Self-Employed Mortgages: No W-2? No Problem.

- By Jim Blackburn

- on

- Tags: Blog Posts for - Emails 1-10

If you own a business, work for yourself, or earn 1099 income, qualifying for a mortgage can feel like a battle.

Traditional lenders often require two years of tax returns, W-2s, and a long paper trail that doesn’t reflect how self-employed income works. But the reality is—there are now loan programs designed specifically for entrepreneurs, freelancers, and independent contractors.

You don’t need to hide your write-offs or force your finances into a W-2-shaped box. You just need the right lender and the right documentation strategy.

What Counts as “Self-Employed”?

Most lenders define self-employed as:

- Owning 25% or more of a business

- Receiving income via 1099 instead of W-2

- Filing a Schedule C, K-1, or business tax return

This applies to full-time entrepreneurs, side-hustle income, or anyone who doesn’t receive traditional pay stubs.

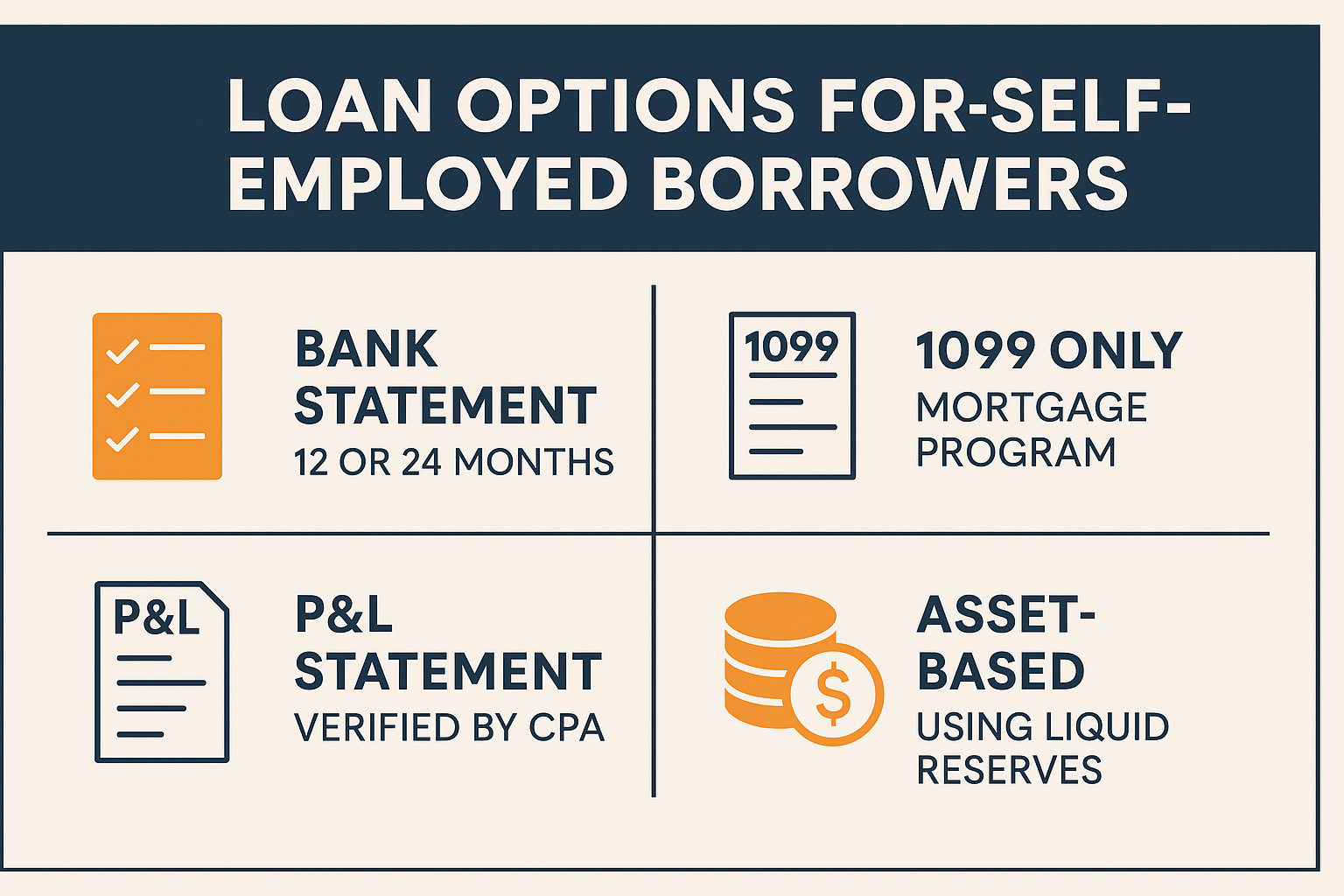

Loan Options That Work for You

Self-employed borrowers can qualify using alternative documentation, including:

- 12 or 24 months of personal or business bank statements

- 1099-only mortgage programs

- P&L-based loans verified by a CPA

- Asset-based loans using liquid reserves instead of income

- Loans with CPA letters confirming income stability

These are often classified as non-QM loans, but they’re fully legitimate and widely used by business owners.

What Lenders Want to See

You don’t need to be perfect—you just need to be consistent.

To qualify, most lenders will want:

- A stable or increasing income trend over the last year or two

- Clean business and personal bank statements

- A strong credit profile (usually 620+)

A down payment of 10–20%, depending on the loan type

Common Use Cases

Self-employed borrowers we work with include:

- Real estate agents

- Rideshare drivers and delivery workers

- Marketing freelancers and consultants

- E-commerce store owners

- Content creators and influencers

- Small business operators of all types

Want to Know What You Qualify For?

Strategy: Match the Loan to the Income Type

One of the biggest mistakes entrepreneurs make is applying for a mortgage through a lender that only looks at tax returns. If you write off a lot of expenses, that can drastically reduce your qualifying income.

Instead, work with a lender that matches your real income flow to a loan structure that makes sense.

Your Business. Your Mortgage.

You’ve built your own income stream—now build your own path to homeownership. We’ll help you structure your finances in a way that works with the loan, not against it.

Ready to Take Your First Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- 💡 Takes just 5 minutes

- 📊 Tailored results based on your answers

- 🔒 No credit check required

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- 💡 Only 2 minutes to complete

- 📊 Quick turnaround on pre-approval

- 🔒 No credit score impact

Got a Few Questions First?

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a Call