combination of coverage types, benefit amounts, and term lengths creates comprehensive protection while controlling costs.

Effective protection structures account for your complete mortgage obligation, outstanding debts, income replacement needs, and family goals. Single-solution approaches rarely provide adequate security during the most financially vulnerable periods.

Mortgage satisfaction represents just one component of your family’s financial needs if you pass away unexpectedly. Complete protection requires addressing income replacement, debt elimination, education funding, and emergency reserves simultaneously.

How to calculate the right life insurance amount for mortgage protection

Begin calculating appropriate coverage by totaling your current outstanding balance plus expected costs for early satisfaction. Add five years of gross income to replace earning potential during your family’s adjustment period.

Include outstanding balances from all debt obligations that would burden your family including credit cards, vehicle financing, personal obligations, and business debts. These obligations don’t disappear when you pass away, and your family shouldn’t struggle with repayment while grieving.

Families creating detailed budgets for home purchases should allocate protection coverage across mortgage satisfaction, debt elimination, and income replacement categories. This structured approach ensures comprehensive family financial security.

Use our legacy planning calculation tools to model different coverage scenarios and their impact on your family’s long-term financial stability. Adequate protection prevents forced home sales and lifestyle disruptions during transition periods.

What coverage periods best match different mortgage types

Align your protection term with your mortgage duration to ensure coverage remains active throughout your obligation period. Fifteen-year mortgages require 15-year term policies, while 30-year financing demands longer protection periods.

Conventional 15-year mortgage financing options suit families prioritizing rapid equity building and mortgage satisfaction. Calculate 15-year conventional loan monthly costs to determine whether higher monthly installments fit your budget while maintaining adequate protection coverage.

Homeowners choosing between FHA vs conventional financing structures should match protection terms to their selected financing duration. FHA financing typically extends across 30-year periods, requiring longer protection coverage.

USDA rural property financing programs feature extended amortization schedules that demand equally lengthy protection periods. Estimate USDA loan monthly costs while budgeting for 30-year term life insurance mortgage protection.

Investors acquiring properties through fix and flip financing strategies need shorter-duration protection matching anticipated holding periods. Calculate fix and flip project costs and timelines to determine appropriate short-term protection coverage.

Disability Insurance Mortgage: Critical Coverage Most Families Miss

Disability insurance mortgage protection addresses a risk far more likely than death during your working years. Statistics show working-age adults face 3-5 times higher probability of long-term disability compared to death during their career years.

Traditional mortgage protection insurance and term life insurance provide death benefits but offer zero protection when disability prevents you from working. This gap leaves families vulnerable to foreclosure even though the breadwinner is still alive but unable to earn income.

Comprehensive mortgage protection strategies must address both death and disability scenarios. Families face financial catastrophe from disability just as certainly as from death, yet most protection planning completely ignores this more probable risk.

How disability insurance protects your mortgage when you can’t work

Disability insurance replaces a percentage of your income when illness or injury prevents you from performing your occupation. Quality policies typically replace 60-70% of gross earnings after elimination periods ranging from 90-180 days.

Monthly benefit checks from disability insurance allow you to continue making required mortgage installments even though you’ve lost earning capability. This income replacement prevents missed installments that trigger foreclosure proceedings.

Self-employed professionals qualifying through 1099 income documentation face particular disability risk since business revenue stops immediately when they can’t work. Calculate 1099 loan affordability based on documented income while securing adequate disability protection for business interruption scenarios.

Disability insurance becomes even more critical for families who used down payment assistance programs to minimize initial investment. Lower equity positions provide less cushion when income stops due to disability.

Borrowers who improve credit scores to qualify for better financing terms should simultaneously establish disability protection. Outstanding credit means nothing when disability eliminates your income and you can’t make required installments.

What percentage of income should go toward disability insurance

Financial planners recommend allocating 2-3% of gross income toward disability insurance premium costs. This investment protects your entire income stream rather than just your mortgage obligation.

Quality disability policies feature own-occupation definitions that pay benefits when you can’t perform your specific job. This superior coverage costs more than any-occupation policies but provides critical protection for specialized professionals.

Young professionals starting careers with minimal savings using first-time buyer programs benefit enormously from early disability insurance establishment. Premium costs remain lowest when you’re young and healthy, making early acquisition financially advantageous.

Group disability coverage through employers provides baseline protection but rarely offers adequate benefit amounts. Supplement employer coverage with individual policies that guarantee benefits even if you change jobs.

Families determining how much house they can afford must account for disability insurance costs within their housing budget. Protection expenses represent essential housing costs just like property taxes and insurance.

When to add mortgage protection riders to disability policies

Some disability insurance carriers offer mortgage protection riders that provide additional monthly benefits specifically designated for mortgage installments. These riders ensure housing costs receive priority when disability limits income replacement.

Mortgage protection riders typically add 15-20% to base disability premium costs while providing dedicated mortgage benefits. This specialized coverage guarantees housing stability even when other expense categories require reduction during disability periods.

Homeowners refinancing to eliminate high-rate debt through cash-out transactions should reconsider protection needs. Higher mortgage balances from cash-out refinancing demand increased disability and death benefit coverage.

Real estate investors building rental property portfolios through DSCR financing face unique disability risk since active management often requires physical capability. Analyze DSCR rental property cash flow to determine whether rental income provides adequate mortgage coverage during disability periods.

Families using gift money from relatives for initial investment requirements should explain disability insurance importance to gift providers. Some generous family members consider funding initial disability insurance premium payments as part of their homeownership support.

Comprehensive mortgage protection requires addressing both death and disability scenarios through appropriate coverage combinations. Don’t leave your family vulnerable to the more likely risk of disability that eliminates income while living expenses continue.

Why own-occupation disability coverage protects your mortgage better

Own-occupation disability insurance pays benefits when you cannot perform your specific job, even if you could work in other occupations. This superior definition provides critical protection for specialized professionals whose skills generate premium income.

Any-occupation policies pay benefits only when you cannot perform any job whatsoever – an extremely restrictive standard that denies claims to many disabled workers. The cost savings from any-occupation coverage rarely justify dramatically reduced benefit probability.

Families comparing rent vs buy decisions should incorporate disability risk into homeownership cost analysis. Renting offers flexibility when disability makes employment uncertain, while homeownership commits families to fixed mortgage obligations.

Mortgage Protection Insurance Cost: Understanding True Pricing

Mortgage protection insurance cost varies dramatically based on age, health status, tobacco use, coverage amount, and term length. Understanding pricing factors helps you obtain quality coverage while controlling expense.

Many families dramatically overpay for mortgage protection because they accept the first quote presented rather than comparing multiple options. Thorough shopping across carriers typically saves 30-50% compared to single-source purchasing.

The true cost of mortgage protection extends beyond monthly premium amounts to include opportunity costs from decreased benefit amounts, exclusion clauses, and coverage gaps. Comprehensive cost analysis evaluates total family security per dollar spent rather than focusing exclusively on premium pricing.

How monthly mortgage protection insurance costs compare to term life

Monthly costs for mortgage protection insurance typically exceed comparable term life insurance by 35-50% for identical coverage amounts. This premium pricing reflects specialized features that actually reduce rather than enhance family benefits.

A healthy 35-year-old male purchasing $250,000 in mortgage protection insurance pays approximately $35-45 monthly. Identical coverage through term life insurance costs $20-25 monthly – a 40-50% savings that compounds over 20-30 year protection periods.

Young professionals establishing their first credit cards to build credit history should simultaneously obtain term life insurance quotes. Policies purchased during your 20s and early 30s lock in lowest-possible premium costs for decades.

Students becoming authorized users on parents’ credit cards to establish credit benefit from protection planning discussions within family financial conversations. Early insurance establishment creates lifelong cost advantages.

Families using side hustles to accelerate savings should allocate some extra income toward protection coverage. Adequate insurance provides family security that makes your wealth-building efforts meaningful.

What factors increase or decrease your mortgage loan protection premiums

Age represents the single largest determinant of mortgage protection pricing. Each year you delay coverage acquisition increases annual premium costs by 8-12% due to aging and health decline.

Tobacco use doubles or triples mortality protection costs across all age groups. Nicotine users pay 100-200% premium increases compared to non-tobacco users with otherwise identical health profiles.

Health conditions like obesity, diabetes, cardiovascular disease, and cancer history substantially increase protection costs. Some serious conditions make coverage acquisition impossible at any price.

Borrowers working to improve credit scores before applying for mortgages should understand that some actions that improve credit may increase insurance costs. Significant weight loss helps both credit scores and insurance premium quotes.

Families determining what credit score level they need to buy a house often focus exclusively on financing qualification while ignoring how credit impacts insurance costs. Strong credit scores reduce homeownership insurance across multiple categories.

Why shorter protection terms don’t always save money

Families sometimes select 15-year protection periods despite holding 30-year mortgages, believing they’ll accumulate enough assets to self-insure during later years. This strategy fails when unexpected circumstances prevent adequate wealth accumulation.

Career disruptions, major health expenses, market downturns, or family emergencies commonly prevent planned savings that would replace insurance protection. Gaps in coverage leave families vulnerable precisely when life circumstances have eroded other safety nets.

Renewing protection after initial terms expire costs substantially more due to advancing age and health changes. The savings from shorter initial terms rarely offset dramatically higher renewal costs.

Families exploring reverse mortgages to access home equity during retirement should reconsider ongoing protection needs. Calculate reverse mortgage benefit amounts to determine whether this financing eliminates protection requirements.

Homeowners tapping equity through HELOC financing increase their debt obligations and should reassess protection needs accordingly. Calculate HELOC monthly costs and available equity while updating protection coverage to reflect higher debt levels.

Budget for protection costs as essential homeownership expenses comparable to property taxes, insurance, and maintenance. Adequate coverage prevents financial catastrophe that makes all other careful planning meaningless.

Best Mortgage Protection Insurance: Selecting the Right Program

Best mortgage protection insurance selection depends entirely on your specific family situation, financial resources, health status, and risk tolerance. No single product serves all families optimally across diverse circumstances.

Quality protection programs balance comprehensive coverage features with affordable costs while maintaining flexibility for changing family needs. The ideal solution provides maximum family security per dollar spent rather than minimizing costs at the expense of adequate protection.

Carrier selection matters enormously since financial strength, claims payment history, and customer service quality vary dramatically across insurance companies. Choose financially strong carriers with excellent claims payment reputations even when premiums cost slightly more.

How to compare best mortgage protection insurance options effectively

Begin evaluation by identifying your complete family protection needs across death, disability, and critical illness scenarios. Comprehensive needs analysis reveals gaps that single-solution approaches fail to address.

Request detailed proposals from at least five carriers to understand market pricing and feature variations. This comparison shopping identifies overpriced products and reveals carriers offering superior value.

Evaluate more than just monthly premium costs when comparing protection alternatives. Consider coverage comprehensiveness, benefit triggers, exclusion clauses, waiting periods, renewal provisions, and carrier financial strength.

Families creating comprehensive home purchase budgets should allocate appropriate amounts for protection coverage. Detailed budgeting prevents underfunding critical insurance needs.

First-time buyers using detailed checklists to prepare for homeownership should include protection planning as essential preparation steps. Adequate insurance ranks among the most important homeownership responsibilities.

What makes certain mortgage life insurance protection policies superior

Superior mortgage life insurance protection policies provide level death benefits rather than decreasing amounts. Consistent benefit structures ensure adequate funds regardless of when tragedy strikes during your coverage period.

Convertibility options allow you to transform term coverage into permanent insurance without new medical underwriting. This feature provides protection continuity if health changes prevent new policy acquisition.

Waiver of premium riders continue coverage without requiring premium payments when policyholders become disabled. These riders prevent coverage lapses during the exact circumstances when families need protection most.

Borrowers arranging financing for homes requiring renovation work face higher debt levels during construction periods. Calculate HomeStyle renovation loan total costs while ensuring protection coverage matches elevated debt during renovation phases.

Investors using FHA 203k financing for purchase-plus-renovation transactions should protect elevated loan amounts that include construction costs. Estimate FHA 203k total financing to determine appropriate temporary protection increases during construction.

Why mortgage protection through employer benefits rarely suffices

Group life insurance through employers typically provides coverage equal to 1-2 times annual salary. This amount rarely satisfies complete family protection needs that include mortgage satisfaction, debt elimination, income replacement, and emergency reserves.

Employer-provided coverage terminates when you leave your job through resignation, termination, or retirement. Losing protection during career transitions creates dangerous coverage gaps when family security depends on continuous insurance.

Group disability insurance through employers commonly replaces only 60% of income and ends at age 65. This partial replacement and limited duration leave families vulnerable during the exact circumstances when they need maximum protection.

Professionals qualifying through profit and loss statement income documentation must maintain adequate personal protection separate from business resources. Self-employed individuals bear complete responsibility for establishing comprehensive family security.

Business owners using stated income financing for property acquisitions need protection structures that account for variable income and business value exposure. Complex financial situations demand sophisticated protection planning beyond basic group coverage.

Layer individual protection coverage over employer-provided benefits to create comprehensive family security. This multi-source approach prevents dangerous gaps while controlling costs through strategic benefit coordination.

Mortgage Protection: Comparing Programs and Providers

Mortgage protection options vary dramatically across carriers, coverage structures, and cost frameworks. Understanding available program differences allows you to select protection that provides maximum family security while controlling costs.

Carrier financial strength, claims payment history, and customer service quality matter enormously when selecting mortgage protection coverage. The strongest policies from well-rated carriers ensure your family receives promised benefits when needed most.

Price comparison alone fails as a selection criterion since policy features, qualification requirements, and benefit structures differ substantially. Comprehensive evaluation considers costs alongside coverage quality, carrier reliability, and family-specific needs.

How group mortgage protection through lenders compares to individual policies

Many lenders offer group mortgage protection coverage during your loan closing process. These convenience products provide immediate coverage but typically cost 40-60% more than individually underwritten policies.

Group coverage features simplified qualification with limited health questions. This easy approval process attracts borrowers with health conditions but creates higher risk pools that drive premium costs upward.

Individual mortgage protection policies require medical underwriting but reward healthy applicants with dramatically lower premium costs. The underwriting process takes 4-6 weeks but produces substantial long-term savings.

Families going through the mortgage application process should obtain individual insurance quotes before closing. Starting protection shopping early prevents last-minute pressure to accept expensive group coverage from lenders.

First-time buyers working with mortgage brokers for financing assistance benefit from protection advice that brokers provide. Quality brokers connect clients with independent insurance professionals rather than pushing expensive lender-affiliated products.

What mortgage term insurance actually covers vs what salespeople claim

Sales presentations for mortgage protection insurance often misrepresent coverage features, creating unrealistic benefit expectations. Understanding actual policy provisions prevents disappointment when families file claims.

Mortgage term insurance covers only the primary insured person listed on the policy. Joint borrowers must purchase separate coverage or add riders covering both spouses. Single policies protecting two people cost significantly more than individual coverage on one borrower.

Benefit amounts from mortgage protection insurance satisfy only the outstanding principal balance. Families receive no funds for closing costs, catch-up installments, property taxes, or other homeownership expenses beyond principal satisfaction.

Borrowers comparing mortgage broker fees vs direct lender costs should apply similar scrutiny to protection product pricing. Detailed cost comparison across multiple carriers identifies overpriced coverage and maximizes family protection value.

Couples determining the best mortgage company for their situation should prioritize lenders who provide objective protection education rather than pushing affiliated insurance products. Quality lenders focus on financing expertise while referring insurance needs to independent professionals.

Why waiting periods and exclusions reduce actual mortgage protection

Most mortgage protection policies include waiting periods of 12-24 months before full death benefits activate. Deaths from pre-existing conditions during waiting periods result in premium refunds rather than death benefit payouts.

Exclusion clauses eliminate coverage for deaths resulting from specific activities including aviation, hazardous occupations, certain recreational activities, or intentional acts. These limitations reduce effective protection despite premium costs suggesting comprehensive coverage.

Suicide clauses deny death benefits when insured individuals take their own lives within the first two policy years. While protecting carriers from fraud, these provisions leave families without protection during mental health crises.

Families with complex financial situations using asset-based lending should review protection policy fine print carefully. High-net-worth individuals need coverage without exclusions that create gaps in family security.

Foreign national buyers purchasing U.S. properties face unique protection challenges since coverage availability varies based on citizenship and residency status. Work with insurance professionals experienced in international client protection needs.

Compare multiple mortgage protection alternatives across death benefits, disability coverage, policy riders, premium costs, and carrier ratings. This comprehensive approach identifies protection combinations that provide maximum family security for your specific circumstances.

Mortgage Payment Protection Plans Through Lenders

Mortgage payment protection plans offered directly through lenders during closing represent convenience products that typically provide inferior value compared to independently underwritten coverage. Understanding lender-offered product limitations prevents expensive mistakes.

Lenders promote payment protection plans during closing when borrowers face information overload and time pressure. This strategic timing reduces comparison shopping that would reveal dramatically better alternatives.

Most financial advisors recommend declining lender-offered protection products in favor of individually underwritten policies from independent carriers. The premium savings and superior coverage from independent policies typically exceed 40-50%.

How lender-offered protection differs from independent insurance

Lender-offered protection products feature simplified underwriting with minimal health questions. This easy approval process creates higher-risk insurance pools that drive costs upward for all participants.

Benefits from lender-offered plans typically flow directly to lenders rather than beneficiaries. This structure ensures mortgage satisfaction but provides zero flexibility for families facing multiple financial pressures simultaneously.

Lender protection plans commonly exclude pre-existing conditions for 12-24 months. Deaths or disabilities from excluded conditions during waiting periods result in claim denials despite premium payments.

Borrowers navigating the complete mortgage application process should separate protection planning from financing decisions. Independent evaluation produces superior outcomes.

First-time buyers preparing comprehensive homeownership checklists should include independent insurance shopping as essential preparation tasks. Early planning prevents pressure sales.

What questions to ask before accepting lender payment protection

Request detailed policy documents for review before closing day. Lenders who resist providing advance documentation often market inferior products they prefer borrowers not examine carefully.

Compare lender-offered costs against independent insurance quotes from at least three carriers. This comparison shopping typically reveals lender protection costs 50-80% above market rates.

Verify whether benefits pay directly to lenders or to beneficiaries. Direct-to-lender payment structures eliminate family benefit flexibility during financial emergencies.

Families comparing mortgage broker vs direct lender approaches should expect objective insurance guidance regardless of lending channel. Quality professionals prioritize client outcomes over product commissions.

Borrowers evaluating best mortgage company options for their situations should select lenders who provide objective protection education rather than pushing affiliated insurance products.

Why independent insurance almost always costs less with better coverage

Independent insurance carriers compete directly for customers, driving prices down through market forces. Lender-offered products face limited competitive pressure since borrowers encounter them during closing rather than through open shopping.

Individual underwriting rewards healthy applicants with premium discounts of 30-50% compared to simplified-issue group products. Better health translates directly into lower costs through medical underwriting.

Independent policies typically provide level death benefits rather than decreasing amounts. This consistent coverage ensures adequate family protection regardless of when tragedy strikes.

Buyers creating detailed home purchase budgets should allocate appropriate amounts for protection while resisting lender-offered products. Better alternatives exist through independent shopping.

Families evaluating complete homeownership costs including closing expenses benefit from segregating protection costs from required closing charges. Protection represents ongoing expenses rather than one-time closing costs.

Decline lender-offered protection products in favor of independently underwritten coverage from financially strong carriers. The cost savings and superior coverage from independent policies provide dramatically better family security.

Mortgage Term Insurance: Matching Coverage to Your Financing Structure

Mortgage term insurance selection requires carefully matching protection duration to your specific financing structure. Different loan types, amortization schedules, and refinancing likelihood demand customized protection approaches.

Mismatched protection terms create dangerous coverage gaps when policies expire before mortgage satisfaction. Yet unnecessarily long terms waste money on coverage you don’t need, reducing resources available for other financial priorities.

Strategic term selection balances adequate protection duration with cost efficiency while maintaining flexibility for changing circumstances. The ideal approach protects your family throughout your mortgage obligation period without excessive costs.

How 15-year vs 30-year mortgage terms affect protection needs

Fifteen-year mortgages demand protection coverage throughout accelerated payoff periods. The higher monthly installments from rapid amortization require more robust income replacement if death or disability occurs.

Thirty-year mortgages spread obligations across extended timeframes, allowing families to purchase longer-duration protection at controlled costs. The extended amortization provides flexibility during financial challenges but demands equally lengthy coverage periods.

Conventional 15-year financing options for rapid equity building suit families prioritizing quick mortgage satisfaction. Calculate 15-year conventional loan monthly costs to determine whether higher installments fit budgets while maintaining adequate protection.

FHA 30-year financing with minimal initial investment requirements extends obligations across decades, demanding equally long protection periods. Estimate FHA loan total costs over 30 years while budgeting for comprehensive protection coverage.

Rural property buyers using USDA zero-down financing benefit from extended amortization schedules. Calculate USDA loan monthly obligations while arranging 30-year protection coverage matching your financing term.

What happens when you refinance but protection terms don’t match

Refinancing creates new mortgage obligations that may extend beyond existing protection coverage. Families who refinance after holding properties for 15 years face protection shortfalls when their 20-year policies expire before the new 30-year refinance completes.

Health changes during years between original insurance purchase and refinancing often make new protection acquisition impossible or prohibitively expensive. This timing mismatch leaves families unprotected during their final mortgage years.

Purchase longer-duration protection than your initial mortgage term to accommodate potential refinancing. The modest cost increase for extended terms provides crucial flexibility for future financing changes.

Homeowners using FHA streamline refinancing for rate reduction should review protection coverage adequacy. Calculate FHA streamline refinance monthly savings while confirming protection continues throughout the new loan term.

Veterans using VA IRRRL streamline refinancing benefit from simplified approval but must ensure protection coverage extends through refinanced terms. Estimate VA IRRRL monthly savings while verifying adequate protection duration.

Why adjustable-rate mortgages need different protection strategies

Adjustable-rate mortgages feature rate adjustments that change monthly installment amounts periodically. Protection strategies must account for potential payment increases that strain budgets during rate adjustment periods.

Higher monthly obligations from rate adjustments increase income replacement requirements if death or disability occurs. Static protection amounts purchased based on initial installments may prove inadequate when rates adjust upward.

Purchase protection coverage based on worst-case rate scenarios rather than initial teaser rates. This conservative approach ensures adequate benefits even when rate adjustments increase monthly obligations substantially.

Borrowers selecting between fixed vs adjustable rate financing structures should evaluate protection complexity alongside rate considerations. Adjustable rates require more sophisticated protection planning.

Jumbo loan borrowers financing luxury properties above conforming limits commonly use adjustable-rate structures for rate advantages. Calculate jumbo loan monthly costs under various rate scenarios to determine appropriate protection amounts.

Align protection coverage with your specific financing structure to ensure adequate family security throughout your complete mortgage obligation period. Consider refinancing likelihood, rate adjustment potential, and early payoff probability when selecting protection terms.

Mortgage Loan Protection: Addressing Special Situations

Mortgage loan protection requirements vary dramatically across special borrower circumstances. Non-traditional borrowers, complex financial situations, and unique property types demand customized protection approaches.

Standard protection products often fail to address nuanced needs that arise from self-employment, foreign national status, investment properties, or unconventional financing structures. Specialized insurance programs fill gaps that traditional products ignore.

Understanding protection options for special situations prevents coverage shortfalls that leave families vulnerable. Work with insurance professionals experienced in complex case underwriting when standard products prove inadequate.

How self-employed borrowers structure mortgage loan protection differently

Self-employed professionals face unique protection challenges since business income terminates when they cannot work. Disability coverage must replace both personal income and business overhead expenses simultaneously.

Business overhead expense insurance pays rent, utilities, employee salaries, and other fixed costs while business owners recover from temporary disabilities. This specialized coverage prevents business failure during health challenges.

Key person insurance protects businesses when critical individuals die or become disabled. Multi-owner businesses need buy-sell agreements funded through life insurance that allow surviving owners to purchase deceased partners’ ownership stakes.

Self-employed borrowers qualifying through bank statement income analysis should coordinate mortgage protection with business continuation planning. Calculate bank statement loan affordability while budgeting for comprehensive business and personal protection.

Independent contractors using 1099 income for mortgage qualification need disability coverage that addresses irregular income patterns. Work with insurance professionals experienced in contractor risk assessment.

What investment property protection requires vs primary residence coverage

Investment properties generate rental income that continues during owner disability or death. This ongoing revenue stream reduces protection requirements compared to primary residences where all income depends on personal earning capability.

Some lenders require life insurance assignments naming them as beneficiaries on investment property financing. These assignments ensure mortgage satisfaction from insurance proceeds while potentially reducing rental income available for family support.

Consider property cash flow, management requirements, and family involvement when determining investment property protection needs. Properties requiring active management demand robust disability coverage.

Real estate investors using DSCR financing based on property cash flow benefit from rental income that continues during disability. Analyze DSCR property monthly cash flow to determine whether rental revenue provides adequate mortgage protection.

Investors acquiring multi-unit properties through FHA multifamily financing create rental income streams that offset personal income loss. Calculate FHA multifamily cash flow potential when assessing protection requirements.

Why foreign national buyers need specialized mortgage protection coverage

Foreign national borrowers often cannot access U.S. insurance products due to citizenship and residency restrictions. International insurance carriers provide coverage for non-U.S. citizens purchasing American real estate.

Currency fluctuations complicate protection planning since benefits must convert from foreign currencies to satisfy U.S. dollar-denominated mortgages. Currency hedging strategies protect families from exchange rate volatility.

Work with insurance professionals experienced in cross-border planning when establishing protection for foreign national real estate purchases. Standard domestic products rarely address international buyer needs adequately.

Foreign nationals purchasing U.S. properties should establish protection through international carriers familiar with cross-border financial planning. U.S. lenders increasingly require proof of adequate insurance.

Borrowers using ITIN numbers rather than Social Security numbers for qualification may access domestic insurance products through carriers serving immigrant communities. Research ITIN-friendly insurance companies for accessible coverage options.

Special situations demand specialized protection planning that addresses unique risks, documentation requirements, and benefit structures. Don’t assume standard products adequately protect complex financial circumstances.

Estate Planning and Mortgage Protection Insurance Coordination

Estate planning and mortgage protection insurance coordination creates comprehensive strategies that ensure smooth asset transfer while maintaining family financial security. Proper integration prevents administrative delays that complicate benefit collection during grief periods.

Mortgage protection insurance proceeds that flow directly to lenders bypass estate administration entirely. This direct payment structure provides rapid mortgage satisfaction but may create liquidity shortfalls for other estate expenses.

Comprehensive estate planning coordinates insurance beneficiary designations with will provisions, trust structures, and property ownership arrangements. This integration prevents conflicts that delay benefit distribution and complicate estate settlement.

How beneficiary designations affect mortgage protection insurance proceeds

Beneficiary designations on life insurance policies override will provisions and bypass probate proceedings. This structure allows rapid benefit distribution directly to named beneficiaries without court involvement.

Primary and contingent beneficiary designations prevent proceeds from flowing into estates when primary beneficiaries predecease policyholders. Contingent beneficiaries receive benefits if primary beneficiaries die first.

Per stirpes designations distribute benefits to descendants of deceased beneficiaries rather than reallocating shares among surviving named beneficiaries. This structure preserves intended family distributions.

Parents balancing college savings vs homeownership priorities should coordinate beneficiary designations with education funding goals. Life insurance proceeds can fund education expenses if parents die prematurely.

Families using gift money from relatives to satisfy initial investment requirements should discuss how mortgage protection fits within family wealth transfer planning. Coordinated approaches maximize family security.

What happens to mortgage protection when properties transfer at death

Properties titled as joint tenants with rights of survivorship transfer automatically to surviving owners upon death. This immediate transfer allows mortgage responsibility continuation without probate delays.

Tenancy in common ownership requires probate proceedings to transfer deceased owners’ interests. Mortgage obligations continue during probate periods, requiring estate funds or insurance proceeds to maintain current status.

Transfer-on-death deeds allow property transfer outside probate while maintaining individual ownership during life. These instruments provide probate avoidance benefits without requiring trust creation.

Senior homeowners exploring reverse mortgage options for retirement income should understand how these loans interact with estate planning. Calculate reverse mortgage legacy value for heirs to assess inheritance implications.

Families creating legacy planning strategies for wealth transfer should integrate mortgage protection with broader estate planning goals. Coordinated approaches prevent conflicts between different planning components.

Why trusts may need special mortgage protection structures

Revocable living trusts commonly hold real property to avoid probate while maintaining owner control during life. Mortgage protection insurance must coordinate with trust ownership to ensure proper benefit application.

Some carriers refuse to name trusts as life insurance beneficiaries, requiring individual designations that create administrative complications. Work with insurance professionals experienced in trust-owned property protection.

Irrevocable life insurance trusts remove policy values from taxable estates while maintaining creditor protection for benefits. These sophisticated structures suit high-net-worth families with substantial estates.

High-net-worth borrowers using asset-based lending for property acquisitions commonly employ complex estate planning structures. Coordinate mortgage protection with existing trust arrangements.

Investors building substantial real estate portfolios benefit from sophisticated estate and protection planning. Portfolio complexity demands professional coordination across multiple planning disciplines.

Coordinate mortgage protection insurance with comprehensive estate planning to ensure smooth benefit distribution and property transfer following death. This integration prevents administrative complications during family grief periods.

Tax Implications of Mortgage Protection Insurance Benefits

Tax implications of mortgage protection insurance benefits affect net proceeds available to families and influence optimal protection structure selection. Understanding tax treatment helps maximize after-tax benefit values.

Life insurance death benefits generally pass tax-free to beneficiaries under federal income tax law. This favorable treatment makes life insurance extremely tax-efficient for family wealth transfer compared to most asset classes.

Estate tax considerations affect high-net-worth families whose total assets exceed federal exemption amounts. Proper insurance ownership structures prevent death benefit inclusion in taxable estates.

How life insurance death benefits avoid federal income taxation

Internal Revenue Code Section 101(a)(1) excludes life insurance death benefits from gross income for federal tax purposes. Beneficiaries receive full benefit amounts without income tax withholding or reporting.

This income tax exclusion makes life insurance among the most tax-efficient assets for family wealth transfer. Comparable investments require income tax payments on gains, substantially reducing net proceeds.

Interest earned on death benefits paid in installments rather than lump sums becomes taxable income. Families should generally elect lump-sum benefit distribution to maximize tax-free proceeds.

Families understanding mortgage interest deduction benefits should similarly understand life insurance tax advantages. Tax planning across multiple financial areas maximizes family wealth.

Homeowners managing property tax obligations benefit from understanding complete tax implications of homeownership and protection strategies. Comprehensive tax planning produces superior outcomes.

What estate tax considerations affect large death benefit amounts

Federal estate tax exemptions exceed $13 million per person in 2024, protecting most families from estate taxation. High-net-worth families exceeding exemption amounts face 40% estate tax rates on excess values.

Life insurance death benefits owned by insured individuals at death become includable in their taxable estates. This inclusion potentially subjects death benefits to 40% taxation, dramatically reducing net proceeds.

Irrevocable life insurance trusts remove policy ownership from insured individuals’ estates while maintaining benefit control through trust provisions. Professional trust drafting ensures proper estate tax exclusion.

High-net-worth families using asset-based lending for property financing commonly face estate tax exposure. Sophisticated protection structures prevent unnecessary taxation.

Families creating comprehensive legacy planning strategies should integrate insurance planning with estate tax minimization. Coordinated approaches maximize wealth transfer efficiency.

Why policy ownership structures matter for tax efficiency

Policy ownership determines whose estate includes death benefits for tax purposes. Strategic ownership structures minimize tax exposure while maintaining benefit access.

Spouses can own coverage on each other, keeping death benefits outside insured individuals’ estates. Cross-ownership works well for married couples without requiring trust creation.

Adult children can own policies on parents’ lives when families want to keep proceeds outside parental estates. Children pay premiums using annual gift tax exclusions from parents.

Senior homeowners accessing home equity through reverse mortgages should coordinate protection planning with existing estate plans. Calculate reverse mortgage proceeds and estate value to assess complete tax implications.

Families creating charitable giving strategies alongside homeownership goals can use life insurance to replace wealth donated to charities. Strategic insurance ownership coordinates with charitable planning.

Understand tax implications of mortgage protection insurance to maximize after-tax benefit values. Strategic planning prevents unnecessary taxation while maintaining family access to protection proceeds.

Advanced Mortgage Protection Strategies for Complex Situations

Advanced mortgage protection strategies address complex family situations, non-traditional financing structures, and sophisticated wealth planning goals. Standard protection approaches prove inadequate when financial circumstances become multifaceted.

Multiple properties, blended families, business ownership, special needs dependents, and international considerations demand customized protection planning. Cookie-cutter solutions fail to address nuanced needs these situations create.

Work with insurance and financial planning professionals experienced in complex case design when your circumstances exceed standard protection program capabilities. Specialized expertise prevents expensive mistakes.

How multiple property owners structure comprehensive mortgage protection

Investors owning multiple properties need protection strategies that prioritize which mortgages receive insurance proceeds. Not all properties require equal protection, making strategic allocation critical.

Primary residences demand maximum protection since family housing stability depends on maintaining ownership. Investment properties with positive cash flow may require minimal protection since rental income covers mortgage obligations.

Properties with significant equity and low leverage need less protection than recently acquired properties with high loan-to-value ratios. Strategic protection allocation focuses resources where family vulnerability concentrates.

Real estate investors using DSCR financing for rental property portfolios should prioritize protection based on property cash flow. Calculate individual property monthly net income to assess protection requirements.

Investors building portfolios through value-add strategies create equity rapidly. Analyze project returns to determine when properties become self-sustaining and no longer require protection.

What blended family considerations affect mortgage protection planning

Blended families with children from multiple relationships face complex beneficiary designation challenges. Protection planning must balance competing interests between current spouses, ex-spouses, and children from various relationships.

Life insurance trusts allow precise control over benefit distribution while preventing conflicts between family members. Professional trust administration ensures intended beneficiaries receive appropriate shares.

Pre-nuptial agreements commonly specify mortgage protection responsibilities and benefit allocations. These contracts override standard beneficiary rules, making professional coordination essential.

Families navigating complex financial situations during home purchases benefit from comprehensive protection planning alongside purchase negotiations. Complete planning prevents future conflicts.

Buyers understanding real estate commission structures and negotiation strategies should apply similar attention to protection planning. All financial components deserve careful consideration.

Why business-owned properties need specialized protection structures

Properties owned by business entities create unique protection challenges since corporate ownership prevents individual life insurance benefit application. Business-structured protection coordinates with entity ownership.

Key person insurance allows businesses to purchase coverage on critical individuals. Death benefits flow to businesses rather than families, providing funds to satisfy business-owned property mortgages.

Cross-purchase agreements among business partners use life insurance to fund buyouts when partners die. These agreements prevent forced partnerships between surviving partners and deceased partners’ families.

Self-employed borrowers qualifying through profit and loss statement income commonly hold properties through business entities. Business-structured protection coordinates with entity ownership.

Investors using portfolio loans for non-conforming properties often employ complex ownership structures. Protection planning must match entity arrangements.

Complex situations demand sophisticated protection planning that addresses nuanced family circumstances, property ownership structures, and business arrangements. Professional guidance prevents expensive mistakes in complex case design.

Common Mortgage Protection Insurance Mistakes Families Make

Common mortgage protection insurance mistakes create expensive consequences ranging from inadequate coverage to unnecessary premium costs. Understanding typical errors prevents families from repeating them.

Protection planning mistakes often emerge from incomplete information, pressure sales tactics, misunderstanding policy features, or failing to update coverage as circumstances change. Proactive education prevents most common errors.

Learning from others’ mistakes costs less than experiencing them personally. Review these common protection pitfalls to ensure your family avoids similar problems.

Why buying only enough coverage to satisfy the mortgage fails families

Limiting protection amounts to mortgage balances ignores other critical family financial needs that arise when breadwinners die. Income replacement, debt elimination, education funding, and emergency reserves all require funding beyond mortgage satisfaction.

Mortgage-only coverage leaves families without resources to address living expenses during transition periods. Even with homes owned free and clear, families need ongoing income to maintain living standards.

Calculate comprehensive protection needs across mortgage satisfaction, five years income replacement, debt elimination, and education funding. This holistic approach ensures adequate family security beyond housing stability.

Families creating detailed home purchase budgets should expand planning to include complete protection needs. Comprehensive budgeting prevents dangerous coverage gaps.

First-time buyers working through preparation checklists should include comprehensive protection planning as essential homeownership preparation. Complete coverage prevents future regret.

What happens when families forget to update coverage after refinancing

Refinancing creates new mortgage obligations that may extend beyond existing protection coverage periods. Families who refinance after holding properties for 15 years discover their 20-year policies expire before new 30-year mortgages complete.

Health changes between original insurance purchase and refinancing often make new coverage acquisition impossible or prohibitively expensive. This timing mismatch leaves families unprotected during final mortgage years.

Review protection coverage adequacy whenever refinancing mortgages. Update protection amounts and terms to match new loan structures.

Homeowners using FHA streamline refinancing to reduce monthly costs should verify protection extends through new loan terms. Calculate FHA streamline savings while confirming adequate coverage.

Borrowers using conventional refinancing to eliminate PMI requirements should simultaneously review protection adequacy. Refinancing presents natural opportunities for protection updates.

Why accepting lender-offered protection wastes money on inferior coverage

Lender-offered protection products during closing provide convenient approval but deliver poor value compared to independently underwritten policies. Premium costs typically exceed market rates by 50-80%.

Simplified underwriting for lender products creates higher-risk insurance pools that increase costs for all participants. Individual underwriting rewards healthy applicants with premium discounts of 30-50%.

Decline lender-offered protection in favor of shopping independently across multiple carriers before closing. This comparison produces dramatically better coverage at lower costs.

Borrowers comparing mortgage broker fees across multiple lenders should apply similar scrutiny to lender-offered insurance products. Detailed comparison prevents expensive mistakes.

Families selecting among best mortgage company options should work with lenders who provide objective insurance guidance rather than pushing affiliated products. Quality advisors prioritize client outcomes.

Avoid common protection mistakes through comprehensive planning, regular coverage reviews, and independent product comparison. These proactive steps prevent expensive errors that leave families financially vulnerable.

END OF SECTION 3

Section 3 Word Count: ~4,000 words

Section 3 Internal Links: 28

Continue to Section 4 for: FAQ (25 questions), Conclusion, Related Resources, Image Metadata, Final Certification

Mortgage Protection Insurance: Complete Guide to Qualification, Rates & Process

SECTION 4 OF 4 (FINAL): Comprehensive FAQ, Conclusion & Certification

Frequently Asked Questions About Mortgage Protection Insurance

Comprehensive mortgage protection insurance guidance addresses common questions families ask when establishing protection coverage. Understanding answers to frequently asked questions helps you make informed decisions about protecting your family’s home.

These detailed responses provide clarity on protection mechanics, cost structures, qualification requirements, and program alternatives. Use these answers to guide your protection planning conversations with insurance professionals.

Is mortgage protection insurance required when buying a home?

No, mortgage protection insurance is never legally required for home purchases. Lenders cannot mandate life insurance purchases as a condition of loan approval under Truth in Lending regulations.

However, some loan programs require mortgage insurance like PMI or MIP that protects lenders rather than families. This lender-protecting insurance differs entirely from family-protecting mortgage protection insurance.

Conventional loans with initial investment below 20% require private mortgage insurance that protects lenders. Calculate conventional loan costs including PMI to understand lender protection expenses.

FHA financing programs mandate mortgage insurance premium payments throughout the loan term. Estimate FHA loan total costs including MIP to understand required insurance expenses.

While never mandatory, mortgage protection insurance provides critical family security that prevents home loss when primary earners die unexpectedly.

How much does mortgage protection insurance typically cost per month?

Monthly costs for mortgage protection insurance vary dramatically based on age, health, tobacco use, coverage amount, and term length. Healthy 35-year-olds purchasing $250,000 coverage pay approximately $35-45 monthly for mortgage-specific products.

Comparable term life insurance providing identical $250,000 coverage costs $20-25 monthly for the same healthy 35-year-old. This 40-50% cost difference makes term life insurance significantly better value.

Age substantially affects pricing, with costs increasing 8-12% annually as you age. Forty-five-year-olds pay 60-80% more than 35-year-olds for identical coverage amounts.

Young professionals establishing first credit cards to build credit history should simultaneously obtain insurance quotes. Early purchase locks in lowest-possible premium costs.

Families using side income to accelerate savings should allocate some extra earnings toward protection coverage. Adequate insurance makes wealth-building efforts meaningful.

Can you get mortgage protection insurance with pre-existing medical conditions?

Yes, but qualification difficulty and premium costs increase substantially with serious medical conditions. Simplified-issue mortgage protection products feature easier approval for health-impaired applicants.

Diabetes, heart disease, cancer history, and other serious conditions may disqualify applicants from standard term life insurance. Mortgage protection insurance carriers often accept these higher-risk applicants.

However, easier qualification comes with higher costs and coverage limitations. Pre-existing condition waiting periods of 12-24 months commonly apply, reducing actual protection during initial policy years.

Borrowers improving credit scores to qualify for better financing terms should simultaneously work on health improvements. Better health produces insurance premium savings comparable to credit-driven rate improvements.

Families determining what credit score level they need for home purchases should understand that health status affects insurance availability just as credit affects lending approval.

What’s the difference between mortgage protection insurance and private mortgage insurance (PMI)?

Mortgage protection insurance protects your family from losing their home if you die. Private mortgage insurance protects lenders if you default on loan obligations.

PMI becomes required on conventional loans with initial investment below 20%. This lender-protecting insurance provides zero family benefits.

Mortgage protection insurance pays death benefits when borrowers die, allowing families to satisfy mortgages and maintain homeownership. Benefits flow to families rather than lenders.

First-time buyers exploring FHA financing options pay mortgage insurance premium that similarly protects lenders. Calculate FHA costs including MIP to understand these lender protection charges.

Families need mortgage protection insurance for family security regardless of whether financing requires PMI or MIP for lender protection.

Does mortgage protection insurance cover disability and unemployment?

Some mortgage protection products include disability coverage that makes mortgage installments when policyholders cannot work. However, most traditional mortgage protection insurance covers only death benefits.

Disability riders add 30-50% to base premium costs while providing critical protection against income loss from illness or injury. These riders prevent foreclosure when disability eliminates earning capability.

Unemployment protection rarely appears in quality mortgage protection products. The short-term nature of most unemployment makes this coverage less valuable than disability insurance.

Self-employed borrowers qualifying through bank statement income particularly need disability protection since business income stops immediately when they can’t work.

Purchase separate disability insurance rather than relying on mortgage protection disability riders. Standalone disability coverage typically provides superior benefits and broader income protection.

How long does mortgage protection insurance last?

Mortgage protection insurance terms typically match mortgage durations – 15 years for 15-year mortgages, 30 years for 30-year financing. Term selection should align with your loan structure.

Some policies feature decreasing benefit amounts that mirror declining mortgage balances. While reducing costs, this structure eliminates protection precisely when other financial needs intensify.

Level benefit term policies maintain consistent death benefits throughout coverage periods. This structure ensures adequate funds regardless of when tragedy strikes during your mortgage obligation.

Homeowners using USDA 30-year financing for rural properties need equally lengthy protection coverage. Calculate USDA loan monthly costs while arranging 30-year protection.

Purchase protection terms slightly longer than mortgage durations to accommodate potential refinancing that extends obligations beyond original loan terms.

Can mortgage protection insurance be canceled, and will I get my money back?

Yes, you can cancel mortgage protection insurance anytime, but most policies provide no premium refunds upon cancellation. You forfeit all premiums paid if you terminate coverage.

Return of premium policies refund paid premiums if you survive the term without filing claims. However, these policies cost 40-60% more than standard term coverage.

The higher costs for return of premium features rarely justify the benefit since most policyholders never recover premium amounts even with refund provisions.

Families creating comprehensive home maintenance plans should approach protection with similar long-term perspective. Insurance represents essential ongoing expense rather than recoverable investment.

View protection insurance as expense similar to property taxes rather than investment expecting returns. The value comes from family security, not premium recovery.

Does mortgage protection insurance pay off the full mortgage balance?

Most mortgage protection policies pay death benefits equal to coverage amounts you purchased. If coverage matches your outstanding balance, benefits satisfy the complete mortgage.

However, decreasing-balance policies reduce benefits over time as mortgages amortize. These policies pay less in later years, potentially leaving mortgage shortfalls if coverage decreases faster than your balance.

Level-benefit term insurance maintains consistent death benefit amounts throughout coverage periods. This structure ensures adequate mortgage satisfaction regardless of when death occurs.

Borrowers using jumbo financing for luxury properties need substantial protection amounts. Calculate jumbo loan monthly obligations to determine appropriate coverage levels.

Purchase coverage amounts slightly exceeding mortgage balances to account for costs, catch-up installments, and other expenses beyond simple principal satisfaction.

What happens to mortgage protection insurance if you refinance?

Existing mortgage protection insurance continues protecting your family after refinancing, but coverage may no longer match your new mortgage structure. Review and update protection when refinancing.

Refinancing that extends mortgage duration beyond existing protection terms creates dangerous coverage gaps. Policies expiring before mortgages complete leave families unprotected.

Health changes between original insurance purchase and refinancing often make new coverage acquisition difficult or expensive. Plan protection terms conservatively to accommodate potential refinancing.

Homeowners using cash-out refinancing to consolidate debt increase mortgage balances requiring higher protection amounts. Update coverage to match increased debt obligations.

Veterans using VA cash-out refinancing to access equity should recalculate protection needs based on higher post-refinance balances.

Is mortgage protection insurance worth it compared to term life insurance?

For most families, term life insurance provides superior value compared to mortgage-specific protection products. Term life costs 30-50% less while offering greater benefit flexibility.

Mortgage protection insurance makes sense primarily for health-impaired individuals who cannot qualify for term life insurance. The simplified underwriting justifies higher costs when alternative coverage proves unavailable.

Healthy applicants almost always benefit more from term life insurance that provides equivalent death benefits at substantially lower costs. The premium savings over 20-30 years become substantial.

Young professionals buying their first homes particularly benefit from term life insurance flexibility. Changing family needs demand adaptable coverage.