What Happens to a Reverse Mortgage When You Pass Away?

- By Jim Blackburn

- on

- Tags: Blog Posts for - Emails 1-10

If you’re thinking about a reverse mortgage, chances are you’re not just thinking about yourself — you’re thinking about what happens after you’re gone.

The good news? A reverse mortgage doesn’t erase your legacy — it can actually help preserve it, if planned wisely.

Let’s walk through what happens step-by-step when the borrower passes away, and what it means for your family.

The Basics

A reverse mortgage becomes due and payable when:

- The last surviving borrower passes away

- The home is no longer the primary residence

- Or the borrower permanently moves to assisted living

At that point, your heirs will have options — and control over what happens next.

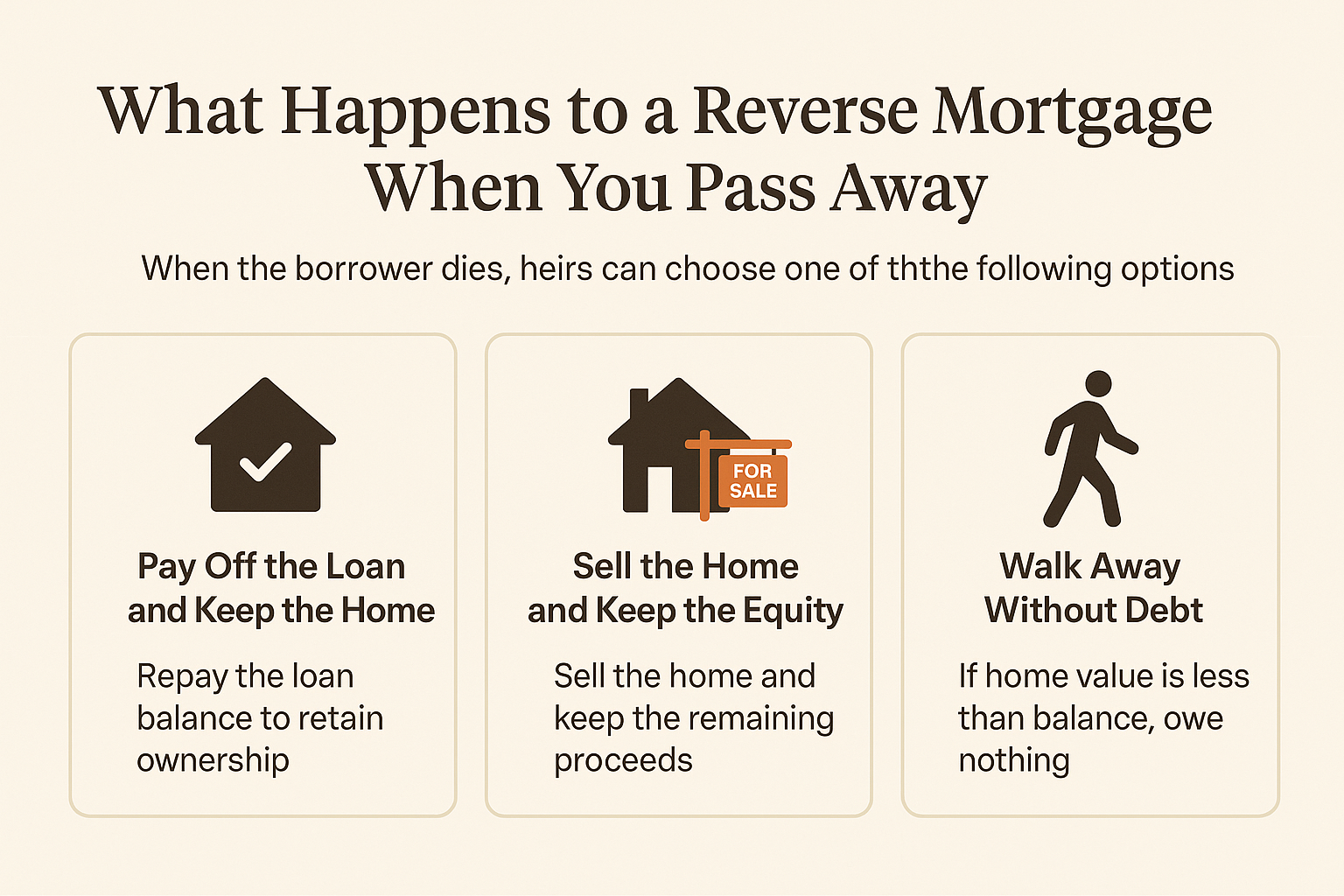

Option 1: Pay Off the Loan and Keep the Home

If your children or heirs want to keep the house, they can choose to pay off the reverse mortgage balance — either with cash or by refinancing into a new loan in their name.

Important:

- The amount they must repay will never exceed the value of the home

- If the loan balance is less than the home value, they keep the remaining equity

- If the home is worth less than the loan, the FHA insurance covers the difference — not your family

This is called a non-recourse loan — and it’s built to protect both you and your heirs.

Option 2: Sell the Home and Keep the Equity

Most families choose to sell the home, pay off the reverse mortgage, and keep any remaining proceeds.

For example:

- Home sells for $500,000

- Reverse mortgage balance is $350,000

- Your heirs keep the remaining $150,000 (after closing costs)

It’s a simple, dignified way to transfer value — even if you used equity during your lifetime.

Option 3: Walk Away Without Debt

If the home is worth less than what’s owed on the reverse mortgage, your heirs can simply walk away — with no obligation.

The lender will handle the sale and collect what they can from FHA insurance.

Your heirs won’t owe a dime out of pocket.

That’s one of the most powerful protections reverse mortgages offer.

What About Probate or Legal Issues?

If your home is in a trust or will, we’ll work with your estate attorney to make sure everything transitions smoothly.

It’s helpful to have:

- A recorded trust

- Clear beneficiaries

- Open conversations with your loved ones before taking the loan

We also recommend a quick conversation with your financial advisor — or we’re happy to make introductions.

Why Planning Ahead Matters

When you plan ahead, a reverse mortgage becomes a tool to:

- Stay in your home longer

- Reduce financial strain on family

- Transfer remaining wealth more efficiently

- Avoid rushed or emotional home sales after death

It’s not just about accessing equity — it’s about protecting what matters most.

Final Thought

When done right, a reverse mortgage gives you freedom now and clarity later.

It’s not just about what you leave behind — it’s about how you live today.

Let’s build wisely. Your stairway starts here.

Ready to Take Your First Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- 💡 Takes just 5 minutes

- 📊 Tailored results based on your answers

- 🔒 No credit check required

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- 💡 Only 2 minutes to complete

- 📊 Quick turnaround on pre-approval

- 🔒 No credit score impact

Got a Few Questions First?

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a Call