Reverse Mortgage vs. HELOC: Which One Builds More Security?

- By Jim Blackburn

- on

- Tags: Blog Posts for - Emails 1-10

As a homeowner, your equity is a powerful tool. But when it’s time to tap into it — especially in retirement — how you access that equity can make all the difference.

Two of the most common options?

A Reverse Mortgage and a Home Equity Line of Credit (HELOC).

While they might seem similar on the surface, they’re built for very different seasons of life.

Here’s a clear comparison to help you decide which one protects your lifestyle, your finances, and your peace of mind.

What They Have in Common

Both a Reverse Mortgage and a HELOC:

- Use your home’s equity as collateral

- Allow you to access funds without selling your home

- Can be used for anything — home repairs, medical bills, daily living, or emergencies

- Offer flexibility in how and when you use the money

But that’s where the similarities end.

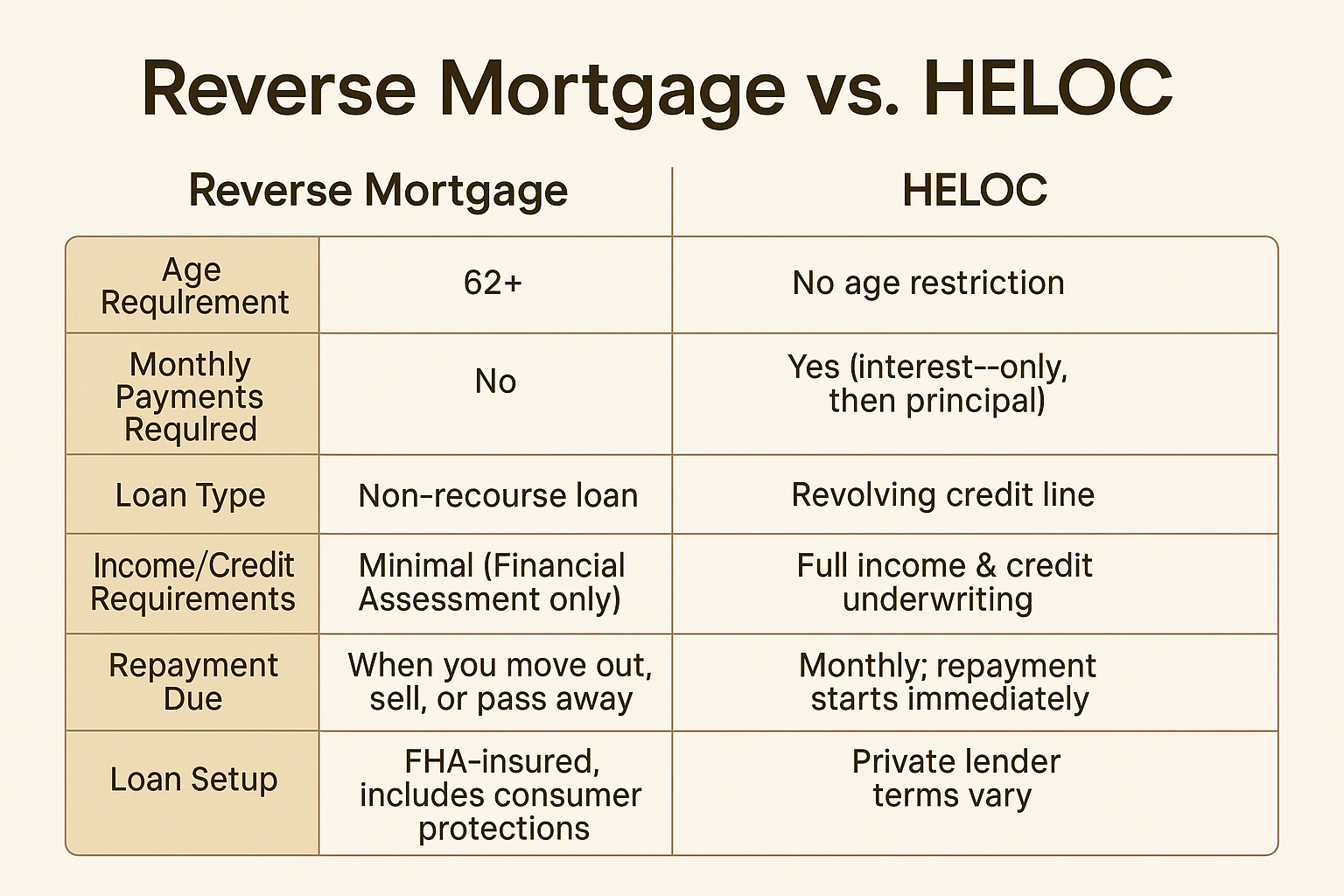

Key Differences at a Glance

Why Retirees Prefer Reverse Mortgages

HELOCs can be helpful — but they come with risk.

You’re required to make monthly payments, which can be difficult on a fixed income. And if you miss those payments, you could face foreclosure.

A reverse mortgage, on the other hand:

- Requires no monthly payments

- Offers flexible payout options (lump sum, monthly, or line of credit)

- Can’t be canceled or frozen like a HELOC

- Won’t require repayment until the home is no longer your primary residence

That’s why many retirees see it as a way to stay independent, not just to access cash.

HELOCs Are Great When…

- You’re still working and have strong income

- You need funds short-term and plan to repay quickly

- You want to keep your existing mortgage and just add a credit line

- You don’t mind (or prefer) making monthly payments

In some cases, a HELOC may be a good stepping stone to a reverse mortgage later on — especially if your needs evolve.

Not Sure Which One’s Right for You?

This isn’t a one-size-fits-all conversation.

We’ll look at:

- Your age and financial goals

- Your current mortgage and monthly obligations

- Whether you want to downsize, age in place, or preserve wealth

We don’t just offer loans — we offer guidance. No pressure. Just options that serve you.

Final Thought

Equity is meant to serve your life — not trap you in the past.

Whether you choose a HELOC or a reverse mortgage, the key is using your home to enhance your freedom, not limit it.

Let’s build wisely. Your stairway starts here.

Ready to Take Your First Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- 💡 Takes just 5 minutes

- 📊 Tailored results based on your answers

- 🔒 No credit check required

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- 💡 Only 2 minutes to complete

- 📊 Quick turnaround on pre-approval

- 🔒 No credit score impact

Got a Few Questions First?

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a Call