Tax-Free Cash Flow in Retirement? How a Reverse Mortgage Fits

- By Jim Blackburn

- on

- Tags: Blog Posts for - Emails 1-10

When it comes to retirement income, what you keep matters just as much as what you earn.

That’s why savvy retirees — and their financial advisors — are turning to reverse mortgages as a way to access tax-free cash without triggering unnecessary tax burdens, account withdrawals, or financial stress.

Here’s how it works — and why it’s one of the most underused tools in retirement income planning.

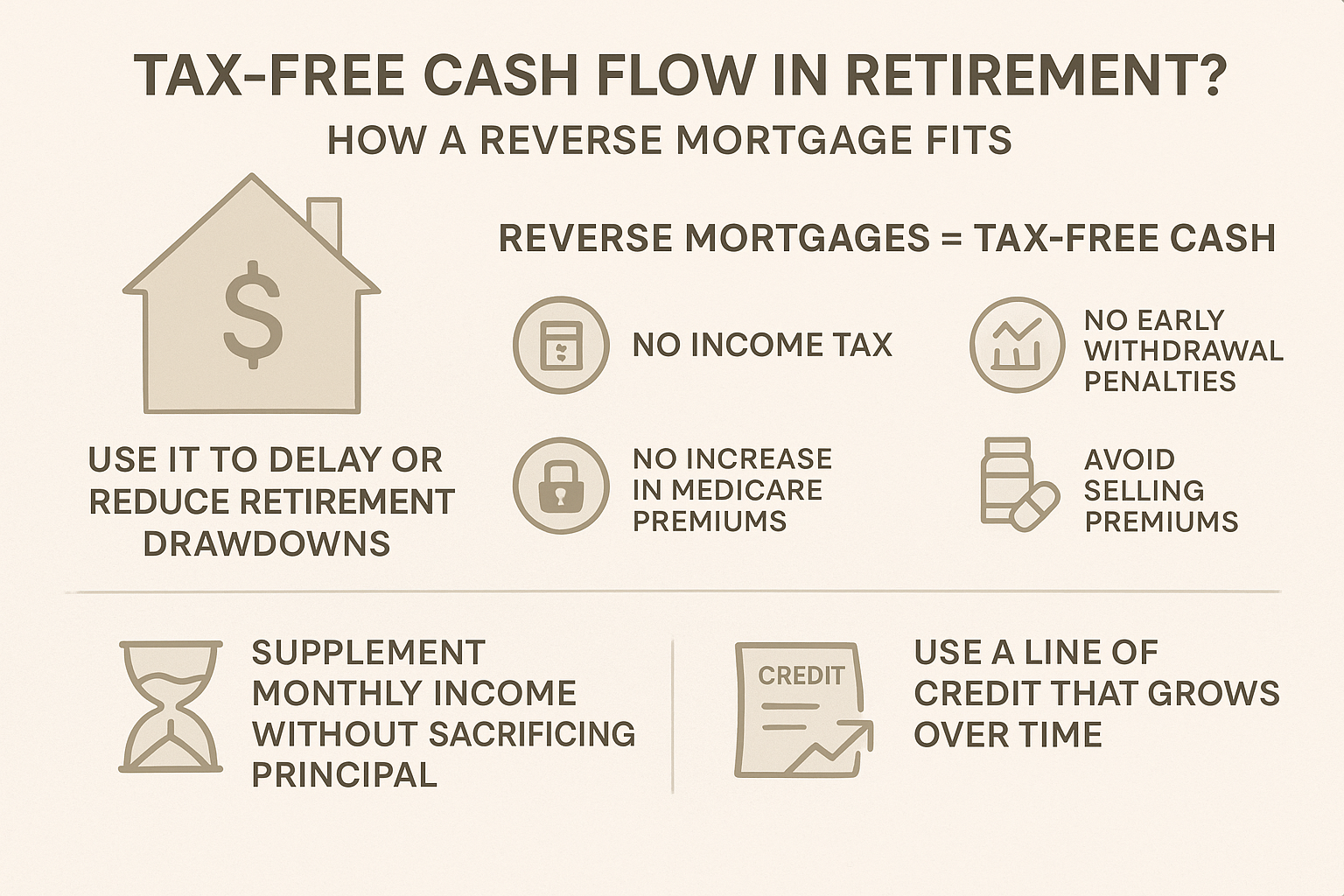

Reverse Mortgages = Tax-Free Cash

The money you receive from a reverse mortgage is not considered taxable income by the IRS.

That means:

- No income tax

- No impact on Social Security

- No early withdrawal penalties

- No increase in Medicare premiums

It’s not a loophole — it’s simply a loan, not income — and it can be used to fund anything: living expenses, home updates, medical care, even legacy planning.

Use It to Delay or Reduce Retirement Drawdowns

One of the smartest ways to use a reverse mortgage?

Don’t use your retirement accounts until you need to.

Instead, you can:

- Delay Social Security to maximize future payouts

- Reduce required minimum distributions (RMDs)

- Preserve investment portfolios in down markets

- Avoid selling taxable assets during a downturn

It’s a powerful buffer that gives your long-term plan more breathing room — especially when markets are volatile.

Supplement Monthly Income Without Sacrificing Principal

Many retirees use reverse mortgages to create a predictable stream of monthly funds, helping with:

- Everyday expenses

- Healthcare costs

- Travel or hobbies

- Gifting or family support

And since you’re not depleting your retirement accounts or selling your home, you can maintain stability and flexibility.

Use a Line of Credit That Grows Over Time

Prefer not to take a lump sum?

You can set up a reverse mortgage line of credit — one that grows over time, offering more borrowing power the longer it sits unused.

Unlike a HELOC, it can’t be canceled by the lender and doesn’t require monthly payments. It’s a safe, smart way to prepare for future “what-ifs” while protecting your current finances.

Tax Planning Bonus: Less Stress for Heirs

Since reverse mortgage proceeds are tax-free, they don’t complicate your estate’s tax exposure — and your heirs may still inherit home equity if the loan balance is less than the home’s value.

And thanks to non-recourse protection, your family will never owe more than the home is worth.

Work With a Team That Understands the Bigger Picture

At Stairway Mortgage, we don’t just issue loans. We build financial strategies.

We’ll coordinate with your financial planner or CPA, review your retirement income plan, and help structure the reverse mortgage to support your lifestyle and tax goals.

Final Thought

Reverse mortgages aren’t just about freeing up cash — they’re about doing it the smart way.

If you want tax-free income that won’t disrupt your retirement plan, your benefits, or your investments, this tool could be the missing piece.

Let’s build wisely. Your stairway starts here.

Ready to Take Your First Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- 💡 Takes just 5 minutes

- 📊 Tailored results based on your answers

- 🔒 No credit check required

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- 💡 Only 2 minutes to complete

- 📊 Quick turnaround on pre-approval

- 🔒 No credit score impact

Got a Few Questions First?

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a Call