Not all condos are created equal—and not all are eligible for traditional financing.

If you’re looking at a condotel, resort unit, or a condo with too many short-term rentals or investor-owned units, you may be told it’s “non-warrantable.” That’s not a deal-breaker. It just means you need a specialized loan designed for these unique properties.

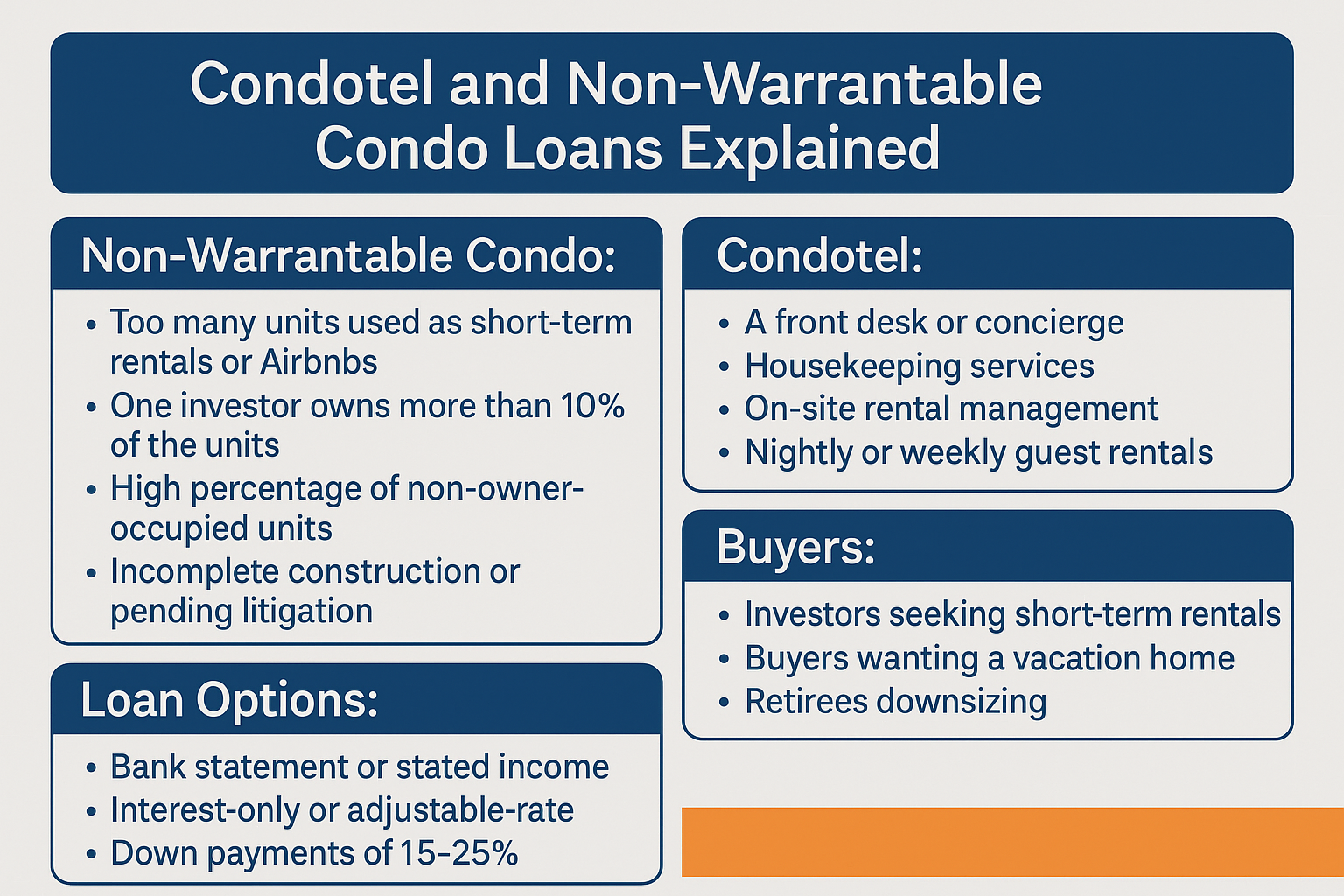

A condo is considered non-warrantable if it doesn’t meet conventional lending guidelines from Fannie Mae or Freddie Mac.

Common reasons include:

A condotel is a condo located in a building that functions like a hotel. It often includes:

Traditional lenders see this as a commercial risk, so they decline financing—even when the unit is individually owned.

This is where portfolio and non-QM loans step in.

Available programs may include:

These loans are manually underwritten by lenders that specialize in unique condo projects.

Many buyers fall in love with a property, make an offer, and only then find out it’s non-warrantable. That’s when deals fall apart.

The smarter approach: work with a lender upfront who can verify the building’s status and offer loan options based on it.

We work with lenders that go beyond cookie-cutter guidelines to help you close on high-performing, high-potential properties.

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a Call