How To Qualify For Mortgage: Complete Guide to Qualification, Rates & Process

How To Qualify For Mortgage: Complete Guide to Qualification, Rates & Process

Understanding how to qualify for mortgage financing determines whether homeownership remains a dream or becomes reality. The qualification process evaluates your financial capacity, creditworthiness, and ability to sustain homeownership obligations over time.

This comprehensive guide reveals exactly how to qualify for mortgage approval, exploring credit requirements, income verification standards, employment history expectations, and capital requirements across multiple loan program types.

Key Summary

In this comprehensive guide:

- Learn credit score requirements for mortgage approval across government and conventional programs that impact qualification

- Understand debt to income ratio standards for mortgage qualification and how lenders calculate your borrowing capacity

- Discover employment history verification for mortgage applications and documentation requirements lenders use to confirm income stability

- Calculate how much mortgage you can afford based on income, existing obligations, and qualification guidelines

- Master the mortgage pre-qualification process for stronger purchase offers and clear budget understanding

What Does It Mean to Qualify for a Mortgage?

To qualify for mortgage financing means demonstrating to lenders that you possess the financial capacity, creditworthiness, and stability to repay borrowed funds over the loan term. Qualification encompasses multiple evaluation components.

Lenders assess your credit history to gauge past financial responsibility. They examine your income to verify you earn enough to sustain obligations. Review the FHA loan qualification standards for government-backed options with flexible requirements.

Employment history confirms income stability and continuity. Asset reserves demonstrate financial cushion for unexpected expenses. Existing debt obligations factor into affordability calculations.

How Do Lenders Evaluate Borrowers?

The evaluation process follows standardized underwriting guidelines that vary by loan program. Understanding conventional loan qualification criteria reveals stricter standards than government programs.

Traditional conforming loans require stronger credit profiles and larger reserves. Government-backed programs offer more flexibility for first-time buyers and those with limited savings. Calculate your monthly costs using the FHA loan calculator to understand qualification impacts on affordability.

Automated underwriting systems initially evaluate applications using algorithms. Manual underwriting provides flexibility for unique situations that don’t fit automated parameters.

What Are the Main Qualification Components?

Five primary components determine mortgage qualification success:

Credit score for mortgage approval measures past financial behavior and predicts future payment reliability. Scores range from 300-850, with higher scores qualifying for better terms. Learn about building credit for mortgage approval through strategic credit management.

Debt to income ratio for mortgage qualification compares monthly obligations to gross monthly income. Lower ratios indicate more capacity to handle new housing costs. Use the debt to income ratio calculator to determine your current position.

Income verification for mortgage applications confirms earning capacity through tax returns, pay stubs, and employment documentation. Stable, documented income strengthens approval odds. Explore bank statement loan options for self-employed borrowers with alternative documentation.

Initial capital requirements vary by loan program, from zero for VA loan qualification to 20% for some jumbo loan scenarios. Calculate your initial investment needs based on purchase price and program selection.

Understanding Credit Score Requirements for Mortgage Approval

Credit scores represent the most visible qualification metric and significantly impact approval decisions and interest rate pricing. Knowing credit score for mortgage approval standards helps you target appropriate programs.

What Credit Score Do You Need?

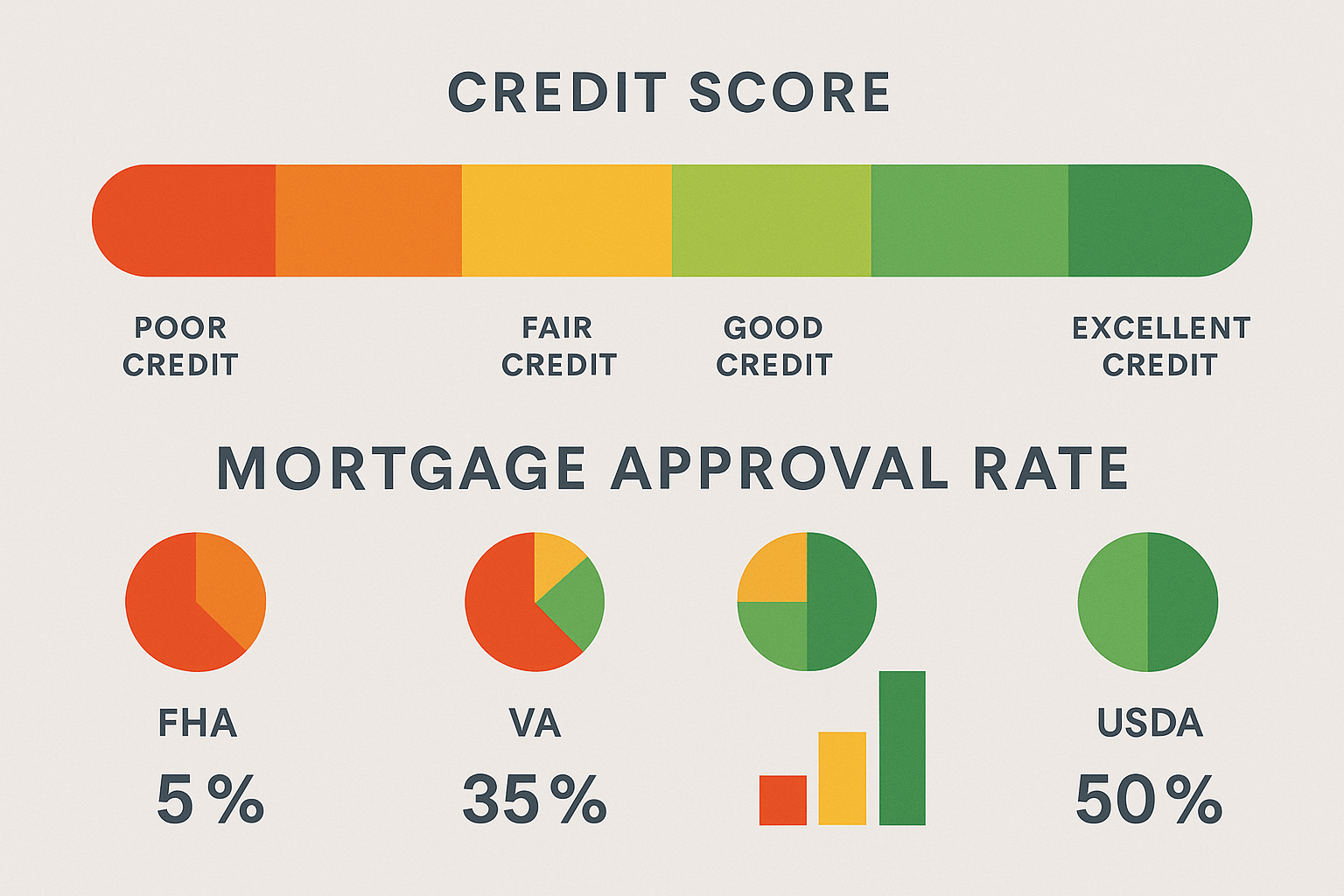

Minimum credit requirements vary dramatically across loan programs:

FHA loan credit requirements accept scores as low as 580 for 3.5% initial capital options. Scores between 500-579 may qualify with 10% initial capital. Calculate FHA loan qualification scenarios with different credit profiles.

Conventional loan credit standards typically require 620 minimum, though 740+ scores access best pricing. Use the conventional loan calculator to see rate differences across credit tiers.

VA loan credit expectations vary by lender, typically requiring 580-620 minimum despite no official VA floor. Veterans benefit from no initial capital requirement regardless of credit score. Review VA loan qualification criteria for service members.

USDA loan credit requirements generally need 640 minimum for automated approval, though manual underwriting accommodates lower scores with compensating factors. Calculate USDA loan scenarios for rural property purchases.

Jumbo loan credit standards typically require 700+ for high-balance financing exceeding conforming limits. Portfolio lenders may accept 660+ with strong compensating factors.

How Do Different Credit Events Impact Qualification?

Specific credit events create waiting periods before mortgage qualification:

Bankruptcy requires 2-4 years waiting, depending on chapter and loan program. Chapter 7 bankruptcy requires 2 years for FHA and VA loans, 4 years for conventional. Chapter 13 requires 4 years for conventional, though FHA and VA may approve after 1 year of successful plan payments.

Foreclosure creates 3-7 year waiting periods, varying by program and circumstances. FHA requires 3 years, conventional requires 7 years, VA requires 2 years. Learn about rebuilding credit after foreclosure through strategic credit management.

Short sales typically require 2-4 years waiting, treated more leniently than foreclosure in most programs. Deed-in-lieu of foreclosure follows similar timelines to foreclosure completion.

Late payments within the past 12 months create qualification challenges even without severe events. Multiple 30-day lates in the past year may trigger denial or require compensating factors. Recent 60+ day lates create significant barriers.

How Can You Improve Your Credit Score for Mortgage Qualification?

Strategic credit improvement accelerates qualification timeline and improves rate pricing:

Pay all obligations on time without exception for 12+ months before application. Payment history comprises 35% of credit scoring and recent performance weighs heavily. Review first-time buyer credit preparation strategies to avoid common pitfalls.

Reduce credit card balances below 30% utilization, ideally below 10% for optimal scoring. Utilization affects 30% of credit scores and updates monthly. Learn about debt reduction strategies that improve qualification without requiring higher income.

Avoid opening new credit accounts 6-12 months before application. New accounts lower average account age and create hard inquiries that temporarily reduce scores. Calculate optimal qualification timing based on your credit profile.

Dispute legitimate errors on credit reports through formal processes. Inaccurate negative items damage scores without reflecting actual credit risk. Allow 30-60 days for dispute resolution before final application.

Consider authorized user status on established accounts with excellent payment history. This strategy can accelerate score improvement for those with thin credit files. Ensure the primary account reports to all three bureaus for maximum impact.

Mastering Debt to Income Ratio Requirements for Mortgage Qualification

Debt to income ratio for mortgage approval represents a critical qualification metric that determines how much you can borrow. Understanding DTI calculations helps you optimize qualification positioning.

What Is Debt to Income Ratio?

DTI compares your monthly debt obligations to gross monthly income, expressed as a percentage. Lenders calculate front-end (housing only) and back-end (all debts) ratios.

Front-end DTI includes principal, interest, property taxes, insurance, and HOA fees divided by gross monthly income. This ratio typically maxes at 28-31% for conventional loans. Calculate your housing ratio using the monthly cost calculator to understand capacity.

Back-end DTI includes all monthly obligations: housing, credit cards, auto loans, student loans, personal loans, child support, and alimony divided by gross income. Maximum back-end ratios vary significantly by program. Use the DTI calculator to determine your current ratio and qualification capacity.

What Are Maximum DTI Limits by Loan Program?

Debt to income ratio for mortgage standards vary dramatically across programs:

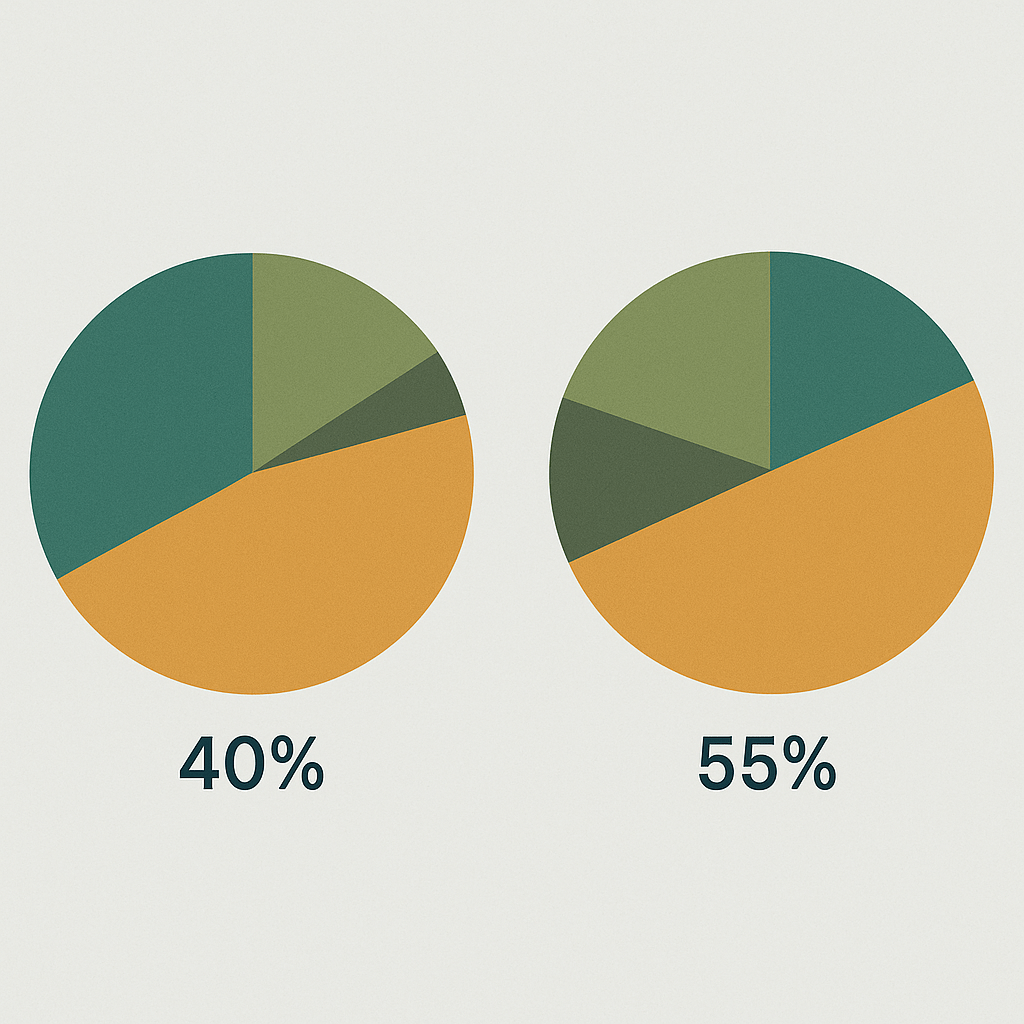

FHA loan DTI limits allow up to 46.9% back-end ratio with standard approval, up to 56.9% with strong compensating factors like high credit scores or cash reserves. Calculate FHA qualification with elevated DTI scenarios to understand capacity.

Conventional loan DTI requirements typically cap at 45-50% back-end ratio depending on credit score, assets, and other factors. Lower ratios qualify for better rate pricing. Review conventional loan qualification parameters for various DTI scenarios.

VA loan DTI flexibility technically has no hard maximum, though most lenders cap around 60% with residual income requirements providing additional affordability verification. Calculate VA loan qualification with elevated DTI levels to assess approval likelihood.

USDA loan DTI caps at 43% back-end for automated approval, though manual underwriting accommodates higher ratios with strong compensating factors. Review USDA qualification requirements for rural property financing.

Jumbo loan DTI standards vary by lender but typically max at 43% for high-balance financing, sometimes extending to 45% for exceptional borrowers with 20%+ initial capital and 740+ credit scores.

What Debts Are Included in DTI Calculations?

Lenders include specific obligations in DTI calculations while excluding others:

Included obligations: credit card minimum payments, auto loans, student loans, personal loans, mortgage payments on other properties, HOA fees, child support, alimony, tax liens, 401(k) loans, co-signed obligations, and lease payments.

Student loans follow specific calculation rules. If not in deferment, lenders use the actual payment. If in deferment or forbearance, they use 0.5-1% of balance as estimated payment or actual payment if documented. Understand how student loans affect qualification and strategies to optimize DTI positioning.

Installment loans with less than 10 months remaining may be excluded from DTI at lender discretion. Paying debts down to this threshold before application can significantly improve qualification capacity.

Excluded items: utilities, cell phone bills, insurance premiums (except those escrowed), groceries, entertainment expenses, medical bills not in collection, and childcare costs unless included in alimony calculations.

How Can You Lower Your DTI for Better Mortgage Qualification?

Strategic DTI reduction expands borrowing capacity and improves approval odds:

Pay down or pay off smaller debts to eliminate monthly obligations. Eliminating a $200 monthly payment may increase borrowing capacity by $35,000-40,000 depending on rates. Calculate the impact of debt reduction on qualification capacity.

Consider debt consolidation to reduce total monthly obligations, though this strategy requires careful analysis of total costs versus short-term DTI benefits. Consolidation may extend repayment timelines while lowering monthly commitments.

Increase income through raises, bonuses, second jobs, or side businesses. Additional income requires 2-year history for full consideration in qualification. Learn about documenting alternative income sources for self-employed applicants.

Avoid taking on new debt during the qualification process. New obligations increase DTI and may disqualify previously approved applications. Wait until after closing to finance furniture, vehicles, or other purchases.

Consider co-borrower strategies to include additional income without corresponding debt if the co-borrower has low obligations. This approach works particularly well for married couples or family purchases.

Income Verification for Mortgage Applications: Documentation Requirements

Income verification for mortgage approval ensures borrowers possess sufficient earning capacity to sustain housing obligations. Documentation requirements vary significantly by employment type and loan program.

What Income Documentation Do Lenders Require?

W-2 employees typically provide 30 days of pay stubs, 2 years of W-2 forms, and 2 years of tax returns. Some lenders waive tax returns for salaried employees with stable, straightforward income. Review standard documentation requirements for employed applicants.

Self-employed borrowers face more extensive documentation: 2 years of personal tax returns, 2 years of business returns (1065, 1120, or 1120S), year-to-date profit and loss statement, and year-to-date balance sheet. Explore bank statement loan alternatives that simplify self-employed qualification using deposits rather than tax returns.

Commission-based income requires 2-year history averaging for qualification purposes. Recent commission increases may not qualify for full use without extended history demonstrating sustainability. Calculate income averaging impact on qualification capacity.

Bonus and overtime income similarly requires 2-year history for full consideration. Declining bonus patterns may result in conservative income calculations or complete exclusion. Learn about maximizing income documentation for qualification purposes.

How Do Lenders Calculate Self-Employed Income?

Self-employed income calculation follows complex rules that often surprise borrowers:

Lenders add back certain deductions: depreciation, depletion, business use of home (partial), meals and entertainment (partial), and one-time non-recurring losses. These additions increase qualifying income above tax return net income.

They subtract certain items: one-time non-recurring gains, unpaid distributions from S-Corps, and declining income trends. K-1 income from partnerships receives scrutiny for stability and distribution patterns.

The calculation averages 24 months of adjusted net income for monthly income qualification. Declining income trends may result in using only the lower year or further conservative adjustments. Review alternative income verification options for complex self-employment situations.

Business ownership percentage matters significantly. Owners with 25%+ stake require full business returns for income calculation even if receiving W-2 wages. This requirement catches many small business owners unprepared.

What Alternative Income Documentation Options Exist?

Non-traditional income sources expand qualification options for non-W-2 borrowers:

Bank statement loan programs qualify self-employed borrowers using 12-24 months of business bank statements. Lenders apply percentage factors to deposits (typically 50-75%) to calculate qualifying income. Calculate bank statement loan qualification using your deposit history.

Asset depletion programs qualify borrowers using investment accounts, dividing total assets by 240 months (20 years) or 360 months (30 years) for monthly income calculation. This approach works well for retired individuals or those with significant liquid assets.

DSCR loan programs for investment properties qualify based on rental income versus personal income, eliminating personal income verification entirely. Property cash flow determines qualification. Learn about DSCR loan qualification for real estate investors.

1099 income requires 2-year history similar to self-employment, though calculation methods differ slightly. Lenders typically use gross 1099 income less business expenses documented on Schedule C.

Social Security, pension, and disability income qualify at face value if continuity for 3+ years is documented. These income sources often provide straightforward qualification without complex calculations.

How Does Employment History Affect Mortgage Qualification?

Employment history for mortgage approval demonstrates income stability and continuity:

Most programs require 2 years of consistent employment history in the same field. Job changes within the same industry typically don’t create issues if income remains stable or increases.

Recent job changes require analysis of circumstances. Promotions within the same company rarely create concerns. Career changes into different fields require explanation and may affect income usability.

Employment gaps exceeding 1-2 months require written explanations. Extended gaps may necessitate longer employment history after returning to work before qualifying for full income consideration.

Recent college graduates may qualify with less than 2 years employment if working in their field of study. The education and training period may substitute for employment history in these situations.

How Much Mortgage Can I Afford: Calculating Your Qualification Capacity

Understanding how much mortgage can I afford requires analyzing income, debts, initial capital, and ongoing costs within program-specific qualification parameters.

What Is the 28/36 Rule for Mortgage Affordability?

The traditional 28/36 rule suggests housing costs shouldn’t exceed 28% of gross monthly income, while total debts shouldn’t exceed 36%. While many modern programs allow higher ratios, these percentages provide conservative affordability benchmarks.

Front-end ratio (28%) includes principal, interest, taxes, insurance, and HOA fees. A $6,000 monthly gross income allows $1,680 for housing under this guideline. Calculate your housing capacity using the affordability calculator to understand realistic budgets.

Back-end ratio (36%) includes housing plus all other monthly debts. The same $6,000 income allows $2,160 total obligations, leaving $480 for non-housing debts if maximizing housing costs. Use the how much can I afford calculator for personalized capacity analysis.

Many borrowers qualify for higher ratios through program flexibility, but conservative ratios provide financial cushion for unexpected expenses and maintain comfortable living standards. Review first-year homeownership budgeting considerations beyond qualification calculations.

How Do Interest Rates Impact Affordability?

Interest rates dramatically influence purchasing power and qualification capacity:

A 1% rate difference changes monthly costs approximately $60 per $100,000 borrowed. On a $300,000 loan, a rate move from 6% to 7% increases costs $180 monthly, reducing qualification capacity roughly $30,000-35,000.

Rate changes affect both qualification and long-term costs. Use the interest rate comparison calculator to understand total cost implications across rate scenarios.

Borrowers can maximize affordability through rate buydowns, paying discount points upfront to lower rates. This strategy makes sense for long-term homeowners but less so for short-term holders. Calculate break-even timelines for buydown decisions.

Credit score significantly impacts available rates, creating substantial cost differences over loan terms. A 100-point score difference may change rates 0.5-1.0%, costing tens of thousands over 30 years. Review credit improvement strategies to optimize rate pricing.

What Are Total Homeownership Costs Beyond the Mortgage?

Qualification calculations focus on housing costs, but complete affordability analysis requires considering additional expenses:

Property maintenance typically costs 1-4% of home value annually depending on age and condition. A $300,000 home may require $3,000-12,000 yearly maintenance on average. Learn about maintenance budgeting for realistic cost planning.

Utilities vary by home size, age, and location. A 2,000 sq ft home in moderate climate typically costs $200-400 monthly for utilities, higher in extreme climates or older, less efficient homes.

Homeowners insurance depends on coverage limits, location, construction type, and risk factors. Coastal properties and areas with natural disaster risk face premium insurance costs affecting overall affordability.

Property taxes vary dramatically by location, from under 0.5% annually in some states to over 2.5% in others. A $300,000 home in Texas ($7,500 annual) costs nearly $500 more monthly than the same home in Alabama ($1,500 annual).

HOA fees range from $0 for single-family homes to $500+ monthly for full-service condos with extensive amenities. These mandatory fees impact qualification calculations and ongoing affordability. Calculate total ownership costs beyond principal and interest.

How Does Initial Capital Affect Qualification and Affordability?

Initial capital requirements dramatically impact affordability calculations and qualification success:

Zero capital programs like VA loans and USDA loans maximize purchasing power by financing 100% of value. This approach reserves capital for closing costs, reserves, and moving expenses. Calculate VA loan qualification capacity without initial capital requirements.

3.5% initial capital FHA programs provide accessible entry for first-time buyers while keeping monthly costs manageable through competitive rates and low mortgage insurance. Review FHA qualification scenarios with minimal capital.

20% capital conventional financing eliminates mortgage insurance, reducing monthly costs $150-250 on typical loans. The trade-off between capital preservation and monthly cost reduction requires careful analysis. Compare conventional loan scenarios with various capital amounts.

Larger capital reduces loan amounts, lowering monthly obligations and improving qualification capacity for those with tight DTI ratios. Capital deployment strategy should align with overall financial planning. Review capital optimization strategies for first-time buyers.

Mortgage Pre-Qualification vs Pre-Approval: Understanding the Difference

Mortgage pre qualification represents an early-stage estimate while pre-approval involves comprehensive documentation review and underwriter verification. Both serve different purposes in the home buying journey.

What Is Mortgage Pre-Qualification?

Pre-qualification provides preliminary borrowing capacity estimates based on stated information without verification. The process takes minutes and requires no documentation or credit review.

Loan officers estimate capacity using verbal income, debt, and initial capital information. They apply program-specific qualifying ratios to calculate approximate loan amounts. Start the pre-qualification process to understand initial capacity.

Pre-qualification letters demonstrate basic interest to sellers but carry limited weight in competitive markets. They don’t involve underwriter review or documentation verification.

The process serves useful purposes: understanding general affordability, comparing program options, and beginning home search with realistic budgets. Learn about effective home search strategies using pre-qualification information.

What Is Mortgage Pre-Approval?

Pre-approval involves comprehensive application submission, documentation collection, credit report review, and often automated underwriting approval. The process provides verified borrowing capacity.

Borrowers complete full applications, provide income documentation, authorize credit reports, and allow lenders to verify employment and assets. Automated underwriting systems analyze all data against program guidelines. Begin the pre-approval process for stronger purchase positioning.

Pre-approval letters carry significantly more weight with sellers, especially in competitive markets. They demonstrate verified ability to close transactions within specified timelines.

The process identifies qualification issues early, allowing time to address credit problems, documentation gaps, or income concerns before finding homes. Review pre-approval strategies for efficient processing.

How Long Does Pre-Approval Last?

Pre-approvals typically remain valid 60-90 days, though credit reports expire after 120 days requiring refresh for older approvals. Material changes in financial circumstances require revalidation.

Employment changes during pre-approval period require updated documentation and potentially new underwriting review. Job loss obviously invalidates approval, but promotions or position changes also need verification.

Taking on new debt during pre-approval affects qualification even with existing approval. New auto loans, credit cards, or personal loans change DTI calculations and may disqualify previously approved amounts.

Lenders require updated documentation as approvals age. Pay stubs, bank statements, and other dated documents need refreshing to ensure current information accuracy. Learn about maintaining approval through the purchase process.

What Are Common Pre-Approval Mistakes to Avoid?

First-time buyers frequently make pre-approval errors that complicate or derail purchases:

Changing financial circumstances without lender notification creates closing delays or denials. All material changes require immediate disclosure regardless of perceived impact.

Making large purchases between pre-approval and closing changes qualification parameters. New debt increases DTI, potentially disqualifying approved amounts. Review common first-time buyer mistakes to avoid throughout the process.

Changing jobs during the process requires careful management and lender communication. Some changes don’t affect qualification, while others necessitate starting over with new documentation.

Failing to maintain bank account levels for reserve requirements creates last-minute funding gaps. Lenders verify assets again immediately before closing to confirm reserve requirements.

Initial Capital Requirements: Navigating Different Loan Program Options

Initial capital requirements vary dramatically across loan programs, from zero for veterans and rural buyers to 20%+ for jumbo loans. Understanding program-specific requirements optimizes qualification strategy.

What Are Zero-Down Loan Programs?

Several programs eliminate initial capital requirements entirely, maximizing purchasing power:

VA loans offer 100% financing for eligible veterans, active military, and qualifying spouses with no initial capital requirement. Only the VA funding fee and closing costs require upfront funds. Calculate VA loan qualification capacity with zero capital.

USDA loans provide 100% financing for rural and suburban properties meeting location and income requirements. Zero capital purchases work well for budget-conscious buyers in eligible areas. Review USDA loan qualification parameters for your situation.

These programs maximize purchasing power while preserving capital for emergencies, improvements, or other investments. However, they typically include funding fees or mortgage insurance adding to monthly costs. Compare zero-capital program options for your scenario.

What Are Low-Down-Payment Options?

Minimal capital programs bridge the gap between zero-capital and traditional financing:

FHA loans require 3.5% initial capital with 580+ credit scores, or 10% with 500-579 scores. This approach balances accessibility with monthly cost management through low mortgage insurance premiums. Calculate FHA qualification capacity with minimal capital requirements.

Conventional loans with 3-5% initial capital serve first-time buyers and repeat buyers with limited capital through Fannie Mae’s HomeReady and Freddie Mac’s Home Possible programs. These options eliminate income restrictions on most conventional programs. Review conventional low-capital scenarios for comparison.

Down payment assistance programs provide grants or forgivable second mortgages covering some or all initial capital requirements. Programs vary by location and often include income restrictions. Learn about assistance program qualification for your area.

How Does Initial Capital Affect Monthly Costs?

Capital amount directly impacts monthly obligations through loan size and mortgage insurance requirements:

Zero capital financing maximizes monthly costs through higher loan amounts and required insurance. A $300,000 purchase with no capital requires financing $300,000 plus funding fees, potentially $304,500 total.

3.5% capital ($10,500 on $300,000) reduces loan amounts and slightly lowers insurance on FHA loans. Total financing drops to approximately $293,000 including upfront insurance premiums.

20% capital ($60,000 on $300,000) eliminates mortgage insurance entirely on conventional loans, reducing monthly costs $150-250. Total financing drops to $240,000, lowering principal and interest by $350-400 monthly.

The capital versus monthly cost trade-off requires analyzing opportunity cost of deployed funds, time horizon, and financial flexibility needs. Calculate optimal capital deployment for your situation.

What Are Gift Fund Requirements and Limitations?

Gift funds from family members can supplement personal savings for initial capital and closing costs:

Gifts from family members (parents, siblings, grandparents, etc.) are acceptable for initial capital and closing costs on most programs. FHA loans require specific gift fund documentation including gift letters stating no repayment expectation.

Gift funds require documentation: gift letter stating amount, relationship, property address, and confirmation that no repayment is expected; proof of donor’s ability to provide funds; and proof of transfer to borrower’s account.

Conventional loans require borrowers contribute at least 5% of own funds when making less than 20% initial capital, though this rule varies by occupancy type and program. Review gift fund strategies for effective use.

VA loans allow gift funds for all costs with no borrower contribution requirement, providing maximum flexibility for veterans with limited savings.

Special Qualification Situations: Non-Traditional Borrower Scenarios

Non-traditional income sources, employment situations, and citizenship status create unique qualification challenges requiring specialized loan programs or creative documentation approaches.

How Do Self-Employed Borrowers Qualify?

Self-employment creates documentation complexity but numerous qualification paths exist:

Traditional self-employed qualification requires 2 years of tax returns showing consistent or increasing income. Net income after deductions determines qualifying capacity, often significantly below gross revenue. Calculate traditional self-employed qualification using tax return information.

Bank statement loan programs use 12-24 months of bank deposits, applying percentage factors (typically 50-75%) to calculate income. This approach works well for profitable businesses writing off significant expenses. Review bank statement loan qualification for self-employed scenarios.

Asset depletion programs calculate income from investment accounts, dividing balance by loan term for monthly income. Borrowers with substantial assets but low reported income qualify easily.

Profit and loss statement programs use year-to-date financial statements certified by CPAs, accelerating qualification for growing businesses without 2-year tax history.

What Options Exist for Foreign Nationals?

Non-U.S. citizens can qualify through specialized programs despite lacking domestic credit and employment:

Foreign national loan programs accommodate international buyers using larger initial capital (typically 20-40%) and foreign income documentation. These programs don’t require Social Security numbers or U.S. employment. Calculate foreign national qualification capacity for international purchases.

ITIN loan programs serve non-citizens with Individual Taxpayer Identification Numbers, using U.S. tax returns and employment documentation. Requirements mirror traditional programs but accept ITINs instead of Social Security numbers. Review ITIN loan qualification for eligible borrowers.

Documentation requirements include passport, visa status, foreign income verification, foreign credit reports, and proof of assets for initial capital. Some programs require U.S. bank accounts and translated documents.

How Do Real Estate Investors Qualify?

Investment property purchases require different qualification approaches than owner-occupied homes:

DSCR loans qualify based solely on property cash flow, eliminating personal income verification entirely. The debt service coverage ratio compares rental income to principal, interest, taxes, insurance, and HOA costs. Calculate DSCR loan qualification using rental income.

Traditional investment qualification includes rental income from subject property (75-80% of market rent) and requires borrowers qualify for full payment without rental income until established 2-year history. Review investment property qualification strategies for new investors.

Portfolio lenders offer flexibility for investors owning multiple properties, often allowing 10+ financed properties while conventional programs cap at 10. Experience and strong financials enable expanded lending. Learn about portfolio growth financing for active investors.

What Are Reverse Mortgage Qualification Requirements?

Reverse mortgages serve homeowners 62+ with unique qualification parameters:

Reverse mortgage qualification focuses on age, equity, and ability to maintain property. Income verification determines ability to pay property taxes and insurance rather than loan qualification. Learn about reverse mortgage qualification for senior homeowners.

Financial assessment evaluates property charge payment history, credit history, and residual income available for property charges. Failing financial assessment may require set-asides from loan proceeds.

Counseling sessions with HUD-approved counselors are mandatory, ensuring borrowers understand reverse mortgage terms, costs, and implications before proceeding.

Improving Your Qualification Position: Strategic Preparation Steps

Strategic preparation significantly improves qualification outcomes, approval odds, and rate pricing. Multi-month timelines produce optimal results.

How Can You Improve Credit Scores Before Applying?

Credit optimization requires 3-12 months for substantial improvements:

Pay all obligations on time without exception for 6-12 months before application. Recent payment performance weighs heavily in scoring algorithms and underwriting decisions. Review credit improvement strategies for comprehensive guidance.

Reduce revolving balances below 30% utilization, ideally below 10%. This improvement can increase scores 20-50 points within 30-60 days. Calculate optimal debt reduction scenarios for qualification timing.

Dispute legitimate errors through formal processes at all three bureaus. Allow 30-60 days for dispute resolution and score updates. Learn about effective credit repair approaches compliant with consumer protection laws.

Become authorized user on established accounts with excellent payment history and low utilization. This strategy works particularly well for thin credit files or young borrowers.

Avoid closing old accounts that would reduce average account age. Keep old cards with small recurring charges to maintain history while demonstrating management ability.

What Income Optimization Strategies Work?

Income positioning affects both qualification capacity and rate pricing:

Document all income sources completely. Many borrowers leave qualifying income unclaimed through incomplete documentation. Rental income, part-time work, military allowances, and investment income often qualify.

Maximize bonus and overtime documentation with 2+ year history. Consistent patterns demonstrate reliability and allow full income consideration. Calculate income impacts on qualification capacity across scenarios.

Consider adding co-borrower with income but minimal debt. This strategy increases household income without proportionally increasing obligations if the co-borrower maintains low debt levels.

Time application strategically around bonus payments, commission checks, or seasonal income variations to demonstrate strong recent history. W-2 employees might time applications post-raise for higher qualifying income.

How Should You Prepare Assets and Reserves?

Asset positioning demonstrates financial stability and provides cushion against approval conditions:

Consolidate assets into documented, sourced accounts 2-3 months before application. Large recent deposits require explanations and may not count toward reserves. Review asset documentation requirements for various programs.

Build reserves meeting program requirements. Most programs require 2-6 months of principal, interest, taxes, and insurance in liquid reserves after closing. Calculate required reserve amounts for your scenario.

Avoid moving money between accounts during the application process. Every transfer requires documentation and explanation, creating processing delays and complexity.

Document gift funds properly with letters, proof of transfer, and donor’s source documentation. Early preparation prevents last-minute scrambles affecting closing timelines.

What Documentation Should You Gather in Advance?

Proactive document collection accelerates processing and prevents delays:

Collect 2 years of tax returns, W-2s, and 1099s for all borrowers. Self-employed borrowers need business returns (1065, 1120, 1120S) and year-to-date profit and loss statements.

Gather 30 days of pay stubs showing year-to-date earnings. Employment letters on company letterhead with salary, position, and start date expedite verification.

Obtain 2-3 months of bank statements for all accounts. Statements must show full account numbers and be consecutive without gaps.

Locate source documents for large deposits: gift letters, sale of assets documentation, tax refund confirmation, bonus verification. Unexplained large deposits create underwriting conditions.

Prepare divorce decrees, bankruptcy discharge papers, foreclosure documentation, or other explanatory documents for credit events. Proactive disclosure with documentation prevents surprises during underwriting.

Common Qualification Mistakes and How to Avoid Them

Understanding common errors helps borrowers navigate qualification smoothly without costly delays or denials.

What Financial Changes Should You Avoid During Qualification?

Material financial changes during application processing create problems:

Never change jobs during active application without lender consultation. Some changes don’t affect qualification while others restart the process entirely. Review employment change strategies for unavoidable transitions.

Avoid taking on new debt regardless of size. New credit cards, auto loans, or personal loans change DTI calculations and may disqualify previously approved amounts. Even small obligations matter in marginal qualification scenarios.

Don’t make large purchases on credit between pre-approval and closing. Financing furniture, appliances, or vehicles before closing affects qualification even with existing approval. Learn about closing preparation strategies to avoid last-minute issues.

Never co-sign loans for friends or family during the home buying process. Co-signed obligations appear on credit reports and count in DTI calculations exactly like personal debts.

What Credit Behaviors Cause Qualification Problems?

Credit management during qualification requires special attention:

Avoid applying for new credit accounts 6-12 months before application. Each hard inquiry temporarily reduces credit scores and new accounts lower average age.

Don’t close old credit card accounts to “clean up” credit reports. Closing accounts reduces available credit and increases utilization ratios, potentially lowering scores. Review effective credit management during home buying.

Never ignore collection accounts hoping they’ll disappear. Collections require resolution through payoffs or settlements with proper documentation. Ignoring collections guarantees denial on most programs.

Avoid making large payments toward credit cards without maintaining balances below reported statement dates. Timing matters – lenders see balances reported to bureaus, not current balances.

What Documentation Errors Create Delays?

Incomplete or inconsistent documentation extends timelines and creates approval risks:

Ensure tax returns match W-2s and 1099s exactly. Discrepancies between tax documents and income reports require explanation and resolution. Review income documentation requirements for proper preparation.

Provide complete bank statements without missing pages. Partial statements or single-page summaries don’t satisfy underwriting requirements and require resubmission.

Explain all unusual deposits exceeding 25-50% of monthly income. Large unexplained deposits require sourcing through documentation, creating conditions and delays.

Maintain consistent information across documents. Address, employment, and income inconsistencies between application and supporting documents trigger verification requirements.

What Are Red Flags That Cause Underwriting Scrutiny?

Certain patterns invite enhanced underwriting review and additional conditions:

Recent credit inquiries suggesting debt applications require explanation. Multiple inquiries for credit cards, auto loans, or personal loans in recent months signal potential undisclosed obligations.

NSF fees, low balances, or negative balances on bank statements demonstrate poor money management. Lenders interpret these as financial stress indicators affecting approval decisions. Learn about financial management strategies improving qualification.

Inconsistent employment between credit report and application triggers verification and potentially manual review. Credit reports show employer names requiring explanation for all discrepancies.

Cash-heavy deposits without clear sourcing create problems. Regular cash deposits require documentation of source and explanation of nature.

Program-Specific Qualification Nuances: Understanding Different Requirements

Each loan program carries unique qualification requirements beyond general standards. Understanding program-specific nuances optimizes application strategy.

What Makes FHA Qualification Different?

FHA loans offer flexible qualification but include specific requirements:

Minimum credit scores of 580 for 3.5% initial capital, or 500-579 for 10% capital. These minimums exceed most government programs’ accessibility. Review complete FHA loan requirements for government-backed financing options.

DTI ratios extend to 46.9% standard, potentially 56.9% with compensating factors including high credit scores (680+), minimal increase in housing costs, substantial cash reserves, or conservative loan-to-value ratios. Calculate FHA qualification scenarios with elevated DTI levels.

Mortgage insurance remains for the loan life on purchases with less than 10% initial capital. Only 10%+ capital allows insurance cancellation after 11 years, distinguishing FHA from conventional PMI structures.

Two-year waiting periods after Chapter 7 bankruptcy, three years after foreclosure allow faster recovery than conventional programs requiring four and seven years respectively. Learn about post-bankruptcy qualification paths through FHA programs.

Property standards require FHA appraisal meeting minimum property requirements including safety, security, and soundness standards. Some properties fail FHA requirements despite acceptable condition for conventional financing.

Gift funds cover entire initial capital and closing costs without borrower contribution requirements, maximizing accessibility for buyers with generous family members. Review FHA gift fund strategies for effective implementation.

How Does VA Loan Qualification Differ?

VA loans provide unique benefits for military service members and veterans:

No official minimum credit score exists, though most lenders require 580-620 for automated approval. This flexibility accommodates veterans with credit challenges while maintaining responsible lending standards. Calculate VA loan qualification capacity across credit scenarios.

Zero initial capital requirement regardless of purchase price or location maximizes purchasing power for qualifying veterans. Only closing costs and VA funding fee require upfront capital. Review VA loan benefits for military borrowers.

No maximum DTI ratio exists officially, though lenders typically cap around 60%. Residual income requirements provide additional affordability verification beyond simple DTI calculations. Learn about VA residual income standards for qualification assessment.

Certificate of Eligibility proving service requirements must be obtained through VA before final approval. Online applications process quickly for most veterans with sufficient service records.

Property must serve as primary residence – no investment property purchases. However, multi-unit properties up to four units qualify with owner occupancy of one unit. Explore multi-unit VA purchase strategies for house hacking approaches.

VA funding fee ranges from 1.4-3.6% based on initial capital amount, service type, and prior VA loan use. Veterans with service-connected disabilities enjoy funding fee exemption. Calculate VA funding fee impacts on total financing costs.

What Are USDA Loan Qualification Requirements?

USDA loans serve rural and suburban buyers with specific eligibility criteria:

Location eligibility requires properties in USDA-designated rural areas, though many suburban locations surprisingly qualify. The USDA website provides eligibility maps for address verification. Review USDA loan qualification for eligible areas.

Income limits restrict USDA qualification to households earning below 115% of area median income. Limits vary by county and household size, affecting qualification in higher-income areas. Calculate USDA income eligibility for your location.

Zero initial capital requirement combined with low mortgage insurance makes USDA loans highly competitive for eligible buyers in qualifying locations. Guarantee fees total 1% upfront plus 0.35% annually.

Credit score minimums of 640 enable automated approval, though manual underwriting accommodates lower scores with strong compensating factors including minimal debt, stable employment, and excellent payment history.

Primary residence requirement prohibits investment property purchases, though multi-unit properties don’t qualify under USDA programs regardless of occupancy intentions.

How Do Conventional Loans Compare to Government Programs?

Conventional financing offers different trade-offs than government-backed options:

Credit score requirements of 620 minimum, ideally 740+ for optimal pricing create higher barriers than FHA but provide superior rate pricing for strong borrowers. Compare conventional loan scenarios across credit tiers.

Initial capital options range from 3% to 20%+, with PMI required below 20% equity. PMI cancels automatically at 78% LTV through amortization or upon request at 80% LTV, providing cost reduction unavailable in FHA. Review conventional qualification options for various capital scenarios.

DTI limits typically cap at 45-50% depending on compensating factors, somewhat stricter than FHA’s 56.9% maximum but still accommodating for most borrowers with manageable debt levels.

No property location restrictions enable purchases anywhere, unlike USDA’s rural requirements. Property standards follow conventional appraisal requirements without FHA’s minimum property standards creating broader property eligibility.

Loan limits vary by county, reaching $766,550 in most areas for 2024, higher in expensive markets. Amounts exceeding conforming limits require jumbo loan qualification with stricter standards.

Investment Property Qualification: Special Considerations for Investors

Investment property qualification introduces additional complexity beyond owner-occupied standards. Understanding investor-specific requirements optimizes portfolio growth strategies.

How Does Investment Property Qualification Differ?

Investment purchases require different qualification approaches and standards:

Higher credit scores typically required – 620-640 minimum for conventional investment loans versus 580 for owner-occupied FHA. Strong credit demonstrates investment sophistication and risk management capability. Review investment property loan options for real estate investors.

Larger initial capital requirements range from 15-25% for conventional investment loans versus 3.5% for owner-occupied FHA. Additional capital demonstrates commitment and reduces lender risk exposure. Calculate investment property qualification capacity with various capital scenarios.

Rental income from subject property counts toward qualification at 75-80% of market rent, providing income offset against housing costs. However, 2-year landlord history requirement applies before rental income from other properties qualifies at full value.

Cash reserves increase to 6 months PITI for investment properties versus 2 months for owner-occupied. Multiple investment properties compound reserve requirements, potentially requiring 6 months per property. Learn about building cash reserves for investment portfolios.

DTI calculations include full PITI even when rental income qualifies, initially increasing obligations before rental income offset applies. This approach can challenge qualification for buyers with elevated existing debt.

What Are DSCR Loan Advantages for Investors?

DSCR loans eliminate personal income verification entirely, focusing solely on property cash flow:

Debt service coverage ratio compares monthly rental income to monthly mortgage obligations including principal, interest, taxes, insurance, and HOA fees. Ratios above 1.0 indicate positive cash flow qualifying properties easily. Calculate DSCR qualification capacity using rental projections.

No income documentation required eliminates tax return analysis, W-2 collection, and employment verification. This approach serves self-employed investors and those with complex tax situations. Learn about DSCR loan qualification for portfolio growth.

Credit score requirements typically range 680-700 minimum, somewhat higher than conventional investment loans but accessible for established investors with solid credit management.

Initial capital requirements typically start at 20-25%, comparable to conventional investment loans but without personal income verification complexity. Larger capital may access more competitive pricing.

Property types expand beyond single-family to include multi-unit properties (up to 4 units), condos, and townhomes in most DSCR programs. Some lenders finance 5-8 unit properties through commercial DSCR structures.

How Many Investment Properties Can You Finance?

Conventional financing caps at 10 financed properties total, though reaching this limit requires strong financial profiles:

Properties 5-10 require minimum 720 credit scores, larger reserves, and lower maximum LTV ratios. Each additional property increases qualification complexity and reserve requirements. Review portfolio growth strategies for active investors.

Portfolio lenders eliminate the 10-property limit, financing unlimited properties for qualified investors. These programs require strong financial performance, significant experience, and often private banking relationships. Explore portfolio lending options for large-scale investors.

Commercial loans finance 5+ unit properties under different qualification standards focusing on property performance over personal income. Commercial qualification examines property financials, operator experience, and market conditions. Learn about scaling beyond residential financing through commercial loans.

What Documentation Do Investment Property Purchases Require?

Investment qualification requires comprehensive documentation beyond owner-occupied standards:

Rental income documentation includes current leases, rental history from management companies, and market rent appraisal opinions. Properties with existing tenants require lease copies and payment verification.

Property insurance quotes for landlord policies cost more than homeowner coverage, affecting qualification calculations and closing cost projections. Liability coverage levels impact premiums significantly.

Property management plans become relevant for properties in distant locations. Lenders may require professional management for properties beyond local markets or for inexperienced landlords.

Business entity documentation matters when holding properties in LLCs or corporations. Some lenders require personal guarantees regardless of entity structure while others finance entity-held properties directly.

Self-Employed Borrower Qualification Strategies

Self-employment creates unique qualification challenges requiring specialized documentation approaches and loan program selection.

Why Is Self-Employed Qualification More Complex?

Self-employed borrowers face additional scrutiny and documentation requirements:

Income calculation uses net income after business deductions rather than gross revenue, often significantly lower than actual cash flow. Aggressive tax planning reduces qualifying income. Review self-employed qualification options beyond traditional documentation.

Two-year business history requirement applies in most cases, though exceptions exist for buyers transitioning to established professional practices or franchises with corporate support.

Business type matters significantly. Sole proprietors using Schedule C face different treatment than S-Corp owners receiving W-2 wages, or partnership owners receiving K-1 distributions.

Tax return complexity creates longer processing timelines. Multiple schedules, business returns, and reconciliation requirements extend underwriting periods 1-2 weeks beyond W-2 employee applications.

What Traditional Documentation Do Self-Employed Borrowers Need?

Standard self-employed qualification requires comprehensive tax documentation:

Personal tax returns for 2 years including all schedules demonstrate income stability and trends. Form 1040 with Schedule C for sole proprietors, K-1s for partnerships, or W-2s plus corporate returns for S-Corp owners.

Business tax returns (1065, 1120, 1120S) for 2 years when owning 25%+ of business. Even W-2 employees with significant ownership require business return analysis for income calculation.

Year-to-date profit and loss statements and balance sheets ensure current performance aligns with tax return trends. Significant deviations require explanation and may affect income calculation.

Business licenses and CPA letters verifying business ownership, income stability, and likelihood of continued income strengthen applications and accelerate processing. Learn about effective income documentation for self-employed scenarios.

How Do Bank Statement Loans Simplify Self-Employed Qualification?

Bank statement programs eliminate tax return requirements using deposit analysis:

12-24 months of business bank statements replace tax returns for income calculation. Personal statements work for sole proprietors commingling funds, business statements for separated finances. Calculate bank statement loan qualification using deposit patterns.

Income calculation applies percentage factors to total deposits, typically 50-75% depending on business type and documentation. Higher expense businesses (construction, retail) use lower factors than service businesses.

Credit score requirements typically range 660-680 minimum, somewhat higher than conventional loans but accessible for established business owners with solid personal credit. Review bank statement loan requirements for alternative qualification.

Initial capital requirements start at 10-20%, more than conventional owner-occupied but less than many stated income programs. Larger capital accesses better pricing and terms.

What Are Asset Depletion Loan Benefits?

Asset depletion programs serve borrowers with substantial assets but low reported income:

Liquid assets including checking, savings, investment accounts, and retirement accounts convert to qualifying income by dividing balance by loan term months (240 for 20-year, 360 for 30-year loans). Calculate asset depletion qualification capacity using investment balances.

No tax returns or income documentation required eliminates the challenge of low reported income from tax planning. Retired individuals and wealth holders qualify easily despite minimal W-2 or 1099 income.

Credit score requirements typically range 680-700 minimum with strong financial profiles demonstrating sophisticated money management despite non-traditional income verification.

Initial capital requirements often start at 20-30% given the non-traditional qualification approach, though some programs offer lower options for exceptional borrowers with substantial assets.

Understanding Mortgage Insurance and Its Impact on Qualification

Mortgage insurance protects lenders against default risk when borrowers provide less than 20% initial capital. Understanding insurance costs and cancellation affects qualification and long-term planning.

What Is Private Mortgage Insurance (PMI)?

PMI applies to conventional loans with less than 20% initial capital:

Monthly PMI costs range 0.3-1.5% of loan amount annually depending on credit score, LTV ratio, and initial capital amount. A $300,000 loan may carry $75-375 monthly PMI. Calculate PMI costs across scenarios using the conventional loan calculator.

PMI cancellation occurs automatically at 78% LTV through scheduled amortization, or upon request at 80% LTV with on-time payment history. This feature distinguishes conventional from FHA insurance requiring lifetime payments. Learn about accelerating PMI removal through extra payments.

Lender-paid mortgage insurance (LPMI) eliminates monthly PMI through slightly higher interest rates. This trade-off suits borrowers valuing lower monthly costs over long-term interest savings or planning short holding periods.

Single premium PMI pays insurance upfront at closing, financed into the loan or paid from closing costs. This approach eliminates monthly PMI but locks cost into the loan without cancellation options.

How Does FHA Mortgage Insurance Work?

FHA insurance follows different structures than conventional PMI:

Upfront mortgage insurance premium (UFMIP) totals 1.75% of loan amount, typically financed into the loan. A $300,000 loan adds $5,250 to loan balance, increasing monthly principal and interest by $30-35. Calculate FHA insurance impacts on total costs.

Annual mortgage insurance premium (MIP) ranges 0.45-1.05% depending on loan term, LTV ratio, and loan amount. Most borrowers pay 0.55-0.85% annually, translating to $137-212 monthly on a $300,000 loan.

Lifetime MIP applies to purchases with less than 10% initial capital, remaining for the loan duration without cancellation options. Only refinancing to conventional with 20%+ equity eliminates the insurance cost.

MIP cancellation for 10%+ capital loans occurs after 11 years of payments, providing eventual cost reduction unlike lifetime insurance on minimal capital purchases. Review FHA insurance strategies for various scenarios.

What Are VA Funding Fee Requirements?

VA loans charge upfront funding fees instead of monthly insurance:

Funding fee rates vary by service type, initial capital amount, and prior VA loan use. First-time use with zero capital charges 2.3%, subsequent use charges 3.6%, creating significant cost differences. Calculate VA funding fee impacts on financing needs.

Initial capital reduces funding fees significantly. 5% capital reduces the fee to 1.65% for first use, 10%+ capital reduces it to 1.4%, providing substantial savings for veterans with available capital.

Disability exemptions eliminate funding fees entirely for veterans with service-connected disabilities, regardless of disability percentage. This benefit provides significant savings – $6,900 on a $300,000 loan at 2.3% fee rate.

No monthly mortgage insurance makes VA loans highly competitive even with upfront funding fees. The absence of ongoing insurance costs improves cash flow substantially versus FHA or conventional loans below 20% capital.

How Does USDA Guarantee Fee Compare?

USDA loans charge both upfront and annual fees similar to FHA structure:

Upfront guarantee fee totals 1% of loan amount, financed into the loan in most cases. This cost runs lower than FHA’s 1.75% upfront premium, reducing total financing needs. Calculate USDA loan costs including guarantee fees.

Annual fee of 0.35% remains significantly lower than FHA’s annual MIP (0.55-0.85%) and typical conventional PMI (0.5-1.0%), providing substantial monthly savings. A $300,000 loan pays only $87.50 monthly versus $137-250 in other programs.

Lifetime fee structure mirrors FHA, remaining for the loan duration without cancellation options. However, the lower annual rate makes this less burdensome than FHA’s lifetime MIP.

Refinance Qualification: Unique Requirements and Opportunities

Refinance qualification differs from purchase qualification in several key aspects, creating both opportunities and challenges for current homeowners.

How Does Refinance Qualification Differ from Purchase?

Refinance applications follow modified qualification standards:

Current housing payment history matters significantly. Late mortgage payments in the past 12 months create qualification challenges or denial regardless of credit score improvements in other areas. Review refinance qualification strategies for current homeowners.

Debt-to-income calculations use current obligations without housing cost increases, potentially improving qualification versus purchase scenarios where new housing costs may exceed current payments.

Appraisal requirements verify current property value, affecting loan-to-value calculations and PMI removal opportunities. Declining values may prevent refinancing or require bringing capital to closing. Learn about building home equity for refinance positioning.

Cash-out refinance qualification faces stricter standards including lower maximum LTV ratios, higher credit score requirements, and increased reserve requirements compared to rate-and-term refinancing.

What Are Streamline Refinance Options?

Streamline programs simplify refinancing for existing government loan borrowers:

FHA streamline refinance eliminates appraisal and income verification requirements for current FHA borrowers when lowering rates. Credit reports and mortgage payment history verification suffice for approval. Calculate FHA streamline savings versus full documentation refinancing.

VA Interest Rate Reduction Refinance Loan (IRRRL) streamlines refinancing for veterans with existing VA loans, eliminating appraisal and income documentation when reducing rates. Funding fees run lower than purchase VA loans at 0.5%.

USDA streamline assist eliminates appraisal and credit report requirements for current USDA borrowers when reducing rates by at least 0.5%. This program provides the simplest refinance process across government programs.

Streamline eligibility requires seasoning periods – typically 6-7 months of payments on current loans. No late payments in previous 12 months generally required for approval.

When Should You Refinance?

Strategic refinance timing maximizes benefits while minimizing costs:

Rate reductions of 0.75-1.0% typically justify refinancing costs through monthly savings. Smaller reductions may work for borrowers without closing costs or planning extended ownership. Calculate refinance break-even points for your scenario.

PMI removal through refinancing at 20%+ equity saves $150-300 monthly on typical loans. Paying for appraisal to document equity makes sense when monthly savings exceed cost recovery in 6-12 months. Learn about PMI removal strategies through refinancing.

Cash-out refinancing for home improvements, debt consolidation, or investment capital makes sense when maintaining reasonable LTV ratios and improving overall financial position. Avoid converting home equity to consumer debt without strategic purpose.

Term adjustments like refinancing from 30-year to 15-year loans accelerate equity building while increasing monthly costs. This strategy suits borrowers with improved income since purchase wanting faster payoff. Compare term options for various scenarios.

What Are Cash-Out Refinance Limitations?

Cash-out refinancing faces stricter qualification versus rate-and-term:

Maximum LTV ratios typically cap at 75-80% for conventional cash-out versus 95-97% for rate-and-term. This limitation requires substantial equity for meaningful cash extraction. Review cash-out refinance options and alternatives.

Higher credit score requirements often apply, with 680-700 minimums for cash-out versus 620 for rate-and-term conventional. FHA and VA cash-out programs maintain more flexible credit standards.

Increased reserve requirements of 6-12 months PITI for investment properties or jumbo cash-out versus 2-6 months for rate-and-term demonstrate enhanced financial stability.

Mandatory waiting periods apply after purchase before cash-out eligibility. Most programs require 6-12 months seasoning, preventing immediate equity extraction after closing.

Advanced Qualification Topics: Complex Scenarios and Solutions

Sophisticated buyers encounter unique qualification situations requiring creative solutions and specialized knowledge.

How Do You Qualify with Multiple Properties?

Juggling multiple financed properties introduces complex qualification dynamics:

Existing mortgage obligations count in DTI calculations even when rental income offsets costs. Properties with less than 2-year rental history count at full PITI without income offset. Learn about managing multiple property qualification for active investors.

Rental income from properties owned 2+ years qualifies at 75-80% of gross rent. This discount accounts for vacancy and maintenance despite actual occupancy and costs. Calculate rental income impacts on qualification capacity.

Reserve requirements multiply by property count. Six months PITI per investment property creates substantial cash requirements for large portfolios – $180,000 reserves for five $300,000 investment properties at 6 months each.

Conventional loan limits at 10 financed properties require portfolio lenders for expansion beyond this threshold. Building relationships with portfolio lenders before reaching the limit prevents growth disruptions.

What Are Bridge Loan Qualification Requirements?

Bridge financing helps buyers purchase new homes before selling existing properties:

Bridge loans provide temporary financing secured by existing home equity, typically 6-12 month terms. These loans enable non-contingent offers in competitive markets. Calculate bridge loan capacity using home equity.

Qualification includes DTI calculations with both existing and new housing costs, requiring strong income to carry dual housing expenses temporarily. Lenders also verify existing home marketability and salability.

Credit score requirements typically exceed purchase standards, often requiring 680-720 minimums given the temporary nature and short duration increasing lender risk.

Costs run higher than permanent financing through elevated rates and fees, though the competitive advantage of non-contingent offers may offset costs in hot markets. Learn about bridge loan strategies for seamless transitions.

How Do Non-Warrantable Condos Affect Qualification?

Non-warrantable condos fail to meet Fannie Mae and Freddie Mac financing requirements:

Projects with excessive investor ownership, pending litigation, or inadequate insurance can’t secure conventional financing. Non-warrantable condo loans use portfolio programs with adjusted standards.

Higher initial capital requirements of 20-30% reflect increased lender risk and lack of government agency backing. Conventional 3-5% initial capital options don’t apply to non-warrantable projects.

Elevated credit score requirements of 680-720 minimum serve as compensating factors for the property-specific risk. Strong personal credit offsets project concerns.

Interest rates run 0.5-1.5% higher than warrantable condo rates, reflecting portfolio loan status and limited investor appetite for non-conforming projects. Calculate non-warrantable condo qualification for specific scenarios.

What Options Exist for Unique Properties?

Non-traditional property types require specialized financing approaches:

Mixed-use properties combining residential and commercial space require commercial financing in most cases, though some portfolio lenders finance residential portions separately.

Properties on leasehold land rather than fee simple ownership face financing restrictions. VA loans accommodate leasehold estates meeting term requirements, while conventional programs typically require fee simple ownership.

Properties with acreage exceeding typical residential parcels may face agricultural loan requirements rather than residential financing, particularly for working farms or ranches. Review portfolio loan options for unique property types.

Manufactured homes require permanent foundation attachment and removal of wheels/axles for conventional financing. Older manufactured homes may face restrictions or require specialized programs.

Comprehensive FAQ Section: Mortgage Qualification Questions Answered

What credit score do I need to qualify for a mortgage?

Minimum credit scores vary by program: FHA accepts 580 for 3.5% initial capital, VA and USDA typically require 620, conventional requires 620 minimum with 740+ for optimal pricing, and jumbo loans need 700+. Review credit score requirements across programs.

How is debt to income ratio calculated for mortgages?

DTI divides monthly debt obligations by gross monthly income. Include housing costs, credit cards, auto loans, student loans, personal loans, child support, and other recurring obligations. Exclude utilities, insurance, and non-recurring expenses. Calculate your current DTI for qualification assessment.

How much income do I need to qualify for a mortgage?

Required income depends on purchase price, existing debts, and loan program. Generally, housing costs shouldn’t exceed 28-31% of gross income, and total debts shouldn’t exceed 43-50% depending on program. Determine required income for your target home price.

What employment history do lenders require?

Most programs require 2 years of consistent employment history in the same field. Recent job changes require explanation but don’t automatically disqualify if income remains stable or increases. Learn about employment documentation requirements.

Can I qualify for a mortgage with student loans?

Yes, though student loan payments affect DTI calculations. Lenders use actual payment for active loans, or 0.5-1% of balance for deferred loans. Income-driven repayment plans with $0 payments may use $0 in DTI with proper documentation. Calculate student loan impacts on qualification.

How much should I save for a house?

Initial capital ranges from 0% for VA/USDA loans to 3.5% for FHA, 3-5% for conventional, and 20% to avoid PMI. Also save 2-5% for closing costs plus 3-6 months reserves. Calculate total savings needed for various scenarios.

What is mortgage pre-qualification?

Pre-qualification provides preliminary borrowing estimates based on stated information without verification. It takes minutes and requires no documentation, offering rough capacity estimates for home search planning. Start pre-qualification process today.

How do I get pre-approved for a mortgage?

Submit complete application, provide income and asset documentation, authorize credit report, and allow employment verification. Lenders issue pre-approval letters after automated underwriting approval. Begin the pre-approval process for verified capacity.

Can self-employed people qualify for mortgages?

Yes, through tax return documentation showing 2-year income history, or alternative programs like bank statement loans using deposit analysis. Self-employed qualification requires more documentation but remains achievable. Review self-employed qualification options for your situation.

How long after bankruptcy can I qualify?

Waiting periods vary: Chapter 7 requires 2 years for FHA/VA or 4 years for conventional; Chapter 13 requires 2 years for FHA/VA (1 year with trustee approval) or 4 years for conventional. Learn about post-bankruptcy qualification timelines.

What is the 28/36 rule for mortgages?

The 28/36 rule suggests housing costs shouldn’t exceed 28% of gross income (front-end ratio) and total debts shouldn’t exceed 36% (back-end ratio). Many modern programs allow higher ratios with strong compensating factors. Calculate your housing ratios now.

Can I qualify with no credit history?

Yes, through manual underwriting using alternative credit including rent, utilities, insurance, and cell phone payment history. FHA and some conventional programs accept alternative credit for borrowers without traditional credit files. Review credit building strategies for qualification.

How does mortgage insurance affect qualification?

PMI costs 0.3-1.5% annually on conventional loans below 20% capital, FHA charges 0.45-1.05% annually plus 1.75% upfront, VA charges 1.4-3.6% upfront only, and USDA charges 0.35% annually plus 1% upfront. Insurance costs factor into DTI calculations. Compare insurance costs across programs.

What documents do I need to apply?

Collect 2 years tax returns, 30 days pay stubs, 2-3 months bank statements, employment verification letter, government ID, Social Security card, and documentation for credit events or gift funds. Self-employed borrowers need business returns and financial statements. Review complete documentation requirements for your scenario.

Can I use gift money for initial capital?

Yes, most programs accept gift funds from family members with proper documentation including gift letter, proof of donor ability, and proof of transfer. Some programs require minimum borrower contribution. Learn about gift fund strategies for qualification.

How long does mortgage qualification take?

Pre-qualification takes minutes; pre-approval takes 1-3 days with complete documentation; final approval takes 3-5 weeks on average. Complex situations or incomplete documentation extend timelines. Review the qualification timeline for realistic expectations.

What debts are included in DTI?

Include mortgage, credit cards, auto loans, student loans, personal loans, child support, alimony, HOA fees, and co-signed obligations. Exclude utilities, insurance, groceries, entertainment, and medical bills not in collection. Calculate DTI with all obligations included.

Can I qualify with high DTI?

Some programs accept elevated DTI with strong compensating factors: FHA allows up to 56.9% with high credit scores and reserves; VA technically has no maximum; and conventional caps at 45-50%. Strong income, assets, and credit help offset high DTI. Explore high-DTI qualification options for your situation.

What is residual income for VA loans?

Residual income represents funds remaining after all obligations for living expenses. VA calculates income minus taxes, housing costs, debts, childcare, and maintenance to verify adequate remaining funds. Residual requirements vary by family size and region. Learn about VA qualification standards including residual income.

How do I improve my chances of approval?

Improve credit scores, reduce debt obligations, increase income, build savings for reserves, maintain stable employment, avoid major financial changes during application, and provide complete accurate documentation promptly. Review comprehensive approval strategies for success.

Can I qualify for multiple mortgages?

Yes, though qualification becomes progressively complex. Properties 5-10 require excellent credit, larger reserves, and lower LTV ratios. Portfolio lenders finance unlimited properties for qualified investors. Learn about multi-property qualification strategies.

What are compensating factors in mortgage qualification?

Compensating factors offset qualification weaknesses: high credit scores, substantial reserves, minimal housing cost increase, stable employment, excellent payment history, or low LTV ratios. These factors enable approval despite elevated DTI or marginal credit. Understand compensating factor strategies for borderline scenarios.

How does property type affect qualification?

Single-family homes offer easiest qualification; condos require project approval; multi-unit properties require larger reserves; manufactured homes need permanent foundation; and non-warrantable condos require portfolio financing with stricter standards. Review property-specific qualification requirements.

Can I qualify with recent late payments?