15 vs 30 Year Mortgage: Compare Rates and Find Your Best Option

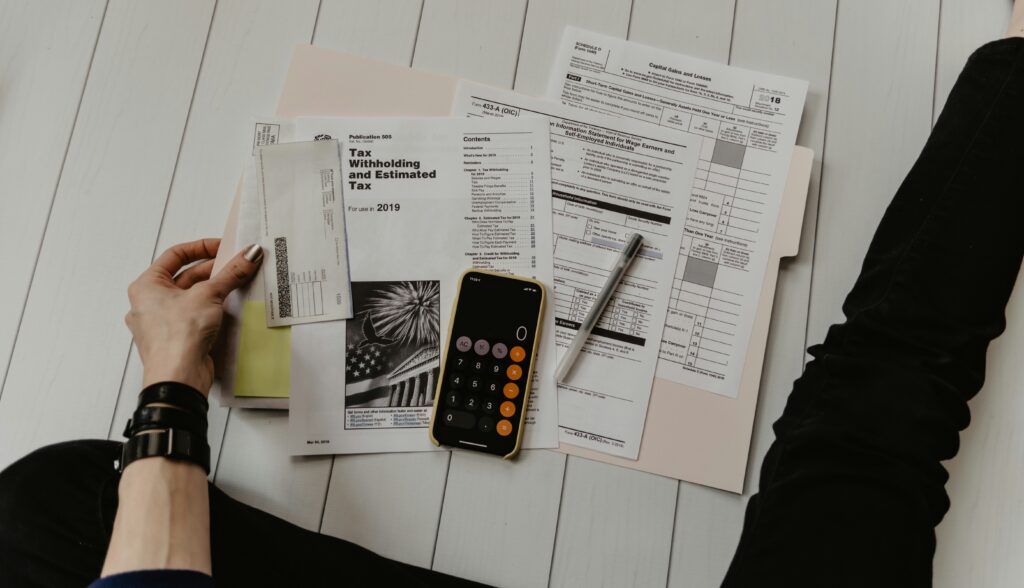

Choosing between a 15-year and a 30-year mortgage can feel like a tug-of-war between paying your home off faster and keeping your monthly payment as low as possible. A clear 15 vs 30 year mortgage rate comparison helps you see how interest rates, monthly payments, and long-term costs stack up side by side so you can make a confident, informed decision that aligns with your cash flow, goals, and timeline.

At the end of the day, the “right” loan term depends on your priorities—building equity quickly, maximizing monthly cash flow, or striking a balance between the two. By using a detailed 15 vs 30 year mortgage rate comparison, you can move beyond guesswork, understand the true cost of each option, and choose the mortgage strategy that best supports your long-term financial plan.

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a CallNot Sure About Your First Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Important Disclaimer

This calculator is for illustrative purposes only and does not constitute financial, legal, or investment advice. Results are based on general assumptions and may not reflect actual performance or eligibility. This is not a loan estimate or approval. Please consult with a licensed mortgage advisor before making financial decisions.

Related Posts

Subscribe to our newsletter

Get new calculators and money tools in your inbox.