Reverse Mortgages & Retirement: Stretching Income Without Selling

- By Jim Blackburn

- on

- Tags: Blog Posts for - Emails 1-10

Retirement should be a time to enjoy the life you’ve built — not worry about running out of money.

But with inflation, rising healthcare costs, and longer life expectancy, many retirees are realizing their savings may not stretch as far as they hoped.

That’s where a reverse mortgage comes in.

It’s not just a way to “tap equity.”

It’s a way to stretch your income, protect your investments, and stay in your home — without selling a thing.

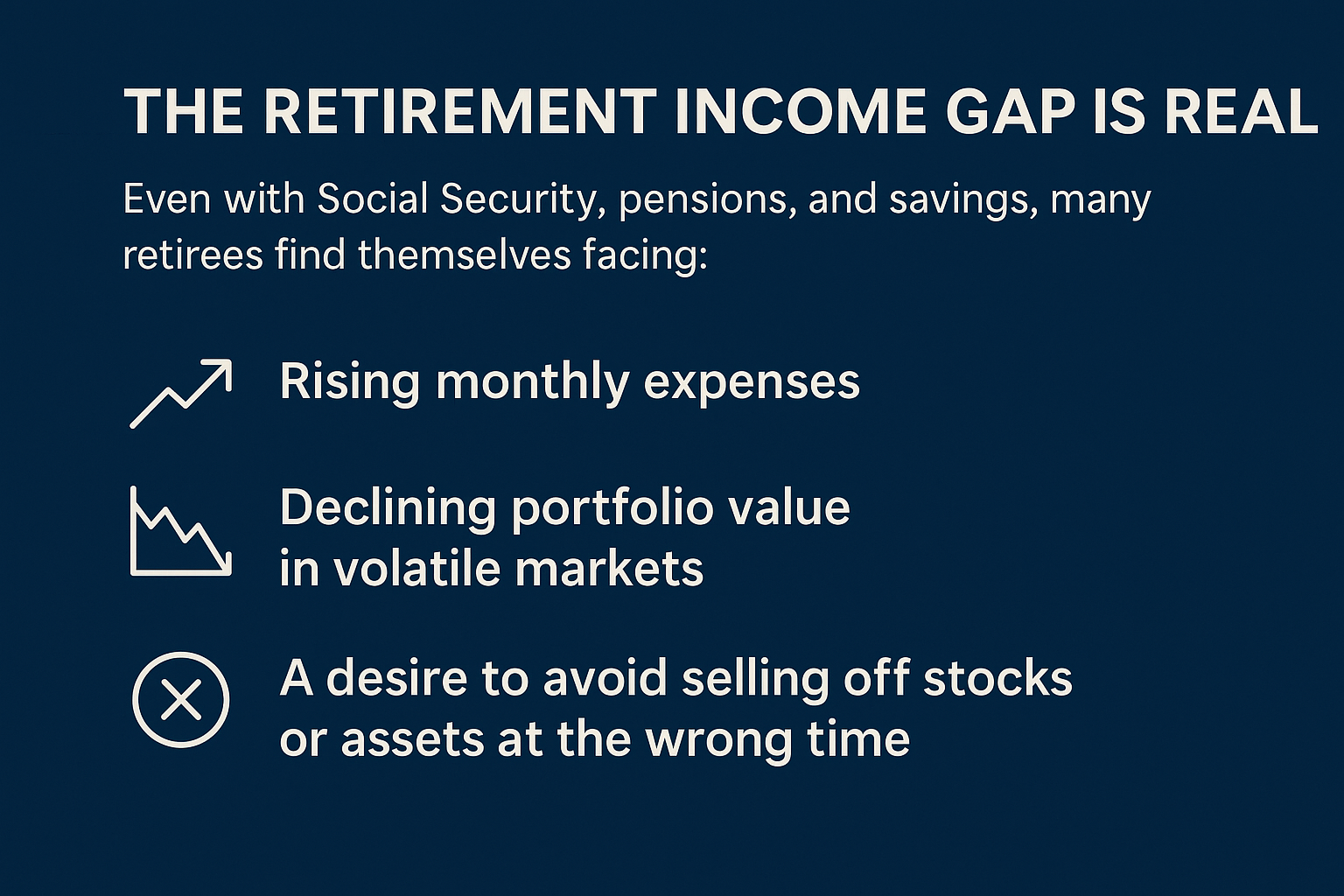

The Retirement Income Gap Is Real

Even with Social Security, pensions, and savings, many retirees find themselves facing:

- Rising monthly expenses

- Declining portfolio value in volatile markets

- A desire to avoid selling off stocks or assets at the wrong time

A reverse mortgage can help bridge that gap, providing tax-free funds without affecting Medicare or Social Security.

Turn Your Home Equity Into Income — Without a Monthly Payment

With a reverse mortgage, you can access a portion of your home equity and receive it as:

- Monthly income

- A line of credit

- A lump sum

- Or any combination of the above

And best of all:

You don’t have to make monthly payments on the loan.

The balance is repaid later — typically when you sell, move out, or pass away.

That means more flexibility now, and more control later.

Avoid Selling Investments in Down Markets

One of the smartest ways retirees use reverse mortgages is to avoid selling off investments when the market dips.

Instead of cashing out IRAs or brokerage accounts at a loss, they:

- Use a reverse mortgage to cover income needs temporarily

- Let their investments recover over time

- Rebalance when the market is in a better position

This strategy helps preserve long-term wealth and reduce stress.

Preserve Your Legacy While Protecting Your Lifestyle

Contrary to the myth, a reverse mortgage doesn’t erase your legacy.

- You still own your home

- Your heirs can choose to keep or sell it

- If the home sells for more than the loan balance, the equity goes to your family

- And if the home is underwater, your heirs can walk away — with no debt owed

That’s called non-recourse protection, and it’s built into every FHA-insured reverse mortgage.

When Is It a Smart Fit?

A reverse mortgage may be a great option if:

- You want to increase monthly cash flow

- You want to protect your portfolio or delay drawing down retirement accounts

- You want to age in place, with dignity and comfort

- You prefer financial independence over relying on family

It’s not about borrowing out of fear — it’s about planning from a position of strength.

Final Thought

A reverse mortgage isn’t just a loan — it’s a retirement income strategy.

Used wisely, it gives you freedom, flexibility, and financial confidence without giving up your home or your future.

Let’s build wisely. Your stairway starts here.

Ready to Take Your First Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- 💡 Takes just 5 minutes

- 📊 Tailored results based on your answers

- 🔒 No credit check required

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- 💡 Only 2 minutes to complete

- 📊 Quick turnaround on pre-approval

- 🔒 No credit score impact

Got a Few Questions First?

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a Call