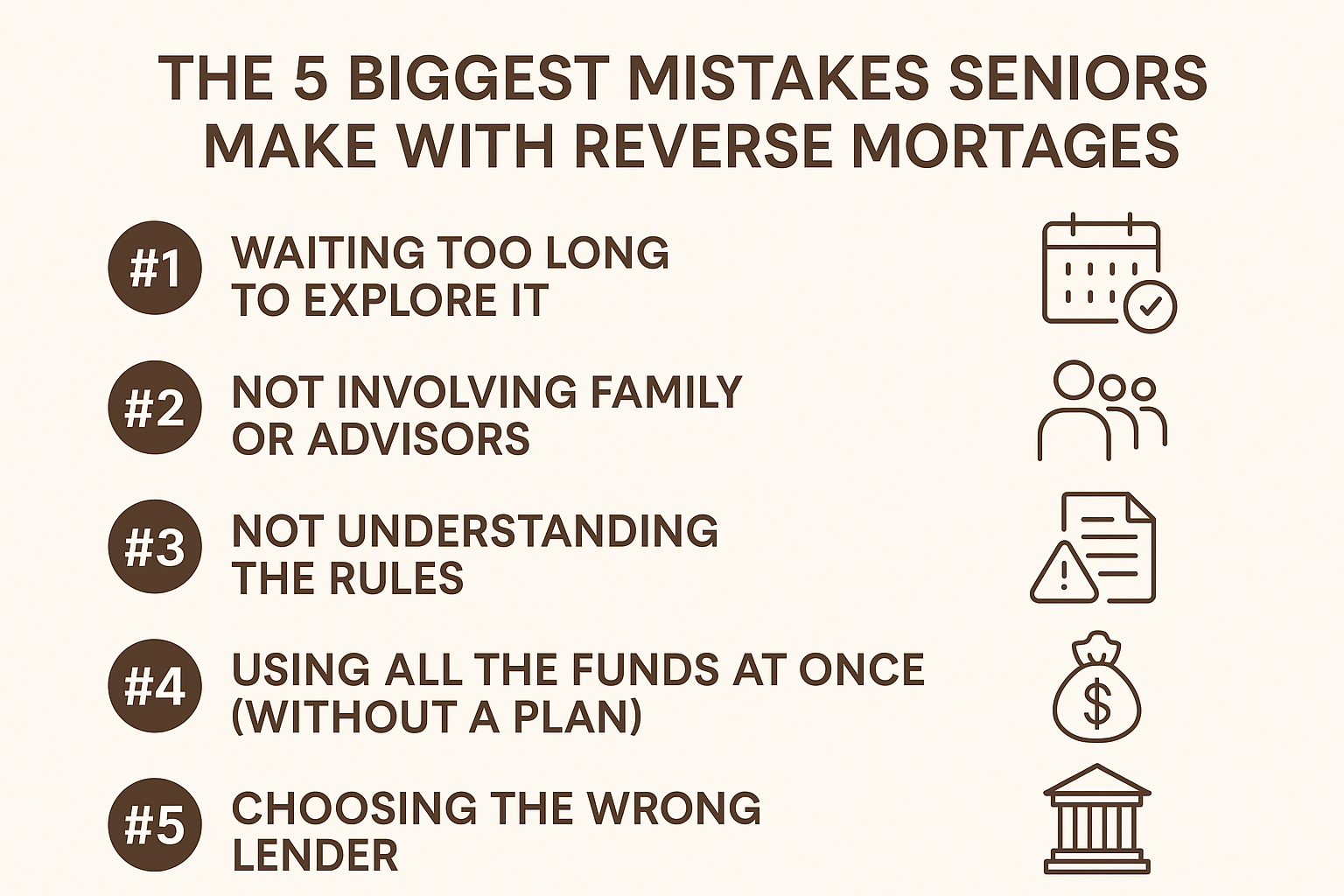

The 5 Biggest Mistakes Seniors Make with Reverse Mortgages

- By Jim Blackburn

- on

- Tags: Blog Posts for - Emails 1-10

Reverse mortgages can be powerful tools for retirement planning — but like any financial decision, they work best when they’re used wisely.

Unfortunately, many seniors miss out on the full benefits (or create unnecessary complications) simply because they don’t understand how these loans work.

Let’s walk through the top 5 mistakes we see — and how you can avoid them.

Mistake #1: Waiting Too Long to Explore It

Many people think a reverse mortgage is a “last resort” — something you do only when you’re out of money.

But the truth is, the sooner you explore the option, the more flexibility you have.

When used early in retirement:

- It can reduce financial stress before it builds

- Preserve your investments

- Help you stay in your home longer

- And prevent emergency decisions later on

Reverse mortgages work best as part of a plan — not a panic.

Mistake #2: Not Involving Family or Advisors

A reverse mortgage affects your estate and long-term finances — so it’s smart to loop in the people you trust.

That could include:

- Your children or heirs

- Your financial planner

- Your attorney or estate planning advisor

The best outcomes happen when everyone’s on the same page. We’re happy to answer questions with your family present — no pressure, just clarity.

Mistake #3: Not Understanding the Rules

Reverse mortgages are simple when explained well — but there are important responsibilities:

You must:

- Live in the home as your primary residence

- Stay current on property taxes, insurance, and maintenance

- Understand what happens when the loan ends

When these expectations are met, you can stay in your home for life.

But if ignored, they can create confusion — or even foreclosure.

We explain everything clearly up front — and help you stay compliant long-term.

Mistake #4: Using All the Funds at Once (Without a Plan)

It can be tempting to take a large lump sum — especially if you’ve waited years to access your equity.

But blowing through your equity quickly can lead to regret.

That’s why we help you choose the right disbursement strategy, whether that’s:

- A line of credit (that grows over time)

- Monthly income

- Or a modest lump sum combined with reserves

This isn’t just about access — it’s about sustainability.

Mistake #5: Choosing the Wrong Lender

Not all lenders are created equal.

Some treat reverse mortgages like a one-size-fits-all product.

Others focus more on sales than on education or long-term planning.

At Stairway Mortgage, we:

- Offer custom strategies

- Work directly with your family and advisors

- And treat your home and future with the respect they deserve

Because you’re not just making a loan decision — you’re building a lifestyle.

Final Thought

Reverse mortgages aren’t risky — but misunderstanding them can be.

By learning the rules, involving your loved ones, and working with the right team, you can use your home’s equity to support your freedom, not limit it.

Let’s build wisely. Your stairway starts here.

Ready to Take Your First Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- 💡 Takes just 5 minutes

- 📊 Tailored results based on your answers

- 🔒 No credit check required

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- 💡 Only 2 minutes to complete

- 📊 Quick turnaround on pre-approval

- 🔒 No credit score impact

Got a Few Questions First?

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a Call