What Is a Reverse Mortgage — and Is It Right for You?

- By Jim Blackburn

- on

- Tags: Blog Posts for - Emails 1-10

If you’re 62 or older and own your home, a reverse mortgage might be the financial tool you didn’t know you needed.

It’s not a scam. It’s not giving your house away.

It’s a strategic way to access the wealth in your home — without selling it or making monthly payments.

Here’s what you need to know.

What Exactly Is a Reverse Mortgage?

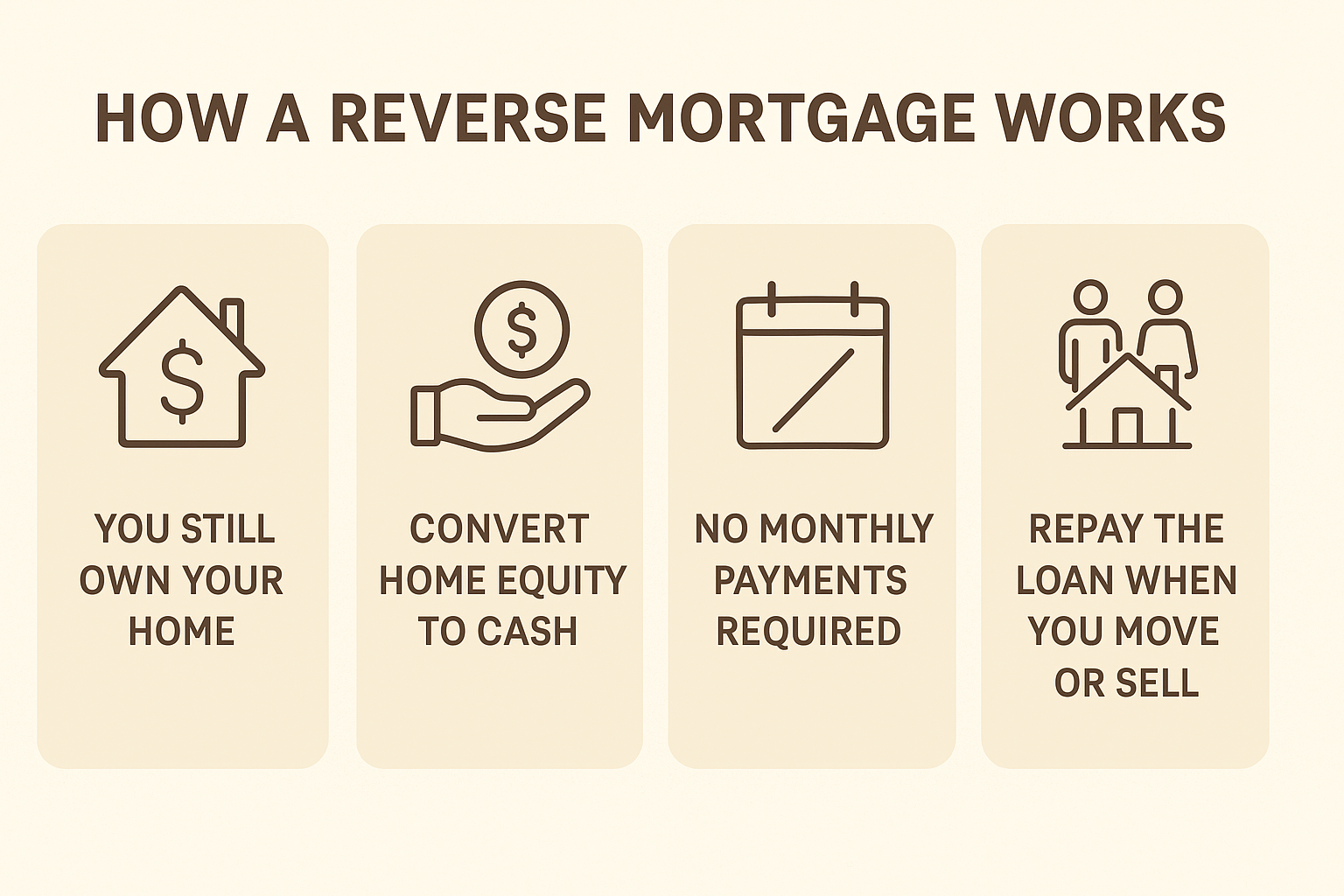

A reverse mortgage is a type of loan that lets homeowners convert part of their home equity into cash — without having to sell the home or make monthly payments.

Instead of you paying the lender, the lender pays you.

You can receive your funds as:

- A lump sum

- Monthly income

- A line of credit

- Or a combination of the above

And yes — you still own your home.

The loan is typically repaid when you sell, move out, or pass away — usually through the sale of the home.

Who Is It For?

Reverse mortgages are available to homeowners who are:

- 62 or older

- Living in their primary residence

- Holding sufficient equity in their home

Whether you’re retired, semi-retired, or looking to create a more flexible lifestyle, this could be a powerful option for:

- Replacing income

- Eliminating a monthly mortgage payment

- Covering healthcare or long-term care expenses

- Aging in place without relying on family or selling assets

Is a Reverse Mortgage Safe?

Yes — when done with a reputable lender and a clear strategy.

Reverse mortgages are federally regulated and come with built-in consumer protections, including:

- Required HUD-approved counseling

- Non-recourse loan protections (you’ll never owe more than the home is worth)

- The ability for heirs to refinance or sell the home when the loan ends

Who Should Consider It?

You may want to consider a reverse mortgage if:

- You’re looking for tax-free cash flow in retirement

- You want to avoid selling investments or triggering capital gains

- You want to stay in your home long-term and make it work for you

- You’re ready to use your equity with intention, not fear

It’s not a fit for everyone — but for the right household, it can extend retirement income, protect other assets, and offer peace of mind.

What Are the Alternatives?

If you’re not sure a reverse mortgage is the right move, we can also help you compare:

- HELOCs (Home Equity Lines of Credit)

- Cash-out refinances

- Downsizing or relocating

- Rental income strategies

No pressure. Just smart options tailored to your goals.

Final Thought

A reverse mortgage isn’t about giving up your home — it’s about finally letting it give back to you.

Whether you want to reduce financial stress, increase independence, or leave a more flexible legacy for your family — it starts with understanding your options.

Let’s build wisely. Your stairway starts here.

Ready to Take Your First Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- 💡 Takes just 5 minutes

- 📊 Tailored results based on your answers

- 🔒 No credit check required

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- 💡 Only 2 minutes to complete

- 📊 Quick turnaround on pre-approval

- 🔒 No credit score impact

Got a Few Questions First?

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a Call