Home Improvements Best ROI: Strategic Renovations That Build Wealth

Home Improvements Best ROI: Strategic Renovations That Build Wealth

Best ROI Home Improvements for Maximum Return on Investment

Every homeowner faces renovation decisions that feel emotionally driven but require financial wisdom. You love your home and want to improve it, but when you’re using equity or financing to fund upgrades, those improvements become investments that need to perform—not just look pretty.

Strategic homeowners understand the difference between renovations that build wealth and those that simply satisfy short-term desires. The highest ROI home improvements increase your property value substantially more than they cost, creating equity while you enjoy the benefits.

In this guide, you’ll discover:

- ROI analysis for major renovation categories (following industry research)

- Kitchen and bath remodel return comparisons with market data

- Curb appeal projects versus interior upgrades performance (based on housing studies)

- High-return versus low-return upgrade strategies

- Market-specific considerations for timing renovations with sale plans (understanding home values)

Whether you’re preparing to sell, building long-term equity, or simply maintaining your investment, knowing which improvements deliver the best returns protects you from wasteful spending while positioning your home as a wealth-building asset.

Planning home improvements? Schedule a call to discuss financing options that maximize your renovation ROI.

What Is Home Improvement ROI?

Return on investment (ROI) measures how much value an improvement adds compared to what it costs. It’s the difference between treating your home as a place to live versus treating it as the financial asset it actually is.

The basic ROI formula:

ROI = (Value Increase – Renovation Cost) ÷ Renovation Cost × 100

Example:

- Kitchen remodel cost: Moderate investment

- Home value increase: Substantial appreciation

- ROI calculation: Strong positive return

That’s a solid return. You’ve created more value than you spent, building equity through strategic improvement.

Why does ROI matter for homeowners? Because when you use financing—whether through a cash-out refinance, HELOC, or home improvement loan—your renovation becomes leveraged investment. Poor ROI means you’ve borrowed money to reduce your equity, while strong ROI means you’ve multiplied your wealth through smart leverage.

Two types of ROI to consider:

Cost Recouped ROI – How much of your investment you recover at sale

- Measured as percentage of cost recovered through increased sale price

- Industry reports track this across renovation categories

- Varies significantly by region and market conditions

Enjoyment ROI – The value you receive from using the improvement

- Not measurable in dollars but real nonetheless

- Includes quality of life improvements and daily satisfaction

- Can justify projects that don’t maximize financial returns

Strategic homeowners balance both types, recognizing that some improvements serve financial goals while others serve lifestyle goals—and the best renovations accomplish both.

Why Home Improvement ROI Matters for Homeowners

Not all renovations create equal value. Some improvements return substantially more than they cost, while others drain equity despite creating beautiful spaces. Understanding which is which protects your largest financial asset.

What makes ROI analysis critical?

When financing renovations through home equity:

- You’re converting long-term wealth into immediate improvements

- Poor ROI means you’ve permanently reduced your net worth

- Strong ROI means you’ve multiplied your equity through leverage

- The interest you pay compounds the importance of smart choices

When preparing to sell:

- High-ROI improvements attract buyers and justify premium pricing

- Low-ROI renovations don’t recover their costs at sale

- Market-appropriate upgrades sell faster at better prices

- Over-improved homes struggle to find buyers willing to pay for excess

When building long-term wealth:

- Strategic improvements create equity that can be tapped later

- Maintenance-focused upgrades preserve value and prevent deterioration

- Energy efficiency improvements reduce operating costs permanently

- Functional additions (bedrooms, baths) increase marketability and value

Beyond the numbers, high-ROI renovations tend to be the ones buyers care about most: kitchens, bathrooms, curb appeal, and functional improvements. Low-ROI renovations tend to be personal preference items: pools, luxury finishes, or highly customized features that don’t appeal broadly.

Use the home improvement loan calculator to model how different financing options impact your renovation budget.

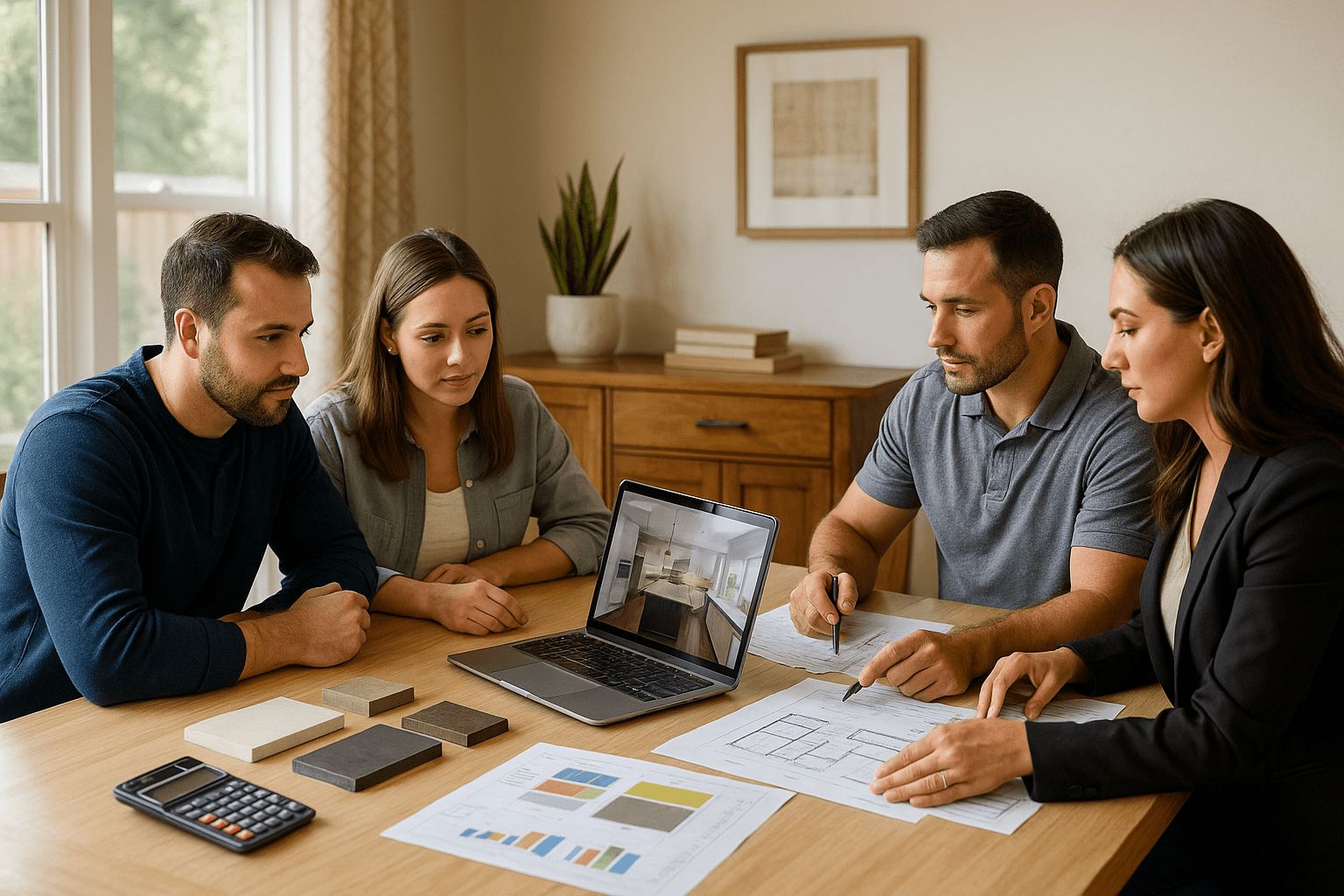

How to Calculate ROI for Major Renovations

Before starting any significant home improvement project, run the numbers to understand what return you can realistically expect. This prevents emotional spending that destroys equity.

Step 1: Determine Current Home Value

Start with accurate baseline valuation:

- Recent comparable sales in your neighborhood

- Current market conditions and trends

- Your home’s condition relative to comparables

- Unique features that add or subtract value

Consider getting a pre-renovation appraisal to establish precise baseline value. This costs several hundred dollars but provides objective starting point.

Step 2: Estimate Renovation Costs Accurately

Calculate complete project costs including:

- Materials at actual market prices

- Labor costs from licensed contractors (get multiple bids)

- Permit fees and inspection costs

- Contingency buffer for unexpected issues

- Financing costs if borrowing for the project

Most renovation budgets underestimate by leaving out:

- Permit fees and inspection requirements

- Demolition and disposal costs

- Temporary living arrangements during construction

- Repairs discovered during renovation

- Budget overruns from scope changes

Industry rule of thumb: Add at minimum extra percentage to your initial estimate for unexpected costs. Renovations almost always exceed initial budgets.

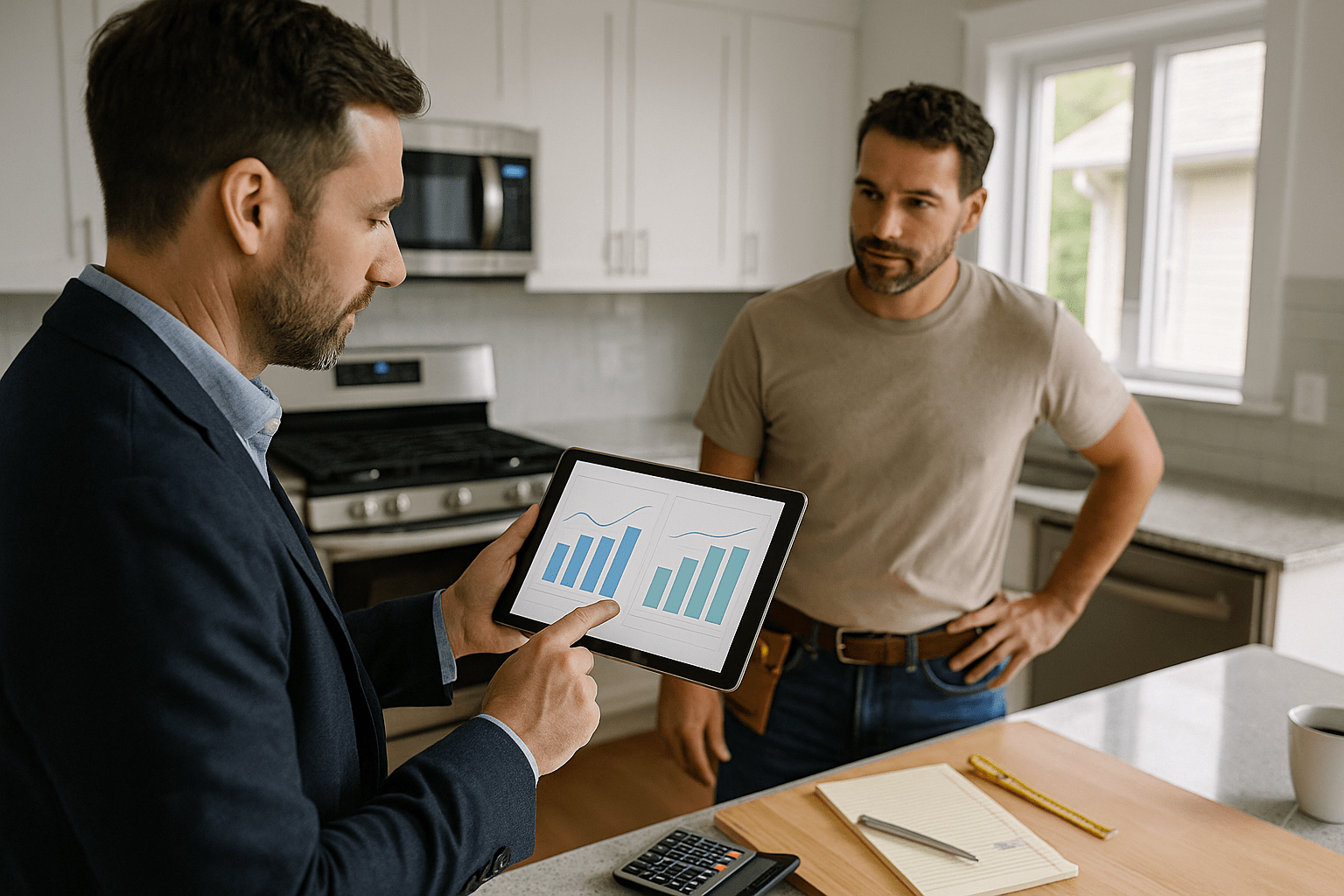

Step 3: Project Post-Renovation Value

Estimate your home’s value after improvements:

- Research recently sold homes with similar upgrades

- Consult local real estate agents for market opinions

- Consider using professional appraisers for major projects

- Account for market ceiling in your neighborhood

Don’t assume improvements add dollar-for-dollar value. A renovation costing moderate investment might only add a portion of that to your home’s market value, especially if you’re already at or near the top of your neighborhood’s price range.

Step 4: Calculate ROI Percentage

Apply the ROI formula:

ROI = (Projected Value Increase – Total Project Cost) ÷ Total Project Cost × 100

Example calculations:

High-ROI Kitchen Update:

- Cost: Moderate investment

- Value increase: Strong appreciation

- ROI: Healthy percentage return

Low-ROI Pool Installation:

- Cost: Substantial investment

- Value increase: Minimal appreciation

- ROI: Negative return

What ROI should you target? Industry data shows:

- Excellent ROI: Recovery of most of investment or more

- Good ROI: Recovery of substantial portion of investment

- Fair ROI: Recovery of moderate portion of investment

- Poor ROI: Recovery of minimal portion of investment

See how strategic renovations worked in this home improvement loan case study where a dentist used equity wisely for value-adding upgrades.

Step 5: Consider Timeline and Break-Even

When do you need to recover your investment?

- Selling within a year: Only do high-ROI projects that recover most costs

- Selling in several years: Moderate-ROI projects can work as you’ll enjoy benefits

- Staying long-term: Lower-ROI projects justified by enjoyment value

The “enjoyment break-even” concept: If a renovation costs a certain amount but improves your daily life significantly, how long do you need to live there for the enjoyment value to justify the cost?

Example: A renovation costs a moderate sum but doesn’t add much value. If you’ll stay for many years enjoying daily benefits, the quality-of-life improvement might justify the expense even though financial ROI is poor.

Kitchen and Bath Remodels: The ROI Kings

Kitchens and bathrooms consistently deliver the highest returns on renovation investment because they’re the rooms buyers care about most and the spaces that show age and wear first.

Kitchen Remodels: Minor vs. Major

Minor Kitchen Remodel (highest ROI):

- Cabinet refacing or painting rather than replacement

- Countertop upgrades to granite or quartz

- New appliances without layout changes

- Updated lighting and hardware

- Fresh backsplash

Typical cost: Moderate investment Typical value increase: Strong return ROI: Often the best percentage return in home improvement

Why minor kitchen remodels win: You’re refreshing the visible elements buyers notice without the massive expense of moving plumbing, electrical, or walls. The visual transformation is dramatic relative to cost.

Major Kitchen Remodel (good ROI but lower):

- Complete cabinet replacement

- Layout changes and expanded footprint

- High-end appliances and custom features

- Structural changes like removing walls

- Premium countertops and fixtures

Typical cost: Substantial investment Typical value increase: Significant appreciation ROI: Good but lower percentage due to higher costs

When major kitchen remodels make sense:

- Your kitchen is functionally obsolete or dangerous

- You’re staying long-term and will enjoy the benefits

- Your home is significantly under-improved for the neighborhood

- The current kitchen actively hurts resale value

The FHA 203k loan program lets you finance major renovations into your purchase or refinance, making large kitchen overhauls more accessible.

Bathroom Remodels: Adding Baths vs. Upgrading Existing

Bathroom Addition (highest value impact):

- Adding a bathroom where one is needed

- Converting half-bath to full bath

- Creating en-suite primary bathroom

Typical cost: Substantial to major investment Typical value increase: Strong appreciation ROI: Good percentage due to significant value impact

Why bathroom additions work: Homes with inadequate bathrooms for bedroom count suffer in resale. Adding bathrooms solves functional problems buyers care about deeply.

Bathroom Upgrade (solid ROI):

- Updating fixtures and finishes

- Improving lighting and ventilation

- New tile, countertops, and cabinets

- Maintaining existing footprint

Typical cost: Moderate investment Typical value increase: Good appreciation ROI: Very good percentage return

Bathroom remodel priorities for best ROI:

- Fix any functional issues (leaks, poor drainage, ventilation)

- Update dated finishes to neutral contemporary styles

- Improve lighting to bright, natural feel

- Ensure adequate storage

- Focus on primary and guest bathrooms over powder rooms

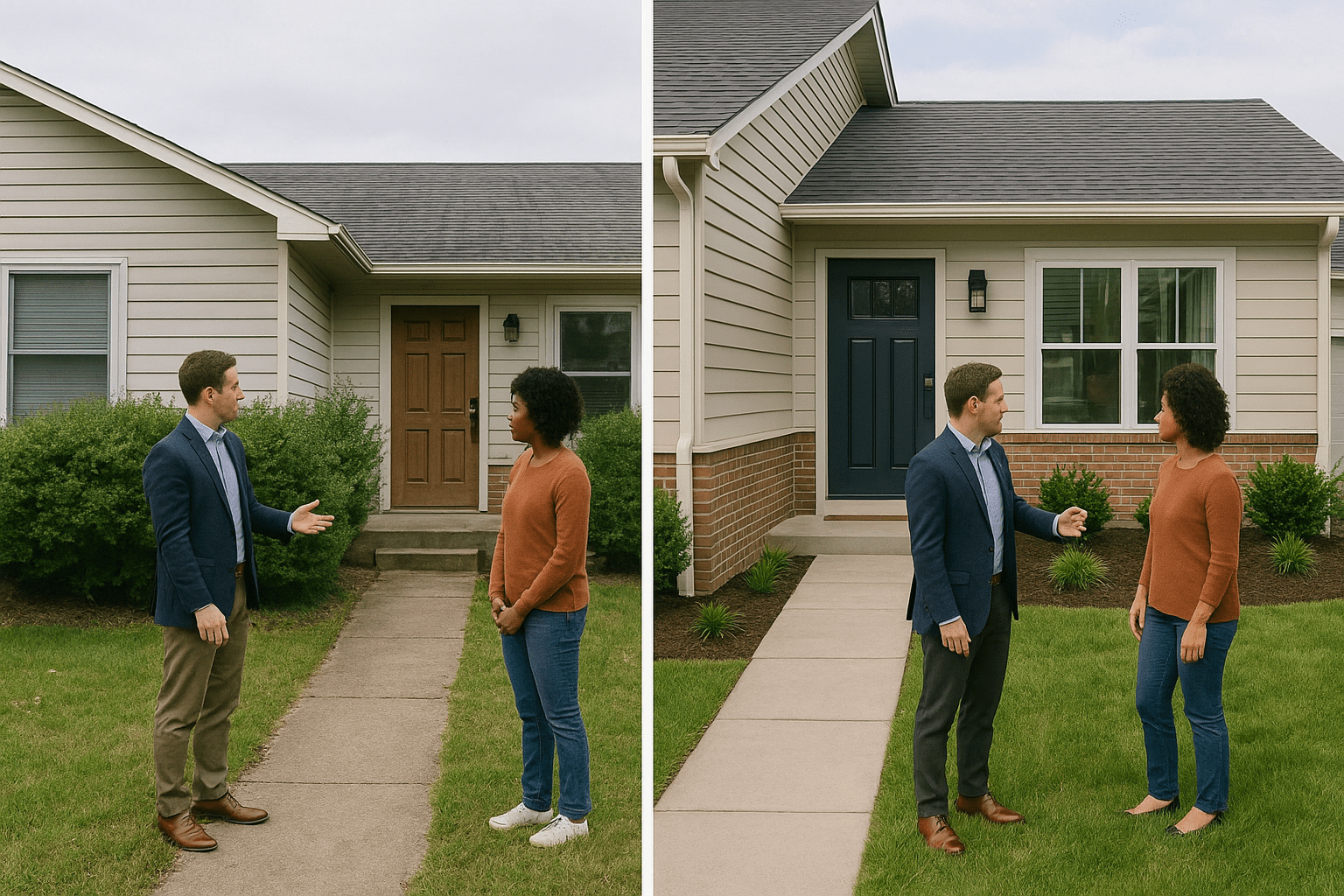

Curb Appeal Projects: High Return for Lower Investment

First impressions matter enormously in real estate, and curb appeal projects typically deliver exceptional ROI relative to their modest costs.

Landscaping and Front Yard Improvements

Strategic landscaping upgrades:

- Professional cleanup and mulching

- Strategic plantings that frame the home

- Defined beds with proper edging

- Healthy, well-maintained lawn

- Seasonal color from flowers or shrubs

Typical cost: Modest investment Typical value increase: Moderate appreciation ROI: Excellent percentage return (often among highest)

Why landscaping works: Buyers form opinions within seconds of seeing a property. Professional landscaping signals that the home is well-maintained and cared for, creating positive bias that influences their perception of everything else.

Exterior Improvements That Pay Off

Entry door replacement:

- One of the highest ROI projects consistently

- New door and hardware update entire facade

- Signals security and maintenance to buyers

Garage door replacement:

- Massive visual impact for moderate cost

- Improves curb appeal dramatically

- High percentage of cost recovered at sale

Exterior painting:

- Fresh paint transforms appearance completely

- Signals maintenance and care

- Choose neutral, market-appropriate colors

Window replacement:

- Energy efficiency improves operating costs

- Visual improvement from outside and inside

- Often qualifies for tax credits or utility rebates

Lighting upgrades:

- Exterior lighting improves safety and aesthetics

- Relatively inexpensive with strong impact

- Highlights architectural features

Use the home improvement loan to finance curb appeal upgrades that deliver quick returns without refinancing your primary mortgage.

High-Return vs. Low-Return Upgrades

Not all improvements create equal value, and some actively hurt your financial position by consuming equity without corresponding value increase.

High-ROI Projects Worth Your Investment

Projects that consistently deliver strong returns:

Energy efficiency improvements:

- New windows (especially in extreme climates)

- Insulation upgrades in attics and walls

- HVAC system replacements when necessary

- Solar panels (varies dramatically by location and incentives)

Added living space:

- Finished basements (if code-compliant)

- Attic conversions to bedrooms

- Garage conversions (market-dependent)

- Accessory dwelling units (ADUs) where permitted

Essential maintenance disguised as improvements:

- Roof replacement when needed

- Siding repair or replacement

- Foundation waterproofing

- HVAC repair or replacement

- Electrical panel upgrades

Why these work: They solve problems buyers care about or add functional space buyers will pay for. They’re not primarily aesthetic—they’re functional improvements that impact livability and operating costs.

Low-ROI Projects to Approach Carefully

Projects that rarely recover their costs:

Swimming pools:

- High installation and maintenance costs

- Limited season in many climates

- Not every buyer wants pool responsibility

- Can actually reduce buyer pool in some markets

Luxury finishes and over-improvement:

- Marble walls and floors

- Smart home systems (rapidly obsolete)

- High-end appliances beyond neighborhood norms

- Custom built-ins that reduce flexibility

Extensive landscaping:

- Elaborate hardscaping and water features

- High-maintenance specialty gardens

- Costs rarely recovered at sale despite beauty

Home theaters and specialty rooms:

- Highly personal and may not appeal to buyers

- Expensive to create properly

- Can consume space buyers want for other purposes

Sunrooms and enclosed patios:

- Often don’t count as living space for appraisal

- Expensive to build properly

- May not fit buyers’ needs

When are low-ROI projects acceptable?

- You’re paying cash, not borrowing

- You’ll stay long enough to justify enjoyment value

- You understand you’re spending for lifestyle, not investment

- Your home isn’t at the top of neighborhood pricing already

See this real-world example in a HomeStyle renovation loan case study where an interior designer balanced aesthetic desires with ROI realities.

Market-Specific Considerations for Timing Renovations

Real estate markets vary dramatically by region, neighborhood, and economic cycle. Smart renovation timing considers these factors alongside ROI calculations.

Understanding Your Neighborhood’s Price Ceiling

Every neighborhood has a practical price ceiling—the maximum amount buyers will pay regardless of improvements. Over-improving past this ceiling wastes money.

How to identify your ceiling:

- Research highest recent sales in your neighborhood

- Note what features those top properties have

- Understand buyer expectations for your price range

- Recognize when you’re approaching or at the ceiling

Example: Your neighborhood’s highest sales cluster around a certain price point. Your home is currently worth a moderate amount. Even if you invest heavily in renovations, buyers won’t pay much more than the ceiling, meaning your improvements create limited value increase.

Strategy when near ceiling:

- Focus on maintenance and repairs, not major upgrades

- Make cosmetic improvements that help you sell at ceiling price

- Avoid expensive renovations that won’t recover costs

- Consider whether moving up makes more sense than over-improving

Timing Renovations with Market Cycles

When markets are hot (seller’s market):

- Buyers compete and overlook cosmetic issues

- Major renovations may not be necessary to sell at premium

- Light staging and basic repairs often sufficient

- Save renovation money and sell as-is

When markets are slow (buyer’s market):

- Strategic improvements help your home stand out

- Buyers are pickier and less willing to do work

- Move-in ready homes command premiums

- Target improvements buyers specifically request

For long-term holds:

- Renovate when you’ll enjoy benefits, not just for resale

- Time projects when financing is favorable

- Complete improvements gradually to spread costs

- Focus on maintenance that prevents deterioration

Regional Variations in ROI

Climate affects which improvements deliver returns:

Cold climates prioritize:

- Energy efficiency (heating costs)

- Finished basements (additional living space)

- Garage improvements (protected parking valued highly)

- Roof and insulation (winter performance critical)

Hot climates prioritize:

- Energy efficiency (cooling costs)

- Outdoor living spaces (used year-round)

- Pool and landscaping (lifestyle match)

- Shade structures and covered patios

Humid climates prioritize:

- Moisture control and ventilation

- Mold-resistant materials

- Proper drainage and gutters

- Deck and porch maintenance

Research your specific market’s preferences before committing to major renovations.

How to Fund Home Improvements Strategically

The financing method you choose impacts your renovation’s overall ROI because interest costs and terms vary dramatically across options.

Cash-Out Refinance for Major Projects

Best for: Large, complete renovations done at once

A cash-out refinance replaces your mortgage with a larger loan, providing cash for renovations while potentially improving your rate or terms.

Advantages:

- Fixed rate and predictable payments

- Potentially lower interest than your current mortgage

- Single consolidated payment

- Can accomplish multiple goals (rate improvement + cash)

Disadvantages:

- Closing costs (several thousand typically)

- Extends your loan term unless you choose shorter term

- Reduces your equity immediately

- Makes sense only if you’ll stay long enough for renovations to add value

When to use cash-out refinance:

- You’re doing comprehensive renovations all at once

- Current rates make refinancing attractive anyway

- You prefer fixed-rate, fixed-term financing

- Your renovation budget is substantial

HELOC for Phased or Flexible Projects

Best for: Renovations done in stages or uncertain scope

A HELOC provides revolving access to your equity similar to a credit card secured by your home.

Advantages:

- Only pay interest on what you actually use

- Flexibility to draw as needed

- Lower closing costs than refinancing

- Keeps your existing favorable mortgage rate intact

Disadvantages:

- Variable rate (payment can increase)

- Requires discipline not to overuse

- Typically interest-only initially, then payment jumps

- Two separate payments (mortgage plus HELOC)

When to use HELOC:

- Your renovation has multiple phases

- You’re not certain of final scope

- Your current mortgage has a great rate you want to keep

- You value flexibility over fixed payments

Home Improvement Loans for Specific Projects

Best for: Defined projects without touching first mortgage

A home improvement loan provides a lump sum at a fixed rate without refinancing your primary mortgage.

Advantages:

- Preserves your current mortgage

- Fixed rate and payment

- Faster closing than refinance

- Lower costs than refinancing

Disadvantages:

- Typically higher rates than first mortgages

- Adds a second payment

- Might have shorter terms

- Limited to smaller amounts than cash-out refinance

When to use home improvement loan:

- You have a great first mortgage rate

- Your project is well-defined with clear budget

- You want fixed payments and fixed rate

- You don’t want to refinance your primary mortgage

FHA 203k and HomeStyle Renovation Loans

Best for: Purchase + renovation or major overhaul

The FHA 203k loan and HomeStyle renovation loan let you finance purchase and renovations in one loan, or refinance and renovate simultaneously.

Advantages:

- Single loan for purchase and improvements

- No need for cash upfront for renovations

- Contractor draws funded through escrow

- Can buy fixer-uppers that need work

Disadvantages:

- More complex process with required inspections

- Contractor requirements and timelines

- Higher loan balance to qualify for

- More paperwork than standard mortgages

When to use renovation loans:

- Buying a fixer-upper that needs immediate work

- Want to refinance and renovate simultaneously

- Don’t have cash for improvements after purchase

- Want structure and oversight on renovation process

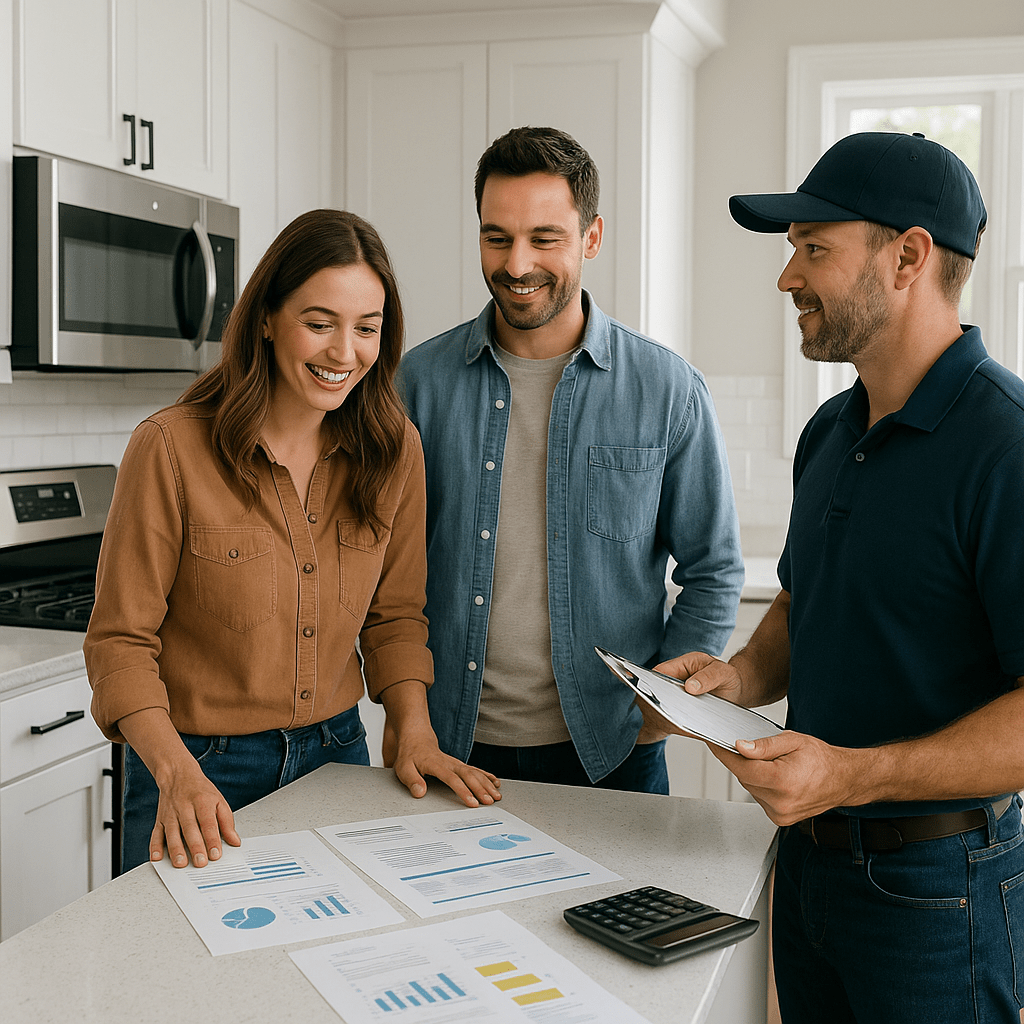

Common Home Improvement Scenarios for Homeowners

How real homeowners approach renovations depends on their specific goals and timeline. Here are typical strategic patterns:

Scenario 1: Pre-Sale Preparation

You’re planning to sell within a year and want to maximize sale price without over-investing. You focus on high-ROI improvements buyers care about: fresh paint, updated lighting, minor kitchen refresh, landscaping, and repairs. You avoid major renovations that won’t recover costs in your timeframe.

Scenario 2: Long-Term Value Building

You’re staying in your home for many years and want to build equity through improvements you’ll also enjoy. You use a HELOC to fund phased renovations: kitchen update first, bathroom remodel next year, basement finishing later. You’re balancing ROI with quality-of-life improvements, prioritizing projects that serve both goals.

Scenario 3: Necessary Maintenance Upgrades

Your home needs a new roof, HVAC system, and window replacement—essential maintenance that affects safety, energy costs, and value preservation. You use a cash-out refinance to fund all necessary repairs at once, treating them as investments that maintain your property’s value and prevent deterioration.

Scenario 4: Functional Addition

Your family has outgrown your home but you love your neighborhood and don’t want to move. You investigate adding a bedroom, bathroom, or finishing your basement to create needed space. You calculate the cost versus value of adding space compared to moving, and determine that renovation delivers better ROI than selling and buying larger.

Scenario 5: Energy Efficiency Investment

Rising utility costs are eating your budget, and your home’s inefficiency affects comfort. You prioritize energy improvements: insulation, windows, HVAC upgrade, and potentially solar panels. These improvements reduce operating costs permanently while adding value, creating ongoing ROI through savings plus increased home value.

How Stairway Mortgage Helps

Financing home improvements strategically requires understanding both renovation ROI and financing options. We help you structure financing that maximizes your improvement budget while minimizing interest costs.

Our team helps you:

- Calculate realistic ROI for planned improvements

- Determine which financing option serves your timeline and goals

- Structure loans that provide renovation funds at favorable terms

- Access multiple lenders for competitive rates on improvement financing

- Coordinate renovation loan requirements with contractor timelines

- Model scenarios comparing different financing approaches

Whether you’re doing minor updates or major overhauls, we show you how to fund improvements in ways that protect and build your equity rather than draining it.

What does the process look like?

- We review your planned improvements and estimated costs

- We calculate realistic value increase based on market data

- We model multiple financing options with total costs

- We recommend the approach that maximizes ROI while minimizing interest

- We handle the application and funding process

- We coordinate with contractors if using renovation loan programs

Ready to fund home improvements strategically? Get pre-approved to understand your financing options and borrowing capacity.

Ready to Get Started?

Strategic home improvements build wealth when you focus on projects that deliver strong returns and finance them appropriately for your situation and timeline.

Next steps for planning high-ROI renovations:

- List improvements you’re considering with estimated costs

- Research value increase for each project in your specific market

- Calculate ROI to prioritize highest-return projects

- Determine your timeline for staying in the home

- Explore financing options that minimize interest while funding your improvements

Don’t renovate based on emotion or trends. Make data-driven decisions that balance your enjoyment with financial returns, ensuring your home improvements build equity rather than consume it.

Have questions about financing home improvements? Schedule a call with a loan advisor who can analyze your renovation plans and recommend optimal financing.

Want to model different financing scenarios? Use the home improvement loan calculator to compare costs across options.

Frequently Asked Questions

Which home improvement has the best ROI?

Entry door replacement, garage door replacement, and minor kitchen remodels consistently rank among highest ROI projects, often recovering most or all of their cost at sale. These improvements create dramatic visual impact for relatively modest investment. However, ROI varies by market, so research your specific area’s preferences. Projects addressing functional deficiencies (adding needed bathrooms, updating dangerous electrical) also deliver strong returns by solving problems that hurt resale value.

Should I renovate my home before selling?

It depends on your local market and home condition. In hot markets, minimal improvements may be sufficient. In slow markets, strategic updates help your home stand out. Focus on repairs, fresh paint, landscaping, and minor kitchen/bath updates—projects that deliver strong ROI quickly. Avoid major renovations close to sale unless your home is significantly dated or damaged. Consider getting agent input on which specific improvements your market demands. Use the conventional loan refinance calculator to see if refinancing for improvements makes sense.

How do I calculate if my renovation will add value?

Research recent sales of comparable homes with and without the improvement you’re considering. The difference represents approximate value addition. Consult local real estate agents for market opinions on value impact. For major projects, consider hiring an appraiser pre-renovation for baseline value and post-renovation projected value. Remember that improvements hitting your neighborhood’s price ceiling won’t add proportional value regardless of quality.

What’s the difference between repair and improvement for ROI?

Repairs address existing problems (roof leaks, broken HVAC, cracked foundation) and typically don’t add value—they prevent value loss. Improvements enhance beyond original condition (kitchen upgrades, finished basement, added bathroom) and potentially add value. However, necessary repairs often deliver excellent ROI by preventing buyers from deducting repair costs from offers. Address all repairs before improvements to maximize return on your renovation investment.

Should I use a HELOC or cash-out refinance for renovations?

It depends on your project scope, timeline, and current mortgage. Use cash-out refinance for large, one-time projects or if refinancing improves your rate anyway. Use HELOC for phased projects, uncertain scope, or to preserve a favorable first mortgage rate. Home improvement loans work well for defined projects without touching your primary mortgage. Compare total costs including interest across all options.

Also Helpful for Homeowners

Related home improvement strategies:

- Cash-Out Refinance – Access equity for major renovations

- HELOC – Flexible funding for phased improvements

- FHA 203k Loan – Purchase and renovate in one loan

What’s Next in Your Journey?

Continue building home equity strategically:

- View all mortgage calculators to model improvement financing

- Explore renovation success stories from other homeowners

- Discover all loan programs for home improvement funding

Explore Your Complete Options

Strategic renovation financing creates wealth:

- Home Improvement Loan – Fixed-rate project funding

- HomeStyle Renovation Loan – Conventional renovation financing

- When to Refinance – Understand all refinancing scenarios

Ready to discuss financing for your home improvements? Schedule a call to explore options that maximize your renovation ROI.

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a CallNot Sure About Your Next Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Related Posts

Subscribe to our newsletter

Get new posts and insights in your inbox.