Reverse Mortgages & College Planning: How Grandparents Are Funding Education Without Sacrificing Retirement

- By Jim Blackburn

- on

- Tags: Blog Posts for - Emails 1-10

Paying for college has never been more expensive — or more emotionally charged.

For grandparents who want to help but are on a fixed income, the desire to contribute can feel at odds with protecting their own retirement.

But there’s a little-known, strategic solution that’s helping families across the country fund college without draining savings or selling assets:

Reverse mortgages.

Here’s how financially savvy grandparents are using housing wealth to support their grandchildren’s future — while protecting their own.

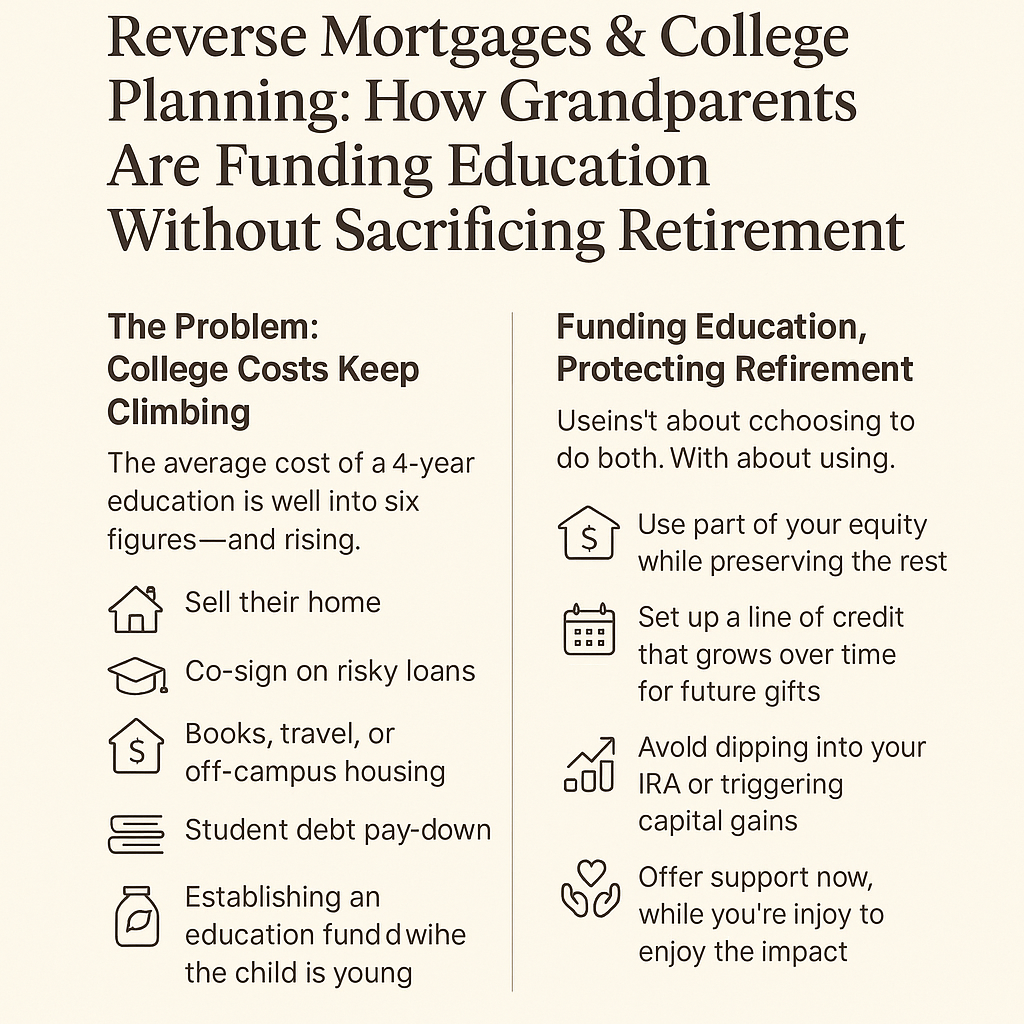

The Problem: College Costs Keep Climbing

The average cost of a 4-year education is well into six figures — and rising.

Parents are often already burdened with mortgages, inflation, or debt, and grandparents (many of whom own their homes outright) often want to help.

But they don’t want to:

- Sell their home

- Co-sign on risky loans

- Cash out retirement accounts

- Reduce their quality of life

This is where home equity becomes a quiet superpower.

The Reverse Mortgage Advantage

A reverse mortgage allows homeowners 62+ to access a portion of their home equity — tax-free and without monthly payments — as long as they live in the home and meet basic responsibilities.

That equity can then be used for anything, including:

- College tuition

- Housing or living expenses for the student

- Books, travel, or off-campus housing

- Student debt pay-down

- Establishing an education fund while the child is young

Funding Education, Protecting Retirement

This isn’t about choosing your grandkids instead of yourself.

It’s about using smart strategy to do both.

With the right reverse mortgage plan, you can:

- Use part of your equity while preserving the rest

- Set up a line of credit that grows over time for future gifts

- Avoid dipping into your IRA or triggering capital gains

- Offer support now, while you’re alive to enjoy the impact

Why It’s a Smart Estate Move

Many grandparents already plan to leave their home to their children or grandchildren.

But rising college costs often hit before that inheritance arrives.

A reverse mortgage can help you:

- Gift equity while living, rather than posthumously

- Fund meaningful education without probate or delay

- Still leave remaining equity to heirs after the loan is repaid

- Avoid tax complications that come with asset liquidation

Plus, if the home sells for more than the loan balance, the remaining equity still passes to your heirs.

When to Consider This Strategy

This could be a great fit if:

- You’re over 62 and own your home

- You want to help fund a grandchild’s education

- You have significant home equity

- You’d prefer not to sell investments or co-sign loans

- You value giving with purpose — while preserving your independence

Final Thought

You don’t need to write a check or sell your home to change a grandchild’s future.

With a reverse mortgage, you can support education goals and retirement peace — giving generously without giving up your security.

Let’s build wisely. Your stairway starts here.

Ready to Take Your First Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- 💡 Takes just 5 minutes

- 📊 Tailored results based on your answers

- 🔒 No credit check required

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- 💡 Only 2 minutes to complete

- 📊 Quick turnaround on pre-approval

- 🔒 No credit score impact

Got a Few Questions First?

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a Call