How Reverse Mortgages Can Support Fair Divorce Outcomes

- By Jim Blackburn

- on

- Tags: Blog Posts for - Emails 1-10

Divorce is never easy — especially later in life, when financial complexity, housing security, and emotional stakes are higher.

For couples over 62, a reverse mortgage can offer a flexible, dignified path forward, helping each spouse maintain financial independence without selling the family home or draining retirement accounts.

Here’s how it works — and how it’s helping more couples split fairly, without unnecessary financial loss.

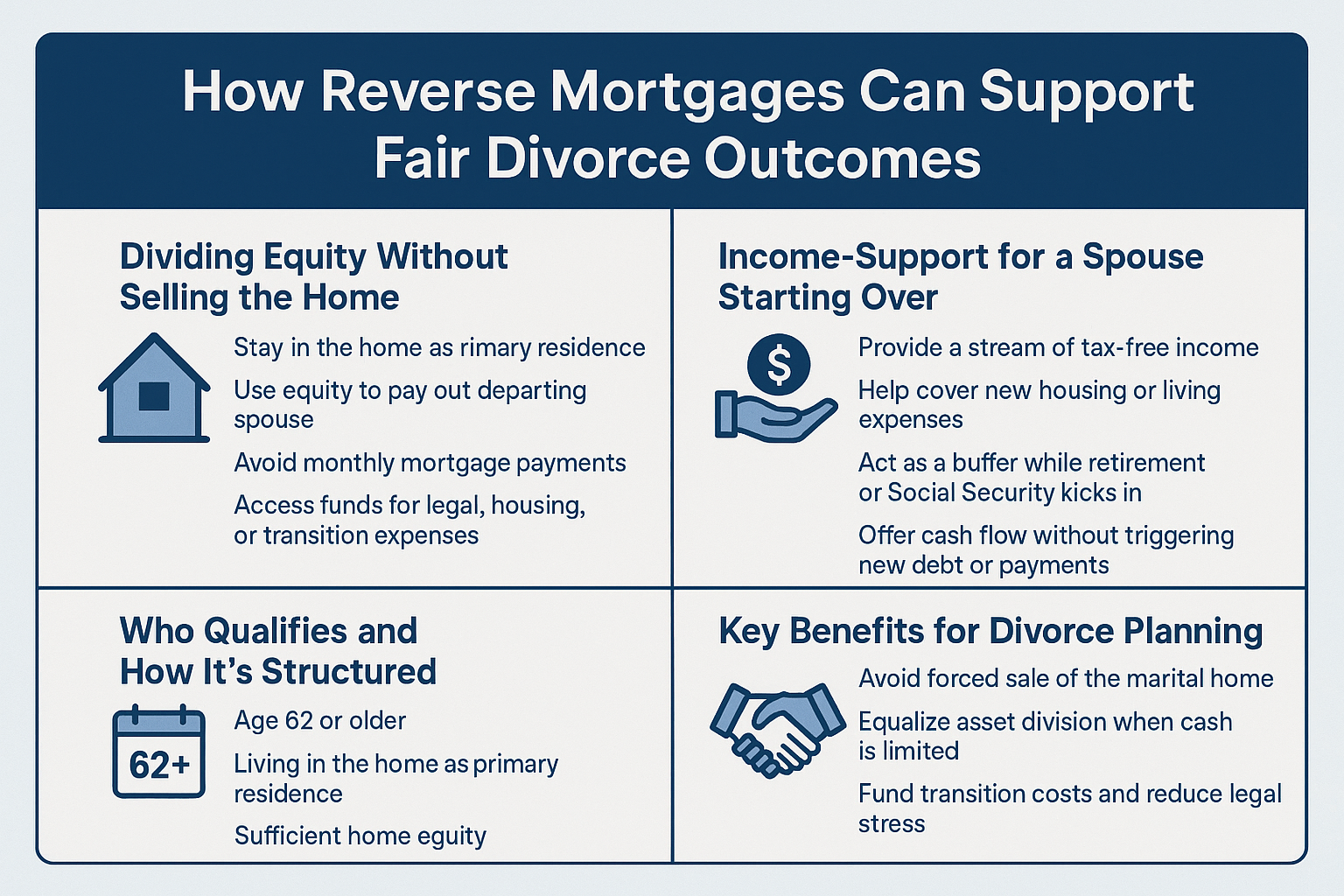

Dividing Equity Without Selling the Home

In many “gray divorces,” the home is the most valuable shared asset — and often the most emotionally significant.

But selling it may not be the preferred option.

A reverse mortgage allows one spouse to:

- Stay in the home as their primary residence

- Use equity to pay out the departing spouse

- Avoid monthly mortgage payments

- Access funds for legal, housing, or transition expenses

This solution can create financial fairness without forcing a home sale in an already stressful season.

Income-Support for a Spouse Starting Over

Often in later-in-life divorces, one spouse has a significantly lower income — or no income at all.

A reverse mortgage can:

- Provide a stream of tax-free income

- Help cover new housing or living expenses

- Act as a buffer while retirement or Social Security kicks in

- Offer cash flow without triggering new debt or payments

This can create stability and dignity during a time of personal upheaval.

Who Qualifies and How It’s Structured

Reverse mortgages require:

- Age 62 or older

- Living in the home as a primary residence

- Sufficient home equity

- Ability to maintain taxes, insurance, and basic upkeep

In divorce scenarios, the reverse mortgage can be written in one spouse’s name only, even if the title is jointly held (pending legal restructuring of ownership).

We work closely with divorce attorneys and financial planners to make sure the loan supports the final agreement.

Key Benefits for Divorce Planning

- Avoid forced sale of the marital home

- Equalize asset division when cash is limited

- Fund transition costs and reduce legal stress

- Help one or both spouses move forward independently

- Preserve other retirement assets for income and longevity

It’s not a patch. It’s a financial tool with built-in protections that helps people transition with more flexibility, security, and control.

Final Thought

Divorce can be overwhelming — but the financial solutions don’t have to be.

If you or your client is navigating separation after 62, a reverse mortgage may be the missing piece that helps both parties start fresh without selling out.

Let’s build wisely. Your stairway starts here — even in seasons of change.

Ready to Take Your First Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- 💡 Takes just 5 minutes

- 📊 Tailored results based on your answers

- 🔒 No credit check required

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- 💡 Only 2 minutes to complete

- 📊 Quick turnaround on pre-approval

- 🔒 No credit score impact

Got a Few Questions First?

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a Call